Overview

In this article, we understand how important it is for homeowners to make informed decisions about their finances. We compare cash-out refinancing and home equity loans, highlighting their key differences, benefits, and drawbacks.

Cash-out refinancing allows homeowners to replace their existing mortgage with a larger one, providing access to cash that can be invaluable for significant expenses. This option can be a great solution for those facing larger financial needs. On the other hand, home equity loans act as secondary mortgages, typically featuring lower closing costs and fixed payments. They are often more suitable for smaller, specific financial needs.

We know how challenging this can be, and we’re here to support you every step of the way as you navigate these options. Understanding the right choice for your situation can empower you to take control of your financial future.

Introduction

Navigating the financial landscape can be overwhelming for homeowners. We understand how daunting it can feel when considering options like cash-out refinancing and home equity loans. Each choice presents unique advantages that can significantly impact your financial well-being. From accessing cash for home improvements to consolidating debt into a single payment, these options can open up new possibilities.

However, the decision-making process often comes with uncertainty. Which option truly aligns with your financial goals while minimizing risks? In this article, we’ll explore the key differences between cash-out refinancing and home equity loans. Our aim is to provide clarity on their benefits and drawbacks, empowering you to make informed decisions that suit your needs.

Define Cash-Out Refinance and Home Equity Loan

For property owners looking to improve their financial situation, understanding the differences between cash out refinance vs home equity loan can be a helpful option. It allows you to replace your current mortgage with a new, larger one, providing you with cash based on the difference between the new amount and your existing mortgage. This cash can be utilized for various purposes, such as enhancing your property, consolidating debt, or addressing other financial needs. While it may incur closing costs similar to a standard mortgage, it can lead to if the new interest rate is lower than the previous one. In fact, refinancing to a lower rate could save you an average of $250 to $400 monthly, depending on your mortgage amount and duration.

On the other hand, a cash out refinance vs home equity loan functions as a secondary mortgage, allowing homeowners to borrow against the value they have built up in their property. This financing is in addition to your existing mortgage and is typically provided as a lump sum with a fixed interest rate. Many families prefer loans against their property for significant expenses, like renovations or educational fees, as these often come with reduced closing costs when considering cash out refinance vs home equity loan. Recent trends show that when considering cash out refinance vs home equity loan options, cash-out refinances made up nearly 38% of all refinances in the second quarter of 2025, highlighting their growing popularity among homeowners eager to utilize their equity effectively.

We know how challenging navigating these options can be, but we’re here to support you every step of the way. Consider your needs and explore these possibilities to find the best solution for your financial journey.

Explore the Benefits of Cash-Out Refinancing and Home Equity Loans

The significant benefits of cash out refinance vs home equity loan can truly make a difference for homeowners.

- Access to Larger Sums: Homeowners can tap into substantial cash amounts, making it ideal for significant expenses or investments, such as home improvements or renovations.

- Potentially Lower Interest Rates: Given the recent decline in mortgage rates in Colorado, property owners might secure a lower interest rate compared to their current mortgage, especially if they act now while rates are favorable.

- Single Monthly Payment: By consolidating debt into one mortgage payment, property owners can simplify their financial management. This is especially advantageous in a market where property taxes and insurance costs are increasing.

- Tax Advantages: Refinancing may also assist property owners in qualifying for tax deductions, offering extra financial relief.

Conversely, home equity loans present several advantages that families may find appealing.

- Lower Closing Costs: Typically, home equity loans incur lower upfront costs than cash-out refinancing, making them a more economical choice for families looking to manage their budgets effectively.

- Fixed Payments: These financial products typically have stable interest rates, guaranteeing consistent monthly payments that assist in budgeting. This is particularly significant as property owners manage rising expenses in Colorado.

- Retain Existing Mortgage Terms: Homeowners can keep their current mortgage rate, which is especially advantageous if interest rates have risen since their initial agreement. This allows them to leverage their existing low rate while accessing additional funds.

In the present financial environment, where the typical property owner has around $320,000 in assets, many are investigating these choices. With , the decision between cash out refinance vs home equity loan becomes critical. We know how challenging this can be. Specialists recommend that property value loans could be more beneficial for numerous residents, particularly as their rates are anticipated to drop more swiftly than mortgage rates. This insight is backed by recent trends showing that property owners can gain from seeking low-rate financing options to meet their needs while maintaining their current mortgage conditions. We’re here to support you every step of the way as you navigate these important decisions.

Examine the Drawbacks of Cash-Out Refinancing and Home Equity Loans

When considering , it’s important to be aware of some potential drawbacks that could impact your financial well-being.

Cash out refinance vs home equity loan typically involves higher closing costs for cash-out refinancing. This can be a significant financial burden for homeowners, especially in 2025 when average closing costs may rise. It’s essential to evaluate your overall financial situation before proceeding.

- Increased Debt: Refinancing can lead to a larger mortgage balance, which might create financial strain if not managed carefully. This increase in debt can be particularly concerning if your financial circumstances change unexpectedly.

- Risk of Foreclosure: Remember, your property serves as security for the loan. If you’re unable to repay, you could face foreclosure, putting your investment at risk.

On the other hand, home equity loans come with their own set of challenges that you should consider:

- Risk of Over-Borrowing: It’s easy to be tempted to borrow more than you actually need, which can lead to unnecessary debt. This can create long-term financial hurdles, particularly if the funds are not used wisely.

- Variable Interest Rates: Many financing options come with variable interest rates that may increase over time. This could elevate your monthly payments and add stress to your budget.

- Effect on Ownership Value: Taking out a loan against your property value reduces your stake in your asset. If property values decline, this can lead to decreased financial stability and potentially leave you underwater on your mortgage.

We know how challenging these decisions can be, and we’re here to support you every step of the way. By understanding these risks, you can make informed choices that align with your financial goals.

Compare Eligibility, Costs, and Suitability for Cash-Out Refinancing vs. Home Equity Loans

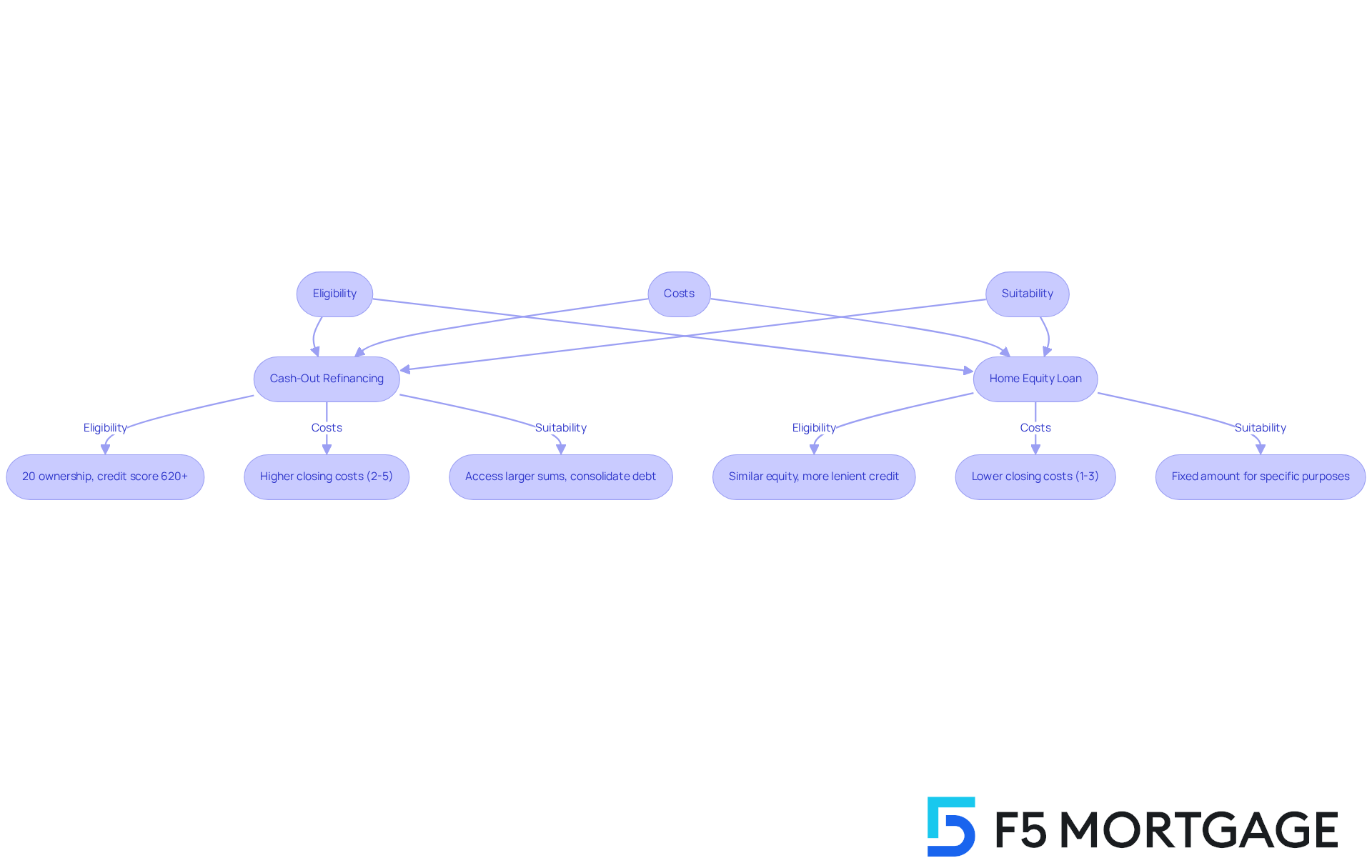

When it comes to assessing eligibility, we understand how important it is for homeowners to . Cash-out refinancing generally requires that you have at least 20% ownership in your property and a favorable credit rating, typically 620 or above. On the other hand, residential equity financing may have similar equity requirements but can be more lenient with credit scores, depending on the lender’s policies.

Now, let’s talk about costs. Cash-out refinancing often comes with higher closing costs, ranging from 2% to 5% of the loan amount, similar to those of a first mortgage. For instance, if you refinance a home in Denver for $500,000, you might expect to pay up to $25,000 in closing costs. However, with down payment assistance programs, not all residents in Colorado have to shoulder that burden. Home value financing options usually have lower closing expenses, often between 1% to 3% of the amount borrowed, making them a more budget-friendly choice initially.

When considering suitability, evaluating cash out refinance vs home equity loan can be a great option for property owners looking to access larger sums of cash and consolidate debt into a single payment, especially if you can secure a lower interest rate. At F5 Mortgage, we work with top lenders to help you compare rates and find the most affordable refinance options available. Conversely, when evaluating cash out refinance vs home equity loan, the latter may be better suited for those who need a smaller, fixed amount of money for specific purposes, such as home improvements or education expenses, without altering their existing mortgage terms.

It’s also important to consider the possible tax advantages linked to HELOCs, which can further impact your decision. This distinction between cash out refinance vs home equity loan is crucial for homeowners like you to consider when deciding which option aligns best with your financial goals. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the distinctions between cash-out refinancing and home equity loans is essential for homeowners seeking to leverage their property for financial gain. We know how challenging it can be to navigate these options, but recognizing the unique benefits and drawbacks of each can empower you to make informed decisions that align with your long-term financial goals.

Cash-out refinancing can provide larger sums of cash and potentially lower interest rates, making it an appealing choice for those looking to consolidate debt or fund significant expenses. On the other hand, home equity loans often come with lower closing costs and fixed payments, which can be advantageous for families needing a smaller, stable amount of financing without altering existing mortgage terms. However, both options come with risks, such as increased debt or the potential for foreclosure. This underscores the importance of careful consideration before proceeding.

Ultimately, the choice between cash-out refinancing and home equity loans hinges on your individual financial circumstances and objectives. We encourage you to evaluate your specific needs, weigh the benefits and drawbacks of each option, and consult with financial professionals to navigate these critical decisions. By doing so, you can better position yourself to utilize your home equity effectively, ensuring a more secure financial future.

Frequently Asked Questions

What is a cash-out refinance?

A cash-out refinance allows property owners to replace their current mortgage with a new, larger one, providing cash based on the difference between the new mortgage amount and the existing mortgage. This cash can be used for various purposes such as home improvements, debt consolidation, or other financial needs.

How does a cash-out refinance differ from a home equity loan?

A cash-out refinance replaces your existing mortgage with a new one, while a home equity loan functions as a secondary mortgage that allows homeowners to borrow against the equity built up in their property. The home equity loan is typically provided as a lump sum with a fixed interest rate.

What are the potential savings from a cash-out refinance?

If the new interest rate from a cash-out refinance is lower than the previous one, homeowners could save an average of $250 to $400 monthly, depending on their mortgage amount and duration.

What are the typical uses for cash obtained through a cash-out refinance?

Homeowners often use the cash from a cash-out refinance for significant expenses such as property renovations or educational fees.

Are there closing costs associated with cash-out refinances?

Yes, cash-out refinances may incur closing costs similar to a standard mortgage, but they can lead to significant savings if the new interest rate is lower than the previous one.

How popular are cash-out refinances compared to home equity loans?

Cash-out refinances have gained popularity, making up nearly 38% of all refinances in the second quarter of 2025, as homeowners look to utilize their equity effectively.