Overview

In this article, we explore ten benefits of adjustable rate mortgages (ARMs) specifically designed for families. We understand how challenging the mortgage process can be, and we want to highlight the potential for lower initial payments, flexibility, and opportunities for equity growth that ARMs can offer.

ARMs can significantly ease financial burdens by reducing monthly costs. This flexibility allows families to customize their loan terms, making homeownership more accessible and manageable. With options for refinancing, families can feel empowered to take control of their financial future.

Ultimately, our goal is to support you every step of the way. By understanding the unique challenges you face, we aim to provide guidance that helps you navigate the mortgage landscape with confidence.

Introduction

Adjustable rate mortgages (ARMs) can seem overwhelming for many families, often clouded by misconceptions and worries about their potential risks. Yet, these financial tools offer a wealth of benefits that can greatly improve homeownership opportunities. By uncovering the advantages of ARMs, families can learn how lower initial rates, flexible payment structures, and the possibility for equity growth can lead to better financial outcomes.

But what occurs when market conditions change? How can families navigate these shifts without jeopardizing their financial stability? We’re here to support you every step of the way. This article explores ten key benefits of adjustable rate mortgages, providing insights that empower families to make informed decisions for their future.

F5 Mortgage: Personalized Guidance for Adjustable Rate Mortgages

For many households, navigating the complexities of an adjustable rate mortgage can feel overwhelming. At F5 Mortgage, we understand how challenging this can be, and we prioritize personalized consultations to clarify the process for you. Each client receives tailored advice that reflects their unique financial circumstances and homeownership aspirations.

By tapping into our vast network of over two dozen lenders, we provide loan options specifically designed for families looking to refinance or purchase homes. This personalized approach streamlines the mortgage process and empowers you to make informed decisions that align with your financial future.

For instance, you might consider strategies like choosing a 5/1 ARM. This option offers reduced initial payments, allowing you to direct resources toward home enhancements or other investments that matter to you. Our dedication to your satisfaction is evident, as we have assisted over 1,000 households, achieving a customer satisfaction rate of 94%.

This emphasis on personalized guidance ensures that families are well-prepared to manage the complexities of an adjustable rate mortgage. Ultimately, we’re here to support you every step of the way, leading to improved financial outcomes for your future.

Cost Savings: How Adjustable Rate Mortgages Can Lower Your Monthly Payments

One of the most appealing aspects of an adjustable rate mortgage is its ability to create significant cost reductions. We understand how challenging financial decisions can be, and generally, ARMs offer lower initial interest costs compared to fixed-rate home loans. This results in considerably decreased monthly payments during the introductory fixed-interest phase. Imagine the relief for households as this financial assistance improves cash flow, allowing them to direct resources toward essential costs or savings.

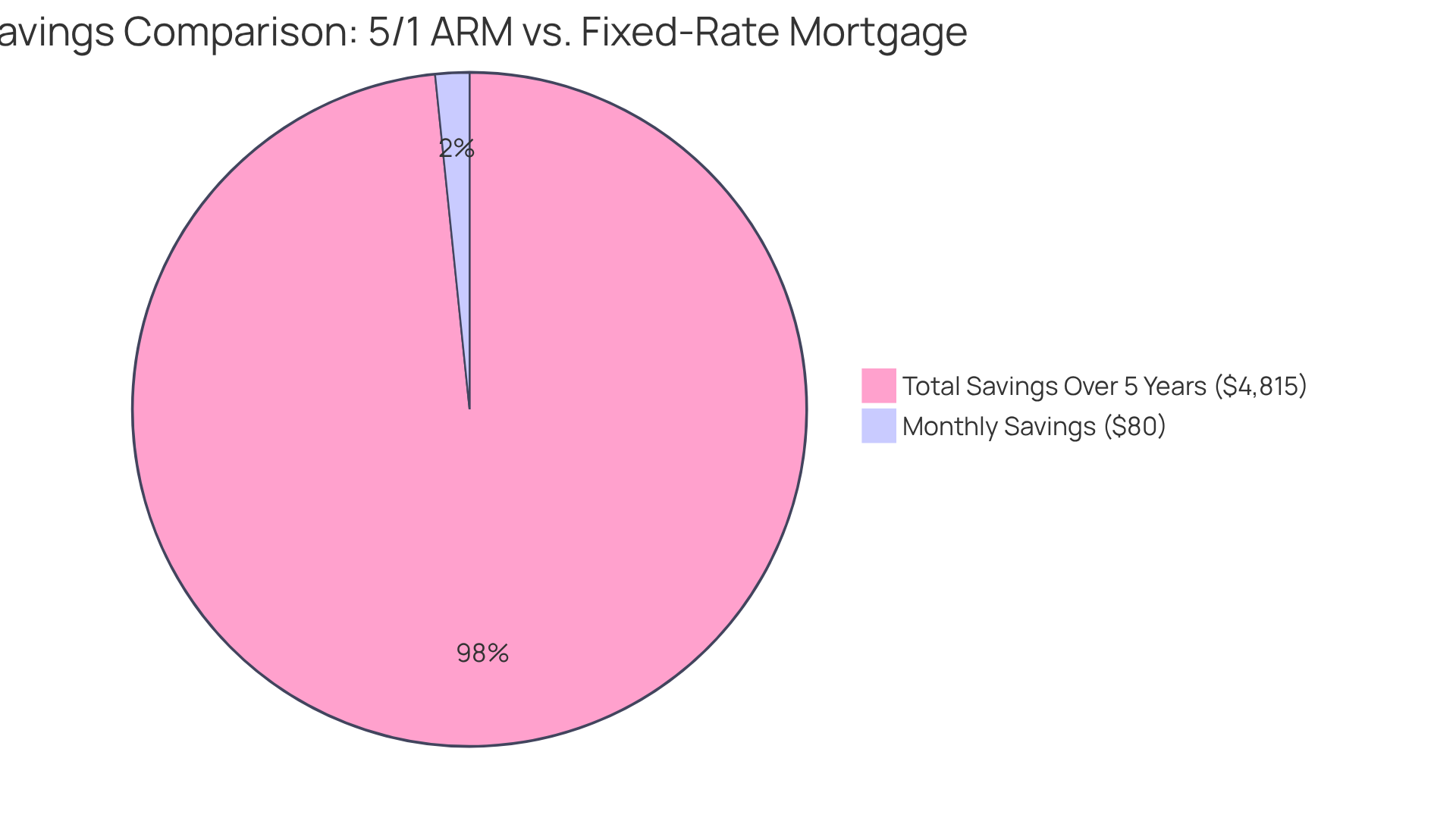

For instance, consider a household that obtains a 5/1 ARM with an introductory percentage of 3.9%. They could save roughly $80 each month compared to a fixed-rate loan at 4.45%. Over five years, this translates to a total savings of around $4,815, making homeownership more accessible and manageable. Furthermore, statistics reveal that 82% of ARM holders currently in the introductory fixed-rate period plan to retain their ARMs once the fixed-rate period concludes. This underscores the long-term benefits of adjustable rate mortgages.

By taking advantage of lower initial rates, households can experience a more comfortable financial situation while managing the responsibilities of homeownership. Unlike traditional lenders who often rely on hard sales tactics and biased information, F5 Mortgage prioritizes transparency and client satisfaction. Our dedication is evident in the success narratives of more than 1,000 households we’ve helped in realizing their homeownership aspirations.

With an average pre-approval duration of under one hour, families can swiftly access the financing options they require. While ARMs provide considerable savings, it’s essential to consider possible risks, such as increases in interest after the initial period. Nevertheless, current property owners with loans under 5% are less likely to be adversely impacted by increasing costs. With competitive rates and personalized service, F5 Mortgage distinguishes itself as a reliable ally for households aiming to enhance their homes.

We’re here to support you every step of the way. Reach out to us today to discover how we can assist you in reducing your home loan expenses.

Flexibility: The Adaptable Nature of Adjustable Rate Mortgages

Adjustable rate mortgages provide a unique versatility that can be incredibly beneficial for families facing fluctuating financial situations. One significant advantage of many ARMs is the option to transition to a fixed-interest mortgage after the initial term. This feature serves as a safeguard against rising interest rates, which is especially important in today’s uncertain economic landscape. We understand how challenging this can be for families trying to secure their financial future.

Families have the flexibility to choose from various ARM types, such as the 5/1 or 7/1, which provide fixed terms for the first five or seven years before adjusting. This customization allows borrowers to align their loans with their anticipated time in their homes, making adjustable-rate loans particularly suitable for those planning to move or refinance in the near future.

Currently, we see a growing trend where more borrowers are opting to convert their adjustable loans to fixed-rate options. This proactive approach reflects a desire to manage potential interest increases effectively. Financial consultants often highlight the flexibility of an adjustable rate mortgage, noting how it can provide initial savings while allowing families to switch to fixed rates as their financial situations stabilize.

For instance, families who initially selected a 7/1 ARM have successfully transitioned to fixed-rate loans. They enjoyed lower monthly payments during the introductory phase and then secured stability as their financial circumstances evolved. This adaptability underscores the potential of adjustable rate mortgages to meet the changing needs of households, making them a viable choice in today’s lending environment. Remember, we’re here to support you every step of the way as you navigate these options.

Lower Initial Rates: The Attractive Starting Point of Adjustable Rate Mortgages

One of the key benefits of an adjustable rate mortgage is its lower initial interest rates compared to fixed-rate options. This lower starting point can significantly ease monthly payments, making homeownership more attainable for families. For example, a household opting for an adjustable rate mortgage like a 5/1 ARM might enjoy a rate that is 1-2% lower than a traditional fixed-rate mortgage. This can lead to substantial savings during the initial years of the loan, providing crucial financial support for families managing other expenses like childcare or education costs.

Moreover, F5 Mortgage offers various down payment assistance programs, such as the FL Assist and MI Home Loan programs, which provide up to $10,000 to eligible borrowers. These initiatives can further alleviate the financial burden on families looking to purchase their first home.

With exceptional customer satisfaction reflected in our 5/5 star reviews, you can trust that F5 Mortgage is dedicated to offering a stress-free and supportive home financing experience. We leverage technology to ensure competitive rates without the hassle of hard sales tactics. We know how challenging this process can be, and we’re here to support you every step of the way.

Equity Growth: Leveraging Adjustable Rate Mortgages in a Rising Market

In a growing real estate market, we know how challenging it can be for families to navigate their options. Adjustable rate mortgages can serve as a strategic resource, enabling households to build equity rapidly. With lower initial payments linked to ARMs, families can allocate more resources toward the principal balance, speeding up their equity growth.

As property values increase, households can enjoy a more significant equity stake in their homes, which opens doors for future investments or refinancing options. This approach is especially beneficial for families looking to enhance their homes or invest in additional properties. Moreover, down payment assistance programs available through F5 Mortgage, such as the MyHome Assistance Program in California and the My Choice Texas Home program, provide crucial financial support, making homeownership more accessible.

Industry specialists emphasize that utilizing an adjustable rate mortgage can greatly improve a household’s financial situation. This enables families to take advantage of market trends while effectively managing their monthly costs. With the typical homeowner holding around $302,000 in accessible equity as of Q1 2025, the opportunity for financial growth through adjustable rate mortgages is significant, particularly in a competitive housing market.

To fully realize these financial benefits, it is generally recommended that families plan to own their homes for at least five years. We’re here to support you every step of the way as you explore your options and make informed decisions for your family’s future.

Market Awareness: Navigating Interest Rate Trends with Adjustable Rate Mortgages

Navigating the complexities of adjustable rate mortgages can be challenging, and we understand how important it is for families to feel secure in their financial decisions. Staying alert to market trends and economic indicators, such as inflation and Federal Reserve policies, is crucial. For example, with interest percentages stabilizing recently, families have a valuable opportunity to observe these trends and identify the best moment to secure favorable loan terms or explore refinancing options.

Did you know that over 35% of home borrowers have chosen adjustable rate mortgages (ARMs) to fund their homes? Many families take advantage of reduced initial costs with an adjustable rate mortgage, but it’s essential to be aware of potential increases in mortgage costs. If forecasts indicate rising rates, refinancing into a fixed-interest loan can provide the peace of mind that comes with consistent monthly payments.

Real-life stories show how families have successfully secured beneficial terms before changes took place, highlighting the economic advantages of being proactive in the home loan sector. By staying informed and engaged, families can navigate the changing landscape of loan costs more effectively, empowering them to make the best decisions for their financial futures. Remember, we’re here to support you every step of the way.

Refinancing Opportunities: Maintaining Control with Adjustable Rate Mortgages

An adjustable rate mortgage can provide families with the flexibility to adapt their financing strategies as their financial situations evolve. We understand how challenging it can be to navigate these changes. When interest rates decrease or a household’s financial circumstances shift, refinancing may become a thoughtful choice to secure a lower rate or transition to a fixed-rate loan.

This adaptability is essential for families facing fluctuations in income or housing needs. For instance, a family that initially chose an adjustable rate mortgage due to its lower initial rates might later decide to refinance into a fixed-rate loan as they establish stability in their home. This proactive approach empowers families to maintain control over their financial commitments, ensuring that their home loan aligns with their current economic environment.

Remember, we’re here to support you every step of the way as you make these important decisions.

Misconceptions: Debunking Myths About Adjustable Rate Mortgages

Many families experience misunderstandings about adjustable rate mortgages, often perceiving them as risky or unstable. We understand how challenging this can be. However, it’s important to recognize that for many borrowers, an adjustable rate mortgage can actually be a safe and beneficial option. For example, a common myth is that these mortgages always result in higher payments. In reality, many loans start with lower rates that can decrease further if market conditions allow.

Families who have successfully utilized adjustable rate mortgages often discover that their initial reduced payments allowed them to buy homes that might otherwise be unattainable, particularly in a market where the average home price surpassed $510,000 at the close of 2024. Financial instructors emphasize that understanding the terms and conditions of adjustable-rate mortgages is crucial, as these loans can provide flexibility and affordability for households.

Additionally, F5 Mortgage offers a variety of loan programs, including nontraditional options, which can further enhance home-buying opportunities. By dispelling these misconceptions and utilizing resources like F5 Mortgage’s comprehensive home buyer’s guide and refinancing guides, families can approach adjustable rate mortgages with a clearer understanding of their potential advantages and risks.

This understanding, along with the outstanding client satisfaction reflected in testimonials from individuals who have navigated the financing process with F5 Mortgage, empowers families to make informed choices in their home-buying journey. We’re here to support you every step of the way.

Financial Planning: Preparing for Future Adjustments with Adjustable Rate Mortgages

Families contemplating an adjustable rate mortgage often face uncertainty regarding future interest changes. We know how challenging this can be, and that’s why proactive financial planning is essential. Start by creating a budget that accommodates potential increases in monthly payments. Setting aside savings to cover any fluctuations can provide peace of mind. By anticipating these changes, you can maintain financial stability and avoid surprises related to your adjustable rate mortgage when your rates adjust.

Understanding how to calculate your break-even point is also crucial. To do this, follow these steps:

- Determine your refinancing costs, which include all closing fees and expenses associated with refinancing.

- Calculate your monthly savings by subtracting your new monthly payment from your current one.

- Divide your refinancing costs by your monthly savings.

For instance, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months.

Consulting with a loan advisor can provide valuable insights into structuring payments and managing finances effectively throughout the term of the loan. We’re here to support you every step of the way, ensuring you stay informed and prepared. F5 Mortgage’s personalized approach and partnerships with top lenders can help you find the best refinancing options tailored to your needs.

Overall Benefits: Why Adjustable Rate Mortgages May Be Right for You

Adjustable rate mortgages can be a wonderful option for families, providing numerous benefits that make homeownership more attainable. With lower initial rates and monthly payments, along with the flexibility to adapt to changing circumstances, ARMs can provide significant financial relief. We understand how important it is to find the right fit for your family’s needs.

Additionally, families can take advantage of down payment assistance programs available through F5 Mortgage, which can open doors to home buying opportunities. This support can make a real difference in your journey toward homeownership. We know how challenging this can be, and we’re here to help you navigate these options.

The ability to refinance as market conditions evolve empowers families to maintain control over their loans. At F5 Mortgage, our commitment to outstanding customer satisfaction, combined with a technology-driven, consumer-focused approach, ensures that you can move through the mortgage process with confidence and ease.

By understanding the unique features of an adjustable rate mortgage and how it aligns with your financial goals, you can make informed decisions that support your long-term aspirations. Remember, we’re here to support you every step of the way as you work towards achieving your dream of homeownership.

Conclusion

Adjustable rate mortgages (ARMs) can be a wonderful option for families looking for financial flexibility in their homeownership journey. By embracing the benefits of lower initial rates and adaptable terms, households can navigate the complexities of home financing while potentially achieving significant cost savings. We know how challenging this can be, and the insights shared throughout this article highlight how ARMs can empower families to make informed decisions that align with their financial goals.

Key points discussed include:

- The cost savings associated with lower monthly payments during the initial fixed-rate period

- The flexibility to transition to fixed-rate options

- The potential for rapid equity growth in a rising market

Additionally, the importance of market awareness and proactive financial planning is emphasized. This allows families to maintain control over their mortgage commitments and adapt to changing economic conditions.

Ultimately, understanding the advantages of adjustable rate mortgages can open doors to homeownership that may have previously seemed unattainable. Families are encouraged to explore these options, leverage personalized guidance from experts like F5 Mortgage, and take proactive steps toward securing their financial futures. With the right approach, ARMs can be a powerful tool for achieving long-term stability and success in homeownership.

Frequently Asked Questions

What is F5 Mortgage’s approach to adjustable rate mortgages (ARMs)?

F5 Mortgage prioritizes personalized consultations to clarify the complexities of adjustable rate mortgages, providing tailored advice based on each client’s unique financial circumstances and homeownership goals.

How does F5 Mortgage assist clients in finding loan options?

F5 Mortgage has a vast network of over two dozen lenders, allowing them to offer loan options specifically designed for families looking to refinance or purchase homes, streamlining the mortgage process.

What are the financial benefits of choosing an adjustable rate mortgage?

Adjustable rate mortgages typically offer lower initial interest costs compared to fixed-rate loans, resulting in decreased monthly payments during the introductory fixed-interest phase, which can improve cash flow for households.

Can you provide an example of potential savings with an adjustable rate mortgage?

For example, a household obtaining a 5/1 ARM with an introductory rate of 3.9% could save approximately $80 each month compared to a fixed-rate loan at 4.45%, translating to total savings of around $4,815 over five years.

What is the customer satisfaction rate for F5 Mortgage?

F5 Mortgage has achieved a customer satisfaction rate of 94%, having assisted over 1,000 households in their homeownership aspirations.

What flexibility do adjustable rate mortgages offer?

Adjustable rate mortgages provide the option to transition to a fixed-interest mortgage after the initial term, which can protect borrowers against rising interest rates and allows customization based on anticipated time in their homes.

What types of adjustable rate mortgages are available?

Common types include the 5/1 and 7/1 ARMs, which offer fixed rates for the first five or seven years before adjusting, making them suitable for families planning to move or refinance soon.

Are borrowers opting to convert adjustable loans to fixed-rate options?

Yes, there is a growing trend of borrowers converting their adjustable loans to fixed-rate options to manage potential interest increases and secure stability as their financial situations evolve.

How quickly can clients expect pre-approval from F5 Mortgage?

F5 Mortgage typically offers an average pre-approval duration of under one hour, enabling families to swiftly access the financing options they require.

What should borrowers consider regarding the risks of adjustable rate mortgages?

While ARMs offer considerable savings, borrowers should be aware of potential risks, such as increases in interest rates after the initial period, although current property owners with loans under 5% are less likely to be adversely impacted.