Overview

Securing home loans can feel daunting, especially for those with bad credit. We understand how challenging this can be, but there are steps you can take to improve your situation. Focus on enhancing your credit score and gaining a clear understanding of your financial landscape. Explore suitable lenders and loan options that cater to your needs.

Start by monitoring your credit reports for any errors that could be holding you back. Maintaining a low debt-to-income ratio is crucial, as it shows lenders that you can manage your finances responsibly. Gather the necessary documentation to present your case effectively.

Consider looking into government assistance programs, such as FHA loans, which can significantly enhance your chances of mortgage approval, even with a poor credit history. Remember, you’re not alone in this journey; we’re here to support you every step of the way. Take these actionable steps, and you’ll be on your path to homeownership in no time.

Introduction

Securing a home loan can feel overwhelming, especially for those grappling with bad credit. A score below 580 often means limited options and higher interest rates, which can be incredibly discouraging. We understand how challenging this can be, and we’re here to support you every step of the way.

This article aims to provide a clear roadmap for navigating the mortgage landscape. By offering actionable steps to enhance your financial standing, we hope to improve your chances of approval. What strategies can you employ to not only secure a loan but also ease the financial burdens that come with poor credit?

Let’s explore these together, so you can feel empowered to take control of your financial future.

Understand Bad Credit and Its Impact on Mortgages

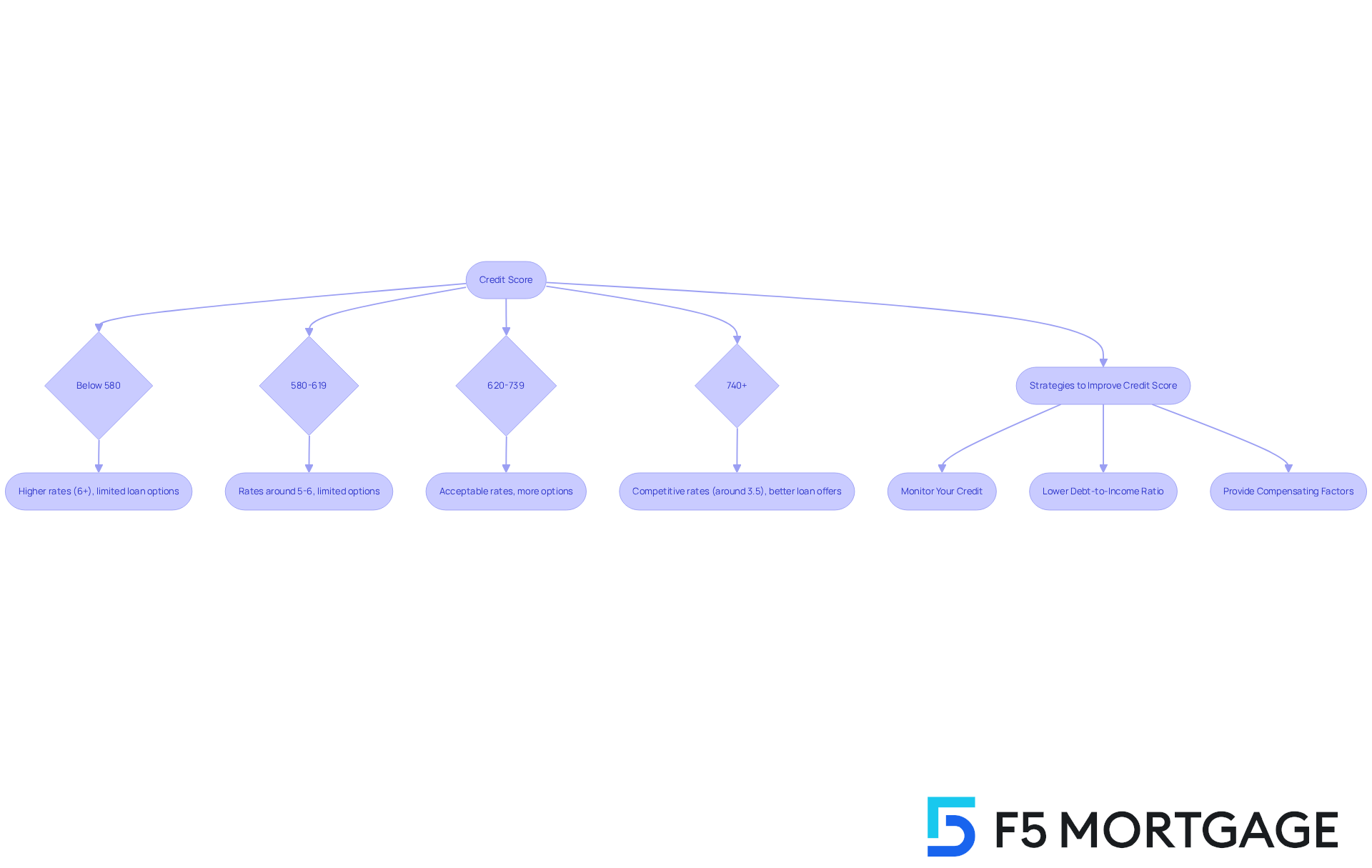

A rating below 580 is often seen as poor, which can significantly limit your access to home loans for people with bad credit. We understand how daunting this can feel. Lenders tend to view low financial ratings as indicative of greater risk, often resulting in higher interest rates or even outright refusals for home loans for people with bad credit. It’s crucial to grasp the components of your credit score—such as payment history, credit utilization, and the length of your credit history. For instance, a rating of 620-739 might qualify you for some loans, but it won’t guarantee the best rates available. Conversely, a score of 740 or above can unlock competitive offers, greatly reducing your overall loan costs.

To enhance your chances of securing a mortgage despite having bad credit, consider these strategies:

- Monitor Your Credit: Regularly check your credit report for errors and discrepancies, as these can negatively impact your score.

- Debt-to-Income Ratio: Lenders typically prefer a DTI ratio of 43% or less. A lower DTI indicates more financial flexibility, improving your approval odds.

- Compensating Factors: If your rating is low, providing compensating elements—such as a larger down payment or a co-signer with excellent financial history—can strengthen your application.

Real-world examples show that individuals with poor financial histories can still secure home loans for people with bad credit. For example, a borrower with a rating of 580 successfully obtained an FHA loan by demonstrating stable income and a willingness to make a larger down payment. This highlights the importance of early planning and understanding how borrowing ratings influence the availability of home loans for people with bad credit.

In 2025, average interest rates for loans with poor ratings can be significantly higher than those for borrowers with favorable ratings. For instance, while a borrower with a rating of 740 might secure a rate around 3.5%, someone with a rating below 580 could face rates exceeding 6%. This disparity underscores the importance of improving your financial rating before applying for home loans for people with bad credit.

Professional insights emphasize that understanding how your financial rating affects loan conditions is essential for securing the best possible offer. By taking proactive measures to manage your finances, you can enhance your financial position and increase your chances of obtaining favorable mortgage rates. Remember, we’re here to support you every step of the way.

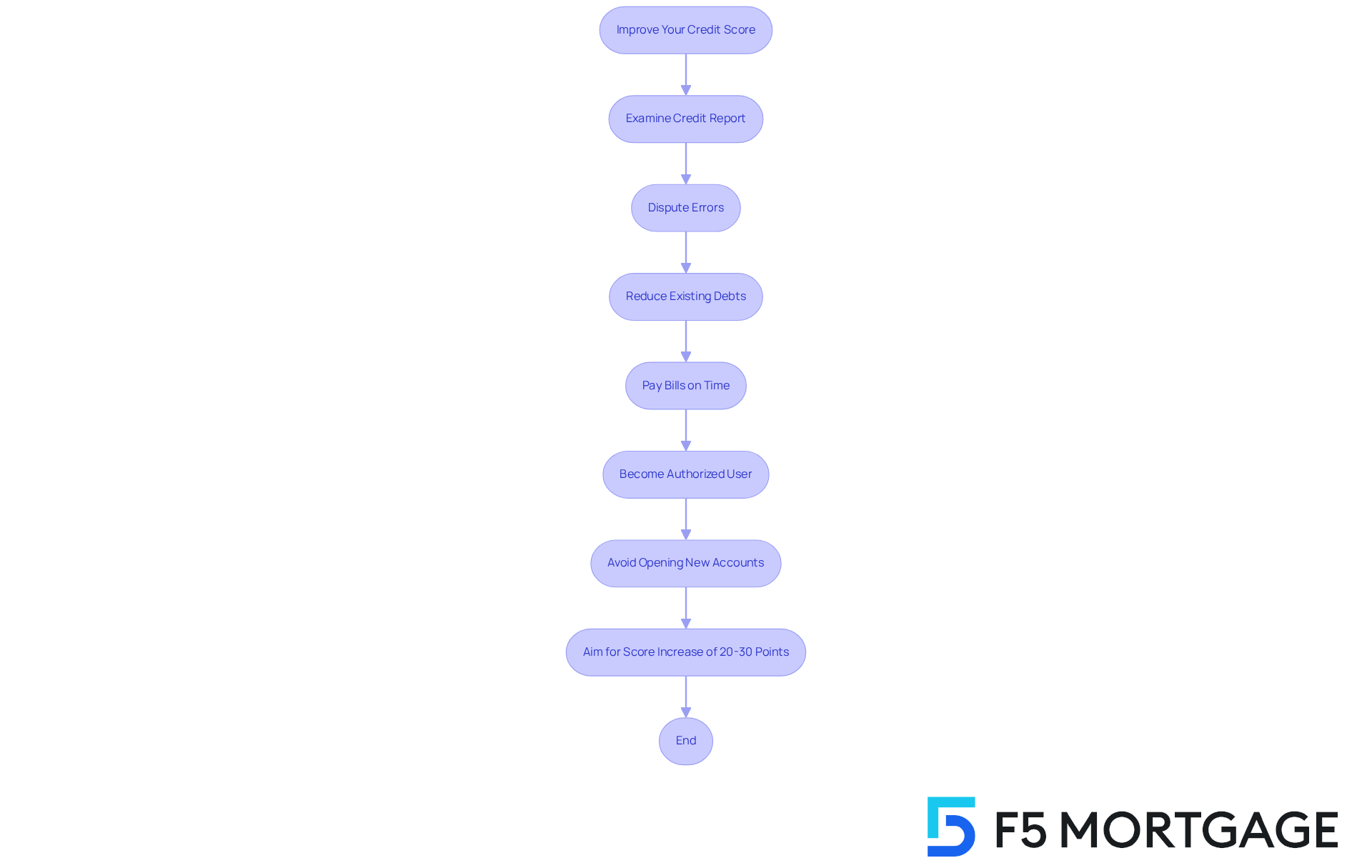

Improve Your Credit Score Before Applying

To improve your rating, we understand how important it is to start by carefully examining your report for any mistakes and contesting discrepancies. Recognizing how to read and identify the warning signs on your financial report, along with disputing and rectifying errors, can assist you in maintaining or enhancing your rating. This step is crucial, as even minor mistakes can negatively affect your results.

Focus on reducing existing debts, especially those with high utilization rates, and ensure that all bills are paid punctually. One effective tactic is to become an authorized user on a responsible individual’s card. This can lead to an increase in your rating by an average of 50 points, allowing you to benefit from their positive financial history.

It’s also wise to avoid opening new loan accounts before applying for home loans for people with bad credit, as this can lead to a temporary decrease in your rating. Aim to boost your score by at least 20-30 points before submitting your loan application. A score in the mid-600s or above is regarded as good and can significantly improve your chances of approval.

By taking these proactive steps, you position yourself more favorably in the eyes of lenders, thereby making home loans for people with bad credit more attainable. Remember, we’re here to support you every step of the way.

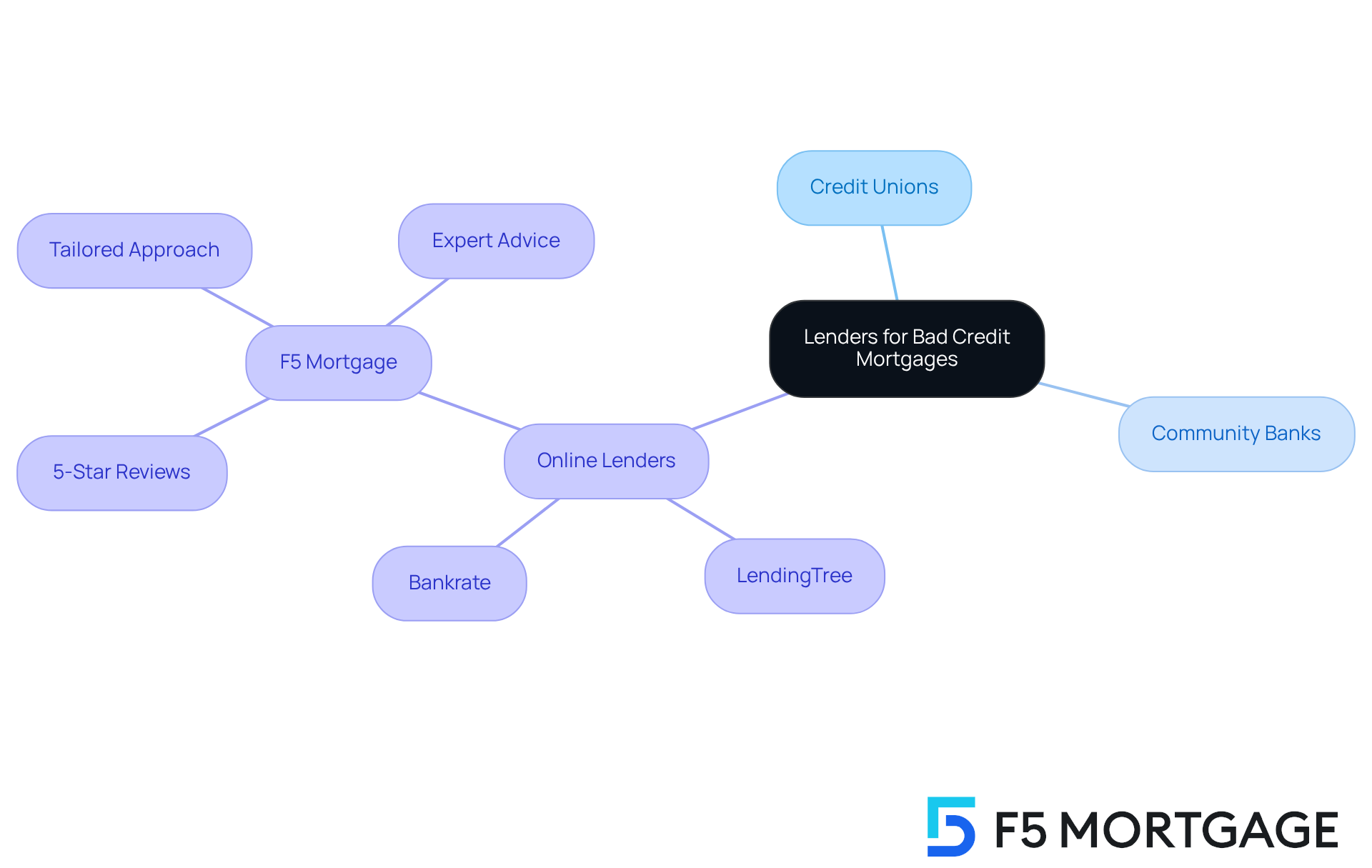

Find Lenders That Cater to Bad Credit Mortgages

When exploring lenders that provide home loans for people with bad credit, we know how important it is to find institutions that prioritize client satisfaction. Consider:

- Credit unions

- Community banks

- Online lenders that offer home loans for people with bad credit and have flexible lending criteria

Websites like LendingTree and Bankrate can be invaluable resources for comparing lenders and their offerings.

Additionally, reaching out to F5 Mortgage may be a great option. They have received 5-star reviews on platforms like Google and Zillow, reflecting their commitment to outstanding service. Clients often share their positive experiences with F5 Mortgage, highlighting the tailored approach and expert advice that make the financing process smooth and worry-free.

As you navigate this journey, always take a moment to read reviews and check the lender’s reputation. Ensuring that they are trustworthy and transparent in their dealings can empower you in making the best decision for your financial future.

Gather Required Documentation and Financial Information

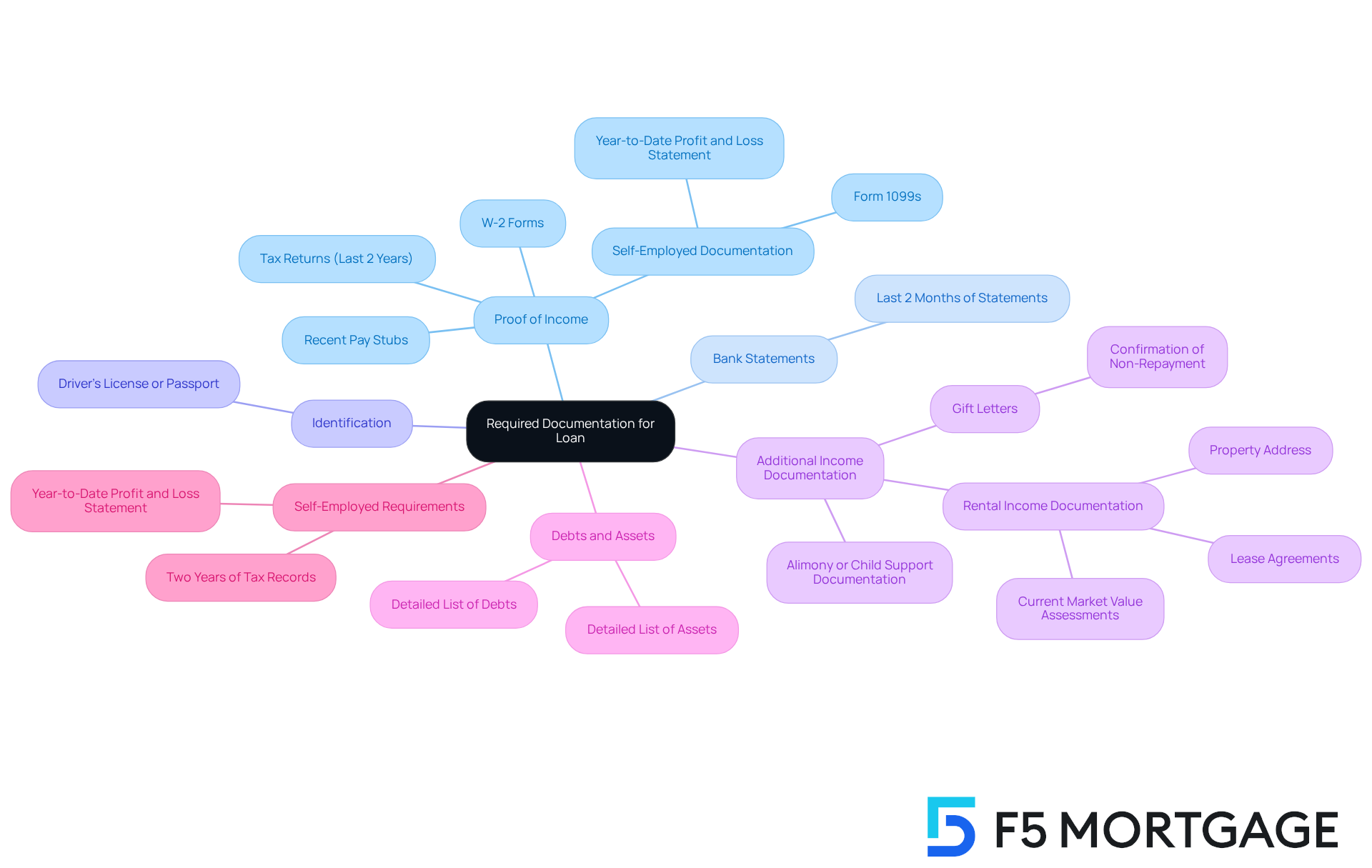

When seeking a loan with F5 Mortgage, we understand how important it is to prepare a comprehensive set of documents to facilitate the approval process. Gathering the right paperwork can feel overwhelming, but we’re here to support you every step of the way. Key documents typically required include:

- Proof of income, which may consist of recent pay stubs, W-2 forms, and tax returns for the past two years. If you’re self-employed, please provide the last two years of personal and business tax returns, K1s, 1099s, and/or W2s.

- Bank statements covering the last two months for all accounts used, demonstrating your financial stability.

- Identification, such as a driver’s license or passport, to verify your identity.

- Documentation of any additional income sources, including alimony or child support, which can strengthen your application.

- A detailed list of your debts and assets, providing lenders with a complete view of your financial situation.

For self-employed individuals, the requirements differ slightly. You must submit a year-to-date profit and loss statement along with two years of tax records, including Form 1099s. This documentation is crucial for verifying income, especially when traditional W-2 forms are not available.

If you are relying on rental income to qualify, ensure you have documentation that includes the property address, lease agreements, and current market value assessments. If you plan to use gift funds for your down payment, be prepared to provide gift letters from donors confirming that the funds do not need to be repaid. While these letters are not required for pre-approval, having them ready can ease the process.

Understanding your Debt-to-Income (DTI) ratio is also vital. A maximum of a 43% DTI ratio is usually required for home loans. This ratio indicates the disparity between your current debt and income, and a better DTI can result in more favorable loan rates. By preparing these documents, you not only accelerate the application process but also provide a clear and precise representation of your financial status to lenders, enhancing your chances of obtaining a favorable loan.

Taking the initiative to collect these documents can greatly improve your mortgage application experience. This is especially true for individuals with poor financial history or low income, who may encounter extra examination during the approval process for home loans for people with bad credit. Remember, we know how challenging this can be, but with the right preparation, you can navigate this journey successfully.

Explore Loan Options and Government Assistance Programs

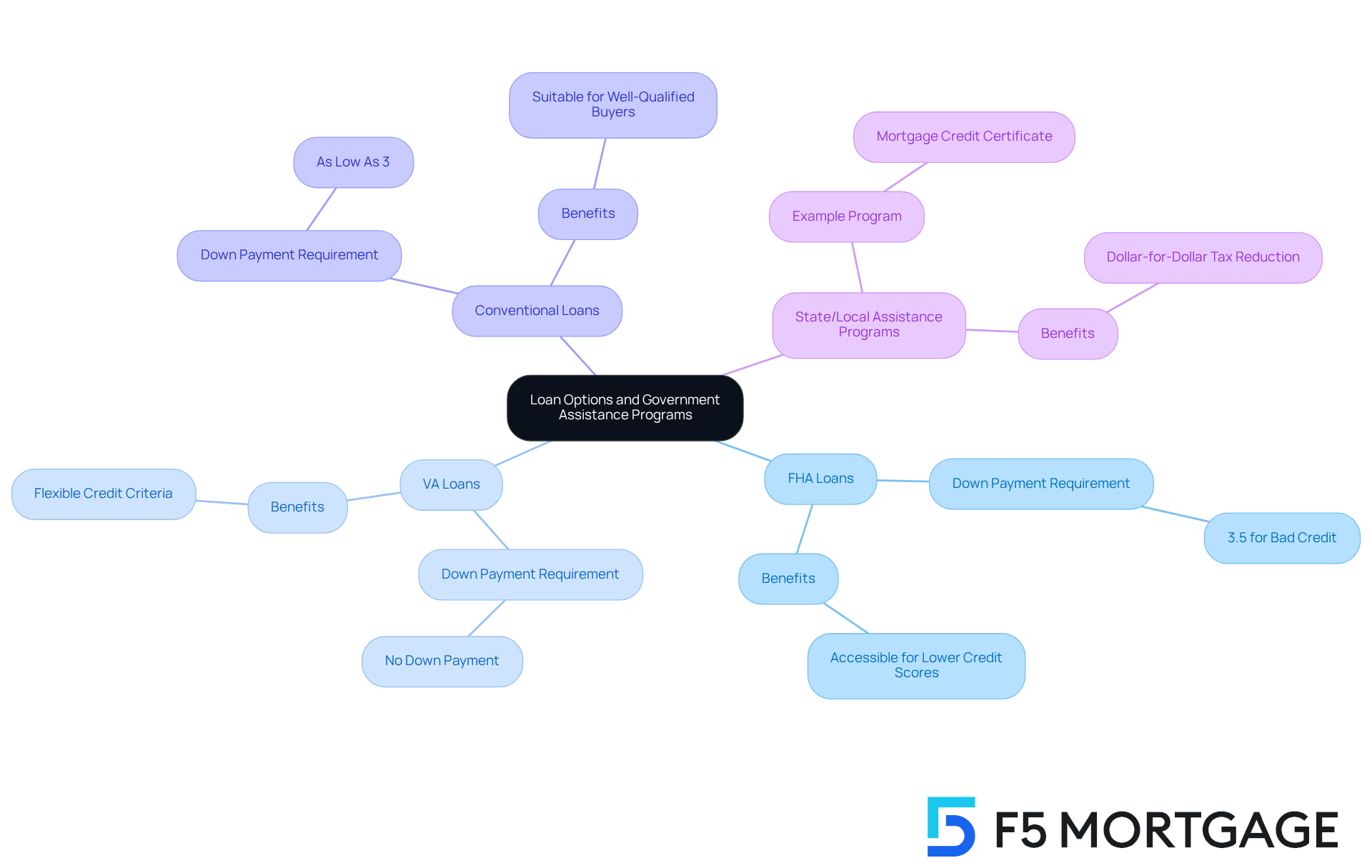

If you’re feeling overwhelmed by financing options, know that there are alternatives available to help you. FHA mortgages are an example of home loans for people with bad credit, as they cater to borrowers with lower credit scores and require a down payment as low as 3.5%. Imagine purchasing a $200,000 home; your down payment could be just $7,000. This can make homeownership more accessible.

For veterans and active-duty service members, VA financing is an excellent option. Often, home loans for people with bad credit require no down payment and provide more flexible credit criteria, which can be a relief during the home-buying process. Additionally, conventional loans might be suitable, allowing down payments as low as 3% for well-qualified buyers.

Don’t forget to explore state and local assistance programs, such as the Mortgage Credit Certificate in Los Angeles County. This program offers a dollar-for-dollar reduction of your federal income tax liability, which can significantly ease your financial burden.

We encourage you to visit websites like the U.S. Department of Housing and Urban Development (HUD) for valuable information on available programs, including down payment assistance and grants for first-time homebuyers. Remember, we’re here to support you every step of the way as you navigate these options.

Navigate the Mortgage Application Process

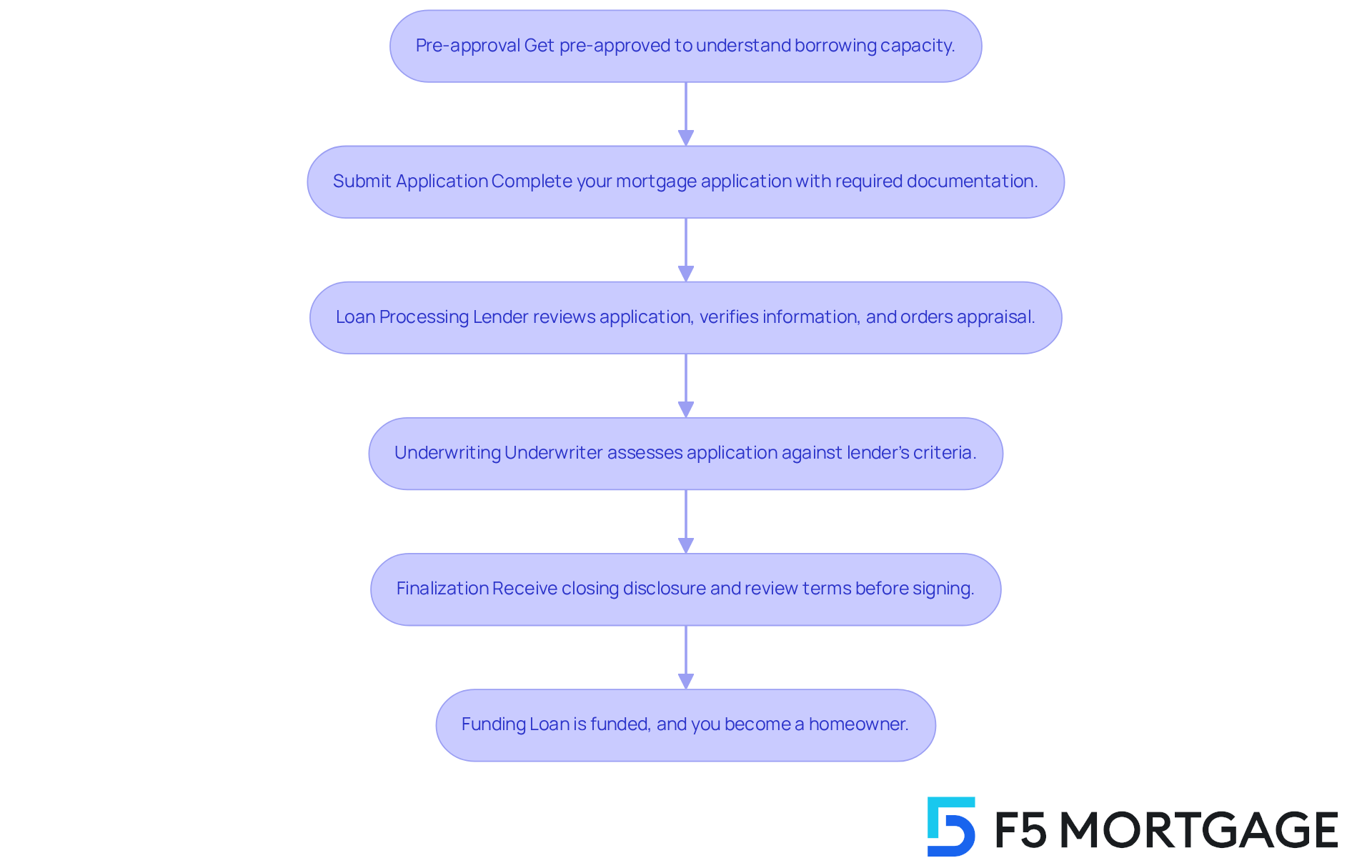

Navigating the mortgage application process with F5 Mortgage can feel overwhelming, but we’re here to support you every step of the way.

-

Pre-approval: Start by getting pre-approved. This helps you understand how much you can borrow and shows sellers that you are a serious buyer. F5 Mortgage offers convenient application options—apply online, by phone, or via chat to get started.

-

Submit your application: Complete your mortgage application with F5 Mortgage, ensuring you provide all required documentation. Our financing specialists are available to assist you in customizing a solution that aligns with your specific objectives. We know how challenging this can be, and we’re here to help.

-

Loan processing: After submitting, the lender will review your application, verify your information, and order an appraisal of the property. This step is crucial, and we are committed to keeping you informed throughout the process.

-

Underwriting: Next, the underwriter will assess your application to determine if you meet the lender’s criteria. This is an important stage, and we understand you may have questions.

-

Finalization: If approved, you will receive a closing disclosure outlining the final terms of your financing. Please review it carefully before signing to ensure everything meets your expectations.

-

Funding: Once all documents are signed, the lender will fund the loan, allowing you to officially become a homeowner. Remember, maintaining open communication with your lender is key for any questions or concerns. Additionally, if you need assistance finding a realtor, F5 Mortgage can connect you with top agents in your area to ensure you secure the best deal possible. We’re dedicated to making this journey as smooth as possible for you.

Conclusion

Securing a home loan with bad credit may feel daunting, but with the right strategies and preparation, it is truly within your reach. We understand how challenging this can be, and recognizing the intricacies of credit scores and their impact on mortgage options is vital for navigating this complex landscape. By taking proactive steps to enhance your credit rating, exploring various lending options, and gathering necessary documentation, you can significantly improve your chances of obtaining favorable home financing.

Key insights from this guide emphasize the importance of:

- Monitoring your credit report

- Maintaining a healthy debt-to-income ratio

- Identifying lenders who specialize in helping those with poor credit histories

Additionally, we highlight various loan options, including FHA and VA loans, along with government assistance programs that can provide essential support. Each step in the mortgage application process, from pre-approval to funding, is crucial for ensuring a smooth transition into homeownership.

Ultimately, the message is clear: even with bad credit, you can secure a home loan by being informed and prepared. By taking the initiative to improve your credit score and understanding the resources available to you, you can navigate this process with confidence. Embrace your journey toward homeownership, and remember that with dedication and the right guidance, achieving your dream of owning a home is well within your reach.

Frequently Asked Questions

What is considered a bad credit score for mortgages?

A credit score below 580 is often viewed as poor, which can significantly limit access to home loans.

How do lenders perceive individuals with bad credit?

Lenders tend to see low financial ratings as indicative of greater risk, often resulting in higher interest rates or outright refusals for home loans.

What components make up a credit score?

Key components of a credit score include payment history, credit utilization, and the length of your credit history.

What credit score range might qualify me for some loans?

A credit score of 620-739 might qualify you for some loans, but it won’t guarantee the best rates.

How does a higher credit score affect loan offers?

A score of 740 or above can unlock competitive offers, greatly reducing overall loan costs.

What strategies can help secure a mortgage with bad credit?

Strategies include monitoring your credit for errors, maintaining a debt-to-income ratio of 43% or less, and providing compensating factors like a larger down payment or a co-signer.

Can individuals with poor credit histories still secure home loans?

Yes, individuals with poor credit can still secure home loans. For example, a borrower with a score of 580 obtained an FHA loan by demonstrating stable income and a willingness to make a larger down payment.

How do interest rates vary for different credit scores?

In 2025, borrowers with a rating of 740 might secure a rate around 3.5%, while those with a rating below 580 could face rates exceeding 6%.

What steps can I take to improve my credit score before applying for a mortgage?

Start by examining your credit report for mistakes, reducing existing debts, paying bills on time, and potentially becoming an authorized user on a responsible individual’s credit card.

What is the recommended credit score to aim for before applying for a loan?

Aim to boost your score by at least 20-30 points, targeting a score in the mid-600s or above, which is regarded as good and can improve your chances of approval.