Overview

FHA loans offer families a pathway to homeownership that is both accessible and supportive. With low down payment requirements and flexible credit score criteria, these loans are particularly attractive for first-time buyers. We understand how challenging it can be to navigate the mortgage process, and we’re here to support you every step of the way.

While FHA loans provide significant advantages, such as reduced initial costs and helpful resources, it’s important to be aware of the challenges they present. Families should consider:

- Mandatory mortgage insurance premiums

- Strict property standards

By understanding both the benefits and the requirements, you can make an informed decision that aligns with your family’s needs.

We encourage you to explore these options thoughtfully. Remember, you’re not alone in this journey; many families have successfully achieved their dream of homeownership with FHA loans. Take the time to weigh your options and feel empowered to take the next step toward securing a home for your family.

Introduction

FHA loans, backed by the Federal Housing Administration, have emerged as a crucial pathway for families aspiring to achieve homeownership. This is particularly true for first-time buyers and those with less-than-perfect credit. We understand how challenging this can be, and these loans offer lower down payment options and flexible credit requirements, making homeownership more accessible than ever.

However, potential borrowers must navigate a landscape filled with both benefits and challenges. From mortgage insurance costs to property eligibility criteria, there are many factors to consider. How can families effectively weigh the pros and cons of FHA loans? By understanding these elements, they can make informed decisions in their pursuit of a new home.

We’re here to support you every step of the way as you explore your options and find the best path to homeownership.

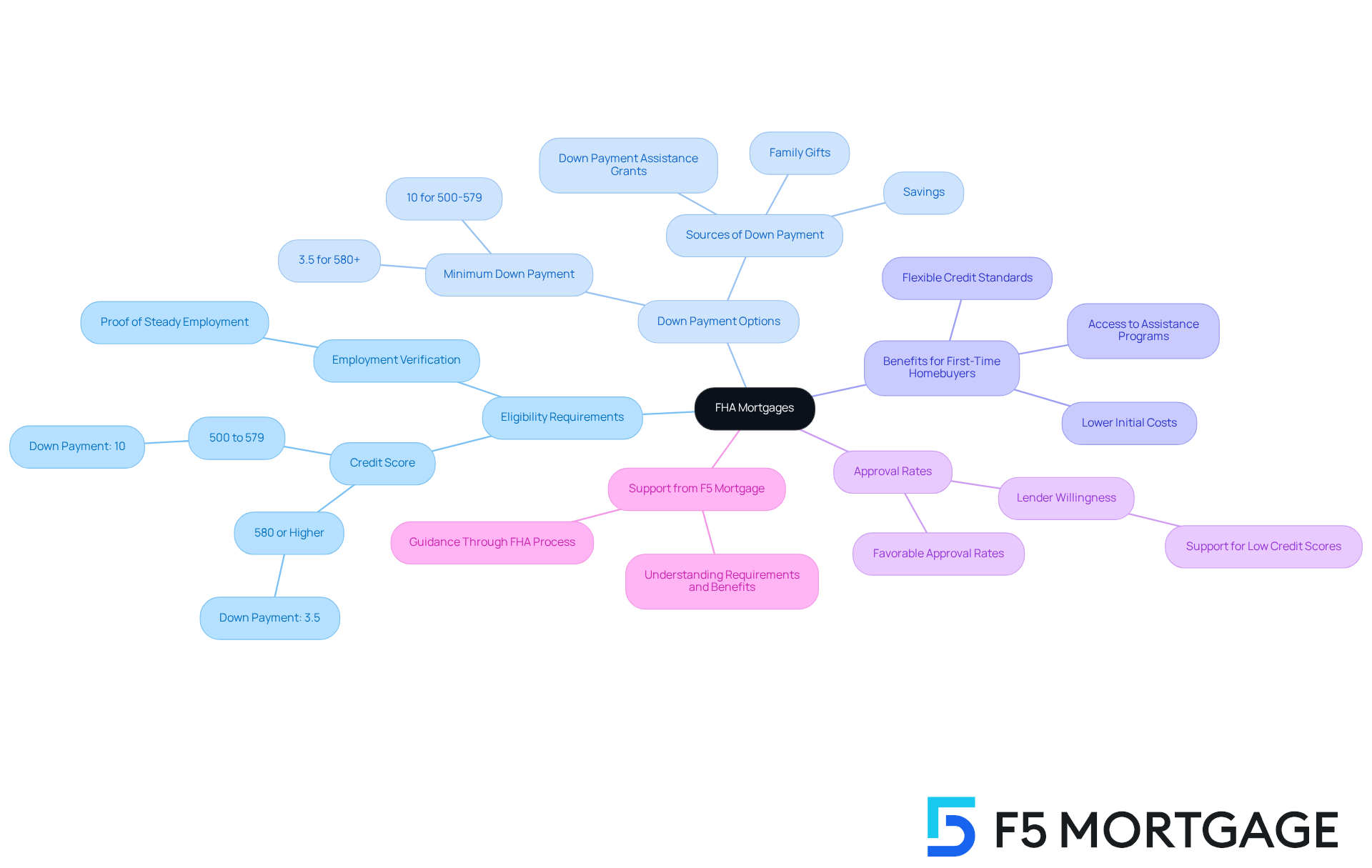

F5 Mortgage: Comprehensive FHA Loan Overview

FHA mortgages, backed by the Federal Housing Administration, serve as a vital resource for families striving to achieve homeownership with fewer obstacles. We understand how challenging this can be, especially for first-time homebuyers and individuals with less-than-perfect credit ratings. With a minimum down payment of just 3.5% for borrowers with a credit score of 580 or higher, FHA mortgages make homeownership more attainable. For those with credit scores between 500 and 579, a down payment of 10% is required, still offering a more accessible option than many traditional financing alternatives.

At F5 Mortgage, we excel in guiding clients through the FHA financing process, ensuring you understand the associated requirements and benefits. Recent updates reveal that FHA financing limits for 2025 range from $524,225 in low-cost areas to $1,209,750 in high-cost regions, allowing families to secure funding that meets their unique needs. Furthermore, the approval rates for FHA mortgages remain favorable, with many lenders eager to assist borrowers who may have faced challenges in securing traditional financing.

Expert opinions highlight that FHA mortgages are particularly beneficial for first-time homebuyers, as they provide a pathway to homeownership that accommodates lower incomes and credit scores. The FHA’s insurance reduces the risk for lenders, encouraging them to offer financing to individuals who might otherwise struggle to qualify. Families can also benefit from down payment assistance programs, further easing the financial burden of purchasing a home.

Overall, considering the FHA loan pros and cons, FHA mortgages represent a strategic choice for households looking to enter the housing market. They combine reduced initial costs, flexible credit standards, and supportive resources from mortgage professionals like F5 Mortgage. We’re here to support you every step of the way as you navigate this important journey.

Low Down Payment: A Key Advantage of FHA Loans

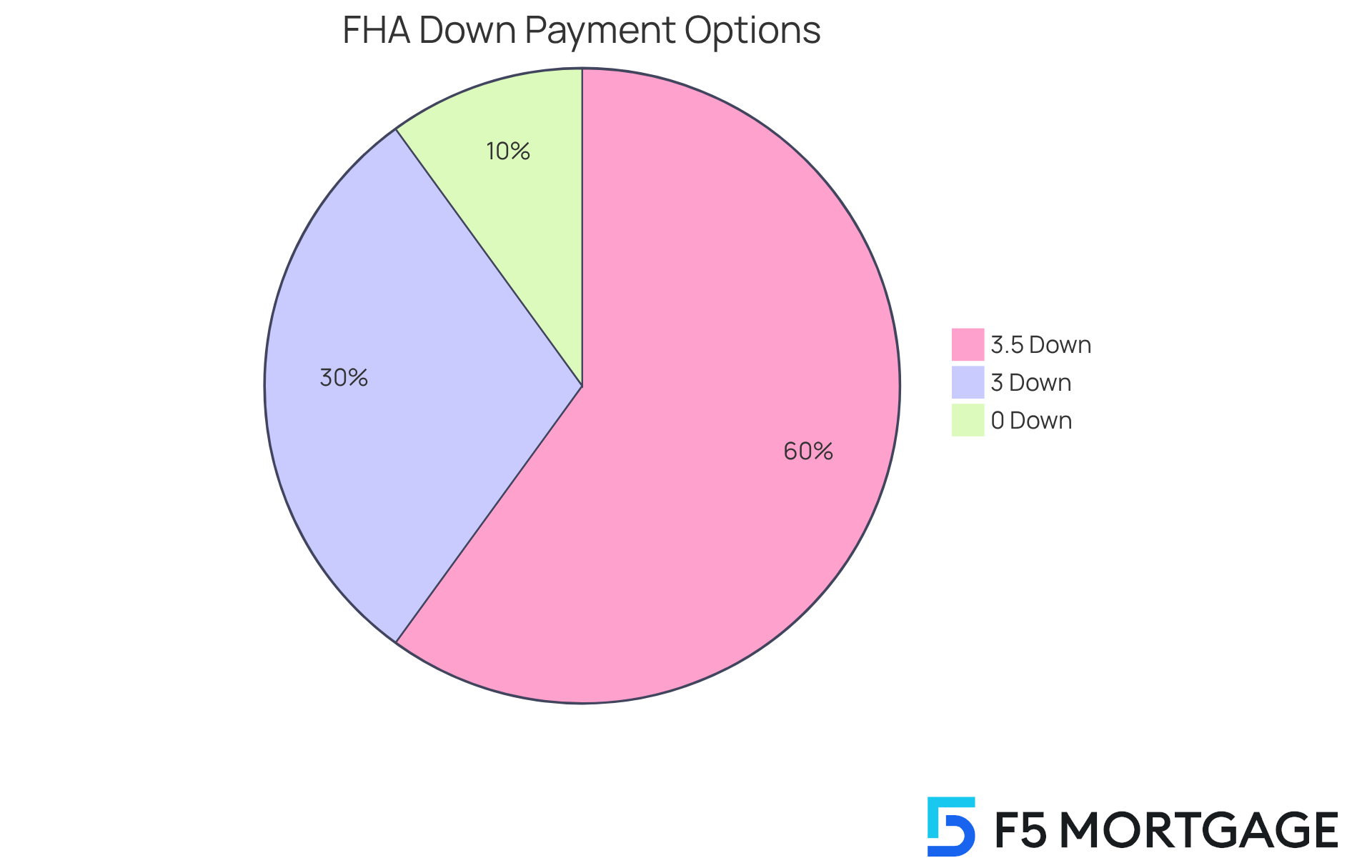

One of the FHA loan pros and cons is the standout characteristic of low down payment requirements, which can be as low as 3.5% of the purchase price. We know how challenging it can be to save for a home, and that’s why F5 Mortgage offers even more flexibility. Households may qualify to purchase a home with as little as 3% down—or even 0% down for certain financing options. This flexibility highlights the FHA loan pros and cons, opening the door to the housing market without the burden of significant savings.

At F5 Mortgage, we’re here to support you every step of the way. Our collaborative approach ensures that you receive guidance through these options, helping you leverage these benefits effectively. You can easily apply online, by phone, or through chat for a customized financial solution that suits your needs.

Contact F5 Mortgage today to explore your options and take the first step toward homeownership. We’re excited to help you on this journey!

Flexible Credit Score Requirements: Accessibility of FHA Loans

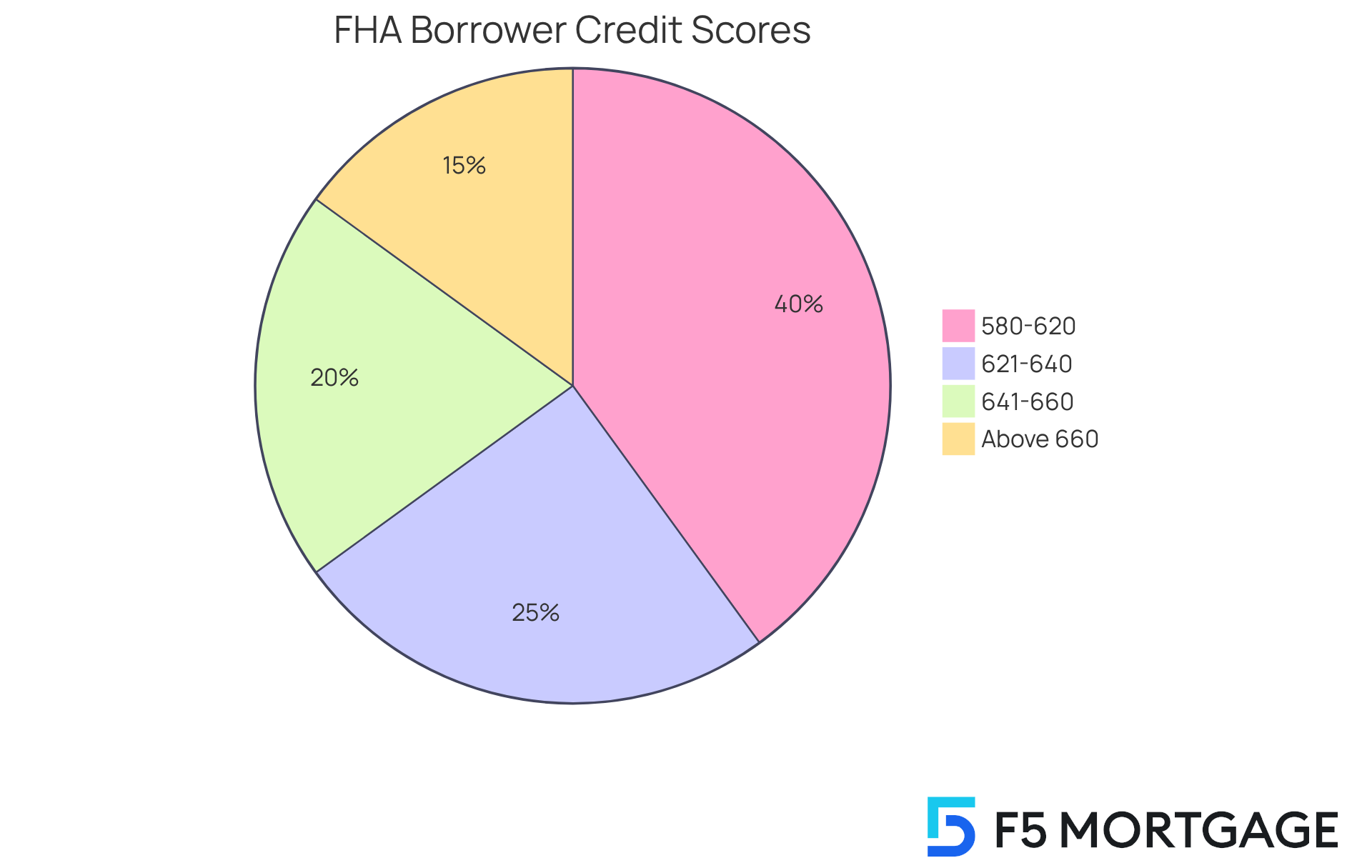

FHA mortgages stand out due to their flexible credit score criteria, making them a suitable choice for families facing credit challenges. If you have a minimum credit score of 580, you can qualify for the 3.5% down payment option. Even if your score is below this threshold, you may still be eligible by choosing a higher down payment. This flexibility opens doors for many households pursuing their dream of homeownership, as about 40% of FHA mortgage borrowers have credit scores between 580 and 620.

Moreover, you can negotiate repairs with sellers during the home buying process, which can significantly enhance the value of your purchase. At F5 Mortgage, we are dedicated to guiding you through the complexities of your credit standing and available options, helping you navigate the path to homeownership with confidence. Financial advisors often emphasize the FHA loan pros and cons as a vital opportunity for families who may find it challenging to secure funding otherwise, reinforcing the program’s role in promoting accessible homeownership.

To truly understand your choices and feel empowered, consider speaking with an F5 Mortgage specialist. We know how challenging this can be, and we’re here to support you every step of the way as you explore your particular financing options.

Mortgage Insurance Premiums: A Costly Consideration

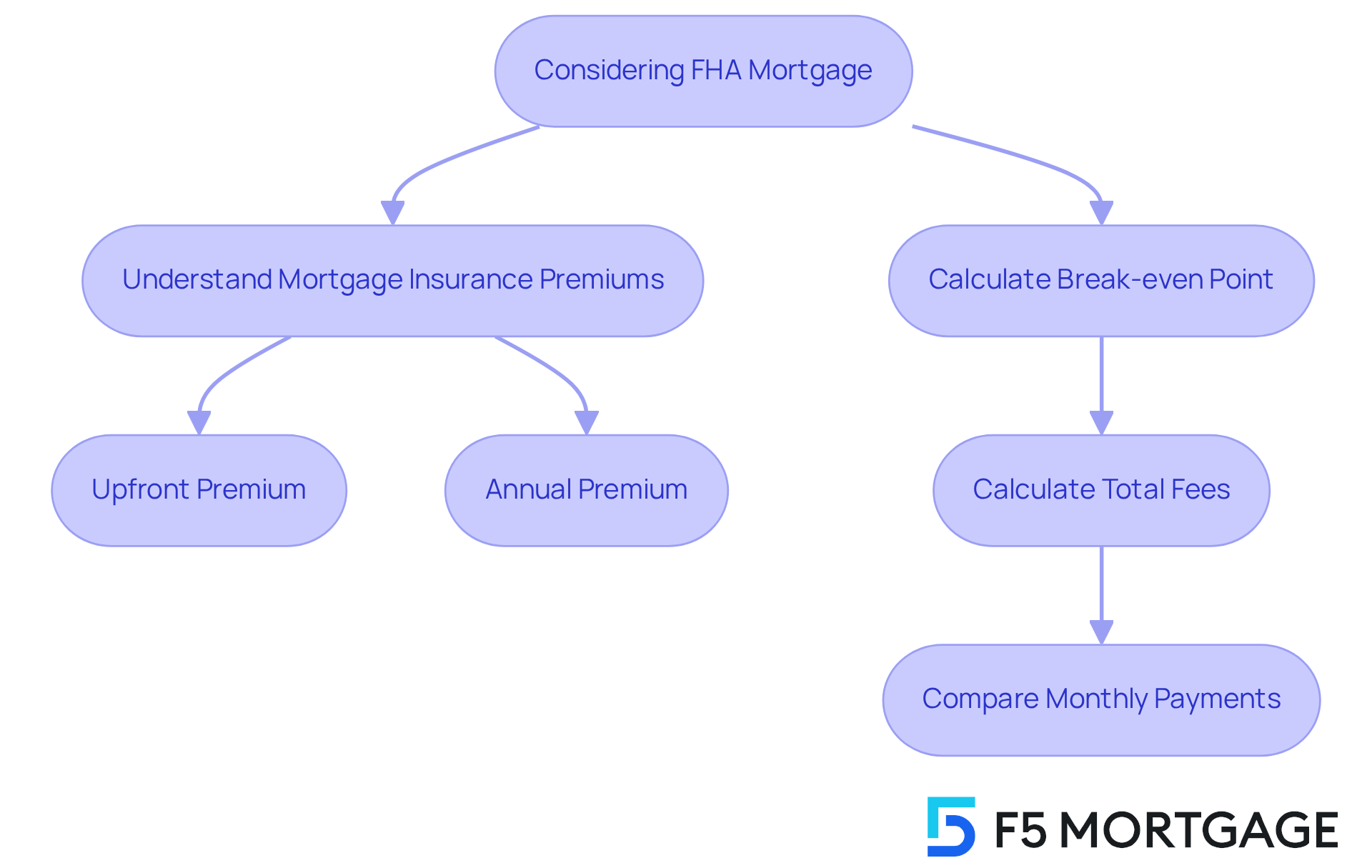

While the FHA loan pros and cons highlight numerous benefits of FHA financing, we understand that it also comes with compulsory mortgage insurance premiums (MIP). This means that borrowers need to pay both an upfront premium and an annual premium, which can increase the total expense of the financing. When considering an FHA mortgage, families must factor in the FHA loan pros and cons into their budget.

Additionally, understanding your break-even point when refinancing is crucial. This involves calculating the total fees incurred from refinancing and comparing your current monthly payment to the new payment. At F5 Mortgage, we provide detailed breakdowns to help clients understand their financial commitments. We’re here to support you every step of the way, especially if you plan to stay in your home for several years. By knowing your options, you can make informed decisions that align with your family’s needs.

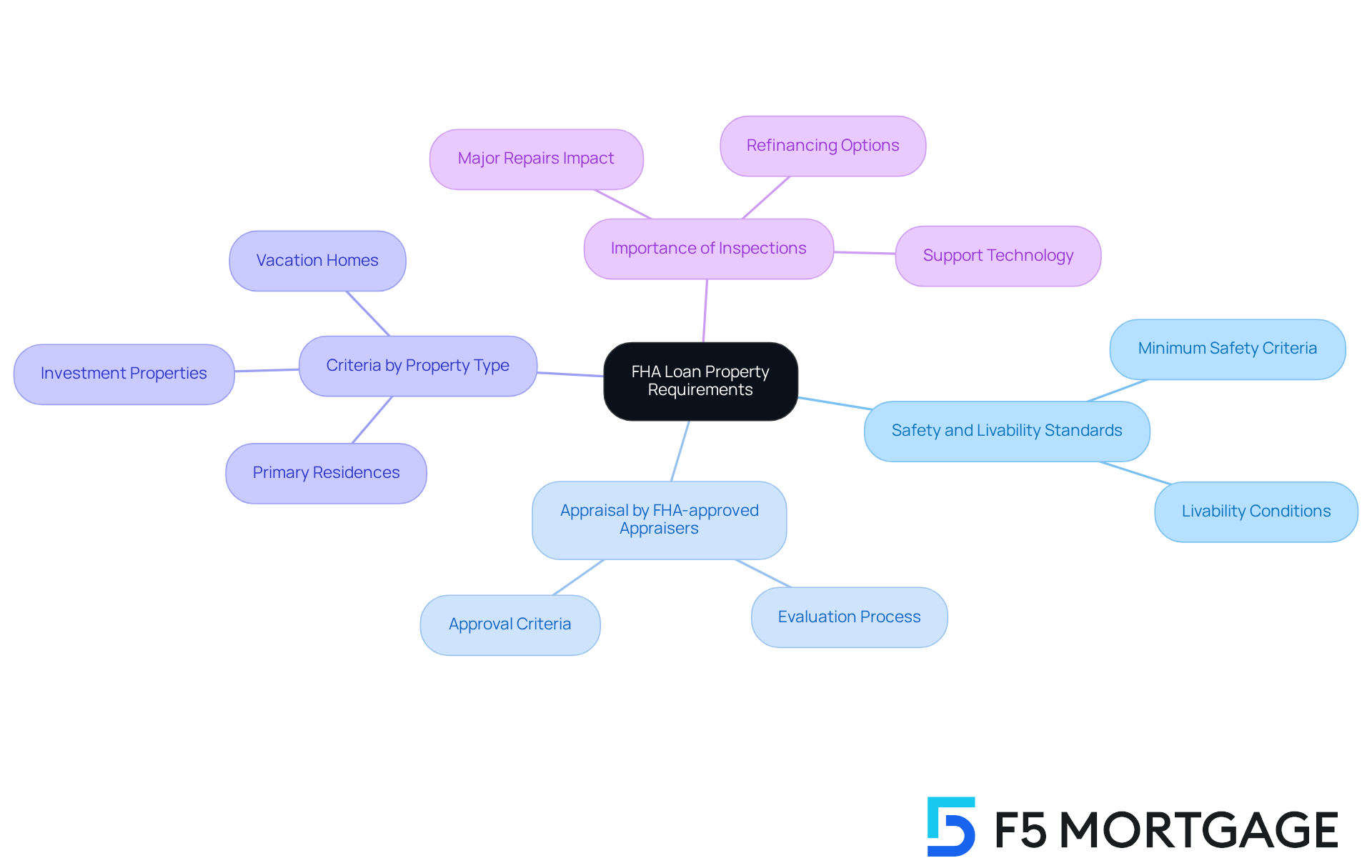

Property Requirements: Limitations of FHA Loans

FHA financing comes with specific property requirements designed to ensure that homes meet safety and livability standards. We know how challenging this can be, so it’s important to understand that properties must be evaluated by an FHA-approved appraiser, and certain criteria must be met for financing approval. Additionally, eligibility and requirements may vary based on property type, with stricter criteria for refinancing investment or vacation properties.

At F5 Mortgage, we emphasize the importance of property inspections. A home requiring major repairs may not qualify for refinancing options, which can be a concern for many families. Our user-friendly technology simplifies this process, guiding you through the requirements without pressure. We’re here to support you every step of the way, ensuring you select properties that qualify for FHA financing while protecting your investment.

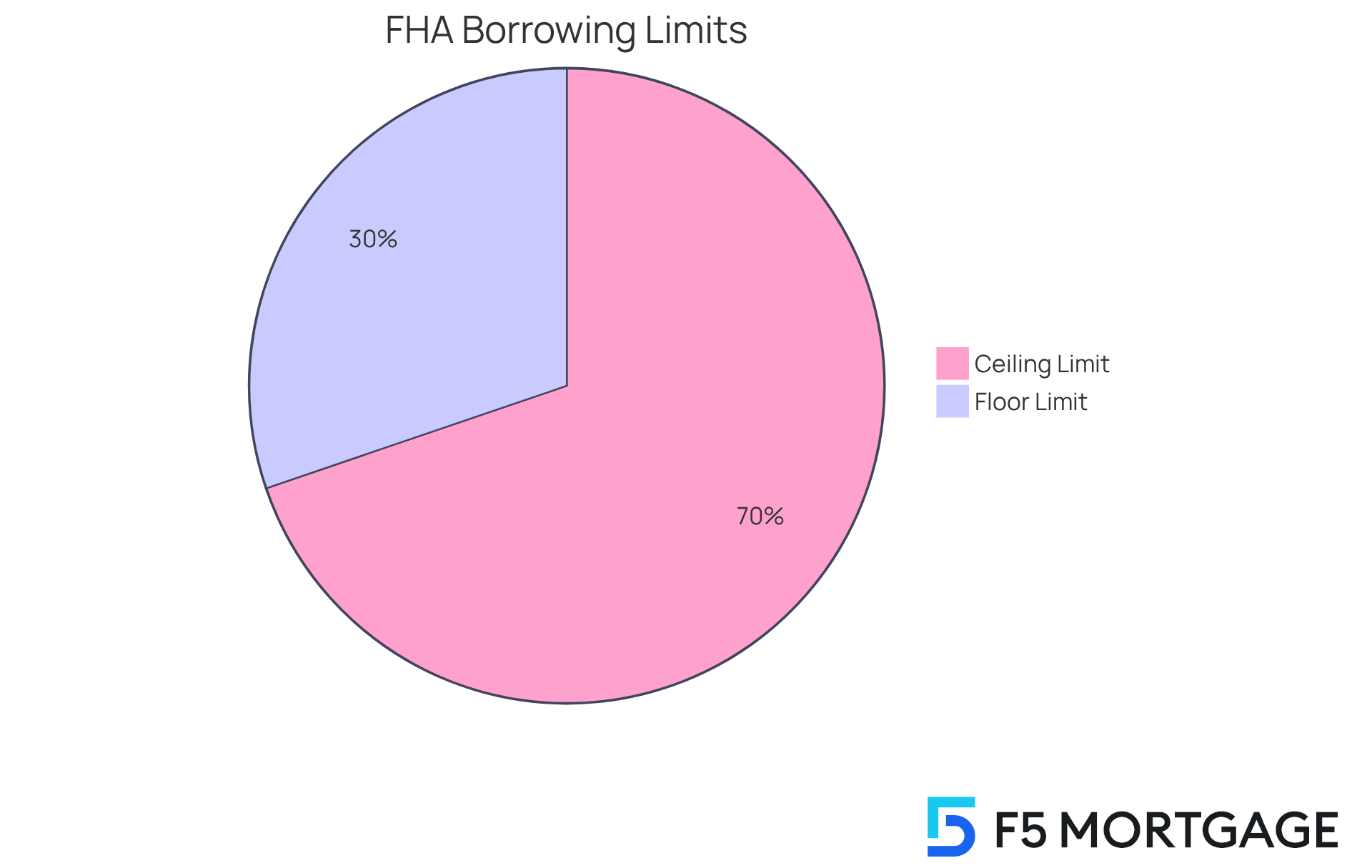

Loan Limits: Constraints of FHA Financing

Navigating the world of FHA financing can feel overwhelming, especially when it comes to understanding borrowing limits. These limits vary by location and are directly influenced by median home prices in each area. For 2025, the FHA floor limit for one-unit properties is set at $524,225, while the ceiling limit for high-cost areas reaches $1,209,750. Knowing these figures is essential, as they significantly impact your household’s borrowing capabilities.

We understand how important it is for families to find homes that fit within their financial capacity. Comprehending these limits helps you identify appropriate properties that align with your budget. At F5 Mortgage, we’re here to support you every step of the way. Our team is equipped to assist you in navigating these limits, ensuring that you find homes that suit your needs and financing options.

With the raised borrowing limits, families may discover more opportunities to purchase homes in their preferred neighborhoods. Considering the FHA loan pros and cons, this financing option becomes a feasible route to homeownership, allowing you to step into a space that truly feels like home.

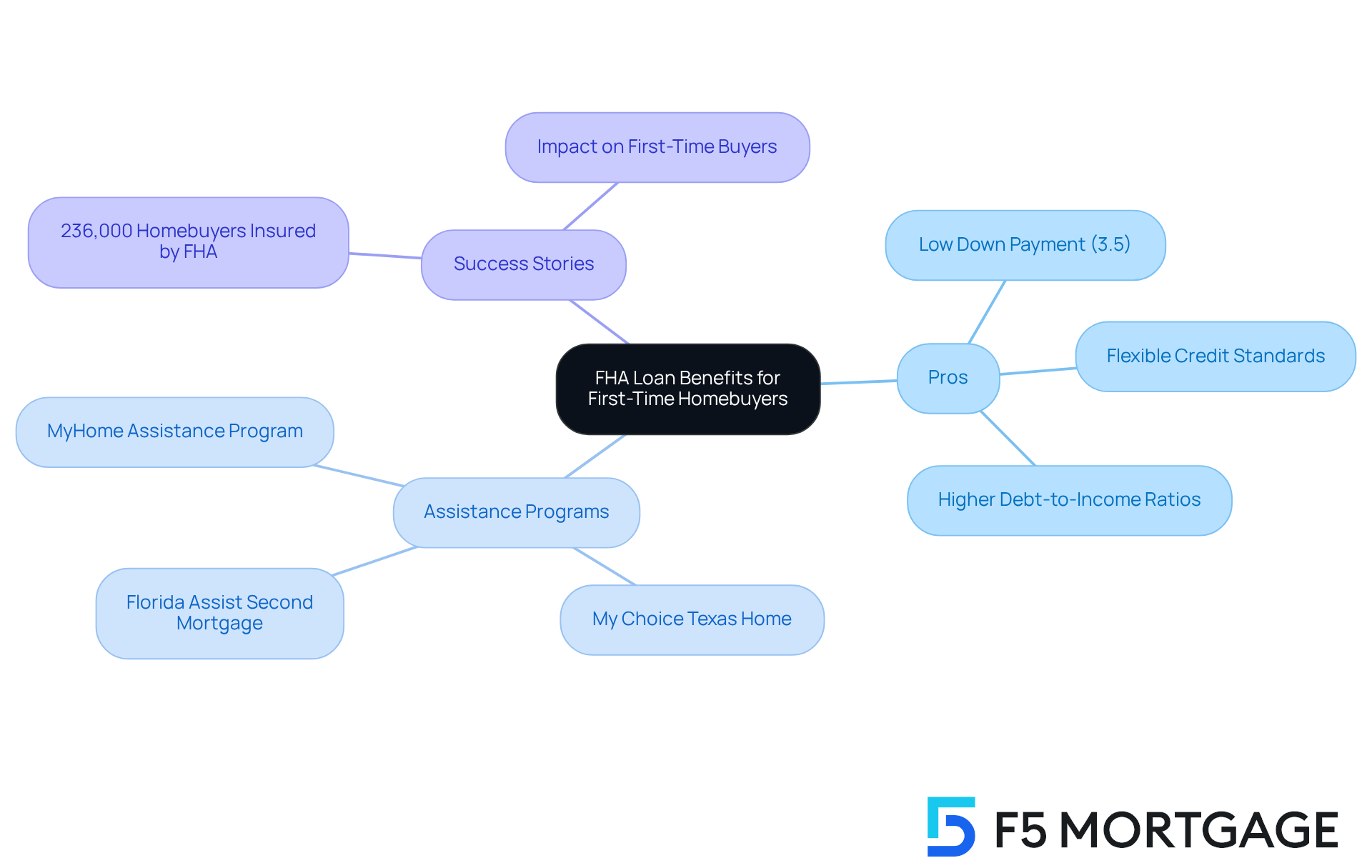

First-Time Homebuyer Benefits: FHA Loan Appeal

When considering FHA loans, it is important to weigh the FHA loan pros and cons, as they are particularly appealing to first-time homebuyers due to their low down deposit requirement of just 3.5% and more flexible credit score standards compared to traditional loans. We understand how crucial this accessibility is, especially since the median initial contribution for first-time buyers was 8% of the purchase price in 2023—an obstacle that can feel overwhelming for many. The FHA program also provides a variety of resources tailored for new purchasers, including down payment assistance initiatives and educational materials that simplify the home-buying process.

At F5 Mortgage, we are dedicated to guiding first-time buyers through these benefits, ensuring they feel well-informed and confident in their decisions. Programs like the MyHome Assistance Program in California, which offers up to 3% of the home’s purchase cost, and the My Choice Texas Home program providing up to 5% for deposit and closing support, enhance home buying possibilities for families. Additionally, Florida offers several down payment assistance programs, such as the Florida Assist Second Mortgage Program, which provides up to $10,000 for initial costs, further supporting families on their journey to homeownership.

Success stories highlight the impact of these programs, with many families achieving homeownership through FHA financing. Since early 2025, FHA has insured mortgages for over 236,000 homebuyers, including a significant number of first-time buyers who have successfully leveraged the program’s advantages to secure their homes.

Financial specialists emphasize the FHA loan pros and cons in today’s market, particularly for individuals facing challenges in saving for a down payment or meeting strict credit criteria. The FHA loan pros and cons include offering lower minimum credit score requirements and allowing debt-to-income ratios as high as 50%, creating opportunities for many who might otherwise struggle to qualify for conventional financing. With the support of F5 Mortgage, first-time buyers can navigate these options effectively, making their home-buying journey a positive experience. Testimonials from satisfied clients underscore the exceptional service provided by F5 Mortgage, reinforcing our commitment to a client-centric approach in home financing.

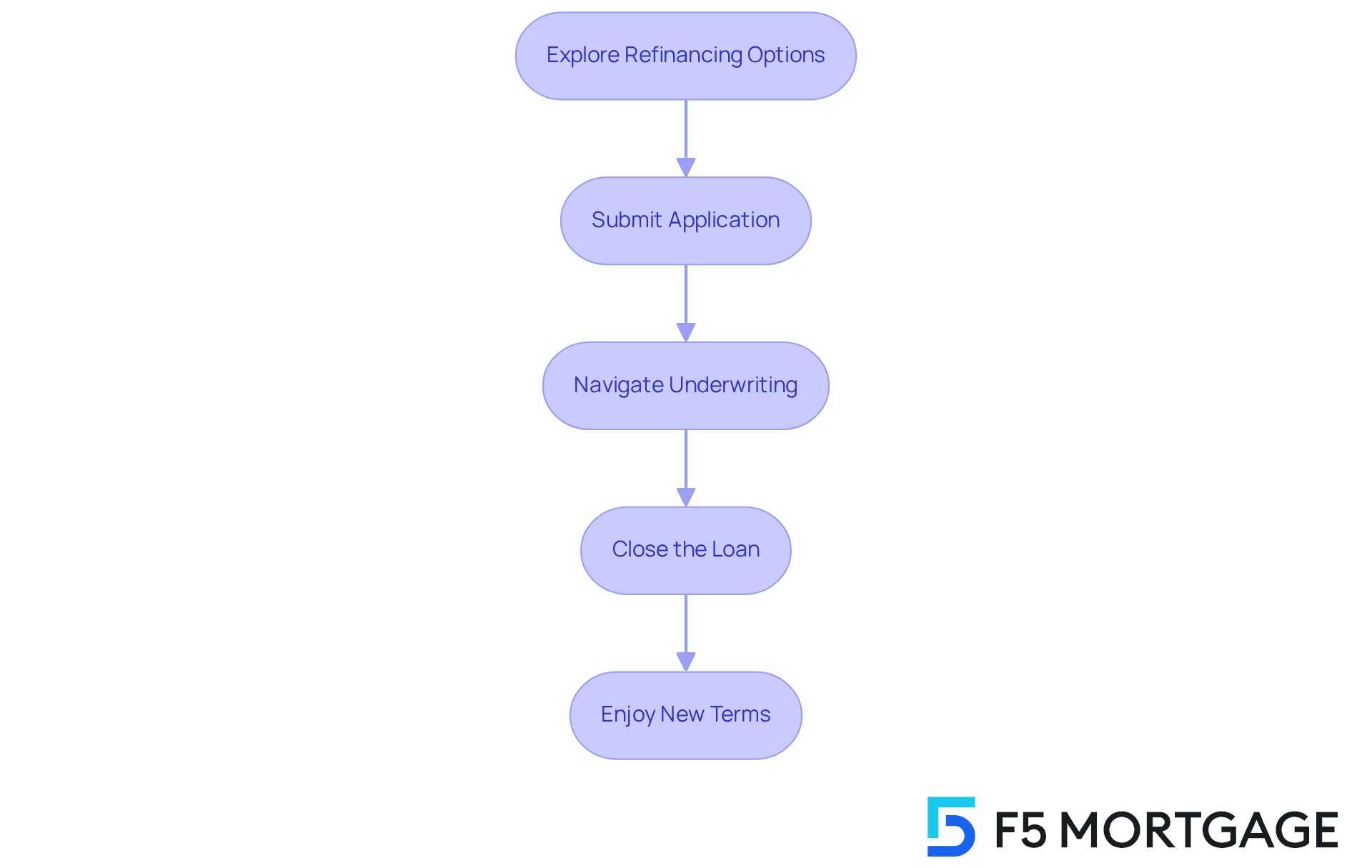

Refinancing Options: Flexibility with FHA Loans

FHA mortgages offer a variety of refinancing alternatives, including the FHA Streamline Refinance program. This program allows homeowners to refinance with minimal documentation and no appraisal required. We understand how important this flexibility can be for families looking to lower their monthly payments or access cash from their home equity.

At F5 Mortgage, we are here to guide you through these refinancing options. We ensure you understand the benefits and requirements involved. Our dedicated team supports you throughout the refinancing journey, from exploring your options and submitting your application to navigating underwriting and closing.

With access to a wide network of lenders, we help you secure competitive rates and terms tailored to your needs. Our goal is to make the refinancing process as seamless as possible, so you can focus on what truly matters—your family’s future.

Debt-to-Income Ratio Flexibility: An FHA Advantage

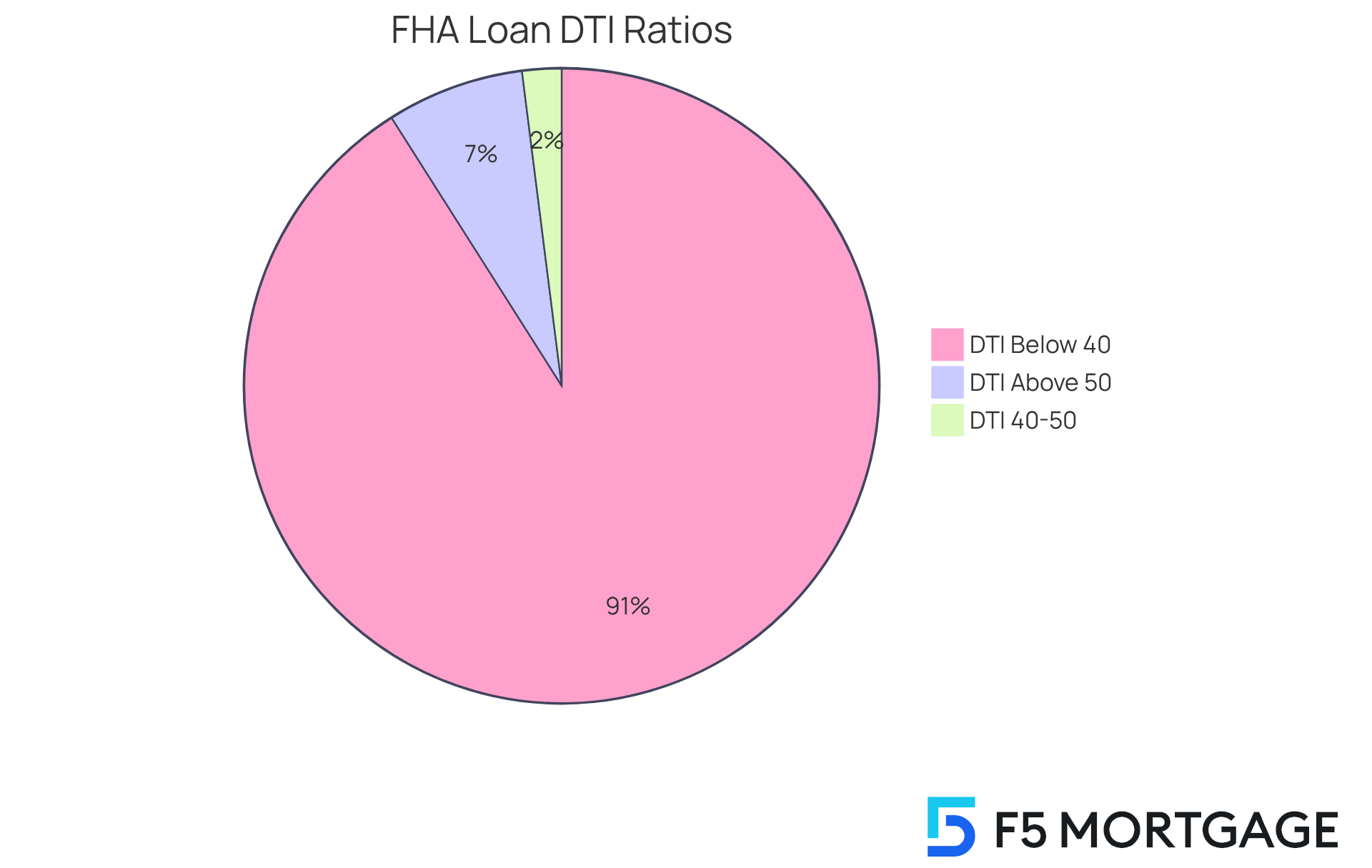

FHA mortgages are well-regarded for their flexible approach to debt-to-income (DTI) ratios, allowing families to qualify with DTI ratios as high as 56.9% under certain circumstances. This flexibility can be a game-changer for those managing existing debts, significantly improving their chances of securing financing. While the typical DTI ratio for FHA mortgages is set at 43%, the highest permissible ratio can reach 56.9% when compensating factors are present. In fact, over 91% of approved loans have a DTI below 40%, indicating that many families can still obtain financing even with higher ratios when these factors are considered.

Families with DTI ratios exceeding 50% may still find opportunities for approval, especially if they collaborate with lenders who take into account aspects like residual income, cash reserves, and a stable employment history. For instance, consider a borrower with a gross monthly income of $6,200 and total monthly obligations of $2,590—this results in a back-end DTI of 41.7%. This example illustrates how manageable debt levels can lead to successful credit applications.

Financial advisors often stress the importance of understanding DTI ratios as part of the FHA loan pros and cons. They highlight that while a higher DTI can complicate the approval process, it does not automatically disqualify a borrower, illustrating some of the FHA loan pros and cons. Lenders may take a holistic view of the borrower’s financial situation, including credit scores and employment stability, to make well-informed decisions.

Ultimately, F5 Mortgage is dedicated to helping clients navigate these complexities. We’re here to support you every step of the way, ensuring you understand how your DTI ratios impact FHA eligibility and exploring tailored options that fit your financial situation. Furthermore, an endorsement from a lender indicates that, based on the financial information provided, the borrower is a strong candidate for a mortgage—an essential factor for families seeking funding.

Disadvantages of FHA Loans: What to Consider Before Applying

When evaluating FHA financing, families should weigh the FHA loan pros and cons, as it can be advantageous but also presents several challenges. One significant drawback is the required mortgage insurance premiums, which can increase monthly payments and remain for the life of the loan unless specific conditions are met. Additionally, FHA mortgages require properties to meet strict safety and quality standards, which may limit choices for buyers in certain markets. For instance, in high-cost areas, the national borrowing limit for FHA mortgages can reach up to $1,209,750, yet this might still be inadequate for families seeking larger homes.

Moreover, families with unique financial situations, such as those with higher debt-to-income ratios, may find FHA loans more accessible. However, they must navigate the complexities of these ratios, ideally keeping them below 43%. The requirement for a minimum down payment of 3.5% for borrowers with credit scores of at least 580 can be attractive, but those with scores between 500 and 580 are required to put down at least 10%, which complicates their financial planning.

Real-world examples highlight these challenges: families looking to buy homes in competitive markets might struggle with the property standards set by FHA, limiting their options to homes that meet specific criteria. Additionally, the closing costs associated with FHA mortgages must be paid upfront, adding another layer of financial responsibility.

As families weigh these factors, F5 Mortgage is dedicated to providing transparent information and personalized consultations to help clients navigate the complexities of FHA loans. We can connect you with top realtors in your area and focus on securing the best mortgage deals tailored to your needs. Understanding the FHA loan pros and cons is essential for making informed decisions that align with your financial goals and homeownership dreams. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

FHA loans offer a wonderful opportunity for families striving for homeownership, especially in a market that can often feel overwhelming. With low down payment options and flexible credit score requirements, these loans are crafted to make home buying more attainable for those who may have encountered hurdles with traditional financing. By grasping the details of FHA loans, families can navigate their choices more effectively and make informed decisions that resonate with their financial aspirations.

This article highlights several key benefits of FHA loans, such as:

- Reduced initial costs

- Favorable approval rates

- A variety of assistance programs designed for first-time homebuyers

However, it also sheds light on essential considerations, including:

- Mandatory mortgage insurance premiums

- Specific property requirements that might limit options in competitive markets

Understanding both the advantages and the potential drawbacks is crucial for families as they evaluate their paths toward homeownership.

Ultimately, the importance of FHA loans cannot be emphasized enough. They act as a vital resource for families eager to enter the housing market, offering pathways that accommodate a range of financial situations. By engaging with knowledgeable mortgage professionals, like those at F5 Mortgage, families can feel empowered to explore their financing options and secure the home they envision. Embracing the opportunities that FHA loans provide can lead to a fulfilling and stable future in homeownership.

Frequently Asked Questions

What is an FHA mortgage?

An FHA mortgage is a home loan backed by the Federal Housing Administration, designed to help families achieve homeownership with fewer obstacles, particularly benefiting first-time homebuyers and those with less-than-perfect credit.

What are the down payment requirements for FHA loans?

The minimum down payment for FHA loans is 3.5% for borrowers with a credit score of 580 or higher. For those with credit scores between 500 and 579, a down payment of 10% is required. Additionally, some financing options may allow for as little as 3% or even 0% down.

What are the FHA financing limits for 2025?

FHA financing limits for 2025 range from $524,225 in low-cost areas to $1,209,750 in high-cost regions.

Who can benefit from FHA mortgages?

FHA mortgages are particularly beneficial for first-time homebuyers, individuals with lower incomes, and those with credit scores that may not meet traditional financing standards. They also offer down payment assistance programs to ease the financial burden.

How do FHA loans accommodate borrowers with credit challenges?

FHA loans have flexible credit score requirements, allowing borrowers with a minimum score of 580 to qualify for the 3.5% down payment option. Those with lower scores can still qualify by providing a higher down payment.

What support does F5 Mortgage offer for FHA financing?

F5 Mortgage guides clients through the FHA financing process, helping them understand the requirements and benefits, and providing customized financial solutions through online applications, phone, or chat.

Can borrowers negotiate repairs during the home buying process with FHA loans?

Yes, borrowers can negotiate repairs with sellers during the home buying process, which can enhance the value of their purchase.

Why are FHA loans considered a strategic choice for homebuyers?

FHA loans combine reduced initial costs, flexible credit standards, and supportive resources from mortgage professionals, making them a strategic choice for households looking to enter the housing market.