Overview

This article addresses the key factors that influence mortgage payments on a $200,000 loan, including:

- Interest rates

- Loan terms

- Down payments

- Property taxes

- Insurance

- Loan types

We understand how challenging navigating these elements can be, and we want to help you make sense of it all. Each of these factors plays a crucial role in determining your overall monthly payment. By grasping how they interact, you can make informed financial decisions regarding homeownership.

Recognizing the importance of these factors is essential for your journey. Interest rates can significantly impact your monthly payment, and understanding loan terms can help you choose the right option for your situation. Additionally, down payments, property taxes, and insurance are vital components that contribute to your financial commitment.

We’re here to support you every step of the way as you explore your options. By empowering yourself with knowledge about these factors, you can take control of your financial future and make decisions that best suit your needs. Remember, you are not alone in this process; we are committed to guiding you through it.

Introduction

Navigating the complexities of mortgage payments on a $200,000 loan can feel overwhelming. We understand how many factors influence your monthly costs, from fluctuating interest rates to the implications of loan terms and down payments. Each of these elements plays a vital role in shaping your financial commitment to homeownership.

As you embark on this journey, you may find yourself asking: how can you make informed decisions that align with your financial goals while steering clear of common pitfalls?

In this article, we will explore the key factors that affect mortgage payments, offering insights and strategies designed to empower you every step of the way.

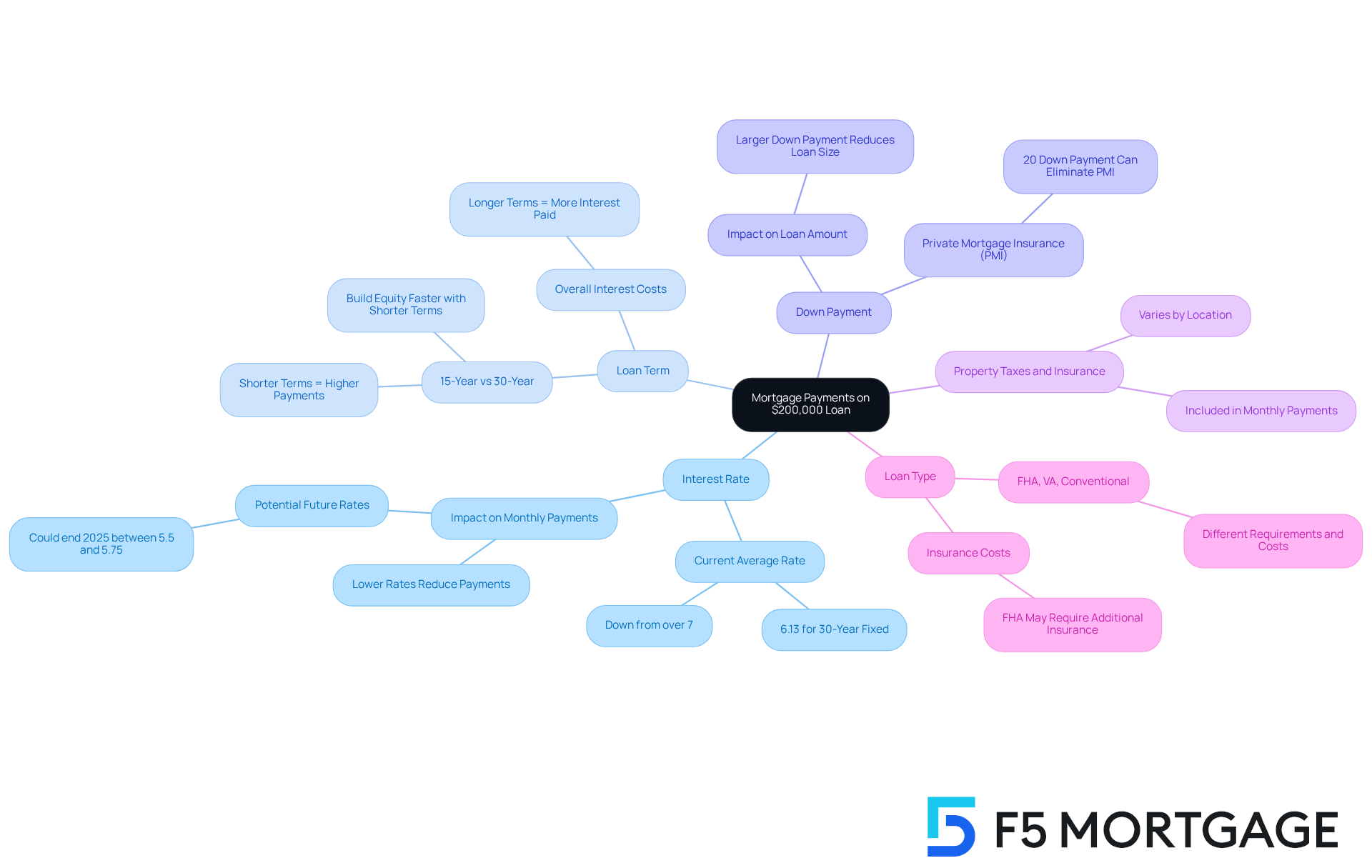

Explore Key Factors Influencing Mortgage Payments on a $200,000 Loan

When evaluating the mortgage payment on 200k, we understand how overwhelming this process can feel. Several critical factors will shape your monthly payments:

-

Interest Rate: The interest rate has a significant impact on your mortgage payment. A lower rate can mean decreased regular installments, which is a relief for many borrowers. Currently, averages for a 30-year fixed mortgage are around 6.13%, down from over 7% earlier this year. This shift is favorable for those looking to secure a loan.

-

Loan Term: The length of the loan—whether 15, 20, or 30 years—affects your monthly payments. Shorter durations typically lead to increased monthly expenses but reduced overall interest costs throughout the term. For example, while a 30-year term may provide lower monthly costs, a 15-year term allows you to build equity more quickly.

-

Down Payment: The initial sum you provide can significantly influence both your borrowing amount and interest rate. A larger down payment can reduce your recurring costs and may eliminate the need for private mortgage insurance (PMI). For instance, making a 20% contribution towards the mortgage payment on 200k can greatly lessen your monthly commitments, offering some peace of mind.

-

Property Taxes and Insurance: These costs often become part of your regular loan installments. Understanding how they are calculated is essential for effective budgeting. Property taxes can vary widely based on location, impacting your overall costs. Knowing this can help you plan better.

-

Loan Type: Different types of financing, such as FHA, VA, or conventional options, come with distinct requirements and costs. For example, FHA financing might require lower down payments but involve additional insurance costs, influencing your overall expenses.

By understanding these factors, we hope to empower you to navigate your loan options more effectively. You’re not alone in this journey; we’re here to support you every step of the way as you make informed choices that align with your financial goals.

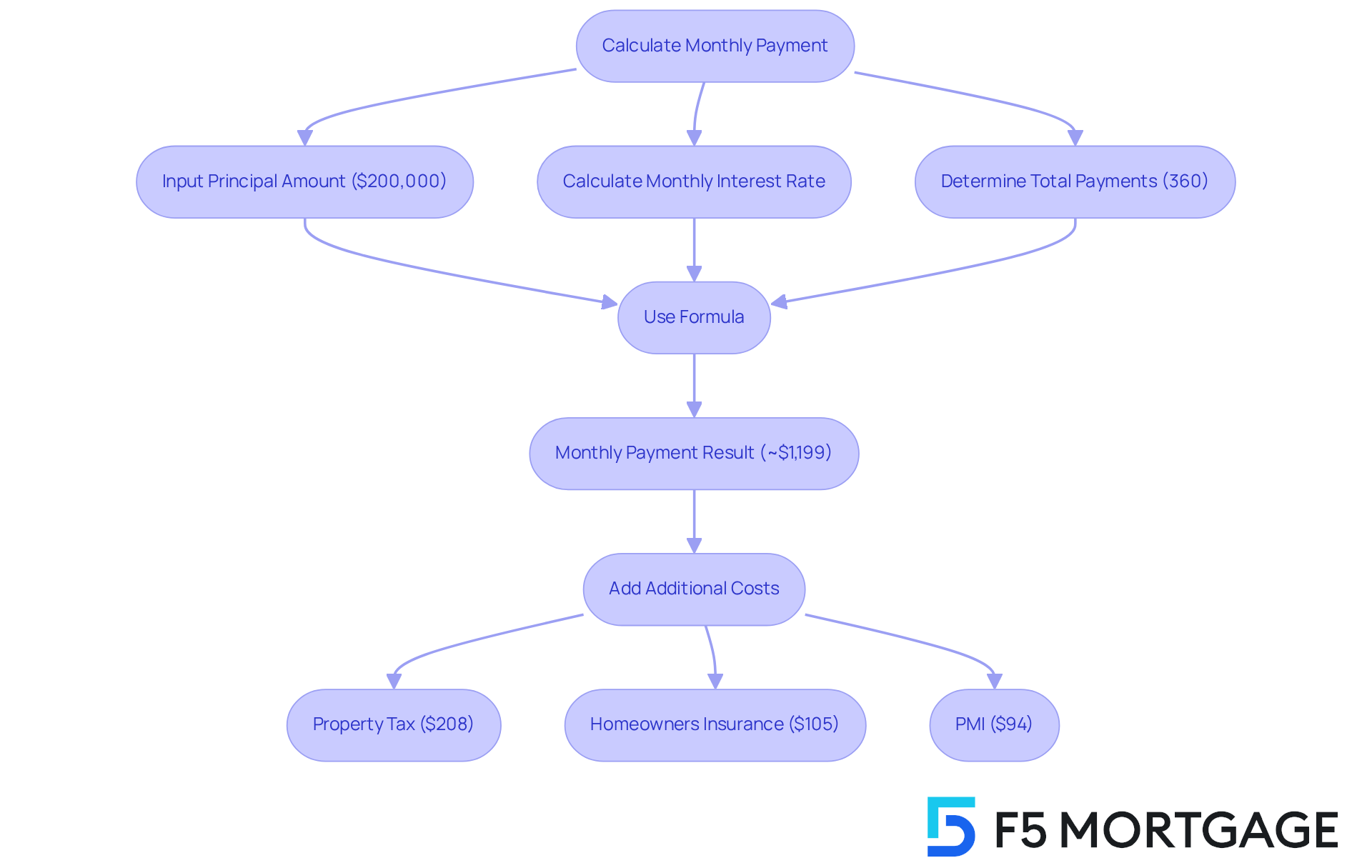

Calculate Monthly Payments: Breakdown of Costs and Amortization

Determining your mortgage payment on 200k can feel overwhelming, but we’re here to help you navigate this process. You can use the following formula to calculate your payment:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

Where:

- M = Total monthly mortgage payment

- P = Principal loan amount ($200,000)

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (loan term in months)

Let’s consider an example that many families might relate to. Assuming a 30-year fixed mortgage with a 6% annual interest rate:

- P = $200,000

- r = 0.06 / 12 = 0.005

- n = 30 * 12 = 360

When we substitute these values into the formula, we find:

M = 200,000[0.005(1 + 0.005)^360] / [(1 + 0.005)^360 - 1]

This calculation results in a monthly payment of approximately $1,199. However, it’s important to remember that the mortgage payment on 200k does not account for additional expenses like property taxes, homeowners insurance, and private loan insurance (PMI). Together, these can significantly increase your overall monthly cost, which includes the mortgage payment on 200k.

For instance, if you consider an average property tax of $208, homeowners insurance of $105, and PMI of $94, the total monthly expense, including the mortgage payment on 200k, could surpass $1,600. We understand how crucial it is to be aware of these costs, as Mark Zihmer, vice president of home loan financing at F5 Mortgage, wisely points out: “It’s always wise to know how to determine a loan cost independently.” Knowing this breakdown is vital for anticipating your financial obligations and effectively planning your budget.

Additionally, if your down payment is less than 20%, PMI will be required, which can further increase your monthly costs. With a maximum DTI ratio of 43% generally needed for home financing, understanding your DTI is essential for securing favorable interest rates.

At F5 Mortgage, we offer a variety of refinancing options for property owners in Colorado. These options can assist you in reducing your interest rate or modifying your terms to better suit your financial circumstances. Having a thorough perspective of your loan obligation ensures that you are well-prepared for homeownership. Remember, we’re dedicated to providing personalized assistance throughout this process, supporting you every step of the way.

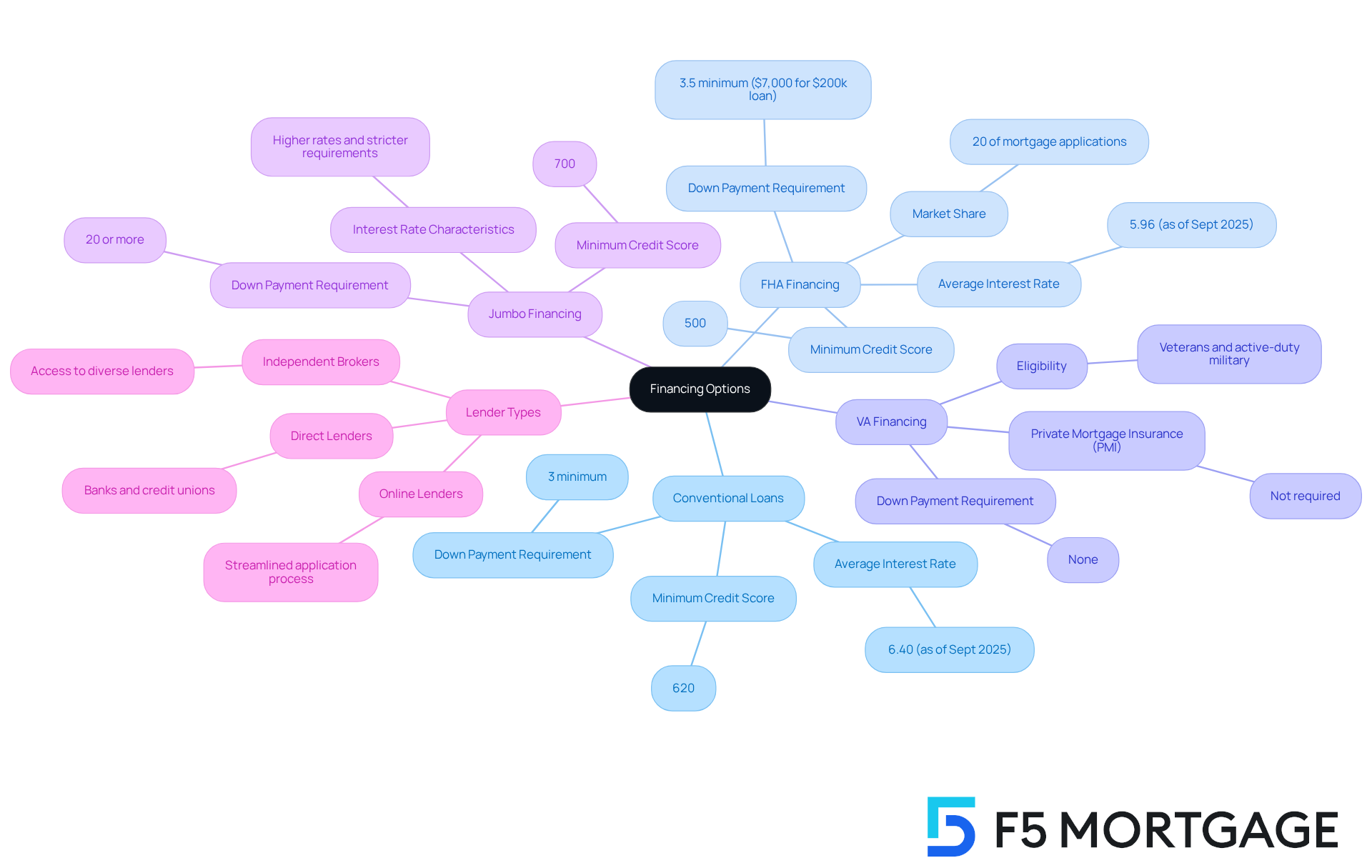

Identify Financing Options: Navigating Mortgage Types and Lenders

When considering financing options for a $200,000 mortgage payment on 200k, we know how challenging this can be. It’s essential to explore various loan types and lenders that can meet your needs:

-

Conventional Loans: These loans are not insured by the government and typically require a minimum credit score of around 620. They often necessitate a down payment of at least 3%, making them suitable for borrowers with stable income and strong credit histories. Traditional mortgages provide competitive interest rates, with the average rate at approximately 6.40% as of mid-September 2025.

-

FHA Financing: Insured by the Federal Housing Administration, FHA financing caters to low-to-moderate-income borrowers. They accept credit scores as low as 500, with a minimum deposit of only 3.5%, which equates to $7,000, representing the mortgage payment on 200k for a $200,000 loan. This accessibility makes FHA financing a popular choice, accounting for nearly 20% of all mortgage applications.

-

VA Financing: Exclusively available to veterans and active-duty military personnel, VA financing offers significant advantages, including no down payment and no requirement for Private Mortgage Insurance (PMI). Supported by the VA, these financial products enable lenders to offer favorable terms, making them an excellent choice for qualified borrowers.

-

Jumbo Financing: For those seeking to fund properties surpassing conforming limits, jumbo financing comes into play. These financial agreements generally demand a higher credit score, frequently about 700, and may require a down payment of 20% or greater. Jumbo mortgages can have stricter credit requirements and elevated interest rates, making them suitable for high-value properties.

Choosing a Lender:

-

Independent Brokers: Collaborating with an independent mortgage broker, such as F5 Mortgage, can provide access to a diverse range of lenders and tailored loan products. This personalized assistance can streamline the loan procedure and help you discover the best financing alternatives.

-

Direct Lenders: Banks and credit unions often offer their own mortgage products, which may include benefits for existing customers. However, it’s crucial to compare their offerings with other lenders to ensure you’re getting the best deal.

-

Online Lenders: These lenders can streamline the application process and often provide competitive rates. However, it’s important to research their reputation and customer service to ensure a positive experience.

By understanding the various financing options available, we’re here to support you every step of the way in making an informed decision that aligns with your financial situation and homeownership goals.

Conclusion

Understanding the intricacies of mortgage payments on a $200,000 loan is essential for any prospective homeowner. We know how challenging this can be. By examining factors such as interest rates, loan terms, down payments, property taxes, and insurance, borrowers can make informed choices that align with their financial goals. Each of these components plays a crucial role in determining the overall affordability of a mortgage, highlighting the importance of thorough research and planning.

Key insights discussed throughout this article emphasize how a lower interest rate can significantly reduce monthly payments. Additionally, the length of the loan and the size of the down payment can further influence overall costs. Recognizing the impact of property taxes, insurance, and the type of loan chosen is vital for accurately budgeting for homeownership. Understanding these elements empowers borrowers to navigate their options confidently and secure the most favorable terms.

Ultimately, being well-informed about mortgage payments on a $200,000 loan can lead to better financial decisions and a more manageable homeownership experience. As the landscape of mortgage financing continues to evolve, leveraging resources and seeking personalized assistance from experts can make all the difference. Taking proactive steps today can pave the way for a secure financial future in your journey towards homeownership. We’re here to support you every step of the way.

Frequently Asked Questions

What are the main factors influencing mortgage payments on a $200,000 loan?

The main factors include the interest rate, loan term, down payment, property taxes and insurance, and loan type.

How does the interest rate affect mortgage payments?

A lower interest rate can lead to decreased monthly payments, making it more affordable for borrowers. Currently, the average for a 30-year fixed mortgage is around 6.13%, which is lower than over 7% earlier this year.

What impact does the loan term have on monthly payments?

The length of the loan affects monthly payments; shorter terms (like 15 years) typically result in higher monthly payments but lower overall interest costs, while longer terms (like 30 years) offer lower monthly payments but may cost more in interest over time.

How does the down payment influence mortgage costs?

A larger down payment can reduce monthly payments and may eliminate the need for private mortgage insurance (PMI). For example, a 20% down payment on a $200,000 loan can significantly lower monthly commitments.

What role do property taxes and insurance play in mortgage payments?

Property taxes and insurance are often included in monthly mortgage payments, and their costs can vary based on location. Understanding these costs is essential for effective budgeting.

How does the type of loan affect mortgage payments?

Different loan types, such as FHA, VA, or conventional loans, have distinct requirements and costs. For instance, FHA loans may require lower down payments but come with additional insurance costs that can affect overall expenses.