Overview

Navigating the journey to homeownership can be daunting, but the FHA loan mortgage calculator is here to help. This vital tool empowers potential homebuyers like you to estimate monthly mortgage payments by simply entering key financial details—such as the loan amount, interest rate, and additional costs like property taxes and mortgage insurance premiums.

By mastering this calculator, you can make informed financial decisions that ease the complexities of home financing. It’s not just about numbers; it’s about understanding your mortgage obligations and the potential costs associated with FHA loans.

We know how challenging this can be, but rest assured, you’re not alone. This tool provides essential insights that can guide you through the process, helping you feel more confident in your choices. Remember, every step you take towards understanding your finances is a step towards your dream home.

Introduction

Understanding the intricacies of home financing can feel overwhelming, especially for first-time buyers who are navigating the complexities of mortgage options. We know how challenging this can be. That’s where the FHA loan mortgage calculator comes in as an invaluable tool. It empowers potential homeowners to estimate their monthly payments and gain clarity on their financial commitments.

However, many are left wondering: how can one effectively utilize this calculator to unlock the best financing opportunities? In this guide, we will explore the essential steps to master the FHA loan mortgage calculator, ensuring you can make informed decisions on your path to homeownership.

Understand the FHA Loan Mortgage Calculator

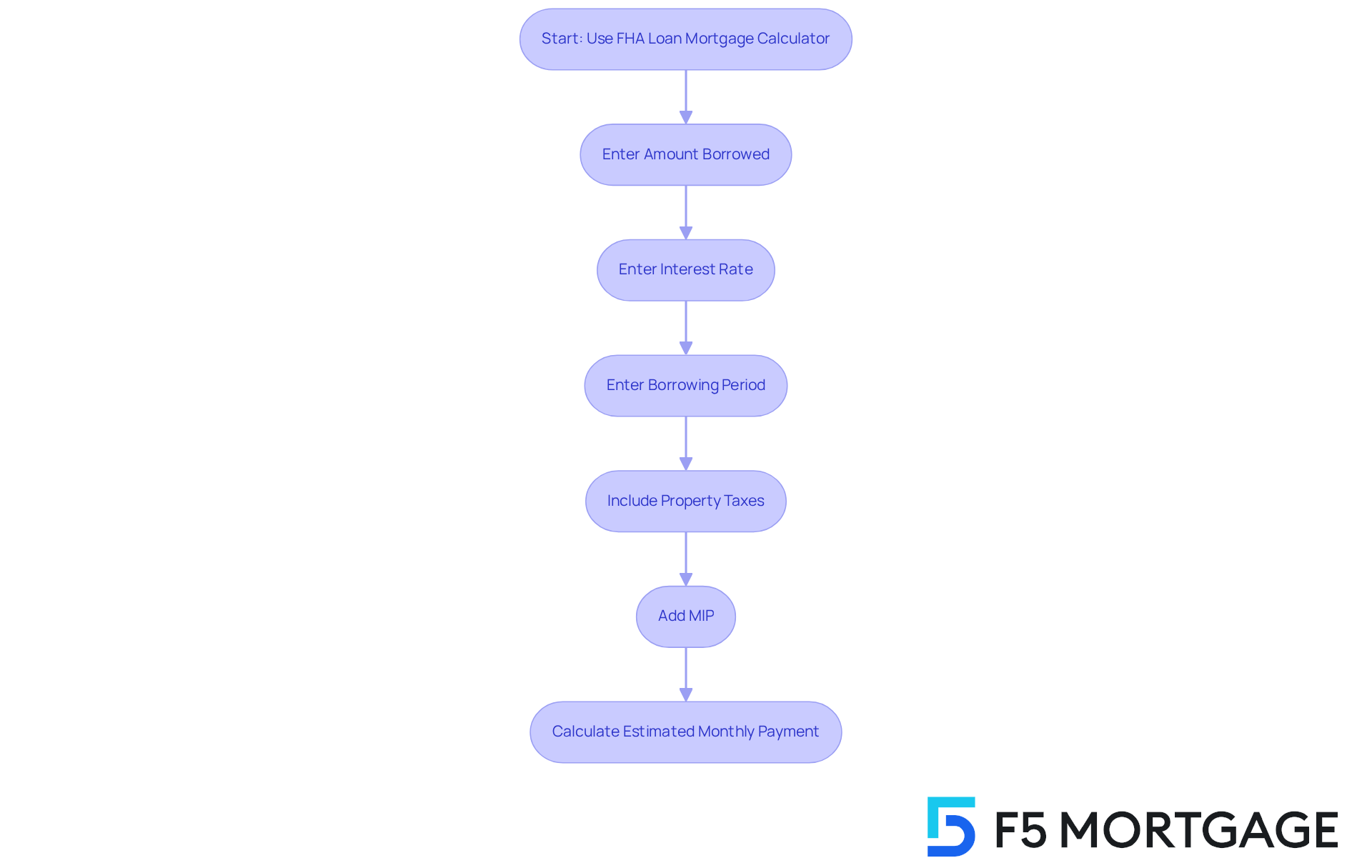

The FHA loan mortgage calculator is an essential tool for potential homebuyers, as it helps you estimate your monthly mortgage costs by entering your financial information. We know how challenging this can be, and this calculator considers vital factors such as the amount borrowed, interest rate, borrowing period, and additional expenses like property taxes and mortgage insurance premiums (MIP). By mastering its use, you can gain valuable insights into your financing options and make informed decisions.

Key components of the calculator include both upfront and annual MIP calculations, which are crucial for accurately budgeting your overall mortgage costs. For instance, if you’re considering an FHA mortgage with a purchase price of $543,300 and a 3.5% down payment, your estimated monthly payment could be around $2,819, factoring in MIP and property taxes.

Real-world examples illustrate how useful the calculator can be:

- For a home valued at $374,500, the monthly payment might be roughly $1,943.

- A $636,100 residence could result in a payment of $3,301.

These figures emphasize how significantly loan size and associated costs can impact your monthly obligations.

Understanding how to efficiently use the FHA loan mortgage calculator not only aids in financial planning but also empowers you to navigate the complexities of property financing with confidence. As financial specialists stress, having a clear grasp of your potential mortgage payments is essential for making wise financial choices in your home-buying journey. Additionally, as you consider your purchase, remember that negotiating repairs with the seller can be a strategic move. It’s common for buyers to request repairs or upgrades as part of their offer, which can influence your overall financing strategy. Ensure that the information you input into the calculator is accurate and up-to-date, as incorrect data can lead to significant inaccuracies in your estimates.

Access and Navigate the FHA Loan Calculator

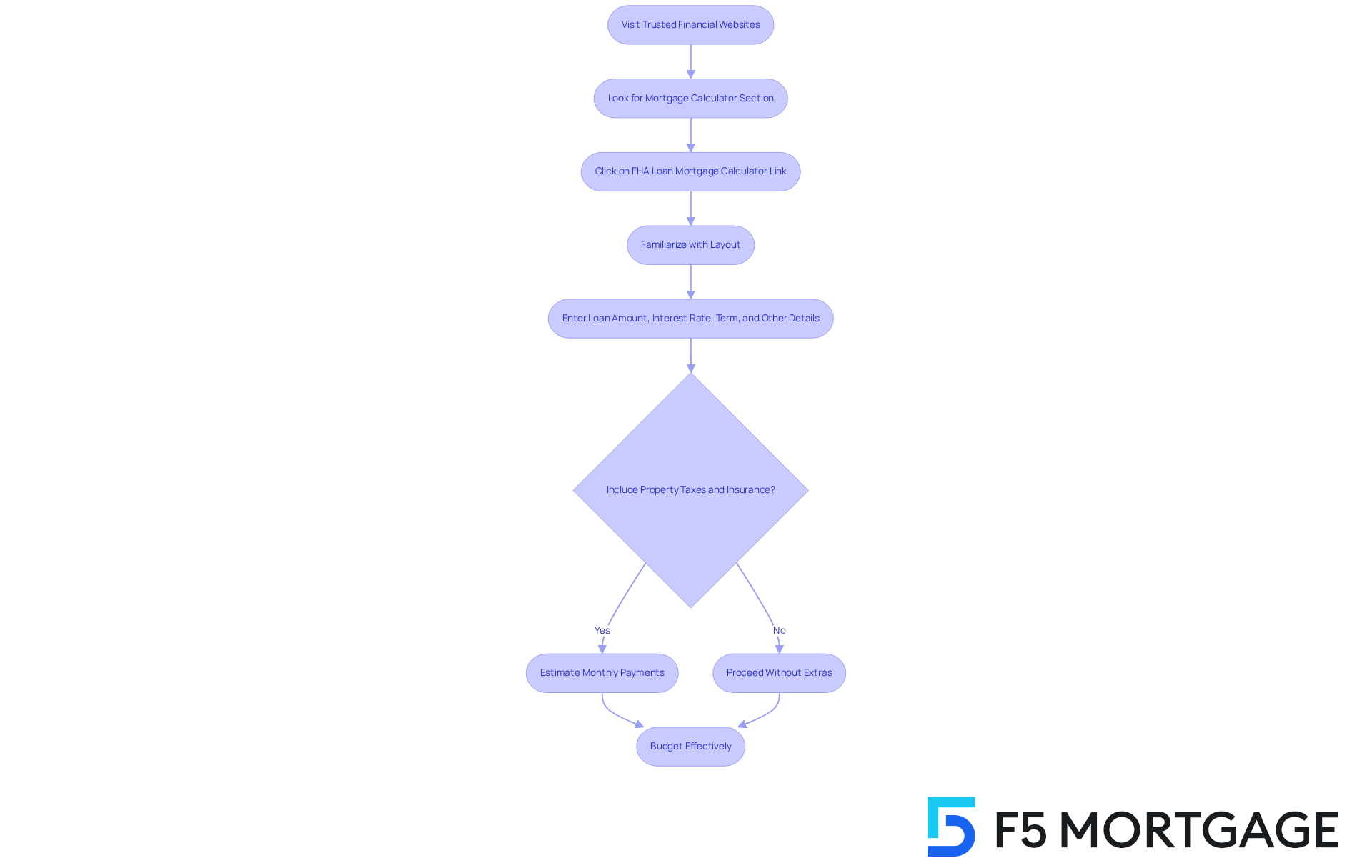

Accessing the FHA loan mortgage calculator is a simple yet crucial step in your journey of purchasing a home. We understand how overwhelming this process can be. To get started, visit trusted financial websites like FHA.com, U.S. Bank, or Zillow. Look for the mortgage calculator section, often found under home financing resources. Once you click on the FHA loan mortgage calculator link, take a moment to familiarize yourself with its layout. It typically includes sections for entering your loan amount, interest rate, term, and other important details.

As you explore the calculator, consider additional features that allow you to include property taxes and insurance. These can provide a more complete estimate of your monthly payments, helping you budget effectively. Hal M. Bundrick, a mortgage specialist, emphasizes the value of these tools: ‘Using an FHA loan mortgage calculator can greatly simplify the property purchasing process, enabling families to make informed choices regarding their financial obligations.’

At F5 Mortgage, we’re here to support you every step of the way. We offer customized assistance during the property purchasing and refinancing process, ensuring you have the resources and guidance necessary to achieve your dream of homeownership. Many users have shared how these calculators not only simplify their journey but also deepen their understanding of potential costs. For instance, one recent user discovered that by utilizing the FHA loan mortgage calculator, they could determine a suitable amount that fit their budget, leading to a successful property purchase with the outstanding service of F5 Mortgage. We’re committed to helping you navigate this important decision with confidence.

Input Essential Information for Accurate Calculations

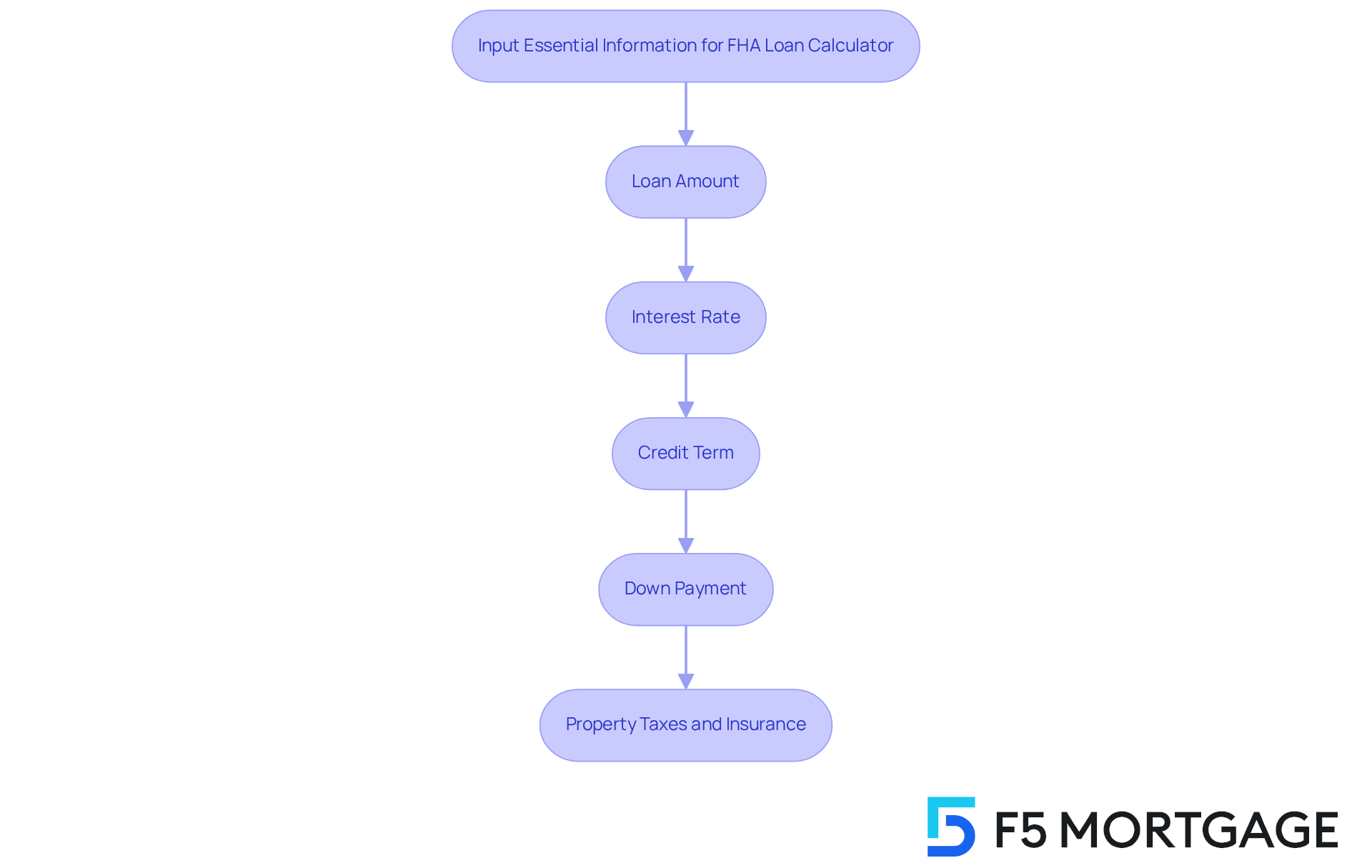

To achieve precise calculations with the FHA Loan Calculator, we know how crucial it is to input the following essential information:

- Loan Amount: This typically reflects the purchase price of the home minus any down payment.

- Interest Rate: Enter the current interest rate for FHA mortgages, which varies according to market conditions. As of September 2025, FHA mortgages are recognized for their competitive rates, making them an appealing choice for many purchasers.

- Credit Term: Specify the duration of the credit, commonly either 15 or 30 years.

- Down Payment: Input the amount you plan to contribute upfront. FHA loans necessitate a minimum upfront contribution of 3.5% for borrowers with a credit score of 580 or above, whereas those with scores ranging from 500 to 579 might have to provide 10%.

- Property Taxes and Insurance: Include estimates for property taxes and homeowners insurance, if applicable, to obtain a more precise monthly cost estimate.

By meticulously inputting this information, you can guarantee that the FHA loan mortgage calculator provides a realistic view of your possible mortgage costs. This empowers you to make knowledgeable choices regarding your home improvement. Remember, we’re here to support you every step of the way.

Interpret the Results of Your FHA Loan Calculation

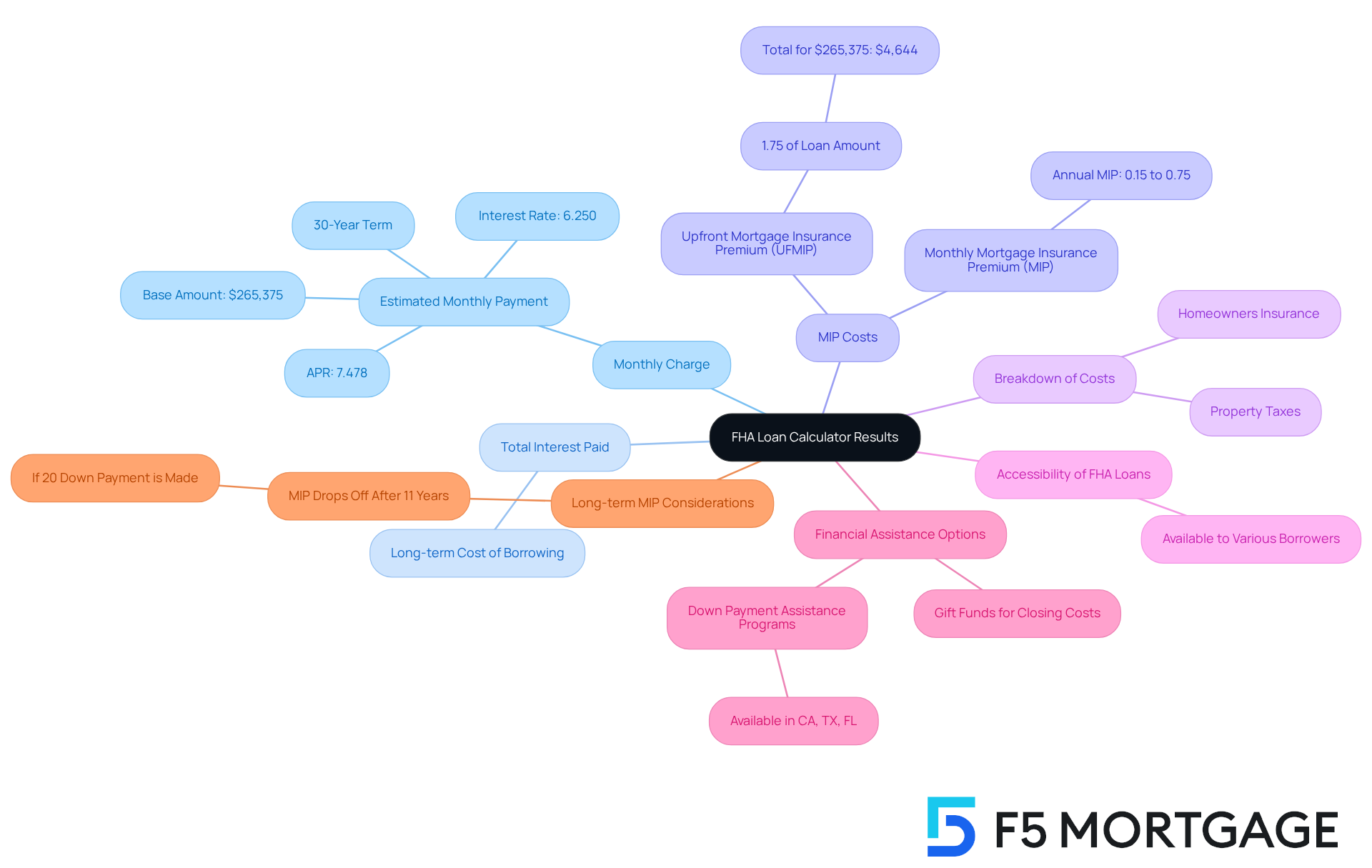

Upon entering your details, the FHA Loan Calculator will yield several key results that are essential for understanding your mortgage obligations:

Monthly Charge: This figure estimates your monthly mortgage cost, encompassing both principal and interest. For instance, a base amount of $265,375 at a 30-year term with a 6.250% interest rate results in an estimated monthly payment of approximately $1,663, with an annual percentage rate (APR) of 7.478%. We know how important it is to find competitive rates, and F5 Mortgage is here to help you achieve homeownership faster.

Total Interest Paid: This metric indicates the total interest you will pay throughout the duration of the borrowing, providing insight into the long-term cost of borrowing. Understanding this figure is crucial for assessing the overall financial impact of your FHA loan mortgage calculator, particularly when considering refinancing options that F5 Mortgage provides. We’re here to support you every step of the way.

MIP Costs: The calculator typically outlines both the upfront mortgage insurance premium (UFMIP) and the monthly mortgage insurance premiums (MIP). The UFMIP is typically 1.75% of the amount borrowed, which, for a $265,375 amount, totals approximately $4,644. This expense is included in the financing, impacting your overall amount and monthly payments. Furthermore, the yearly MIP varies from 0.15% to 0.75% of your borrowing amount, which is a considerable ongoing expense to take into account.

Breakdown of Costs: Some calculators offer a detailed breakdown of additional costs, including property taxes and homeowners insurance. This comprehensive perspective enables you to grasp your total monthly commitments more effectively, ensuring you are well-informed as you navigate your property purchasing journey with the FHA loan mortgage calculator.

Accessibility of FHA Loans: It’s important to note that FHA loans are available to a broad range of borrowers, not just first-time homebuyers. This makes them a viable option for many families looking to upgrade their homes, and F5 Mortgage is here to provide personalized support throughout the process.

Financial Assistance Options: If you are short on funds for closing costs, you can request gift funds or closing cost assistance, which can help ease the financial burden. F5 Mortgage also highlights various down payment assistance programs available in states like California, Texas, and Florida, making homeownership more accessible for families like yours.

Long-term MIP Considerations: If you put down 20% on an FHA mortgage, the MIP will automatically drop off after 11 years. This is a crucial detail for understanding long-term costs.

By interpreting these results, you can determine if the FHA loan aligns with your financial objectives and budget. Understanding the implications of mortgage insurance is vital, as it can significantly affect your monthly payment and overall affordability. With F5 Mortgage’s exceptional service, rated 4.9 from over 300 reviews, you can confidently take the next step toward your dream home.

Explore Additional Resources and Tips for FHA Loan Success

To enhance your understanding and success with FHA loans, we know how valuable the right resources and strategies can be. Here are some essential steps to consider:

FHA Guidelines: Familiarize yourself with the FHA’s official guidelines by visiting HUD.gov. Understanding the financing requirements, limits, and eligibility criteria is vital for navigating the process effectively.

Mortgage Education: Utilize comprehensive online resources, such as F5 Mortgage’s buyer’s guide and refinancing guides. These materials offer valuable insights into the complexities of FHA financing and the overall home purchasing process, helping you feel more confident.

Consult a Mortgage Broker: Engaging with a knowledgeable mortgage broker can provide personalized insights tailored to your unique financial situation. Their expertise can assist you in maneuvering through the intricacies of FHA financing and identifying the best options available.

Stay Informed: Regularly monitor market trends and interest rates, as these factors can significantly influence your mortgage options. Being informed empowers you to make timely decisions that align with your financial goals.

Utilize Online Calculators: Explore various FHA mortgage calculators available online to compare different scenarios. These tools can help you evaluate your financial circumstances and utilize the FHA loan mortgage calculator to identify the most suitable borrowing alternatives for your needs.

Consider Down Payment Assistance: Investigate state and local down payment assistance programs, such as those offered by the Golden State Finance Authority, which can provide up to 7% of the primary financing amount toward closing costs. F5 Mortgage can guide you through finding relevant programs tailored to your needs. These resources can significantly ease the financial burden of purchasing a home, especially for first-time buyers or those with low-to-moderate income.

By leveraging these resources and strategies, you’re taking important steps toward successfully securing an FHA loan and achieving your homeownership aspirations. Remember, we’re here to support you every step of the way.

Conclusion

Mastering the FHA loan mortgage calculator is an important step for anyone looking to upgrade their home. This powerful tool not only simplifies the process of estimating monthly mortgage payments but also empowers buyers to make informed financial decisions. We know how challenging this can be, and by understanding how to effectively use the calculator, potential homeowners can navigate the complexities of FHA loans with greater confidence and clarity.

Throughout this article, we highlighted key components of the FHA loan mortgage calculator, including the importance of accurate data input and the significance of understanding various cost elements such as mortgage insurance premiums, property taxes, and interest rates. Real-world examples demonstrated how different loan amounts can drastically affect monthly payments, reinforcing the need for precise calculations. Additionally, we provided essential tips for accessing the calculator and interpreting its results, ensuring that you are well-equipped to manage your financing options.

Ultimately, the journey to homeownership can be daunting, but utilizing the FHA loan mortgage calculator is a strategic move that can lead to successful financial planning. By leveraging the insights and resources discussed, you can take proactive steps toward achieving your homeownership goals. Embracing this knowledge not only enhances your financial literacy but also fosters a more empowered approach to navigating the housing market.

Frequently Asked Questions

What is the FHA loan mortgage calculator?

The FHA loan mortgage calculator is a tool that helps potential homebuyers estimate their monthly mortgage costs by inputting financial information such as the amount borrowed, interest rate, borrowing period, and additional expenses like property taxes and mortgage insurance premiums (MIP).

Why is the FHA loan mortgage calculator important for homebuyers?

It provides valuable insights into financing options and helps homebuyers make informed decisions regarding their mortgage payments and overall financial planning.

What key components does the FHA loan mortgage calculator consider?

The calculator considers factors such as the loan amount, interest rate, borrowing period, upfront and annual MIP calculations, property taxes, and other relevant expenses.

Can you provide an example of estimated monthly payments using the FHA loan mortgage calculator?

Yes, for a home valued at $543,300 with a 3.5% down payment, the estimated monthly payment could be around $2,819. Other examples include a home valued at $374,500 resulting in a payment of roughly $1,943, and a $636,100 residence leading to a payment of $3,301.

How can inaccurate information affect the estimates from the calculator?

Inputting incorrect or outdated information can lead to significant inaccuracies in the estimated monthly mortgage payments.

Where can I access the FHA loan mortgage calculator?

You can access the FHA loan mortgage calculator on trusted financial websites such as FHA.com, U.S. Bank, or Zillow, typically found under the mortgage calculator section.

What additional features should I look for in the FHA loan mortgage calculator?

Look for features that allow you to include property taxes and insurance in your calculations for a more complete estimate of your monthly payments.

How can using the FHA loan mortgage calculator simplify the home purchasing process?

It helps families make informed choices about their financial obligations, simplifies budgeting, and deepens the understanding of potential costs associated with homeownership.