Overview

This article highlights how families can effectively use interest rate buy downs to manage mortgage costs, making homeownership more accessible. We understand how challenging this can be, and by paying an upfront fee to lower interest rates temporarily or permanently, families can significantly reduce their monthly payments. This guide offers detailed insights into:

- Calculating costs

- Negotiating with sellers

- Understanding market conditions

Our goal is to empower you to maximize the benefits of this financing strategy, ensuring you’re supported every step of the way.

Introduction

Navigating the complexities of mortgage financing can often feel daunting. We understand how challenging this can be, especially for families seeking to make homeownership a reality. One strategy that can significantly ease this journey is the interest rate buy down. This option allows borrowers to reduce their monthly payments by paying an upfront fee.

In this article, we will explore the intricacies of interest rate buy downs, delving into their benefits and the various options available to families. However, as enticing as this strategy may seem, it’s important to consider the potential pitfalls and factors that families must weigh before committing.

We’re here to support you every step of the way.

Understand Interest Rate Buy Downs

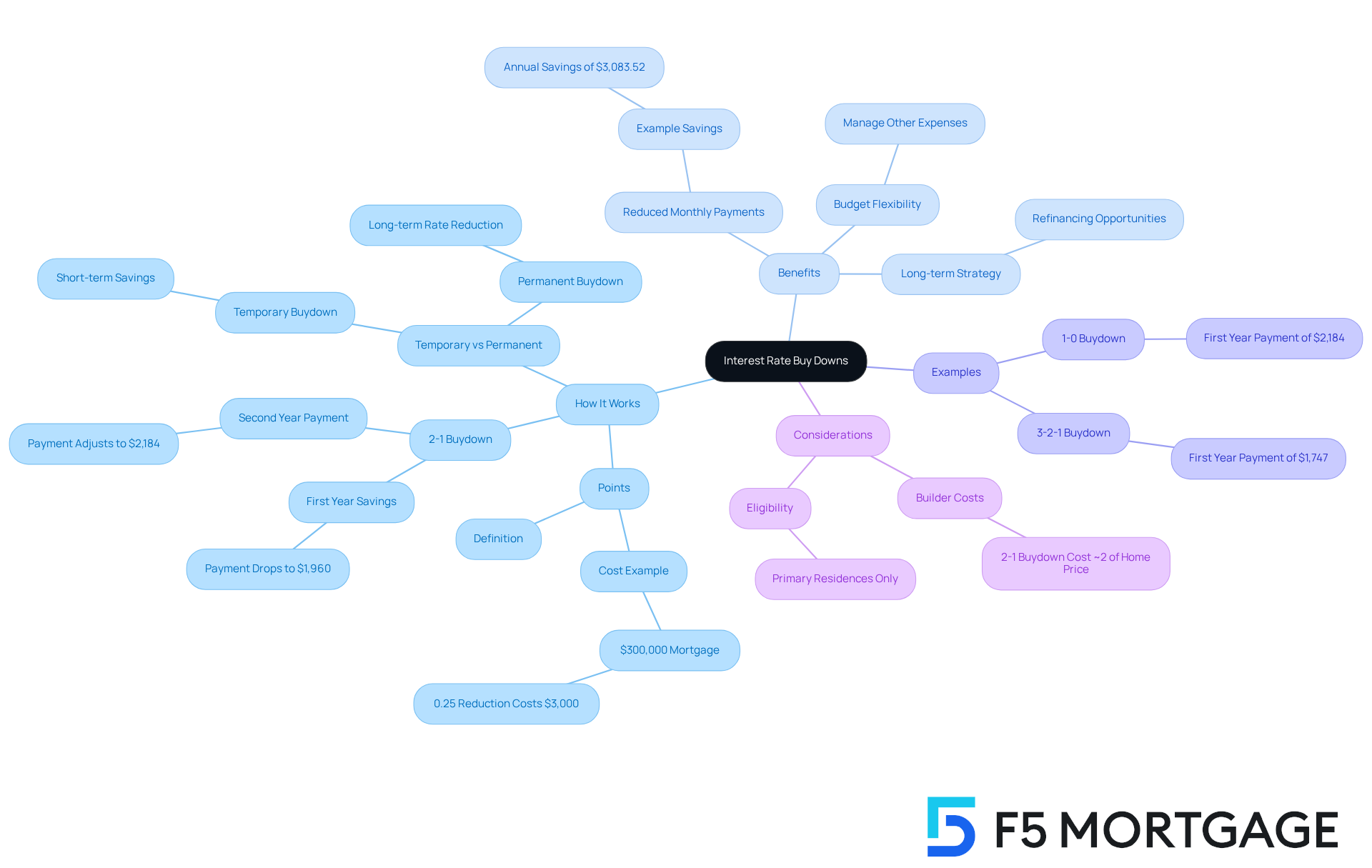

Navigating the world of mortgages can be overwhelming, but understanding strategies like an interest rate buy down can make a significant difference. This financing approach allows you, the borrower, to pay an upfront fee for an interest rate buy down to reduce your interest rate, either temporarily or permanently. By doing so, you can experience substantial reductions in monthly payments, making homeownership much more accessible for families like yours. It’s essential to grasp how this mechanism works to manage your mortgage costs effectively.

Typically, borrowers pay ‘points’—where one point equals 1% of the loan amount—to secure a reduced interest rate. For instance, if you have a $300,000 mortgage, reducing the interest by just 0.25% for one point would require an upfront payment of $3,000. This strategy is particularly advantageous in a high-interest environment as it utilizes an interest rate buy down, allowing families to gradually adjust to their mortgage payments without feeling overwhelmed.

Consider the scenario of a 2-1 buydown, where the cost of borrowing decreases by 2% in the first year and 1% in the second year. This can lead to significant savings. For example, a household with a $350,000 loan at a 7% interest rate could see their first-year payment drop to $1,960, saving $457 each month. By the second year, the payment would adjust to $2,184, still reflecting a considerable decrease compared to the original rate. It’s important to note that the builder expense for a 2-1 buydown is roughly 2% of the home sales price, a crucial factor for families considering this option.

In California, many households often view rate-and-term loans as a refinancing choice to further enhance their financial situation. These loans allow homeowners to replace their existing mortgage with a new one that offers better terms, potentially leading to lower monthly payments. This flexibility is particularly beneficial during periods of declining borrowing costs, enabling families to save money on their overall loan amount.

The benefits of financing buy downs extend beyond immediate savings. They provide families with the flexibility to manage their budgets more effectively, opening up possibilities for investments in home improvements or other essential expenses. Mortgage specialists emphasize that interest rate buy downs can serve as a valuable resource for families navigating a changing lending landscape, helping them secure lower payments and consider refinancing when rates drop. By combining the advantages of loan buy downs with the benefits of term loans, families can strengthen their mortgage strategy for long-term financial well-being.

In summary, loan buy downs can significantly alleviate the financial burden of mortgage payments, making them a favorable choice for families striving to enhance their homeownership experience. We understand how challenging this journey can be, and we’re here to support you every step of the way.

Explore Types of Mortgage Buy Downs

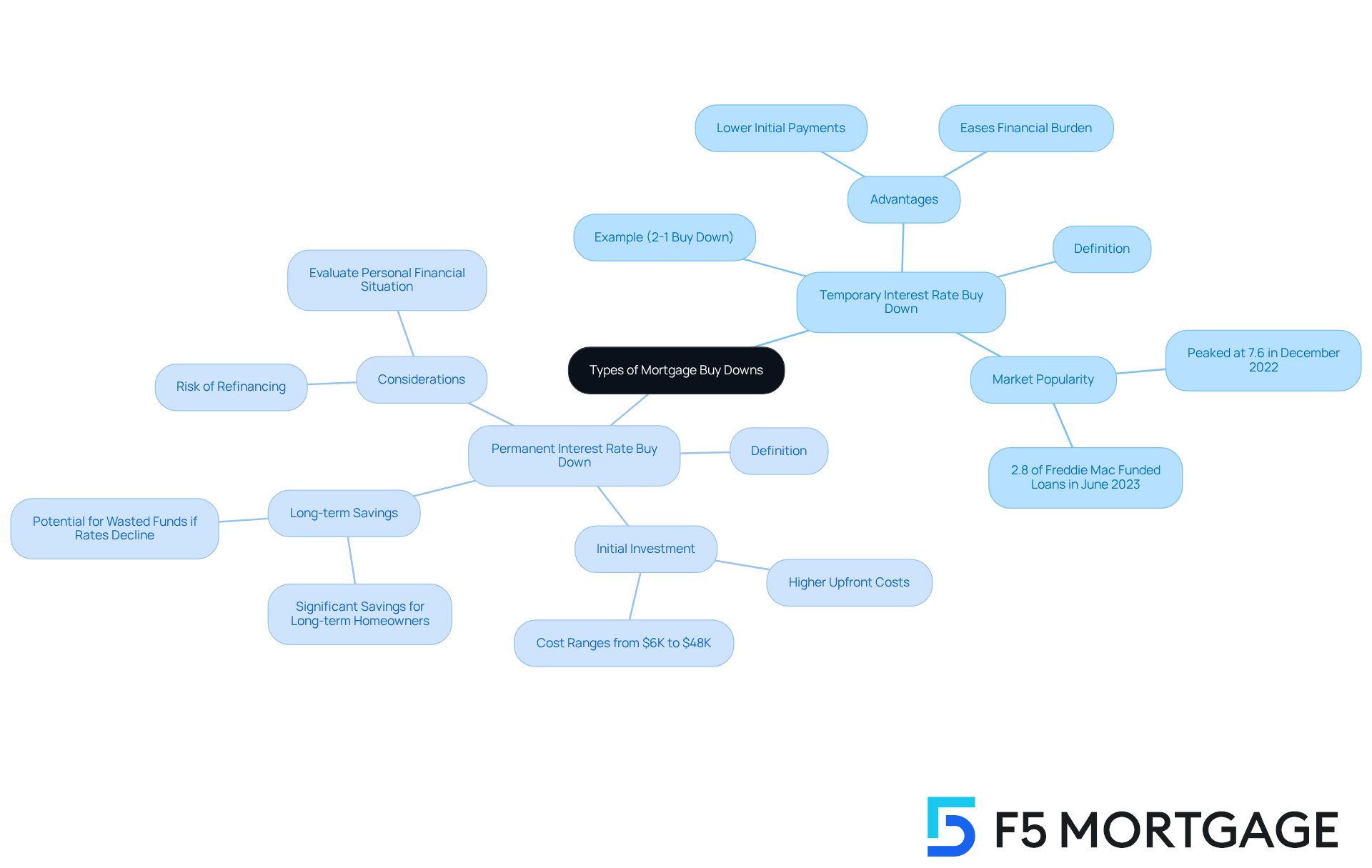

Mortgage buy downs primarily fall into two categories: temporary interest rate buy down and permanent interest rate buy down.

Interest rate buy down options, known as temporary buy downs, lower the borrowing cost for a specified duration, typically during the early years of the loan. For instance, a 2-1 buydown reduces the loan cost by 2% in the first year and 1% in the second year, returning to the initial figure afterwards. This structure can be especially advantageous for families expecting income growth, as it permits lower initial payments while gradually adapting to full mortgage expenses. Notably, temporary buydown mortgages peaked at 7.6% in December 2022, reflecting their growing popularity in today’s market.

Permanent Buy Downs: This method entails paying points in advance to obtain a reduced financial charge for the complete loan duration. Although it requires a higher initial investment, the long-term savings can be substantial, particularly for families planning to stay in their homes for an extended period. However, it is crucial to consider the risk of wasted funds if borrowing costs decline after an interest rate buy down has been acquired. Evaluating your personal financial situation and future plans is essential in deciding which option best suits your needs. As Bomin Kim, Macro & Housing Economics Manager, observes, “This trade-off isn’t surprising since the lower initial payments must be compensated by either higher upfront fees, a greater interest, or both.”

Families utilizing temporary buy downs often find that these arrangements help ease the financial burden during the early years of homeownership. This allows them to allocate savings towards other priorities. In contrast, permanent buy downs may offer more significant savings over time, making them appealing for those committed to long-term homeownership. We know how challenging this can be, so consulting with financial advisors can provide valuable insights into the best choice based on individual circumstances. We’re here to support you every step of the way.

Implement the Buy Down Process

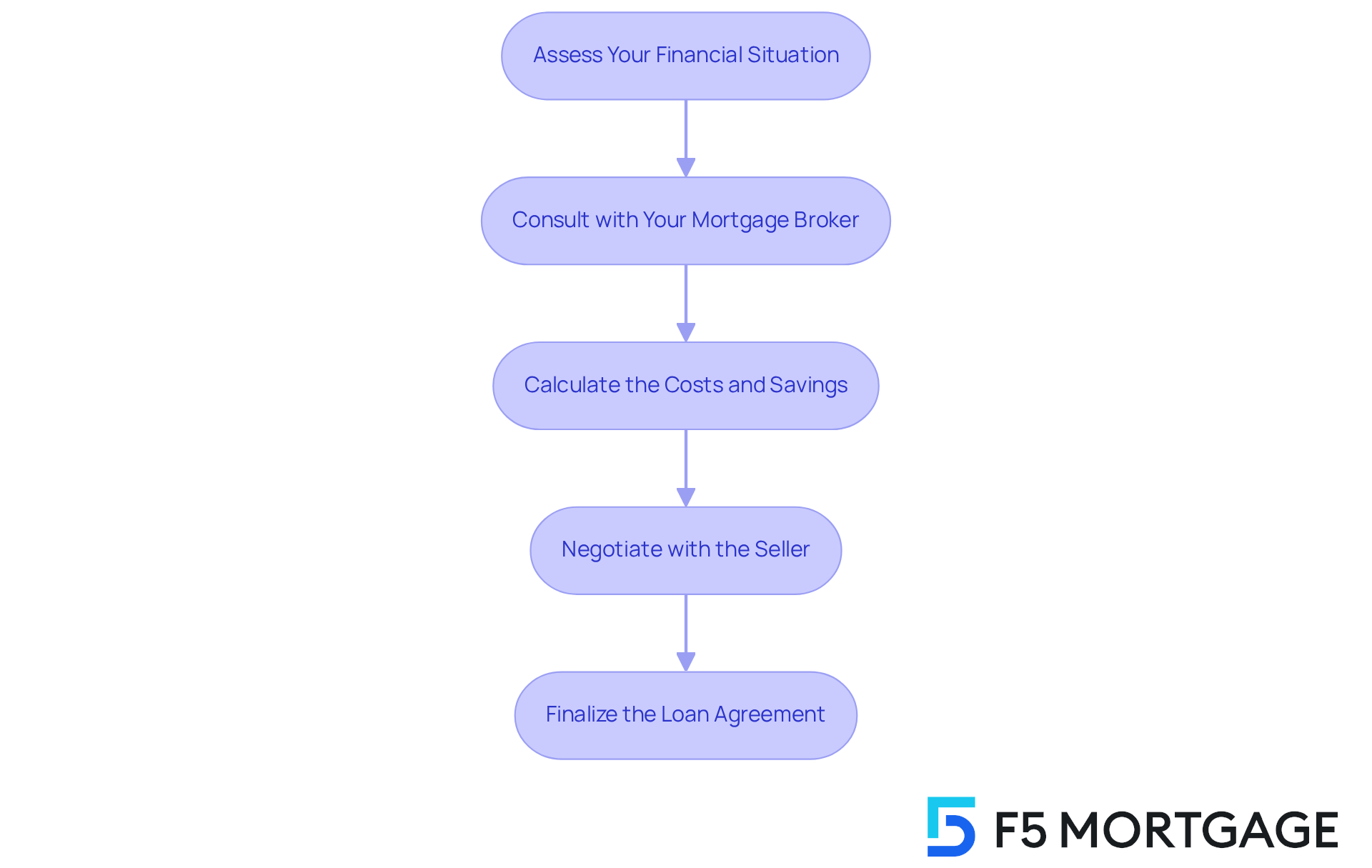

To effectively implement an interest rate buy down, it’s essential to take thoughtful steps that align with your financial journey:

-

Assess Your Financial Situation: Start by evaluating your budget to determine how much you can comfortably pay upfront for the buy down. Reflect on your long-term plans for the home and how long you intend to stay; this will significantly influence your decision.

-

Consult with Your Mortgage Broker: We know how challenging this can be, so engaging with a knowledgeable mortgage broker, like those at F5 Mortgage, can make a difference. They can guide you through various strategies for interest rate buy down tailored to your unique financial situation, helping you navigate the complexities of the mortgage landscape with confidence.

-

Calculate the Costs and Savings: Utilize a mortgage calculator to estimate the potential savings on your monthly payments resulting from the interest rate buy down. It’s important to evaluate these savings against the initial expenses, which may include application fees (ranging from $75 to $500), origination fees (between 0.5% and 1.5% of the loan amount), and discount points (1% of the loan amount for a 0.25% interest decrease). Understanding your break-even point is crucial for assessing the financial viability of the interest rate buy down. For instance, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months. This insight empowers you to make informed decisions.

-

Negotiate with the Seller: If applicable, consider negotiating with the seller to cover part of the buy down cost as part of the purchase agreement. This strategy can significantly reduce your upfront expenses, making the interest rate buy down more attainable and manageable for your family.

-

Finalize the Loan Agreement: After selecting the type of buy down and negotiating costs, finalize your mortgage agreement with the lender. Ensure that all terms are clearly outlined to avoid any misunderstandings in the future. Additionally, F5 Mortgage offers a variety of loan programs, including both standard and nontraditional options, to cater to diverse financial needs, ensuring you have the best possible solutions for your home financing. We’re here to support you every step of the way.

Navigate Challenges and Considerations

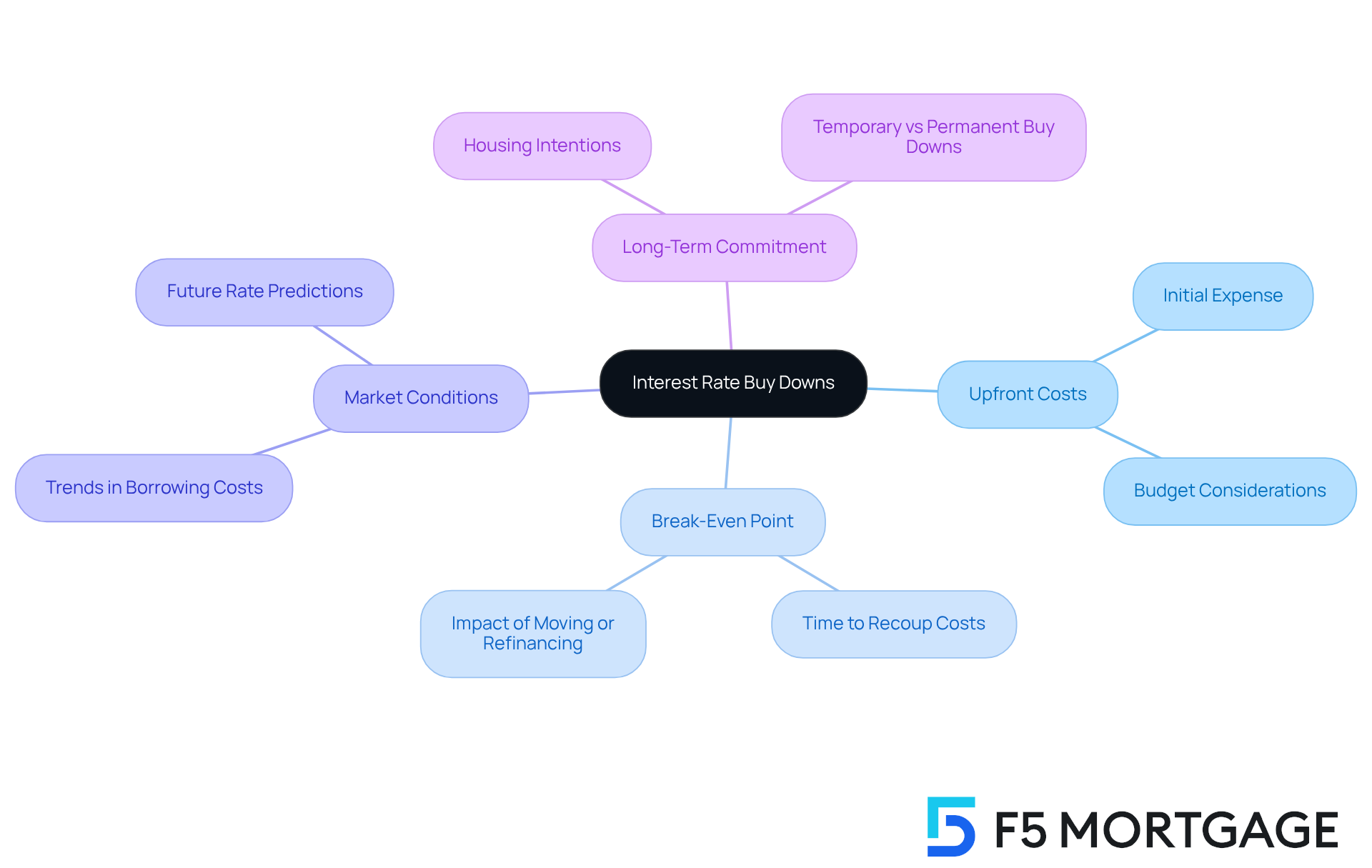

Interest rate buy downs can offer significant benefits, but we understand that families face several challenges and factors to consider:

-

Upfront Costs: The initial expense for a buy down can be considerable, often requiring families to set aside a significant portion of their budget. It’s essential to evaluate your financial readiness to cover these costs without putting pressure on other vital expenses.

-

Break-Even Point: Grasping the break-even point is crucial. This refers to the time it takes to recoup the upfront costs through savings on monthly payments. For example, if a family invests $5,000 in a buy down and saves $200 each month, the break-even point would be 25 months. If you plan to move or refinance before reaching this point, the buy down might not provide the anticipated advantages.

-

Market Conditions: Keeping an eye on borrowing cost trends is important. If prices are predicted to drop, committing to a buy down could lead to unnecessary upfront costs, as future lower rates may present better options without the initial financial burden.

-

Long-Term Commitment: Families should reflect on their long-term housing intentions. If selling or refinancing is on the horizon within a few years, a temporary buy down—like a 2-1 or 3-2-1 buydown—might be a better fit, providing lower payments initially while steering clear of the higher upfront costs tied to permanent buy downs.

By carefully considering these factors, families can make well-informed decisions regarding interest rate buy downs. We’re here to support you every step of the way, ensuring your mortgage strategy aligns with your financial goals and housing plans.

Conclusion

Understanding interest rate buy downs can truly transform the homeownership experience for families, making it more financially manageable and accessible. This strategic approach allows borrowers to reduce their interest rates through upfront payments, leading to lower monthly mortgage obligations. By utilizing this method, families can navigate the complexities of mortgage payments with greater ease, ultimately enhancing their financial stability.

The article highlights several key aspects of interest rate buy downs. It explains the two primary types—temporary and permanent buy downs—each serving different financial needs and goals.

- Temporary buy downs, such as the 2-1 buydown, offer lower initial payments, which can be particularly beneficial for families anticipating income growth.

- In contrast, permanent buy downs require a higher upfront investment but can yield substantial long-term savings.

Furthermore, we know how challenging it can be to assess one’s financial situation. Consulting with mortgage professionals and understanding the break-even point are emphasized as critical steps in the buy down process.

Ultimately, the insights shared in this guide underline the significance of interest rate buy downs in achieving homeownership aspirations. Families are encouraged to consider their unique financial circumstances and long-term housing plans when deciding on the best strategy. By taking informed steps and leveraging the advantages of interest rate buy downs, families can alleviate the financial pressures of mortgage payments. This paves the way for a more secure and fulfilling homeownership journey, and remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is an interest rate buy down?

An interest rate buy down is a financing strategy where the borrower pays an upfront fee to reduce their interest rate, either temporarily or permanently, leading to lower monthly mortgage payments.

How do points work in an interest rate buy down?

Borrowers typically pay ‘points’ to secure a reduced interest rate, where one point equals 1% of the loan amount. For example, reducing the interest rate by 0.25% for a $300,000 mortgage would require an upfront payment of $3,000.

What is a 2-1 buydown?

A 2-1 buydown is a specific type of interest rate buy down where the borrowing cost decreases by 2% in the first year and 1% in the second year, resulting in significant savings on monthly payments.

Can you provide an example of savings with a 2-1 buydown?

For a household with a $350,000 loan at a 7% interest rate, the first-year payment could drop to $1,960, saving $457 each month. In the second year, the payment would adjust to $2,184, still lower than the original rate.

What is the cost for a builder to implement a 2-1 buydown?

The builder expense for a 2-1 buydown is approximately 2% of the home sales price.

How do rate-and-term loans work in California?

Rate-and-term loans in California allow homeowners to refinance their existing mortgage with a new one that offers better terms, potentially leading to lower monthly payments, especially during periods of declining borrowing costs.

What are the overall benefits of interest rate buy downs?

Interest rate buy downs provide immediate savings on monthly payments, allow families to manage their budgets more effectively, and open up possibilities for investments in home improvements or other essential expenses.

How can interest rate buy downs help families in a changing lending landscape?

They can help families secure lower payments and consider refinancing when rates drop, ultimately strengthening their mortgage strategy for long-term financial well-being.