Overview

This article highlights how families can secure favorable FHA interest rates with a 700 credit score. We understand how challenging the mortgage process can be, and we’re here to support you every step of the way. A credit score of 700 not only qualifies borrowers for lower interest rates but also reduces mortgage insurance costs. This ultimately makes homeownership more accessible and affordable for families.

By maintaining a strong credit profile, you can take full advantage of the benefits FHA loans offer. Imagine the peace of mind that comes with knowing you’re on the right path to securing your family’s future. We encourage you to take these steps towards homeownership, as it can lead to a more stable and fulfilling life for you and your loved ones.

Introduction

FHA loans have emerged as a vital pathway to homeownership for many families, offering accessible financing options with down payments as low as 3.5%. We know how challenging this can be, especially for those with a credit score of 700, where the benefits become even more pronounced. Competitive interest rates and potential savings can significantly ease the financial burden of a mortgage.

However, navigating the complexities of FHA financing can feel overwhelming. Understanding how to maximize these advantages raises an important question: what strategies can families employ to not only secure the best rates but also enhance their overall creditworthiness in a fluctuating market?

We’re here to support you every step of the way.

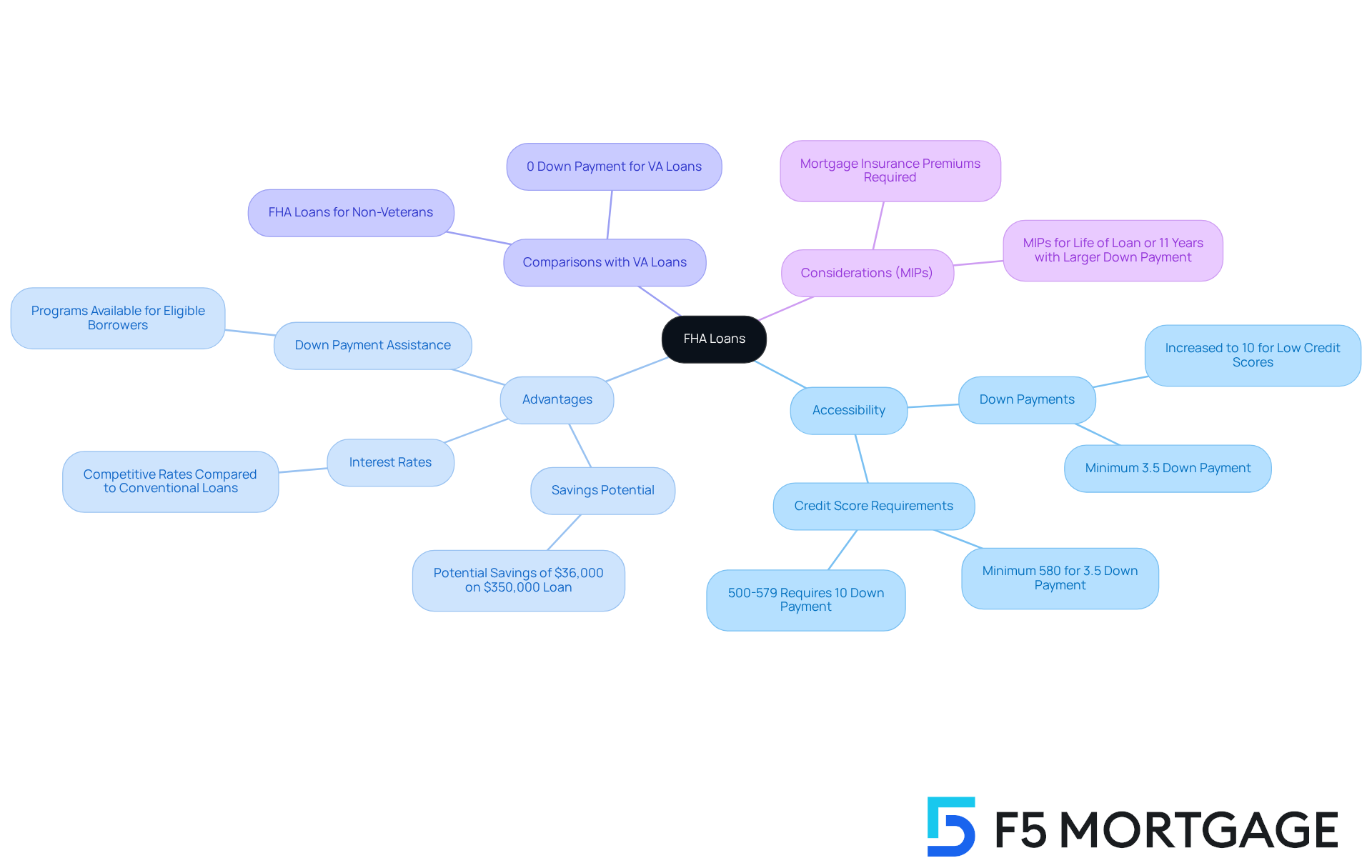

Understand FHA Loans and Their Importance

FHA mortgages, backed by the Federal Housing Administration, play a vital role in making homeownership attainable for a diverse range of families. With down payments starting at just 3.5%, these financial products are particularly beneficial for first-time homebuyers and individuals with limited savings. In 2025, the average down payment for FHA mortgages is significantly lower than the conventional benchmark, which often hovers around 15%. This accessibility is crucial, especially since FHA mortgages represent almost 20% of all mortgage applications, highlighting their appeal among families seeking affordable financing alternatives.

The advantages of FHA financing extend beyond merely reduced down payments. They are designed to accommodate borrowers with credit scores as low as 580, making them more lenient than traditional financing options. This flexibility can lead to substantial savings over the life of the mortgage, with families potentially saving as much as $36,000 in interest on a $350,000 home loan compared to traditional methods. Additionally, the competitive FHA interest rate with a 700 credit score, which was approximately 5.96% as of mid-September 2025, further enhances their attractiveness.

When comparing FHA options to VA options, it’s important to recognize that while both offer low down payment choices, VA options allow eligible veterans to purchase homes with 0% down, making them an appealing alternative for those who qualify. However, FHA mortgages remain a solid choice for many households, especially for those who may not meet the requirements for VA financing.

Real-world examples illustrate the positive impact of FHA financing on families. For instance, a family purchasing a $250,000 home with an FHA loan would only need a down payment of $8,750, significantly alleviating the financial burden. Furthermore, families can take advantage of down payment assistance programs, often available to those utilizing FHA financing, making homeownership even more accessible. These programs can provide essential support, helping families bridge the gap between their savings and the necessary down payment.

However, it is crucial for families to consider the mortgage insurance premiums (MIPs) that accompany FHA financing. These premiums are required for the duration of the financing or can decrease to 11 years with a larger down payment, impacting total financing costs. Understanding the full range of FHA financing options, along with their requirements and costs, is essential for families looking to navigate the home purchasing process successfully in 2025. Overall, FHA mortgages remain an invaluable resource for promoting homeownership, offering families the opportunity to secure their dream homes with manageable financial obligations.

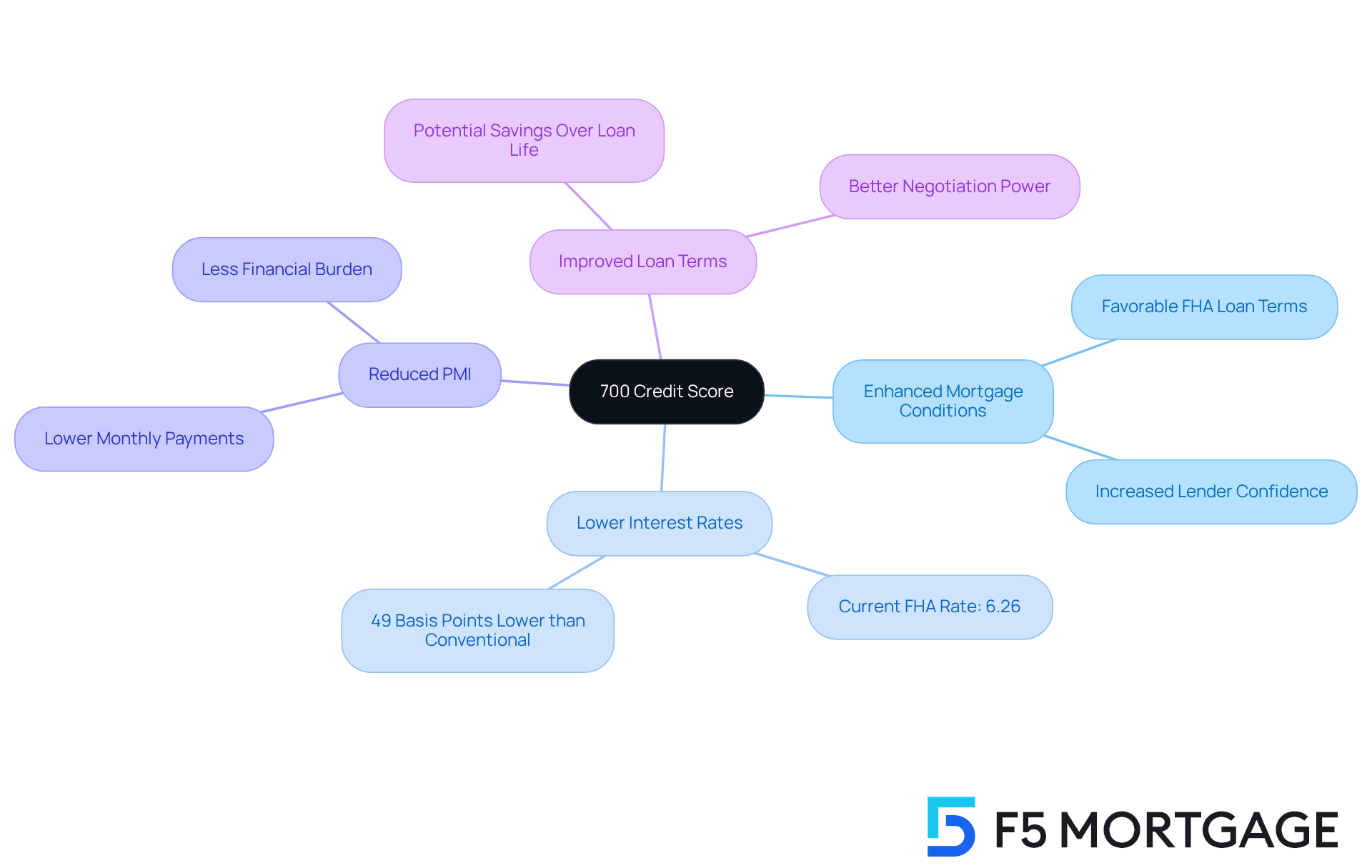

Recognize the Role of a 700 Credit Score

A credit score of 700 is often viewed as a strong indicator of creditworthiness, significantly enhancing a household’s chances of securing favorable mortgage conditions and terms. We understand how crucial this can be for families looking to make a home their own. Lenders typically see a 700 credit score as a sign of responsible credit management, which can result in a favorable FHA interest rate with a 700 credit score. Even a slight reduction in interest rates can translate into substantial savings over the life of the loan. For instance, the current FHA interest rate with a 700 credit score is around 6.26%, which is 49 basis points lower than traditional financing costs.

Additionally, a higher credit score can reduce the need for private mortgage insurance (PMI), leading to even lower monthly payments. We encourage families to regularly check their credit reports for any inaccuracies and take proactive steps to maintain or improve their scores. This diligence can have a direct impact on their mortgage options, empowering them to secure better terms and potentially save thousands over the life of their financing. In fact, many lenders are more inclined to offer improved terms to borrowers with a FHA interest rate with a 700 credit score or above, making it a vital benchmark for families striving to enhance their mortgage funding.

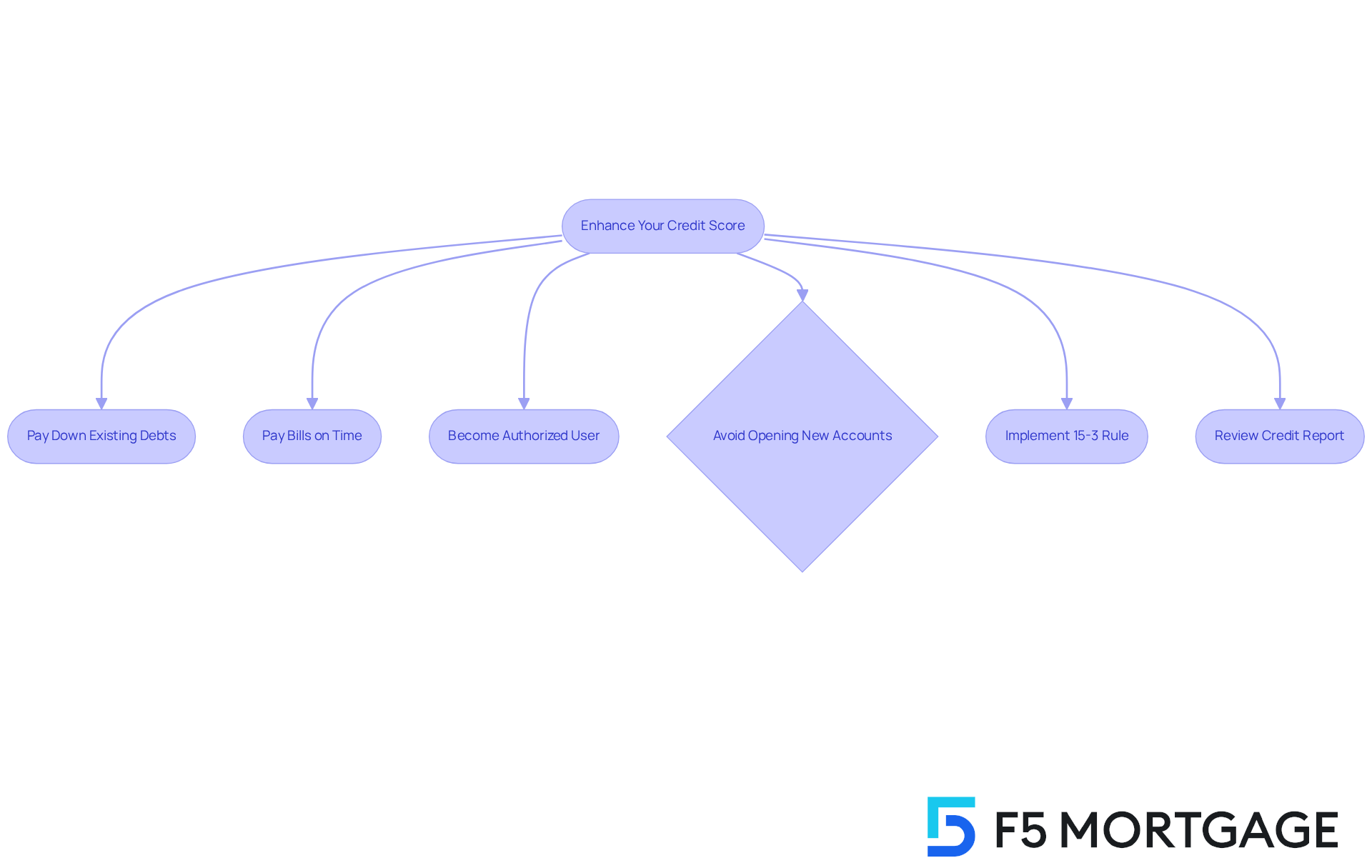

Enhance Your Credit Score for Better Rates

Improving your credit score can feel daunting, but taking small, manageable steps can make a significant difference. Start by focusing on paying down existing debts, especially credit card balances. High utilization can negatively impact your score, and since debt accounts for 30% of your FICO score, managing your credit card usage effectively is essential.

It’s also crucial to pay your bills on time. Remember, payment history is a significant factor in credit scoring, accounting for 35%. If you’re looking for additional support, consider becoming an authorized user on a responsible person’s credit card. This can help you benefit from their positive credit history.

Before applying for a mortgage, try to avoid opening new credit accounts. Doing so can temporarily lower your score, which is the last thing you want when seeking favorable loan terms. Implementing the 15-3 rule—making two payments per billing cycle—can help you maintain a lower credit utilization ratio.

Regularly reviewing your credit report is also important. Look for inaccuracies and don’t hesitate to dispute any errors you find. By following these steps, you can enhance your credit score and potentially qualify for an FHA interest rate with a 700 credit score.

As Andrew Dehan wisely notes, “If you want to improve your credit score fast, pay down your current debt and avoid opening new accounts.” We know how challenging this can be, but remember, we’re here to support you every step of the way.

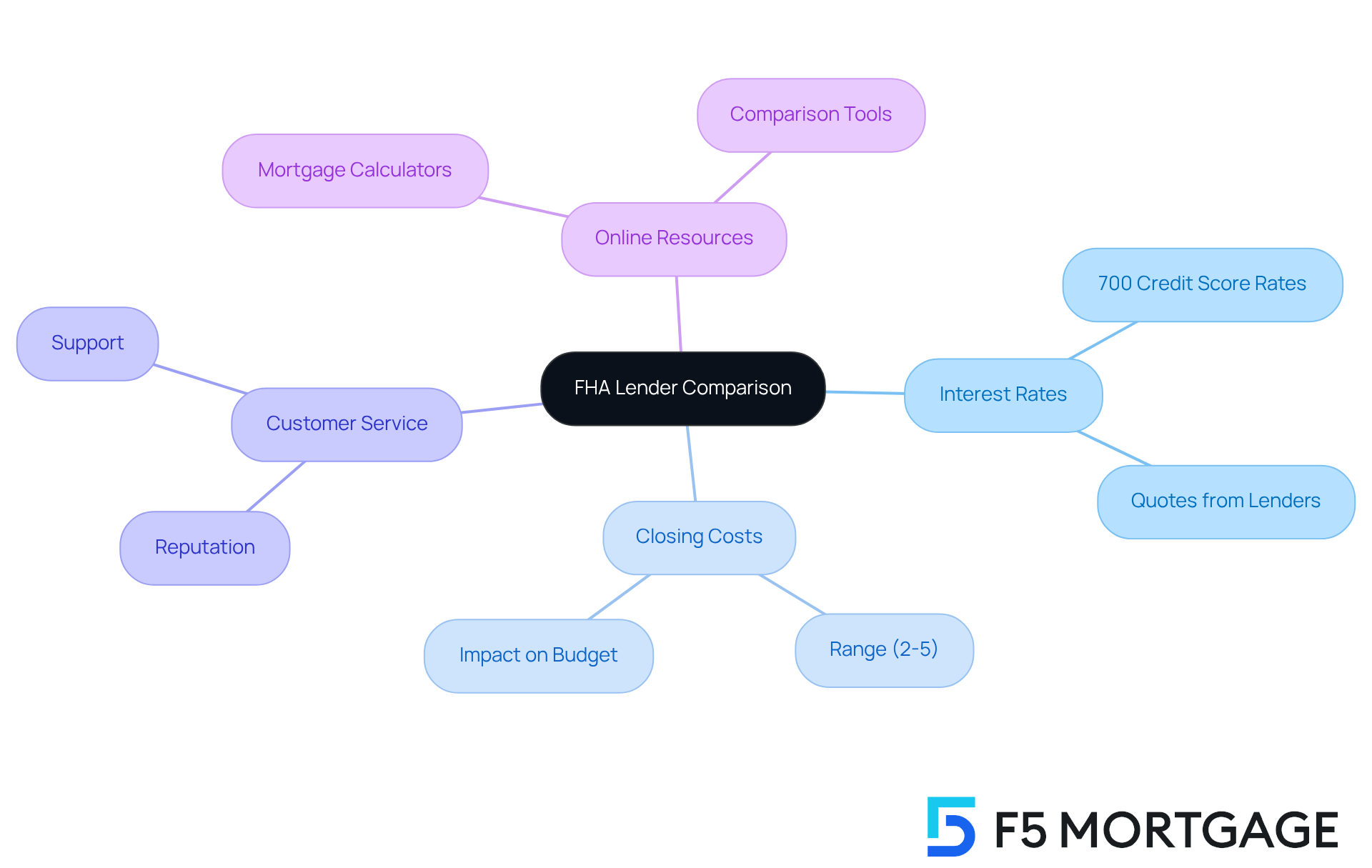

Compare FHA Lenders and Interest Rates

When assessing FHA lenders, we know how challenging this can be for families. It’s essential to concentrate on both the FHA interest rate with 700 credit score and related fees to make informed choices. Start by gathering quotes from various lenders; this simple step can uncover substantial differences in prices and expenses. For instance, borrowers who received five price estimates could save over $6,000 throughout the duration of their financing. Look for lenders that not only offer attractive terms but also maintain low closing expenses, which can vary significantly among lenders.

In 2025, average closing expenses for FHA mortgages can range from 2% to 5% of the home’s purchase price. This makes it crucial to include these costs in your overall budget. Additionally, the lender’s reputation for customer service is vital; a supportive lender can greatly ease the mortgage process, providing peace of mind during this important journey.

Families should take advantage of online resources, such as mortgage calculators, to estimate monthly payments based on different borrowing amounts and the FHA interest rate with 700 credit score. By thoroughly comparing lenders and considering these factors, you can secure the best FHA financing option tailored to your financial situation. Remember, we’re here to support you every step of the way.

Implement Strategies for Securing the Best Rate

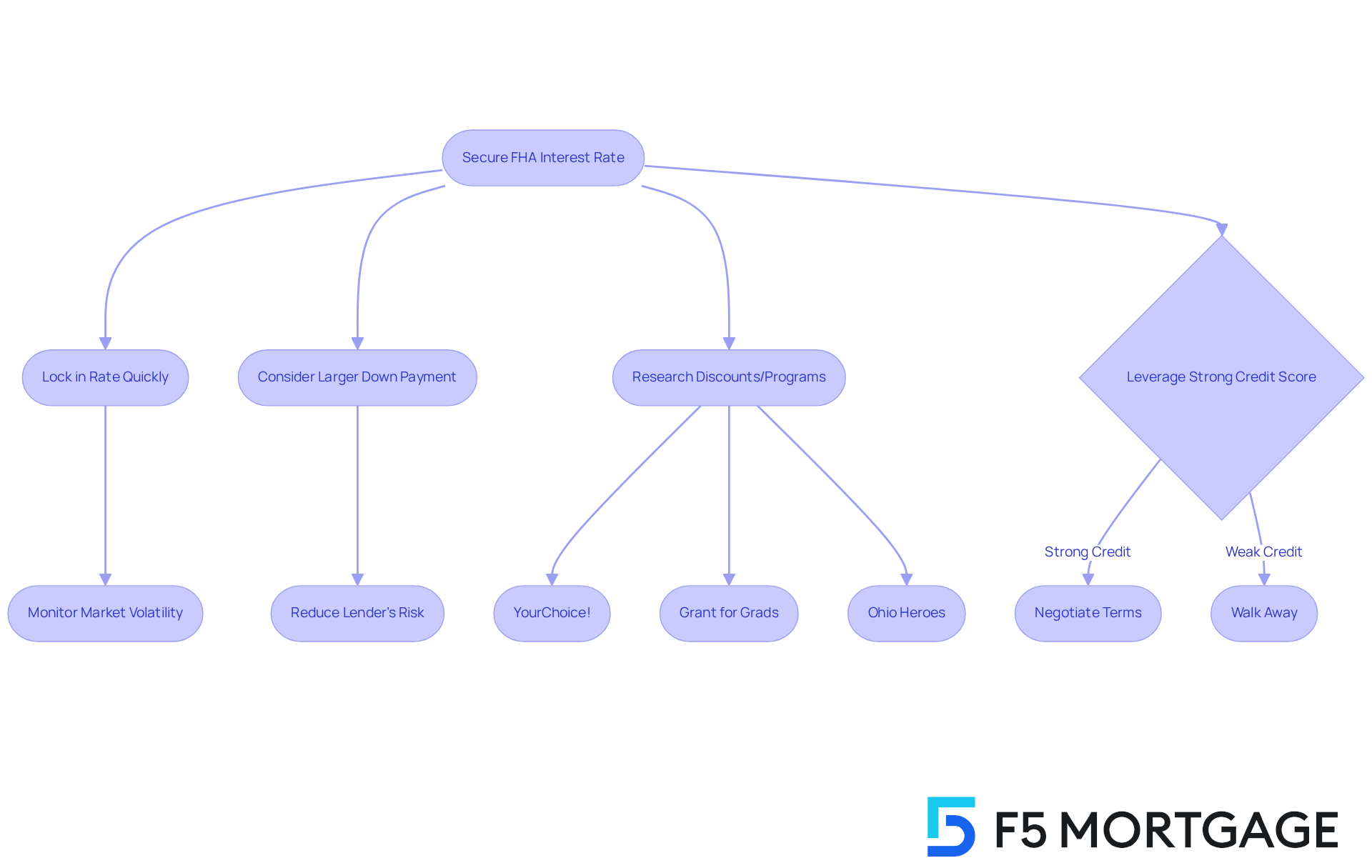

We understand how challenging it is for families to secure the best FHA interest rate with a 700 credit score on an FHA loan. It’s crucial to prioritize locking in your figure with F5 Mortgage as soon as you encounter a favorable offer, since mortgage costs can be quite volatile. A larger down payment, typically around 3.5%, not only decreases the lender’s risk but can also lead to a lower interest charge. Research shows that a significant down payment can greatly influence the terms offered.

Additionally, we encourage you to inquire about any available discounts or programs that lenders may provide to help reduce costs. Programs like YourChoice!, Grant for Grads, and Ohio Heroes can be especially beneficial for first-time homebuyers. If your family has a strong credit score—ideally around 700 or higher—be sure to leverage this advantage during negotiations, as it can significantly impact the terms you receive.

According to Gina Freeman, ‘Comprehending the essential elements that impact mortgage costs can greatly enhance your mortgage negotiation.’ Remember, being prepared to walk away from a lender who isn’t willing to meet your needs can open the door to better options. Often, the most favorable deals are found by exploring multiple lenders. By implementing these strategies, families can significantly enhance their chances of securing a competitive FHA interest rate with a 700 credit score on their FHA loan, and we are here to support you every step of the way.

Conclusion

FHA loans represent a vital pathway to homeownership for many families, especially those with limited savings or first-time buyers. We know how challenging this journey can be. By understanding the importance of maintaining a strong credit score—particularly a 700 or above—families can unlock more favorable FHA interest rates, leading to substantial savings over the life of their loans. This financial opportunity not only makes homeownership more attainable but also lays a foundation for long-term financial stability.

The article highlights several key strategies for families to secure the best FHA rates:

- Enhancing credit scores through diligent debt management and timely bill payments can make a significant difference.

- Comparing various lenders for the most competitive terms is crucial.

- Each step taken can lead to meaningful savings.

- Utilizing down payment assistance programs and understanding the implications of mortgage insurance premiums are essential considerations for families navigating the home buying process.

Ultimately, the journey to homeownership is both achievable and rewarding, especially for families who take proactive measures to improve their creditworthiness and explore all available options. By leveraging the benefits of FHA loans and maintaining a strong credit score, families can not only secure their dream homes but also embark on a path toward financial empowerment. Taking the time to research, compare lenders, and implement effective credit improvement strategies will pave the way for a brighter future in homeownership.

Frequently Asked Questions

What are FHA loans and why are they important?

FHA loans are mortgages backed by the Federal Housing Administration, designed to make homeownership accessible for various families. They offer down payments starting at just 3.5%, making them particularly beneficial for first-time homebuyers and those with limited savings.

How do FHA loan down payments compare to conventional loans?

In 2025, the average down payment for FHA loans is significantly lower than the conventional benchmark, which is around 15%. This makes FHA loans more accessible for families seeking affordable financing options.

Who can benefit from FHA loans?

FHA loans are especially beneficial for first-time homebuyers and individuals with credit scores as low as 580, making them more lenient than traditional financing options.

How much can families save with FHA loans compared to traditional financing?

Families can potentially save as much as $36,000 in interest over the life of a $350,000 home loan when using FHA financing compared to traditional methods.

What is the interest rate for FHA loans with a 700 credit score?

As of mid-September 2025, the FHA interest rate for borrowers with a 700 credit score was approximately 5.96%.

How do FHA loans compare to VA loans?

While both FHA and VA loans offer low down payment options, VA loans allow eligible veterans to purchase homes with 0% down. FHA loans remain a solid choice for many households, especially those who do not qualify for VA financing.

Can families receive assistance with down payments when using FHA loans?

Yes, families can take advantage of down payment assistance programs often available to those utilizing FHA financing, making homeownership more accessible.

What are mortgage insurance premiums (MIPs) and how do they affect FHA loans?

MIPs are required for the duration of FHA financing and can impact total financing costs. They can decrease to 11 years with a larger down payment.

What is the significance of a 700 credit score when applying for an FHA loan?

A credit score of 700 is seen as a strong indicator of creditworthiness, enabling households to secure favorable mortgage terms and potentially lower interest rates, which can lead to significant savings over the life of the loan.

How can families improve their credit scores?

Families are encouraged to regularly check their credit reports for inaccuracies and take proactive steps to maintain or improve their scores, which can directly impact their mortgage options and terms.