Overview

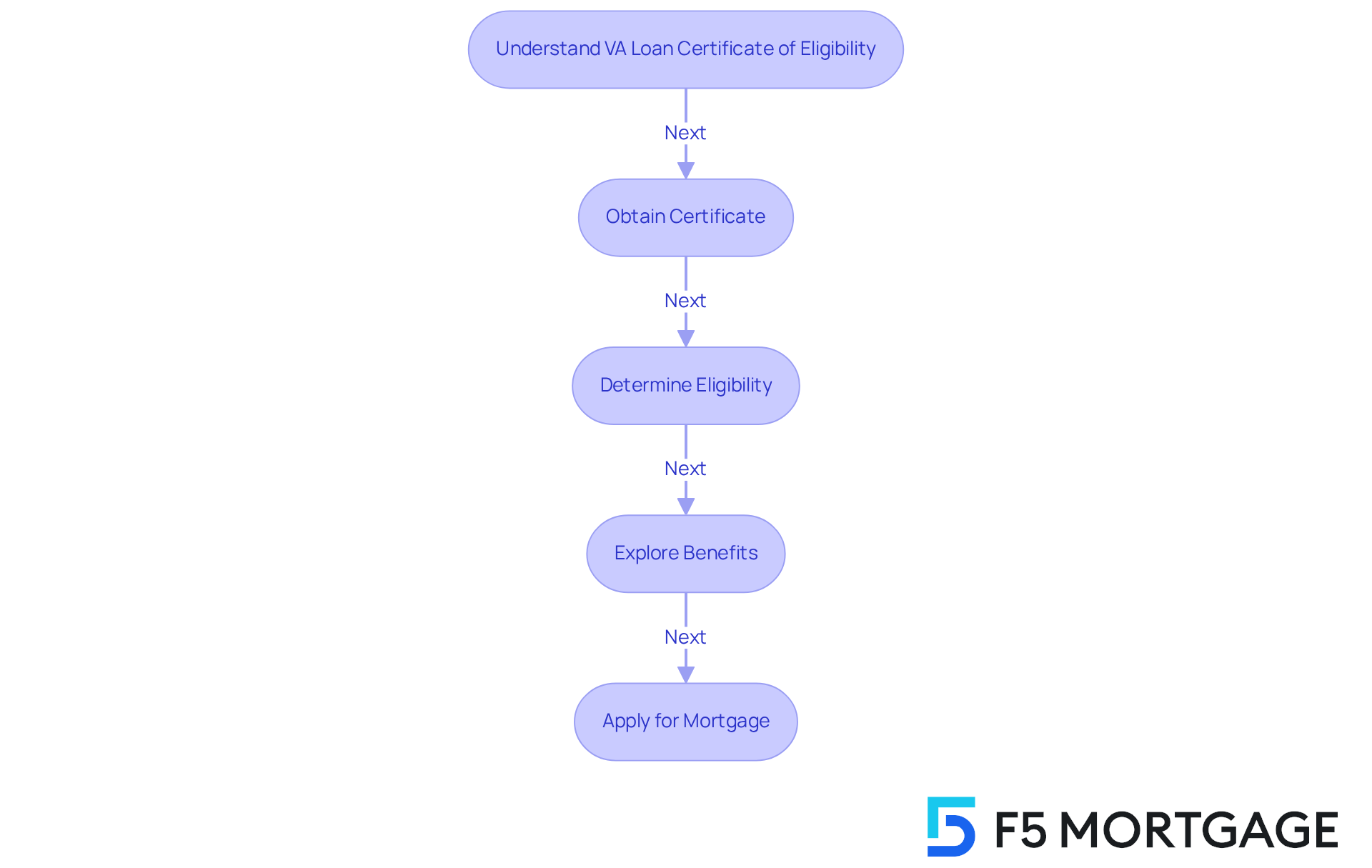

The main focus of this article is to serve as a comprehensive guide for veterans seeking to master the VA Loan Certificate of Eligibility process. We understand how overwhelming this journey can be, and we’re here to support you every step of the way. This guide details the eligibility requirements, application methods, and common challenges you might face. Recognizing these aspects is crucial for successfully navigating your path toward securing a VA-backed home mortgage. By addressing your needs and concerns, we aim to empower you with the knowledge you need to move forward confidently.

Introduction

Navigating the complexities of home financing can indeed feel daunting, especially for veterans eager to leverage the benefits of a VA loan. At the heart of this journey is the VA Loan Certificate of Eligibility, a vital document that not only confirms your eligibility but also opens the door to numerous financial advantages, such as zero down payment and favorable interest rates.

However, the path to obtaining this certificate is not without its challenges. From understanding eligibility requirements to overcoming common application hurdles, many veterans find themselves asking:

- How can you effectively master this process and secure the home you truly deserve?

We know how challenging this can be, and we’re here to support you every step of the way.

Understand the VA Loan Certificate of Eligibility

The VA loan certificate of eligibility is a vital document issued by the Department of Veterans Affairs (VA) that confirms your eligibility for a VA-backed home mortgage. Understanding the VA loan certificate of eligibility is the first step in your journey, as it helps lenders determine if you qualify for the many benefits associated with VA financing, such as no down payment and competitive interest rates.

We know how challenging navigating this process can be, and the VA loan certificate of eligibility is crucial in detailing your entitlement and eligibility based on your service history. It’s important to remember that while the VA loan certificate of eligibility is essential for starting your application, it does not guarantee approval for financing.

By recognizing the significance of the VA loan certificate of eligibility, you empower yourself to take the next steps with confidence. We’re here to support you every step of the way as you explore your options and work towards securing the home you deserve.

Identify Eligibility Requirements for VA Loans

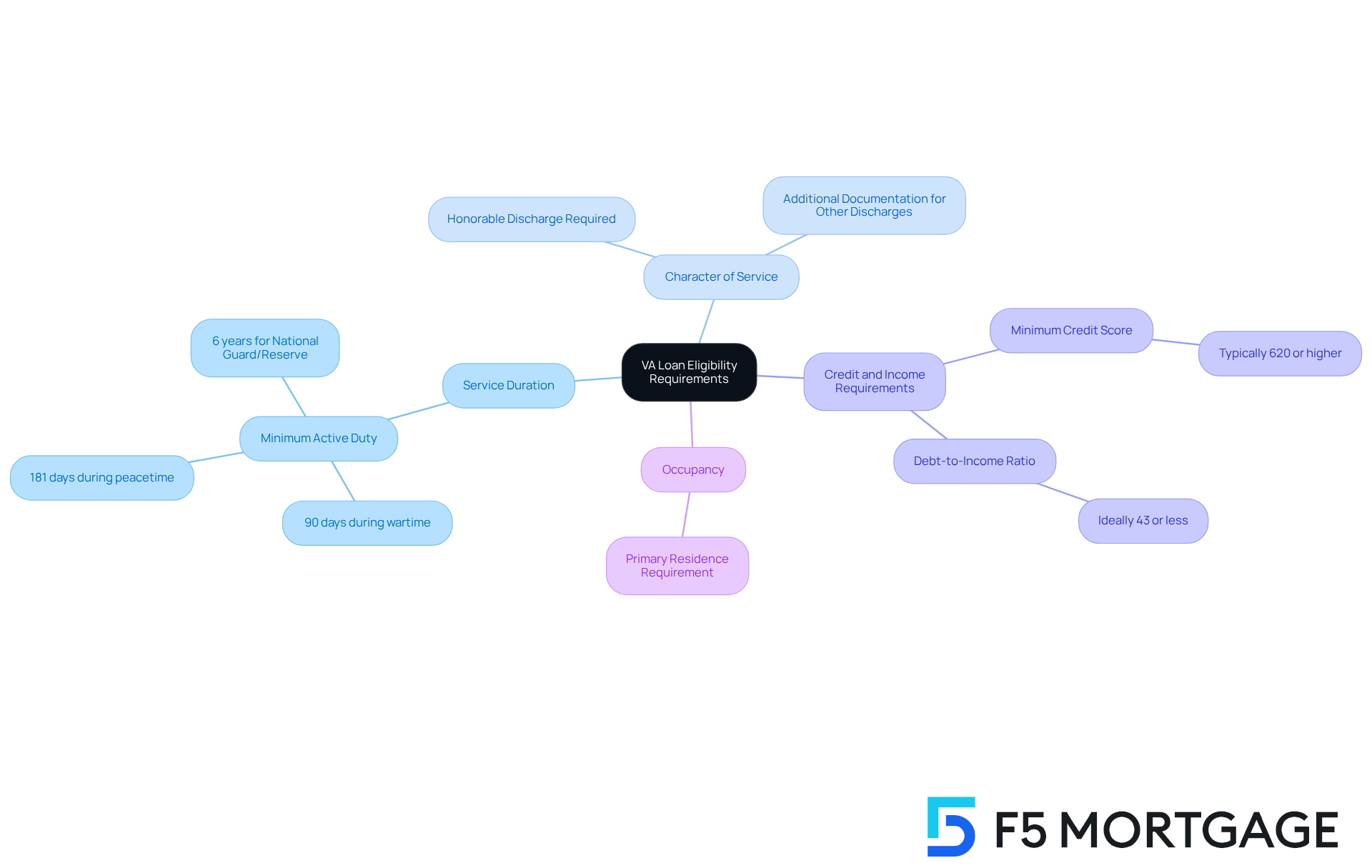

To qualify for a VA loan, we understand that navigating the VA loan certificate of eligibility requirements can feel overwhelming. Here’s what you need to know:

- Service Duration: Veterans must have served a minimum of 90 days of active duty during wartime or 181 days during peacetime. If you’re a National Guard or Reserve member, you can qualify after completing six years of service.

- Character of Service: An honorable discharge is essential for eligibility. If your discharge falls under other conditions, you may need to provide additional documentation to clarify your status.

- Credit and Income Requirements: While the VA does not impose a minimum credit score, most lenders typically expect a score of at least 620. It’s important to demonstrate adequate income to cover your mortgage payments, ensuring your financial stability. Understanding the debt-to-income ratio, which should ideally be 43% or less, is crucial for keeping your monthly mortgage payments manageable.

- Occupancy: The property you acquire must serve as your primary residence, reinforcing the program’s focus on homeownership.

In addition to these eligibility requirements, it’s important for former military personnel to explore various refinancing options available to you. For instance, cash-out refinances can help you access your home equity, while streamlined refinancing options simplify the process and lessen documentation requirements. We know how challenging this can be, and understanding these choices is crucial for evaluating your eligibility for a VA loan certificate of eligibility and preparing the necessary paperwork for your application.

Many former service members have successfully navigated these criteria, sharing positive experiences about how the VA loan process has facilitated their journey to homeownership. The partnership between the VA and real estate experts plays a crucial role in supporting service members in their homeownership journey, particularly when evaluating refinancing options that can enhance your financial stability. Remember, we’re here to support you every step of the way.

Apply for Your VA Loan Certificate of Eligibility

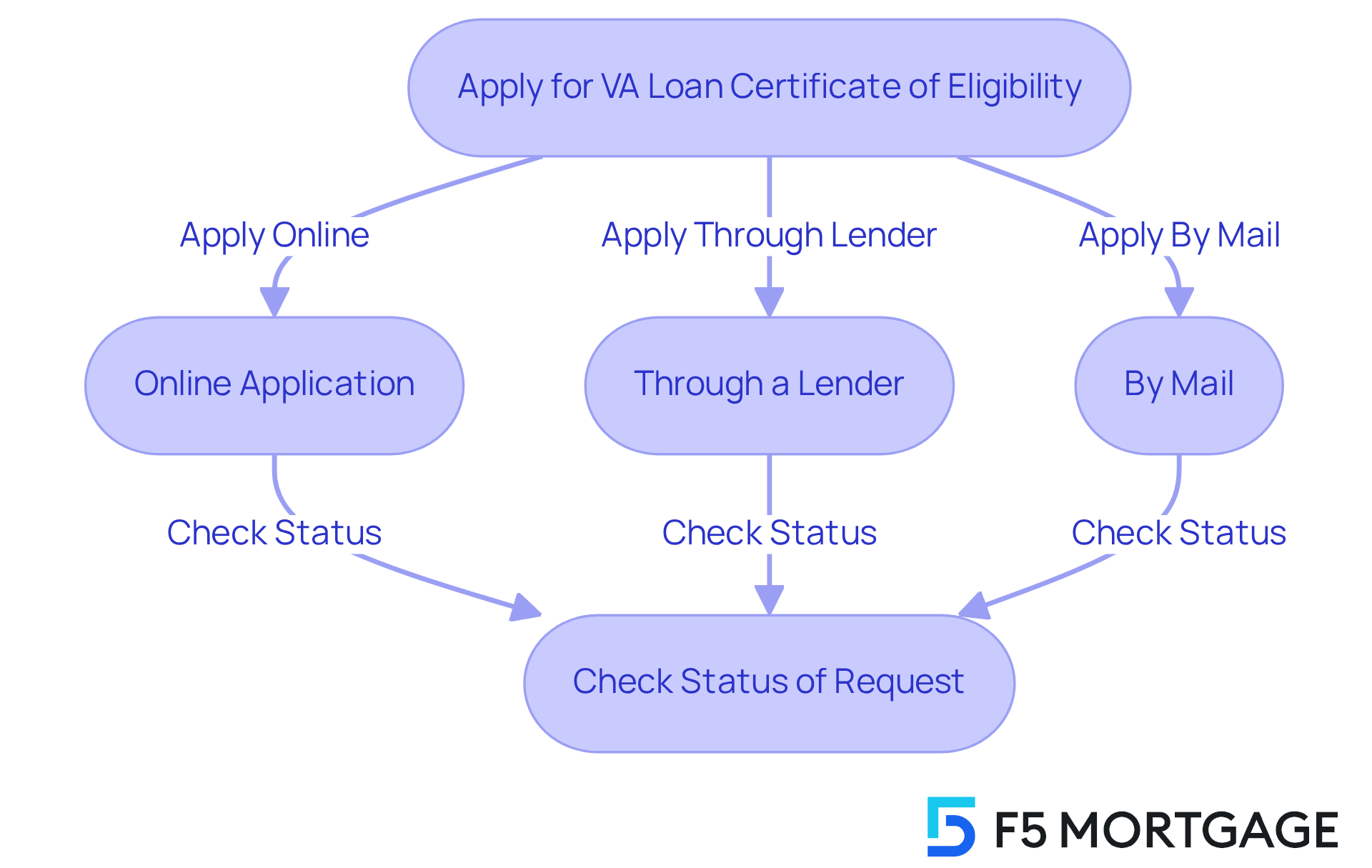

Applying for your VA Loan Certificate of Eligibility can be accomplished through several efficient methods that cater to your needs:

-

Online Application: The quickest method to acquire your COE is through the VA’s eBenefits portal, which is complimentary for former service members and active duty personnel. To do this, simply visit the VA eBenefits website, create an account or log in if you already have one, and navigate to the COE application section. Follow the prompts to submit your request.

-

Through a lender, many veterans find comfort in having a VA-approved lender apply for the VA loan certificate of eligibility on their behalf. This method is often quicker, as lenders can access the VA’s online system directly, streamlining the process. As Samantha Reeves, an Executive Broker, wisely states, ‘the easiest and best method of obtaining a VA loan certificate of eligibility, in our opinion, is going directly through your lender.’

-

By Mail: If you prefer a traditional approach, you can apply by completing VA Form 26-1880, which is the Request for a VA loan certificate of eligibility. Download the form from the VA website, fill it out, and mail it to your regional loan center. Be sure to include any necessary documentation, such as your DD214 or other proof of service.

-

Check Status of Request: After submitting your request, you can monitor the status of your COE inquiry through the VA’s website or by contacting your lender directly. This ensures you remain updated about your progress.

In recent years, a significant percentage of veterans have chosen to use lenders for their COE requests, reflecting a trend towards more streamlined processes. Processing times for COE requests usually require approximately 30 days online, but verification may take longer in uncommon instances. By adhering to these steps, we believe you can effectively navigate through the procedure and obtain your VA benefit advantages. We know how challenging this can be, but we’re here to support you every step of the way.

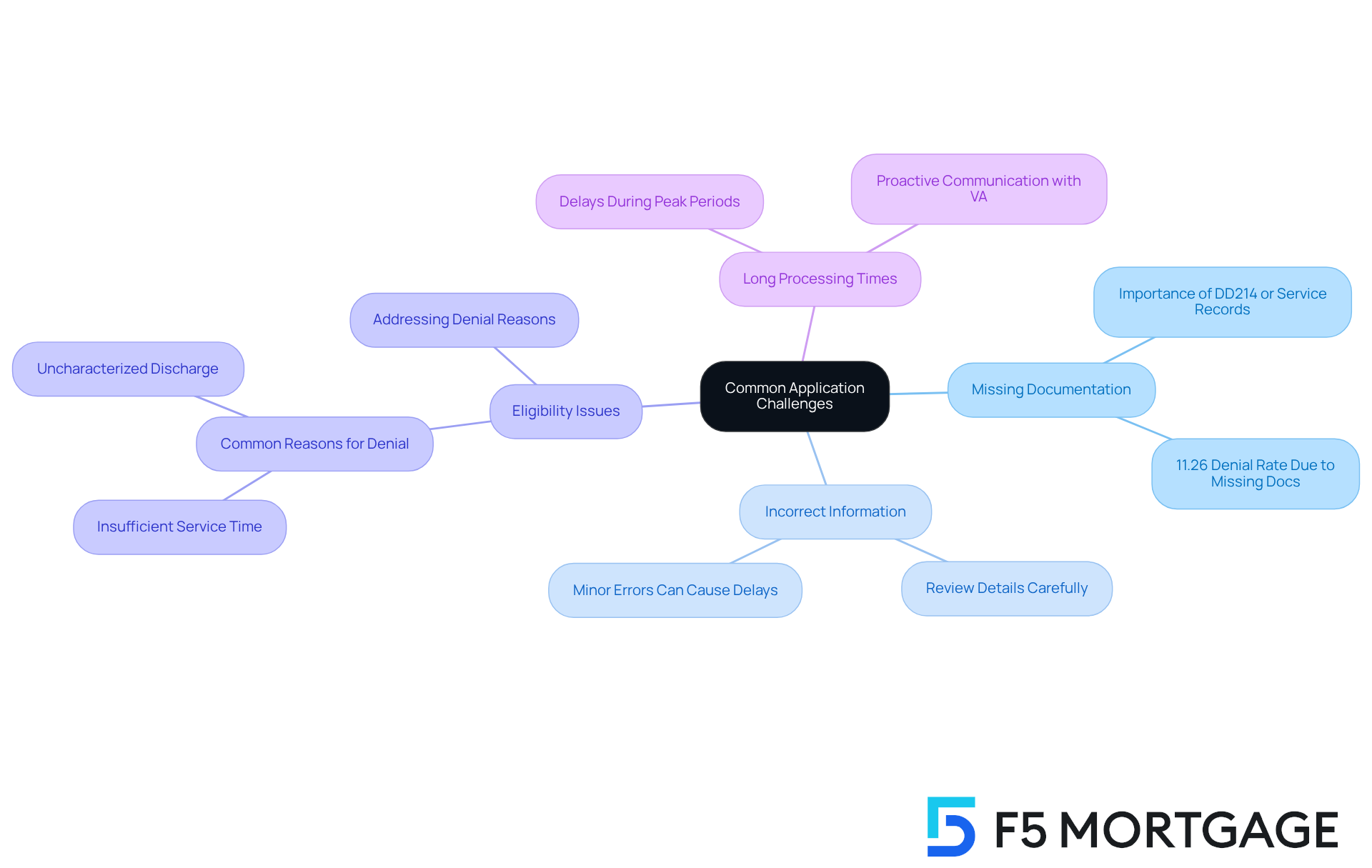

Troubleshoot Common Application Challenges

Applying for your VA loan certificate of eligibility can be a straightforward process, but we understand how challenging this can be. Many applicants face common hurdles that can make the journey feel overwhelming.

-

Missing Documentation: Gathering all necessary documents, such as your DD214 or service records, is crucial. In 2024, 11.26% of VA loan requests were denied, with a significant percentage attributed to missing documentation. This highlights the importance of thorough preparation to avoid unnecessary setbacks.

-

Incorrect Information: It’s vital to ensure that all details on your form are accurate. Even minor inaccuracies can lead to processing delays or outright denials. Veterans have shared that taking the time to carefully review their information can prevent complications later on.

-

Eligibility Issues: If your request is denied, take a moment to carefully review the reasons provided. Common issues include insufficient service time or an uncharacterized discharge. Addressing these specific reasons—such as providing additional documentation or appealing the decision—can lead to successful reapplications. As Levi Rodgers, a real estate expert and retired U.S. Army Green Beret, wisely noted, ‘Discovering you’ve been denied a VA loan certificate of eligibility for a VA home loan can feel like a major setback, but it doesn’t have to end your homeownership journey.’

-

Long Processing Times: Delays can occur, especially during peak application periods. If you find yourself facing a slowdown, consider reaching out to the VA or your lender for updates. Many former service members have shared their experiences of navigating these delays, often finding that proactive communication can help expedite the process.

By understanding these challenges and preparing accordingly, you can navigate the COE application process more effectively. We’re here to support you every step of the way, increasing your chances of a successful outcome.

Conclusion

Obtaining a VA Loan Certificate of Eligibility is a vital step for veterans and service members eager to secure a VA-backed home mortgage. This certificate not only confirms your eligibility but also opens the door to numerous benefits, such as no down payment and competitive interest rates. By understanding the application process and the requirements for the certificate, you can navigate your homeownership journey with confidence.

In this guide, we’ve shared essential insights regarding eligibility criteria, including:

- Service duration

- Character of service

- Credit and income requirements

- Occupancy rules

We’ve also outlined various methods for applying for the certificate—whether online, through a lender, or by mail—to facilitate a smoother application experience. Common challenges, such as missing documentation and processing delays, were addressed, along with strategies to help you overcome these obstacles.

Ultimately, mastering the VA Loan Certificate of Eligibility process is not just about understanding paperwork; it’s about enabling you, as a veteran, to achieve your dream of homeownership. By being proactive, informed, and prepared, you can significantly enhance your chances of success. Remember, it’s essential to take the necessary steps and seek assistance when needed, ensuring that the benefits of VA loans are fully realized. The journey to homeownership is within reach, and we’re here to support you every step of the way.

Frequently Asked Questions

What is a VA loan certificate of eligibility?

The VA loan certificate of eligibility is a document issued by the Department of Veterans Affairs (VA) that confirms your eligibility for a VA-backed home mortgage.

Why is the VA loan certificate of eligibility important?

It helps lenders determine if you qualify for the benefits associated with VA financing, such as no down payment and competitive interest rates.

Does having a VA loan certificate of eligibility guarantee loan approval?

No, while the VA loan certificate of eligibility is essential for starting your application, it does not guarantee approval for financing.

How does the VA loan certificate of eligibility relate to my service history?

The certificate details your entitlement and eligibility based on your service history, which is crucial for determining your qualifications for a VA loan.

What should I do after obtaining my VA loan certificate of eligibility?

After obtaining the certificate, you can take the next steps in your home financing journey, with the support available to help you explore your options.