Overview

F5 Mortgage stands out as the ideal home loan broker for families, thanks to its personalized service, diverse loan options, and an impressive customer satisfaction rate of 94%. We understand how challenging the mortgage process can be, and that’s why F5 prioritizes your unique needs. By offering tailored financing solutions, we strive to make homeownership more accessible and less stressful for families.

Imagine a streamlined application process that puts you at ease, allowing you to focus on what truly matters—your family. With F5 Mortgage, you’re not just another client; you’re part of a supportive community that’s here for you every step of the way. We’re dedicated to ensuring that your journey toward homeownership is as smooth as possible.

Take the first step towards your dream home today. Let us help you navigate the complexities of home loans with care and expertise, making your aspirations a reality.

Introduction

F5 Mortgage stands as a beacon of hope for families navigating the often daunting world of home financing. We understand how challenging this can be, and that’s why we prioritize personalized service alongside a deep understanding of each household’s unique financial situation. By offering tailored mortgage solutions, F5 empowers families to make informed decisions.

However, with so many options available, what truly sets F5 Mortgage apart as the best home loan broker for families? This article explores nine compelling reasons that illustrate how F5 Mortgage not only simplifies the mortgage process but also builds lasting trust with its clients. We’re here to support you every step of the way, ensuring that your journey toward homeownership is as smooth as possible.

F5 Mortgage: Your Independent Partner for Personalized Home Loan Solutions

F5 stands out as the best home loan broker by truly prioritizing the unique needs of its clients over lender interests. We understand how challenging navigating the mortgage process can be, which is why we strive to be the best home loan broker by offering a customized service experience. Our goal is to help households identify the best home loan broker to obtain financing solutions specifically designed for their financial circumstances.

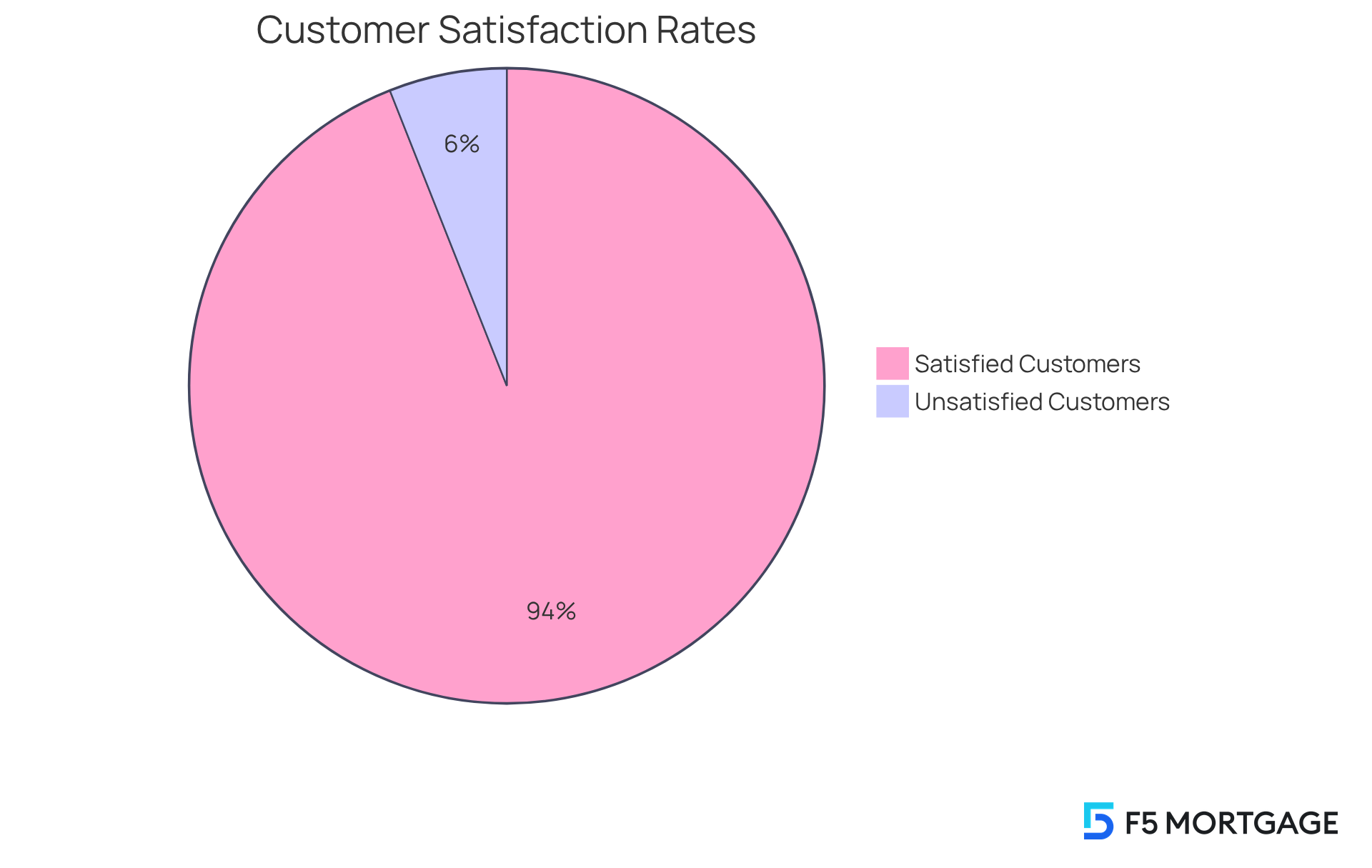

By dedicating time to comprehend each household’s situation, F5 Mortgage, recognized as the best home loan broker, streamlines the financing process and fosters a solid basis of trust. With a remarkable customer satisfaction rate of 94%, we are proud to demonstrate our effectiveness as the best home loan broker in delivering exceptional service. Clients have shared positive experiences, emphasizing our team’s dedication to being the best home loan broker through transparency and support throughout their financing journey.

One satisfied client, Jeff, remarked, “Jeff and his team are outstanding to work with. They made the process easy and worry-free, ensuring we understood everything fully.” This personalized approach not only enhances the overall experience but also empowers families to make informed decisions, ensuring they secure the best home loan broker for achieving the best possible outcomes in their home financing endeavors.

As Ryan McCallister, President and Founder of F5, stated, ‘Our mission at F5 is to provide our customers with the best home loan broker experience from start to finish, and leveraging industry-leading technology is a critical part of that.’ Furthermore, with the majority of financing agreements concluding in under three weeks, we strive to be recognized as the best home loan broker by demonstrating effectiveness in the financing process. We’re here to support you every step of the way.

Diverse Loan Programs: Tailored Options for Every Family’s Needs at F5 Mortgage

At F5 Mortgage, we understand that navigating the world of financing can be overwhelming for families. That’s why we offer a wide variety of financing programs, including:

- Fixed-rate options

- FHA options

- VA options

- Jumbo options

Our goal is to help you discover a mortgage solution that fits your unique financial situation.

For many first-time home purchasers, FHA financing is a particularly beneficial choice. With reduced down payment criteria of just 3.5%, this option makes homeownership more accessible. In fact, FHA financing represented 15.3% of mortgaged sales in April 2025, reflecting a growing trend among new buyers seeking affordable funding alternatives—up from 14.2% the previous year.

Veterans, too, can take advantage of the significant benefits offered by VA financing. With zero down payment options and competitive interest rates, homeownership becomes much more achievable. Notably, VA financing accounted for 7.2% of mortgaged sales, marking the highest level since 2020. This highlights the increasing popularity of this option among qualified borrowers.

At F5, we pride ourselves on our ability to tailor financing options to meet your personal requirements. This approach empowers families to navigate the complexities of home funding with confidence and ease.

Real-world examples illustrate the impact of these customized solutions. Many households have successfully overcome financial obstacles by utilizing FHA financing, while veterans have benefited from VA assistance to purchase homes without the burden of substantial down payments. Our commitment to providing tailored financing consultations and a range of loan options establishes F5 as the best home loan broker and a reliable ally in your journey toward homeownership. We’re here to support you every step of the way.

![]()

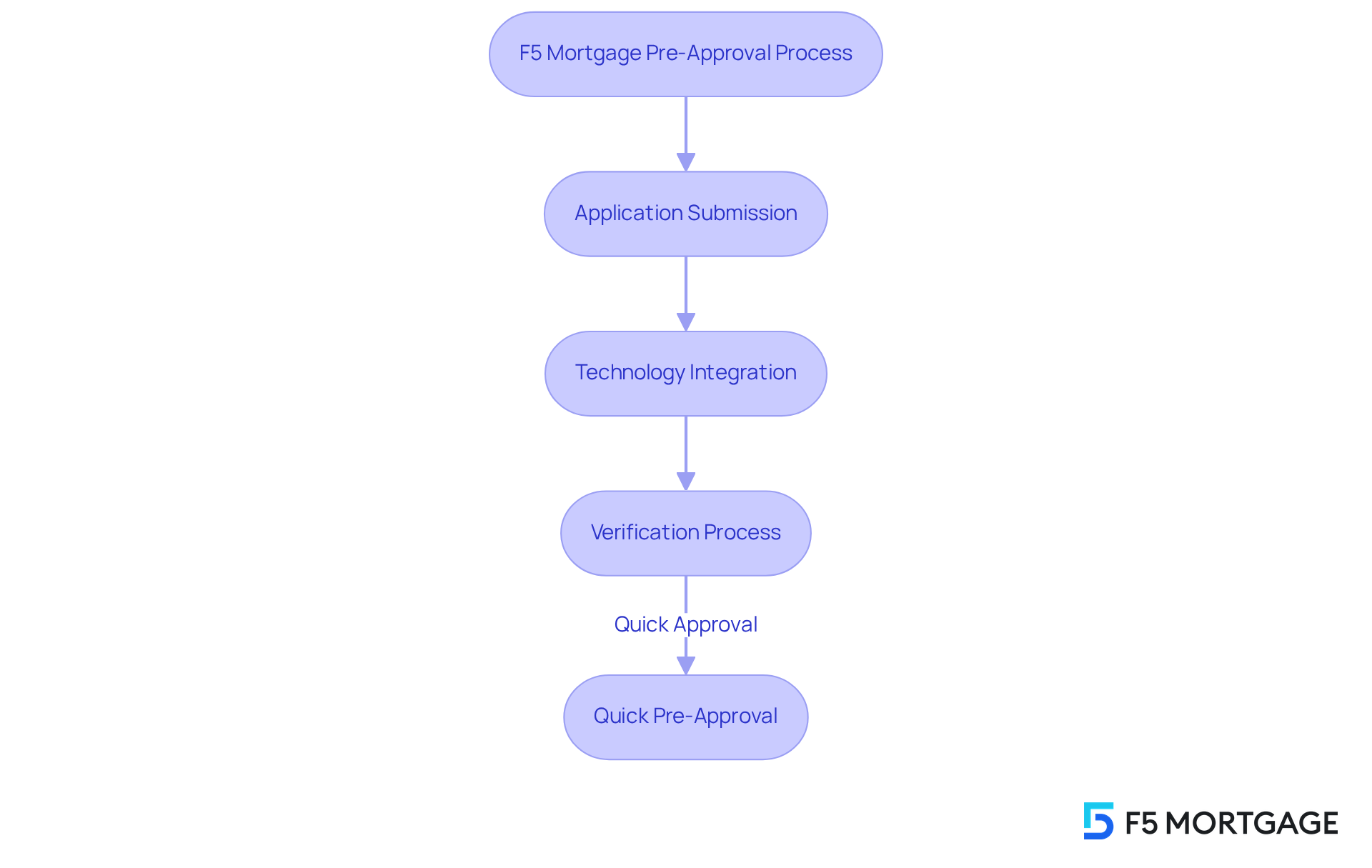

Streamlined Application Process: Quick Pre-Approval in Under an Hour with F5 Mortgage

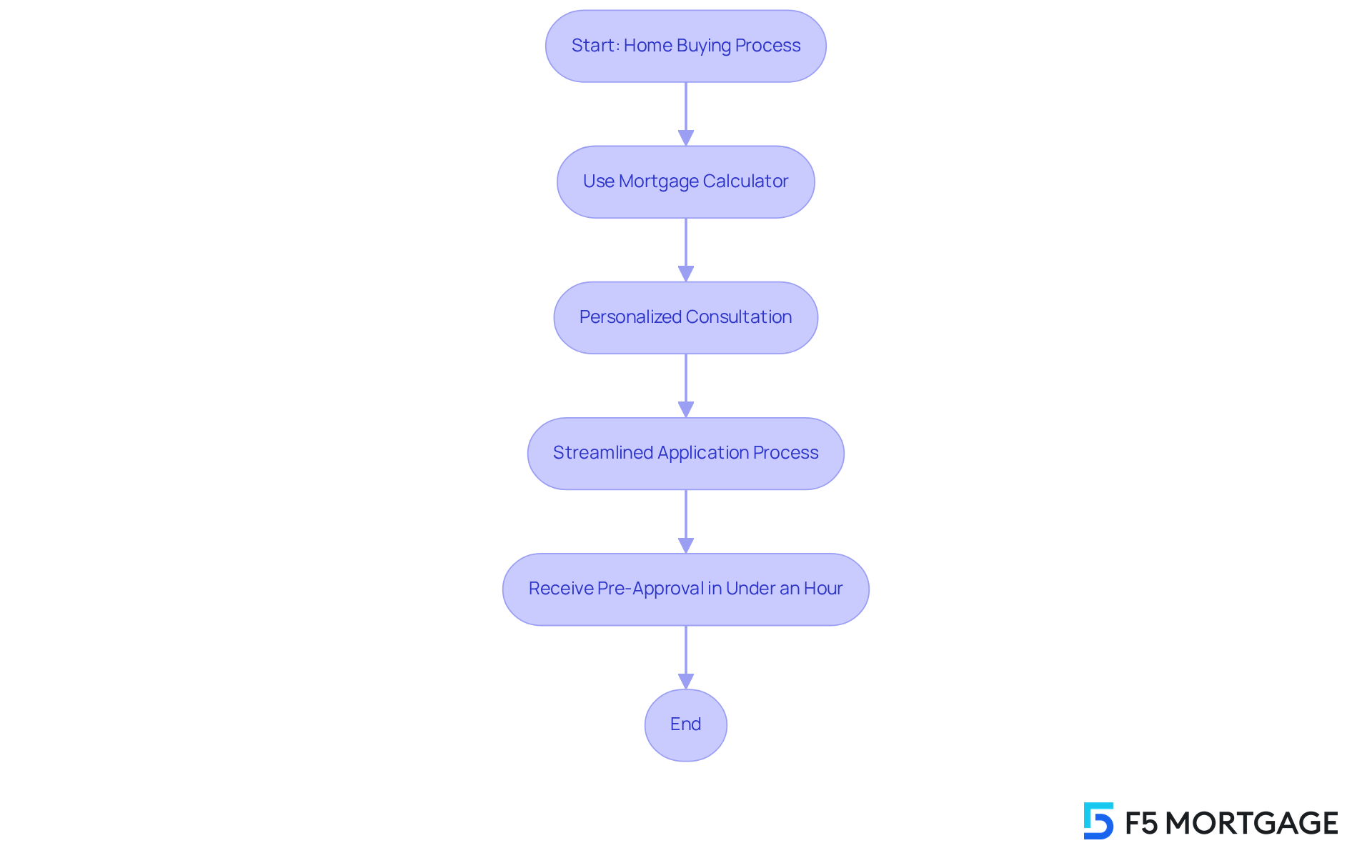

At F5 Financing, we understand how overwhelming the mortgage process can be for families. That’s why we have transformed our application process to allow you to obtain pre-approval in less than an hour. Imagine the relief of knowing your borrowing capacity quickly, enabling you to continue your home search with confidence. Our dedicated team, supported by advanced technology, is focused on optimizing efficiency, easing the stress often associated with high-interest rates and complex documentation.

In 2025, quick pre-approval is more vital than ever. Statistics show that streamlined processes can significantly reduce application times, making it easier for families like yours to navigate this journey. For instance, Truv provides coverage across 96% of the US workforce, enhancing the verification process for lenders and ensuring a smoother experience for you.

This commitment to swift service truly sets F5 apart in the competitive lending environment. We guarantee that you will receive prompt assistance and direction throughout your journey. As Matthew Turner, a specialist in financing processing services, wisely states, “The integration of technology in the pre-approval process is essential for enhancing efficiency and client satisfaction.” We’re here to support you every step of the way.

Competitive Rates and Terms: Ensuring Affordable Home Financing

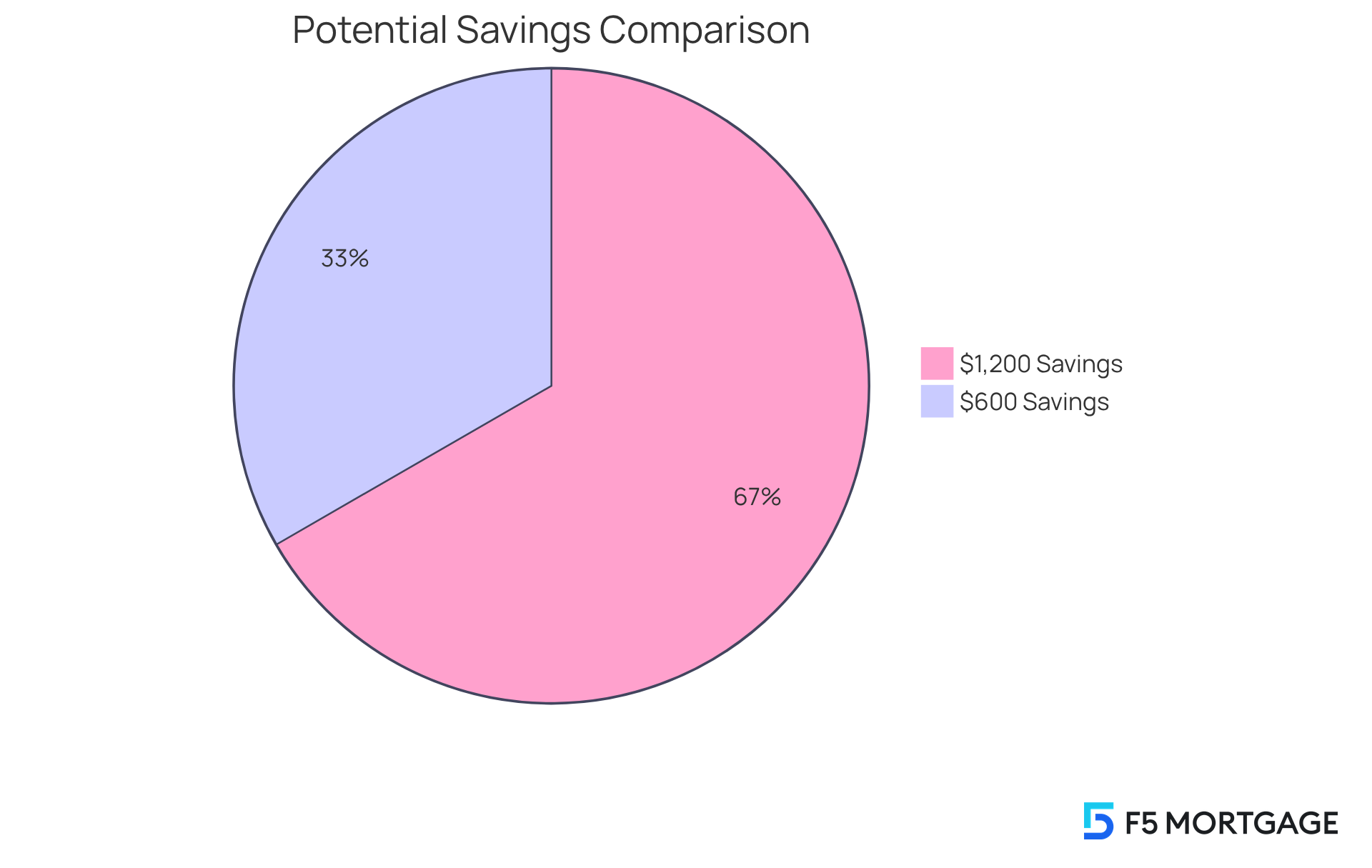

At F5 Mortgage, we understand how challenging navigating the mortgage landscape can be. That’s why we excel in delivering competitive rates and favorable terms tailored to your unique needs. By collaborating with over two dozen top lenders, we offer a diverse array of mortgage options that accommodate various financial situations.

This strategic approach not only allows families to save significantly on their monthly payments but also ensures you secure the most advantageous financing terms available in the market. For instance, households that compare various lenders can potentially save between $600 to $1,200 each year. This highlights the importance of considering different alternatives when making such a significant decision.

With our dedication to openness and personalized assistance, you can rely on us to help you make knowledgeable financial choices. At F5, we’re here to support you every step of the way as you choose the best home loan broker for your journey.

Comprehensive Educational Resources: Empowering Families in Their Mortgage Journey

At F5 Financing, we understand how challenging the financing process can be for households. That’s why we are dedicated to providing a strong selection of educational tools designed to clarify this journey. Our comprehensive home buyer’s guides and refinancing resources equip families with essential information, illuminating the intricacies of financing.

This emphasis on education not only fosters confidence but also enhances decision-making, leading to a more satisfying home buying experience. Research indicates that knowledgeable purchasers are significantly more content with their loan choices. In fact, a remarkable 94% customer satisfaction rate reported by F5 underscores the positive impact of education on decision-making.

By prioritizing client education, we demonstrate our unwavering commitment to exceptional service. We want families to feel supported and knowledgeable every step of the way. Remember, we’re here to support you through this process, ensuring you make informed choices that lead to your dream home.

Fast Closing Times: Most Loans Close in Less Than Three Weeks

At F5 Financing, we understand how crucial it is for families to settle into their new homes quickly. That’s why we take pride in our remarkable closing times—most loans are finalized in under three weeks. This swift turnaround is made possible by our streamlined process and a dedicated team that meticulously manages all required documentation. You can rest assured that your loan will be finalized promptly, allowing you to move in without unnecessary delays.

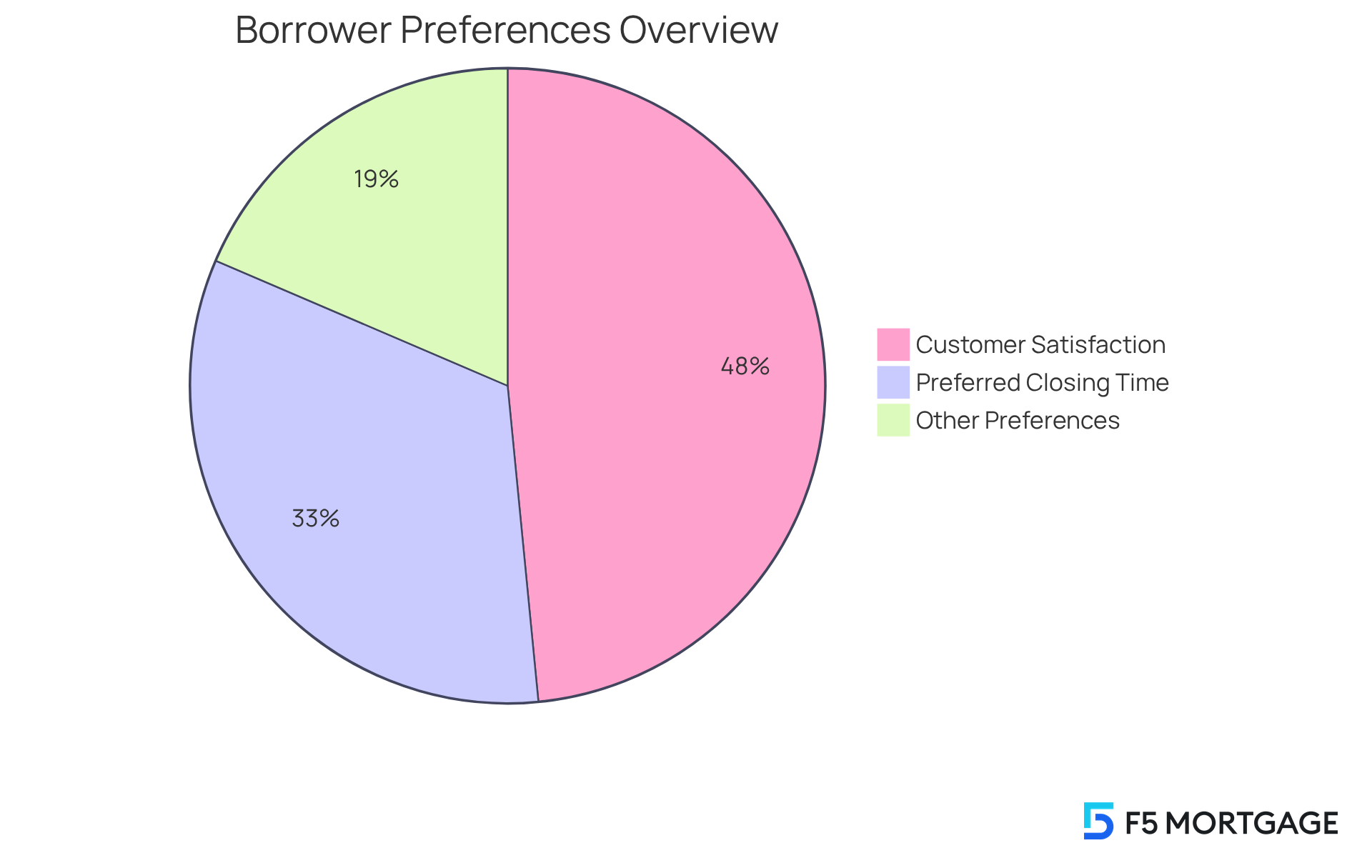

This efficiency not only enhances your experience but also serves as a significant benefit for F5. We know how challenging this can be, and we’re here to support you every step of the way. According to a recent report, nearly 64% of borrowers believe that a mortgage should close within one to three weeks, underscoring the importance of speed in the home buying process.

With a customer satisfaction rate of 94%, it’s clear that our commitment to prompt and effective service resonates with families like yours. Choosing F5 means you’re not just getting a loan; you’re gaining the best home loan broker to help you navigate the complexities of home financing.

High Customer Satisfaction: Building Trust with a 94% Satisfaction Rate

At F5 Mortgage, we understand how challenging the journey to homeownership can be. That’s why we are proud to share that we have achieved an impressive 94% customer satisfaction rate. This remarkable achievement reflects our unwavering commitment to providing exceptional service tailored to the unique needs of each family we work with.

Our clients often express their gratitude for the personalized attention and support they receive throughout the financing process. Bruce Gehrke from J.D. Power emphasizes that service quality and responsiveness are vital for building customer loyalty, and this aligns perfectly with our approach at F5.

In stark contrast to the loan servicing industry, where client satisfaction has dipped to an average score of 596, our strong history positions us as the best home loan broker, fostering trust and establishing us as a dependable ally for individuals seeking home financing. We know how important it is to feel secure in this process.

Moreover, our rapid and effective closing procedure, with most loans concluding in under three weeks, sets us apart from our competitors. This efficiency strengthens our reputation as the best home loan broker for families navigating their homeownership journey. We’re here to support you every step of the way, ensuring that your experience is as smooth and stress-free as possible.

Specialized Support for Unique Financial Situations: Helping Self-Employed Borrowers

At F5, we understand how challenging it can be for self-employed borrowers to secure a loan. You often face unique hurdles, such as stringent documentation requirements and fluctuating income, which can complicate the approval process. To support you effectively, we offer specialized assistance tailored to your needs. Our flexible documentation options allow you to use bank statements instead of traditional income verification methods, streamlining your application process.

Moreover, our brokerage stays informed about the latest guidelines affecting self-employed individuals, ensuring you are aware of any changes that may impact your eligibility. For example, starting December 14, Fannie Mae now requires self-employed borrowers to submit three months of business bank statements, a shift from the previous two-month requirement. By staying ahead of these developments, we empower you to navigate the complexities of financing with confidence.

Our dedication to personalized service means you receive advice customized to your specific financial circumstances. This approach not only alleviates the stress often associated with loan applications but also enhances your chances of securing favorable terms, such as lower interest rates or more flexible repayment options. With a focus on understanding the specific needs of self-employed borrowers, F5 is recognized as the best home loan broker and your trusted partner in achieving your homeownership dreams.

Simplifying the Mortgage Process: Making Home Buying Stress-Free

At F5 Mortgage, we understand how daunting the financing process can be for families. That’s why we are dedicated to transforming your experience into a smooth and hassle-free journey from start to finish. By leveraging cutting-edge technology, we simplify each step of the financing process, empowering you to navigate complexities with confidence.

We know how challenging this can be, and our focus on clarity and efficiency aims to alleviate your anxiety. With user-friendly tools like our mortgage calculator and personalized consultations, we illustrate how technology can enhance your overall experience. Moreover, our streamlined application process promises pre-approval in under an hour, significantly reducing stress for our clients.

As a result, F5 Mortgage has earned the trust of many families, boasting a customer satisfaction rate of 94%. This reflects our commitment to creating a positive and supportive environment for homebuyers. As our chief executive, James Armitage, emphasizes, “Mortgages can feel complex, but the continued progress in modern green finance is making sustainable home buying more accessible than ever.” We’re here to support you every step of the way.

Conclusion

F5 Mortgage stands out as a compassionate choice for families in search of home loan solutions, prioritizing personalized service and client needs above lender interests. This commitment not only simplifies the mortgage process but also fosters a foundation of trust, ensuring that families feel supported every step of the way. With an impressive customer satisfaction rate of 94%, F5 showcases its dedication to delivering exceptional service tailored to the unique financial circumstances of each household.

Throughout the article, key points illuminate the diverse loan options available, streamlined application processes, competitive rates, and educational resources that empower families. F5 Mortgage excels in offering tailored financing programs, quick pre-approval times, and specialized support for self-employed borrowers, making it a reliable partner in the journey toward homeownership. The emphasis on transparency, efficiency, and client education reinforces why F5 is recognized as the best home loan broker for families.

Ultimately, choosing F5 Mortgage means opting for a stress-free home buying experience that prioritizes family needs and financial well-being. Families are encouraged to explore the advantages of working with an independent mortgage broker like F5, as they navigate the complexities of home financing with confidence and clarity. We understand how challenging this can be, and our commitment to exceptional service and personalized solutions positions F5 Mortgage as an invaluable ally in achieving homeownership dreams.

Frequently Asked Questions

What makes F5 Mortgage stand out as a home loan broker?

F5 Mortgage prioritizes the unique needs of its clients over lender interests, offering a customized service experience to help households find financing solutions tailored to their financial circumstances.

What is F5 Mortgage’s customer satisfaction rate?

F5 Mortgage has a remarkable customer satisfaction rate of 94%, reflecting its effectiveness in delivering exceptional service and fostering trust with clients.

What types of loan programs does F5 Mortgage offer?

F5 Mortgage offers a variety of financing programs, including fixed-rate options, FHA options, VA options, and Jumbo options, tailored to meet the unique financial needs of families.

What are the benefits of FHA financing offered by F5 Mortgage?

FHA financing features reduced down payment criteria of just 3.5%, making homeownership more accessible, particularly for first-time home purchasers.

How does VA financing benefit veterans looking to purchase a home?

VA financing offers significant benefits such as zero down payment options and competitive interest rates, making homeownership more achievable for veterans.

How quickly can clients expect to receive pre-approval with F5 Mortgage?

Clients can obtain pre-approval in less than an hour, allowing them to know their borrowing capacity quickly and continue their home search with confidence.

What technology does F5 Mortgage use to streamline the application process?

F5 Mortgage leverages advanced technology to optimize efficiency in the application process, enhancing the experience for clients and reducing application times.

How does F5 Mortgage support clients throughout the financing journey?

F5 Mortgage provides prompt assistance and direction throughout the financing process, ensuring that clients feel supported every step of the way.