Overview

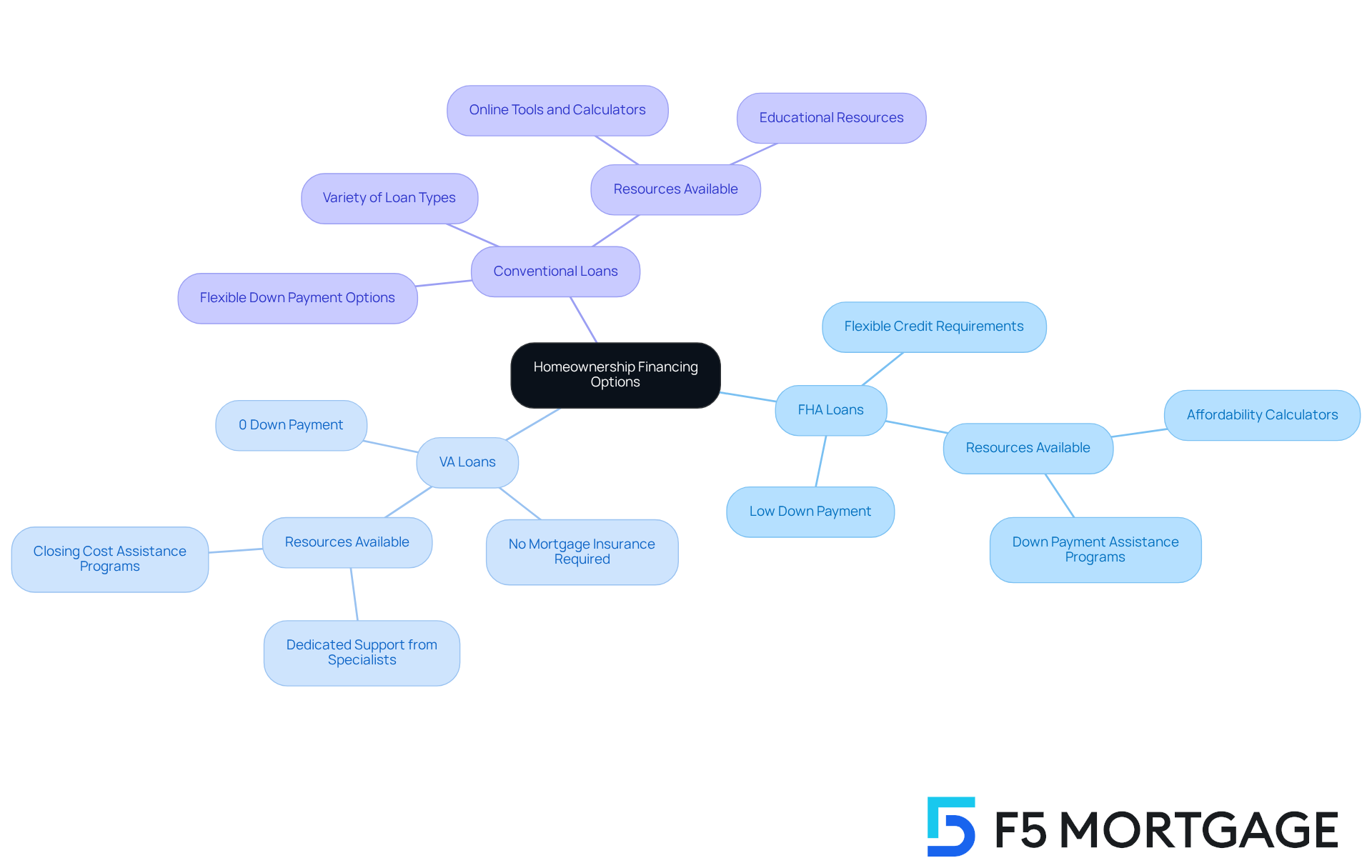

The article highlights various places where families can apply for FHA loans to upgrade their homes, addressing a common challenge many face. We know how overwhelming the process can be, but numerous lenders, including F5 Mortgage and Quicken Loans, offer tailored FHA financing solutions designed with families in mind. These options come with benefits such as low down payments and flexible credit requirements, making home improvements more accessible.

Imagine transforming your living space into a home that truly reflects your family’s needs. With the right support, this dream can become a reality. These lenders are here to support you every step of the way, providing guidance and understanding as you navigate your options.

Taking the first step can feel daunting, but remember, you’re not alone in this journey. Reach out to these lenders to explore the possibilities and find the best solution for your family. Together, we can make your home improvement dreams come true.

Introduction

In the quest for home improvement, we know how challenging it can be for families to secure financing that truly meets their unique needs. FHA loans offer an accessible solution, featuring low down payments and flexible credit requirements. This makes them particularly appealing for those looking to upgrade their living spaces.

However, with a multitude of lenders available, the challenge lies in determining the best places to apply for these loans. Which lenders not only provide competitive rates but also offer personalized support to help you navigate the complexities of the FHA loan process?

We’re here to support you every step of the way.

F5 Mortgage: Personalized FHA Loan Solutions for Homebuyers

At F5, we understand how challenging it can be for families to enhance their homes. That’s why we excel in providing customized and can assist you in understanding tailored specifically for your needs. Our streamlined application process, combined with a strong commitment to your satisfaction, empowers you to secure . With our dedicated team of specialists, we guide you through every stage of the and show you where to apply for FHA loan, making your home enhancements more attainable and less daunting.

- are at the heart of our service. Each client receives a thorough assessment of their unique needs, ensuring that the loan options align perfectly with your financial goals. This client-focused approach shines through in the testimonials from satisfied customers, who highlight the exceptional service and personalized mortgage solutions they received.

- We provide various FHA financing programs to help you understand where to apply for FHA loan, including options designed for home improvements and renovations. For instance, the FHA 203(k) program enables households to finance renovations through FHA support, guiding them on where to apply for FHA loan to make their dream upgrades a reality.

- Our Rapid Pre-Approval process is remarkably efficient, often completed in less than an hour. This allows you to act swiftly in a competitive market. We are committed to providing a stress-free mortgage experience, frequently closing loans in under three weeks.

As financial advisor Jane Doe points out, “Reduced mortgage payments can free up cash flow, enabling households to invest in their future.” This highlights the importance of our tailored consultations, which can significantly enhance your family’s financial well-being. With nearly 60% of active loans having interest rates under 4%, you can take advantage of refinancing options available through F5. Our procedure offers a quicker closing experience, often finalizing financing in less than three weeks. With , you can navigate the complexities of FHA financing with confidence, ensuring your home upgrade aspirations become a reality.

Federal Housing Administration (FHA): Government-Backed Loan Programs

The Federal Housing Administration (FHA) plays a vital role in the housing market by guaranteeing funds provided by approved lenders. This government backing empowers lenders to offer more favorable terms, such as lower down payments and . are particularly beneficial for and individuals with imperfect credit, making them an excellent choice for families looking to improve their living situations.

Consider the benefits of :

- (as low as 3.5%) make homeownership more accessible than ever.

- More flexible credit score criteria compared to traditional financing open doors for a wider array of borrowers.

- The ability to cover closing costs within the mortgage reduces the initial financial burden.

At , we understand how significant these advantages can be for you and your family. We offer a variety of , including FHA options, VA options, and other unconventional alternatives, tailored to meet your unique needs. Our extensive network allows us to provide personalized solutions, ensuring that even if other lenders have said no, you still have options.

We know how challenging this can be, and we’re here to support you every step of the way. Discover how FHA financing can help you realize your homeownership dreams today.

Quicken Loans: Fast and Efficient FHA Loan Applications

F5 Lending LLC is recognized for its quick and effective service in guiding customers on , making it an ideal choice for families seeking prompt funding for home improvements. With a streamlined online application, borrowers can complete their submissions swiftly, often achieving pre-approval in under an hour. This efficiency is crucial for families eager to secure funding without unnecessary delays.

Key features of include:

- that guide families through the process, ensuring they understand their options and feel supported.

- , often within an hour, enabling families to act swiftly in competitive housing markets.

- , including information on where to apply for FHA loan options with down payments as low as 3.5% for credit scores of 580 or higher, making homeownership more attainable.

- , ensuring borrowers feel informed and confident.

- A large network of lenders, allowing for competitive rates and terms tailored to individual needs.

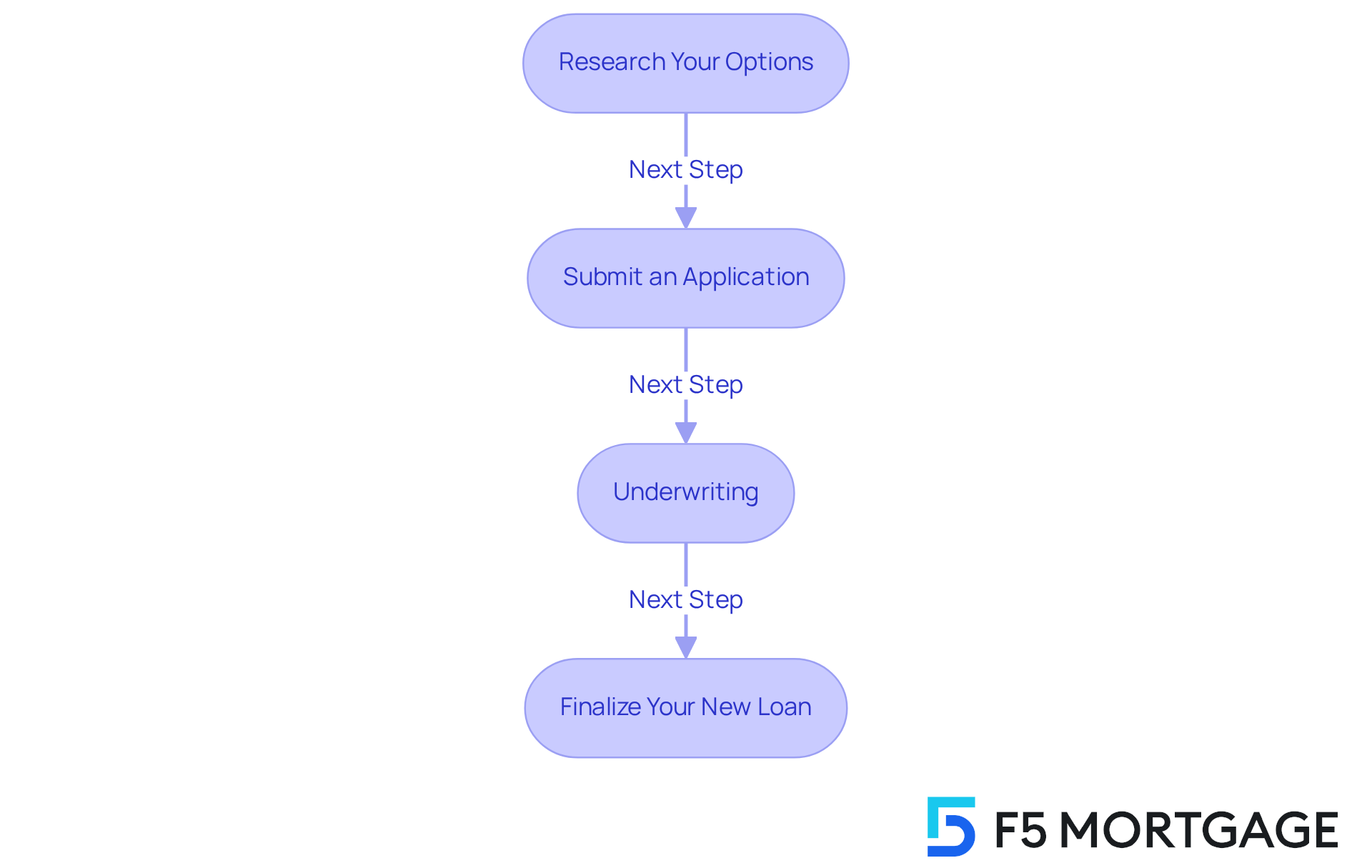

The with F5 Mortgage involves several key steps:

- Research Your Options: We know how challenging this can be. Assess your financial situation and compare multiple lenders to find the best rates and terms.

- Submit an Application: Provide information about your property and financial documents.

- Underwriting: The lender reviews your application, credit history, and other requirements.

- Finalize Your New Loan: Once approved, sign the new documents and pay closing costs.

Real-life success stories highlight families who have benefited from these quick approvals, showcasing how F5 has helped them realize their . Clients have praised the exceptional service, with testimonials noting the dedication of the team in guiding them through the refinancing process. Financial analysts emphasize that understanding where to apply for FHA loan can greatly enhance a family’s ability to navigate the housing market successfully, making home upgrades more attainable. With a focus on customer satisfaction, F5 continues to be a looking to enhance their living situations through FHA financing.

Rocket Mortgage: Simplified FHA Loan Process Through Technology

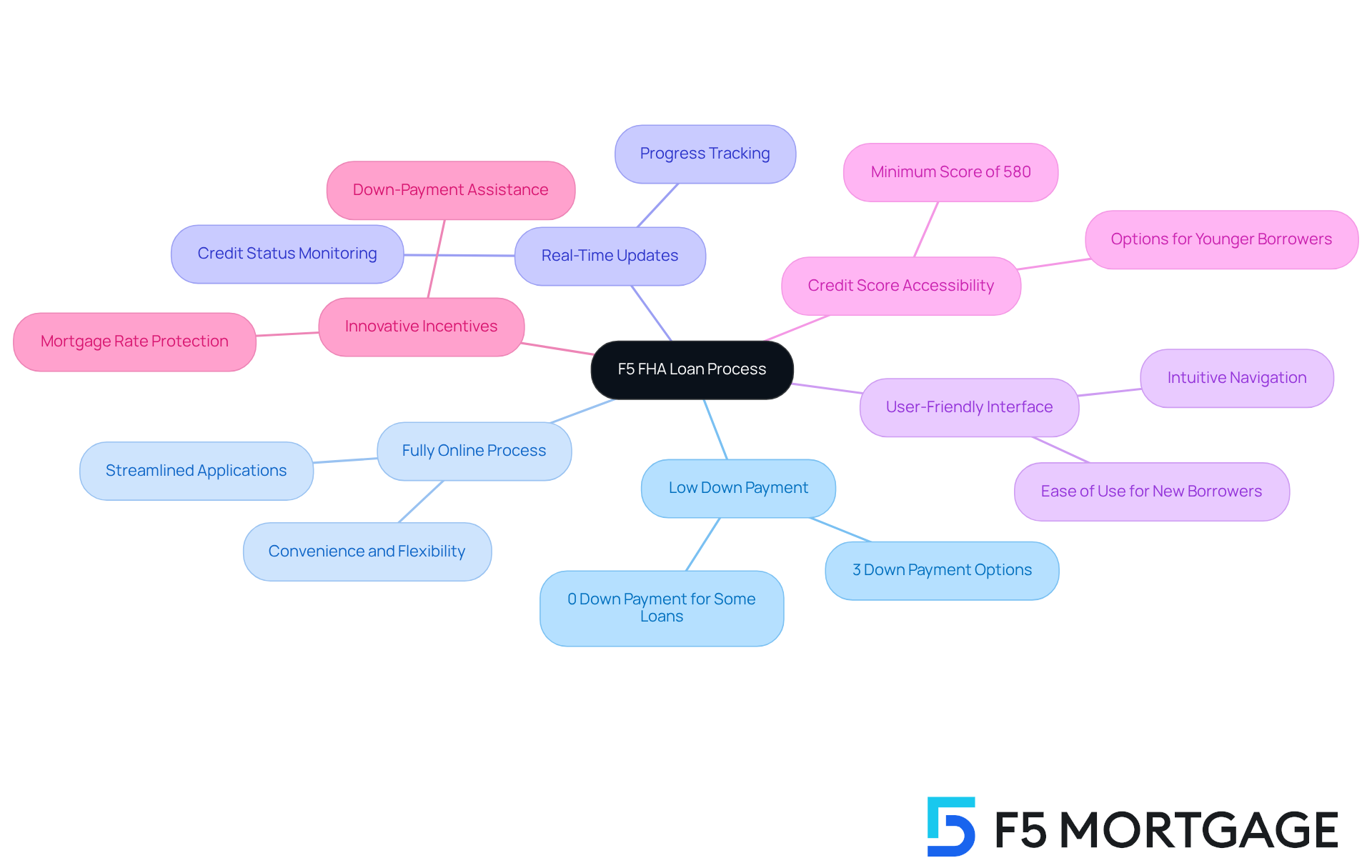

F5 is transforming the procedure by employing and approvals. We understand how daunting the mortgage process can be, which is why their platform enables borrowers to oversee their credits online, monitor progress, and interact with financing officers effortlessly. This tech-driven approach resonates particularly well with younger homebuyers who prefer digital solutions.

Key features of include:

- Qualifying to buy a home with as little as 3% down, or even 0% down for some loan options, making homeownership more accessible.

- A , allowing for convenience and flexibility.

- Real-time updates on credit status, keeping borrowers informed and reducing uncertainty.

- A designed for ease of use, making it accessible even for those new to the mortgage process.

- FHA financing may be available to individuals with a credit score as low as 580, enhancing accessibility for younger borrowers.

- Innovative incentives such as and mortgage rate protection further support homebuyers in their journey.

As technology continues to reshape the housing finance sector, F5 stands out by addressing the preferences of younger purchasers, who are more inclined to use online platforms to learn where to . This shift not only simplifies the borrowing experience but also empowers a new generation of homeowners to navigate the complexities of financing with confidence. We know how crucial it is for borrowers to to ensure they are obtaining the best offer, as may provide considerable savings. We’re here to .

Wells Fargo: Comprehensive FHA Loan Options from a Major Bank

At , we understand that navigating where to apply for an FHA loan can be challenging. That’s why we provide an extensive range of options designed to meet diverse borrower requirements. As a reliable provider in the mortgage sector, we pride ourselves on delivering outstanding service and for families looking for guidance on . Our commitment to your satisfaction makes us a trusted choice among homebuyers.

Key Features:

- A variety of , including both fixed-rate and adjustable-rate options, with .

- Access to that empower homebuyers to make informed decisions.

- Tailored assistance from our skilled mortgage advisors, who guide families on where to apply for FHA loan and help them navigate the intricacies of the .

We also want you to be aware of closing costs, which typically range from 2% to 5% of the home’s value. Currently, the average stands at 6.26%, and we at F5 are committed to projecting competitive rates for the upcoming quarter. This dedication to competitive pricing, combined with our unwavering commitment to your satisfaction, has led to positive experiences for many families who have successfully utilized our FHA financing. Numerous households have shared how our helped them navigate the complexities of the FHA financing process.

While can enhance your chances of securing advantageous terms, F5 stands out with our extensive educational materials and tailored assistance. We know how important it is to feel supported during this journey, and we’re here to guide you every step of the way.

Bank of America: Competitive FHA Loan Products and Resources

At F5 Mortgage, we understand how overwhelming the journey to homeownership can be. That’s why we are proud to offer competitive FHA and a wealth of resources, including guidance on where to apply for , designed specifically for homebuyers like you. With our range of , including FHA mortgages with as little as 3.5% down, VA mortgages with 0% down, and conventional mortgages featuring , we make it easier for families to achieve their dream of owning a home.

Our commitment to is at the heart of what we do. We ensure that you are well-informed throughout the mortgage process, giving you the confidence you need to make the best decisions for your family.

Key Features:

- Enjoy low down payment options and flexible credit requirements tailored to your needs.

- Access comprehensive online resources and tools, including affordability calculators that help you assess different down payment scenarios.

- Receive , who are here to guide you through available in California. Programs like the Golden State Finance Authority’s Open Doors and Platinum Program provide significant support for closing costs.

It’s important to remember that, in addition to the down payment, there will be and obtaining your financing, typically ranging from 2% to 5% of the home’s value. Depending on your down payment amount and type of financing, you may also need to secure mortgage insurance, which could increase your monthly payments.

With F5 Home Loans, families can explore a variety of financing options tailored to their unique needs, paving a smoother path toward homeownership. We know how challenging this can be, but we’re here to support you every step of the way.

Chase Bank: FHA Loans with a Focus on Customer Service

At , we understand how challenging the journey to homeownership can be. That’s why we are dedicated to delivering outstanding customer service through our . Our team of compassionate mortgage professionals is here to guide you on and through the application process, ensuring a smooth experience from start to finish. This focus on service is especially beneficial for who may need that extra bit of support.

- Enjoy personalized assistance from our knowledgeable mortgage advisors who will help you understand your options, including [where to apply for FHA loan](https://britannica.com/money/first-time-homebuyer-programs), along with low down payment solutions like VA and conventional loans.

- Access extensive materials designed to help you comprehend FHA financing and learn where to apply for FHA loan as well as how down payments impact your mortgage funding and payment alternatives.

- Benefit from , including refinancing opportunities that allow you to adjust your terms to reduce payments or eliminate PMI, especially supported by high home appreciation rates in California.

- Take advantage of that can significantly ease the financial burden for first-time homebuyers.

We know how important it is to feel supported during this process, and our clients have shared outstanding testimonials about the exceptional service and personalized loan solutions provided by our dedicated team. With a strong emphasis on client satisfaction, F5 guarantees a , making us a superb option for families looking to enhance their homes.

USAA: FHA Loans Tailored for Military Families

F5 understands the unique challenges when it comes to financing a home. That’s why we offer specifically tailored for you, guiding you on where to apply for an FHA loan and providing distinct advantages and committed assistance throughout your . We know how important it is for military members and their families to access that truly meet their needs.

One of the benefits of working with F5 Finance is the flexibility to modify your financing term during . This allows you to adjust your monthly payments or pay off your debt sooner, giving you greater control over your financial future. If you acquired your home with a standard mortgage and put down less than 20%, refinancing could help you eliminate private mortgage insurance (PMI). Given the rising home values in California, this can significantly enhance your loan-to-value (LTV) ratio.

Additionally, we offer certain that provide extra support for veterans, first responders, and educators. We’re here to ensure these deserving groups receive the assistance they need on their homebuying journey. At F5, we are dedicated to supporting you every step of the way.

LendingTree: Compare FHA Loan Offers from Multiple Lenders

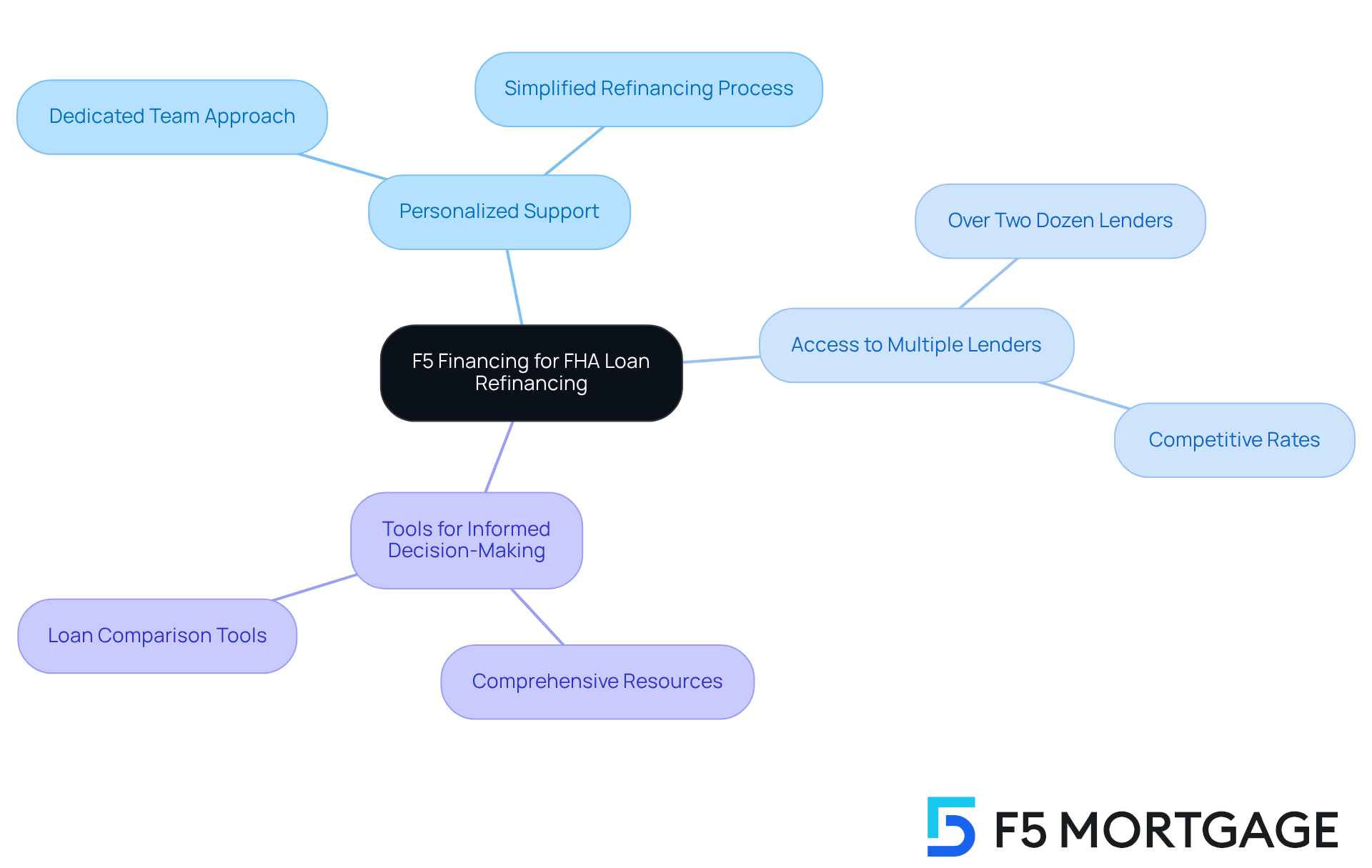

F5 provides a valuable resource for households looking for information on refinancing. We understand how daunting this process can be, and that’s why F5 Financing offers access to a and account managers. This support simplifies the journey of assessing various loan terms and rates tailored to your unique needs. This competitive approach is essential for families striving to secure the best financing options available.

Key features of refinancing with F5 Mortgage include:

- A that ensures personalized support throughout the refinancing process.

- , enabling borrowers to discover the best rates available.

- Comprehensive tools and resources designed to empower you in making informed decisions.

For instance, many households using F5 financing have reported and often inquire about where to apply for FHA loan, with some achieving average savings of thousands of dollars over the life of their loans. Financial advisors emphasize the importance of exploring financing alternatives, noting that ‘the right decision can lead to substantial long-term financial benefits.’ for families looking to understand where to apply for FHA loan financing with confidence and ease.

NerdWallet: Educational Resources for FHA Loan Comparisons

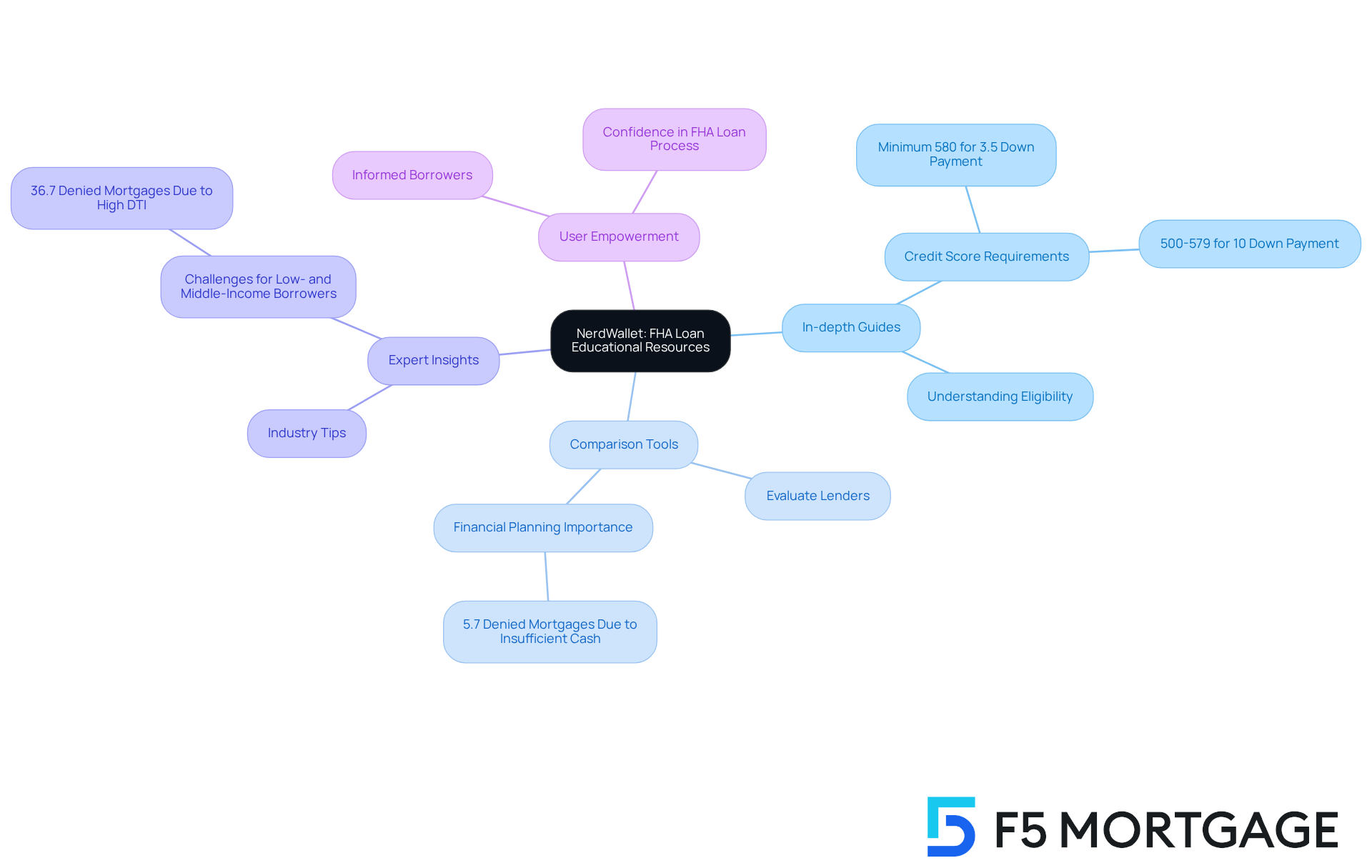

NerdWallet serves as a vital resource for borrowers exploring FHA options, including information on , and offers a comprehensive array of educational materials designed to clarify the . We know how challenging this can be, and our platform features detailed guides that outline and benefits, helping you grasp the essentials of these .

Key features include:

- In-depth Guides: Our thorough explanations of , including credit score thresholds and , empower you to understand your eligibility. For example, a minimum credit score of 580 is necessary for a 3.5% down payment, while those with scores between 500 and 579 can still qualify with a 10% down payment.

- Comparison Tools: You can evaluate various lenders and financing products, enabling informed decisions based on your financial situation. This is particularly crucial, as 5.7% of denied mortgages result from insufficient cash to close, highlighting the importance of careful financial planning.

- Expert Insights: Our platform offers valuable tips and insights from industry experts, including information on where to apply for fha loan, emphasizing the importance of borrower education in the mortgage journey. This guidance is essential, especially for low- and middle-income borrowers who often encounter challenges like , which accounted for 36.7% of mortgage denials in 2022.

- User Empowerment: A significant number of borrowers report feeling more informed after using NerdWallet’s resources, which boosts their confidence in navigating the complexities of FHA loans and knowing where to apply for FHA loan.

By leveraging these educational tools, you can make well-informed decisions, ultimately leading to and improved financial outcomes. We’re here to every step of the way.

Conclusion

Navigating the landscape of FHA loans can be a transformative step for families looking to enhance their homes. We know how challenging this can be, and this article has explored various reputable lenders, such as F5 Mortgage, Quicken Loans, and Wells Fargo. Each offers unique advantages tailored to meet diverse needs. By understanding where to apply for FHA loans, families can leverage government-backed financing options to make home upgrades more accessible and affordable.

Key insights include:

- The benefits of low down payments

- Flexible credit requirements

- The availability of specialized programs for first-time buyers and military families

The streamlined application processes and personalized support provided by these lenders empower borrowers to make informed decisions and secure favorable terms. With resources like NerdWallet and LendingTree, potential homeowners can compare offers and better understand their options. This ensures they choose the best path for their financial situation.

Ultimately, pursuing an FHA loan can significantly enhance a family’s ability to achieve their dream home. The combination of competitive rates, educational resources, and dedicated customer service from these lenders underscores the importance of exploring financing options. We’re here to support you every step of the way as families are encouraged to take the next step in their homeownership journey, leveraging the available tools and support to make their home improvement aspirations a reality.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage specializes in providing personalized FHA financing solutions to help families enhance their homes. They offer a streamlined application process, dedicated support, and various FHA financing programs tailored to individual needs.

How does F5 Mortgage assist clients in the FHA financing process?

F5 Mortgage provides personalized consultations to assess clients’ unique needs, guiding them through every stage of the FHA financing process and helping them understand where to apply for FHA loans.

What are the benefits of FHA loans?

FHA loans offer low down payment options (as low as 3.5%), flexible credit score criteria, and the ability to cover closing costs within the mortgage, making homeownership more accessible, especially for first-time buyers and those with imperfect credit.

What is the FHA 203(k) program?

The FHA 203(k) program allows households to finance renovations through FHA support, enabling them to make home improvements while securing the necessary funding.

How quickly can clients expect pre-approval for an FHA loan with F5 Mortgage?

F5 Mortgage’s Rapid Pre-Approval process is efficient, often completed in less than an hour, allowing clients to act swiftly in competitive housing markets.

What is the typical closing timeline for loans with F5 Mortgage?

F5 Mortgage frequently closes loans in under three weeks, providing a stress-free mortgage experience for clients.

What support does F5 Mortgage provide during the refinancing process?

F5 Mortgage offers comprehensive customer support throughout the refinancing process, including assistance with researching options, submitting applications, underwriting, and finalizing new loans.

How does F5 Mortgage ensure competitive rates and terms for clients?

F5 Mortgage has a large network of lenders, which allows them to provide competitive rates and terms tailored to individual needs, ensuring clients have access to the best possible financing options.

How can FHA financing contribute to a family’s financial well-being?

FHA financing can lead to reduced mortgage payments, freeing up cash flow for families, which can be invested in their future and enhance their overall financial stability.