Overview

We understand how challenging it can be to navigate the home buying process, especially for first-time buyers with low credit scores. Fortunately, low credit score home loans are becoming increasingly accessible through various programs. Options like FHA, VA, USDA, and specialized lenders cater to individuals with credit scores as low as 500 or 580.

These programs, along with state-specific assistance, provide tailored solutions and flexible terms. This means that many individuals can achieve their dream of homeownership, even when faced with financial hurdles. We’re here to support you every step of the way as you explore these opportunities.

By considering these options, you can find a path to homeownership that works for you. Remember, you are not alone in this journey, and there are resources available to help you succeed.

Introduction

Navigating the path to homeownership can be particularly daunting for first-time buyers, especially those grappling with low credit scores. We know how challenging this can be. However, a growing number of lenders are now offering tailored mortgage solutions that make this dream more attainable than ever. This article explores nine viable home loan options specifically designed for individuals with less-than-ideal credit ratings, highlighting the unique benefits and opportunities each presents.

What challenges do these aspiring homeowners face, and how can they effectively leverage these financing options to secure their future? We’re here to support you every step of the way.

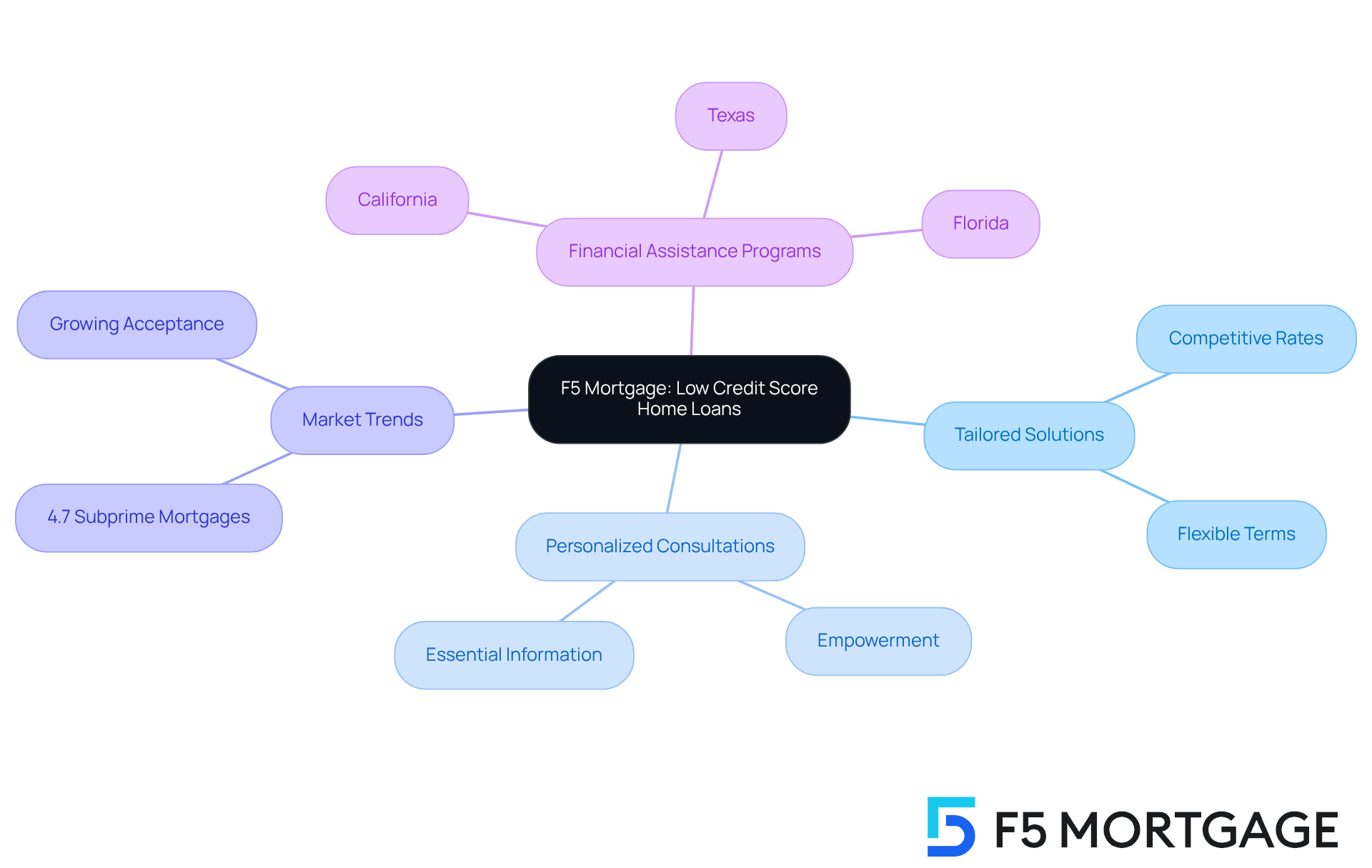

F5 Mortgage: Tailored Solutions for Low Credit Score Home Loans

At F5 Mortgage, we understand how challenging the journey to homeownership can be, especially for first-time buyers looking for . That’s why we excel in providing designed specifically for you. By partnering with a network of over two dozen top lenders, we offer that cater to your unique financial situation.

Our are vital in this process. They equip you with the the complexities of obtaining a home loan, even when faced with financial hurdles. This caring approach not only enhances your satisfaction but also empowers you to .

Recent trends show a growing acceptance of low credit score home loans among lenders. In fact, 4.7% of mortgages issued in Q1 2025 went to . This trend aligns perfectly with our offerings of low credit score home loans at F5 Mortgage, positioning us as a reliable partner for individuals embarking on their . We ensure that clients with less-than-ideal financial backgrounds can discover .

Moreover, we offer extensive , further enhancing your home buying prospects. Remember, we’re here to support you every step of the way.

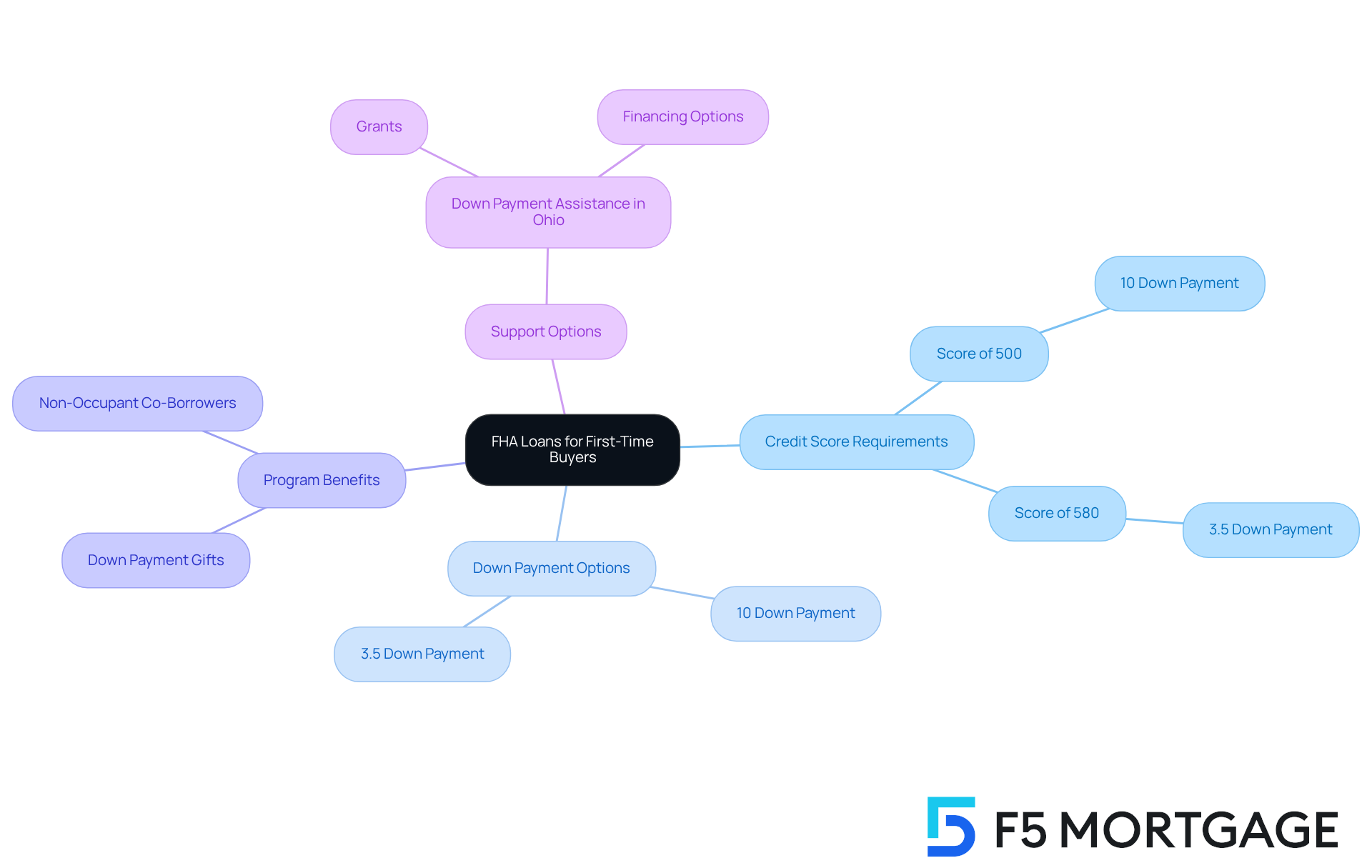

FHA Loans: Minimum Credit Score of 500 for First-Time Buyers

is specifically designed to support , providing a pathway to homeownership through for individuals with credit scores as low as 500, provided they can make a 10% down payment. For those with scores of 580 or higher, the down payment requirement is significantly reduced to just 3.5%. This flexibility is particularly beneficial for those who may struggle to meet the stricter , which makes low credit score home loans an attractive choice.

In 2025, the average down payment percentage for [FHA financing](https://f5mortgage.com/4-steps-to-secure-fha-loan-pre-approval-successfully) remains competitive, making it an appealing choice for first-time buyers. Success stories abound, with many individuals despite initial financial hurdles. Analysts note that recent policy updates could enable an additional 100,000 families each year to secure FHA financing, further highlighting the program’s vital role in promoting homeownership among those who qualify for low credit score home loans.

The advantages of FHA financing go beyond just relaxed credit requirements; they also include:

- The ability to use down payment gifts

- The option for non-occupant co-borrowers

This eases the journey for first-time buyers in today’s financial landscape. Thus, FHA financing stands as a crucial resource for aspiring homeowners seeking low credit score home loans to navigate financial challenges and invest in their futures. We understand how daunting this process can be, and ‘FHA mortgages provide a to enter the housing market, especially for those with limited credit histories.’

Additionally, in Ohio, prospective homeowners can receive ranging from a few thousand dollars to over $30,000, with options for financing or grants, thereby enhancing the accessibility of homeownership for families seeking to renovate their homes.

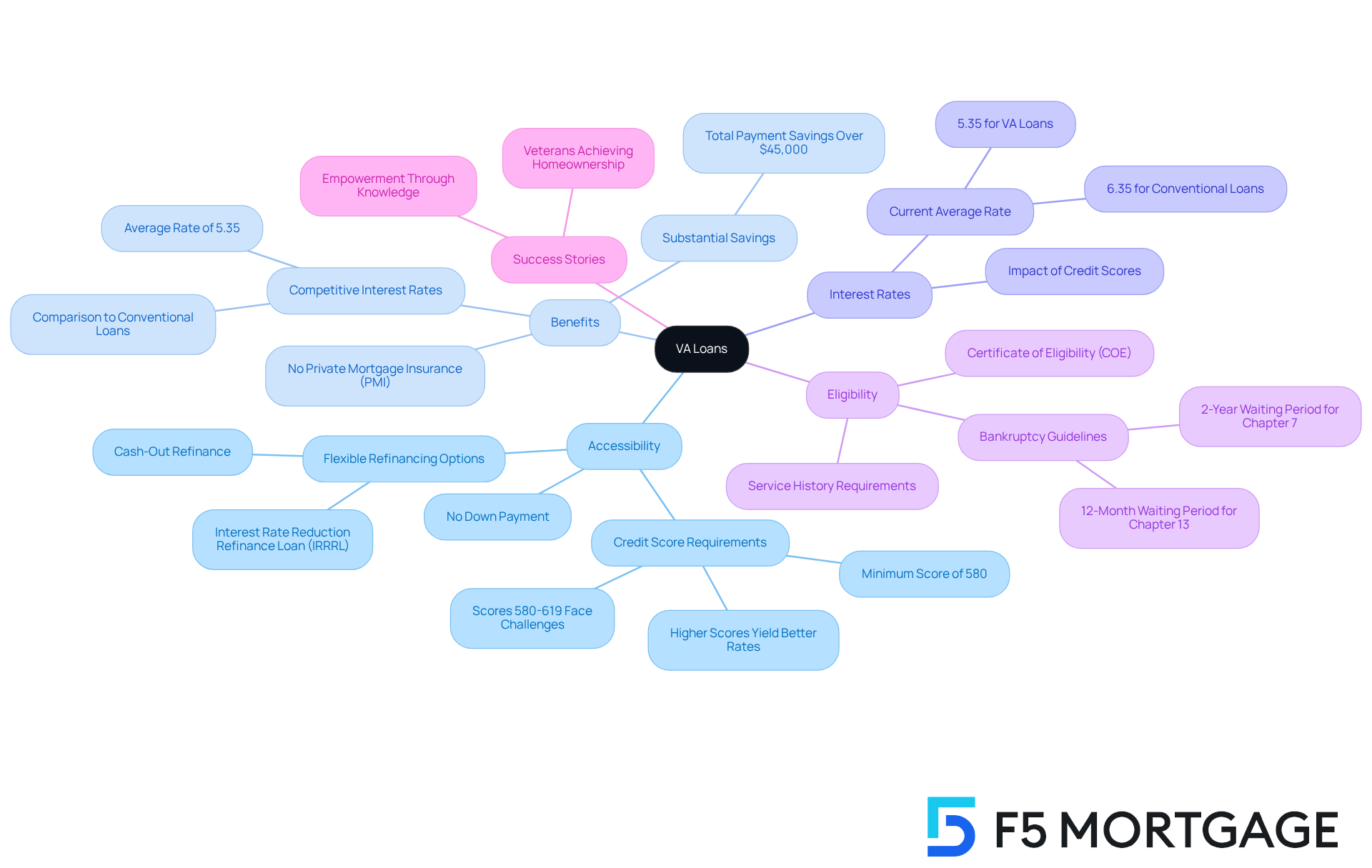

VA Loans: Accessible Financing for Veterans with Credit Scores Starting at 580

provides a compassionate solution for veterans, with many lenders offering to those with . We understand how challenging it can be to secure , and this accessibility is especially beneficial for those facing such hurdles. Remarkably, VA financing often requires , significantly lowering the barriers to homeownership. As of 2025, the average interest rate for a VA mortgage is around 5.35%. This is competitive compared to traditional financing, which frequently exceeds 6.35% for similar amounts.

The VA financing program is thoughtfully designed to assist military service members and veterans, providing them with favorable conditions, including . This can lead to . Mortgage professionals emphasize that , yet the flexibility of VA financing allows individuals to secure low credit score home loans and achieve their dream of homeownership.

Success stories abound, with many veterans successfully obtaining VA financing despite starting with credit scores close to 580. These experiences underscore the program’s dedication to , helping them secure homes and establish stability for their families. Recent updates in VA eligibility have further broadened access, ensuring that even more veterans can take advantage of this invaluable resource. Overall, VA financing stands out as a viable and supportive option for veterans looking to .

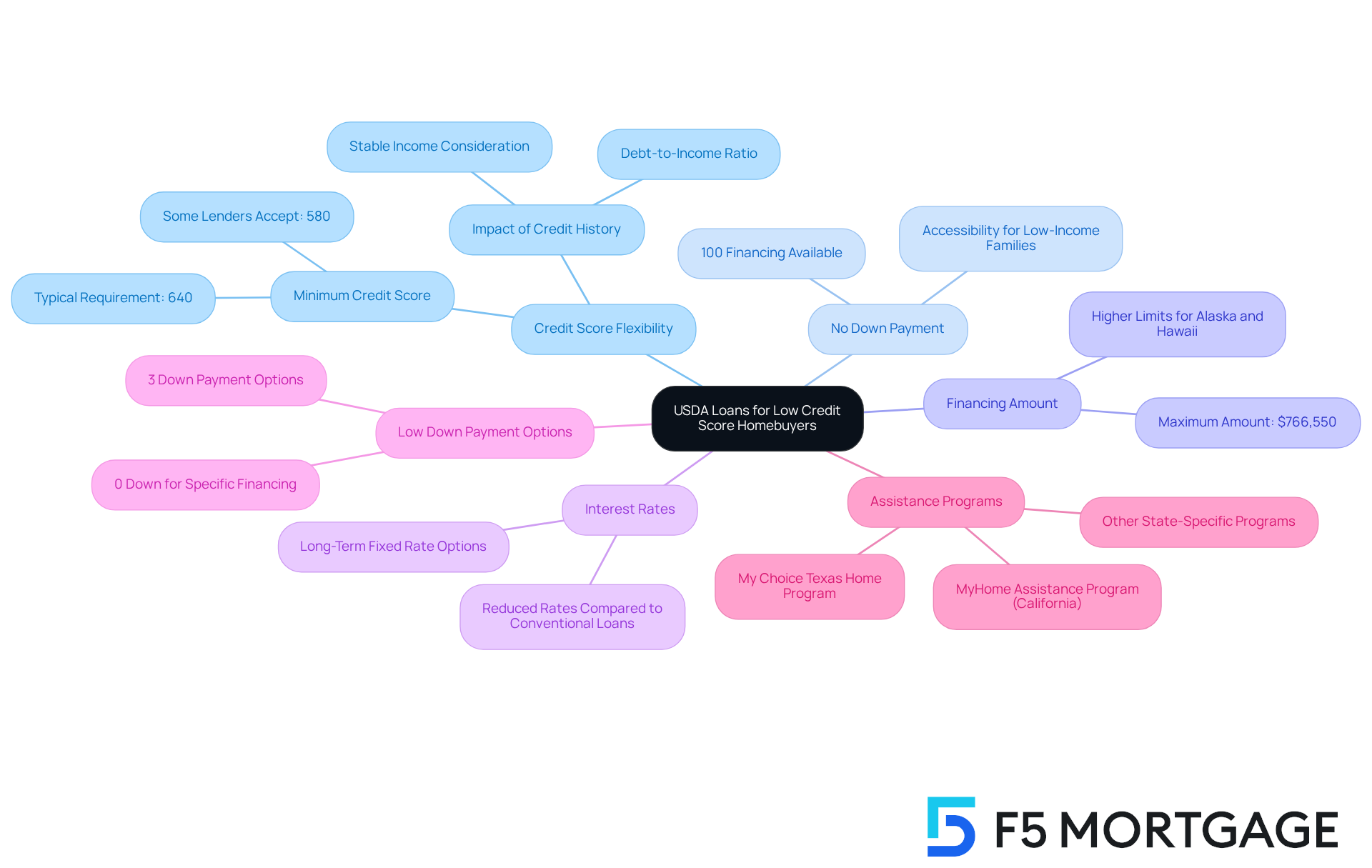

USDA Loans: Low Credit Score Options for Rural Homebuyers

USDA loans provide a wonderful opportunity for low-income and in rural areas. We understand how challenging this journey can be, especially when it comes to securing . While many lenders typically prefer a score of 640 or above, some may offer to those with scores as low as 580, particularly if you have a . This flexibility is crucial, as it allows individuals with limited credit histories to access the dream of homeownership.

One of the significant advantages of USDA financing is the , making it easier for families to purchase homes in designated rural areas. In 2024, the maximum USDA financing amount is set at $766,550 for the continental U.S., which supports a wide range of homebuyers. There are countless who have navigated this process with low credit score home loans, demonstrating that homeownership is within reach for many.

Financial specialists emphasize that for low credit score home loans, offering reduced interest rates and adaptable credit criteria to help individuals fulfill their homeownership aspirations. Moreover, F5 Mortgage presents various , including choices with as little as 3% down or even 0% down for specific financing.

For families seeking additional support, , such as the MyHome Assistance Program in California and the My Choice Texas Home program, are available. These resources can further ease your path to homeownership. We’re here to support you every step of the way as you embark on this exciting journey.

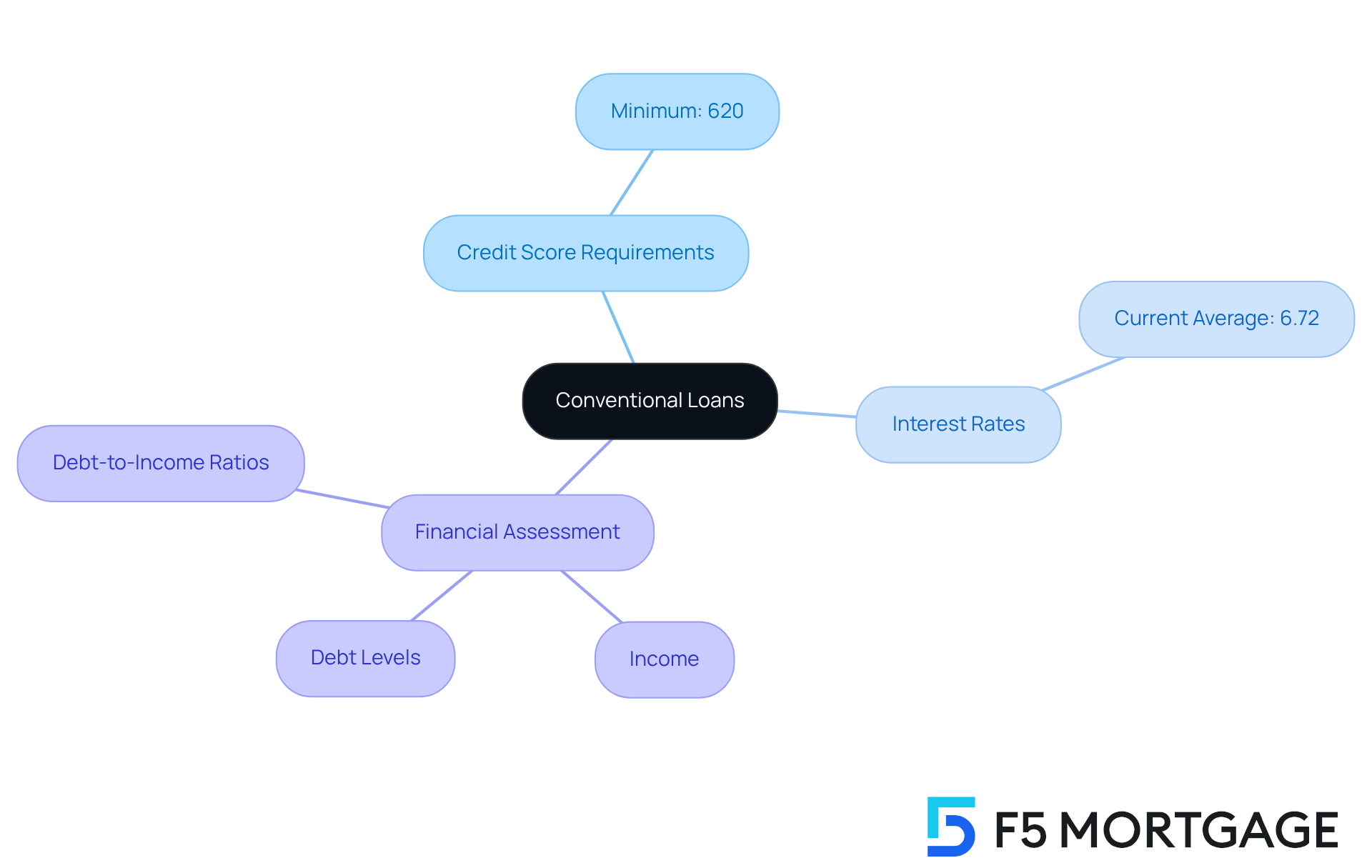

Conventional Loans: Starting Credit Score of 620 for First-Time Buyers

We know how challenging navigating the can be. Traditional mortgages typically require a minimum credit rating of 620, which is higher than the requirements for offered by some government-supported options. However, they can offer and favorable terms for those who meet the criteria. In 2025, the average interest rate for a 30-year fixed-rate conventional mortgage hovers around 6.72%, reflecting a stable yet competitive market for borrowers.

should take a moment to assess their entire financial profile, including income and debt levels, to determine their eligibility for . Many first-time homebuyers have successfully qualified for low credit score home loans by enhancing their and effectively managing their . Success stories abound, showing that with the right approach, is within reach.

Mortgage experts emphasize the importance of understanding the of traditional financing. We’re here to support you every step of the way, as these options can be a practical choice for individuals seeking to .

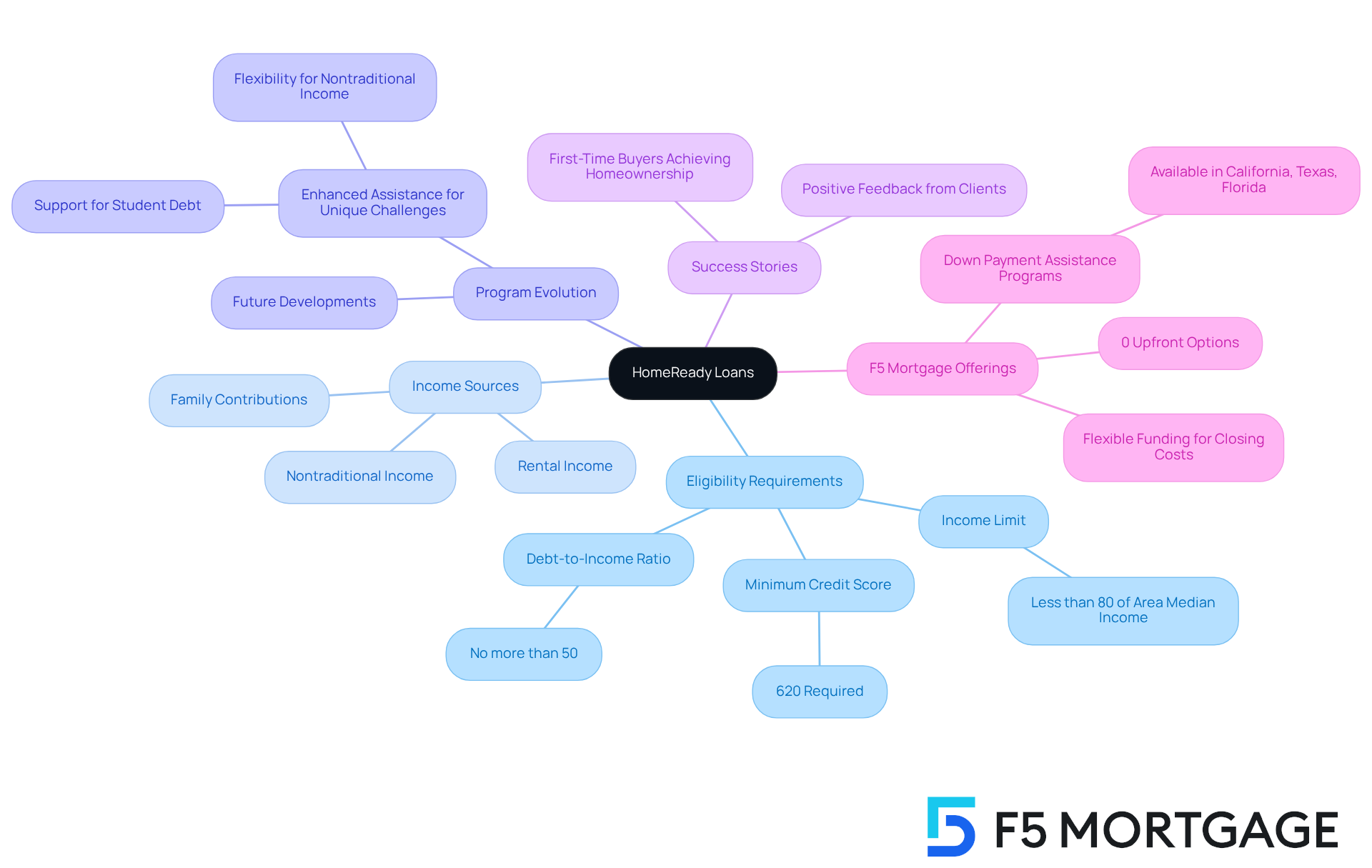

HomeReady Loans: Flexible Options for Low Credit Score Borrowers

, offered by Fannie Mae, is designed specifically for low- to moderate-income borrowers, making the dream of homeownership more attainable. These have a of only 620 and allow down payments as low as 3%, significantly lowering the barrier for . This program’s flexibility extends to various income sources, enabling applicants to include rental income or contributions from family members—crucial support for those with limited savings.

As we look ahead to 2025, the HomeReady program continues to evolve, offering enhanced assistance for borrowers facing unique financial challenges, such as student debt or nontraditional income sources. Many success stories highlight how first-time buyers are through HomeReady programs, even with low credit score home loans that meet the minimum threshold. Financial advisors often emphasize the advantages of HomeReady loans, noting that they not only facilitate homeownership but also provide options for once equity reaches 20%. This combination of low initial deposit requirements and flexible income considerations makes HomeReady an ideal choice for aspiring homeowners navigating the complexities of the mortgage landscape.

Moreover, F5 Mortgage offers multiple low-cost options, including programs with 0% upfront for eligible buyers, ensuring that . We encourage borrowers to explore available through F5 Mortgage, especially in states like California, Texas, and Florida, where . The program also allows for managing down payment and closing costs without a minimum personal contribution, making it even more accessible for those looking to purchase their first home. Our clients truly value our support, as reflected in our 5/5 star ratings on Lending Tree, Google, and Zillow, where they commend our expertise and seamless financing processes.

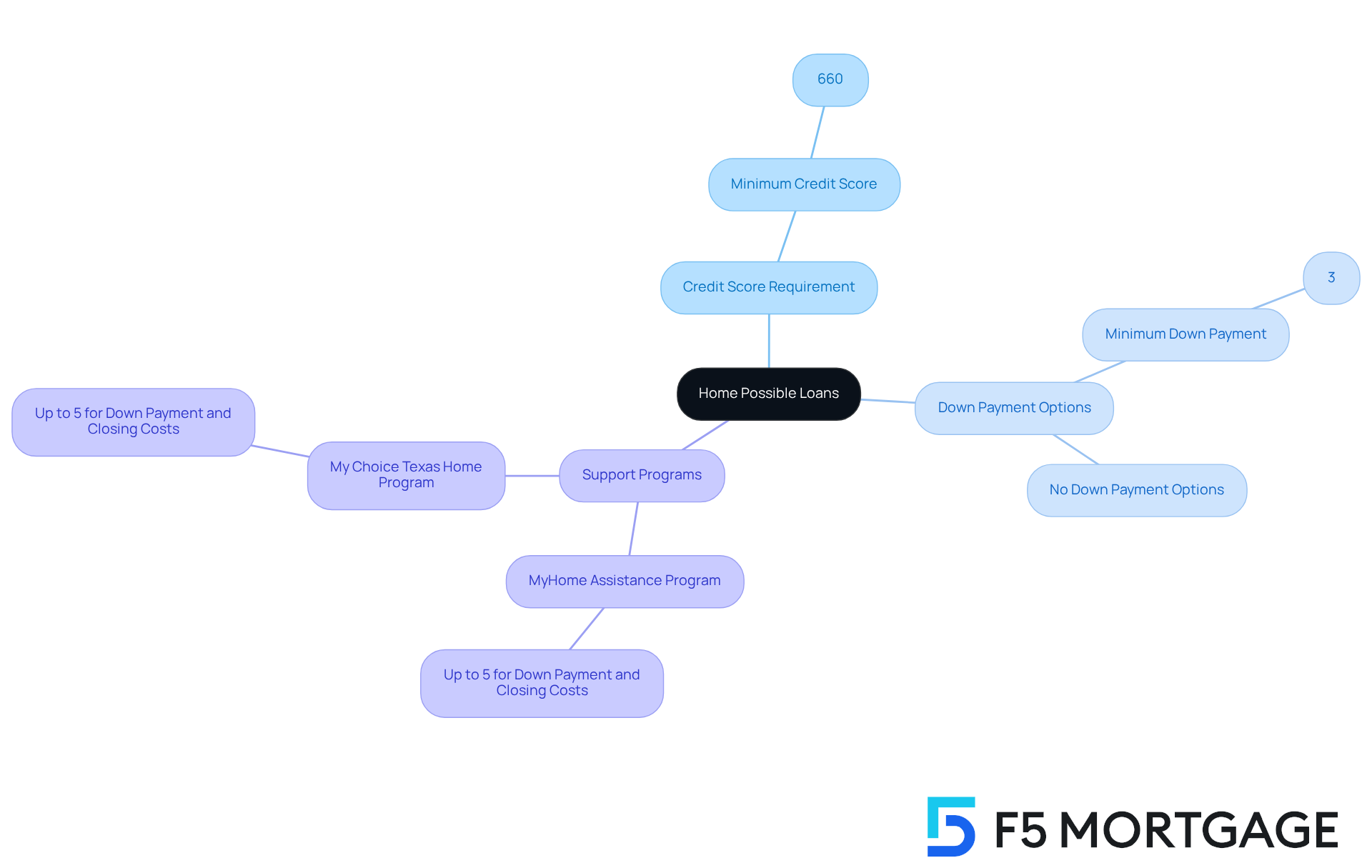

Home Possible Loans: Affordable Financing for First-Time Buyers

Home Possible mortgages, supported by Freddie Mac, offer that can truly make a difference for . We understand how daunting the home-buying process can be, especially when it comes to financing. These have a minimum credit score requirement of 660, allowing for down contributions as low as 3%, and some options even require no at all.

At , we strive to provide several low initial cost options, making for families like yours. If you’re in need of extra support, programs such as the MyHome Assistance Program in California and the My Choice Texas Home program can offer additional help. These initiatives can provide up to 5% for your down payment and closing costs, easing the financial burden.

Home Possible financing options are specifically designed to assist low- to moderate-income borrowers in achieving their dream of homeownership through low credit score home loans. We know how challenging this can be, but these options render homeownership a feasible goal for individuals with limited financial means. We’re here to , empowering you to take the next steps toward your new home.

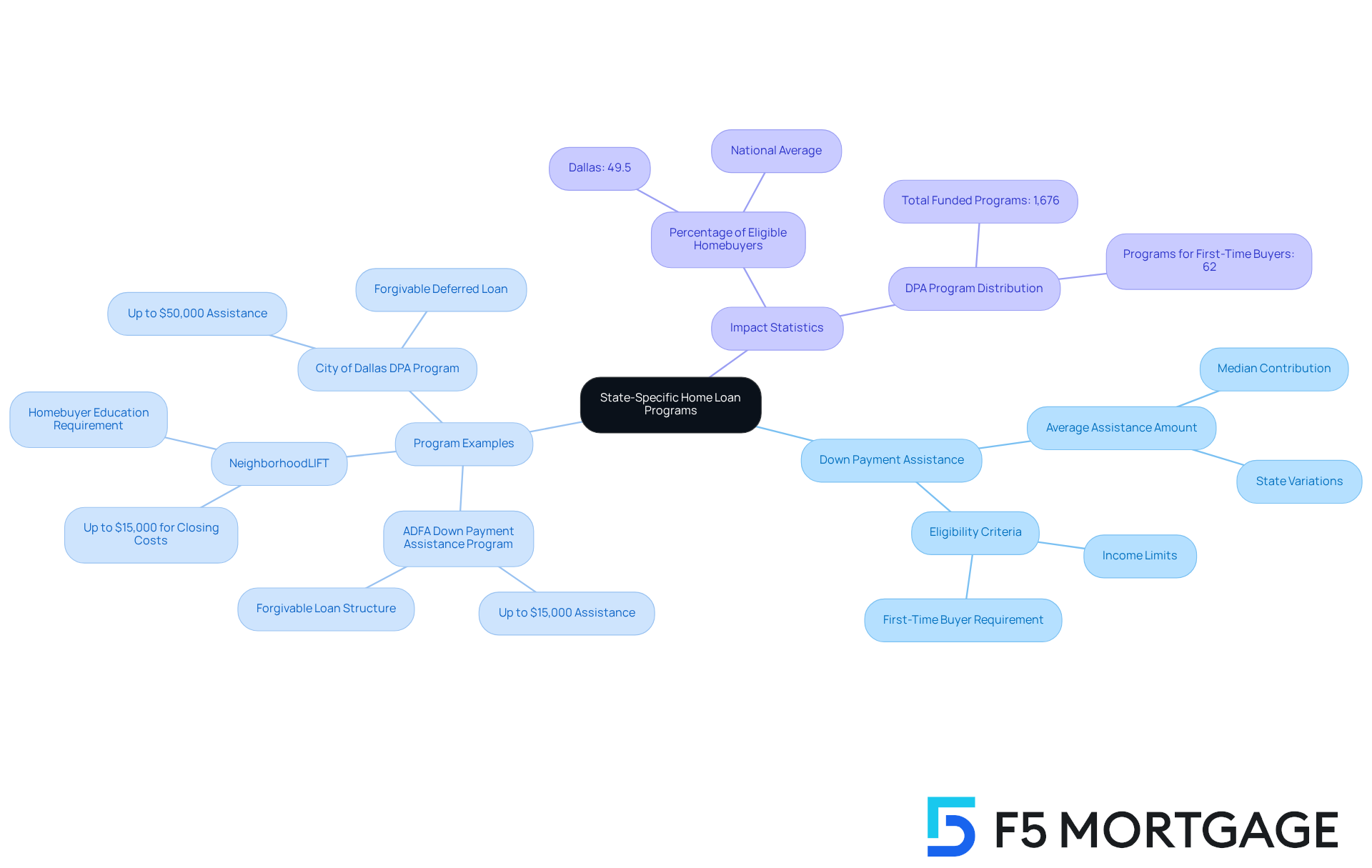

State-Specific Programs: Tailored Home Loan Options for First-Time Buyers

Many states have created customized initiatives to assist , providing vital resources like down payment support, lower interest rates, and advantageous financing conditions. We know how challenging this can be, and these initiatives can differ widely from one state to another. Therefore, it’s crucial for prospective buyers to thoroughly investigate the options available in their locality. As of 2023, there are 1,676 funded (DPA) programs across the U.S., with 62% specifically designed for first-time buyers. For example, in Texas, programs such as the ADFA Down Assistance Program offer up to $15,000 to , greatly alleviating the .

Success stories abound, illustrating the positive impact of these programs. In Dallas, nearly 50% of homebuyers were potentially eligible for DPA, with an average loan amount of $415,000. provide up to $15,000 for down deposit and closing expenses, assisting first-time purchasers in obtaining their homes without excessive financial burden.

The average down payment assistance amount varies by state, with some programs contributing as much as $40,000, particularly in high-cost areas like California. of these , noting that they can be pivotal in making homeownership attainable for many families. We’re here to support you every step of the way, and F5 Mortgage is dedicated to , ensuring they find the best options tailored to their unique financial situations.

Credit Union Loans: Community-Focused Financing for First-Time Buyers

Cooperative financial institution funding presents a wonderful opportunity for , especially those facing challenges with . We understand how daunting this can be. Unlike traditional banks, often embrace more lenient lending criteria, making it easier for you to qualify for a loan. In 2025, average interest rates for union loans start at just 5.000% APR—this can be significantly more favorable than what traditional options offer.

This financial advantage is complemented by the that unions provide, reflecting their commitment to serving the community. Many lending cooperatives are dedicated to the , offering tailored support that is crucial for . Success stories abound, with numerous first-time purchasers securing funding through cooperative banks, proving that low credit score home loans make homeownership possible even for those with imperfect credit histories.

This not only fosters a sense of belonging but also empowers you to make informed decisions on your journey to homeownership. We’re here to , ensuring that you feel confident and well-informed as you take this important step.

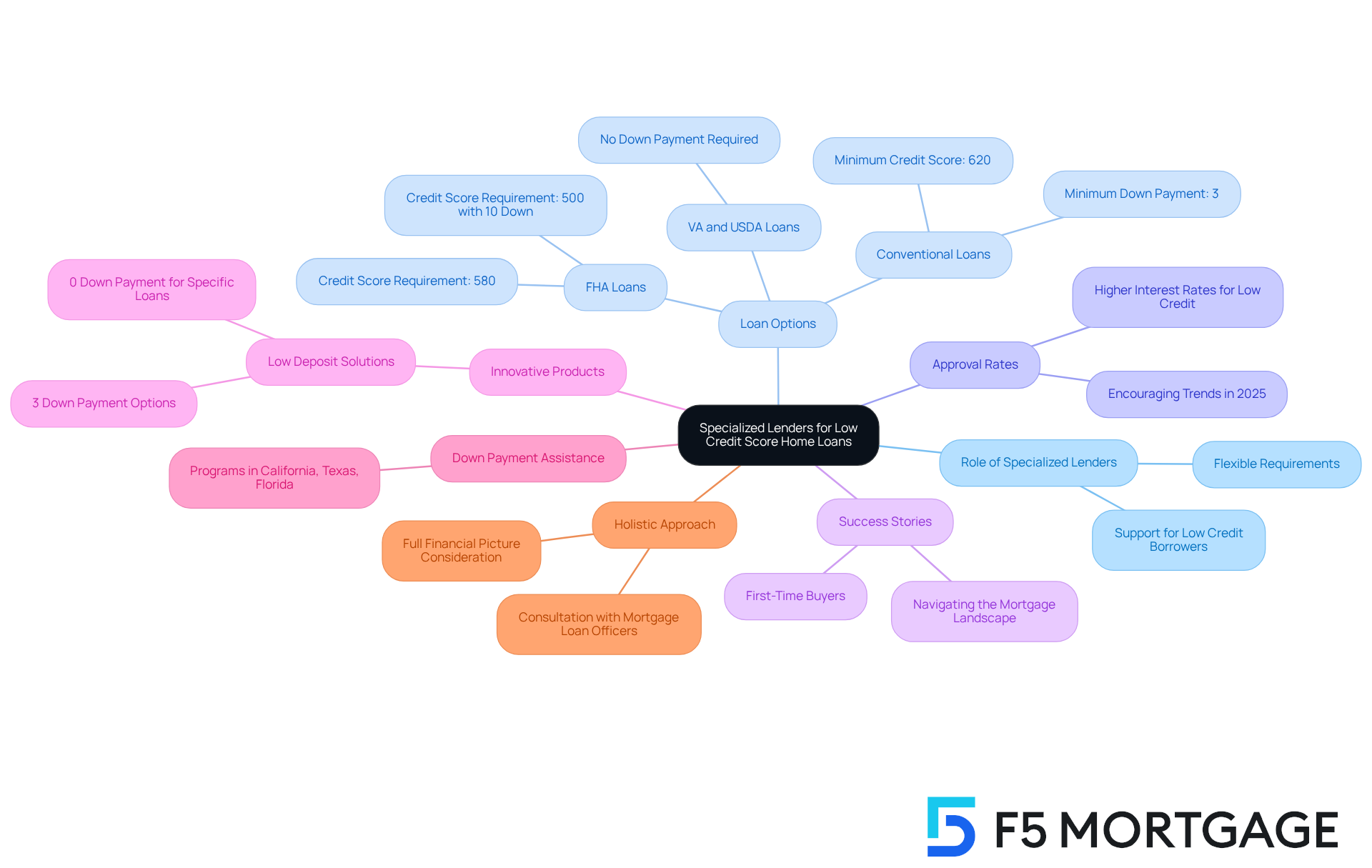

Specialized Lenders: Targeted Solutions for Low Credit Score Home Loans

Specialized lenders play an essential role in providing that are tailored for borrowers with low financial ratings. We understand how challenging this can be, and these lenders typically offer more along with unique low credit score home loans designed specifically for individuals who may struggle to qualify for conventional financing. For instance, for ratings as low as 580, or even 500 with a 10% down payment, making them attainable for numerous first-time purchasers.

In 2025, the average approval rates for specialized lenders have shown encouraging trends. Many borrowers are successfully obtaining loans despite lower financial ratings. Success stories abound, illustrating how have navigated the mortgage landscape with the support of these lenders. Individuals with credit scores around 600 have found viable options in low credit score home loans, albeit often with .

Moreover, specialized lenders like F5 Mortgage are increasingly introducing innovative mortgage products, such as low credit score home loans, that cater to . With options to qualify for a home with as little as 3% down—or even 0% down for specific loans— to explore low deposit solutions. Additionally, various enhance accessibility for first-time buyers. These products not only facilitate homeownership but also empower borrowers to build equity over time.

Recent trends indicate a growing recognition of the importance of personalized service. Many rather than solely their credit scores. This holistic approach enhances the chances of approval and fosters a more inclusive lending environment. To maximize your chances of securing a loan, we encourage potential borrowers to . We’re here to support you every step of the way in understanding your options.

Conclusion

Navigating the path to homeownership can be particularly challenging for first-time buyers with low credit scores. We understand how daunting this can feel. However, there are various financing options available that can help make this dream attainable. From FHA and VA loans to specialized lenders and state-specific assistance programs, numerous resources are designed to support those facing financial hurdles. Understanding these options is crucial for prospective homeowners looking to secure low credit score home loans in 2025.

Key insights highlight the growing acceptance of low credit score loans among lenders. Many programs now offer flexible requirements and down payment assistance. For instance:

- FHA loans allow for credit scores as low as 500.

- VA loans often require no down payment for veterans.

- USDA loans provide access to financing for rural homebuyers with low credit scores.

- Credit unions offer community-focused solutions that cater to individual needs.

Ultimately, the importance of exploring tailored mortgage solutions cannot be overstated. First-time buyers are encouraged to take advantage of the available resources and seek guidance from experts like F5 Mortgage. Considering state-specific programs can significantly ease the financial burden. With the right support and information, achieving homeownership is not only possible but also within reach for many aspiring buyers. We’re here to support you every step of the way.

Frequently Asked Questions

What type of mortgage solutions does F5 Mortgage offer for individuals with low credit scores?

F5 Mortgage provides tailored mortgage options specifically designed for low credit score home loans, partnering with over two dozen top lenders to offer competitive rates and flexible terms.

How does F5 Mortgage assist clients in the home loan process?

F5 Mortgage offers personalized consultations that equip clients with essential information to navigate the complexities of obtaining a home loan, empowering them to make informed decisions about their mortgage options.

What recent trends have been observed regarding low credit score home loans?

Recent trends show a growing acceptance of low credit score home loans among lenders, with 4.7% of mortgages issued in Q1 2025 going to subprime borrowers, aligning with F5 Mortgage’s offerings.

In which states does F5 Mortgage provide financial assistance programs?

F5 Mortgage offers extensive financial assistance programs in California, Texas, and Florida to enhance home buying prospects for clients.

What are the minimum credit score requirements for FHA loans for first-time buyers?

FHA loans are available for first-time homebuyers with credit scores as low as 500, provided they can make a 10% down payment. For those with scores of 580 or higher, the down payment requirement is reduced to 3.5%.

What advantages do FHA loans offer to first-time buyers?

FHA loans offer relaxed credit requirements, the ability to use down payment gifts, and the option for non-occupant co-borrowers, making them an attractive choice for first-time buyers.

How does VA financing assist veterans with low credit scores?

VA financing offers low credit score home loans to veterans with credit scores starting at 580, often requiring no down payment and no private mortgage insurance (PMI), which lowers barriers to homeownership.

What is the average interest rate for VA mortgages as of 2025?

As of 2025, the average interest rate for a VA mortgage is around 5.35%, which is competitive compared to traditional financing options.

What recent updates have been made to VA eligibility?

Recent updates in VA eligibility have broadened access, ensuring that more veterans can take advantage of VA financing resources to secure homes and establish stability for their families.