Overview

Navigating the FHA loan requirements can feel overwhelming, especially for first-time homebuyers in Georgia. We understand how challenging this can be, and we’re here to support you every step of the way. To help you on your journey to homeownership, it’s important to know that the main FHA loan requirements include:

- A minimum credit score of 500.

- If your score is 580 or above, you’ll benefit from a down payment of just 3.5%.

- A maximum debt-to-income ratio of 43%.

These requirements are designed to make homeownership more accessible, offering flexible financing options that meet your needs. By outlining these essential steps, we aim to empower you to secure an FHA loan and turn your homeownership dreams into reality.

Introduction

Navigating the complex landscape of FHA loans can feel overwhelming, especially for homebuyers in Georgia eager to secure their first home. We understand how challenging this can be.

It’s essential to grasp the specific requirements and benefits of FHA financing, as these loans offer unique advantages like lower down payments and more lenient credit score thresholds.

With so much information at your fingertips, how can you ensure that you meet the necessary criteria while maximizing your financing options? This article delves into the essential FHA loan requirements in Georgia, providing insights and guidance to help you confidently embark on your journey to homeownership.

We’re here to support you every step of the way.

F5 Mortgage: Streamlined FHA Loan Application Process

At F5 Mortgage, we understand how challenging can be, especially for first-time homebuyers. That’s why we offer a streamlined FHA financing application process that allows you to apply conveniently online, by phone, or through chat. Our commitment to efficiency means you can receive pre-approval in under an hour, alleviating the stress that often comes with mortgage applications.

Imagine the relief of knowing that you can manage the intricacies of obtaining with assurance. We prioritize your needs, ensuring that the [FHA loan requirements GA](https://f5mortgage.com/loan-programs/fha-loans/georgia) and the paperwork feel less daunting. Our dedication to tailored service means that you can anticipate assistance throughout the entire process, helping you meet FHA loan requirements GA and secure advantageous financing terms.

We’re here to support you every step of the way, making your journey to homeownership smoother and more manageable. With F5 Mortgage, you’re not just a client; you’re part of our family, and we’re committed to guiding you through this important milestone.

Minimum Credit Score: 500 for FHA Loans in Georgia

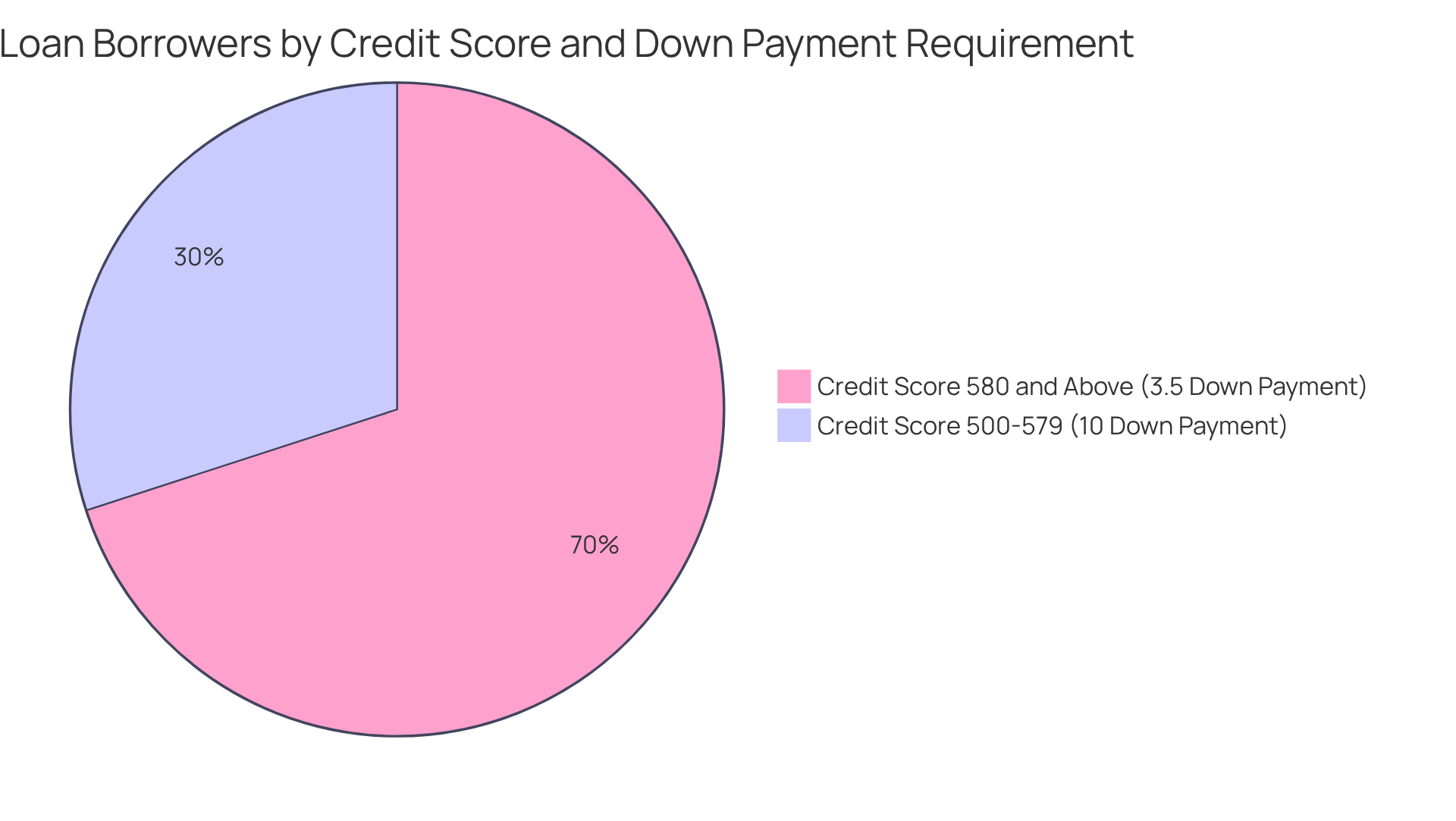

In Georgia, we understand how challenging it can be to navigate the homebuying process, especially if you have concerns about your credit score. Thankfully, homebuyers can qualify for an FHA loan with of just 500. This lower threshold offers a lifeline for individuals with less-than-perfect credit histories, granting them access to home financing that might otherwise feel out of reach.

For those with a credit score of 580 or above, the down payment requirement is lowered to only 3.5%. This flexibility opens doors for many, particularly first-time homebuyers and those seeking to improve their living situations. Real-world examples highlight this accessibility: borrowers with credit scores in the 500-579 range can still obtain FHA financing, albeit with a higher down payment of 10%. This tiered approach not only enhances approval rates but also encourages responsible financial behavior among potential homeowners.

We know how important it is to keep a strong credit score, as it can significantly influence your credit terms and conditions, ultimately leading to better financing alternatives. Therefore, grasping the [fha loan requirements ga](https://f5mortgage.com/fha-loan-max-florida-key-requirements-and-benefits-explained) is essential for anyone contemplating an FHA mortgage in Georgia. Remember, we’re here to support you every step of the way on your journey to homeownership.

Down Payment Requirement: 3.5% for FHA Loans

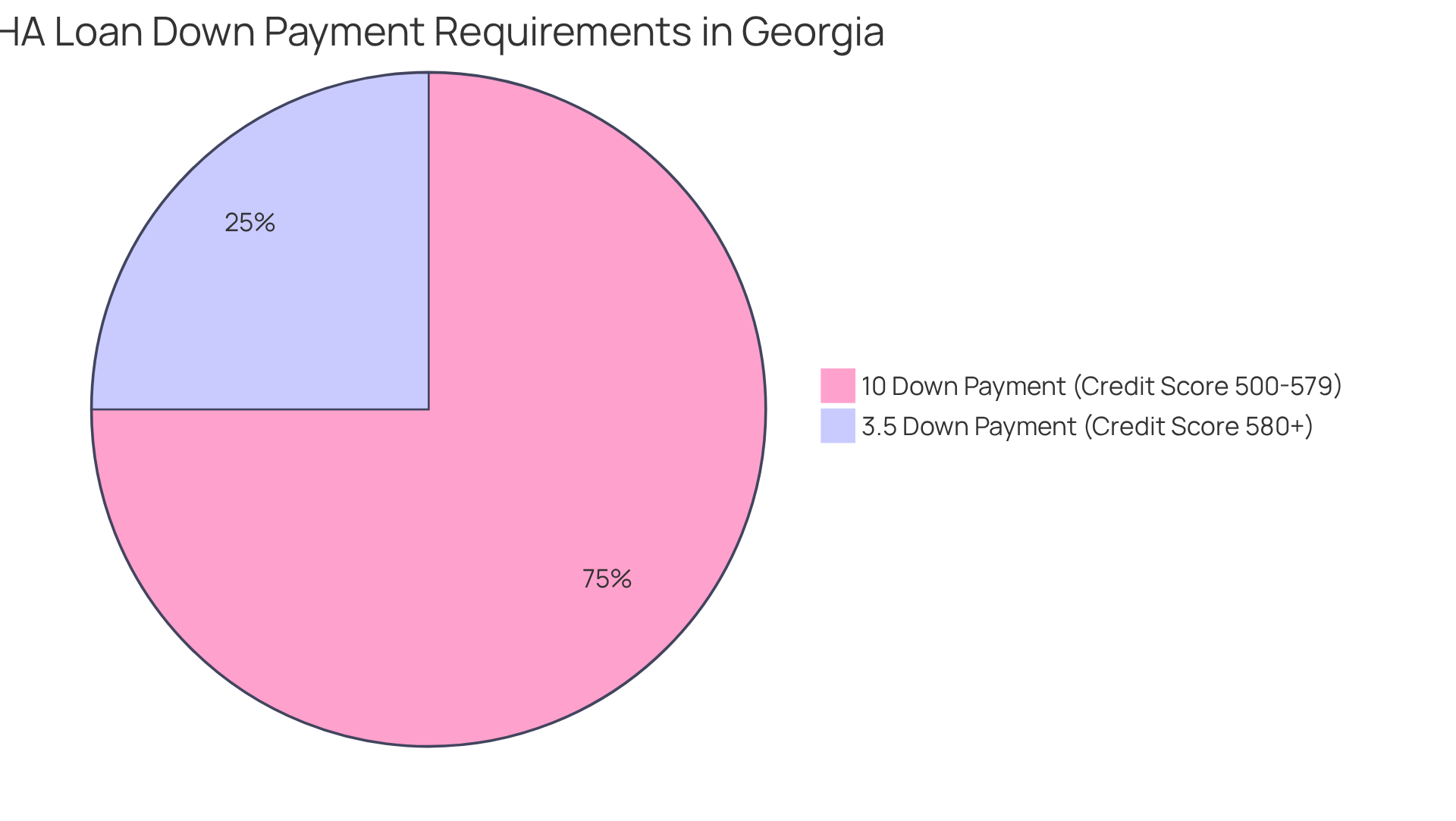

The FHA loan requirements GA present a significant opportunity for homebuyers in Georgia, requiring a minimum deposit of just 3.5% for individuals with a credit score of 580 or higher. This means a on a $250,000 home, making the dream of homeownership more attainable for many families. For those with credit scores between 500 and 579, the down payment requirement rises to 10%, equating to $25,000 for the same home price.

The appeal of FHA loan requirements GA lies in its flexibility and lower entry costs, which are particularly beneficial for first-time homebuyers or those with limited savings. In 2023, 82% of FHA purchase loans were secured by first-time buyers, which emphasizes the FHA loan requirements GA and the program’s accessibility for moderate-income families.

We understand how challenging it can be to navigate the path to homeownership. Experts emphasize that reduced initial costs can significantly support buyers, allowing them to allocate resources toward other essential expenses. A smaller upfront contribution can alleviate the financial pressure on new homeowners, making it easier to manage monthly payments and other costs associated with owning a home.

Real-life stories illustrate this advantage: many families have successfully utilized the 3.5% down option to obtain their dream homes, often with the assistance of programs that help lower initial expenses. These initiatives can cover part or all of the upfront costs, making FHA mortgages even more affordable and enabling more families to realize their homeownership aspirations.

Debt-to-Income Ratio: Maximum 43% for FHA Loans

Navigating [FHA loan requirements GA](https://f5mortgage.com/loan-programs/fha-loans/california) can feel overwhelming, especially when considering the maximum allowable debt-to-income (DTI) ratio, which is typically set at 43%. This means that families should aim to keep their debt obligations, including the mortgage, below 43% of their gross monthly income. Yet, it’s important to know that FHA loan requirements GA may allow lenders to show flexibility, permitting in certain cases, such as if you can make a larger upfront contribution or have substantial cash reserves.

We understand that life can be unpredictable, and studies indicate that individuals with DTI ratios exceeding 43% can still qualify for FHA loan requirements GA if they present strong compensating factors. For example, someone with a DTI ratio of 50% might find approval possible under the FHA loan requirements GA if they have a significant down payment or a robust savings account, which showcases their ability to handle additional financial responsibilities.

Financial analysts emphasize the importance of maintaining a manageable DTI ratio, as it can significantly influence FHA loan requirements GA for credit approval rates. A lower DTI not only boosts your eligibility under the FHA loan requirements GA but also places you in a better position for securing favorable interest rates.

In addition to FHA options, Colorado residents have a range of refinancing choices, including conventional mortgages and VA financing. Traditional financing often requires a good credit score and a low DTI, while VA options present beneficial terms for military personnel and their spouses. Understanding these choices can empower you to make informed decisions about your mortgage solutions.

At F5 Mortgage, we recognize how important this journey is for families. We leverage technology to offer competitive mortgage rates and personalized support, ensuring a stress-free experience as you upgrade your home. Remember, we’re here to support you every step of the way.

FHA Loan Limits: Vary by County in Georgia

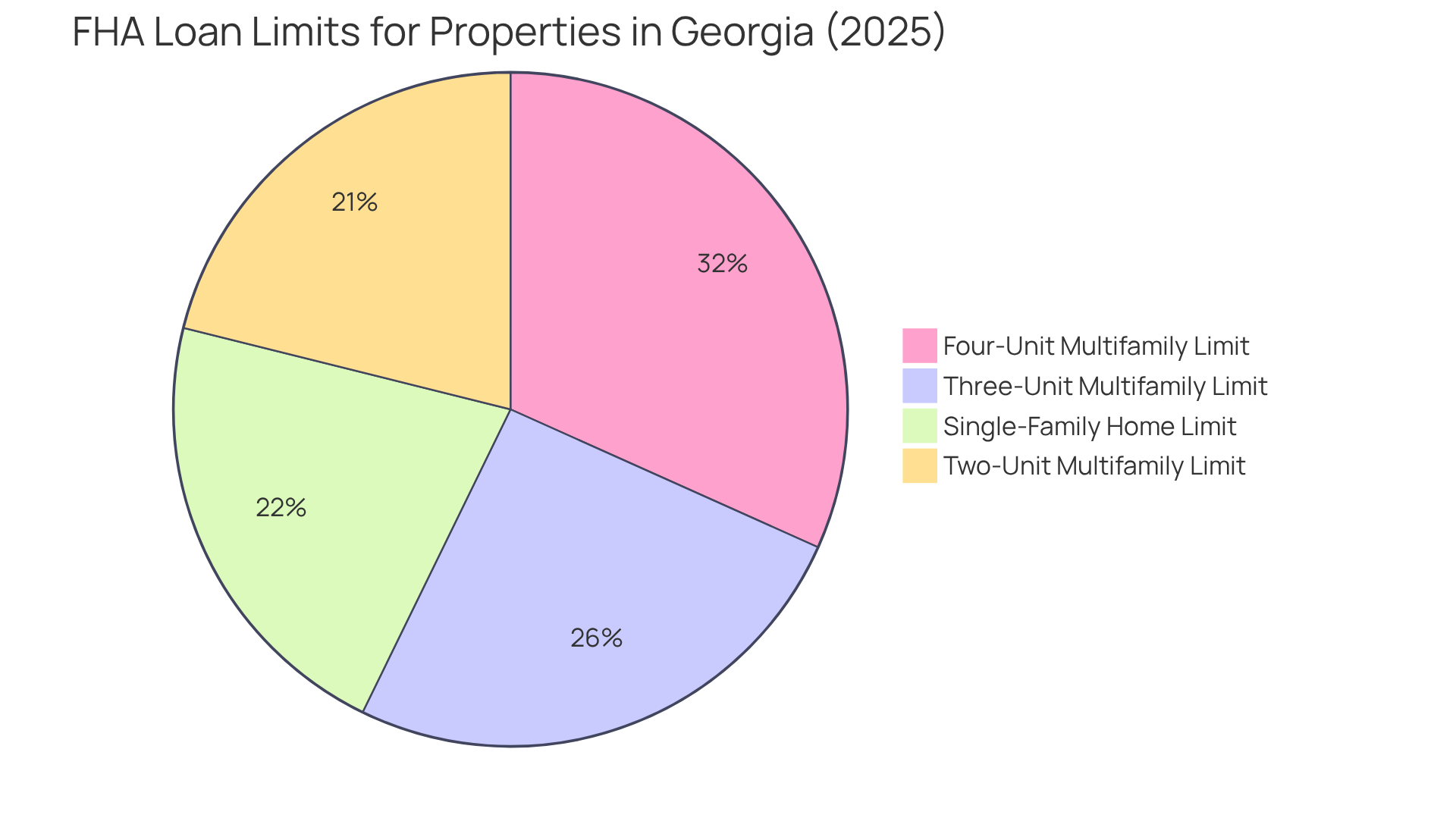

Navigating the world of FHA financing and GA can feel overwhelming, especially when you’re trying to find the right home for your family. In Georgia, the [FHA loan requirements GA](https://f5mortgage.com/9-benefits-of-fha-streamline-for-homeowners-in-2025) set these financing limits by county, with a baseline limit of $524,225 applicable to most areas. However, for those in high-cost counties, the limit can go as high as $688,850 for single-family homes. For instance, in Carroll County, the FHA borrowing limit for a single unit is $688,850, and multifamily properties can reach thresholds of $881,850 for two units and $1,065,950 for three units.

Understanding the FHA loan requirements GA is crucial for homebuyers like you, as they help identify properties that fit within your financing capabilities. FHA mortgages offer a low down payment of just 3.5% for borrowers with a credit score of 580 or above. If your score is 500, you’ll need to put down a minimum of 10%. The FHA loan requirements GA provide accessibility that makes FHA financing an appealing choice for many families, particularly in areas where housing prices are on the rise.

As the U.S. Department of Housing and Urban Development (HUD) adjusts these limits each year, it’s essential to stay informed. For 2025, the range is set from a floor of $524,225 to a ceiling of $1,209,750. We know how challenging this can be, but staying updated on these figures will empower you as you navigate the housing market. Remember, we’re here to support you every step of the way.

Mortgage Insurance Premium: Required for FHA Loans

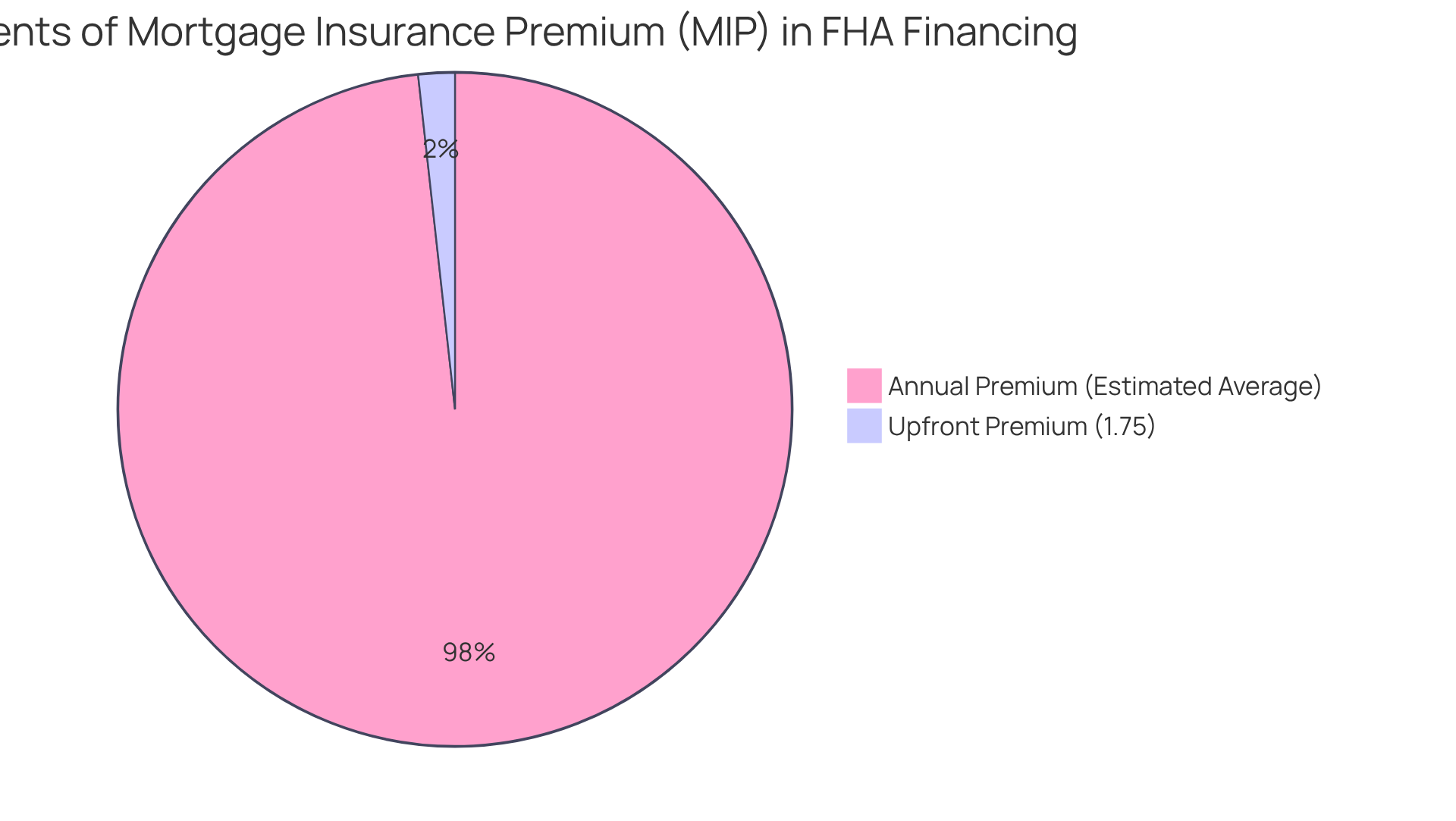

Navigating the world of FHA financing can feel overwhelming, especially when it comes to understanding the Mortgage Insurance Premium (MIP). This essential component includes an upfront premium of 1.75% of the amount financed, along with an annual premium that varies based on the term and amount. While MIP does increase the overall cost of financing, it plays a vital role in helping individuals with lower credit scores—those with FICO scores as low as 580—secure the funding they need.

As of June 2025, the Federal Housing Administration has announced a decrease in the yearly MIP, which is expected to save homebuyers up to $800 annually on standard mortgages. This change enhances the appeal of FHA financing, making it a more viable option for many families. Understanding the FHA loan requirements GA, particularly the cost implications of MIP, is crucial for prospective clients, as it significantly impacts monthly expenses and overall affordability.

For instance, individuals who manage MIP expenses effectively can still benefit from FHA loan requirements GA, which include a minimum down payment of just 3.5%. This combination of lower upfront costs and manageable ongoing expenses positions FHA financing, particularly the FHA loan requirements GA, as an attractive choice for homebuyers. Moreover, refinancing options like FHA Cash-Out Refinance and FHA Streamline Refinance can further assist families in managing their mortgage costs.

At F5 Mortgage, we know how challenging this can be. Our technology-driven approach allows families to explore these refinancing options with personalized support, ensuring they find the best rates and terms without the stress of traditional hard sales tactics. We’re here to .

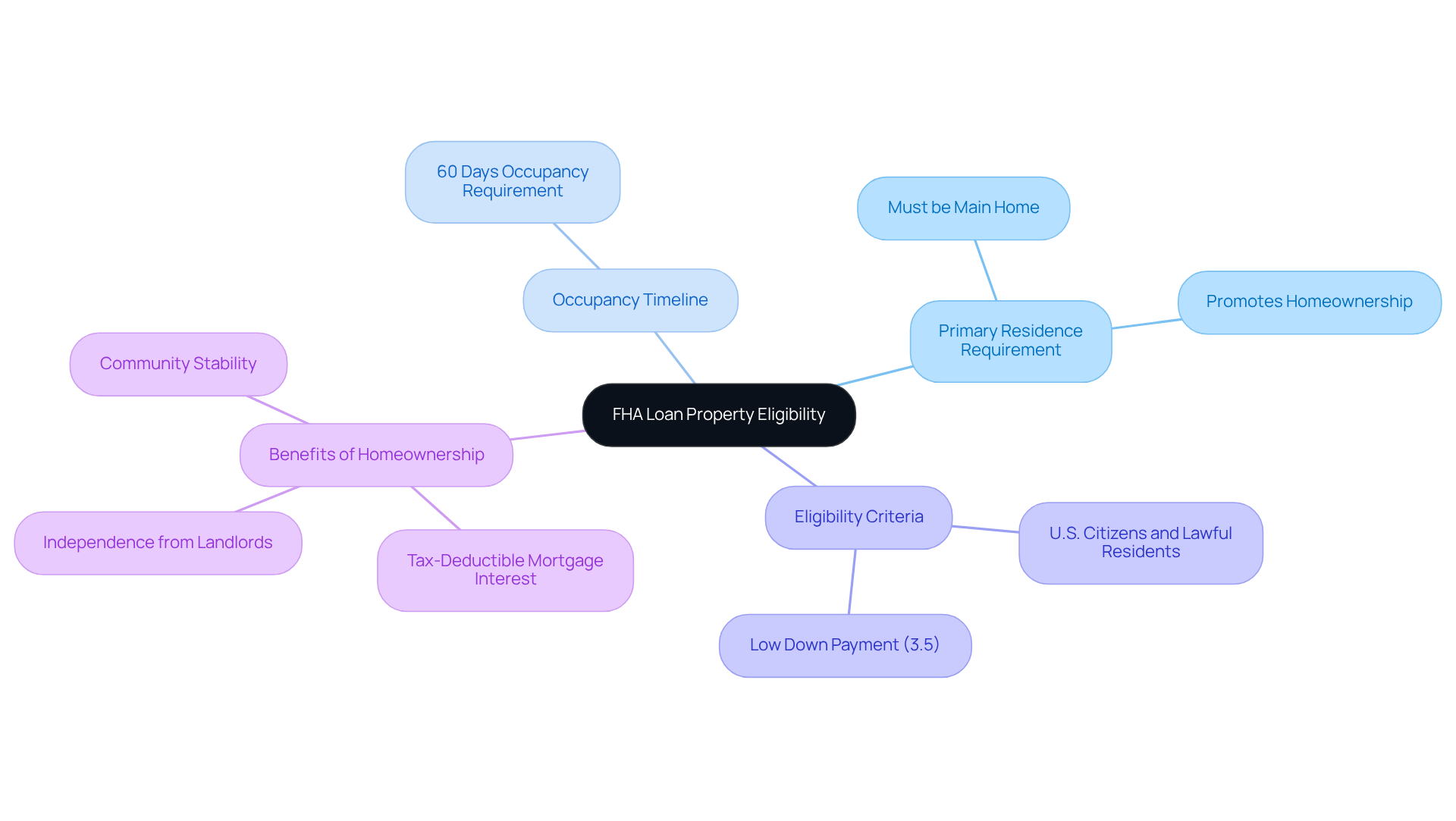

Property Eligibility: Must Be Primary Residence

According to [FHA loan requirements GA](https://f5mortgage.com/georgia-refinance), FHA mortgages are specifically designed for primary residences, which means the property you acquire must serve as your main home. We understand how important it is to settle into a space that feels like your own. According to FHA loan requirements GA, borrowers are required to occupy the property within 60 days of closing, a stipulation aimed at promoting homeownership over investment properties. This focus on is essential, as it aligns with the FHA’s mission to support sustainable homeownership.

As of June 2025, the updated FHA loan requirements GA further reinforce this policy by limiting eligibility to U.S. citizens and lawful permanent residents. This change represents a broader initiative to ensure that FHA financing is accessible to individuals who can meet long-term financial commitments related to homeownership. We know how challenging this can be, and these measures are in place to support you.

Housing authorities emphasize the importance of this requirement, noting that it helps maintain the integrity of FHA programs. For instance, Caitlin Vannoy from the National Association of REALTORS® highlights that stable residency is crucial for fulfilling financial commitments. This is about creating a foundation for your family’s future.

Moreover, owning a home through an FHA mortgage allows you to enjoy significant benefits, such as tax-deductible mortgage interest, which can enhance your financial flexibility. Imagine living without a landlord, crafting a space that truly reflects your personal style and needs, and fostering a sense of independence.

Statistics show that occupancy rates for FHA mortgages are high, with a substantial percentage of borrowers successfully meeting the primary residence requirement. Many homebuyers, especially first-time purchasers, effectively fulfill the FHA loan requirements GA by using FHA financing to acquire their initial homes, ensuring they inhabit the property as their principal residence. This commitment to primary occupancy not only supports your homeownership goals but also contributes to community stability and growth. We’re here to support you every step of the way.

FHA Appraisal Guidelines: What to Expect

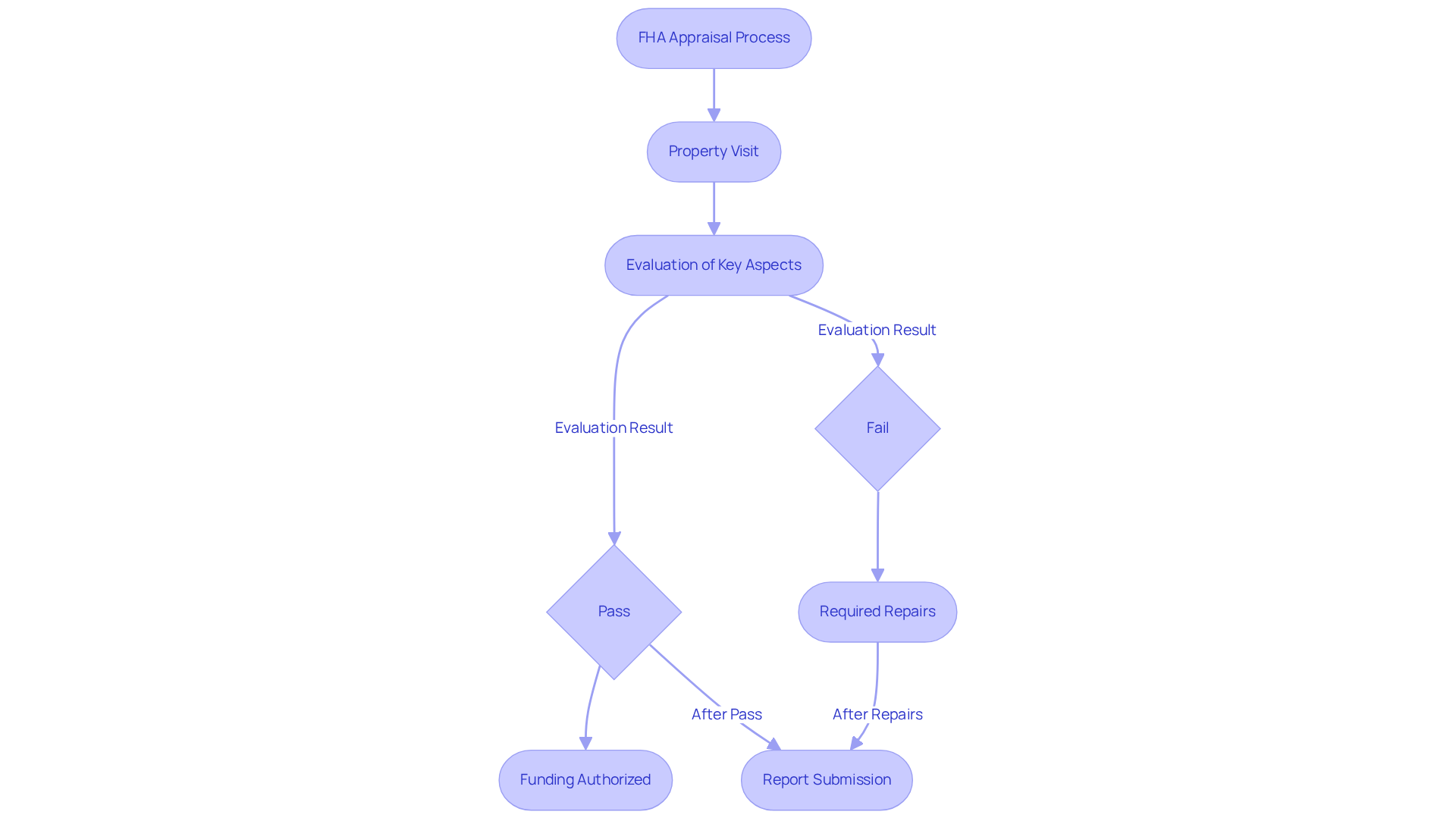

FHA appraisals are essential in determining a property’s market value and ensuring it meets important safety and livability standards. We understand how crucial this process is for you, and you can expect a thorough evaluation of your home’s condition. The appraiser will focus on critical aspects such as the roof, foundation, and overall safety features. Typically, the appraisal process takes about 1-2 weeks from the property visit to report submission, with costs ranging from $400 to $700, depending on factors like property size and location.

During the appraisal, the appraiser will assess whether the property meets FHA standards. For example:

- The roof must have at least two years of life left.

- Homes built before 1978 must be free from peeling or chipping lead-based paint.

- Structural damage, active pest infestations, and other hazards can lead to appraisal failures.

If the property does not satisfy these standards, required repairs must be completed before funding can be authorized. We’re here to support you every step of the way, so be aware that lenders might request an inspection to verify the property is in good shape, as homes needing significant repairs may not be eligible for refinancing.

Examples of properties that typically meet FHA appraisal standards include:

- Well-maintained single-family homes

- Townhouses

- Certain multi-family units, provided they adhere to safety regulations and structural integrity.

By understanding the FHA loan requirements in Georgia, you can prepare efficiently for the appraisal process, ensuring a smoother route to obtaining your FHA financing. We know how challenging this can be, but will empower you on your journey.

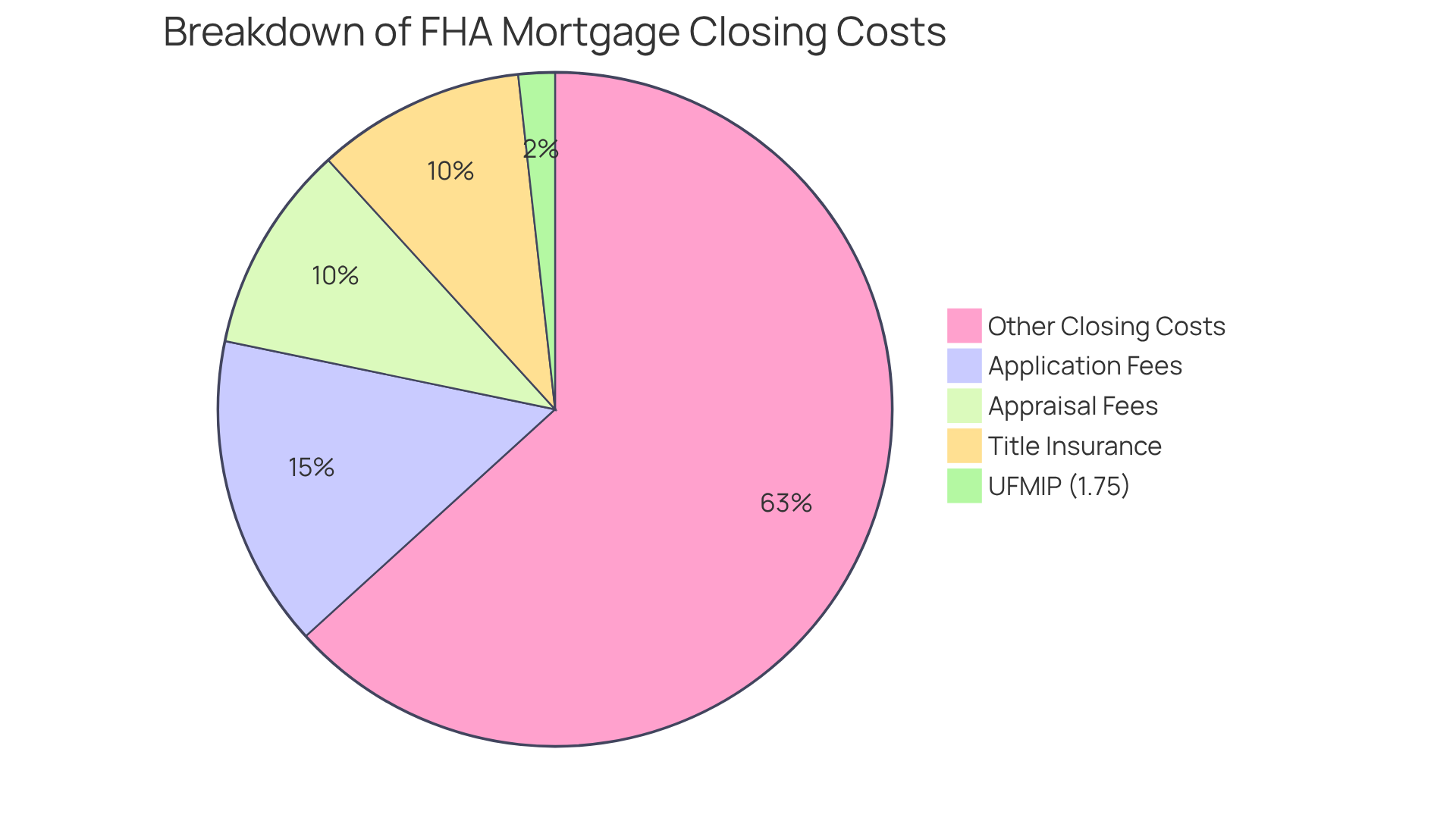

Closing Costs: Essential Fees for FHA Loans

Closing expenses for FHA mortgages can be a significant concern, typically ranging from 2% to 6% of the loan amount. This means individuals should be prepared for considerable costs. These expenses encompass various charges, including:

- Application fees

- Appraisal fees

- Title insurance

- The upfront mortgage insurance premium (UFMIP), a one-time cost of 1.75% of the borrowed amount.

For example, on a $250,000 home, closing costs could total between $6,250 and $15,000.

To alleviate these financial burdens, we encourage individuals to request a from their lender. This document outlines expected fees and can greatly assist in budgeting. Additionally, exploring closing cost assistance programs can provide valuable support; sellers may contribute up to 6% of the home’s sale price towards these costs, significantly easing the out-of-pocket expenses.

Many have successfully navigated FHA closing expenses by incorporating their UFMIP into the financing. This strategy reduces initial cash requirements while slightly increasing monthly payments. Furthermore, understanding the Loan Estimate and Closing Disclosure documents is crucial, as they detail the estimated and final costs, helping individuals avoid surprises at closing.

Mortgage brokers often recommend that clients set aside approximately 2% to 6% of the borrowed amount for closing expenses. This highlights the importance of careful planning. By staying informed and proactive, individuals can confidently navigate the complexities of FHA financing closing costs, knowing that support is available every step of the way.

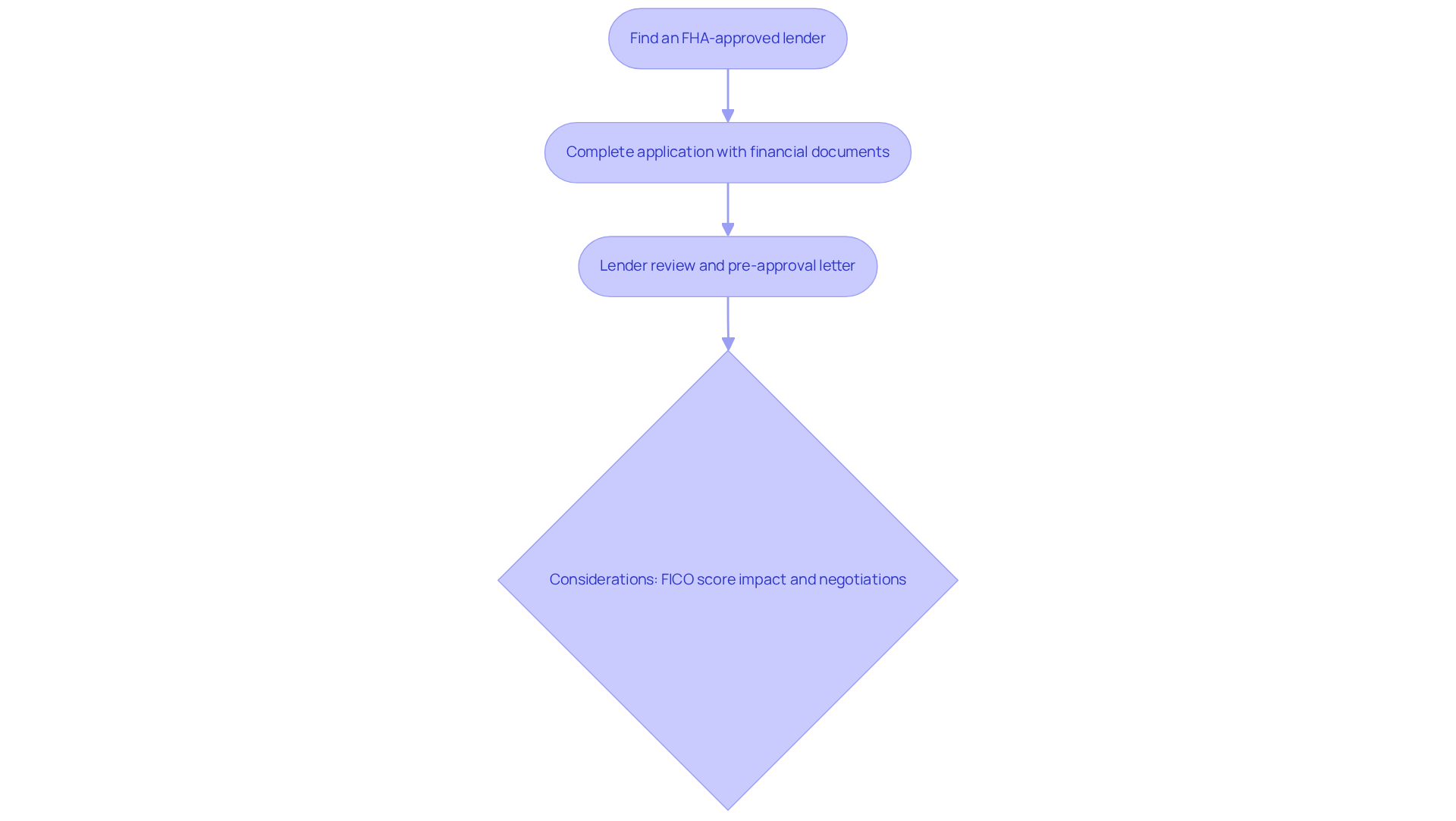

Pre-Approval Process: Steps to Secure FHA Financing

Navigating the world of FHA financing can feel overwhelming, but we’re here to support you every step of the way. To start, it’s essential to find an FHA-approved lender and complete a detailed application that adheres to the FHA loan requirements GA. This initial step typically requires submitting important financial documents, such as income verification and credit history.

One of the most appealing aspects of the FHA loan requirements GA is the low down payment of just 3.5%. This feature makes them an attractive option for many homebuyers. Once your application is submitted, the lender will conduct a thorough review and issue a pre-approval letter. This letter is more than a formality; it provides you with a competitive edge when making offers on properties.

As of June 2025, the average time to secure FHA financing is around 30 to 45 days, highlighting the importance of timely pre-approval. Securing pre-approval not only simplifies the purchasing process but also allows you to focus on finding your perfect home with confidence. One lender shared, “Pre-approval helps with two things: It saves time. You don’t have to wait to be approved before your offer is accepted.”

It’s important to note that applying for pre-approval may temporarily affect your FICO score, but this change is usually manageable. This consideration allows you to shop around for lenders without significant long-term impacts on your credit. Remember, during negotiations, you can request repairs or upgrades from sellers, which can influence your final purchase agreement and overall financing strategy.

To take that crucial first step toward securing your FHA loan, familiarize yourself with the and consider applying online or over the phone with F5 Mortgage today!

Conclusion

Navigating the FHA loan requirements in Georgia offers a wonderful opportunity for homebuyers, particularly those who may encounter challenges like lower credit scores or limited savings. By understanding these requirements—from the minimum credit score of 500 to the various down payment options—you can take confident steps toward homeownership. With support from lenders like F5 Mortgage, this process can be streamlined, making it more accessible and less daunting.

Key insights highlight the importance of credit scores, the flexibility of down payments, and the necessity of primary residency, all crucial in securing FHA financing. Additionally, varying loan limits by county and the implications of mortgage insurance premiums emphasize the need for prospective buyers to stay informed. Each of these elements contributes to a clearer understanding of how to navigate the complexities of obtaining an FHA loan in Georgia.

Ultimately, the journey to homeownership can be made smoother with the right knowledge and support. If you’re contemplating an FHA loan, it’s essential to explore these requirements thoroughly and seek assistance from knowledgeable lenders who prioritize your needs. By doing so, you can turn your aspirations into reality, fostering a sense of stability and community growth. Embracing the FHA loan opportunities available in Georgia can lead to a brighter future for many families.

Frequently Asked Questions

What is the application process for FHA loans at F5 Mortgage?

F5 Mortgage offers a streamlined FHA financing application process that can be completed online, by phone, or through chat. They aim to provide pre-approval in under an hour, making the process more convenient and less stressful for applicants.

What are the minimum credit score requirements for FHA loans in Georgia?

In Georgia, homebuyers can qualify for an FHA loan with a minimum credit score of 500. Those with a credit score of 580 or above can benefit from a lower down payment requirement of 3.5%.

What is the down payment requirement for FHA loans?

The down payment requirement for FHA loans is 3.5% for borrowers with a credit score of 580 or higher. For those with credit scores between 500 and 579, the down payment requirement increases to 10%.

How does the down payment requirement affect first-time homebuyers?

The lower down payment requirements, particularly the 3.5% option, make homeownership more attainable for first-time homebuyers and those with limited savings. In 2023, 82% of FHA purchase loans were secured by first-time buyers, highlighting the program’s accessibility.

What support does F5 Mortgage provide to homebuyers?

F5 Mortgage is committed to supporting homebuyers throughout the entire process of obtaining an FHA mortgage, ensuring that they understand the requirements and receive tailored assistance to secure favorable financing terms.

How does having a strong credit score influence FHA loan terms?

A strong credit score can significantly influence the terms and conditions of FHA loans, leading to better financing alternatives and potentially lower down payment requirements for borrowers.

Are there programs available to assist with down payment costs?

Yes, there are initiatives that can help lower initial expenses, potentially covering part or all of the upfront costs associated with FHA mortgages, making them even more affordable for families.