Overview

This article is here to help you understand the eligibility criteria and application steps for FHA loans in Georgia. We know how challenging it can be to navigate the homeownership journey, especially for low to moderate-income families. FHA loans can be a valuable resource, assisting you in achieving your dream of owning a home.

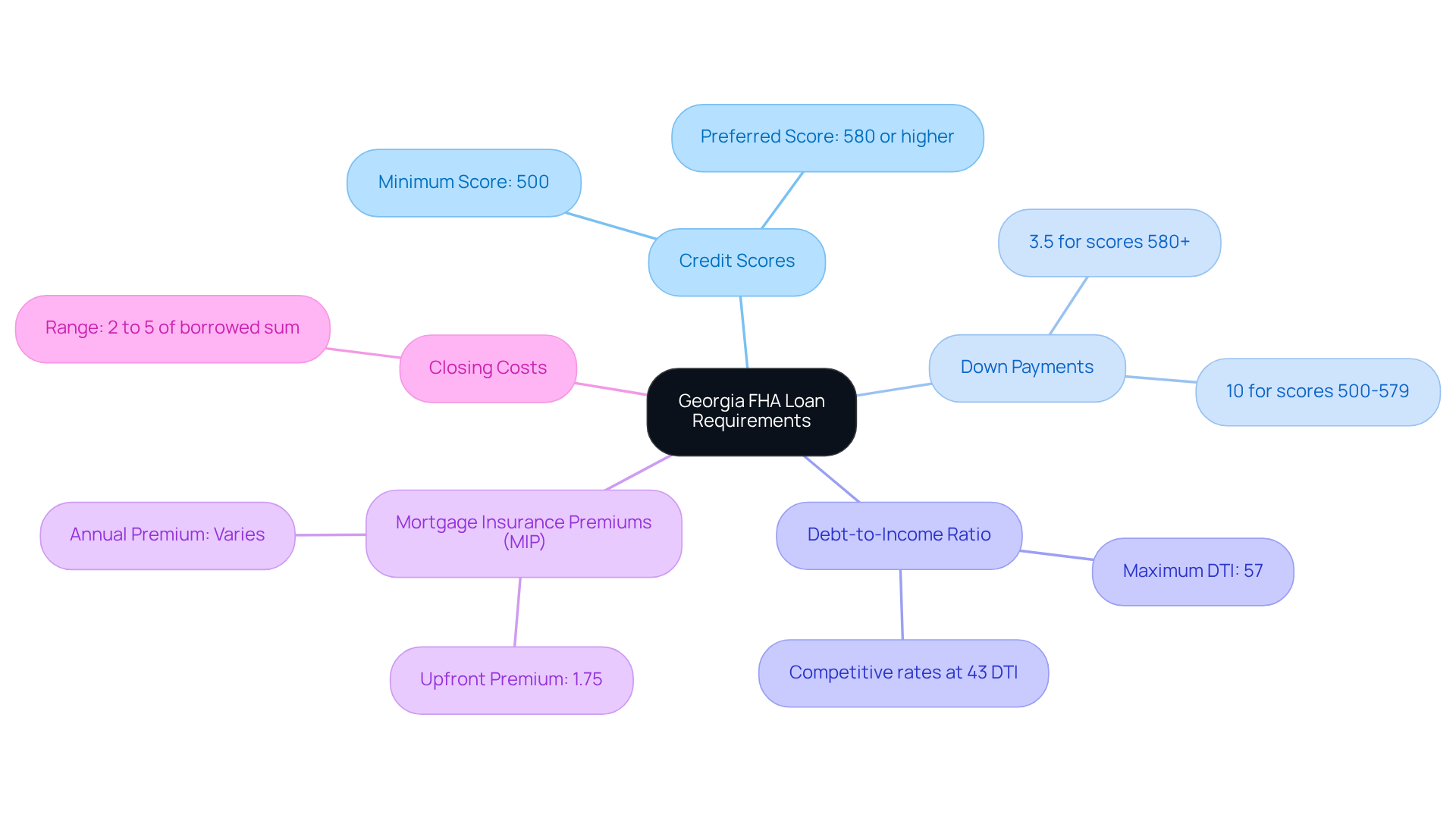

We’ll outline the key requirements, including credit score thresholds and debt-to-income ratios, to simplify the process for you. Understanding these criteria is essential, as it can make your journey towards securing an FHA loan much smoother.

By recognizing the challenges you face, we aim to provide you with the knowledge and support needed to take the next steps. Remember, we’re here to support you every step of the way as you work towards homeownership.

Introduction

Navigating the path to homeownership can often feel daunting, especially for families in Georgia facing unique challenges in the housing market. We understand how overwhelming this process can be, but there is hope. FHA loans are designed to assist low to moderate-income families, offering a lifeline with their attractive features like low down payments and flexible credit requirements.

However, understanding the specific eligibility criteria and application steps is crucial. What essential knowledge do you need to successfully secure an FHA loan and make the dream of homeownership a reality in Georgia? We’re here to support you every step of the way.

Explore FHA Loans: Basics and Benefits in Georgia

FHA mortgages, or Federal Housing Administration mortgages, are designed with the intention of helping low to moderate-income families achieve their dream of homeownership. We understand how challenging this can be, especially in Georgia, where these loans offer several compelling advantages that can make a significant difference:

- Lower Down Payments: You can secure a home with a down payment as low as 3.5% if your credit score is 580 or higher. If your score falls between 500 and 579, a higher down payment may be necessary, typically around 10%. Additionally, some financing options may allow for down payments as low as 0%, making homeownership more attainable than you might think.

- Flexible Credit Requirements: FHA financing is accommodating to lower credit scores, broadening access for a diverse range of applicants. This flexibility is particularly crucial for first-time homebuyers who may not have an extensive credit history to rely on.

- Competitive Interest Rates: Often, FHA financing provides lower interest rates compared to traditional mortgages. This can significantly reduce your monthly payments and overall financial strain, giving you peace of mind.

- Assistance Programs: The state offers various down payment assistance initiatives, including a $5,000 grant for first-time homebuyers. This can be combined with FHA financing, further easing your financial burden and making homeownership more achievable.

These features make FHA mortgages especially beneficial for first-time homebuyers in Georgia by meeting the Georgia FHA loan requirements, which allows you to navigate the path to homeownership with greater ease and confidence. Many families have successfully benefited from the simplified application process and supportive resources provided by institutions like F5 Mortgage, known for its commitment to helping clients obtain FHA financing efficiently. We encourage you to work with a lender like F5 Mortgage to get pre-qualified, so you can better understand what you’ll be able to afford as you begin your house hunting journey.

Understand Eligibility Criteria for FHA Loans in Georgia

Qualifying for a loan can feel overwhelming, but understanding the Georgia FHA loan requirements will help us support you every step of the way. To help you navigate this process, let’s break down the key criteria you’ll need to meet:

- Credit Score: You’ll need a minimum credit score of 500. If you’re aiming for the 3.5% down payment option, a score of at least 580 is required. This flexibility opens doors for many first-time homebuyers and those with less-than-perfect credit.

- Debt-to-Income Ratio: Typically, your total monthly debts should not exceed 43% of your gross monthly income. However, FHA mortgages can accommodate debt-to-income ratios up to 57% for qualified borrowers, making them more accessible than conventional financing.

- Employment History: A steady employment history for at least two years is essential. This requirement ensures you have a reliable income source to support your mortgage payments.

- Primary Residence: Remember, the property must serve as your primary residence. It cannot be used as an investment property or second home.

- Legal Residency: You must be a U.S. citizen, a permanent resident, or a non-permanent resident with a valid work permit. This ensures compliance with federal regulations.

- Borrowing Limits: The highest FHA borrowing limit for single-family residences in Georgia is $498,257 in most counties, with elevated limits of $688,850 in the Atlanta-Sandy Springs-Alpharetta metropolitan region.

- Mortgage Insurance Premiums: FHA mortgages require an upfront mortgage insurance premium (UFMIP) of 1.75% of the amount borrowed, along with an annual mortgage insurance premium (MIP) that varies from 0.45% to 1.05%.

Real-life examples highlight the accessibility of FHA financing. For instance, a borrower with a credit score of 570 who provides a 10% down payment can still qualify. This demonstrates the program’s inclusivity and commitment to helping families achieve their dreams of homeownership. Mortgage specialists emphasize that FHA programs are especially beneficial for families looking to enhance their residences, offering reduced down payment criteria and more flexible credit standards compared to traditional financing options. The Georgia FHA loan requirements create a combination of criteria that makes FHA financing a viable option for many residents of Georgia who aspire to own a home.

Examine Financial Requirements: Credit Scores, Down Payments, and Insurance

When applying for an FHA loan, understanding the Georgia FHA loan requirements can help ease the overwhelming feeling of the process. It’s important to consider several key financial requirements, including the Georgia FHA loan requirements, that can impact your journey toward homeownership.

- Credit Scores: A minimum credit score of 500 is necessary to qualify for an FHA loan, but a score of 580 or higher is preferred to secure more favorable terms.

- Down Payments: The standard down payment is 3.5% for borrowers with a credit score of 580 or above. For those with scores ranging from 500 to 579, a larger down payment of 10% is required.

- Debt-to-Income Ratio: We know how crucial your budget is, and borrowers must sustain a debt-to-income (DTI) ratio of under 57% to assess eligibility for FHA financing in Georgia. Many lenders demand a maximum DTI ratio of 43% for home financing, which can lead to more competitive mortgage rates.

- Mortgage Insurance Premiums (MIP): FHA mortgages require both upfront and annual mortgage insurance premiums. The initial premium is typically 1.75% of the borrowed sum, while the yearly premium varies according to the amount borrowed and duration.

- Closing Costs: Additionally, consider closing expenses, which usually range from 2% to 5% of the borrowed sum.

Understanding the Georgia FHA loan requirements is essential for prospective borrowers, as these requirements directly affect the total expense of financing and the overall affordability of homeownership. We’re here to support you every step of the way.

Moreover, property owners in the state have several refinancing choices to contemplate, such as modifying interest rates or altering terms to benefit from current mortgage rates. Knowing home equity requirements is also crucial, as many lenders require homeowners to maintain at least an 80% home-to-value ratio.

Furthermore, F5 Mortgage boasts a customer satisfaction rate of 94%, reflecting its commitment to helping clients navigate these requirements effectively. Programs such as the Dream initiative provide additional financial support, making homeownership more attainable for first-time buyers. Remember, you’re not alone in this process, and we’re dedicated to helping you achieve your dream of owning a home.

Navigate the Application Process for FHA Loans in Georgia

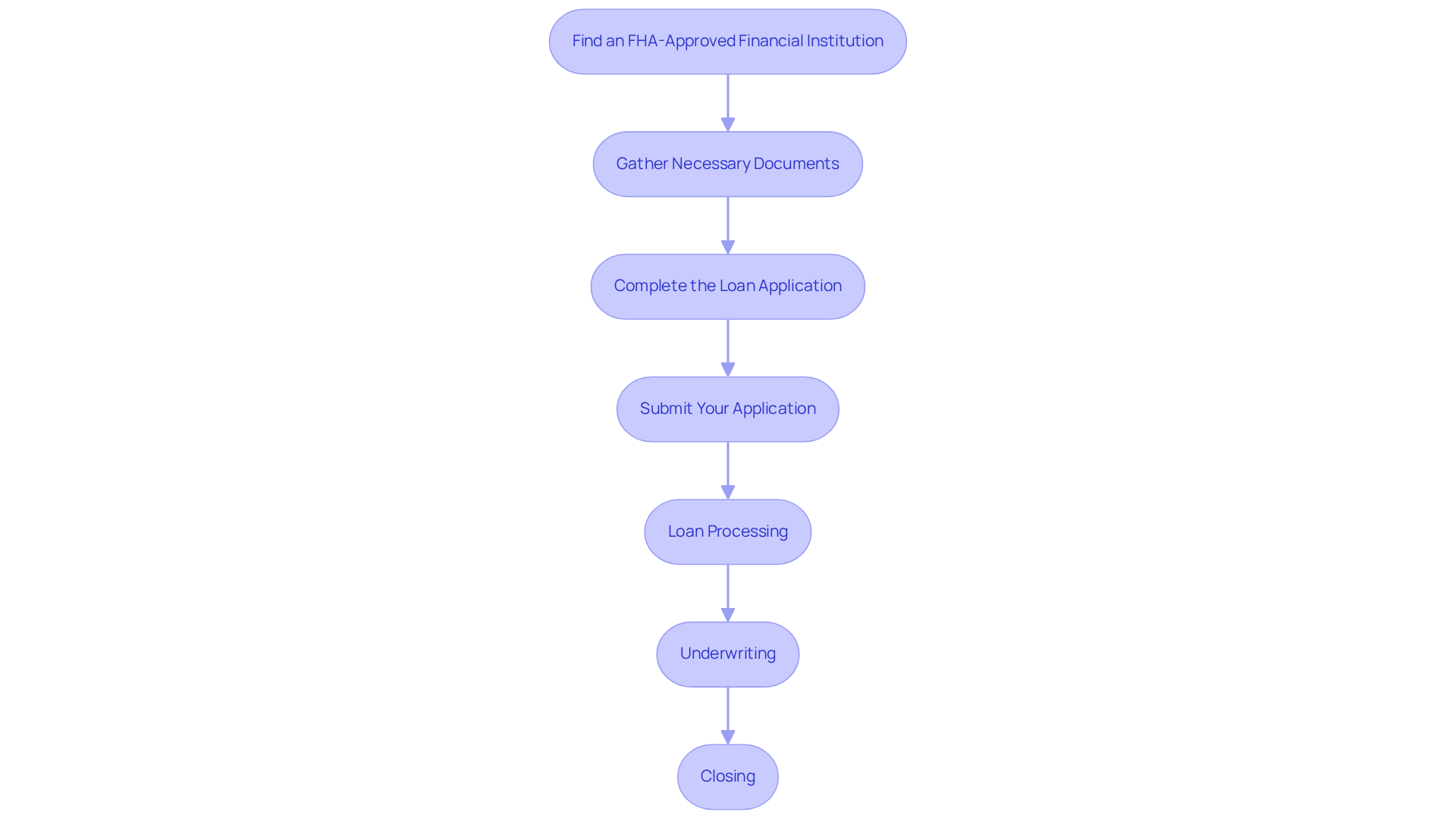

Navigating the application process for an FHA loan in Georgia can feel overwhelming due to the Georgia FHA loan requirements, but we’re here to support you every step of the way. This journey consists of several essential steps designed to simplify your path to homeownership:

- Find an FHA-Approved Financial Institution: Start by researching providers approved by the FHA. This step is crucial, as these institutions offer specific terms and conditions tailored to FHA financing.

- Gather Necessary Documents: Prepare your financial documentation, including tax returns, pay stubs, bank statements, and proof of assets. Having these ready will make the application process smoother and less stressful.

- Complete the Loan Application: Fill out the FHA loan application form carefully, ensuring that all required information is included. This step is vital for the financial institution to assess your eligibility accurately.

- Submit Your Application: Once your application is complete, submit it along with the necessary documentation to your chosen financial institution. Timely submission can help expedite the processing time.

- Loan Processing: The financial institution will review your application, verify your information, and evaluate your creditworthiness. This stage is critical, as it determines your eligibility for financial assistance.

- Underwriting: After approval, your application will enter the underwriting phase, where the financial institution finalizes the terms and conditions of your financing.

- Closing: Finally, you will attend a closing meeting to sign the final documents and receive the keys to your new home.

In Georgia, the average duration to handle requests for Georgia FHA loan requirements typically ranges from 30 to 45 days, depending on the provider’s efficiency and the completeness of your application. Many successful applicants share how thorough preparation and a clear understanding of the requirements made their experience much smoother. By following these steps and collaborating with an FHA-approved lender, you can navigate the FHA loan application process with confidence.

Conclusion

FHA loans in Georgia offer a wonderful opportunity for aspiring homeowners, especially those from low to moderate-income backgrounds. We understand how daunting the homeownership journey can be, but by familiarizing yourself with the eligibility criteria and application steps, you can navigate this process with greater confidence. The flexibility of credit requirements, lower down payment options, and various assistance programs make FHA financing an appealing choice for many, particularly first-time buyers.

This article highlights several important aspects of FHA loans, such as the necessary credit scores, debt-to-income ratios, and the significance of having a steady employment history. These requirements are thoughtfully designed to facilitate access to homeownership. We also detail the application process, from selecting an FHA-approved lender to closing on your new home. These insights underscore the comprehensive support available to those looking to secure an FHA loan in Georgia.

Ultimately, this information serves as a gentle reminder for prospective homebuyers. By leveraging the benefits of FHA loans and understanding the associated requirements, you can take meaningful steps toward achieving your dream of homeownership. Engaging with a knowledgeable lender, like F5 Mortgage, can simplify this process further and provide the guidance you need to make informed decisions. Embrace the opportunity that FHA loans offer and take the first step on your journey toward owning a home in Georgia today.

Frequently Asked Questions

What are FHA loans?

FHA loans, or Federal Housing Administration mortgages, are designed to help low to moderate-income families achieve homeownership.

What are the advantages of FHA loans in Georgia?

FHA loans in Georgia offer several advantages, including lower down payments, flexible credit requirements, competitive interest rates, and access to assistance programs.

What is the minimum down payment required for FHA loans?

The minimum down payment for FHA loans is 3.5% if your credit score is 580 or higher. For scores between 500 and 579, a higher down payment of around 10% may be required. Some financing options may allow for down payments as low as 0%.

How do FHA loans accommodate different credit scores?

FHA financing is flexible with credit requirements, making it accessible to applicants with lower credit scores, which is particularly beneficial for first-time homebuyers with limited credit history.

How do FHA loans compare to traditional mortgages in terms of interest rates?

FHA loans often provide lower interest rates compared to traditional mortgages, which can reduce monthly payments and overall financial strain.

Are there assistance programs available for FHA loan applicants in Georgia?

Yes, Georgia offers various down payment assistance programs, including a $5,000 grant for first-time homebuyers, which can be combined with FHA financing to ease financial burdens.

Who can help with the FHA loan application process in Georgia?

Lenders like F5 Mortgage specialize in helping clients obtain FHA financing efficiently and can assist with the pre-qualification process to understand affordability during house hunting.