Overview

Navigating the mortgage process can be overwhelming, and we understand how challenging this can be. In this article, we explore the key differences between prequalification and preapproval, highlighting their distinct roles in assessing your borrowing potential.

- Prequalification offers a quick and informal estimate based on self-reported information, which can be a helpful starting point.

- Preapproval involves a more detailed evaluation of your financial documents, providing a stronger indication of your financial readiness.

This stronger position not only enhances your competitiveness in the housing market but also empowers you with the confidence to make informed decisions. We’re here to support you every step of the way as you work towards securing your dream home. By understanding these differences, you can take the necessary steps to prepare for your future in homeownership.

Introduction

We know how challenging it can be to navigate the complexities of mortgage prequalification and preapproval. For many prospective homebuyers, these two crucial steps in the home financing journey can feel overwhelming. They serve distinct purposes, yet they are often misunderstood, leading to confusion and missteps in the buying process. By exploring the key differences and implications of each, you can gain clarity on your borrowing potential and streamline your path to homeownership.

But what happens when these terms are used interchangeably? This article delves into the essential distinctions between prequalification and preapproval, equipping you with the knowledge to make informed decisions in your quest for a new home. We’re here to support you every step of the way.

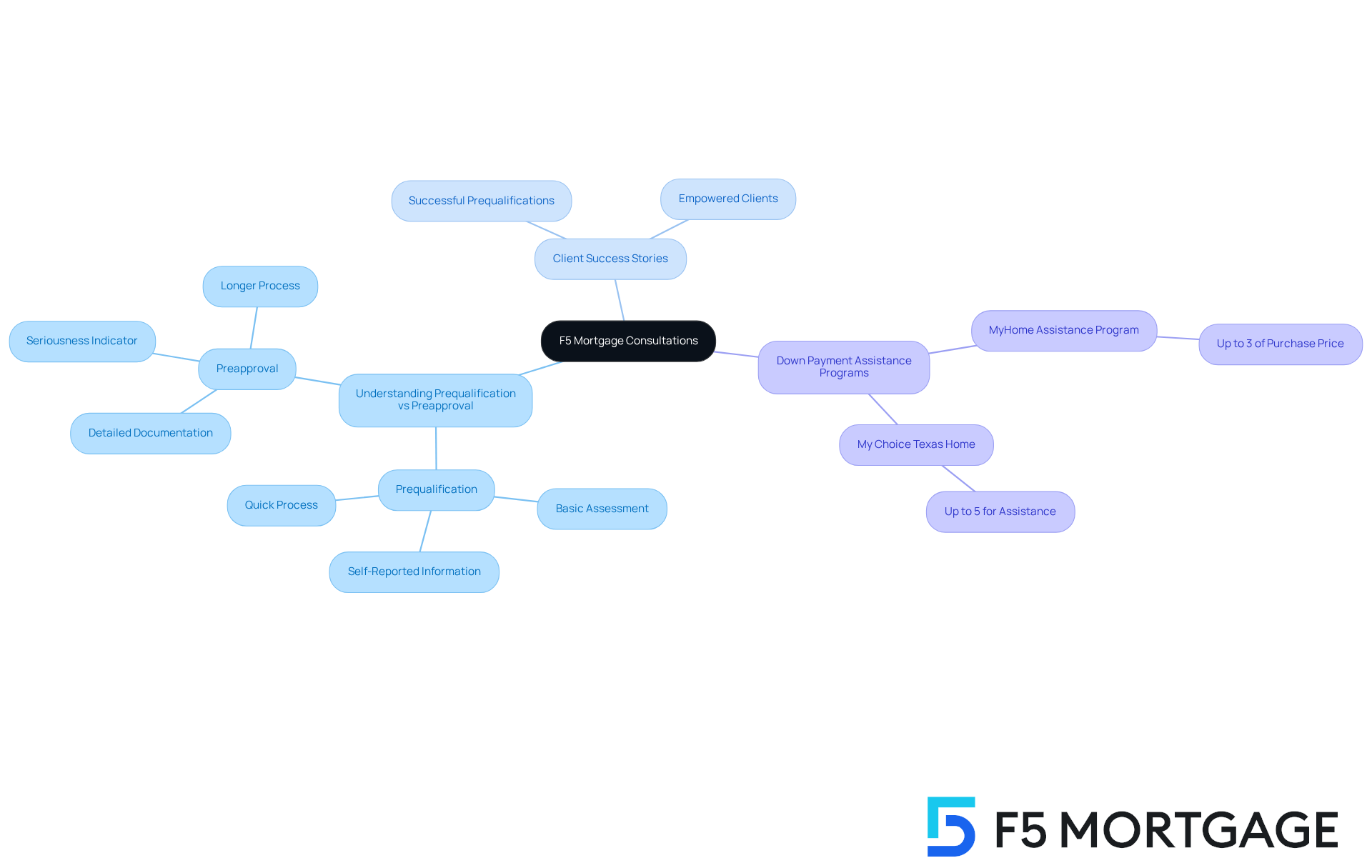

F5 Mortgage: Personalized Mortgage Consultations for Prequalification Insights

At F5 Mortgage, we understand how challenging navigating the mortgage process can be. That’s why we offer tailored financing consultations designed to help individuals like you understand the differences between prequalification vs preapproval with clarity. By evaluating your unique financial situation, our brokerage provides customized insights that empower you to assess your borrowing potential with confidence. This personalized approach simplifies the home financing journey and fosters assurance as you prepare for homeownership.

Our experts emphasize the essential role of these consultations in clarifying the mortgage landscape. We want you to feel supported and informed at every stage of your journey. Successful examples from our clients illustrate how personalized consultations have led to successful prequalification, showcasing our commitment to your education and empowerment.

Additionally, we provide insights into various down payment assistance programs, such as:

- The MyHome Assistance Program in California, which offers up to 3% of the home’s purchase price

- The My Choice Texas Home program, providing up to 5% for down payment and closing assistance

Understanding the difference between prequalification vs preapproval is crucial, as it helps families enhance their homes and make informed decisions tailored to their financial circumstances.

If you’re considering homeownership, reaching out for a personalized consultation can be a valuable first step. We’re here to support you every step of the way.

Understanding Prequalification vs. Preapproval: Key Definitions and Differences

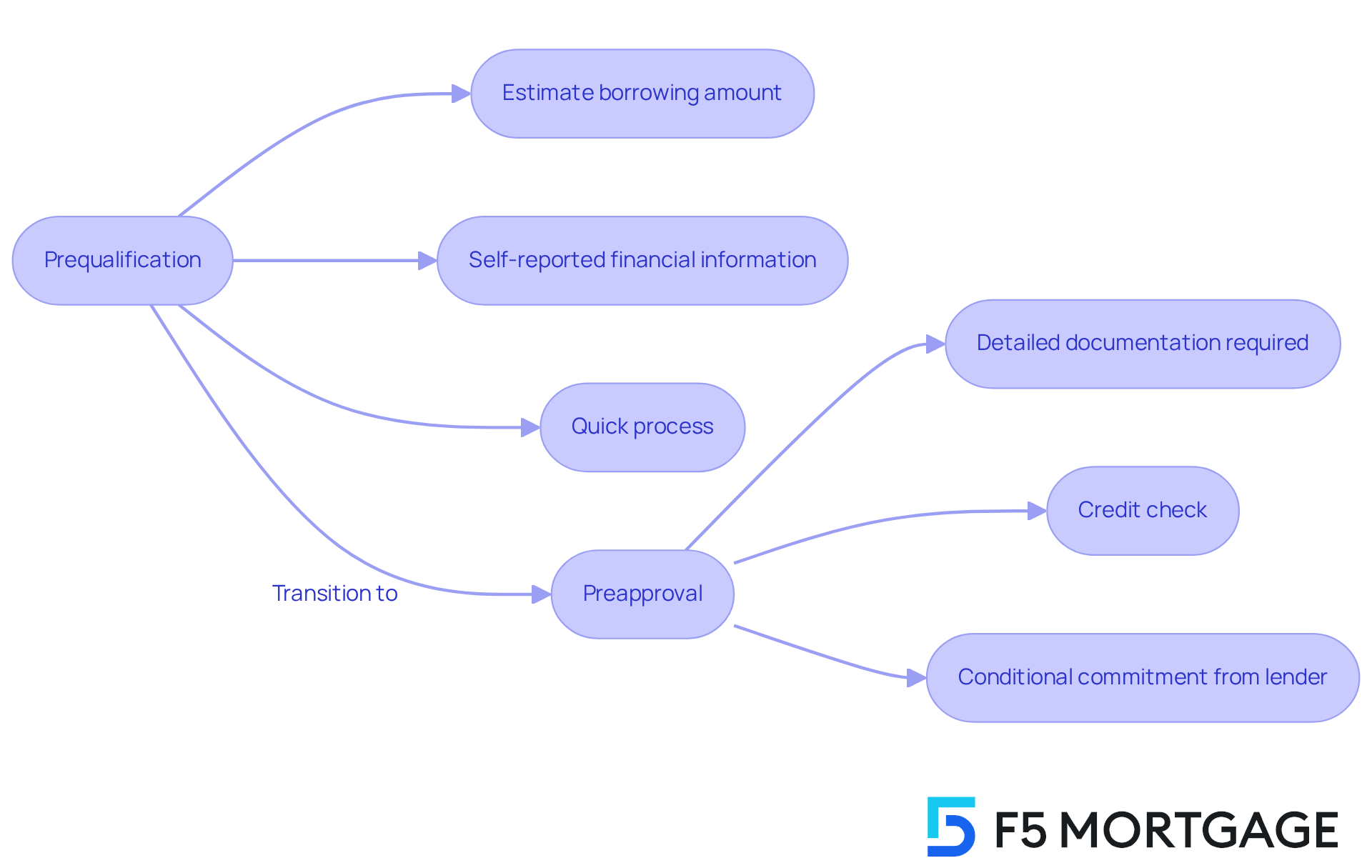

Prequalification serves as an initial assessment where lenders estimate how much you might be able to borrow based on self-reported financial information. This process is relatively straightforward and can often be completed quickly, providing a rough idea of your borrowing potential. However, it lacks the depth of validation that comes with prior approval.

In contrast, prior authorization involves a more rigorous evaluation, requiring detailed documentation such as pay stubs, tax returns, and a credit check. This thorough process results in a conditional commitment from the lender, indicating a higher likelihood of securing a loan. As highlighted by industry specialists, prior approval is seen as a more robust indication to sellers, improving a buyer’s stance in negotiations. Imagine having a validated approval letter in hand; it can greatly enhance your credibility, making you more competitive in a crowded market.

Despite the benefits of prior approval, many homebuyers remain unclear about the differences between prequalification vs preapproval. We know how challenging this can be. Research indicates that a significant portion of potential buyers may not fully understand how these terms impact their home buying journey. Thus, securing preapproval is essential, as it not only clarifies your financial position but also simplifies the buying experience. This enables quicker offers and possibly more seamless transactions. We’re here to support you every step of the way.

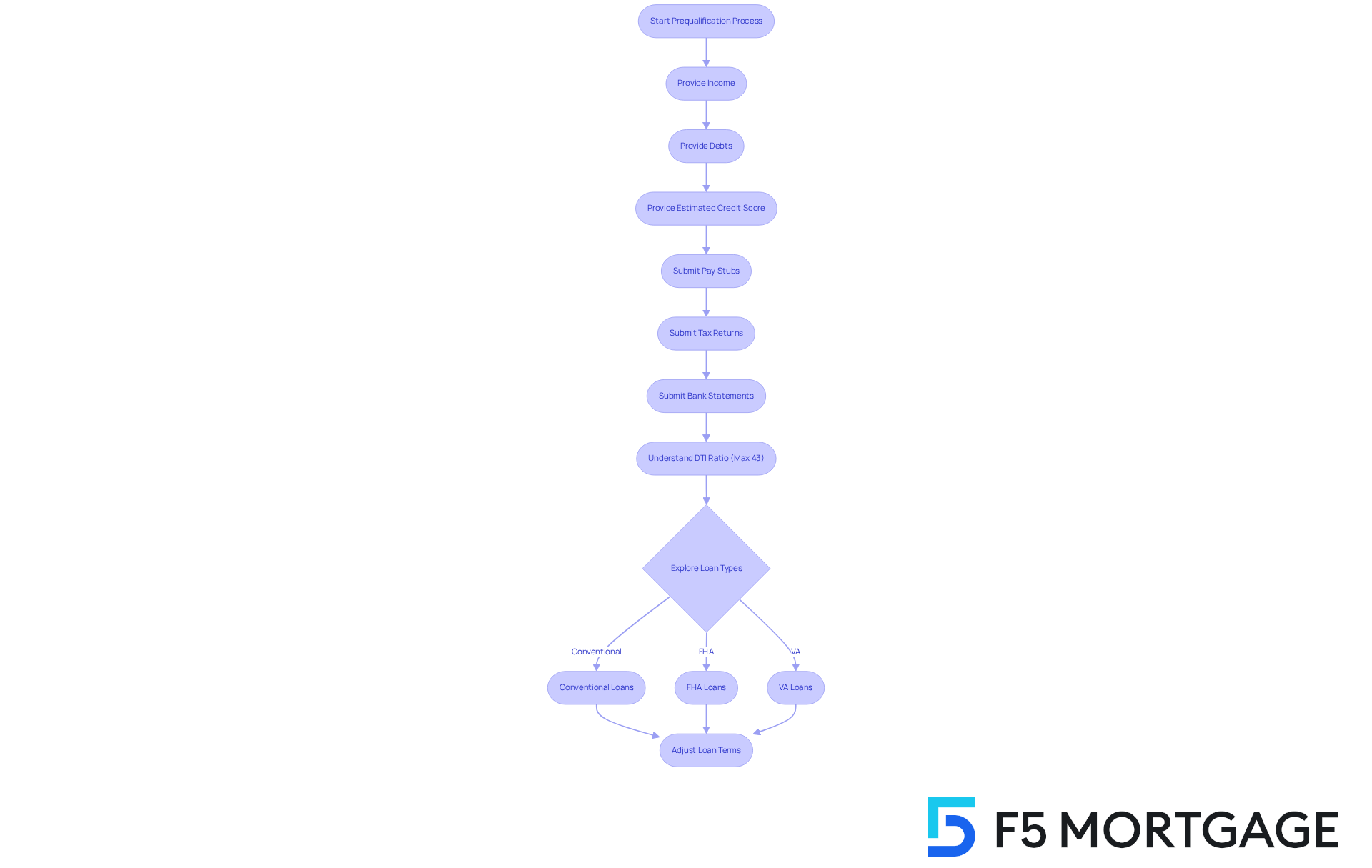

Prequalification Requirements: What Information You Need to Provide

The process of prequalification vs preapproval can feel overwhelming, but we’re here to support you every step of the way. To begin, you’ll typically need to provide some basic financial information, including your income, debts, and estimated credit score. Lenders may ask for documentation like pay stubs, tax returns, and bank statements to verify your financial status.

Understanding your Debt-to-Income (DTI) ratio is crucial. A maximum of 43% DTI is generally necessary for home loans, which can significantly affect your borrowing power and interest rates. By having this information ready, you can speed up the prequalification vs preapproval process and gain a clearer understanding of your financial position.

Additionally, exploring refinancing options available in Colorado, such as:

- Conventional loans

- FHA loans

- VA loans

can open up various pathways to beneficial loan conditions. We know how challenging this can be, but understanding how to adjust your loan term can also help you lower your monthly payments or eliminate private mortgage insurance (PMI). This knowledge can make the comparison of prequalification vs preapproval even more advantageous for your home improvement journey.

Timeline for Prequalification and Preapproval: How Long Does Each Take?

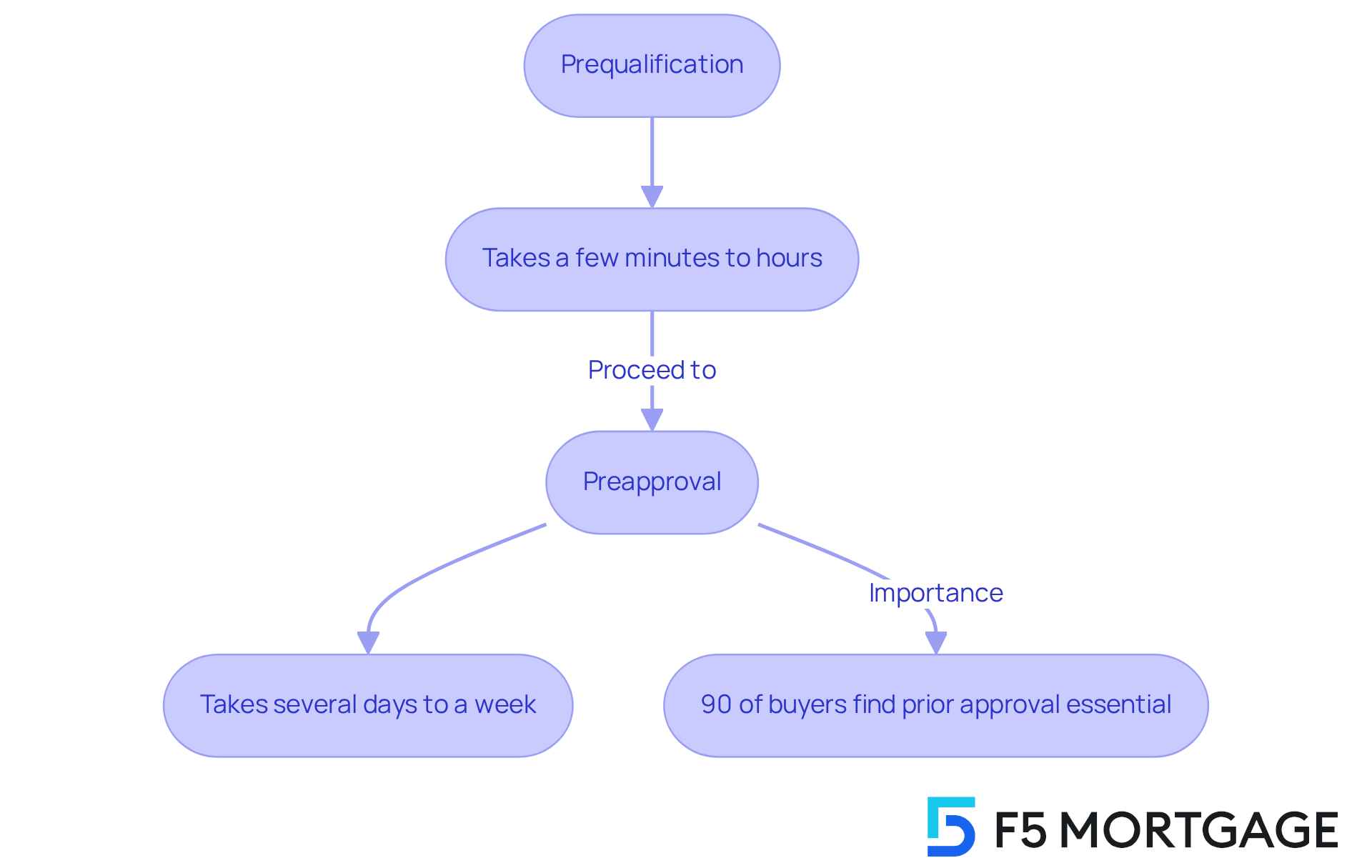

Prequalification is a quick procedure, often completed in just a few minutes to a few hours, depending on the lender’s specific methods. This rapid turnaround allows potential homebuyers to quickly gauge their borrowing capacity. In contrast, prior approval is a more detailed process that typically takes several days to a week due to the need for a comprehensive review of financial documents, including income verification and credit checks.

We understand how challenging navigating these timelines can be, especially in a competitive market where urgency can significantly impact the success of an offer. Statistics show that many homebuyers emphasize the importance of prequalification vs preapproval to speed up their home search, with 90% of purchasers viewing prior approval as essential for making informed offers. Expert opinions indicate that while prequalification vs preapproval offers an initial estimate, obtaining prior approval is crucial for serious buyers, as it verifies their financial readiness and improves their likelihood of securing a desired property.

At F5 Mortgage, we’re here to support you every step of the way, prioritizing a seamless experience without hard sales tactics. Our clients receive personal service alongside competitive rates. In 2025, the average duration for approval remains at approximately 10 business days, highlighting the necessity for buyers to start this process early in their home search. By being proactive, homebuyers can navigate the complexities of the market with confidence, ensuring they are prepared to act swiftly when they find the right home.

Credit Score Implications: How Prequalification and Preapproval Affect Your Score

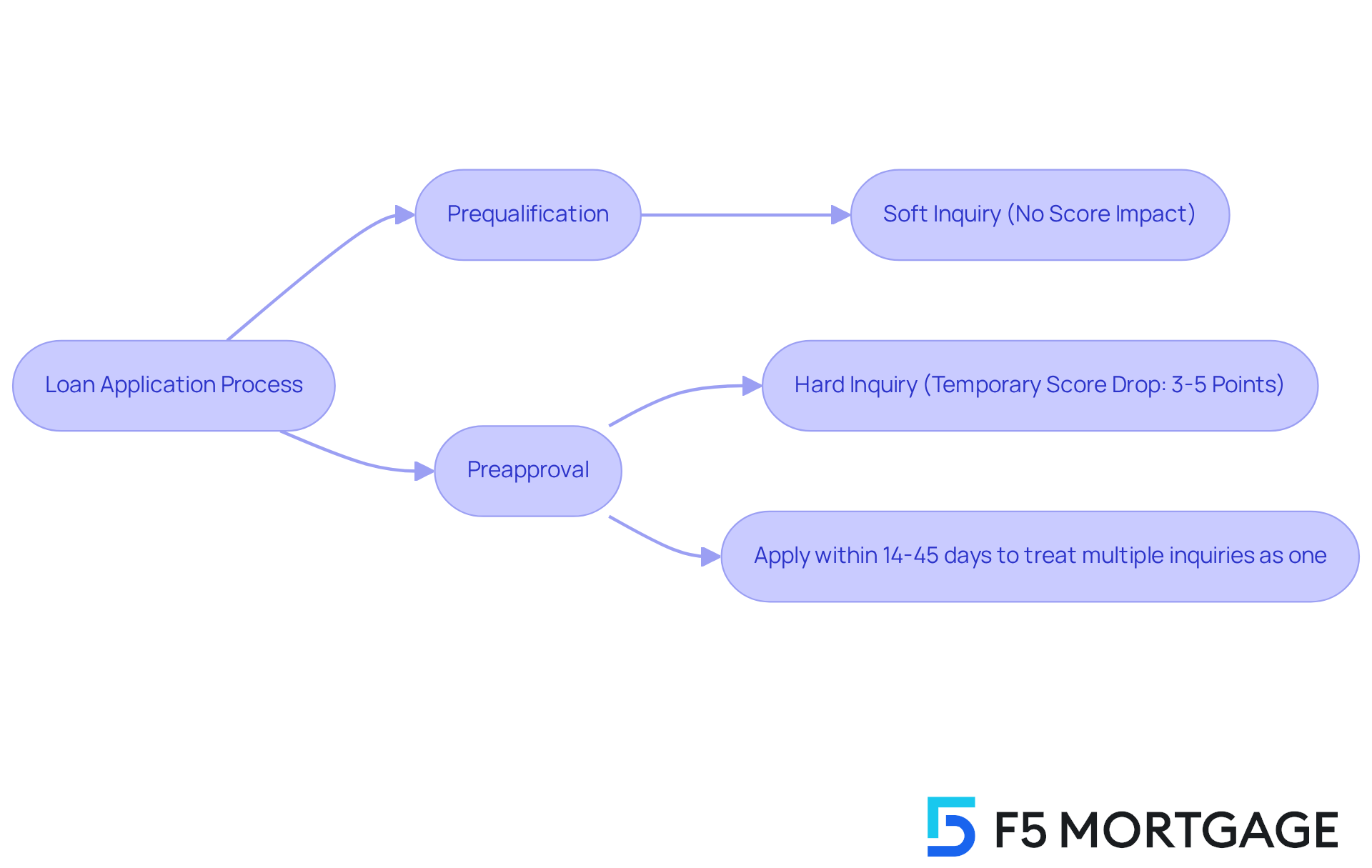

Prequalification typically involves a soft credit inquiry, which won’t affect your credit score. On the other hand, prior approval requires a hard credit inquiry, which can cause a temporary drop in your score—usually between three to five points. We understand how challenging this can be, and knowing the difference between prequalification vs preapproval is essential for borrowers. Effective credit score management is vital when preparing for a loan application.

To help minimize the impact of hard inquiries, borrowers can strategically time their applications. By applying for preapproval from multiple lenders within a 14 to 45-day window, all inquiries can be treated as a single inquiry. This approach significantly reduces the overall effect on your credit score.

Credit specialists emphasize that while a hard inquiry may lead to a minor decrease, the benefits of securing a loan far outweigh this temporary setback. By maintaining a stable credit profile and correcting any inaccuracies in their credit reports, borrowers can position themselves favorably for better mortgage terms. We’re here to support you every step of the way as you navigate this process.

Benefits of Prequalification vs. Preapproval: Which Option is Right for You?

Prequalification serves as a valuable starting point for families embarking on their home-buying journey. It offers a quick estimate of borrowing potential without requiring extensive financial documentation. This procedure typically involves a soft inquiry, allowing buyers to gauge their financial readiness in just a few minutes. However, for committed purchasers aiming to enhance their bids and simplify the buying process, obtaining prior approval is the favored option. This more stringent process necessitates a formal application and verification of financial details, leading to a letter of intent that clearly specifies the mortgage amount and conditions the lender is prepared to provide.

Success stories abound for clients who chose to get approved in advance. This not only enhances their offers but also places them advantageously in competitive markets. Purchasers with approval letters are often seen as more trustworthy by sellers, resulting in swifter negotiations and possibly quicker closings. In fact, many families find that obtaining prior approval allows them to act quickly when they discover their perfect home, significantly decreasing the time invested in the purchasing process.

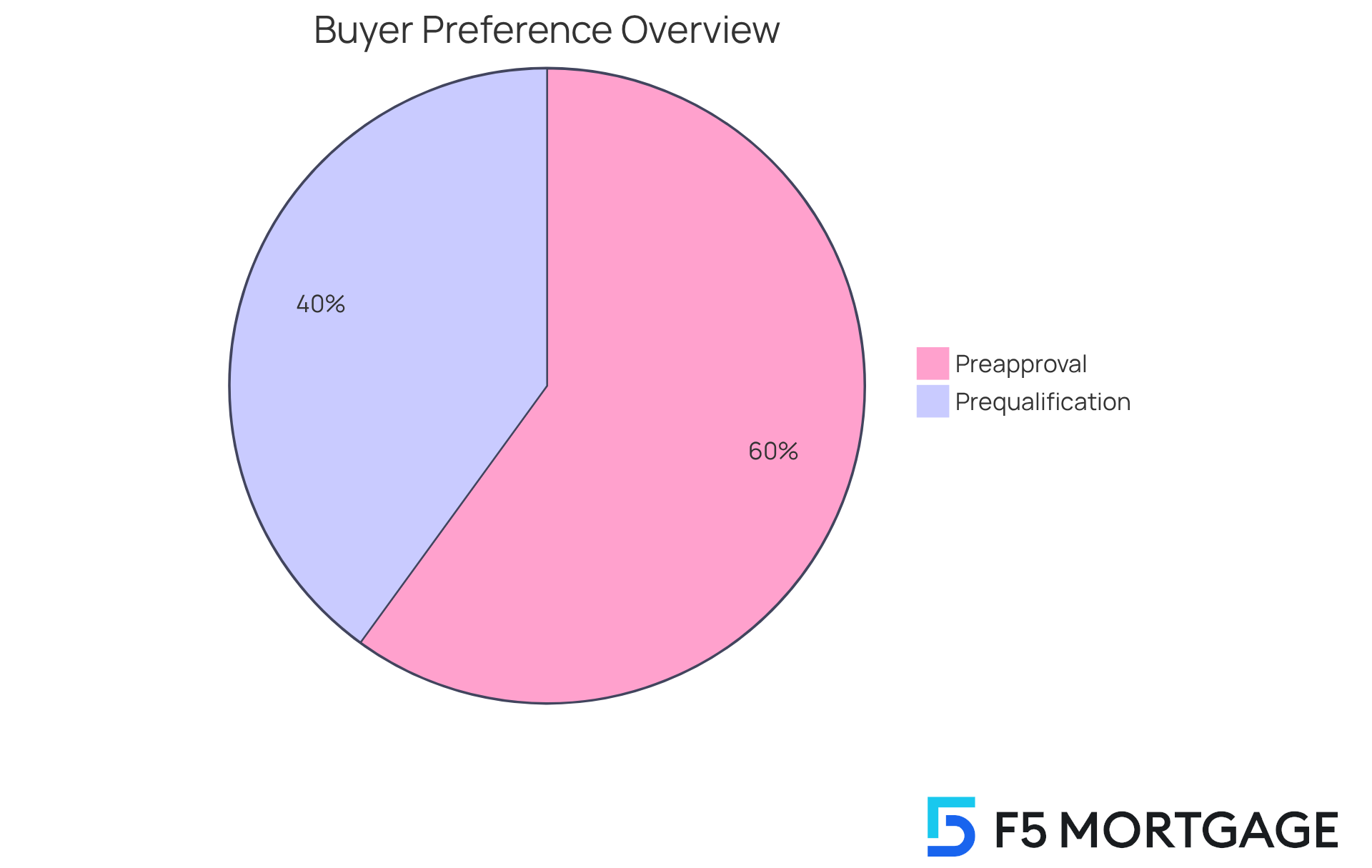

Statistically, over 60% of buyers select prior approval over prequalification, recognizing its advantages in securing a mortgage. Expert insights indicate that prior approval is especially beneficial for individuals prepared to make a significant investment. It offers a clear understanding of home-buying capacity and assists buyers in focusing their search on properties within their confirmed price range. Ultimately, understanding the unique advantages of prequalification vs preapproval empowers clients to make informed choices that align with their home-buying objectives. We know how challenging this can be, and we’re here to support you every step of the way.

Common Misconceptions: Debunking Myths About Prequalification and Preapproval

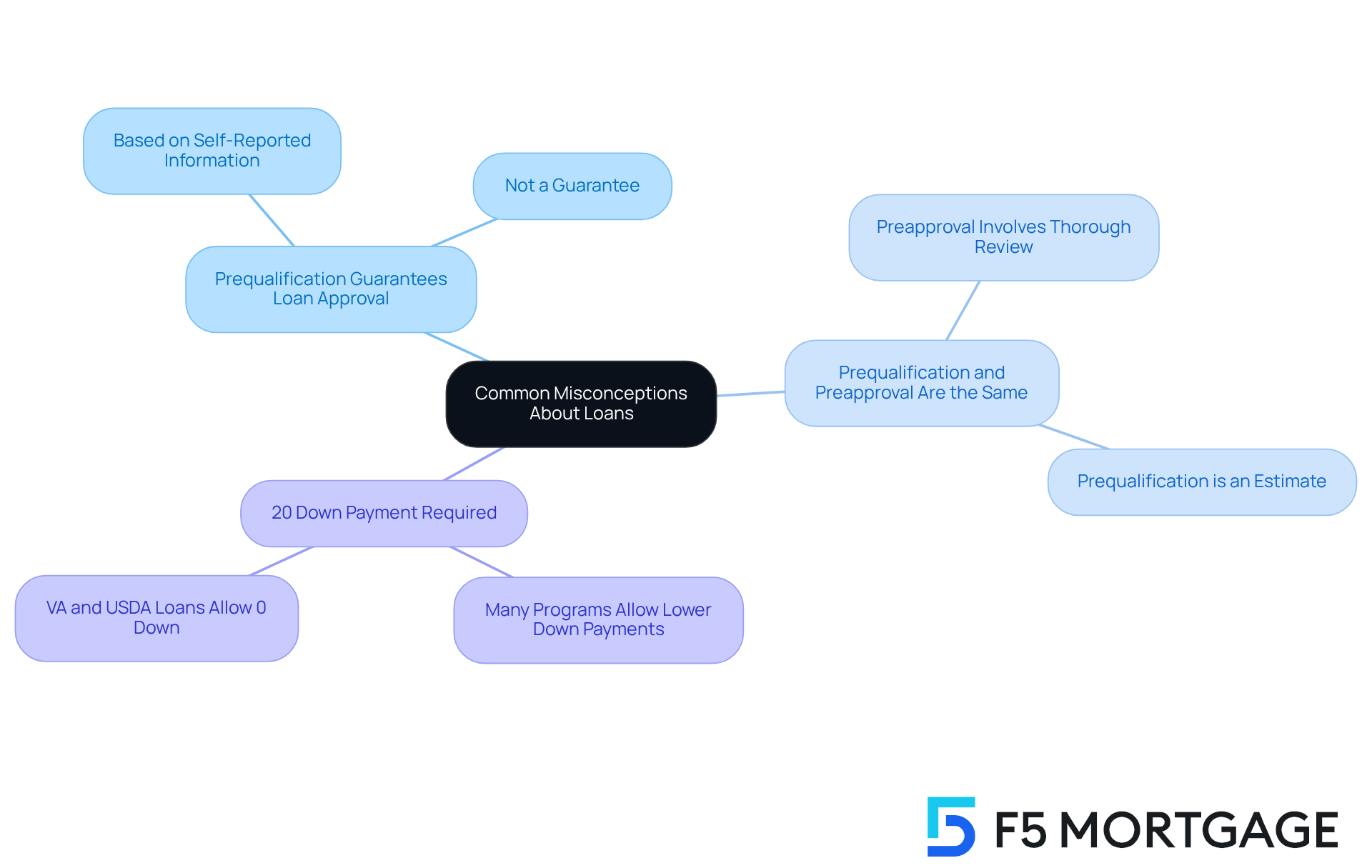

Many families often feel confused about the loan process, and one common misconception is that prequalification vs preapproval means that prequalification guarantees loan approval. This is not true. Prequalification is merely an estimate based on self-reported information, which can lead to misunderstandings. Another myth is that prequalification vs preapproval are the same; however, preapproval involves a more thorough review of your financial documents.

When you receive an approval, it reflects the lender’s decision that, based on the financial information you provide, you’re a good candidate for a loan. In this approval, you typically receive an estimate of your loan amount, interest rate, and potential monthly payment. It’s also important to note that terminology can vary among lenders, particularly in the context of prequalification vs preapproval, with some using these terms interchangeably.

Additionally, many purchasers wrongly assume they need a 20% down payment to secure a loan. In reality, several financing programs permit down payments as low as 3% or even 0% for qualified borrowers. By dispelling these misconceptions, we can help you engage in the loan process with a clearer understanding. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Role of Lenders and Brokers: Navigating Prequalification and Preapproval

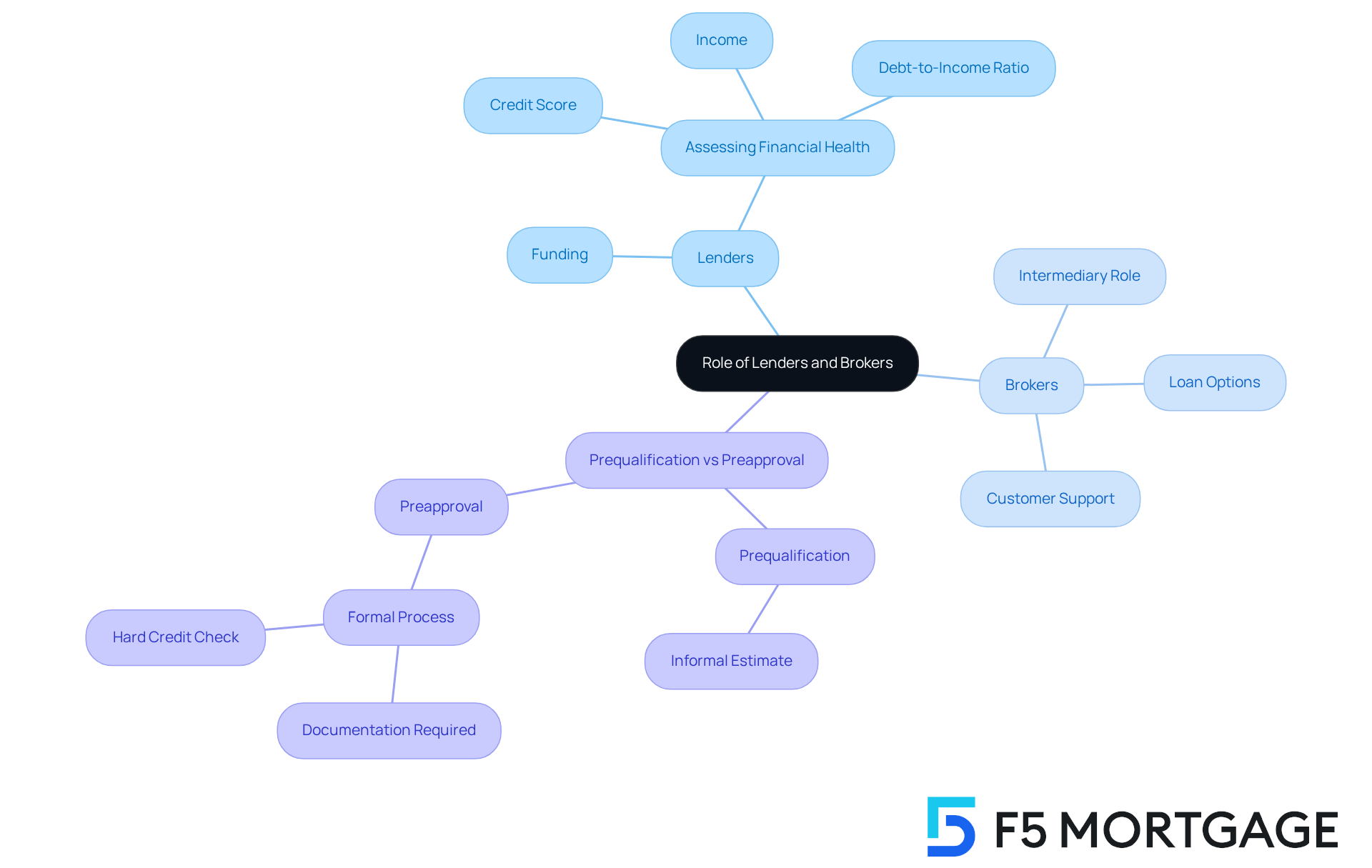

Lenders and brokers play a vital role in the steps of home financing, particularly in understanding prequalification vs preapproval. Lenders not only provide the necessary funding but also assess the borrower’s financial health, considering factors like income, credit score, and debt-to-income ratio. On the other hand, brokers, such as F5 Mortgage, serve as valuable intermediaries, guiding individuals through the complexities of loan options and helping them secure terms that align with their unique financial situations.

Brokers enhance the mortgage experience by leveraging their connections with various lenders. This means customers can access a wider array of loan options, often resulting in better rates and conditions than they might find on their own. For instance, brokers assist individuals in understanding the differences between prequalification vs preapproval, where:

- Prequalification is an informal estimate of borrowing capacity

- Preapproval is a more formal process that involves documentation and a hard credit check

Many customers prefer to work with brokers rather than lenders due to the personalized service and expertise they provide. Brokers streamline the loan process, ensuring that individuals feel informed and confident in their decisions. At F5 Mortgage, our dedicated loan agents, including Alyssa Alberton, are here to support you through the intricacies of the financing journey, particularly for self-employed individuals who may face unique challenges. Effective collaborations between brokers and lenders often lead to smoother workflows, with brokers facilitating communication and negotiation for their clients, ultimately enhancing the overall experience.

We know how challenging this can be, but remember, you’re not alone. We’re here to support you every step of the way.

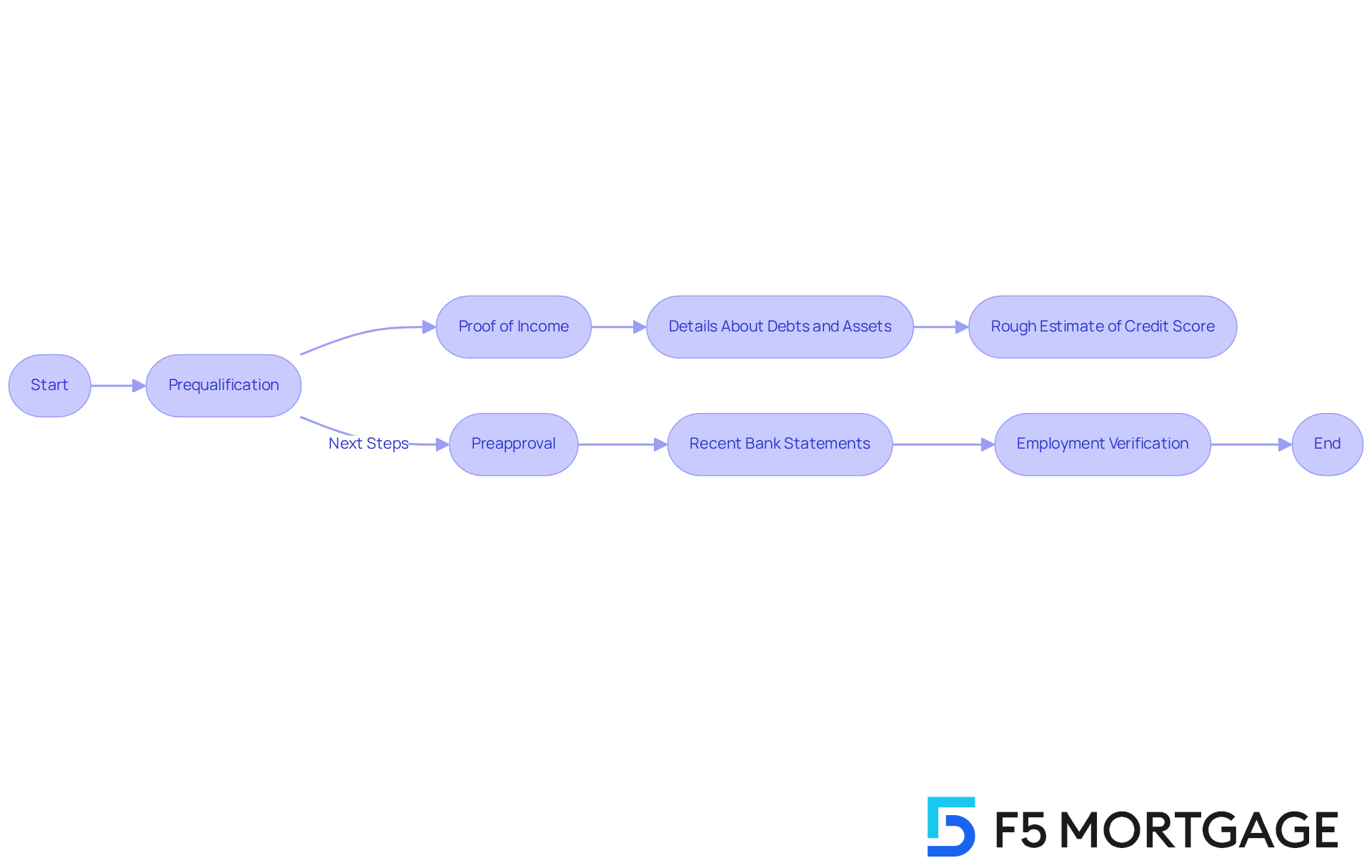

Prequalification and Preapproval Checklist: Steps to Prepare for Your Mortgage

Preparing for mortgage prequalification vs preapproval can feel overwhelming, but we’re here to support you every step of the way. Gathering essential documents is key. This includes:

- Proof of income, such as pay stubs and tax returns

- Details about your debts and assets

- A rough estimate of your credit score

In contrast, the procedure of prequalification vs preapproval requires more comprehensive documentation, including:

- Recent bank statements

- Employment verification

Arranging these documents efficiently can greatly enhance your workflow, enabling faster evaluations and approvals.

For many individuals, carefully organizing paperwork leads to a more seamless lending experience. Those who provided complete income verification—like W-2 forms and recent pay stubs—found it easier for lenders to assess their financial standing accurately. We understand how challenging this process can be, so we recommend maintaining a checklist of required documents. Ensuring consistency between your application figures and supporting documentation can significantly boost your chances of prior approval. This proactive approach not only increases your chances but also positions you advantageously in a competitive market.

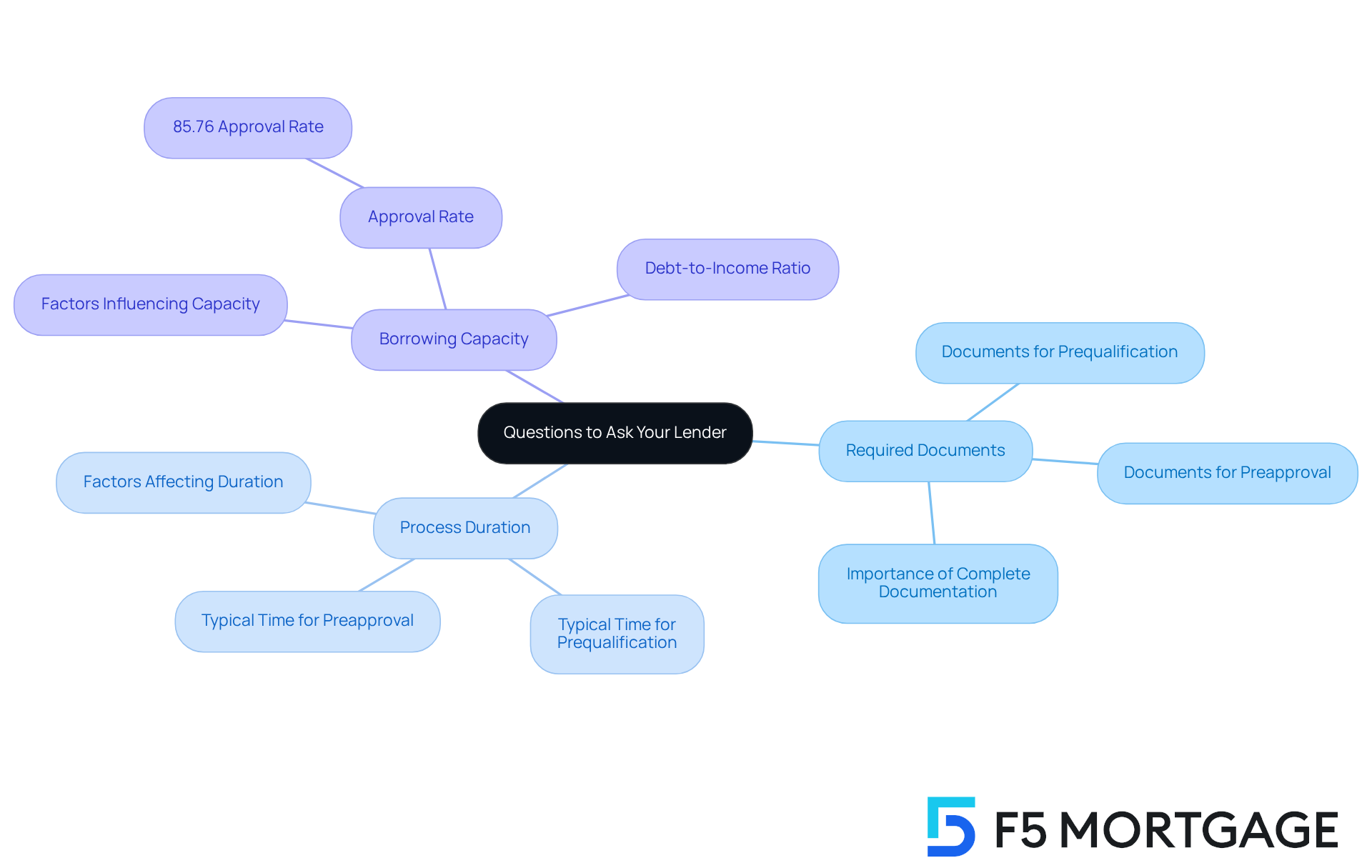

Questions to Ask Your Lender: Ensuring Clarity in Prequalification and Preapproval

When interacting with lenders, we understand that clients may have many questions about the mortgage approval process. It’s important to focus on asking the right questions to ensure clarity and confidence. Here are some key inquiries to consider:

- What documents do I need for both prequalification and preapproval?

- How long does each process typically take?

- What factors will influence my borrowing capacity?

These questions not only help you grasp the requirements but also set realistic expectations for the timeline ahead. For example, clients who actively sought clarification on document requirements often reported smoother experiences, with many achieving results in under an hour when comparing prequalification vs preapproval.

An approval signifies that the lender believes you are a suitable candidate for a home loan based on your financial information. Typically, it provides an estimate of your loan amount, interest rate, and possible monthly payment. Statistics show that 85.76% of loan applications submitted by home buyers lead to approval, highlighting the importance of being well-prepared.

By engaging with lenders through thoughtful inquiries, you can greatly enhance your home-buying experience. This approach ensures you feel knowledgeable and confident as you navigate the complexities of financing. At F5 Mortgage, we recognize how challenging this can be, and we are here to support you every step of the way. We believe in transforming the mortgage experience by leveraging technology to offer transparent, competitive rates without the pressure of hard sales tactics. Our goal is to change the traditional practices that often intimidate borrowers, fostering a more empowering experience for our clients.

Conclusion

Understanding the distinctions between prequalification and preapproval is essential for anyone embarking on the journey to homeownership. We know how challenging this can be, and having clarity on these terms can significantly enhance your confidence and position in the competitive housing market.

Prequalification offers a quick estimate of your borrowing potential based on self-reported information. It serves as a helpful starting point, allowing prospective buyers to gauge their financial readiness quickly. In contrast, preapproval involves a thorough review of your financial situation, providing a more reliable commitment from lenders. This not only strengthens your negotiating power with sellers but also streamlines the buying experience, ensuring that you are prepared to make informed offers.

Additionally, understanding the timeline, credit score implications, and necessary documentation for each process equips you with the knowledge needed to navigate the mortgage landscape effectively. Engaging in personalized mortgage consultations can further enhance your understanding and readiness. By seeking expert guidance, you can clarify your options and make informed decisions that align with your financial goals.

Whether you are just starting to explore homeownership or are ready to make an offer, leveraging the insights gained from this article can empower you to take confident steps toward securing your dream home. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer?

F5 Mortgage offers personalized mortgage consultations to help individuals understand the differences between prequalification and preapproval, evaluate their financial situation, and assess their borrowing potential.

What is the difference between prequalification and preapproval?

Prequalification is an initial assessment based on self-reported financial information, providing a rough estimate of borrowing potential. In contrast, preapproval involves a detailed evaluation with documentation such as pay stubs and credit checks, resulting in a conditional commitment from the lender.

Why is preapproval important for homebuyers?

Preapproval is important because it provides a more robust indication of a buyer’s financial position, enhancing their credibility and competitiveness in negotiations. It can lead to quicker offers and a smoother transaction process.

What information is needed for the prequalification process?

For prequalification, you typically need to provide basic financial information including your income, debts, estimated credit score, and possibly documentation like pay stubs, tax returns, and bank statements.

What is the maximum Debt-to-Income (DTI) ratio generally required for home loans?

A maximum DTI ratio of 43% is generally necessary for home loans, which can significantly impact your borrowing power and interest rates.

What down payment assistance programs does F5 Mortgage provide insights into?

F5 Mortgage provides insights into programs such as the MyHome Assistance Program in California, offering up to 3% of the home’s purchase price, and the My Choice Texas Home program, providing up to 5% for down payment and closing assistance.

What refinancing options are available in Colorado?

In Colorado, refinancing options include conventional loans, FHA loans, and VA loans, which can provide beneficial loan conditions.

How can understanding prequalification and preapproval benefit homebuyers?

Understanding prequalification and preapproval can clarify a buyer’s financial position, simplify the home buying experience, and help them make informed decisions tailored to their financial circumstances.