Introduction

Homeownership often represents a family’s largest financial asset, and we know how significant that can be. With the right strategies, it can also serve as a powerful tool for financial empowerment. As families increasingly seek to leverage home equity loans for major expenses, understanding the intricacies of this financing option becomes crucial.

This article delves into essential facts about equity loans, exploring how they can open doors to financial opportunities. However, it’s important to also highlight the potential risks involved. What should families consider before tapping into their home’s value? How can they navigate this complex landscape effectively? We’re here to support you every step of the way.

F5 Mortgage: Your Partner for Personalized Home Equity Loan Solutions

At F5 Mortgage, we understand how challenging it can be to navigate the world of property financing. That’s why we’re committed to being a supportive partner for families seeking to unlock the value of their homes. With personalized consultations, we tailor our approach to fit your unique financial situation, ensuring you feel heard and understood.

In 2025, many households are turning to independent mortgage brokers like us, recognizing the importance of personalized advice in making complex financial decisions. By connecting with over two dozen leading lenders, F5 Mortgage offers a diverse range of financing options designed to meet your needs, whether you’re looking to refinance or purchase a new property.

We know that the mortgage process can feel overwhelming, which is why we’ve streamlined our application procedure. Imagine getting pre-approved in under an hour! This efficiency makes your journey to securing property financing not just quick, but also stress-free.

As homeowners increasingly seek to leverage equity loans on homes—averaging nearly $150,000 over the past five years—our personalized consultations become essential. We’re here to support you every step of the way, helping families like yours make informed decisions about their financial futures. Let’s work together to turn your dreams into reality.

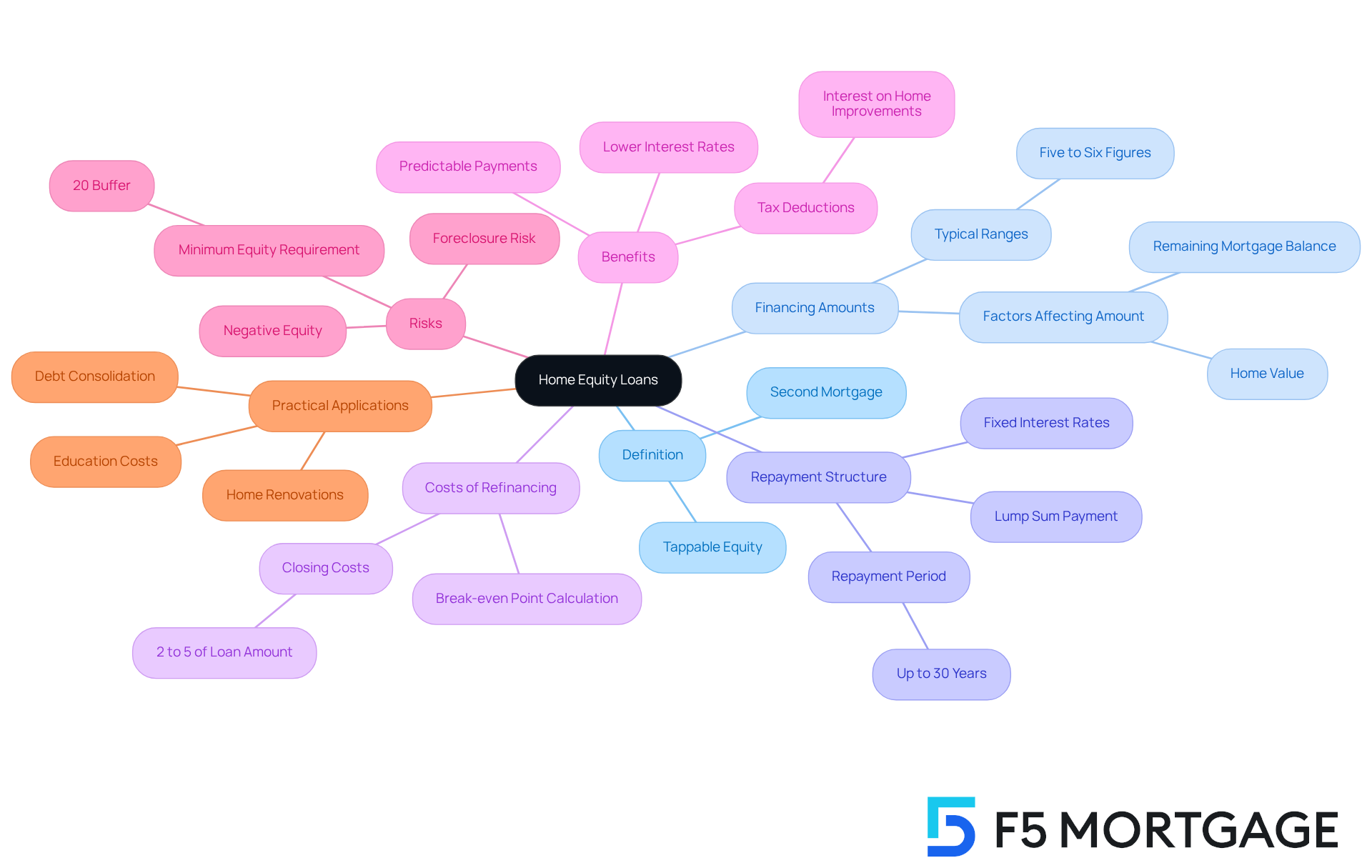

Understanding Home Equity Loans: Definition and Basics

Equity loans on homes, often called a second mortgage, allow homeowners to tap into the value of their asset. Equity loans on homes represent the difference between your home’s current market value and the remaining balance on your mortgage. In 2025, homeowners can typically secure financing amounts ranging from five to six figures through equity loans on homes, which depend on how much equity they have. At F5 Mortgage, we offer a variety of financing programs, including both standard and nontraditional options, so families can find the best financial solutions for their needs.

Home value financing provides a lump sum that you pay back over a set period, usually with a stable interest rate. This means you can count on consistent monthly payments. This financial tool can be especially helpful for families looking to cover significant expenses like renovations, education costs, or debt consolidation. Financial consultants often highlight the advantages of equity loans on homes, noting that they typically have lower interest rates compared to personal loans or credit cards. This makes it a smart choice for addressing larger financial needs. For instance, a family might use equity loans on homes to fund a major home improvement project, boosting their property’s value while potentially benefiting from tax deductions on the interest paid.

It’s also essential to understand the costs tied to refinancing in California. The fees for finalizing a mortgage refinance usually range from 2% to 5% of the amount borrowed, which can significantly impact your overall financial strategy. For example, if you’re refinancing a $300,000 mortgage, you might expect to pay between $6,000 and $15,000 in closing costs. To make this process smoother, families should calculate their break-even point by figuring out their refinancing costs, estimating their monthly savings, and dividing the costs by the savings to see how long it will take to recover these expenses.

Evaluating financing options and fee structures from various lenders, like F5 Mortgage, is crucial to securing the best terms. However, it’s important to be aware of the risks associated with mortgage financing, including the possibility of foreclosure if payments are missed. Understanding how to effectively use equity loans on homes can empower families to make informed financial decisions and enhance their overall financial security. For example, Mr. and Mrs. S decided to borrow against their rental properties for renovations, showcasing a practical application of property financing.

Moreover, property owners should keep in mind that lenders typically prefer to keep 20% of a property’s value untouched as a safety net against defaults. This can affect how much capital you can access. In today’s market, the average property owner has experienced a value loss of around $9,200 each year, highlighting the importance of understanding your financial situation when considering property improvements.

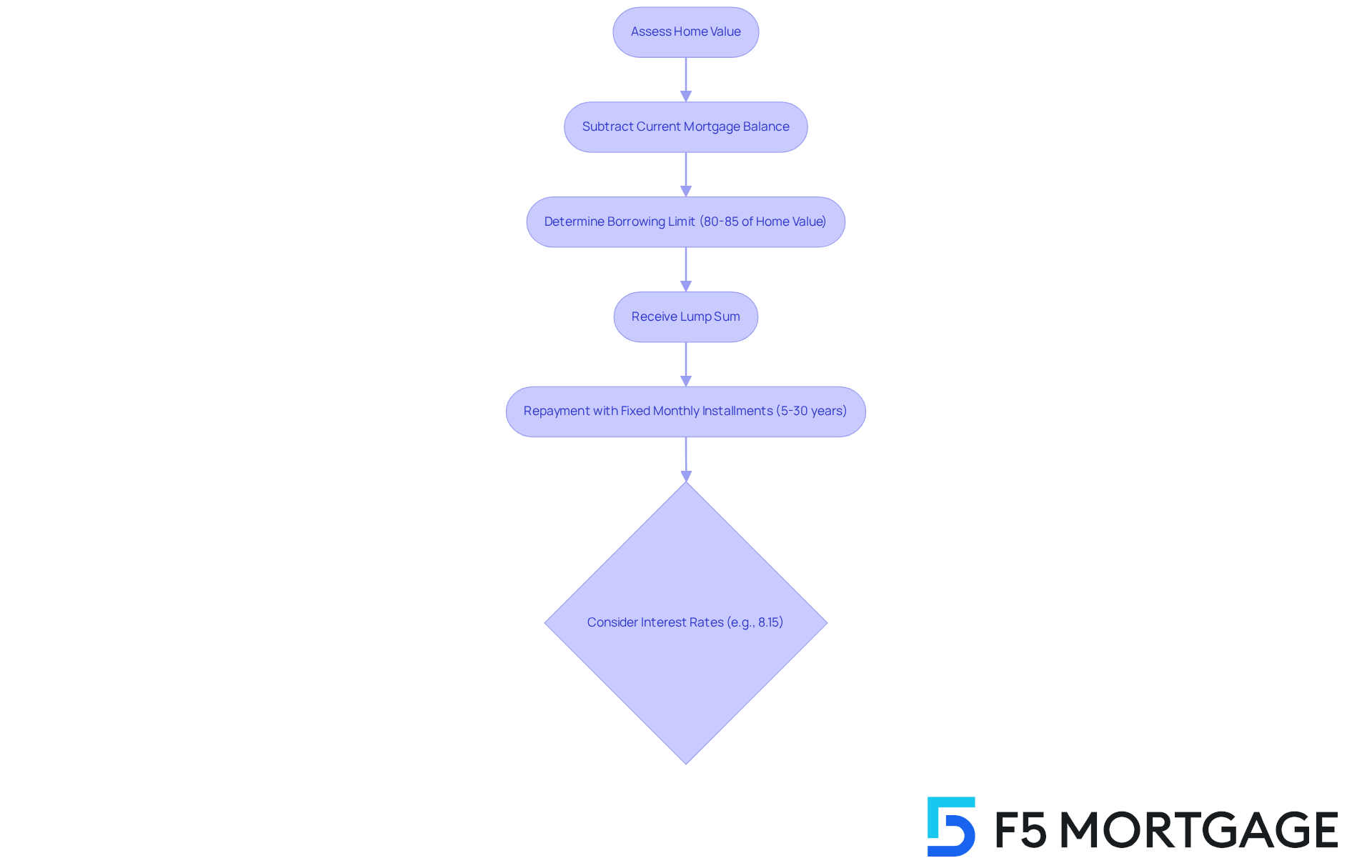

How Home Equity Loans Work: Key Mechanics Explained

Home value financing, such as equity loans on homes, can be a lifeline for property owners, allowing them to borrow against their property’s value. Imagine having access to 80-85% of that value when you need it most. This option can be especially helpful for families facing significant expenses, like renovations or educational costs.

So, how does it work? The amount you can borrow is determined by subtracting your current mortgage balance from your property’s assessed worth. Once approved, you receive a lump sum, which you can repay through fixed monthly installments over a term that ranges from 5 to 30 years. With typical interest rates around 8.15% for a 15-year term, this financing often proves to be a more budget-friendly choice compared to unsecured loans, which can carry higher rates.

We know how challenging financial decisions can be, especially when it comes to your family’s future. With homeowners currently holding a record $17.6 trillion in value, equity loans on homes can provide considerable financial flexibility. It’s about making your home work for you, easing the burden of unexpected costs, and giving you peace of mind.

If you’re considering this option, remember that you’re not alone. We’re here to support you every step of the way, helping you navigate the process and find the best solution for your family’s needs.

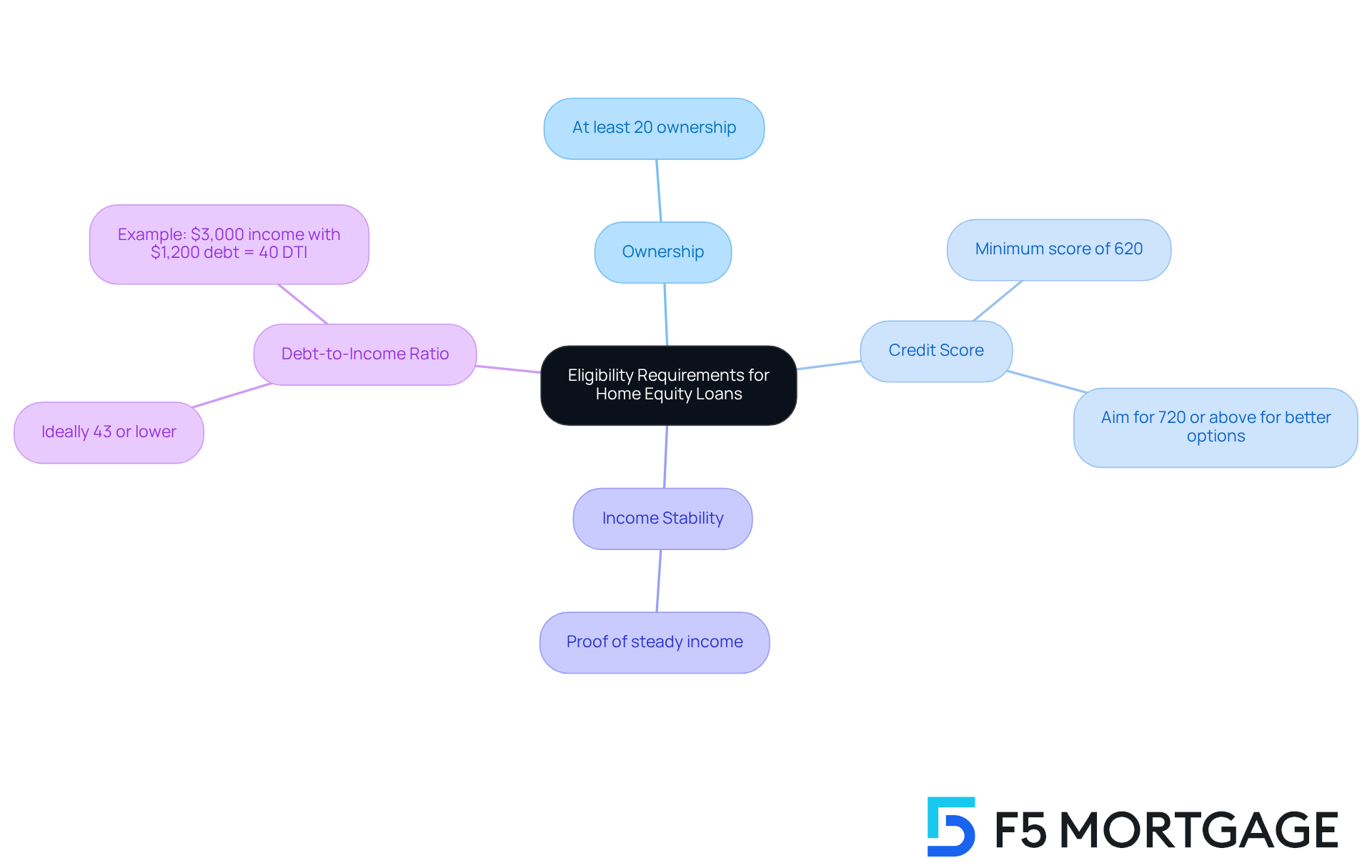

Eligibility Requirements for Home Equity Loans: What You Need to Know

Navigating the world of property collateral credit can feel overwhelming, but we’re here to support you every step of the way. To qualify, there are a few essential standards you’ll need to meet. Typically, borrowers should have:

- At least 20% ownership in their property

- A credit score of 620 or higher

- A steady income

Lenders will closely examine your debt-to-income (DTI) ratio, which ideally should be 43% or lower. This helps them assess your ability to manage additional payment obligations. We know how challenging this can be, so it’s important to prepare the necessary documentation. Gather:

- Proof of income

- Your credit history

- Details about your existing mortgage

to make the application process smoother.

As of early 2025, the average credit score among applicants seeking property-backed financing is around 720. This highlights the importance of maintaining a strong credit profile. Understanding these criteria can empower you to navigate the property financing landscape with confidence. Remember, you’re not alone in this journey; we’re here to help you succeed.

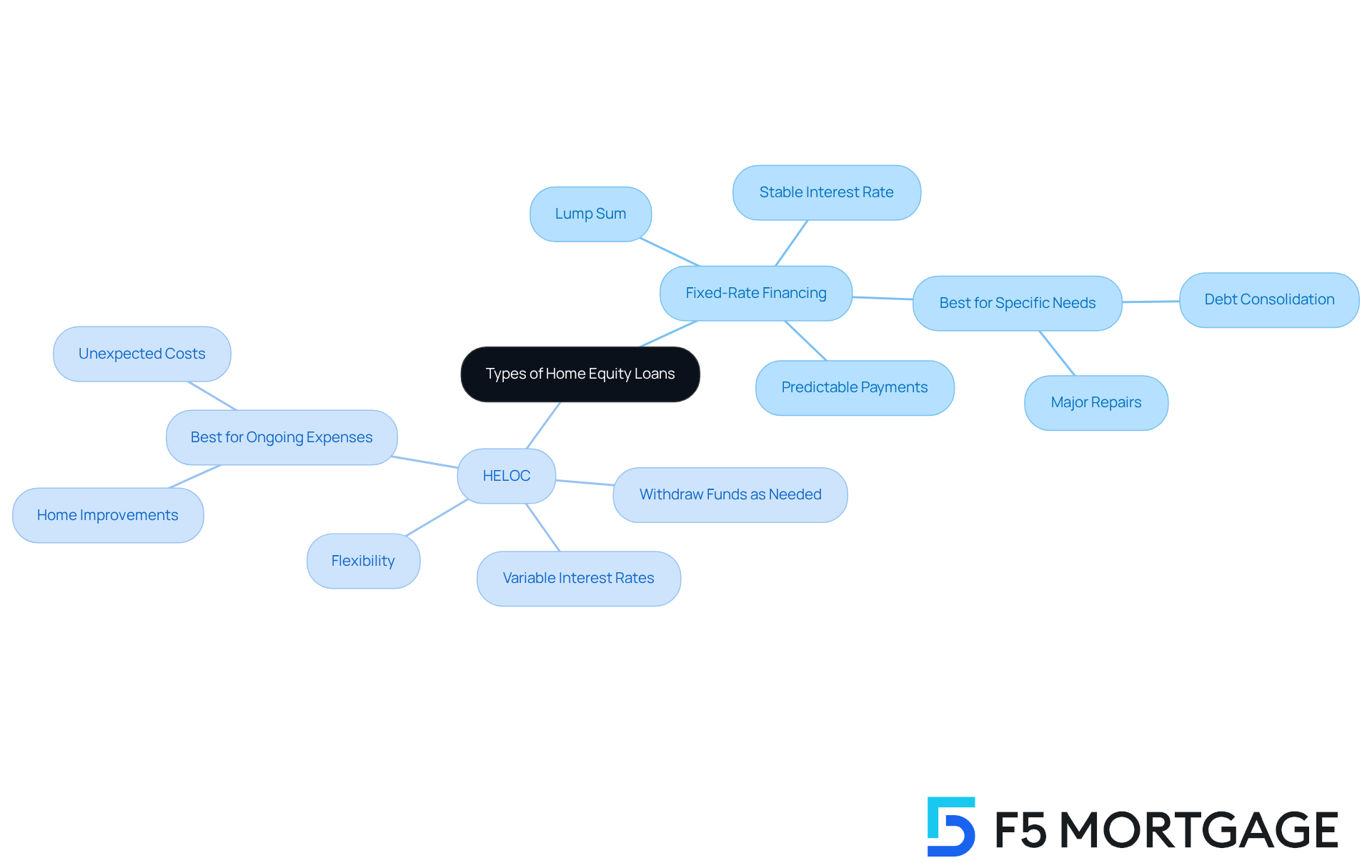

Types of Home Equity Loans: Exploring Your Options

When it comes to borrowing against residential assets, families often face two main options: fixed-rate residential asset financing and equity loans on homes, commonly known as HELOCs. A fixed-rate equity financing offers a lump sum with a stable interest rate, which means predictable monthly payments. This can be a great choice for households needing a specific amount for things like consolidating debt or making significant property repairs.

On the other hand, a HELOC works a bit like a credit card. It allows borrowers to withdraw funds as needed, up to a set limit, but keep in mind that the interest rates can vary over time. This flexibility can be appealing, especially for families who anticipate ongoing expenses.

As you weigh these options, it’s important to consider your financial goals and spending habits. For instance, if you’re gearing up for a major renovation, a fixed-rate financing option might be more suitable due to its predictability. Conversely, if you expect to have continuous costs, a HELOC could be the better fit because of its adaptable nature.

Current trends indicate that nearly 30% of U.S. property owners are thinking about equity loans on homes or borrowing against their assets or lines of credit in the coming year. Many are leaning towards equity loans on homes due to their flexible features. Financial planners stress the importance of choosing a loan that aligns with your individual financial health and comfort level with repayment. As one expert wisely pointed out, “The right option depends on individual goals, financial health, and comfort with repayment.”

In today’s financial landscape, where interest rates are expected to gradually decline, homeowners are increasingly viewing their property value as a vital asset. This shift highlights the need for families to understand the implications of their choices. Interestingly, 54% of homeowners are hesitant to tap into their assets, primarily due to concerns about high interest rates and unclear repayment terms. By carefully weighing the pros and cons of fixed-rate loans versus HELOCs, families can make informed decisions that truly meet their financial needs.

If you’re curious about specific refinancing options available through F5 Mortgage, we encourage you to reach out for personalized advice tailored to your unique financial situation. We know how challenging this can be, and we’re here to support you every step of the way.

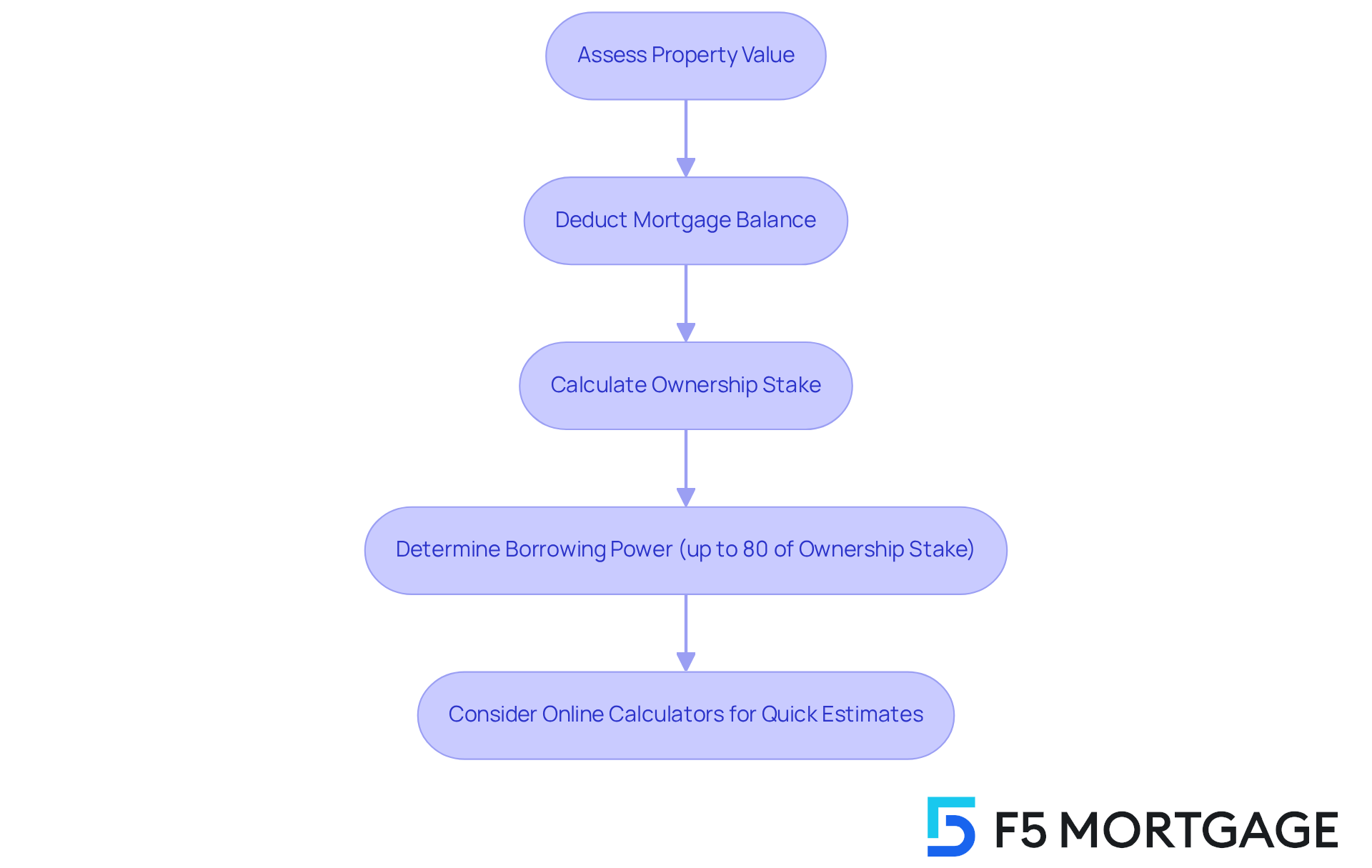

Calculating Home Equity: How to Determine Your Borrowing Power

Calculating your property value can feel overwhelming, but it’s a crucial step in understanding your financial situation. Start by deducting your current mortgage balance from the assessed worth of your home. For instance, if your home is appraised at $300,000 and your mortgage balance is $200,000, you have a $100,000 ownership stake.

Most lenders typically allow homeowners to secure equity loans on homes for up to 80% of this value. In our example, that means you could access around $80,000. We know how challenging it can be to navigate these numbers, especially when considering the average mortgage-holding homeowner has about $302,000 in value as of Q1 2025. This means many families can effectively utilize equity loans on homes as a valuable asset.

To make this process easier, consider using online calculators. They can provide quick estimates of your borrowing capacity, helping you make informed choices about your financial options. Remember, we’re here to support you every step of the way as you explore your possibilities.

Benefits of Home Equity Loans: Unlocking Financial Opportunities

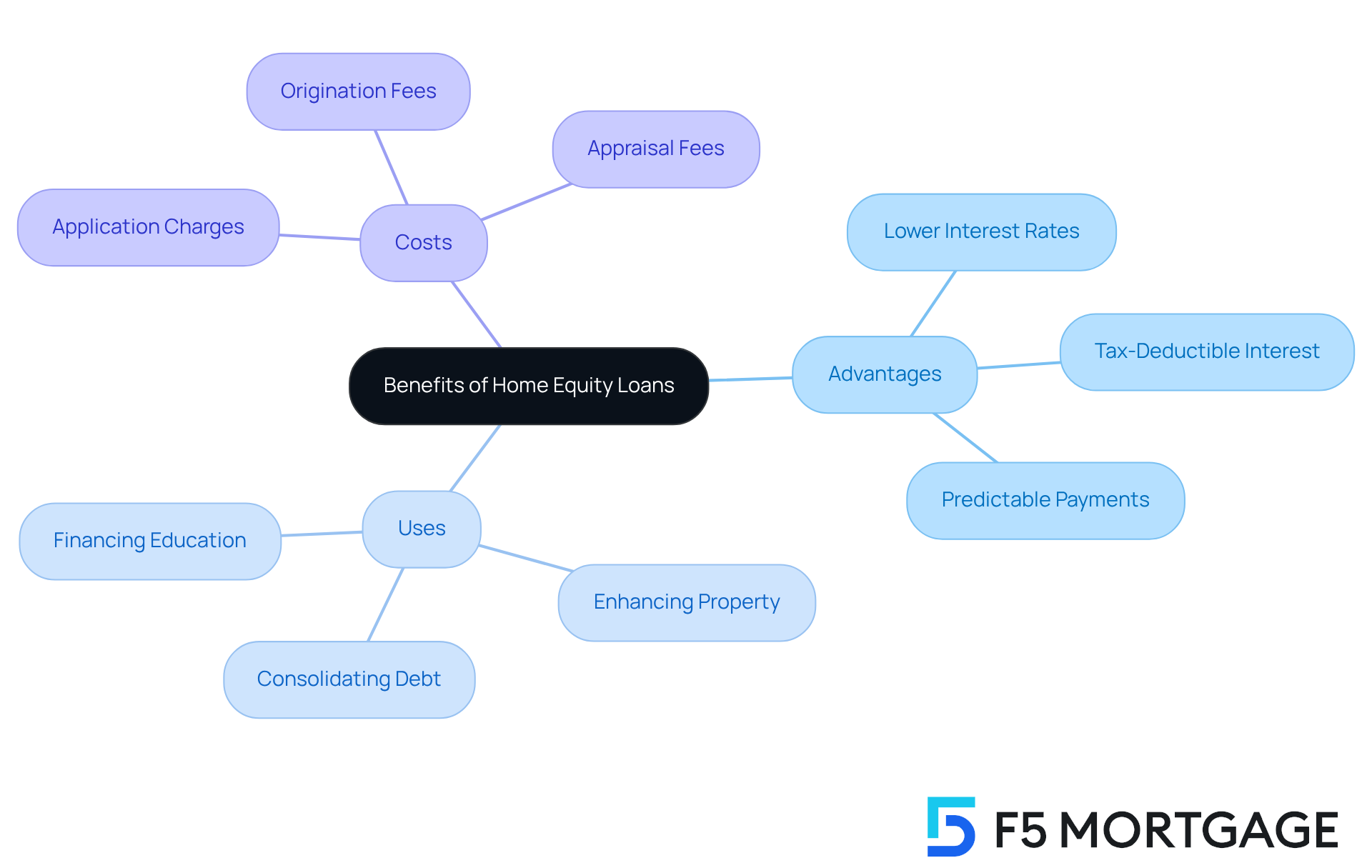

Home value financing, such as equity loans on homes, can be a wonderful option for families, offering benefits like lower interest rates compared to unsecured credit. This makes it a desirable choice for those looking to manage their finances effectively. With predictable monthly payments, homeowners can budget with confidence while accessing significant funds for important expenses.

One of the most appealing aspects is that the interest paid on residential financing may be tax-deductible. This can provide extra financial relief, helping families save more in the long run. Families can use these funds for various purposes, such as:

- Enhancing their property

- Consolidating debt

- Financing education

This flexibility transforms home value financing into a valuable tool that supports both immediate needs and long-term goals.

However, it’s important to note that a minimum ownership stake of 20% is typically required to qualify for equity loans on homes. Even if your home is mortgage-free, you can still withdraw value from it. But, families should also be aware of the risks associated with equity loans on homes, including the potential for foreclosure if repayments aren’t made.

When considering your options, comparing residential asset financing with HELOCs can provide deeper insights into their flexibility. Home value financing often comes with fixed rates, while HELOCs offer variable rates, which can affect your monthly payments.

To make the most of residential property loans, it’s wise to consult with a financial advisor. They can help you explore the best strategies tailored to your unique situation. When evaluating refinancing options, families should compare rates, costs, and terms from various lenders. For instance, F5 Mortgage offers competitive rates and personalized service designed to meet individual needs.

Understanding the costs associated with refinancing is crucial for making informed decisions. These can include:

- Application charges

- Origination fees

- Appraisal fees

In California, refinancing costs typically range from 2% to 5% of the amount borrowed. This can encompass application fees from $75 to $500, origination fees of 0.5% to 1.5% of the borrowed amount, and appraisal fees usually between $300 and $500, depending on your location and property type.

We know how challenging this process can be, but we’re here to support you every step of the way.

Challenges of Home Equity Loans: What to Watch Out For

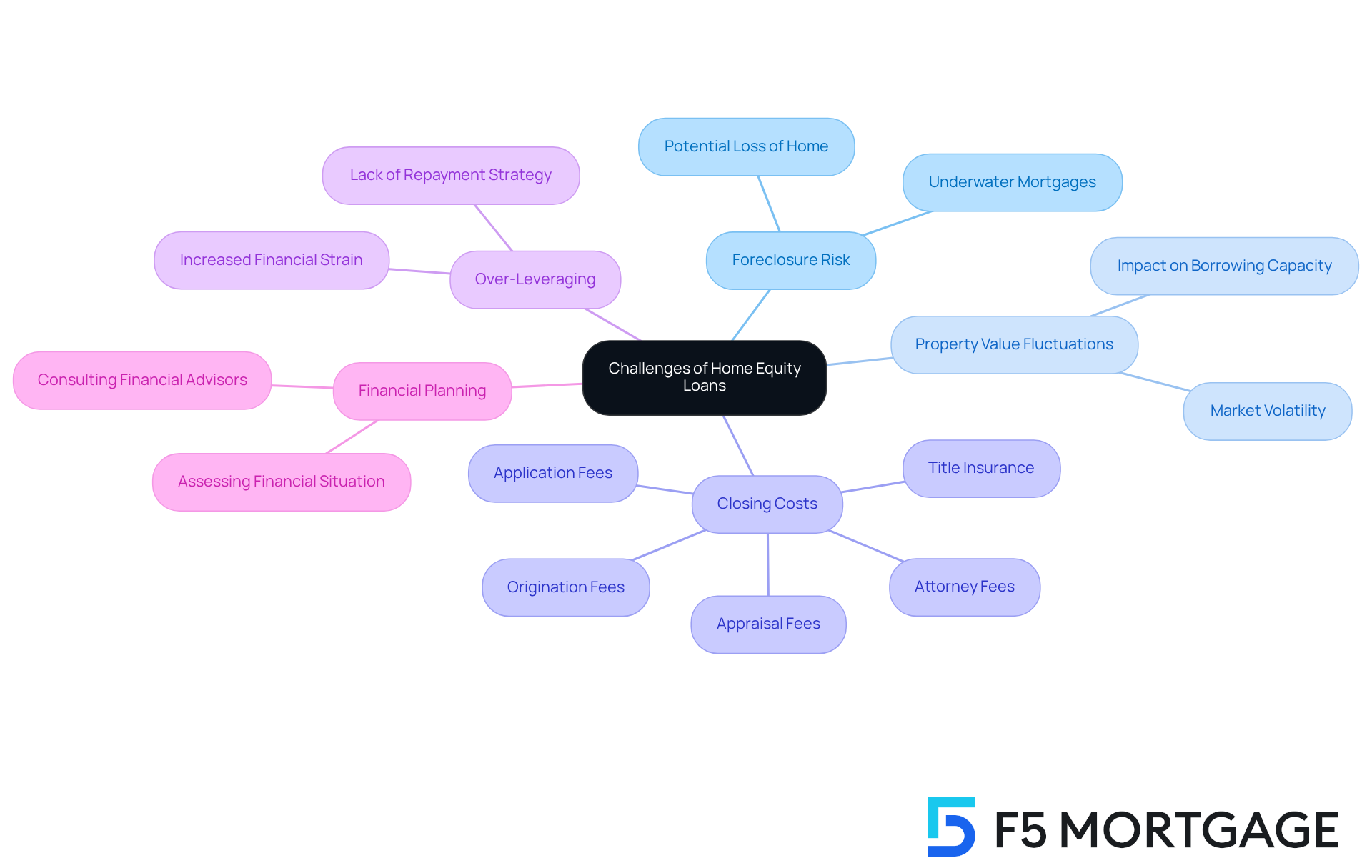

While equity loans on homes can offer significant benefits, they also come with risks that families need to navigate carefully. One major concern is the possibility of foreclosure if borrowers can’t keep up with repayments. This risk becomes even more pronounced when property values fluctuate; a decline in real estate prices can diminish ownership stakes, leaving homeowners with less borrowing capacity than they expected.

To get a clear picture of equity loans on homes, lenders typically order a home appraisal to assess the property’s current market value. This valuation directly impacts mortgage rates and the availability of equity loans on homes.

Families should also be mindful of the closing costs and fees associated with these financial products, as they can significantly increase the total borrowing cost. In California, for instance, the cost of finalizing a mortgage refinance usually falls between 2% and 5% of the borrowed amount. If your new credit amount is $300,000, you might find yourself paying anywhere from $6,000 to $15,000 in closing expenses. This can include:

- Application fees (ranging from $75 to $500)

- Origination fees (between 0.5% and 1.5% of the borrowed amount)

- Appraisal fees (typically between $300 and $500)

- Title search and title insurance (around 0.5% to 1% of the borrowed amount)

- Attorney fees (approximately $500 or more)

Looking ahead to 2025, average closing costs for property financing are expected to be substantial, underscoring the importance of thorough financial planning.

Financial advisor Steve Sexton warns about the dangers of over-leveraging. He points out that using property-backed financing to address cash flow issues can actually increase financial strain if there’s no clear repayment strategy in place. As he puts it, “If you’re hoping it will assist your cash-flow issues, it will probably have the contrary effect if you don’t have an organized strategy to repay the amount.”

The risks of equity loans on homes extend beyond immediate financial concerns. Borrowers may find themselves underwater on their mortgages, meaning they owe more than their property is worth, which can severely limit future financial options. Therefore, it’s crucial for families to carefully assess their financial situations and consult with financial advisors before committing to property-based borrowing.

We know how challenging this can be, and we’re here to support you every step of the way.

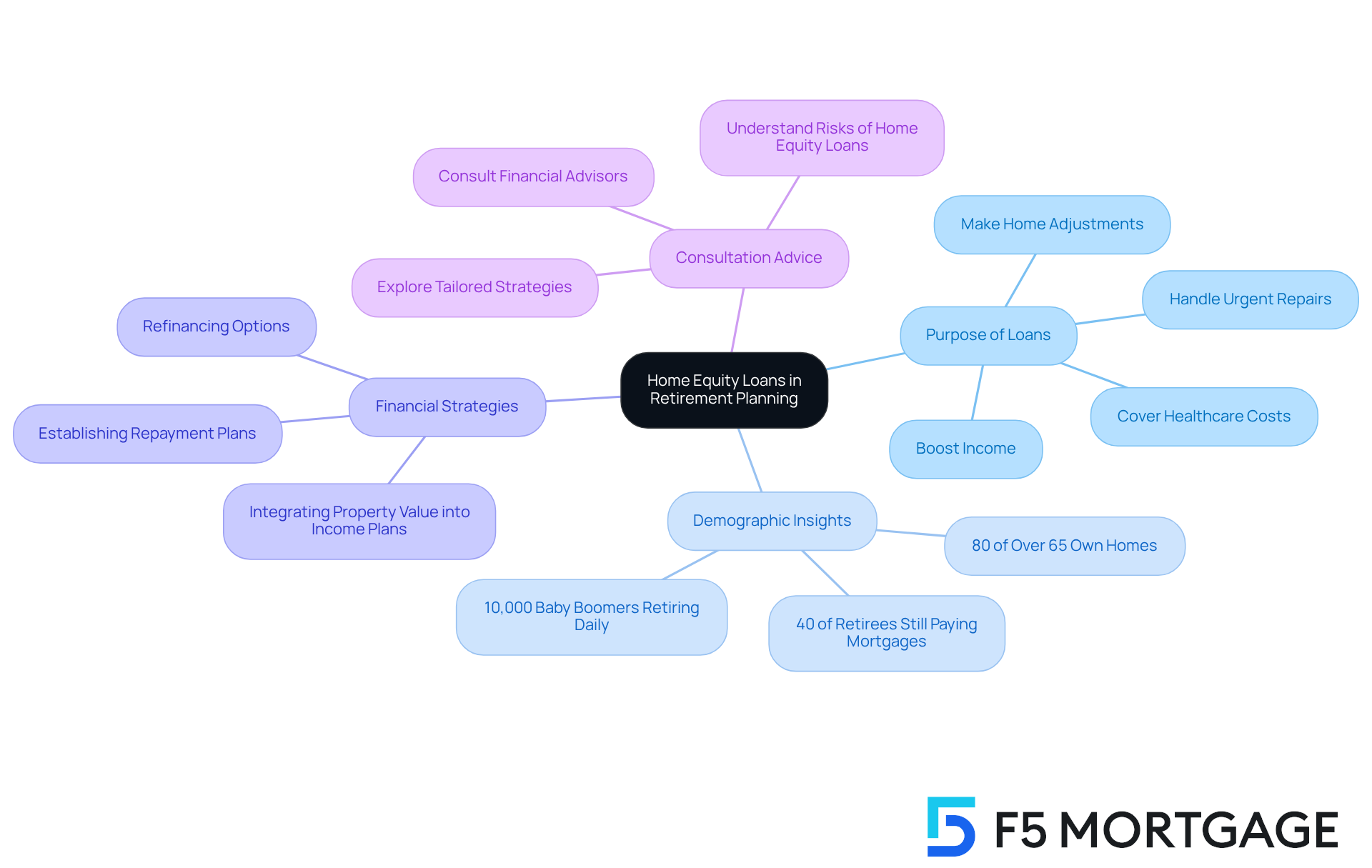

Home Equity Loans and Retirement Income: Planning for the Future

Home equity financing, specifically equity loans on homes, is becoming a vital part of retirement planning. Many retirees are turning to these credits to boost their financial stability, using the funds to increase their income, cover healthcare costs, or make necessary adjustments to their homes for aging in place. For instance, it’s common for retirees to borrow significant amounts—averaging around $50,000—to handle urgent repairs or fund lifestyle enhancements. This way, they can maintain their quality of life without needing to sell their homes.

The flexibility that equity loans on homes provide allows retirees to access cash while still owning their properties, which is particularly beneficial since nearly 80% of people over 65 own their houses. However, it’s crucial for retirees to establish a solid repayment plan to protect their property value and avoid potential pitfalls. As financial planners often remind us, “The benefits of aging in place shouldn’t be overlooked.” This underscores the importance of having a stable living environment during retirement.

Moreover, with over 40% of retirees still making monthly mortgage payments, equity loans on homes can provide a much-needed financial cushion by tapping into their property value. This strategy not only aids in managing everyday expenses but also supports long-term financial goals, allowing retirees to enjoy their golden years with peace of mind. By learning how to effectively integrate property value into their retirement income plans, retirees can navigate their financial futures with greater confidence.

To start planning for the use of their residential assets, retirees should consider refinancing their current mortgages to secure better terms or access the equity in their homes. This process involves replacing their existing mortgage with a new one, potentially leading to lower payments or increased cash flow. Consulting with a financial advisor can help retirees explore their refinancing options and create a personalized strategy that fits their unique financial situation.

Navigating Home Equity Loans: The Role of a Trusted Mortgage Broker

Navigating the home equity financing process can feel overwhelming. We know how challenging this can be, but a reliable mortgage broker like F5 Mortgage is here to support you every step of the way. Brokers offer crucial insights into various loan options, helping families understand eligibility criteria and guiding them through the application process.

With access to a vast network of lenders, brokers can secure competitive rates and favorable terms tailored to your financial goals. This professional support not only simplifies the borrowing experience but also empowers families to make informed decisions. Imagine transforming a potentially daunting process into a seamless journey.

In fact, many families are now turning to brokers for equity loans on homes, recognizing the value of personalized service and expert guidance. If you’re considering this path, reaching out to a mortgage broker could be the first step toward achieving your financial dreams.

Conclusion

Home equity loans have become an essential financial resource for families aiming to tap into their property’s value while managing significant expenses. We understand how challenging this can be, and by grasping the details of these loans, families can make informed choices that align with their financial goals and needs. The role of personalized guidance, like that offered by mortgage brokers such as F5 Mortgage, is crucial; they simplify the process and ensure families feel supported every step of the way.

In this article, we’ve shared key insights about the mechanics of home equity loans, eligibility requirements, and the various types available. The benefits—like lower interest rates and predictable payments—show why many families are turning to equity loans for financing home improvements, education, or debt consolidation. However, it’s important to recognize the potential risks, such as the threat of foreclosure and the impact of fluctuating property values.

As families navigate the complexities of home equity loans, a proactive approach is essential. Engaging with a trusted mortgage broker can provide the expertise needed to evaluate options and develop a tailored strategy. By doing so, families can unlock the financial opportunities that home equity loans present while safeguarding their long-term financial well-being. Taking that first step by reaching out for personalized advice can pave the way for a more secure financial future.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage is an independent mortgage broker that provides personalized home equity loan solutions. They offer consultations tailored to individual financial situations and connect clients with over two dozen leading lenders to provide a diverse range of financing options.

What are home equity loans?

Home equity loans, often referred to as second mortgages, allow homeowners to borrow against the value of their property. The loan amount is determined by the difference between the home’s market value and the remaining mortgage balance.

How much can homeowners typically borrow through home equity loans?

In 2025, homeowners can typically secure financing amounts ranging from five to six figures through home equity loans, depending on the amount of equity they have in their property.

What are the benefits of using home equity loans?

Home equity loans generally have lower interest rates compared to personal loans or credit cards, making them a cost-effective option for covering significant expenses, such as renovations, education costs, or debt consolidation. They provide a lump sum that can be paid back over a set period with stable monthly payments.

What are the typical costs associated with refinancing a mortgage in California?

The fees for finalizing a mortgage refinance in California usually range from 2% to 5% of the amount borrowed. For example, refinancing a $300,000 mortgage may incur closing costs between $6,000 and $15,000.

What is the importance of understanding the break-even point in refinancing?

Understanding the break-even point helps families calculate how long it will take to recover refinancing costs by estimating monthly savings and dividing the costs by those savings. This evaluation is crucial for making informed financial decisions.

What risks should homeowners be aware of when using home equity loans?

Homeowners should be aware of the risk of foreclosure if they miss payments on their home equity loans. It’s important to understand the terms and conditions of the loan to avoid potential financial pitfalls.

How much of a property’s value do lenders typically prefer to keep untouched?

Lenders usually prefer to keep 20% of a property’s value as a safety net against defaults, which can affect the amount of capital homeowners can access through equity loans.

What is the current market trend regarding property value loss?

On average, property owners have experienced a value loss of around $9,200 each year, highlighting the importance of understanding one’s financial situation when considering property improvements and financing options.