Overview

This article highlights the benefits of no-cost refinancing, a solution that can ease your financial burdens and improve your family’s overall financial health. We understand how challenging managing expenses can be, and this option may help you secure lower interest rates and adjust your mortgage terms without any immediate costs.

Imagine being able to redirect those funds toward essential expenses, ultimately enhancing your family’s economic stability. By considering no-cost refinancing, you can take a significant step towards financial relief. We’re here to support you every step of the way, guiding you through this process with care and understanding.

In summary, no-cost refinancing not only helps you save money but also empowers you to make informed financial decisions that benefit your family in the long run. If you’re ready to explore this opportunity, we encourage you to take action and reach out for more information.

Introduction

No-cost refinancing has emerged as a powerful financial strategy for families seeking relief from the pressures of mortgage payments. We understand how challenging this can be. By eliminating upfront costs, homeowners can restructure their loans without the burden of immediate expenses. This allows them to redirect funds toward essential needs and long-term savings.

However, as enticing as this option may seem, it raises important questions about the potential long-term implications.

- Does it truly align with your individual financial goals?

- What are the hidden costs of no-cost refinancing?

We’re here to support you every step of the way in ensuring you are making the best choice for your financial future.

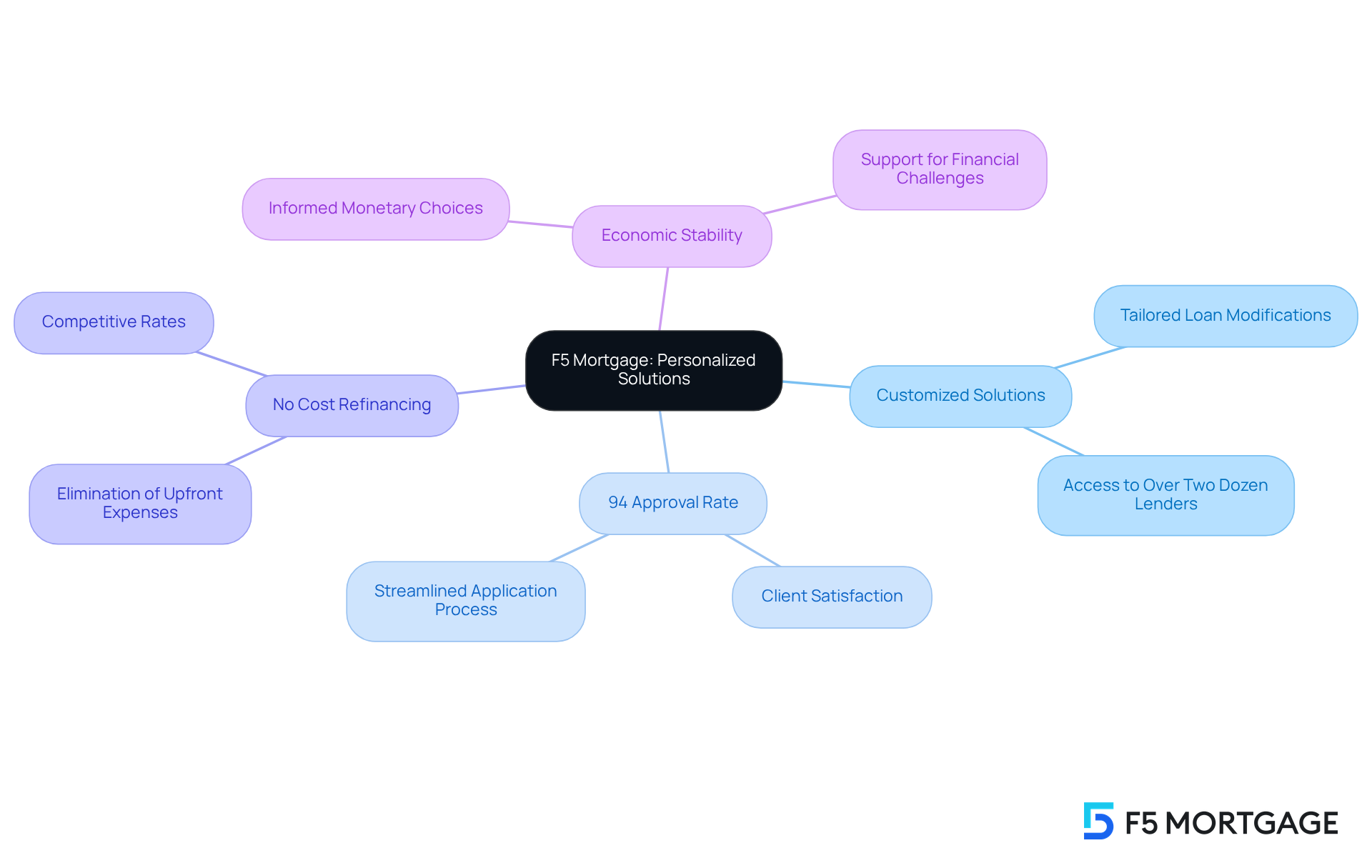

F5 Mortgage: Personalized Solutions for No Cost Refinancing

At F5 Mortgage, we understand how challenging financial circumstances can be for families. That’s why we excel in providing customized loan modification solutions tailored to your unique situation. By leveraging a robust network of over two dozen lenders, we ensure that you receive options that truly meet your needs.

Our client-focused approach simplifies the loan modification process, leading to an impressive 94% approval level. We’re here to support you every step of the way, offering no cost refinance options for loan restructuring that eliminate upfront expenses. This means you can access competitive rates, allowing you to save money while restructuring your finances.

These customized solutions empower households to make informed monetary choices, ultimately enhancing your overall economic stability. As one mortgage broker beautifully stated, ‘Customized loan options not only alleviate financial burdens but also provide families with the flexibility they need to thrive.’ Let us help you navigate this journey with compassion and expertise.

What is No Cost Refinancing?

No-cost loan restructuring is a mortgage choice that allows borrowers to avoid upfront closing costs, which can often range from 2% to 6% of the loan amount. Instead of paying these costs out of pocket, they are typically rolled into the loan balance or offset by a slightly higher interest rate. This option is especially helpful for homeowners who want to reduce immediate expenses while still securing favorable loan terms.

We understand how overwhelming financial decisions can be. Financial specialists highlight that this choice can be particularly advantageous for those anticipating future interest rate decreases. It provides the flexibility to restructure again without incurring significant initial costs. For instance, homeowners with existing loans above 7% may find restructuring appealing, especially with current rates between 6.62% and 6.85%.

Consider the stories of homeowners who have successfully managed their finances using no cost refinance. By avoiding initial expenses, they can allocate funds toward home repairs or paying off higher-interest debts, ultimately improving their financial situation. This strategy is also beneficial for clients who do not plan to stay in their homes long-term, allowing them to avoid immediate financial strain while enjoying lower monthly payments.

In today’s market, where 82.8% of homeowners with mortgages hold rates below 6%, the popularity of the no-cost refinance option is increasing. This statistic underscores the favorable conditions that make loan restructuring appealing, enabling homeowners to take advantage of these trends without the burden of upfront payments. It’s a compelling choice for many families seeking financial relief.

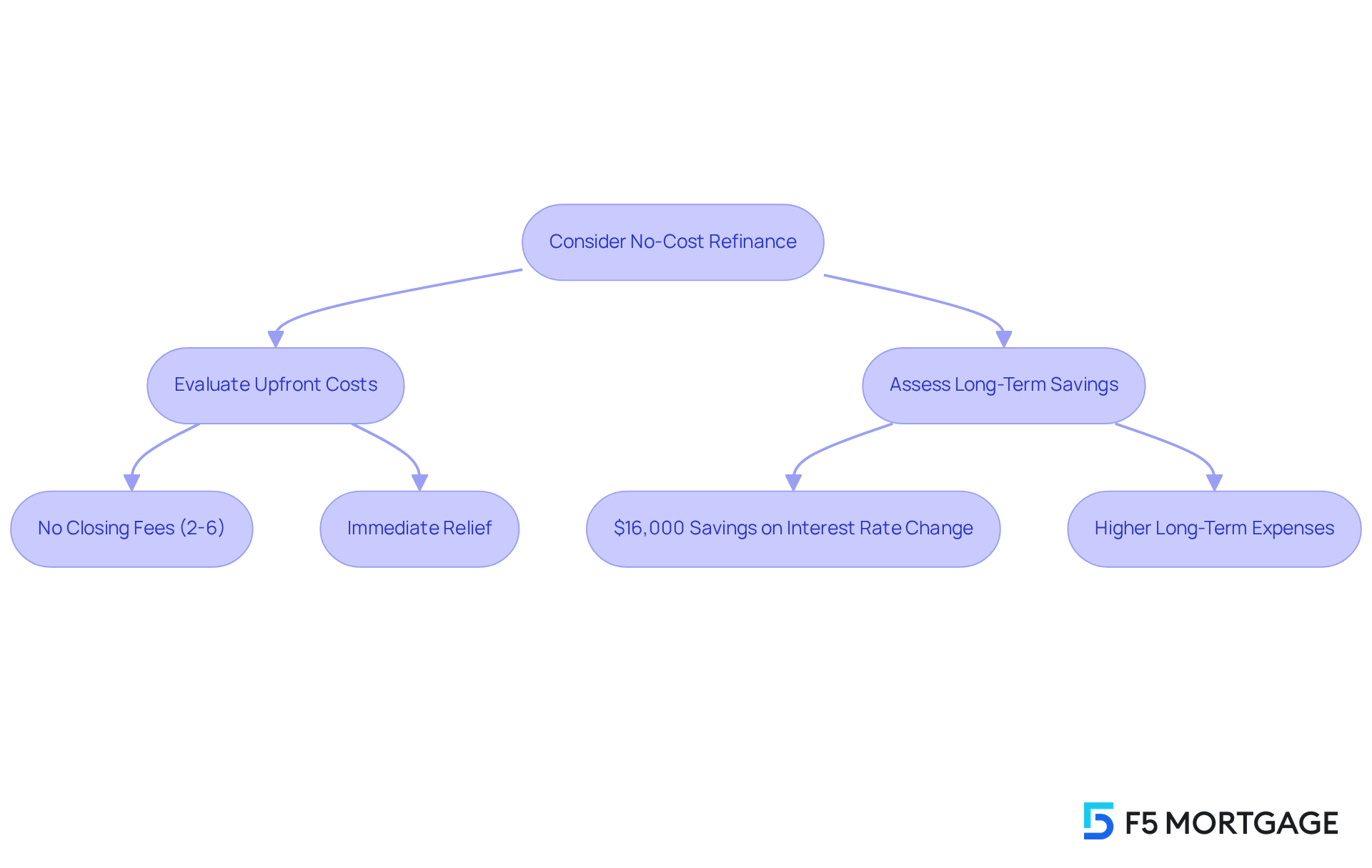

Save on Upfront Costs with No Closing Fees

No-cost refinance provides a significant advantage by eliminating upfront closing fees, which can typically range from 2% to 6% of the loan amount. We understand how challenging it can be to manage these costs. This accessibility enables households to pursue a no cost refinance of their mortgages without the burden of immediate expenses, making it an appealing choice for those with limited savings. By avoiding these fees, families can redirect their funds toward essential expenses, such as home improvements, education, or emergency savings.

For instance, households that choose zero-cost loan restructuring can save almost $16,000 throughout the duration of a loan when transitioning from a 7% to a 5% interest rate. This substantial saving is particularly beneficial for those planning to sell their homes within a few years, as it allows them to invest in their future without the upfront financial strain. Financial advisors frequently emphasize the advantages of a no cost refinance, highlighting that this method not only simplifies the process of obtaining new loans but also aids households in managing their finances more efficiently. As Lindsay VanSomeren states, “For many people, one of the biggest obstacles is the closing costs, which can run several thousands of dollars.”

It’s important to note that while no cost refinance can provide immediate relief, it may lead to higher long-term expenses due to increased interest rates. By opting for a no cost refinance, households can focus on their long-term financial objectives while enjoying the immediate relief of reduced upfront expenses. To maximize benefits, we encourage families to compare several quotes from lenders to ensure they are making the most informed decision. We’re here to support you every step of the way.

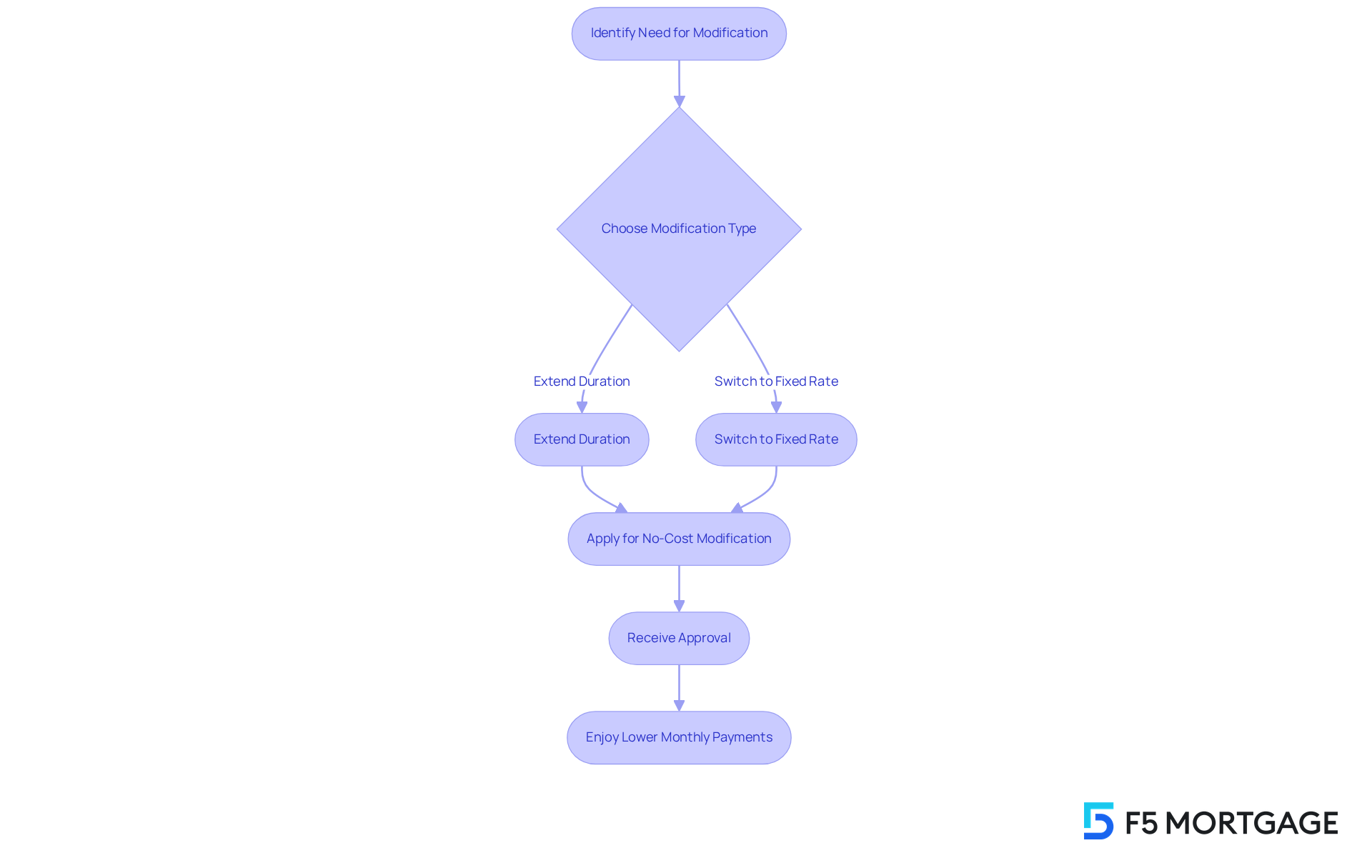

Adjust Your Mortgage Terms Without Extra Charges

No-cost loan modification empowers homeowners to adjust their mortgage terms—such as extending the loan duration or transitioning from an adjustable-rate to a fixed-rate mortgage—without incurring additional fees. We know how challenging managing a mortgage can be, and this flexibility is particularly beneficial for households seeking to lower their monthly payments or customize their mortgage to suit their changing financial situations. For instance, numerous families have successfully reduced their monthly payments through no-cost loan restructuring, enabling them to direct resources towards other necessary expenses or savings.

Recent trends indicate a significant rise in rate-and-term refinancing, with a month-over-month increase of 17.4% and a year-over-year increase of 18.4%. This surge reflects a growing awareness among homeowners of the benefits of a no cost refinance to adjust their mortgage terms without incurring extra charges. Financial planners highlight that such flexibility can lead to substantial savings, allowing households to manage their budgets more effectively. As financial planner Mike Vough notes, “As market conditions evolve and affordability challenges persist, non-QM lending offers a path for qualifying creditworthy borrowers who may not meet qualified mortgage guidelines.”

The Federal Housing Finance Agency announced new conforming loan limits for 2025, established at $806,500, which creates even greater opportunities for households to engage in a no cost refinance. This change in the market highlights the significance of proactive refinancing, such as no cost refinance options, which can secure lower costs and protect against future increases, ensuring long-term stability in mortgage payments. For example, a household that refinanced their mortgage to benefit from decreased costs was able to lower their monthly payment by over $200, allowing for funds to be allocated for education savings. By utilizing these options, families can improve their financial well-being and reach their homeownership objectives. We’re here to support you every step of the way.

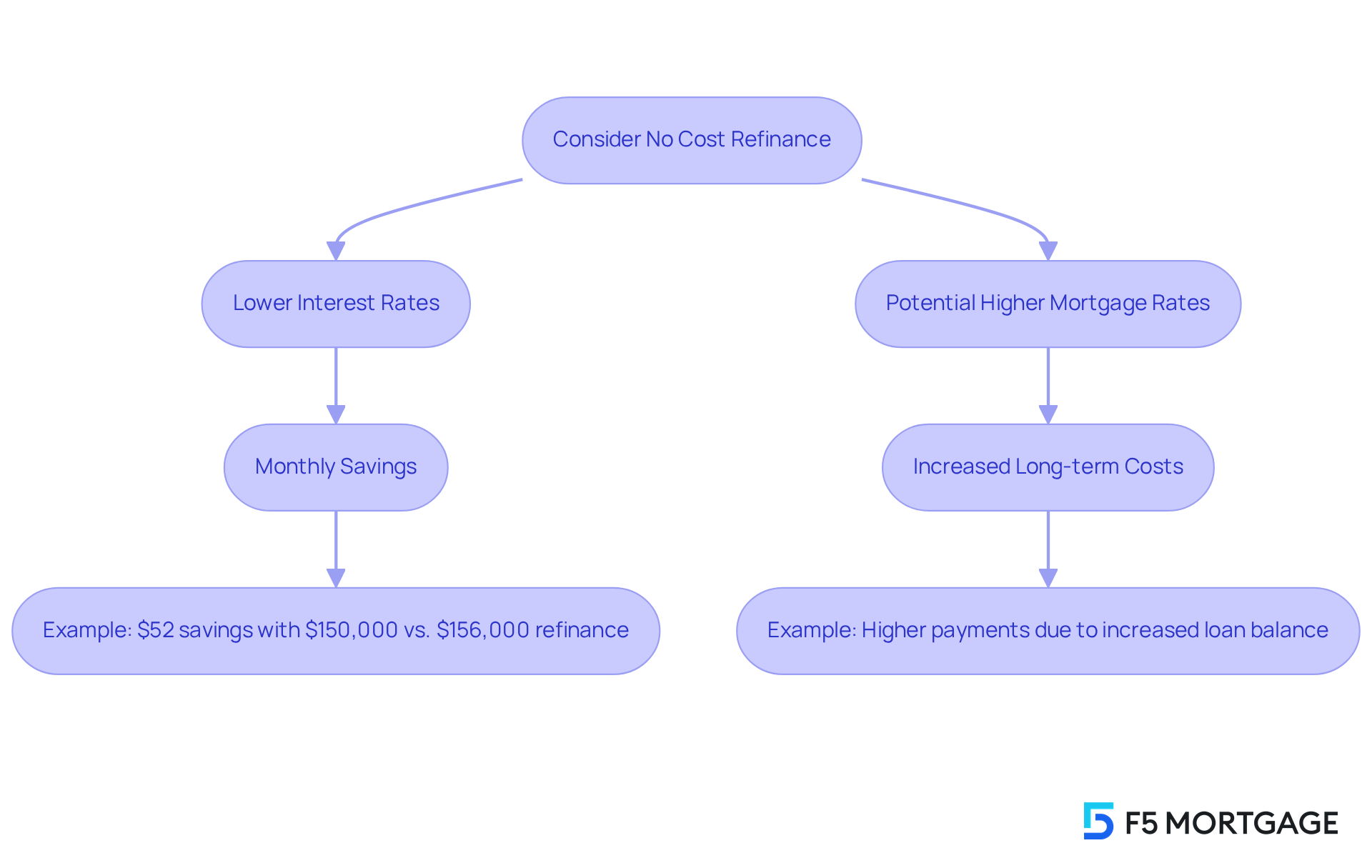

Access Lower Interest Rates with No Cost Options

No cost refinance can be a lifeline for homeowners, enabling them to secure lower interest rates compared to their current mortgages. This can lead to substantial long-term savings that ease financial burdens. For instance, a modest 1% reduction in interest rates can significantly lower monthly payments, freeing up resources for other essential expenses.

In 2025, as mortgage costs fluctuate, many families have successfully taken advantage of these favorable conditions, realizing impressive savings. We understand how even small changes in financial obligations can provide meaningful relief, especially for households striving to enhance their financial security.

However, it’s crucial to be aware that opting for a no cost refinance might result in a higher mortgage rate, which could increase long-term costs. Real-world examples highlight how families have benefited from restructuring their loans, with some reporting monthly savings of hundreds of dollars. For instance, the difference in monthly payments between a $150,000 refinance and a $156,000 refinance is approximately $52.

This strategy not only alleviates immediate financial pressures but also positions families for a more secure financial future. With a remarkable customer satisfaction level of 94% at F5 Mortgage, you can feel confident that you are making informed decisions throughout your loan adjustment journey. We’re here to support you every step of the way.

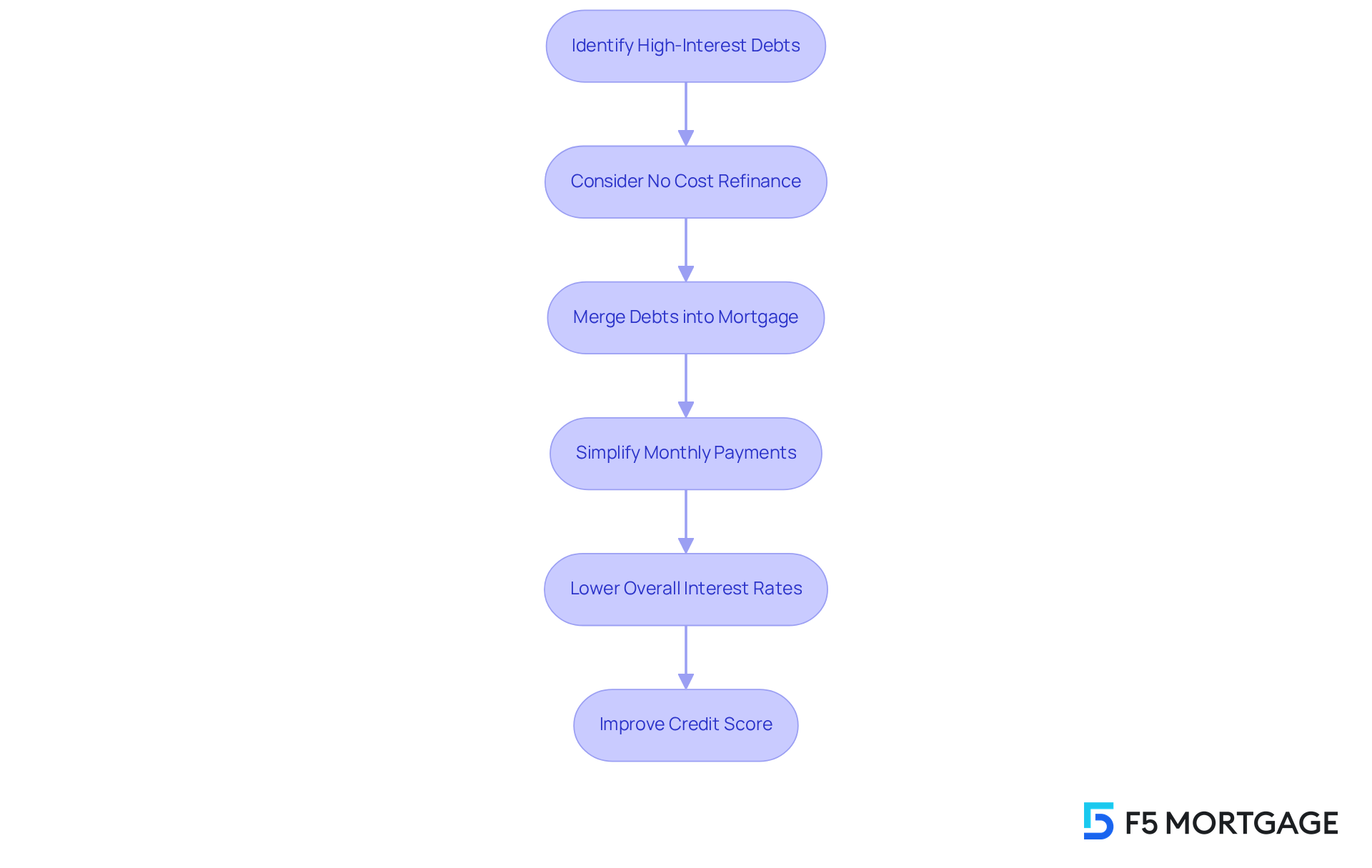

Consolidate Debt and Simplify Payments

No cost refinance can be a powerful ally for families looking to consolidate their debts. By merging high-interest obligations, like credit card balances, into a mortgage, homeowners can simplify their financial lives. Imagine streamlining your monthly payments and potentially lowering your overall interest rates. This approach makes managing finances not just easier, but also more achievable.

Many families have successfully reduced their monthly obligations by $1,000, $2,000, or even $3,000 through this method. With average credit card interest rates hovering around 20%, switching to a mortgage rate that is typically much lower can lead to significant savings. Mortgage specialists emphasize that restructuring loans can simplify finances, transforming multiple high-interest accounts into one manageable payment.

This strategy not only alleviates economic stress but can also improve credit scores over time as debts are paid down more effectively. By taking advantage of no cost refinance options, homeowners can regain control over their financial situations and work towards a more stable future.

With Americans’ total credit card debt reaching a staggering $1.166 trillion, the need for effective debt consolidation strategies is more pressing than ever. The new 90% cash-out refinance product allows homeowners to tap into additional equity, enhancing their ability to consolidate high-interest debts.

Additionally, it’s wise to consider potential tax advantages tied to loan restructuring, making this option even more attractive. Remember, it’s important to shop around for lenders to secure the best possible terms and rates. We know how challenging this can be, and we’re here to support you every step of the way.

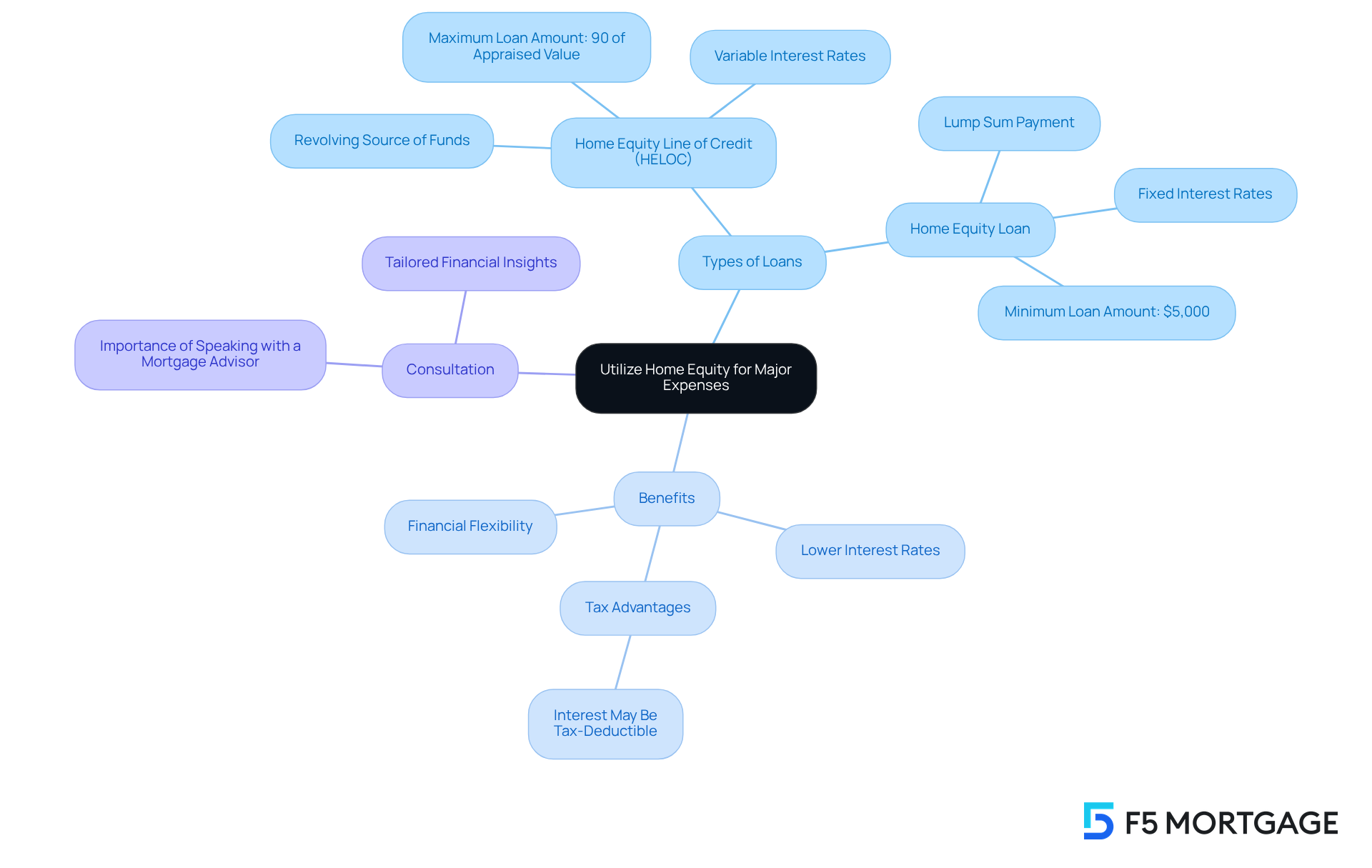

Utilize Home Equity for Major Expenses

Homeowners, we understand how challenging it can be to manage significant expenses like home renovations, education, or medical bills. One effective way to ease this burden is by strategically leveraging your home equity through a no cost refinance. This approach allows you to access essential funds without the immediate concern of closing costs, making it a financially savvy choice for your family.

Many families have successfully funded their renovations or educational pursuits by tapping into their home equity. With Home Equity Lines of Credit (HELOCs), you can borrow up to 90% of your home’s appraised value. Financial advisors often recommend this strategy, highlighting that home equity loans typically offer lower interest rates compared to personal loans. This can make a significant difference when managing large expenses.

As DFCU Financial mentions, “A HELOC or HEFT can be your key to unlocking your home’s hidden wealth and constructing a robust economic future.” Additionally, utilizing home equity loans may provide tax advantages, as the interest on these loans can often be tax-deductible. By using no cost refinance, you can unlock your home’s potential while maintaining financial flexibility.

To explore these options further, we encourage you to consult with a mortgage advisor. They can provide tailored insights and assist you in making informed decisions that support your family’s financial well-being. We’re here to support you every step of the way.

Enhance Cash Flow with No Cost Refinancing

No-cost refinance offers households a strategic way to enhance their cash flow by eliminating upfront expenses and potentially lowering monthly payments. This newfound financial flexibility allows families to redirect funds toward savings, investments, or essential expenses, ultimately fostering improved financial health. For instance, homeowners transitioning from higher interest rates can see significant reductions in their monthly payments, with typical savings estimated at around $300 to $400 each month. This is especially true for those moving from rates exceeding 7% to current averages between 6.62% and 6.85%.

Additionally, families can benefit from cash-out mortgage options. These options enable them to consolidate high-interest debts, such as credit cards, into their home loan. Approximately 5 million borrowers accessed a total of $430 billion in home equity through mortgage restructuring, highlighting the considerable advantages of this choice. Not only does this simplify monthly payments, but it also reduces overall interest expenses, contributing to greater economic stability. Experts emphasize that restructuring should be approached with a clear financial plan, focusing on benefits like eliminating private mortgage insurance (PMI) or consolidating debt. For example, a case study reveals that removing PMI via a loan modification can yield monthly savings of up to $150, allowing households to allocate additional funds toward their financial goals.

As mortgage strategist Nicole Rueth wisely notes, “Refinancing should improve your overall finances, and that rate is just one of the numbers to consider.” By making informed choices and weighing potential drawbacks, such as loan modification costs, families can leverage restructuring to enhance their cash flow and achieve greater economic flexibility. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

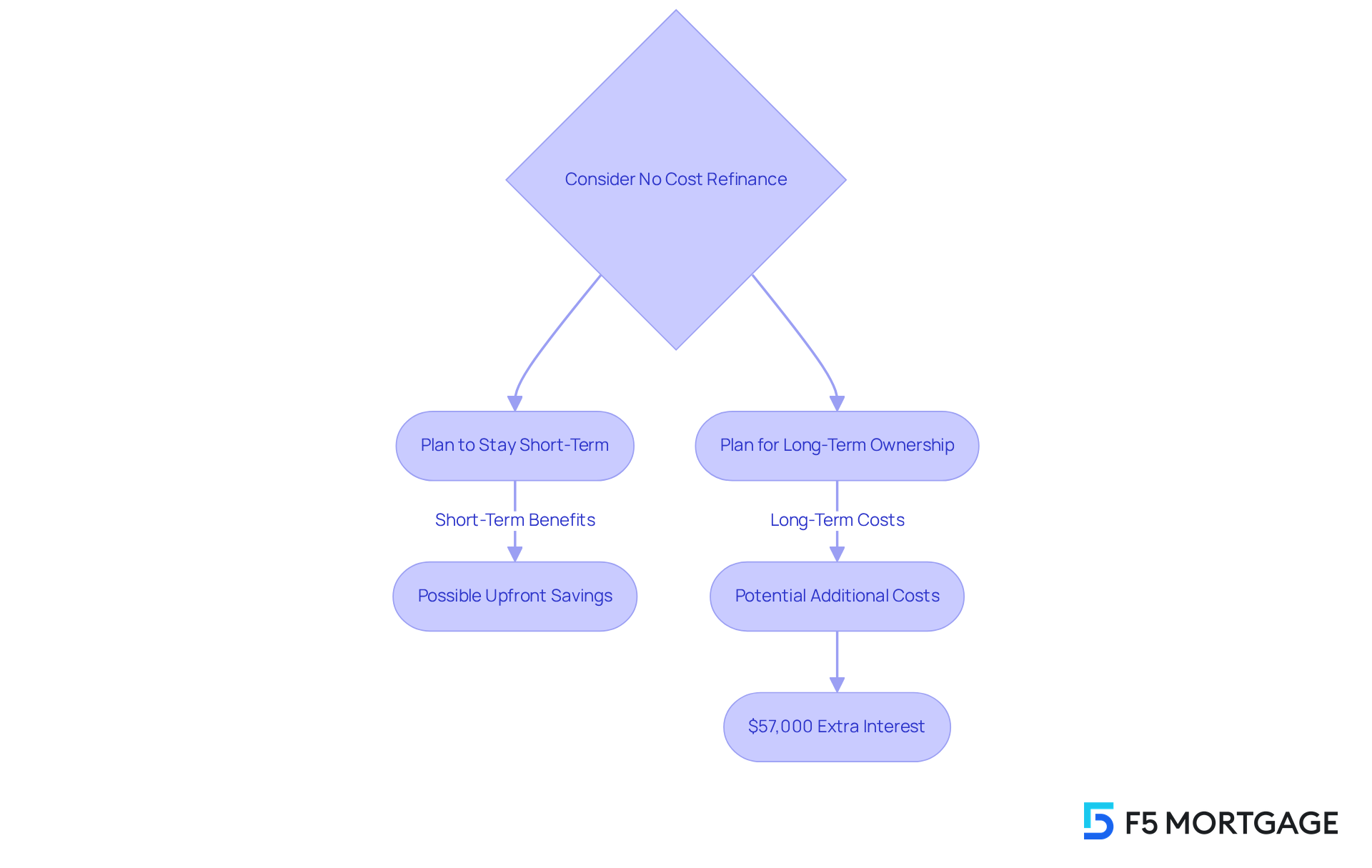

Evaluate Long-Term Financial Benefits

While no cost refinance may seem appealing with its immediate benefits, it’s essential for households to carefully consider the long-term financial implications. We understand how overwhelming this decision can be. An elevated interest charge can significantly increase the total interest paid over the life of the loan. For example, selecting a no cost refinance might save you some upfront costs, but it could result in paying thousands more in interest over time—potentially an additional $57,000 over 30 years.

Financial advisors often suggest that families reflect on their homeownership strategies. If you plan to stay in your home for a short period, those immediate savings might be beneficial. However, long-term property owners may find that the higher costs outweigh the initial advantages. It’s crucial to weigh your options carefully.

Moreover, we encourage households to explore negotiating mortgage rates and comparing offers from various lenders. This proactive approach can help ensure that you make informed decisions that align with your overall financial strategy. Remember, we’re here to support you every step of the way as you navigate this important process.

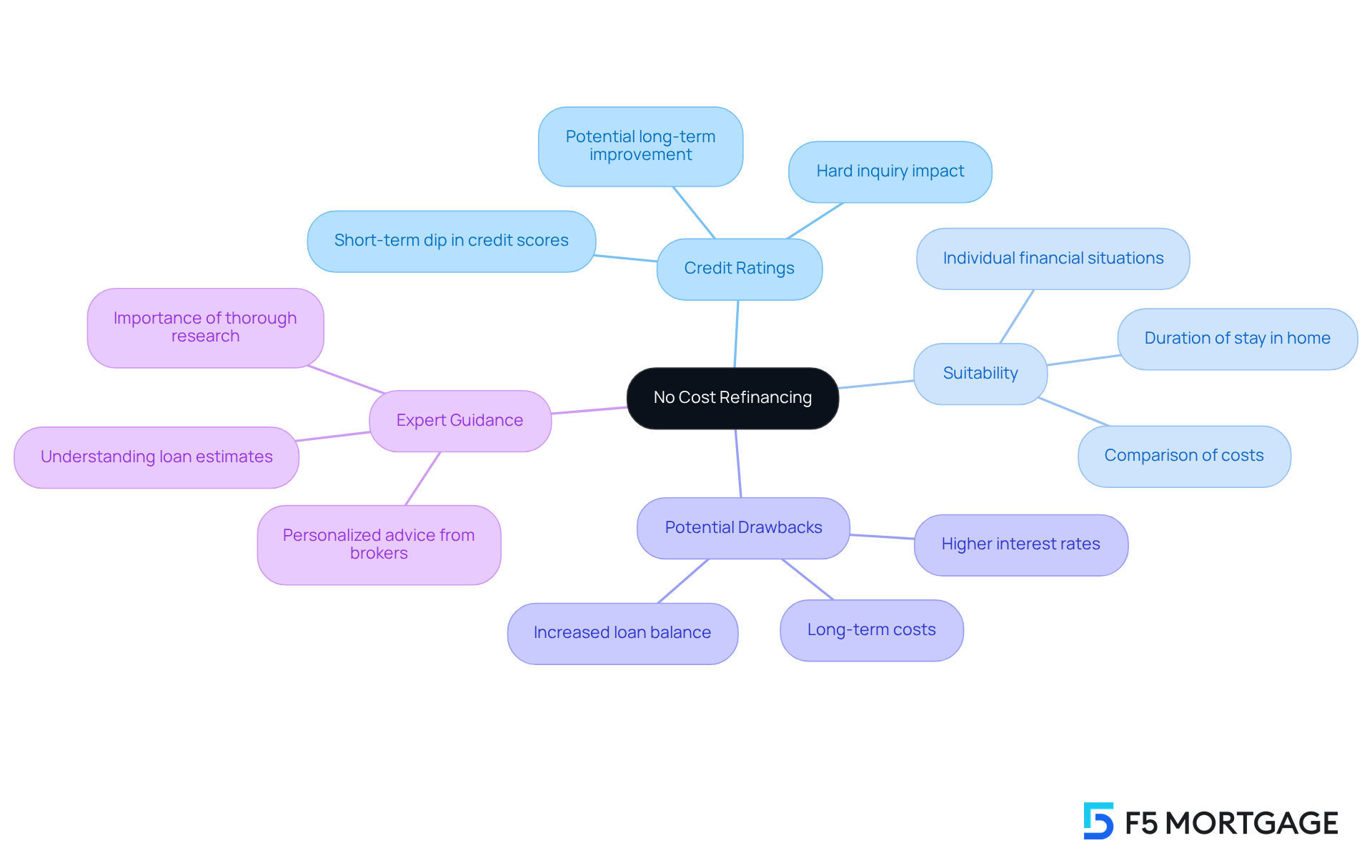

Address Common Questions About No Cost Refinancing

Property owners often find themselves with urgent questions about no cost refinance options for their loans. They are especially concerned about how these adjustments might affect their credit ratings, whether they are suitable for their specific situations, and what potential drawbacks exist. Understanding these factors is crucial for families who want to make informed decisions. For instance, while a no cost refinance can provide immediate relief from upfront fees, it frequently results in higher interest rates, which can affect long-term financial health. Mortgage brokers, like those at F5 Mortgage, underscore the importance of assessing individual circumstances before moving forward. They provide personalized guidance, helping clients navigate the complex landscape of financial options.

Talking with a knowledgeable mortgage broker can shed light on how restructuring a loan might influence credit scores. Typically, restructuring loans can lead to a short-term dip in credit scores due to the hard inquiry and the creation of a new credit account. However, if managed responsibly, the new loan can ultimately enhance credit scores over time. For families considering this option, it’s essential to weigh the benefits against potential risks, ensuring that the decision aligns with their long-term financial goals.

There are numerous examples of families who have successfully sought guidance from mortgage brokers regarding no cost refinance. These consultations often reveal that while no cost refinance options may seem attractive, they might not be suitable for everyone. As one mortgage broker pointed out, ‘If you can improve your financial situation through restructuring and wish to avoid the risk of rates continuing to drop, consider seeking a loan today.’ This highlights the necessity of thorough research and personalized guidance when making financial choices. Additionally, it’s important to remember that only 1.2 million homeowners in the U.S. qualify for a better interest rate through refinancing, emphasizing the need for expert advice in a competitive market.

Conclusion

No-cost refinancing offers a wonderful opportunity for families striving to enhance their financial situation without the worry of upfront costs. By removing closing fees and granting access to lower interest rates, this option enables homeowners to make thoughtful financial choices that can lead to lasting savings and improved economic stability.

Throughout this article, we’ve highlighted the key benefits of no-cost refinancing. Families can:

- Save on upfront costs

- Adjust mortgage terms without incurring additional charges

- Effectively consolidate debt

Moreover, families can tap into their home equity for significant expenses, ultimately boosting their cash flow and providing greater financial flexibility. We understand how challenging these decisions can be, so the importance of informed decision-making and personalized guidance from mortgage experts cannot be overstated. This support helps families navigate the complexities of refinancing with confidence.

In summary, no-cost refinancing is not merely a financial tool; it is a strategic approach that can yield substantial benefits for homeowners. By assessing individual circumstances and grasping the long-term implications, families can take charge of their financial futures. Engaging with knowledgeable mortgage advisors can further enrich this journey, empowering families to make choices that resonate with their unique goals and aspirations. Embracing no-cost refinancing could be the key to unlocking a more secure and prosperous financial path.

Frequently Asked Questions

What is F5 Mortgage’s approach to refinancing?

F5 Mortgage specializes in providing personalized loan modification solutions tailored to individual financial situations, leveraging a network of over two dozen lenders to ensure clients receive options that meet their unique needs.

What does “no cost refinancing” mean?

No-cost refinancing allows borrowers to avoid upfront closing costs, which usually range from 2% to 6% of the loan amount. Instead, these costs are typically rolled into the loan balance or offset by a slightly higher interest rate, making it an appealing option for those looking to reduce immediate expenses.

Who can benefit from no-cost refinancing?

Homeowners anticipating future interest rate decreases, those with existing loans above 7%, and clients who do not plan to stay in their homes long-term can benefit from no-cost refinancing, as it allows them to restructure their loans without incurring significant initial costs.

How can no-cost refinancing help with financial management?

By avoiding initial expenses, homeowners can allocate funds toward home repairs or paying off higher-interest debts, ultimately improving their financial situation. This strategy is particularly useful for families with limited savings.

What are the potential savings from no-cost refinancing?

Households can save nearly $16,000 over the duration of a loan when transitioning from a 7% to a 5% interest rate by opting for no-cost refinancing, which is especially beneficial for those planning to sell their homes within a few years.

What should borrowers consider when opting for no-cost refinancing?

While no-cost refinancing provides immediate relief from upfront expenses, it may lead to higher long-term costs due to increased interest rates. Borrowers are encouraged to compare quotes from multiple lenders to make informed decisions.

Why is no-cost refinancing becoming more popular?

With 82.8% of homeowners holding mortgage rates below 6%, the favorable market conditions are making no-cost refinancing an appealing choice for many families seeking financial relief without the burden of upfront payments.