Overview

Securing your mortgage loan approval today can feel overwhelming, but understanding the mortgage process is the first step. We know how challenging this can be, and we’re here to support you every step of the way. Begin by assessing your financial readiness and gathering the required documentation. Once you have everything in place, you can submit your application with confidence.

It’s crucial to comprehend the lender’s decision-making criteria. This knowledge will empower you and help you navigate the process more effectively. The article outlines these steps in detail, emphasizing the importance of pre-approval. This not only enhances your negotiating position but also streamlines the home-buying process, which is essential in a competitive market. Remember, taking these steps can make a significant difference in your journey toward homeownership.

Introduction

Navigating the mortgage loan approval process can often feel daunting, especially for first-time homebuyers. We understand how challenging this can be. However, by grasping the essential steps and requirements, you can simplify this journey and feel empowered to make informed decisions. This guide outlines the key actions necessary to secure mortgage approval, from assessing your financial readiness to submitting a well-prepared application.

But what if your application is denied? How can you stand out in a competitive market? Exploring these questions can provide valuable insights and support you in achieving a successful mortgage approval. We’re here to guide you every step of the way.

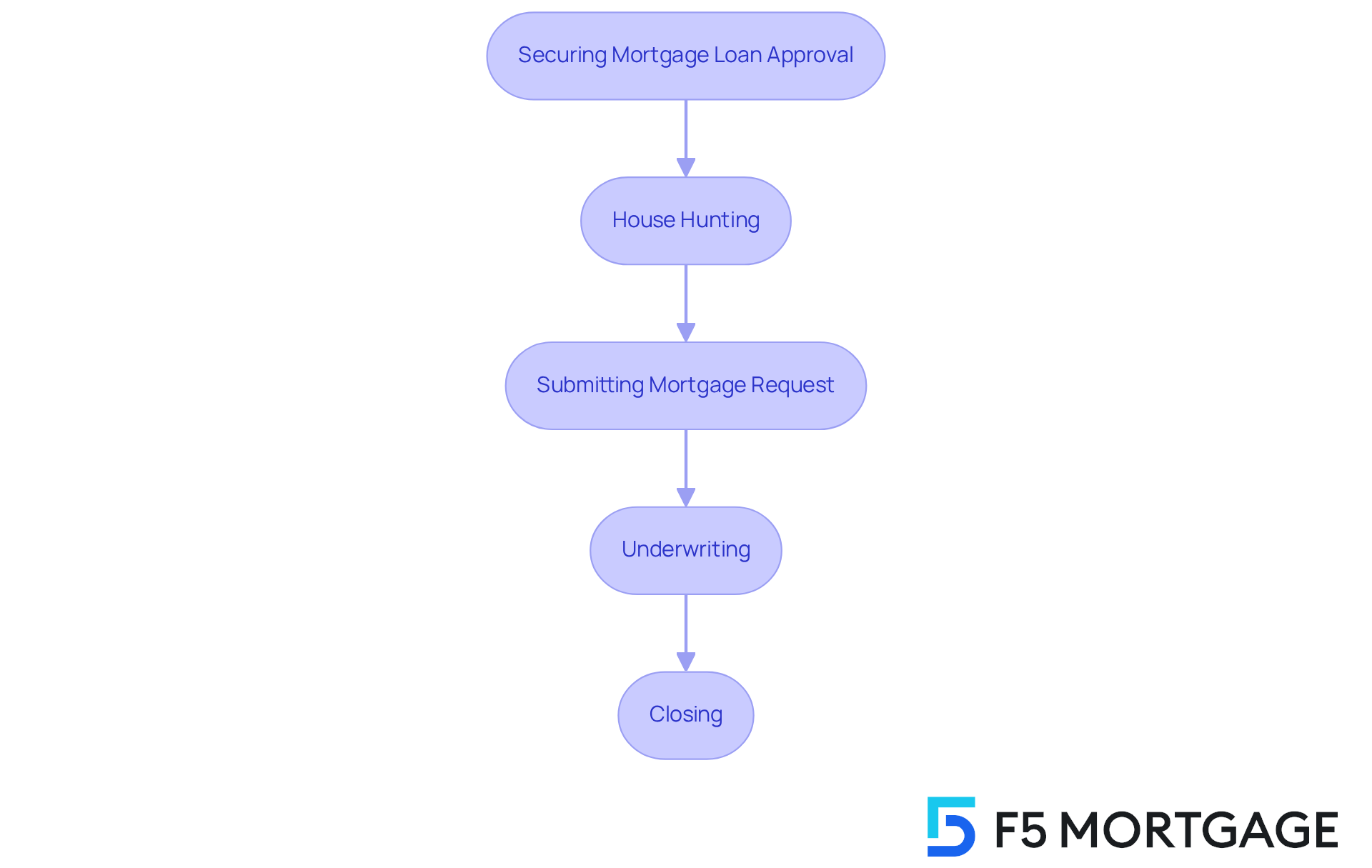

Understand the Mortgage Process

Navigating the loan process can feel overwhelming, but breaking it down into clear steps can make it more manageable. We know how challenging this can be, so here’s a streamlined overview to guide you through:

- is a crucial first step before house hunting. This process involves a lender assessing your , including credit history, income, and debts, to determine the maximum loan amount you qualify for. In a competitive market, being pre-approved not only informs you of your budget but also increases your appeal to sellers, who favor buyers showing . Sellers often consider offers only from to avoid last-minute financing issues. Mortgage loan approval signifies that, based on your financial information, you are a suitable candidate for a mortgage, giving you an estimate of your loan amount, interest rate, and potential monthly payment. Some financial institutions may refer to this as ‘prequalification’ or ‘preapproval.’

- House Hunting: Armed with your pre-approval, you can confidently search for homes that fit your budget. This clarity allows you to focus on properties that meet your financial needs, preventing you from falling in love with homes beyond your means.

- Once you find an appropriate home, you’ll submit a formal request for mortgage loan approval to your financial institution. This step is vital as it initiates the underwriting process.

- Underwriting: During this evaluation process, the lender will thoroughly assess your submission, verifying your financial information and the property’s value. This step is essential for ensuring that the loan aligns with lending guidelines. ensures compliance and enhances your chances of success.

- Closing: If your mortgage loan approval is successful, you’ll finalize the loan and complete the purchase of your home. This stage typically involves signing documents and settling any closing costs.

Comprehending these steps is crucial for a seamless financing experience. Notably, pre-approved buyers can act quickly when they find a home, which is particularly advantageous in today’s seller’s market characterized by low inventory. In fact, approximately 79.6% of loans issued recently were to super-prime borrowers, highlighting the . By securing pre-approval, you not only streamline your but also position yourself favorably in negotiations, making your offer stand out in a competitive landscape. As the Federal Reserve Bank of New York states, ‘Pre-approved buyers are seen as serious and , which can significantly enhance their negotiating position.’ We’re here to support you every step of the way—consider for to further assist your home-buying journey.

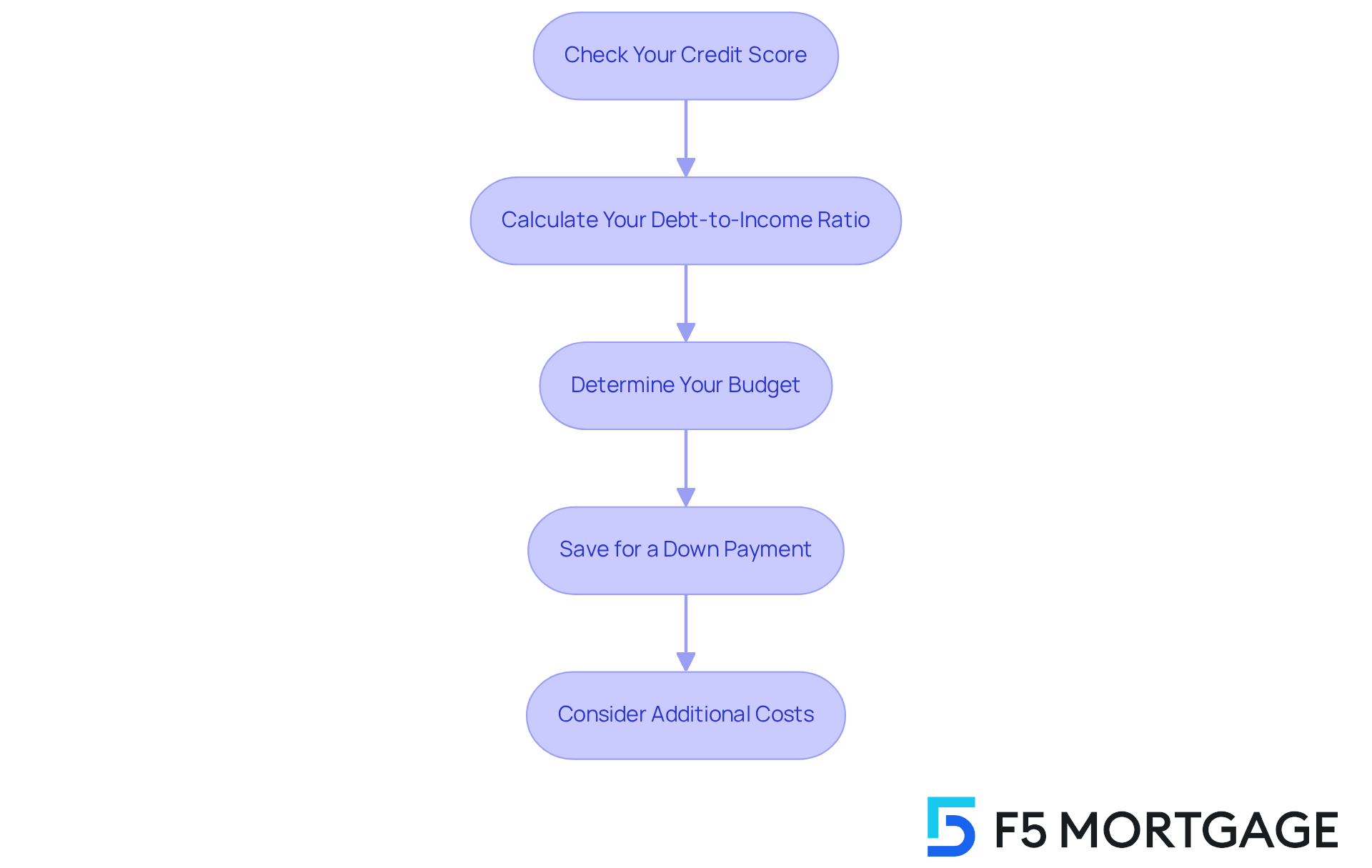

Assess Your Financial Readiness

Before seeking a loan, it’s crucial to evaluate your . We understand how overwhelming this process can feel, and we’re here to support you every step of the way. Here’s how to prepare effectively:

- : Start by obtaining your credit report and score. An elevated credit score, usually exceeding 740, can greatly enhance your likelihood of obtaining beneficial loan conditions, such as lower interest rates and decreased private housing insurance (PMI) expenses.

- Calculate Your : Lenders generally prefer a debt-to-income (DTI) ratio below 43%. This ratio compares your to your gross monthly income, assisting lenders in assessing your capacity to handle extra loan payments.

- Determine Your Budget: Assess your monthly expenditures to establish how much you can comfortably allocate towards a without straining your finances. This step is crucial for maintaining a balanced lifestyle while fulfilling your loan responsibilities.

- Save for a : Aim for a down payment of at least 20% of the home’s purchase price to avoid PMI. However, options exist for lower down payments, such as , which require as little as 3.5% down with a minimum credit score of 580.

- : Don’t forget to factor in property taxes, homeowners insurance, and maintenance costs when determining your overall budget. These expenses can significantly affect your monetary situation and should be included in your calculations.

By thoroughly assessing your monetary circumstances, you’ll be better prepared to engage with creditors and achieve that aligns with your needs and objectives. Remember, we know how challenging this can be, and taking these steps will empower you to make informed decisions.

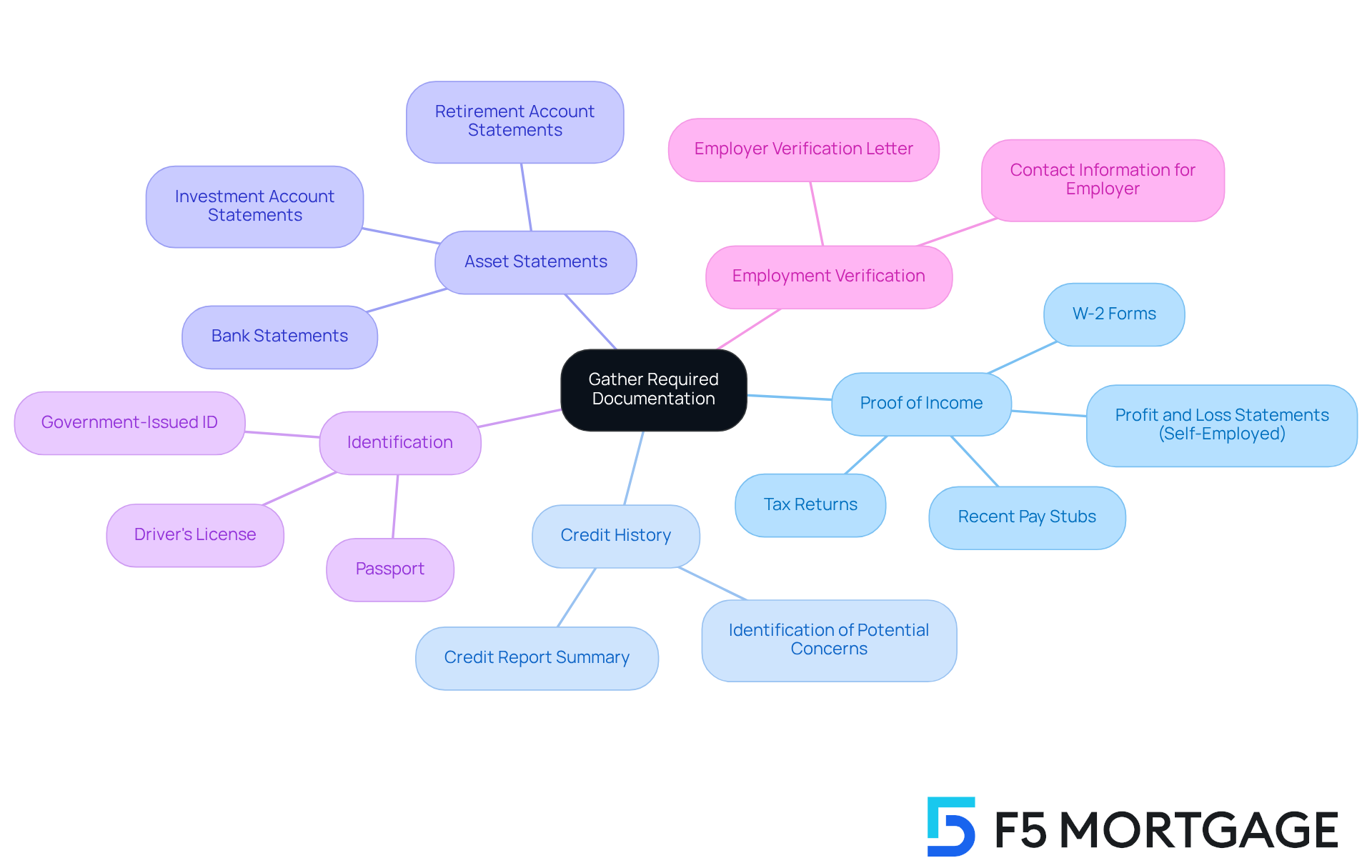

Gather Required Documentation

To streamline your , we know how crucial it is to . Here’s a helpful guide to ensure you’re prepared:

- : Include recent pay stubs, W-2 forms, or tax returns. If you’re self-employed, you may need to provide additional documentation, like profit and loss statements. This helps demonstrate your financial situation clearly.

- : While creditors will obtain your credit report, having a summary of your credit history at hand can help you assess your financial status. It also allows you to identify any potential concerns that might affect your application.

- : Providing bank statements and investment account statements showcases your financial stability. Recent statements for checking, savings, and retirement accounts are particularly important, as they help your ability to manage down payments and closing costs.

- Identification: A government-issued ID, such as a driver’s license or passport, is typically required to verify your identity and legal eligibility for a loan. This step is essential for ensuring everything is in order.

- : Some financial institutions may ask for a letter from your employer confirming your position and salary. This verification is vital for establishing income stability, a key factor in loan approval.

Having these documents prepared not only speeds up the but also to financial institutions. By being proactive, you enhance your chances of obtaining a beneficial loan. Remember, we’re here to support you every step of the way.

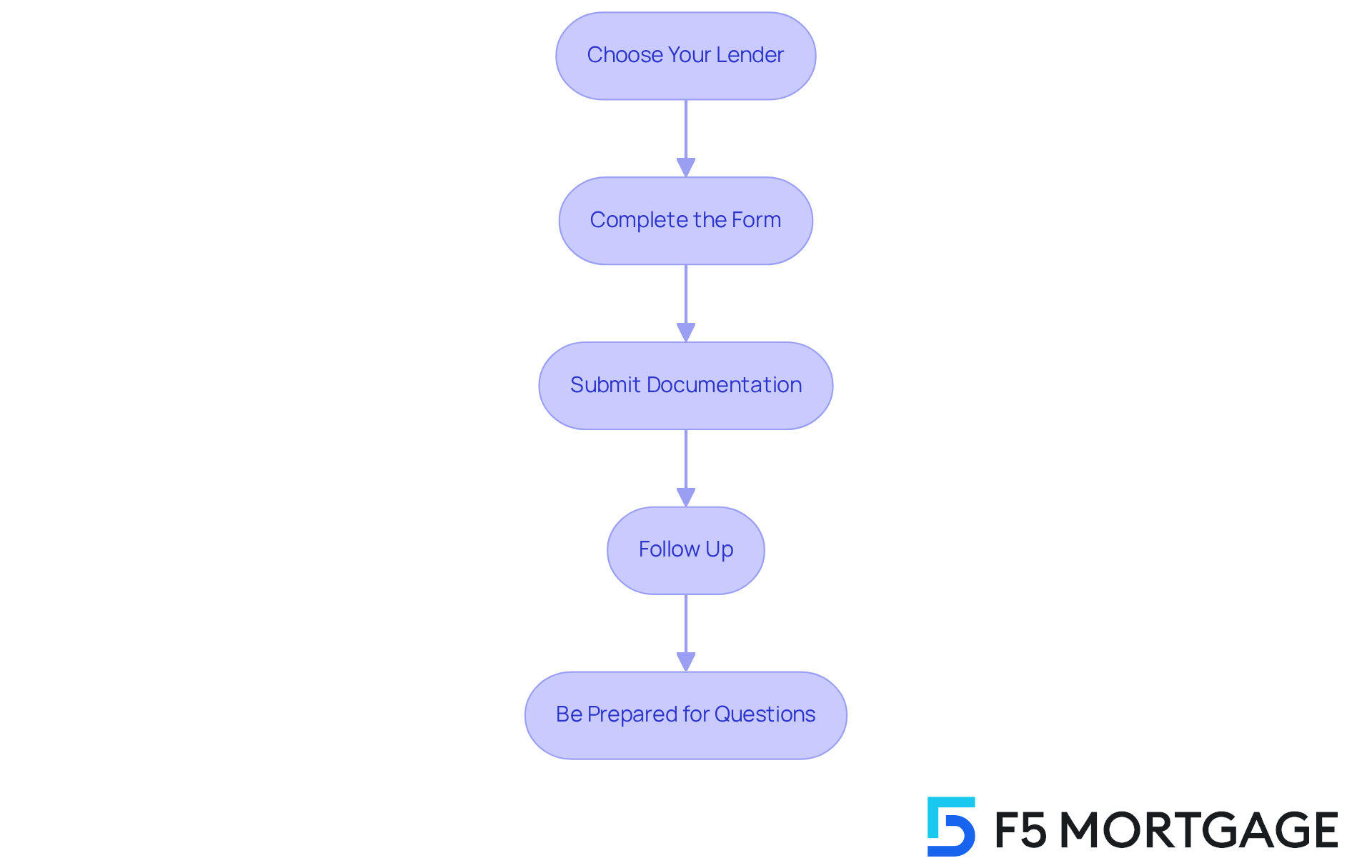

Submit Your Mortgage Application

Once you’ve gathered your documentation and assessed your , it’s time to submit your request for . At , we understand how important this step is for you. You have the convenience of applying online, by phone, or through chat, allowing you to choose the method that best suits your needs. Let’s walk through the steps together:

- : We know how overwhelming it can be to find the right lender. Research and select one that offers and terms tailored to your needs. Consider F5 Mortgage for our and competitive rates.

- Complete the Form: Take your time to fill out the form accurately, providing all the requested information. Whether you apply online, by phone, or via chat with one of our , we’re here to help tailor a loan that meets your goals.

- : Attach the you collected earlier to support your request. This includes proof of income, tax returns, and details of your debts and assets. We’re here to support you every step of the way.

- : After submission, it’s wise to check in with your financial institution to confirm receipt of your request and documents. Staying proactive can ease your mind.

- Be Prepared for Questions: Lenders may have follow-up questions or request additional information. Being ready to respond promptly can make a difference.

Submitting your request accurately and promptly can enhance your chances of a smooth mortgage loan approval. Remember, we’re here to guide you through this journey.

Understand the Lender’s Decision

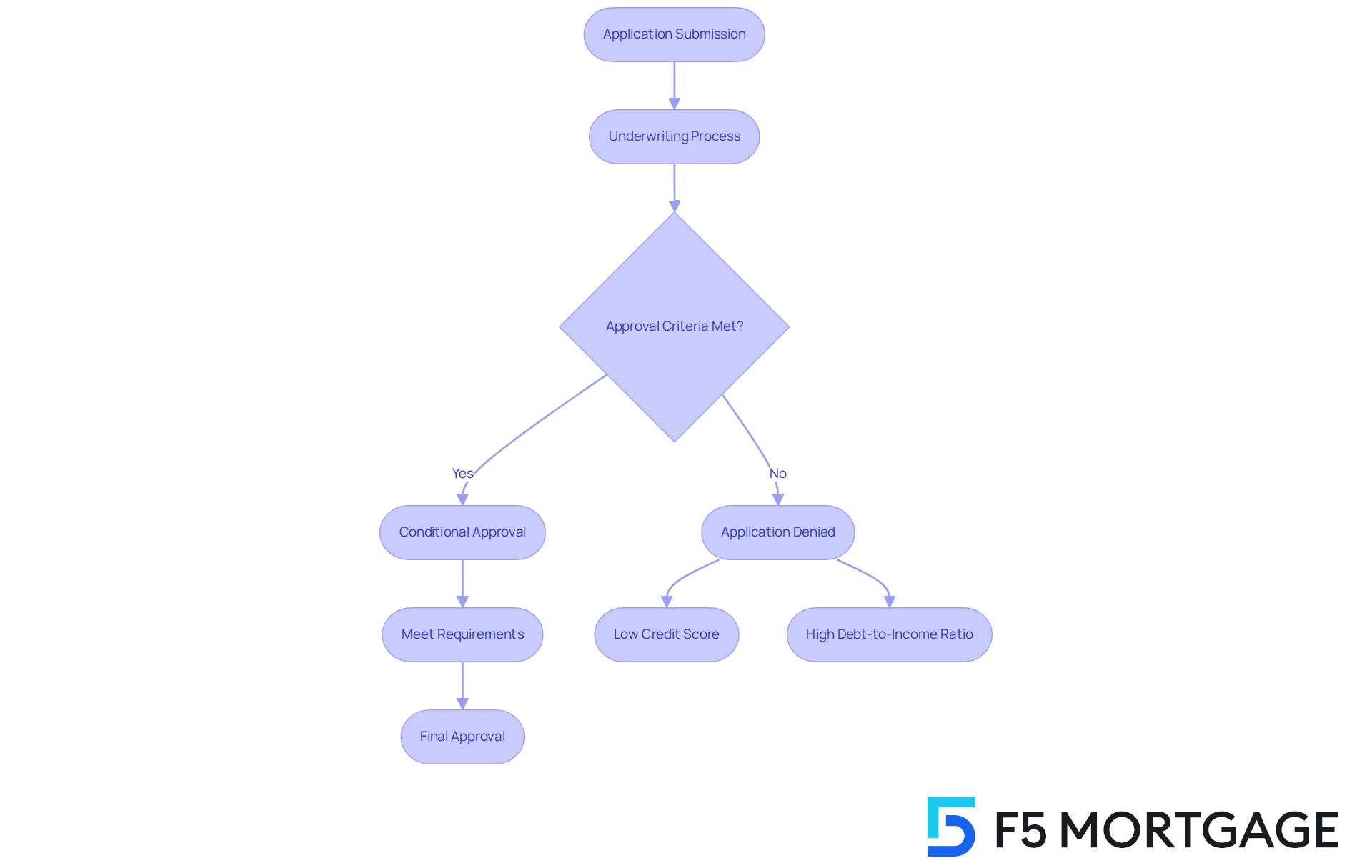

After submitting your application, it’s important to understand how lenders make their decisions. We know how challenging this can be, and we’re here to support you every step of the way.

- : Lenders conduct a thorough analysis of your submission, credit history, and financial documents to assess risk. This process is crucial in determining your eligibility for mortgage loan approval.

- : Several key factors influence the decision. Your or higher for conventional loans in 2025. Additionally, your debt-to-income ratio and employment history play significant roles. A stable employment record can greatly enhance your chances of approval.

- : If your request is approved, you may receive a conditional approval. This means you must meet specific requirements—such as providing additional documentation or clarifying financial details—before finalizing the loan.

- Denial Reasons: If your application is rejected, creditors are required to provide explanations. Common denial factors include low credit scores, often below the required threshold, or that exceed acceptable limits.

- Next Steps: If you are approved, carefully follow the provider’s instructions for closing the loan. If denied, take this opportunity to address the issues raised, such as improving your credit score or reducing debt, and consider reapplying in the future.

By understanding the , you can with greater confidence and clarity.

Conclusion

Securing mortgage loan approval is a pivotal step in the home-buying journey, and we know how challenging this can be. Understanding the process can significantly ease this experience. By breaking down the mortgage process into manageable steps—from assessing financial readiness to submitting documentation and understanding lender decisions—you can navigate this often complex landscape with confidence and clarity.

Key insights highlighted throughout this article emphasize the importance of being pre-approved. This not only defines your budget but also positions you favorably in a competitive market. Additionally, assessing financial preparedness, gathering necessary documentation, and understanding the lender’s evaluation criteria are crucial elements that contribute to a successful mortgage application. Each step plays a vital role in paving the way toward homeownership, ensuring that you are well-equipped to make informed decisions.

Ultimately, the journey to securing a mortgage loan approval is not just about meeting financial criteria; it is about empowering you to take charge of your home-buying experience. By following these outlined steps and being proactive, you can enhance your chances of approval and make your offers stand out. Embracing this knowledge allows for a smoother transition into the world of homeownership, encouraging a sense of readiness and confidence in what can often feel like an overwhelming process.

Frequently Asked Questions

What is the first step in the mortgage process?

The first step is securing mortgage loan approval, where a lender assesses your financial situation, including credit history, income, and debts, to determine the maximum loan amount you qualify for.

Why is being pre-approved important?

Being pre-approved informs you of your budget and increases your appeal to sellers, who prefer buyers showing financial readiness. Sellers often consider offers only from pre-approved buyers to avoid last-minute financing issues.

What does mortgage loan approval signify?

Mortgage loan approval indicates that, based on your financial information, you are a suitable candidate for a mortgage, giving you an estimate of your loan amount, interest rate, and potential monthly payment.

What should I do after getting pre-approved?

After getting pre-approved, you can confidently search for homes that fit your budget, allowing you to focus on properties that meet your financial needs.

What happens once I find a home I want to buy?

You will submit a formal request for mortgage loan approval to your financial institution, which initiates the underwriting process.

What is the underwriting process?

The underwriting process involves the lender thoroughly assessing your submission, verifying your financial information and the property’s value to ensure the loan aligns with lending guidelines.

What occurs during the closing stage?

During the closing stage, if your mortgage loan approval is successful, you will finalize the loan and complete the purchase of your home, which typically involves signing documents and settling any closing costs.

How can pre-approved buyers act in a seller’s market?

Pre-approved buyers can act quickly when they find a home, which is advantageous in a seller’s market characterized by low inventory. This readiness can enhance their negotiating position.

What financial factors should I assess before seeking a loan?

You should check your credit score, calculate your debt-to-income ratio, determine your budget, save for a down payment, and consider additional costs like property taxes and homeowners insurance.

What is a good credit score for obtaining beneficial loan conditions?

A credit score exceeding 740 can greatly enhance your likelihood of obtaining favorable loan conditions, such as lower interest rates and decreased private housing insurance (PMI) expenses.

What is the preferred debt-to-income ratio for lenders?

Lenders generally prefer a debt-to-income (DTI) ratio below 43%.

How much should I aim to save for a down payment?

Aim for a down payment of at least 20% of the home’s purchase price to avoid PMI, although options exist for lower down payments, such as FHA loans, which require as little as 3.5% down with a minimum credit score of 580.