Overview

Securing a pre-approved mortgage loan can feel overwhelming, but we’re here to support you every step of the way. The article outlines five essential steps that can help ease your journey.

- Gather the required documentation. This might seem daunting, but having everything in order will save you time and stress later on.

- Apply through a suitable lender. It’s important to find one who understands your needs and can guide you through the process.

- Remember, clear communication is key. By maintaining an open dialogue with your lender, you can address any potential issues proactively.

- By following these steps, you can enhance your chances of obtaining pre-approval.

- This not only strengthens your position in a competitive housing market but also gives you peace of mind.

We know how challenging this can be, but taking these actions can empower you to navigate the mortgage process with confidence.

Introduction

Navigating the journey to homeownership can feel overwhelming, especially in a competitive market where every advantage matters. Securing a pre-approved mortgage loan not only clarifies your budget but also positions you as a serious contender in negotiations.

We understand how challenging this process can be, as it often involves gathering the right documentation and addressing potential credit issues.

What steps can you take to ensure a smooth pre-approval experience and maximize your chances of success?

We’re here to support you every step of the way.

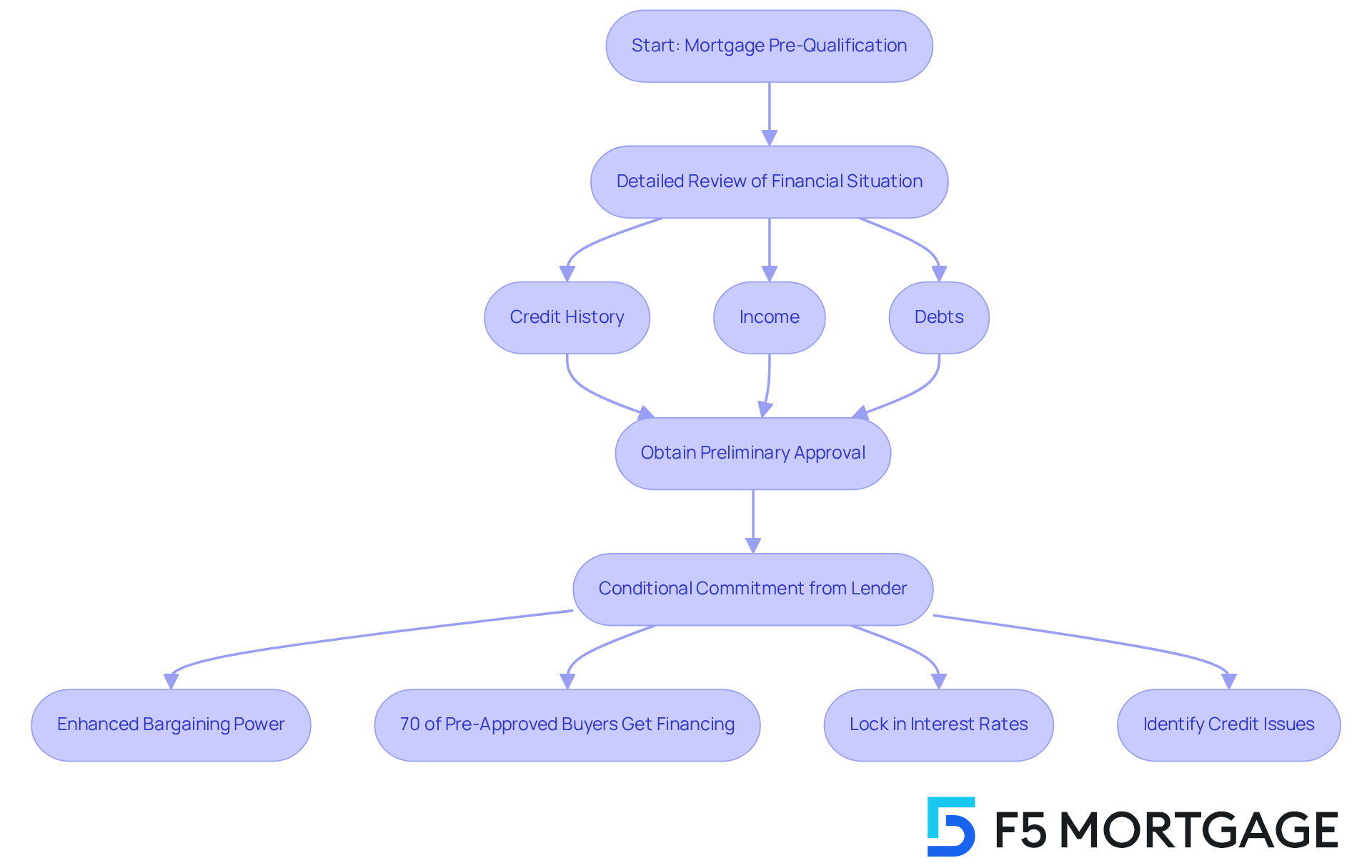

Understand Mortgage Pre-Approval

is a vital step in your home purchasing journey. It’s where a lender thoroughly assesses your to determine how much they are willing to lend. This process involves a detailed review of your credit history, income, and debts. While pre-qualification gives a rough estimate of your borrowing potential, obtaining offers a more accurate assessment and a conditional commitment from the lender. This formal acknowledgment significantly enhances your bargaining power when making an offer on a home, signaling to sellers that you are a serious buyer with the .

In 2025, the importance of mortgage pre-qualification is greater than ever, particularly in a . Buyers who secure are better positioned to act quickly when they find the right property, allowing them to make confident offers. Statistics reveal that over 70% of homebuyers who seek prior approval successfully obtain financing, underscoring its effectiveness.

Financial advisors consistently highlight the advantages of pre-approval. It not only clarifies your budget but also locks in interest rates for a specific period, shielding you from potential rate hikes. As Josh Lewis, a certified mortgage consultant, wisely notes, “Getting preapproved prior to the season will give you an advantage over other buyers.” This proactive approach enables you to identify and address any credit or debt-to-income issues early on, potentially saving you money throughout the life of your loan.

Moreover, can set you apart in a crowded market, where sellers often favor buyers with financing already arranged. By obtaining prior approval, you demonstrate your readiness and commitment, making your offers more appealing. It’s also wise to compare rates, costs, and terms with multiple lenders, including , to fully understand your options at current interest rates. F5 Mortgage provides competitive rates and personalized service, increasing your chances of securing favorable terms.

It’s essential to keep in mind that a typically lasts for 90 to 120 days, and lenders are not obligated to provide a loan even if a borrower was previously authorized. Therefore, if you were pre-approved in the past, it’s crucial to consult your lender for a re-evaluation of your credit, income, and assets—especially if there have been any changes in your financial situation. As the housing market continues to evolve, understanding the nuances of loan pre-authorization will empower you to navigate the complexities of home purchasing with greater ease and confidence.

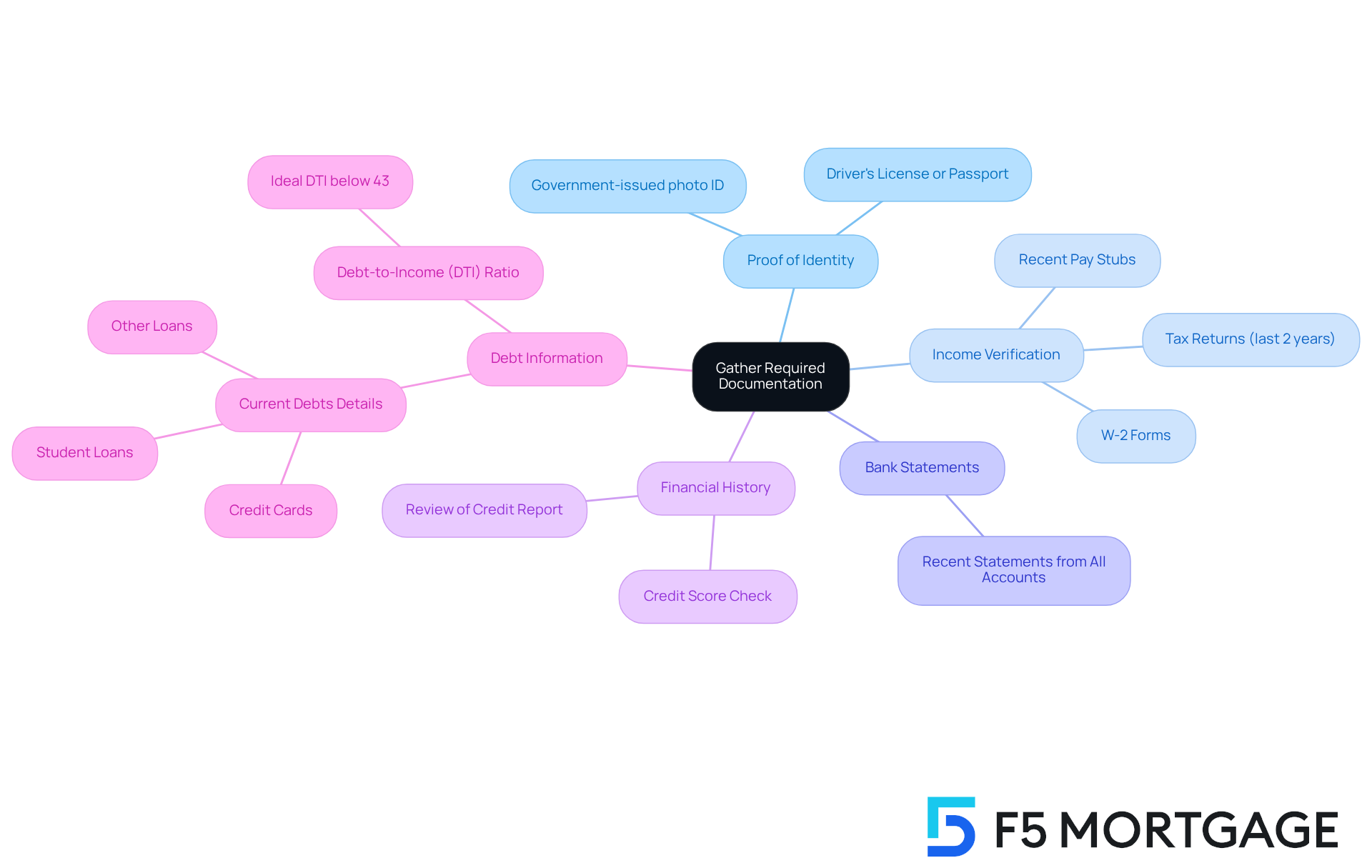

Gather Required Documentation

Obtaining a can feel overwhelming, but gathering the right documents can help make the process smoother. We understand how challenging this can be, and we’re here to . Here’s a helpful list of the most :

- Proof of Identity: A government-issued photo ID, like a driver’s license or passport, is essential for verifying your identity.

- : Recent pay stubs, W-2 forms, or tax returns from the past two years are crucial for demonstrating your income stability.

- Bank Statements: Providing recent statements from all your bank accounts helps verify your assets and financial health.

- Financial History: While lenders will obtain your report, can help you identify any potential issues.

- Debt Information: Gather details about any current debts, including credit cards, student loans, or other loans. Lenders will assess your , which should ideally be below 43% for favorable loan rates. A better DTI can lead to more favorable loan terms, making it essential to manage your debts effectively.

Keep in mind that a is typically valid for 120 days, so it’s important to act within this timeframe. If you seek a pre approved mortgage loan from several lenders within 45 days, it will only count as a single inquiry on your report, which can help protect your credit score.

Having these documents organized and ready will not only but also enable your lender to make a quicker and more informed decision. As financing specialist Emily Roberts explains, “Home loan pre-qualification necessitates that a purchaser complete a loan application; submit evidence of income, employment, and assets; and show strong credit via a hard credit inquiry.” A thorough checklist can help ensure you don’t overlook any , ultimately speeding up your loan application process. By examining your finances and resolving any possible concerns before applying, you can improve your likelihood of a seamless approval experience.

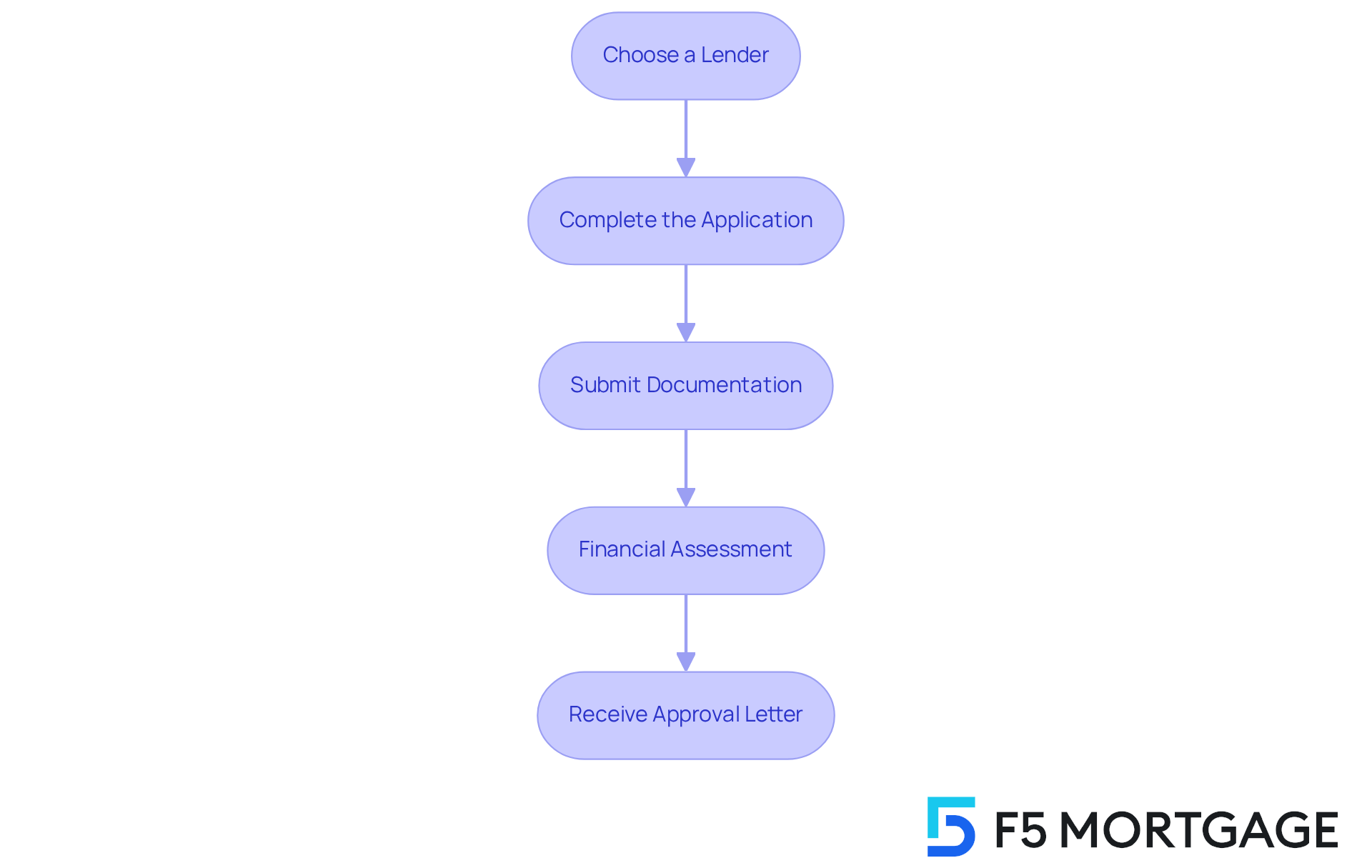

Apply for Pre-Approval

To initiate the mortgage pre-approval process, follow these essential steps:

- Choose a Lender: We know how challenging it can be to find the right lender. Start by researching lenders that offer . , recognized for its and diverse loan offerings. You can apply online, by phone, or through chat, allowing you to custom-tailor a loan that meets your goals. Obtaining a provides buyers with a clear insight into their purchasing capacity, including projections of loan sums, interest rates, and monthly installments. This clarity enhances your standing in the eyes of sellers and real estate agents.

- Complete the Application: When filling out F5 Mortgage’s mortgage application form, it’s important to accurately detail your financial situation, including income, debts, and assets. This step is crucial as it lays the .

- Submit Documentation: Attach all necessary documents to your application, such as proof of income, tax returns, and bank statements. Ensuring completeness will help you avoid delays in processing, allowing you to move forward with confidence.

- : The lender will perform a financial assessment to evaluate your creditworthiness. A strong financial score, ideally 740 or above, can significantly improve your chances of securing favorable mortgage rates. Before applying, take a moment to and dispute any errors that could affect your score.

- Receive Approval Letter: Once approved, you will receive an you qualify for. This letter is crucial, as it demonstrates your financial capability to sellers, strengthening your position in negotiations. Keep in mind that approval letters usually expire in three months or less, so it’s important to act quickly. Furthermore, a pre approved mortgage loan does not assure final loan approval, as additional underwriting steps will take place once an offer is presented.

By adhering to these steps, you can with confidence, making informed choices as you begin your home-buying journey. We’re here to support you every step of the way.

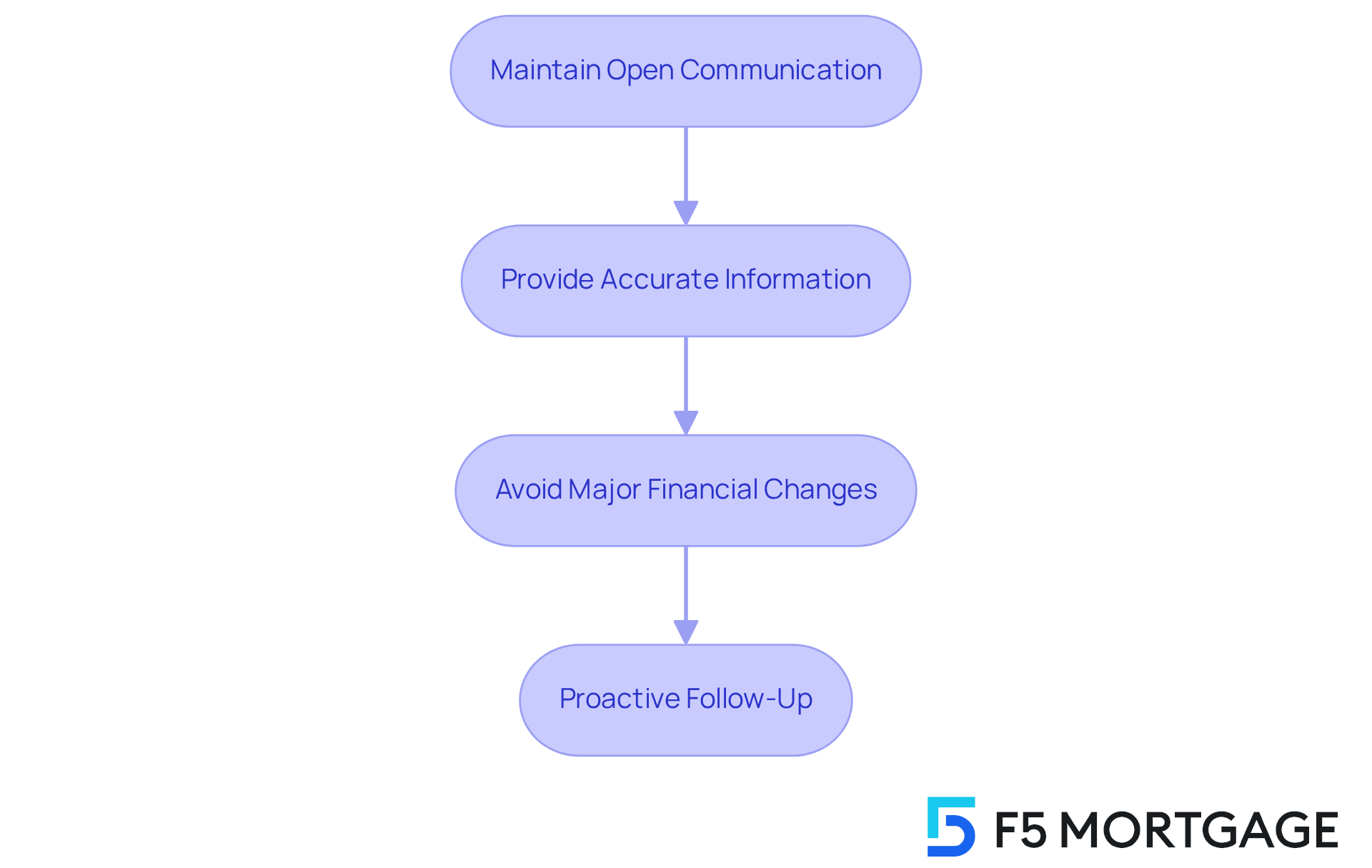

Navigate the Pre-Approval Process

Successfully navigating the can feel overwhelming, but with the right approach, you can make it a smoother experience. Here are some critical steps to guide you:

- Maintain Open Communication: Regularly engage with your lender throughout this journey. Don’t hesitate to ask questions for clarification on any requirements. Remember, can significantly enhance your experience and help alleviate any concerns you may have.

- Provide Accurate Information: Honesty is paramount. Ensure that all information regarding your is precise. Discrepancies can lead to delays or even denial of your application, underscoring the importance of transparency. We know how challenging this can be, but being upfront will serve you well.

- Avoid Major Financial Changes: It’s essential to abstain from during this preliminary stage. Actions like acquiring new debt or switching jobs can negatively impact your credit score and endanger your approval status. Mortgage experts stress that maintaining a is crucial for a seamless experience.

- Proactive Follow-Up: If you haven’t received updates from your lender within a reasonable timeframe, take the initiative to follow up. This not only shows your commitment but also helps keep your application on track. Remember, you are your own best advocate.

By being proactive and knowledgeable, you can with assurance, which will improve your chances of obtaining the you require. We’re here to support you every step of the way.

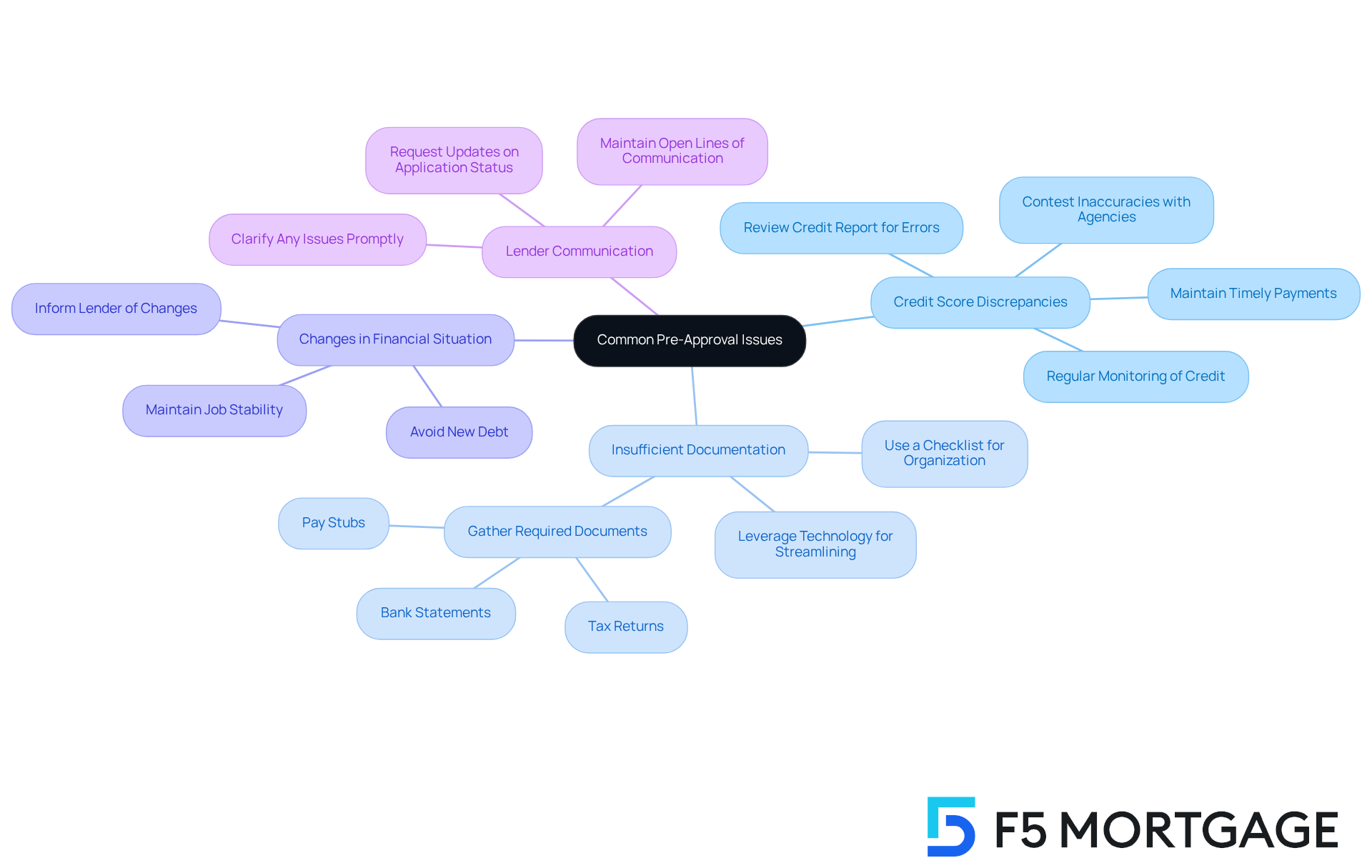

Troubleshoot Common Pre-Approval Issues

During the , we know how challenging it can be when that may impact your chances of securing a mortgage. By addressing these proactively, you can significantly enhance your experience, especially with ‘s commitment to transparency and client empowerment—without the pressure of hard sales tactics.

- Credit Score Discrepancies: If your , it’s crucial to review your credit report for errors. Discrepancies can often be resolved by contesting inaccuracies with financial agencies. Financial advisors recommend regularly monitoring your credit and addressing any issues promptly to improve your score before reapplying. As Amber Ernst, a sales manager, states, “Lenders want to know that you have these funds available to cover your down payment and closing costs.”

- : A significant percentage of mortgage applications face delays due to incomplete or inaccurate documentation. Ensure that all required documents—such as pay stubs, tax returns, and bank statements—are thorough and accurate. Keeping a checklist can help you stay organized and avoid unnecessary delays. At F5 Mortgage, we leverage technology to streamline this process, ensuring you have a .

- Changes in Financial Situation: , such as taking on new debt or changing jobs, can jeopardize your pre-approval status. Lenders prioritize stability, so it’s advisable to until after your mortgage closes. If a job change is necessary, ensure it’s in the same field and ideally offers equal or higher pay, and inform your loan officer immediately. F5 Mortgage emphasizes the importance of to navigate these changes effectively.

- Lender Communication: is essential. If you encounter delays or feel there’s a lack of communication, don’t hesitate to reach out for updates. Maintaining an open line of communication can help clarify any issues and show your dedication to the procedure. At F5 Mortgage, we prioritize transparency and are here to support you every step of the way. Remember to keep your lender updated about any financial changes that might happen during the procedure.

By being aware of these potential challenges and taking proactive steps to address them, you can significantly improve your chances of a smooth pre-approval process and move closer to achieving your homeownership goals.

Conclusion

Securing a pre-approved mortgage loan is a crucial step in your home buying journey, one that significantly enhances your position in a competitive market. We know how challenging this can be, but by understanding the importance of pre-approval, gathering the necessary documentation, and following a structured application process, you can navigate the complexities of financing with greater confidence and efficiency.

Throughout this guide, we shared key insights on the benefits of mortgage pre-approval. You’ll gain clarity on your budget, have the ability to lock in interest rates, and increase your appeal to sellers. The outlined steps—from gathering essential documents to addressing common issues—empower you to approach the mortgage pre-approval process with a proactive mindset. Remember, open communication with lenders and a thorough understanding of your financial situation can prevent potential pitfalls and facilitate a smoother experience.

In conclusion, obtaining a pre-approved mortgage loan is not merely a formality; it’s a strategic advantage in your home buying process. By taking the time to prepare and understand all aspects of mortgage pre-approval, you position yourself as a serious contender in the housing market. Embracing this proactive approach not only enhances the likelihood of securing favorable terms but also paves the way toward achieving your homeownership dreams. We’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage pre-approval and why is it important?

Mortgage pre-approval is a process where a lender assesses your financial situation to determine how much they are willing to lend. It provides a more accurate assessment of your borrowing potential and a conditional commitment from the lender, enhancing your bargaining power when making an offer on a home.

How does mortgage pre-qualification differ from pre-approval?

Pre-qualification gives a rough estimate of your borrowing potential based on a brief review of your finances, while pre-approval involves a detailed assessment of your credit history, income, and debts, providing a more precise evaluation and commitment from the lender.

Why is mortgage pre-approval particularly important in a competitive housing market?

In a competitive housing market, buyers with prior approval are better positioned to act quickly when they find a property, allowing them to make confident offers. Over 70% of homebuyers with prior approval successfully obtain financing, highlighting its effectiveness.

What are the advantages of obtaining mortgage pre-approval?

Pre-approval clarifies your budget, locks in interest rates for a specific period, and helps identify any credit or debt-to-income issues early on. It also makes your offers more appealing to sellers, as it shows you are a serious buyer.

What documents are typically required for mortgage pre-approval?

Common documents needed include: – Proof of Identity (government-issued photo ID) – Income Verification (recent pay stubs, W-2 forms, or tax returns) – Bank Statements (recent statements from all bank accounts) – Financial History (credit report) – Debt Information (details about current debts)

How long is a mortgage pre-approval valid?

A mortgage pre-approval is typically valid for 90 to 120 days.

What should I do if my financial situation has changed since my last pre-approval?

If your financial situation has changed, it’s important to consult your lender for a re-evaluation of your credit, income, and assets, even if you were previously pre-approved.

How can I protect my credit score while seeking mortgage pre-approval?

If you seek pre-approval from several lenders within 45 days, it will only count as a single inquiry on your credit report, helping to protect your credit score.

What is the ideal debt-to-income (DTI) ratio for favorable loan rates?

The ideal debt-to-income (DTI) ratio should be below 43% for favorable loan rates.

How can I improve my chances of a smooth mortgage pre-approval process?

Organizing the required documents and addressing any financial issues beforehand can streamline the application process and improve your chances of a seamless approval experience.