Overview

Understanding how to effectively use a paying off mortgage early calculator can feel daunting. However, we know how challenging this can be, and we’re here to support you every step of the way. This article outlines four essential steps to guide you through the process:

- Grasp the calculator’s purpose

- Gather the necessary information

- Input your data

- Interpret the results

By following these steps, you can visualize how different payment strategies impact your mortgage payoff timeline. Imagine the potential interest savings you could achieve! This understanding empowers you to make informed financial decisions that align with your long-term goals, bringing you one step closer to financial freedom. Remember, you’re not alone in this journey; many homeowners share similar concerns and aspirations.

Introduction

Understanding the intricacies of mortgage repayment can feel overwhelming. We know how challenging this can be. Yet, the right tools can simplify your journey toward financial freedom. A paying off mortgage early calculator serves as a powerful ally for homeowners eager to reduce their debt and save on interest costs.

By exploring potential savings and strategies for accelerated payments, you can take control of your financial future. Imagine being able to visualize your mortgage payoff timeline while ensuring that your efforts align with your long-term financial goals. We’re here to support you every step of the way.

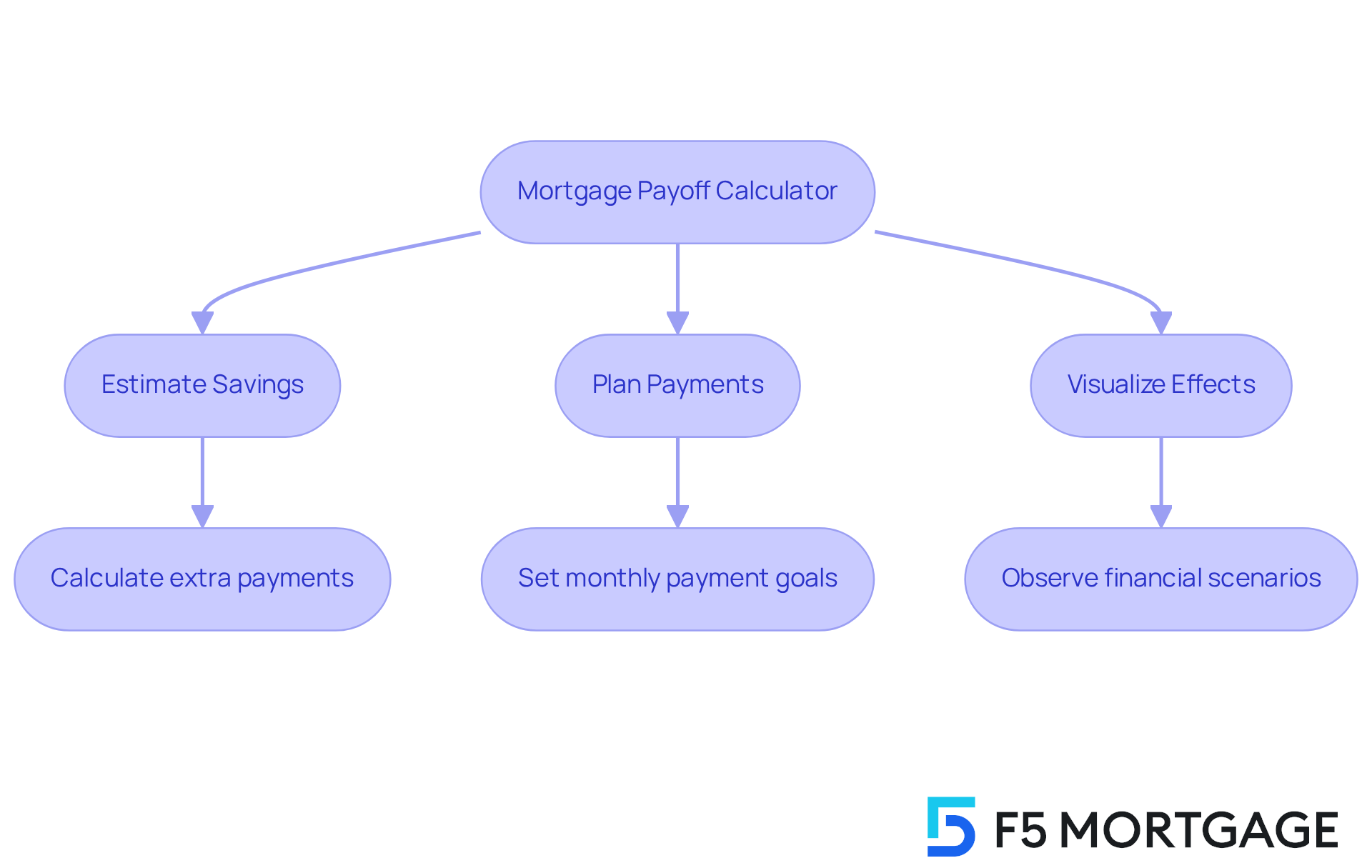

Understand the Purpose of a Mortgage Payoff Calculator

A paying off mortgage early calculator is a valuable financial tool designed to help homeowners understand how quickly they can eliminate their debt and the savings they can achieve through extra contributions. By entering various parameters like the loan amount, interest rate, and payment frequency, users can visualize the impact of different payment strategies. Understanding this tool’s purpose is essential for homeowners who want to manage their loans efficiently and work toward financial independence sooner.

We understand how challenging it can be to navigate mortgage decisions. Generally, it is recommended that homeowners consider living in their house for at least five years before expecting it to pay off. This timeframe allows for better equity accumulation and market stability. Such considerations are crucial when using a paying off mortgage early calculator, as they help homeowners align their repayment strategies with long-term financial goals.

Key Benefits:

- Estimate Savings: Calculate potential savings on interest by making extra payments.

- Plan Payments: Determine how much to pay monthly to reach payoff goals.

- Visualize Effects: Observe how various financial scenarios influence the duration and total costs incurred.

For instance, homeowners who switch to biweekly installments can make 26 half-payments each year, effectively contributing an additional full installment toward the principal annually. This strategy can significantly shorten the loan term and reduce interest costs. Furthermore, financial specialists recommend maintaining an emergency fund covering three to six months of expenses before allocating extra funds to loan payments. This ensures that homeowners remain financially secure while striving toward their payoff objectives.

Homeowners can make informed decisions that align with their financial aspirations by leveraging the paying off mortgage early calculator. We’re here to support you every step of the way.

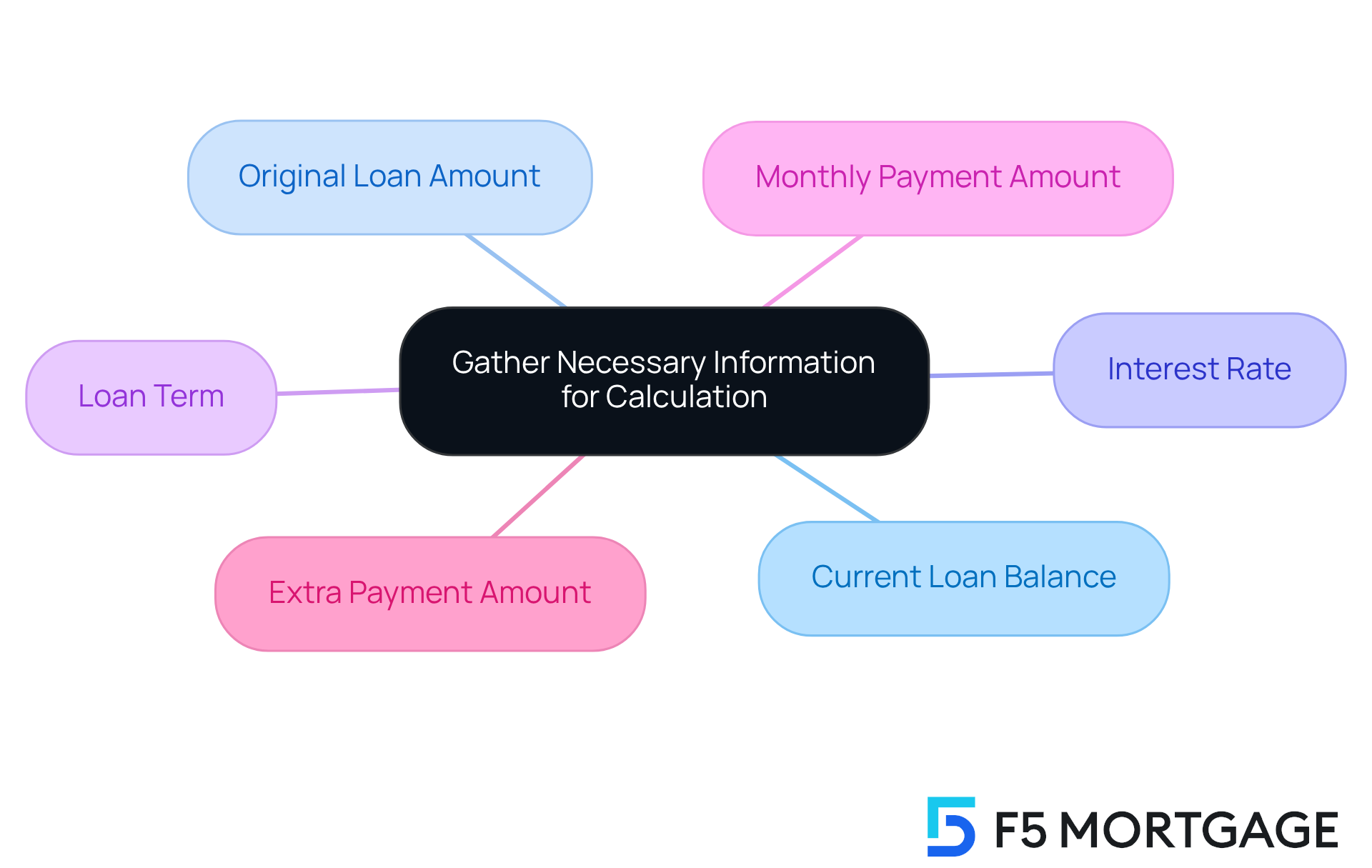

Gather Necessary Information for Calculation

Before you dive into using a mortgage payoff calculator, we know how important it is to gather some key information to ensure your calculations are spot on:

- Current Loan Balance: This is the remaining amount you owe on your home loan.

- Original Loan Amount: Think of this as the initial sum you borrowed when you secured your loan.

- Interest Rate: This is the yearly interest rate attached to your loan.

- Loan Term: Consider the total duration of the loan—whether it’s 15, 20, or 30 years.

- Monthly Payment Amount: This reflects your current monthly housing payment.

- Extra Payment Amount: Any additional amount you plan to pay each month or as a lump sum matters here too.

Having this information readily available not only streamlines the calculation process but also enhances the accuracy of the results. Precise information is essential, as it can greatly affect your approach to loan repayment. For instance, did you know that first-time homebuyers often start with original loan amounts averaging around $200,000? This makes the use of a paying off mortgage early calculator vital for effective financial planning. As loan specialists often stress, verifying that all your numbers are accurate with a paying off mortgage early calculator can lead to significant savings on financing costs over time.

Taylor Getler, a home and finance writer for NerdWallet, shares, “If you can manage to do this, it will save you a significant sum in interest costs.” Furthermore, ensuring that any additional payments are directed toward the principal is crucial, as this can help speed up your loan payoff.

Understanding your Debt-to-Income (DTI) ratio is also important. A lower DTI can open the door to more advantageous refinancing choices and loan rates, especially for families looking to enhance their homes. F5 Mortgage offers various refinancing options tailored to your needs, including conventional loans, FHA loans, and VA loans, each with specific eligibility requirements designed to help you achieve your financial goals more effectively.

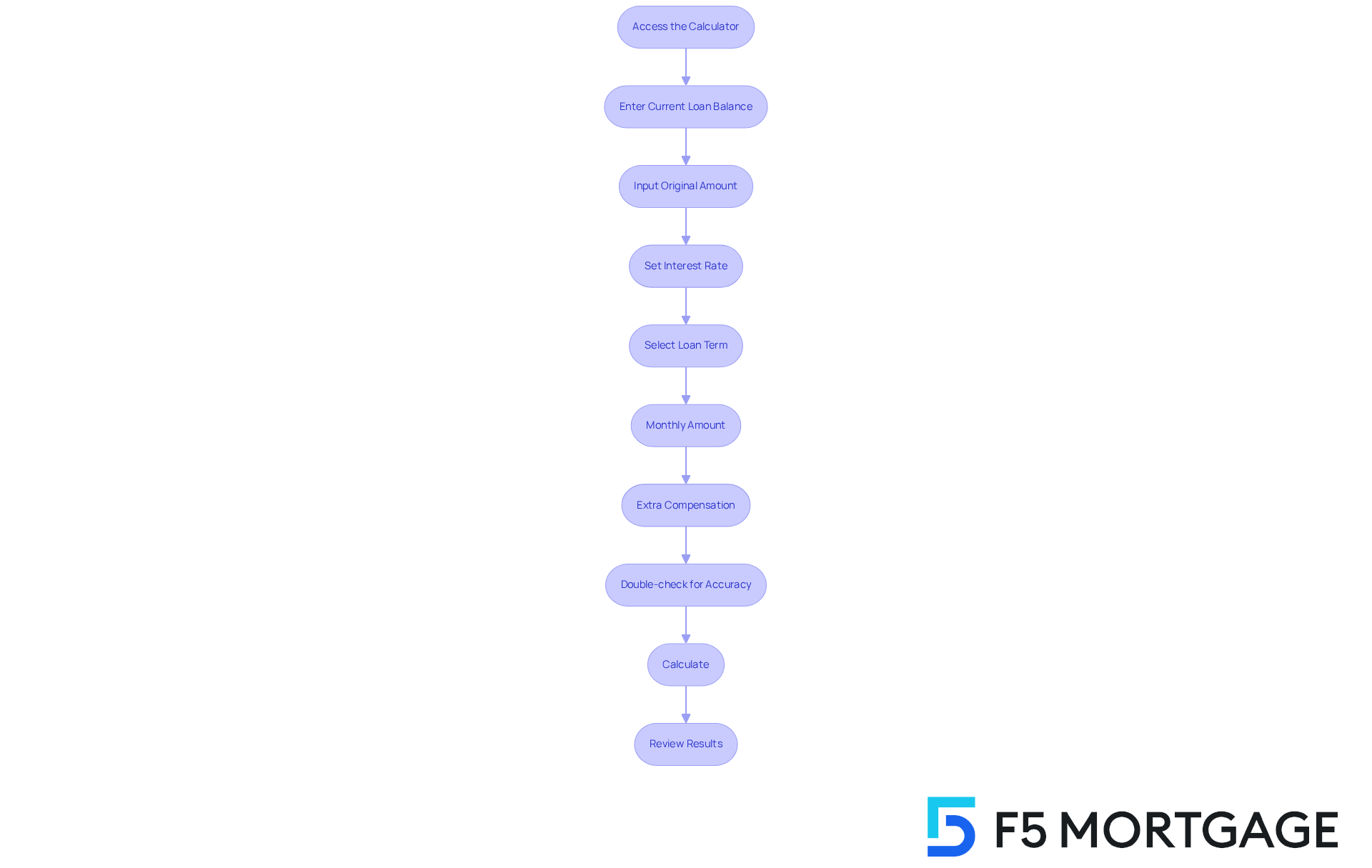

Input Data into the Calculator

To effectively use a mortgage payoff calculator, follow these steps:

- Access the Calculator: Start by navigating to a trustworthy online loan payoff calculator. We know how important it is to find reliable tools.

- Enter Current Loan Balance: Input the remaining balance of your loan, which reflects what you still owe. This step is crucial for understanding your financial position.

- Input Original Amount: Enter the initial sum you borrowed to establish a baseline for your calculations. This helps you see the bigger picture.

- Set Interest Rate: Fill in your mortgage’s annual interest rate, as this will significantly impact your total interest paid over time. Knowing this can empower your decisions.

- Select Loan Term: Choose the duration of your loan from the available options, typically ranging from 15 to 30 years. This choice can affect your monthly payments and overall costs.

- Monthly Amount: Enter your current monthly charge to assess how it fits into your overall repayment strategy. It’s essential to see how it aligns with your budget.

- Extra Compensation: If you intend to make extra monthly or one-time contributions, enter those amounts to observe how they can speed up your payoff. Every little bit can make a difference.

After entering all the required information, double-check for accuracy before proceeding to calculate. Utilizing a paying off mortgage early calculator can uncover significant savings; for example, making an extra monthly payment of $1,113 can save you around $20,806 in interest and reduce your repayment period by almost four years. This tool not only assists in planning but also enables families to make informed choices regarding their repayment strategies.

Understanding your Debt-to-Income (DTI) ratio is vital. A lower DTI (with a maximum of 43% generally needed for home financing) can result in better interest rates and refinancing alternatives. For families in Colorado, exploring refinancing opportunities with F5 Mortgage can provide access to various loan types, including conventional and FHA loans, which may offer better terms based on your financial situation. As financial specialists frequently highlight, precise calculations are essential for effective loan management. After utilizing the calculator, consider exploring extra resources or seeking advice from a finance expert to further improve your repayment strategy. We’re here to support you every step of the way.

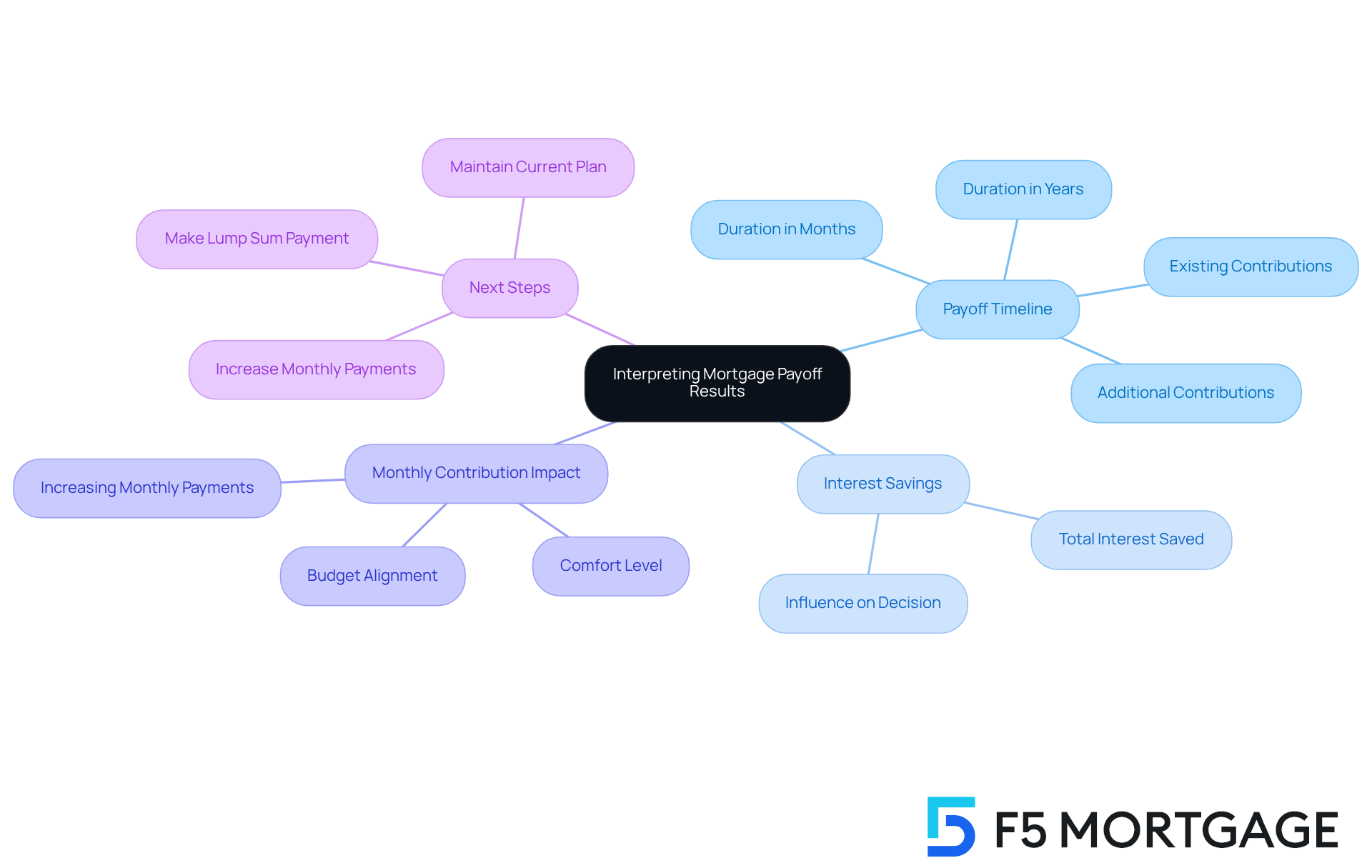

Interpret the Results and Plan Your Next Steps

Once you have used the paying off mortgage early calculator to calculate your mortgage payoff options, it’s time to interpret the results.

Payoff Timeline: We understand how important it is to know the duration in months or years required to settle your mortgage, especially when considering your existing and additional contributions.

Interest Savings: Take a moment to observe the total interest saved by making those extra contributions. This figure can be significant and may greatly influence your decision to pay more each month.

Monthly Contribution Impact: It’s essential to understand how increasing your monthly contribution affects your overall financial situation. Make sure it aligns with your budget and comfort level.

Next Steps: Based on the results, think about whether to modify your financial strategy. You might decide to increase your monthly payments, make a lump sum payment, or simply maintain your current plan.

By interpreting these results, you can create a tailored plan that aligns with your financial goals and helps you achieve mortgage freedom sooner with a paying off mortgage early calculator. Remember, we’re here to support you every step of the way.

Conclusion

Using a paying off mortgage early calculator can truly transform the way homeowners approach their debt. It empowers them to take control of their financial future. By understanding the calculator’s purpose and functionality, individuals can develop effective strategies to pay off their mortgage faster. This ultimately leads to significant savings on interest and a clearer path to financial independence.

Throughout this guide, we’ve shared key insights that we know can help. Gathering accurate information is crucial, as is knowing the steps to input data effectively and how to interpret the calculator’s results. Homeowners have learned that even small adjustments, such as making extra payments or switching to biweekly installments, can greatly impact the duration and cost of their mortgage. Additionally, understanding one’s Debt-to-Income ratio can open doors to better refinancing options, making the journey toward mortgage freedom even more attainable.

Ultimately, leveraging a paying off mortgage early calculator is not just about crunching numbers; it’s about making informed financial decisions that align with your long-term goals. We encourage homeowners to take action by utilizing this powerful tool, exploring additional resources, and possibly consulting with financial experts to refine their repayment strategies. The road to mortgage freedom is within reach, and with the right planning and commitment, it can be achieved sooner than expected.

Frequently Asked Questions

What is the purpose of a mortgage payoff calculator?

A mortgage payoff calculator helps homeowners understand how quickly they can eliminate their debt and the potential savings from making extra contributions. It allows users to input parameters like loan amount, interest rate, and payment frequency to visualize different payment strategies.

How can a mortgage payoff calculator benefit homeowners?

Key benefits include estimating savings on interest from extra payments, planning monthly payments to achieve payoff goals, and visualizing how various financial scenarios affect the duration and total costs of the mortgage.

What is the recommended timeframe for homeowners to stay in their house before expecting it to pay off?

It is generally recommended that homeowners consider living in their house for at least five years to allow for better equity accumulation and market stability.

How can changing payment frequency impact mortgage payoff?

Switching to biweekly installments allows homeowners to make 26 half-payments each year, effectively contributing an additional full installment toward the principal annually. This strategy can significantly shorten the loan term and reduce interest costs.

What financial considerations should homeowners keep in mind before making extra mortgage payments?

Homeowners should maintain an emergency fund that covers three to six months of expenses before allocating extra funds to loan payments to ensure financial security while working toward their payoff objectives.

How can homeowners use the mortgage payoff calculator to align with their financial goals?

By using the mortgage payoff calculator, homeowners can make informed decisions that align with their financial aspirations, helping them manage their loans efficiently and work toward financial independence sooner.