Overview

Navigating the mortgage process can feel overwhelming, especially when considering a home upgrade for your family. This article outlines four essential steps to help you pre-qualify for a mortgage, making the journey smoother and more manageable.

Understand the Pre-Qualification Process:

It’s crucial to understand the pre-qualification process. This knowledge empowers you to take control of your financial future.Gather Necessary Documentation:

Gathering the necessary documentation is vital. We know how challenging this can be, but being organized will enhance your chances of securing favorable loan terms. As you gather your documents, remember that each piece brings you closer to your goal.Compare Lenders:

Comparing lenders is the third step. With so many options available, it’s important to find one that fits your family’s needs. Take your time to explore different offers and don’t hesitate to ask questions. We’re here to support you every step of the way.Navigate Common Challenges:

Navigating common challenges is part of the process. By being informed and prepared, you can set a realistic budget and improve your credibility with sellers. Remember, this preparation is not just about securing a loan; it’s about creating a brighter future for your family.

Introduction

Navigating the mortgage pre-qualification process can feel overwhelming for families eager to upgrade their homes. We understand how challenging this can be. It’s essential to grasp the intricacies of this critical first step, as it not only determines your borrowing capacity but also shapes your entire home-buying experience.

With nearly 21% of mortgage applications being rejected recently, understanding the differences between pre-qualification and pre-approval becomes increasingly vital.

How can families ensure they are well-prepared to face these challenges and secure favorable loan terms? We’re here to support you every step of the way.

Understand Mortgage Pre-Qualification

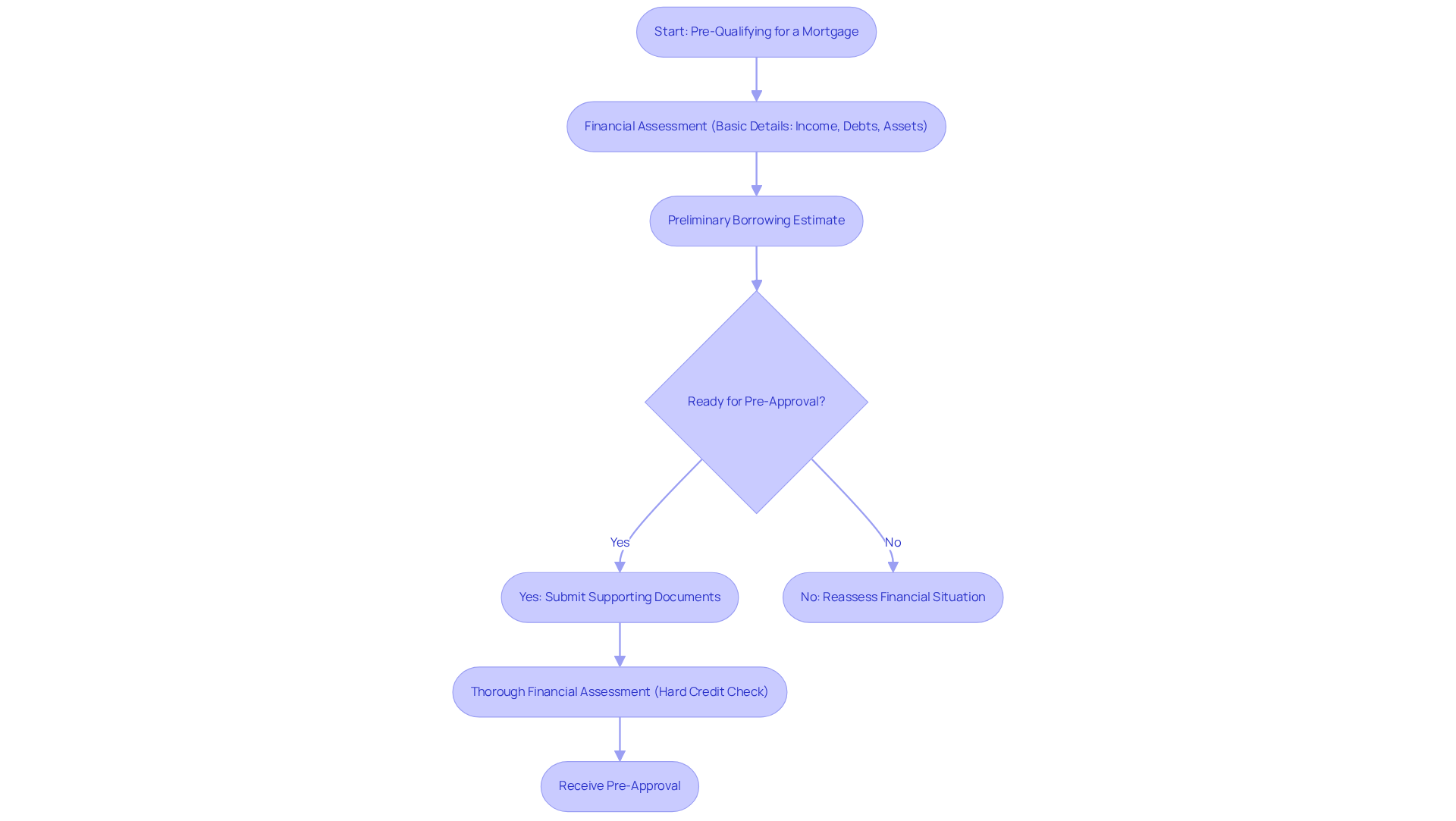

The crucial first step in your home buying journey is to pre qualify mortgage, which allows you to understand your borrowing capacity based on your financial profile. This initial procedure typically involves a gentle financial assessment and minimal documentation, requiring only basic details about your income, debts, and assets. By sharing this information, lenders can provide a preliminary estimate of how much you can borrow. This estimate is vital for establishing a realistic budget as you search for your new home.

Understanding the difference between initial qualification and pre-approval is essential for navigating the loan landscape effectively. While initial qualification gives you a rough estimate, involves a thorough assessment of your financial situation, including a hard credit check and the submission of supporting documents. When you receive pre-approval, it indicates that the lender believes you are a strong candidate for a mortgage. This process provides an estimate of your loan amount, interest rate, and potential monthly payments. Such a detailed analysis not only strengthens your position when making offers on homes but also enhances your credibility with sellers.

Despite the significance of these processes, studies indicate that around 40% of homebuyers do not fully understand the distinctions between pre-approval and initial qualification. We know how challenging this can be, and financial advisors emphasize that initial approval is a vital first step. It helps you set a homebuying budget and assess your financial readiness. Additionally, it’s common for buyers to negotiate with sellers regarding repairs or upgrades as part of their offer, which can influence the final purchase price.

Many families have successfully navigated the pre qualify mortgage process, often finding themselves better prepared to secure favorable loan terms and ultimately achieve their homeownership dreams. In a market where the average home loan application rejection rate rose to nearly 21% in 2024, understanding these processes becomes even more critical. We’re here to support you every step of the way as you embark on this journey.

Gather Necessary Documentation for Pre-Qualification

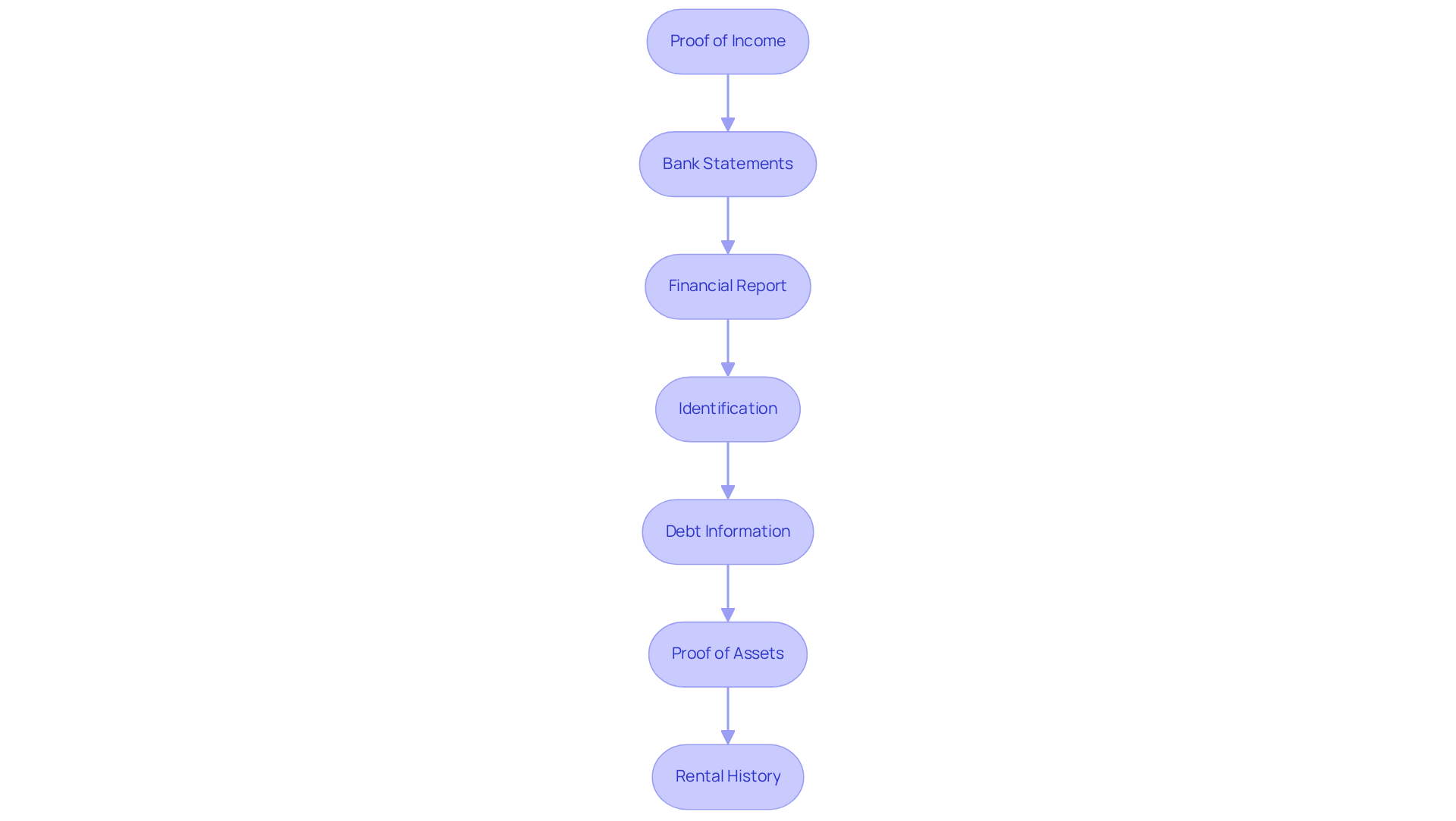

Gathering essential documents is crucial to successfully pre qualify mortgage. We understand how overwhelming this process can be, so here’s a comprehensive checklist to help you prepare:

- Proof of Income: Include recent pay stubs, W-2 forms, or tax returns for the past two years. If you’re self-employed, you may need to provide additional documentation, such as profit and loss statements, to verify your income.

- Bank Statements: Collect your bank statements for the last two to three months to demonstrate your savings and financial stability. This is particularly important for self-employed borrowers who may have fluctuating income. By reviewing your overall financial situation, including income and expenses, you can pre qualify mortgage and understand how much you can afford to borrow.

- Financial Report: While lenders will obtain your financial report, reviewing your score beforehand can help reveal any potential problems that may influence your ability to pre qualify mortgage. Remember, a hard inquiry may temporarily reduce your score by a few points. Keeping your card debt low will also assist you in qualifying for a better loan.

- Identification: A government-issued ID, such as a driver’s license or passport, is typically required to confirm your identity.

- Debt Information: Be prepared to disclose any existing debts, including student loans, car loans, or charge card balances. Lenders will evaluate your debt-to-income (DTI) ratio, which is a crucial element in establishing your loan eligibility. Having a plan for managing your debt can further strengthen your application.

- Proof of Assets: Providing documentation of your assets, such as bank or investment account statements, is necessary to pre qualify mortgage for pre-approval. We recommend having some money saved up for emergencies—ideally three months of income—to ensure your financial stability.

- Rental history: A strong rental background can assist first-time homebuyers in securing a pre qualify mortgage, while past evictions may adversely affect credit scores.

Having these documents arranged and prepared will simplify the assessment process, enabling you to showcase a comprehensive financial overview to your lender. This preparation not only enhances your chances of approval but also demonstrates your seriousness to sellers when making an offer on a home. Remember that pre-approvals are typically valid for 60 days, so plan accordingly. We’re here to .

Compare Lenders and Understand Pre-Qualification Implications

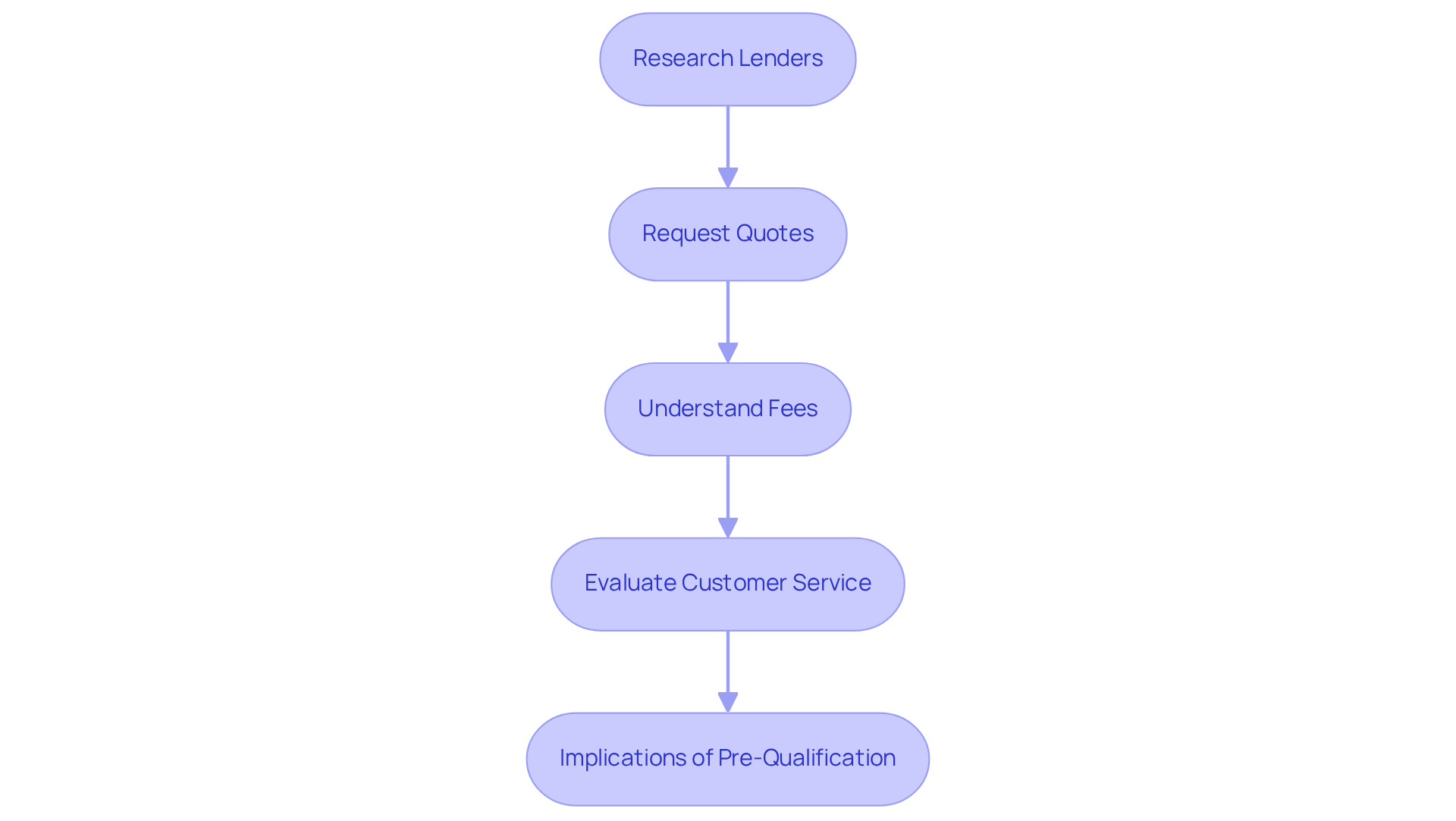

After you pre qualify mortgage, it is essential to compare lenders to obtain the best loan for your family’s home improvement. We know how challenging this process can be, so follow these steps to ensure you make an informed decision:

- Research Lenders: Seek out lenders that offer competitive rates and favorable terms. Independent loan brokers like F5 Finance can provide a wider range of choices compared to conventional banks, improving your likelihood of discovering the best offer. F5 Mortgage utilizes cutting-edge technology to simplify the lending experience, guaranteeing highly competitive rates without the inconvenience of aggressive sales techniques.

- Request Quotes: Reach out to multiple lenders to gather quotes. Ensure that you are comparing similar loan types and terms to facilitate an accurate assessment of costs and benefits. This step is crucial in understanding your options and making an informed choice.

- Understand Fees: Be vigilant about any fees associated with the loan, including origination fees, closing costs, and prepayment penalties. These charges can significantly influence the total expense of your loan. In 2022, the average homebuyer faced approximately $6,000 in closing costs, a notable increase from $4,889 in 2021. F5 Mortgage aims to remove junk fees that can complicate the homebuying experience, empowering you to make informed financial choices.

- Evaluate Customer Service: Assess the lender’s reputation for customer service. A lender that communicates effectively and offers continuous assistance can significantly improve your experience throughout the loan process. In 2025, customer satisfaction with mortgage lenders remains a critical factor, with many families prioritizing service quality alongside competitive rates. F5 Mortgage combines cutting-edge technology with personal service, ensuring a stress-free experience.

- Implications of Pre-Qualification: Remember that pre-qualification offers an estimate of your borrowing capacity but does not guarantee loan approval. It’s essential to remain within your budget and be prepared for potential fluctuations in your borrowing ability as you progress. As mentioned by the Consumer Financial Protection Bureau (CFPB), concerns regarding junk fees can further complicate the homebuying experience, affecting your overall financial situation.

As you assess lenders, think about how their charges and service quality will influence your overall financing experience. We’re here to .

Navigate Common Challenges in the Pre-Qualification Process

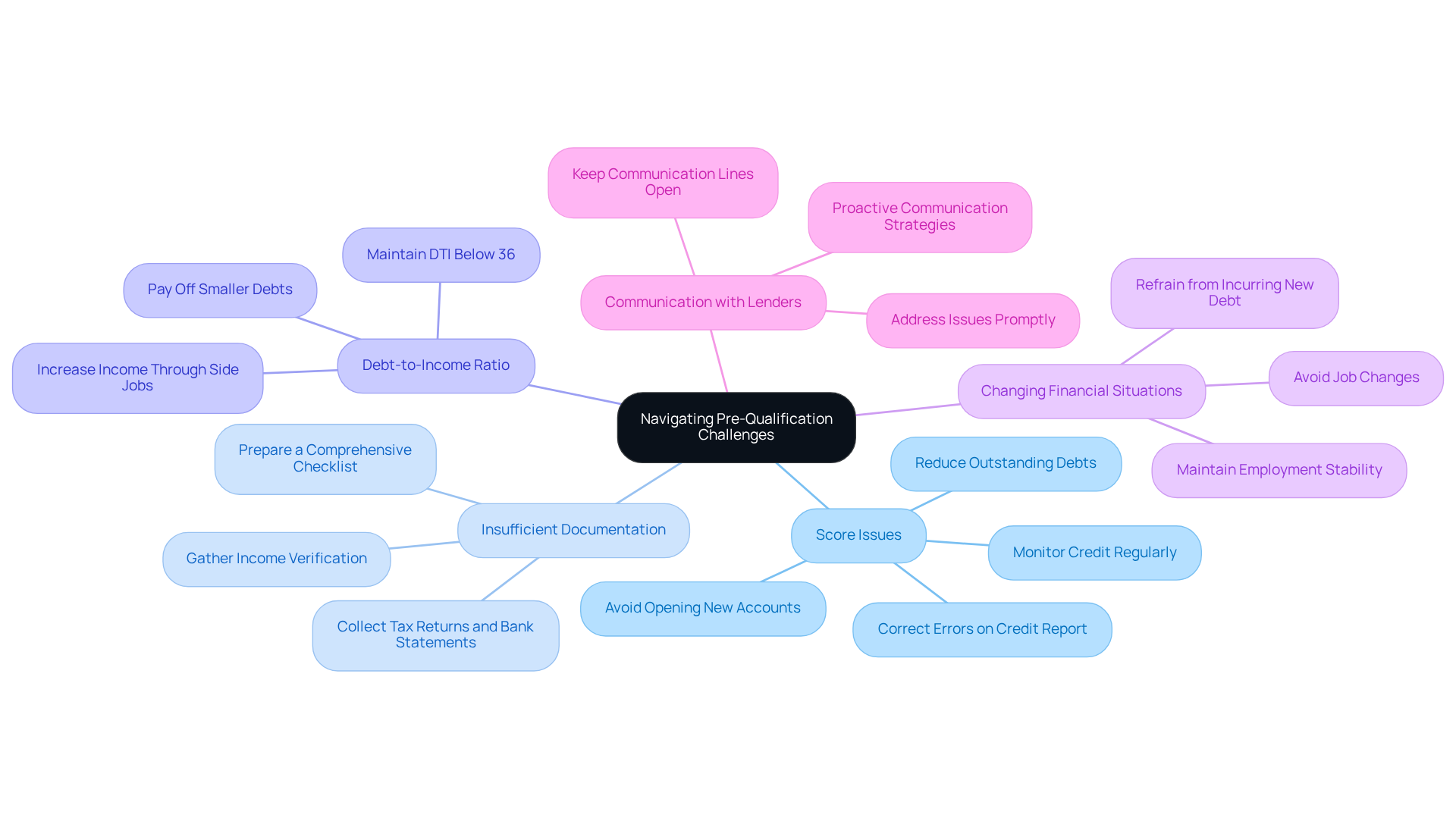

Navigating the initial approval process can feel overwhelming for families eager to enhance their homes, especially in a landscape where traditional lenders often rely on aggressive sales tactics and misleading information. We understand how challenging this can be, so here are some common issues and strategies to address them:

- Score Issues: A lower-than-expected credit score can hinder your ability to pre qualify mortgage for a home loan. To boost your score, consider strategies like , correcting errors on your report, and refraining from opening new accounts. Families that actively reduced their credit card balances saw an average increase of 50 points in their scores, significantly improving their mortgage eligibility. Keeping an eye on your credit and paying bills on time are essential steps in this process.

- Insufficient Documentation: Having all necessary documentation prepared is vital. Missing documents can lead to delays in the qualification process. Utilize a comprehensive checklist to ensure you have everything in order, including income verification, tax returns, and bank statements. At F5 Mortgage, we simplify this process, ensuring you have the support needed to gather your documents without stress.

- Debt-to-Income Ratio: Lenders assess your debt-to-income (DTI) ratio to gauge your borrowing capacity. A DTI above 43% may limit your options. To enhance this ratio, think about paying off smaller debts or increasing your income through side jobs or freelance work. Homebuyers with a DTI below 36% are more likely to secure favorable loan terms, making it crucial to manage your debts effectively. F5 Mortgage provides personalized support to help you navigate these financial metrics.

- Changing financial situations make it important to maintain financial stability during the pre qualify mortgage process. Avoid significant changes, such as switching jobs or incurring new debt, as these can adversely affect your eligibility. Job changes are a common reason for mortgage denial, particularly if they lead to gaps in employment history. Our team at F5 Mortgage is here to guide you through these challenges and support you every step of the way.

- Communication with Lenders: Keep communication lines open with your lender. Addressing any issues promptly can prevent complications later on. Proactive communication can greatly enhance your chances of a smooth initial assessment experience. At F5 Mortgage, we prioritize transparent communication, ensuring you feel supported throughout the entire process.

By understanding these challenges and preparing accordingly, families can navigate the pre qualify mortgage process more effectively, bringing them closer to securing their dream home. Reach out to F5 Mortgage today for personalized assistance and to experience a refreshing approach to mortgage financing.

Conclusion

Understanding the mortgage pre-qualification process is essential for families looking to upgrade their homes. We know how challenging this can be, but by grasping the steps involved—from initial qualification to gathering necessary documentation and comparing lenders—families can position themselves for success in the competitive housing market. This foundational knowledge empowers buyers to navigate their financial landscape and enhances their credibility when making offers on homes.

The article outlines four critical steps:

- Understanding mortgage pre-qualification

- Gathering necessary documentation

- Comparing lenders

- Navigating common challenges

Each step provides valuable insights into how families can effectively prepare for their home purchase. By being proactive and informed, potential buyers can avoid common pitfalls that may arise during the pre-qualification process, ultimately leading to a smoother and more successful home-buying experience.

As families embark on their journey to homeownership, it is crucial to take these steps seriously. The mortgage pre-qualification process can significantly impact loan approval and overall financial health. By seeking assistance and utilizing available resources, families can overcome challenges and secure the best possible loan terms. Embracing this proactive approach will not only facilitate a successful home upgrade but also foster long-term financial stability.

Frequently Asked Questions

What is mortgage pre-qualification?

Mortgage pre-qualification is the initial step in the home buying process that helps you understand your borrowing capacity based on your financial profile. It typically involves a gentle financial assessment with minimal documentation, requiring basic details about your income, debts, and assets.

Why is mortgage pre-qualification important?

Pre-qualification provides a preliminary estimate of how much you can borrow, which is vital for establishing a realistic budget as you search for your new home.

How does pre-qualification differ from pre-approval?

Pre-qualification gives a rough estimate of your borrowing capacity, while pre-approval involves a thorough assessment of your financial situation, including a hard credit check and submission of supporting documents. Pre-approval indicates that the lender believes you are a strong candidate for a mortgage.

What are the benefits of getting pre-approved?

Pre-approval provides an estimate of your loan amount, interest rate, and potential monthly payments. It strengthens your position when making offers on homes and enhances your credibility with sellers.

Do many homebuyers understand the difference between pre-qualification and pre-approval?

Studies indicate that around 40% of homebuyers do not fully understand the distinctions between pre-approval and initial qualification.

How can initial approval help homebuyers?

Initial approval helps you set a homebuying budget and assess your financial readiness, which is vital for navigating the home buying process.

What challenges do homebuyers face in the mortgage application process?

In 2024, the average home loan application rejection rate rose to nearly 21%, making it critical for homebuyers to understand pre-qualification and pre-approval processes.

How can families benefit from the pre-qualification process?

Many families find themselves better prepared to secure favorable loan terms and ultimately achieve their homeownership dreams by successfully navigating the pre-qualification process.