Overview

Finding the best mortgage broker for your family can feel overwhelming, but it doesn’t have to be. We know how challenging this can be, which is why it’s essential to evaluate brokers based on four key criteria:

- Experience

- Reputation

- Communication style

- Financial options

By focusing on these aspects, you can find a broker who truly understands your needs.

Asking the right questions during the selection process is crucial. This not only helps you gauge their expertise but also ensures they align with your family’s unique situation. Remember, a supportive broker will guide you through the complexities of home financing, making the journey smoother.

Ultimately, choosing the right mortgage broker is about securing favorable terms for your family’s future. By taking these steps and prioritizing your concerns, you’re empowering yourself to make informed decisions. We’re here to support you every step of the way.

Introduction

Navigating the labyrinth of home financing can often feel like an insurmountable challenge. We know how overwhelming it can be, especially for families seeking the best mortgage options. Mortgage brokers play a pivotal role in this process, acting as trusted intermediaries who can simplify the complexities of securing a loan.

By understanding the essential criteria for selecting the right broker, families can unlock significant advantages in their home-buying journey. Learning how to effectively evaluate and negotiate offers empowers you to make informed decisions. But with so many options available, how can you ensure you are making the best choice for your unique needs? We’re here to support you every step of the way.

Understand the Role of a Mortgage Broker

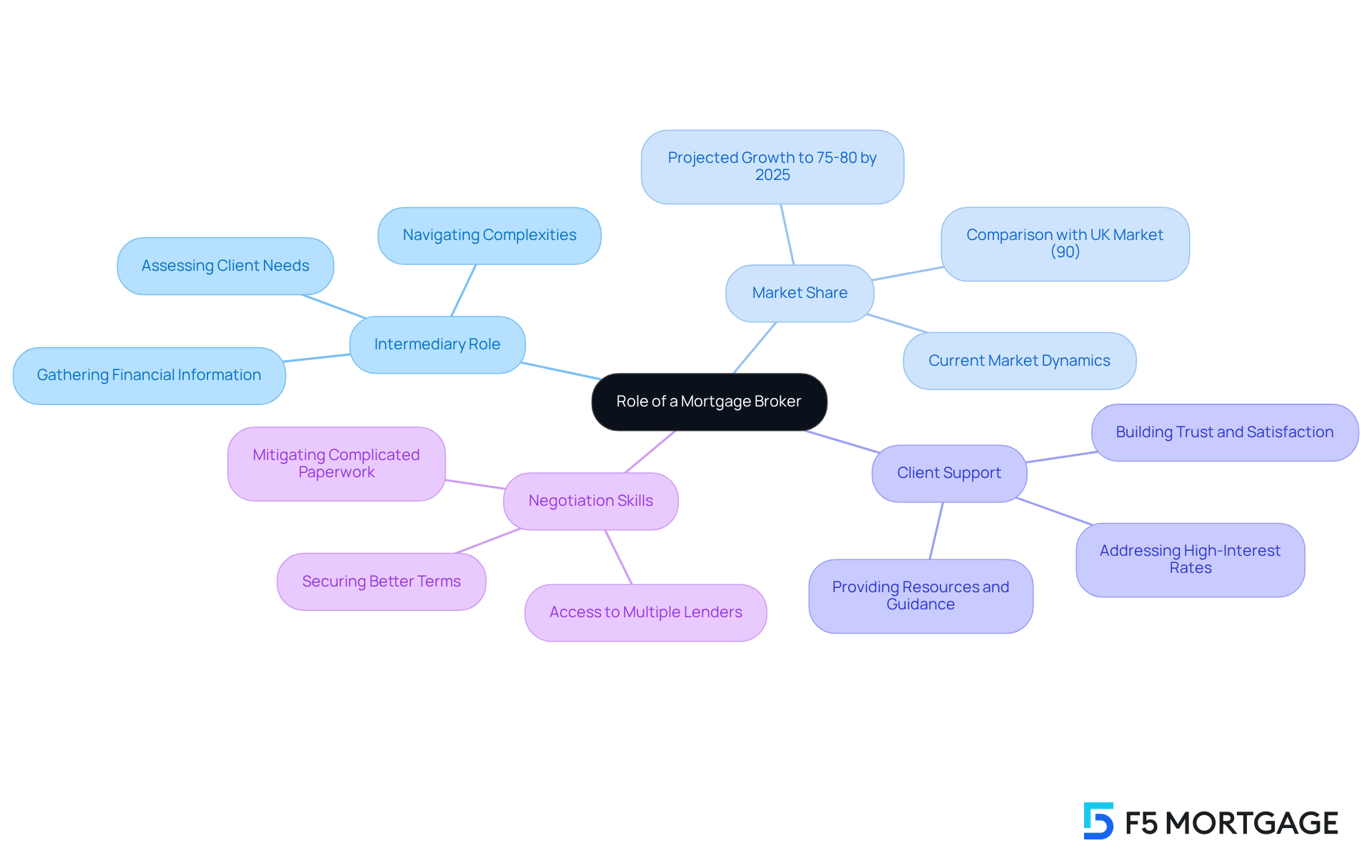

Navigating the loan process can feel overwhelming, but a loan broker is here to help. Acting as a vital intermediary between you and potential financiers, they assist you in managing the complexities of obtaining a loan. By gathering information about your financial situation and assessing your needs, brokers shop around to find the best mortgage broker options available for you. With access to a wide range of lenders, they often negotiate better terms than you might find on your own.

In fact, it’s estimated that by 2025, the intermediary market share in Australia could reach 75% to 80%. This reflects their growing importance in the home purchasing landscape. Understanding the role of the best mortgage broker is crucial, as it empowers you to leverage their expertise effectively throughout the financing process. We know how challenging this can be, and brokers are here to help you navigate specific hurdles like high-interest rates and complicated paperwork, ensuring a smoother experience.

The connections formed between agents and clients often lead to increased satisfaction. Many positive testimonials highlight the trust and peace of mind clients experience during their home-buying journey. As Anja Pannek, CEO of MFAA, wisely states, “The importance that loan consultants provide their clients cannot be overlooked.” We’re here to support you every step of the way, making your journey toward homeownership a little easier.

Identify Key Criteria for Selecting a Broker

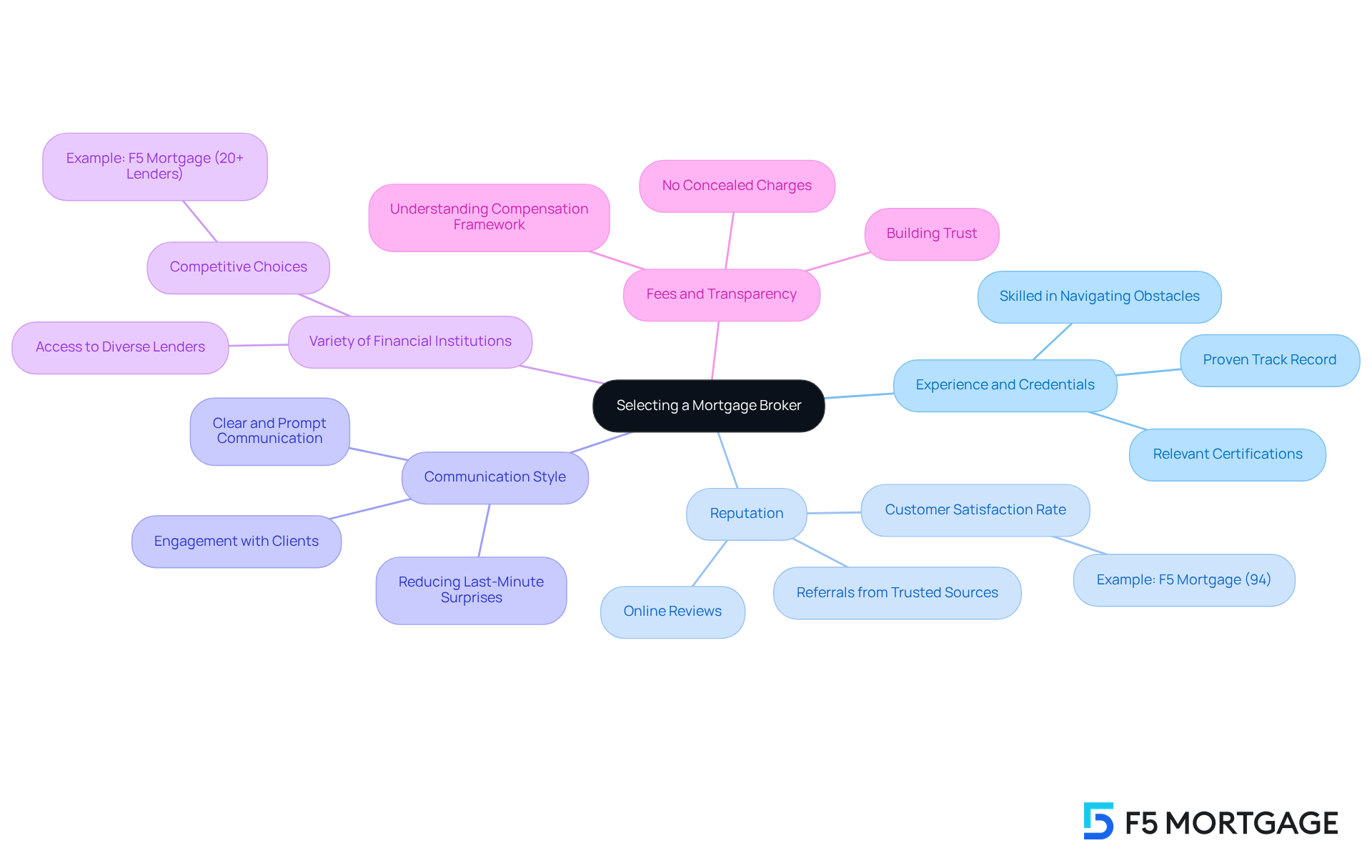

When selecting the best mortgage broker, it’s important to keep in mind several key criteria that can guide your decision-making process.

-

Experience and Credentials: We know how challenging this can be, so it’s essential to choose agents with a proven track record and relevant certifications. Skilled agents are adept at navigating obstacles, which can significantly influence your mortgage journey.

-

Reputation: Investigate online reviews and seek referrals from trusted sources. An agent with a history of positive feedback, such as F5 Mortgage, which has assisted over 1,000 families and boasts a customer satisfaction rate of 94%, is more likely to provide exceptional service.

-

Communication Style: Choose an agent who communicates clearly and promptly. Effective communication ensures you remain informed throughout the mortgage process, reducing the likelihood of last-minute surprises. Engaging early with clients can further enhance satisfaction, making the process smoother for everyone involved.

-

Variety of Financial Institutions: Verify that the intermediary has access to a diverse selection of financial institutions. This variety enhances your opportunities for obtaining advantageous terms, as firms such as F5 Mortgage collaborate with more than twenty leading lenders to present competitive choices tailored to your needs.

-

Fees and Transparency: It’s crucial to comprehend the compensation framework of the intermediary and verify that there are no concealed charges. A transparent fee arrangement fosters trust and helps you make informed financial decisions.

By concentrating on these standards, you can find the best mortgage broker who aligns with your objectives and enhances your homeownership journey. Remember, we’re here to support you every step of the way.

Evaluate Potential Brokers: Questions to Ask

When assessing potential mortgage professionals, we understand how crucial it is to ask the right questions to identify the best mortgage broker. These inquiries can help you determine their suitability for your unique needs:

- What types of loans do you specialize in? Understanding their expertise in various loan options, such as fixed-rate, FHA, VA, or jumbo loans, can help you see if they align with your financial goals.

- How many financial institutions do you collaborate with? An intermediary with a broad network of over two dozen lenders, like F5 Mortgage, can provide a diverse selection of options, increasing your chances of finding the best deal.

- What is your fee structure? Clarifying how they charge for their services—whether through a flat fee, commission, or a combination—can help you avoid unexpected costs later in the process.

- Can you provide references? Speaking with past clients can offer valuable insights into the broker’s service quality and customer satisfaction, which is notably high at 94% for F5 Mortgage. This can help you assess the reliability and effectiveness of the best mortgage broker.

- How will you communicate with me throughout the process? Setting clear communication expectations from the beginning can prevent misunderstandings and make your experience smoother as you navigate the intricacies of obtaining a loan.

- What unique services do you offer? Inquire about customized loan consultations and tools like an easy-to-use loan calculator, which can enhance your overall experience and assist you in making informed choices.

We know how challenging this can be, and we’re here to support you every step of the way.

Compare Offers and Negotiate Terms

To effectively compare and negotiate mortgage offers from different brokers, follow these essential steps:

-

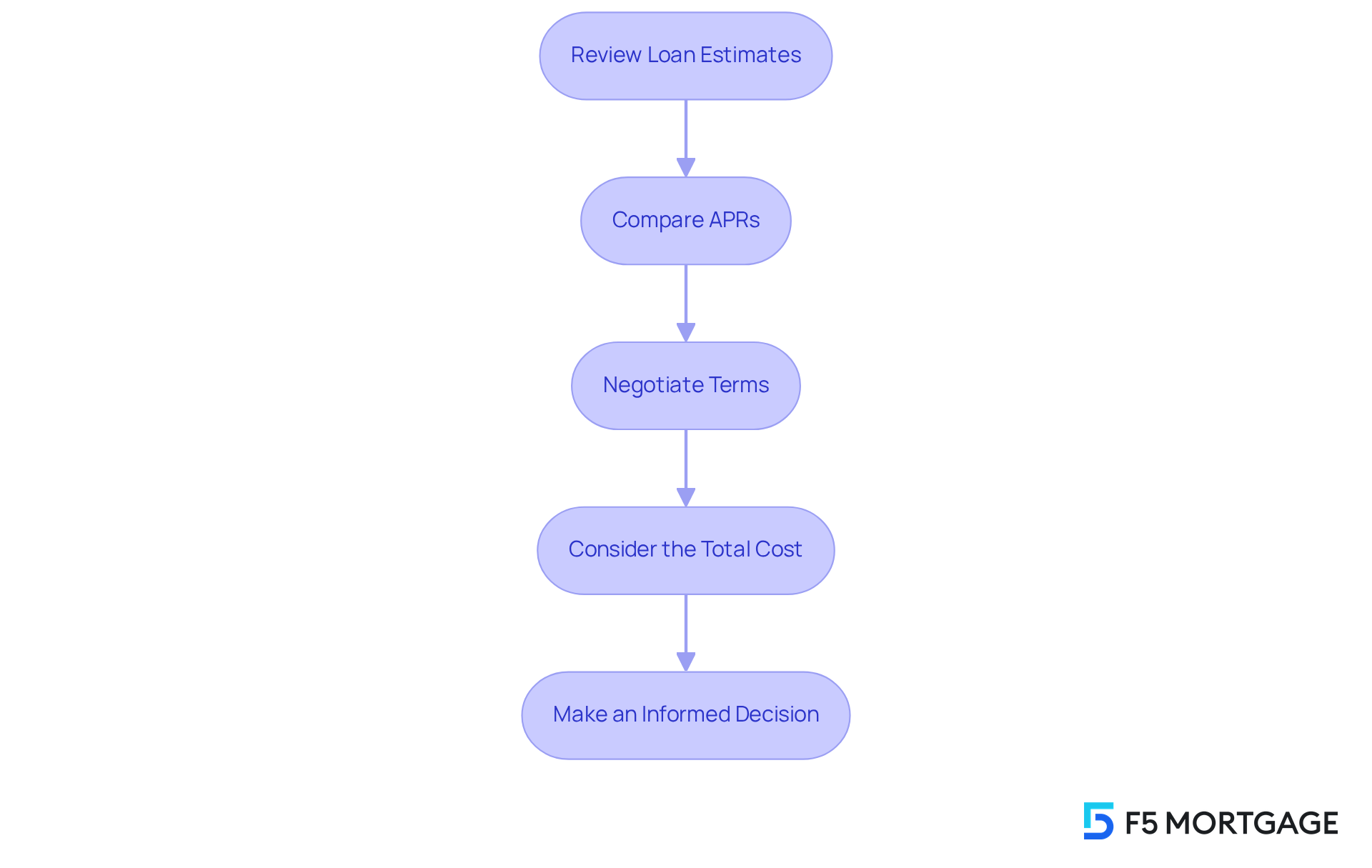

Review Loan Estimates: We know how overwhelming it can be to sift through numerous Loan Estimates. Pay close attention to interest rates, closing costs, and monthly payments. This initial review is crucial for understanding the financial implications of each offer, helping you feel more confident in your choices.

-

Compare APRs: The Annual Percentage Rate (APR) is more than just a number; it includes both the interest rate and related charges, giving you a clearer picture of the total expense of the loan. This metric is vital for making informed comparisons between different loan options, ensuring you choose what truly fits your needs.

-

Negotiate Terms: Engaging in discussions with intermediaries can feel daunting, but remember, you have the power to ask for lower fees or better interest rates. Don’t hesitate to mention competing offers. Being open about your intention to consult various financiers can encourage brokers to present their best pricing. As Brian Green, a senior loan advisor, wisely states, “Being transparent that you plan on talking to multiple lenders before making a decision helps make sure each lender is putting their best foot forward.”

-

Consider the Total Cost: It’s easy to focus solely on monthly payments, but we encourage you to look beyond that. Assess the overall expense of the loan throughout its duration, including all interest and charges. This comprehensive view will help you understand the long-term financial impact of your mortgage. Additionally, keep in mind that some fees, like application and processing fees, are negotiable, while others, such as appraisal and recording fees, are typically non-negotiable.

-

Make an Informed Decision: After thoroughly comparing all aspects, select the best mortgage broker and offer that aligns best with your financial objectives and comfort level. Remember, the right choice should not only meet your immediate needs but also support your long-term financial health.

By adhering to these steps, you can improve your negotiating strength and obtain a loan that meets your family’s requirements. With the current 30-year fixed-rate mortgage rate at 6.89%, being proactive in negotiations is more important than ever to ensure you receive the best possible terms. Furthermore, with 44.4% of sellers agreeing to concessions during negotiations, there are opportunities to request reductions in fees or other favorable terms.

Conclusion

Finding the right mortgage broker is a crucial step for families navigating the often complex world of home financing. We understand how challenging this can be, and by recognizing the pivotal role that mortgage brokers play, families can leverage their expertise to simplify the loan process and secure favorable terms. This knowledge empowers families to make informed decisions that align with their financial goals, ultimately leading to a smoother home-buying experience.

Key considerations for selecting a mortgage broker include:

- Experience

- Reputation

- Communication style

- Access to a variety of lenders

Asking the right questions during the evaluation process can further clarify which broker is best suited to meet specific needs. Additionally, comparing offers and negotiating terms effectively can lead to significant savings and a better overall loan experience.

In conclusion, the journey to homeownership can be daunting, but with the right mortgage broker by your side, it becomes much more manageable. We’re here to support you every step of the way. Families are encouraged to take the time to research and engage with potential brokers, ensuring they choose a partner who not only understands their unique circumstances but also advocates for their best interests. By doing so, families can navigate the mortgage landscape with confidence and secure the best possible outcomes for their future.

Frequently Asked Questions

What is the role of a mortgage broker?

A mortgage broker acts as an intermediary between you and potential lenders, helping you navigate the loan process by gathering information about your financial situation, assessing your needs, and shopping around for the best mortgage options available.

How do mortgage brokers help with obtaining a loan?

Mortgage brokers assist by managing the complexities of obtaining a loan, negotiating better terms with lenders, and providing access to a wide range of financing options that you might not find on your own.

What is the projected market share of mortgage brokers in Australia by 2025?

It is estimated that the intermediary market share in Australia could reach 75% to 80% by 2025, indicating the growing importance of mortgage brokers in the home purchasing landscape.

Why is it important to understand the role of a mortgage broker?

Understanding the role of a mortgage broker empowers you to leverage their expertise effectively throughout the financing process, ensuring a smoother experience when navigating challenges like high-interest rates and complicated paperwork.

What benefits do clients experience when working with mortgage brokers?

Clients often experience increased satisfaction due to the trust and peace of mind that comes from the connections formed with their brokers during the home-buying journey. Positive testimonials highlight the support and guidance brokers provide.