Overview

Securing your home mortgage pre-approval can feel overwhelming, but we’re here to support you every step of the way. To make this process easier, follow these three essential steps:

- Gather your financial documents

- Check your credit score

- Choose a suitable lender

We know how challenging this can be, but organizing your financial information and understanding your credit standing are crucial. By doing so, you can enhance your chances of receiving a favorable pre-approval from a lender. This step is vital in your home buying journey, and taking these actions can empower you to move forward with confidence.

Introduction

Securing a home mortgage pre-approval can be a pivotal moment in your journey to homeownership. We understand how daunting this process can feel for many prospective buyers. By grasping the intricacies of mortgage pre-approval, you not only empower yourself with knowledge but also enhance your negotiating power in a competitive market.

Yet, what happens when the excitement of homeownership meets the complexities of financial assessments? This guide is here to support you every step of the way, unraveling the essential steps to obtaining pre-approval. We will address common concerns and illuminate the path toward making informed decisions in the home-buying process.

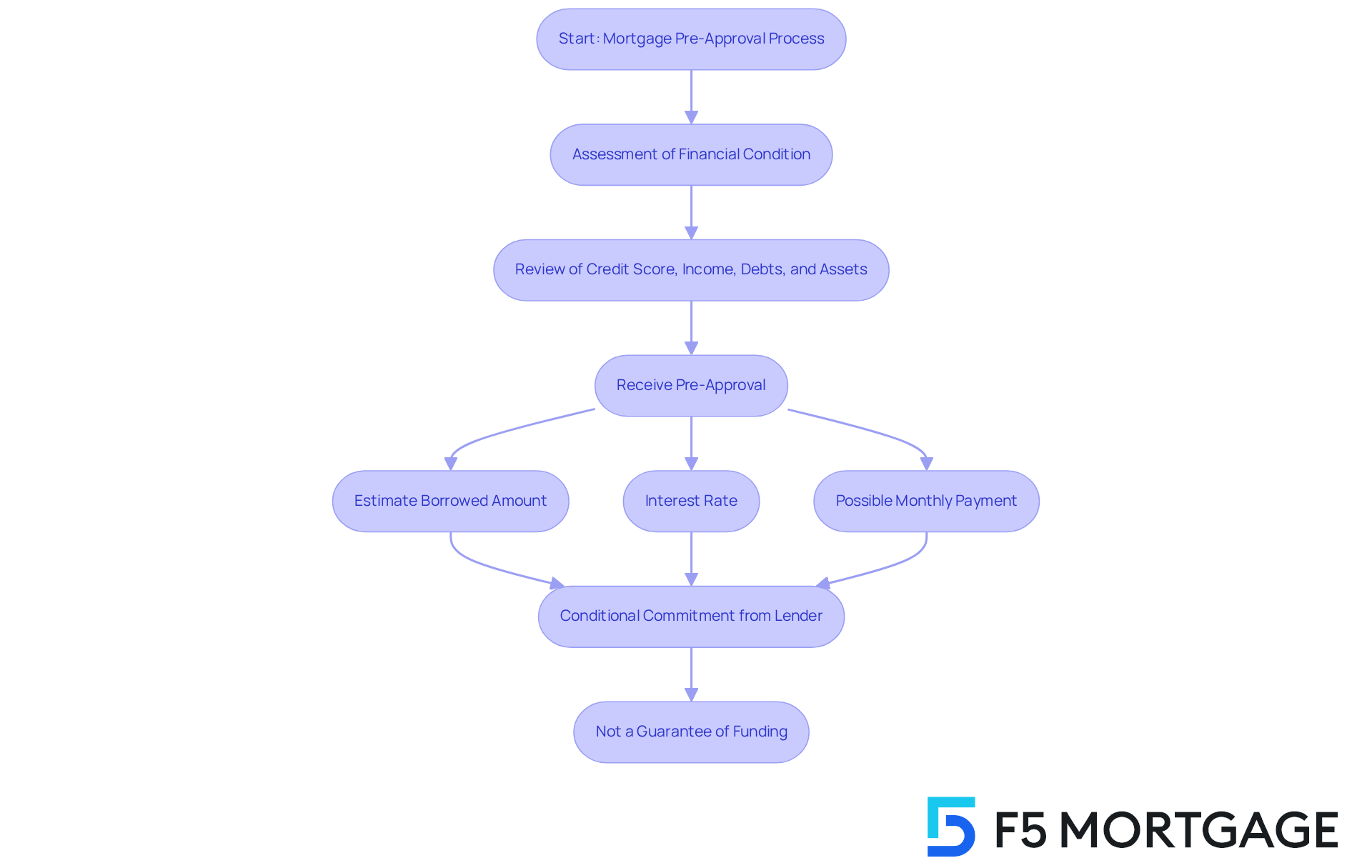

Understand Mortgage Pre-Approval

Home mortgage pre approval is a crucial step in your home purchasing journey. We understand how overwhelming this process can feel, and that’s why we’re here to support you every step of the way. This important process involves a creditor assessing your financial condition to determine how much they can offer you. Typically, this includes a thorough review of your credit score, income, debts, and assets.

When you receive home mortgage pre approval, it indicates that the financial institution considers you a based on the information you provide. This usually includes an estimate of your borrowed amount, interest rate, and possible monthly payment. Home mortgage pre approval provides you with a conditional commitment from the lender, significantly enhancing your bargaining power when making an offer on a home.

Additionally, having this clarity helps you understand your budget, allowing you to focus on properties within your financial reach. Remember, a home mortgage pre approval does not guarantee funding; it signifies your eligibility based on the details shared during the application process. At F5 Mortgage, we leverage user-friendly technology to simplify this journey, ensuring a stress-free experience as we guide you through the mortgage process.

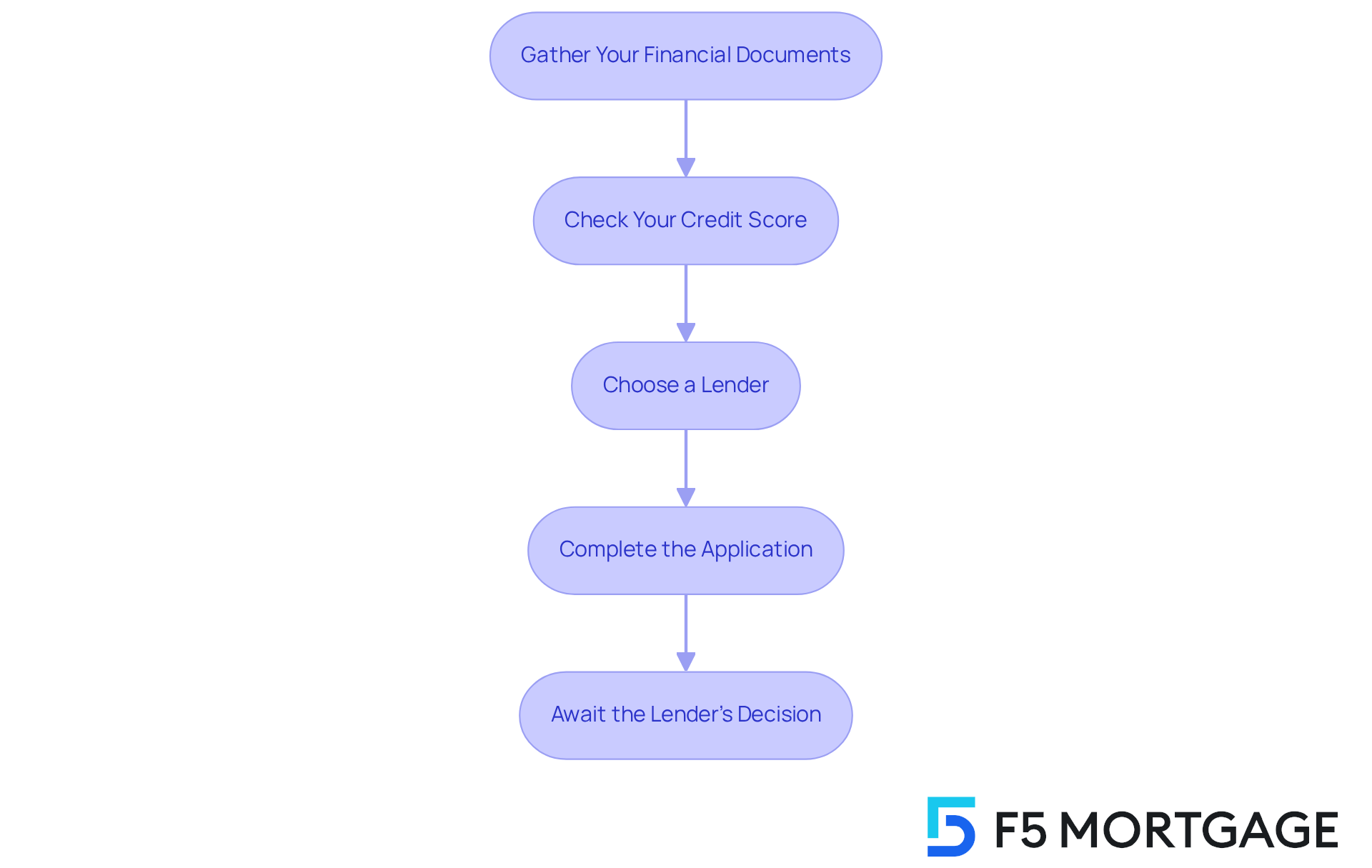

Follow These 5 Steps to Get Pre-Approved

- Gather Your Financial Documents: We know how overwhelming it can be to start this process. Begin by collecting essential documents like your W-2 forms, recent pay stubs, bank statements, and tax returns. Creditors will need this information to evaluate your financial well-being, including your Debt-to-Income (DTI) ratio, which should ideally be under 43% for mortgage financing.

- Check Your Credit Score: Before you apply, take a moment to check your credit score. Understanding where you stand can alleviate some stress. A higher score may lead to more competitive mortgage rates, especially if you aim for a conventional financing option, which typically requires a score of at least 740.

- Choose a Lender: Selecting the right lender is crucial, and we’re here to help. Research and find a lender that aligns with your needs, considering factors like interest rates, customer service, and the variety of financing options available. For instance, F5 Mortgage offers various refinancing alternatives, including FHA mortgages, which require a minimum credit score of 580 and involve two insurance premiums: an upfront premium of 1.75% of the amount financed and an annual premium ranging from 0.45% to 0.85%. Additionally, VA loans are accessible for military personnel and their partners, providing competitive rates and a streamlined application process.

- Complete the Application: When you’re ready, fill out the lender’s pre-approval application form. It’s important to be truthful and detailed in your answers to avoid any delays. Remember, F5 Mortgage is here to assist you in navigating this process, ensuring compliance and enhancing your chances of approval.

- Await the Lender’s Decision: After submitting your application, take a deep breath. The lender will evaluate your information and, if you meet their criteria, provide you with a conditional approval letter. This letter will outline the amount you are for, empowering you when making offers on homes. With F5 Mortgage, you can expect outstanding service and support throughout this journey.

Address Common Concerns About Pre-Approval

Many prospective homebuyers have concerns about the home mortgage pre-approval process. We understand how challenging this can be, so here are some common worries and ways to address them:

- Will applying for pre-approval hurt my credit score? While financial institutions will conduct a hard inquiry on your credit report, this is a standard part of the process. If you limit your applications to a short time frame, the impact on your score will be minimal.

- What if I don’t get pre-approved? Don’t be discouraged if you are not pre-approved. Instead, view this as an opportunity to review your financial situation, improve your credit score, or save for a larger down payment. Remember, a home mortgage pre-approval indicates that a lender believes you are a good candidate for a mortgage, and it provides you with an estimate of your loan amount, interest rate, and potential monthly payment.

- How long does advance approval last? Typically, a pre-approval is valid for 60 to 90 days. If you don’t find a home within that time, you may need to reapply.

- Can I still change financial institutions after getting pre-approved? Yes, you can switch lenders at any time. However, it’s advisable to do so before you start making offers on homes to avoid confusion and delays.

At F5 Mortgage, we’re here to support you every step of the way in obtaining your home mortgage pre-approval. Our clients have expressed exceptional satisfaction with our services, often highlighting how our team helps navigate the complexities of the mortgage process, particularly the home mortgage pre-approval, ensuring a smooth experience from pre-approval to closing. Additionally, we offer various down payment assistance programs, such as FL Assist and the MI Home Loan program, which can significantly enhance your home buying opportunities.

Conclusion

Securing a home mortgage pre-approval is a vital step in your home buying journey, one that can significantly boost your financial confidence and purchasing power. We understand how daunting this process can be, but by grasping the intricacies of pre-approval—from gathering necessary documents to selecting the right lender—you can navigate this complex landscape with greater ease. This journey not only clarifies your budget but also positions you as a serious candidate in the eyes of sellers.

In this article, we’ve highlighted essential insights, such as:

- The importance of a solid credit score

- The steps needed to complete the pre-approval application

- Ways to address common concerns that may arise

Each of these elements is crucial in ensuring that you are well-prepared and informed, ultimately leading to a smoother home purchasing experience.

As your path to homeownership unfolds, taking the time to secure a mortgage pre-approval can lay the groundwork for success. Embracing this proactive approach alleviates stress and empowers you to make informed decisions in a competitive market. Whether you’re weighing the benefits of pre-approval or understanding the documentation required, the insights shared here serve as a valuable guide for anyone looking to embark on their home buying journey. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage pre-approval?

Mortgage pre-approval is a process where a creditor assesses your financial condition to determine how much they can offer you for a home mortgage. This includes a review of your credit score, income, debts, and assets.

Why is mortgage pre-approval important?

Mortgage pre-approval is important because it indicates that a financial institution considers you a suitable candidate for a mortgage. It provides you with an estimate of your borrowing amount, interest rate, and possible monthly payment, enhancing your bargaining power when making an offer on a home.

Does mortgage pre-approval guarantee funding?

No, mortgage pre-approval does not guarantee funding. It signifies your eligibility for a mortgage based on the information provided during the application process.

How does mortgage pre-approval help in the home buying process?

Mortgage pre-approval helps you understand your budget, allowing you to focus on properties within your financial reach and making the home buying process more manageable.

How does F5 Mortgage assist with the mortgage pre-approval process?

F5 Mortgage utilizes user-friendly technology to simplify the mortgage pre-approval journey, ensuring a stress-free experience as they guide you through the mortgage process.