Overview

Navigating the mortgage pre-approval process can feel overwhelming, but we’re here to support you every step of the way. This article outlines three essential steps to help you achieve success:

- Understanding the process

- Gathering necessary documentation

- Navigating common challenges

First, let’s talk about the importance of a thorough financial evaluation. We know how challenging this can be, but taking the time to assess your financial situation is crucial. It sets the foundation for your mortgage journey.

Next, gathering the required paperwork can seem daunting. However, having everything in order can significantly enhance your chances of securing a mortgage efficiently. We’ll guide you on what documents you need and how to organize them.

Finally, addressing potential obstacles is key. By anticipating challenges and knowing how to navigate them, you empower yourself to move forward with confidence. This comprehensive guide is designed to help you overcome hurdles and achieve your homeownership dreams.

Introduction

Navigating the path to homeownership often begins with a crucial yet sometimes daunting step: mortgage pre-approval. We understand how challenging this can be. This formal process not only clarifies how much a buyer can borrow but also positions them as serious contenders in a competitive market.

As potential homeowners prepare to make one of the biggest financial decisions of their lives, understanding the mortgage pre-approval process can unlock opportunities and streamline their journey. However, what happens when unexpected challenges arise, or when the requirements seem overwhelming?

We’re here to support you every step of the way. This guide will illuminate the essential steps to mortgage pre-approval success, addressing common pitfalls and providing clarity for a smoother home-buying experience.

Understand Mortgage Pre-Approval

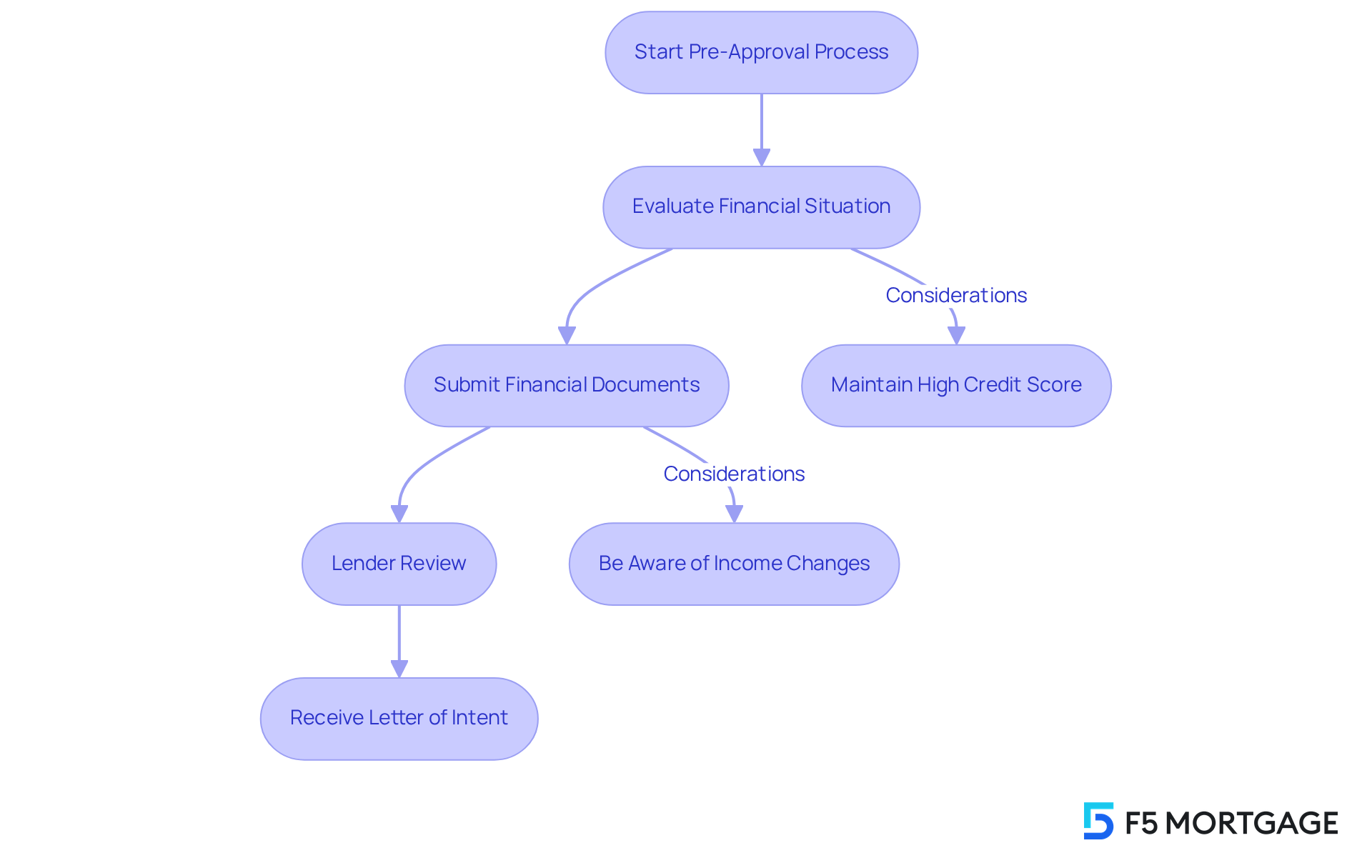

Obtaining pre approval for mortgage is an important step in your home-buying journey. It’s an official procedure where a lender evaluates your financial situation to determine how much you can borrow for a home. Unlike pre-qualification, which gives a rough estimate based on self-reported information, pre-authorization involves a thorough review of your financial documents, including credit history, income, and debts. This process results in a letter of intent, showing sellers that you are a serious buyer with the financial backing to make an offer. Understanding this distinction is vital for homebuyers, as it simplifies the purchasing experience and enhances your negotiating power when making an offer on a property.

The initial approval process can often be completed in less than an hour, providing buyers with a significant advantage in today’s market. This proactive approach allows you to act quickly in a competitive environment, where many real estate agents require a letter of approval to schedule showings. Without this letter, you risk missing out on desirable properties.

Experts emphasize that obtaining pre approval for mortgage can be a game changer. It signals to sellers that you are committed and financially ready, which is essential in a market where mortgage rates have recently ranged from 6% to 8%. Additionally, keeping a high credit score during this time is crucial, as it can lead to quicker approvals and better mortgage terms. Major changes to your income, such as job loss or salary cuts, can complicate the approval process and may even lead to denial.

By focusing on mortgage pre-qualification, homebuyers can zero in on properties that align with their budget and financial capabilities, ultimately increasing their chances of securing their dream home. Moreover, reducing contingencies in offers can strengthen your homebuyer profile, making your offer more attractive in a competitive market. With over 1,000 families assisted by F5 Mortgage, the brokerage’s dedication to and a streamlined process shines through.

Gather Required Documentation

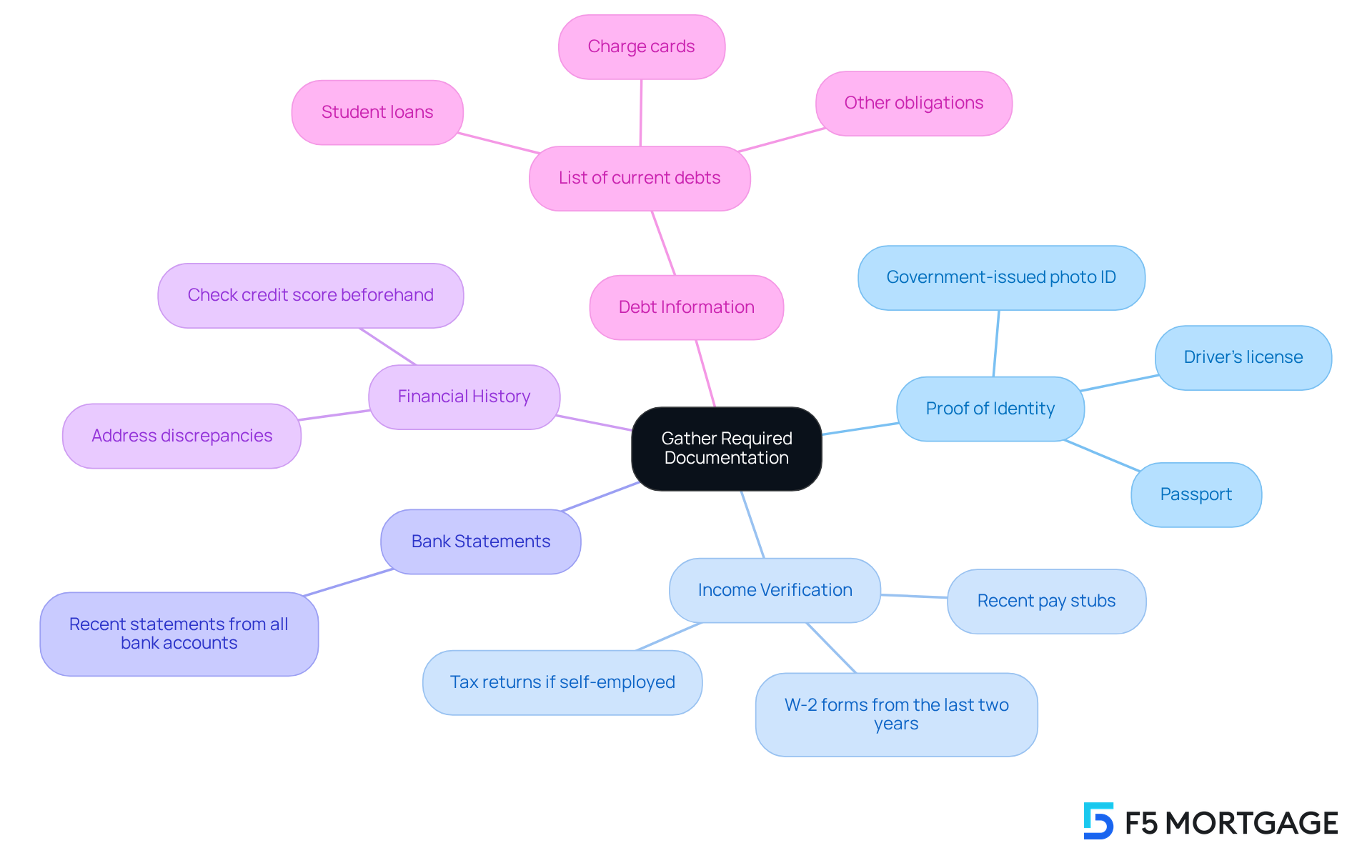

Obtaining pre approval for mortgage can feel overwhelming, but it is crucial to gather the necessary documentation for a smoother process. Here’s a helpful checklist to prepare:

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport.

- Income Verification: Recent pay stubs, W-2 forms from the last two years, and tax returns if self-employed.

- Bank Statements: Recent statements from all bank accounts to verify your assets.

- Financial History: While lenders will retrieve your report, checking your score beforehand allows you to address any discrepancies.

- Debt Information: A detailed list of current debts, including charge cards, student loans, and other obligations.

Being well-prepared with these documents can significantly speed up the process of obtaining pre approval for mortgage. Delays often occur due to missing documentation, which can hinder your ability to secure a mortgage in a timely manner. We know how challenging this can be, but according to industry experts, is one of the best ways to improve your chances of pre approval for mortgage (Lauren Nowacki). By showing organization and preparedness, you indicate to lenders that you are serious about your home purchase, enhancing your chances of a seamless approval process. Remember, obtaining a pre approval for mortgage typically lasts 60 to 90 days, so being prepared can make a significant difference in your home buying journey. Additionally, if you are receiving financial assistance for your down payment, be sure to provide a gift letter to confirm that the funds do not need to be repaid.

Navigate Common Challenges and FAQs

Navigating the pre approval for mortgage process can present several challenges, and we understand how overwhelming it can feel. Here are some common issues and FAQs that may help you along the way:

- What if my credit score is low? If your rating falls below the preferred range, it’s advisable to take proactive steps to improve it before applying. This may involve reducing outstanding debts or correcting inaccuracies on your financial report. Most lenders generally require a , but options like FHA loans may be accessible for scores as low as 500-580, depending on other financial factors. Notably, 38 percent of aspiring homeowners believe that a prospective buyer needs ‘excellent credit’ to secure a mortgage, which can lead to misconceptions about eligibility.

- How long does the preliminary approval duration last? The initial approval process typically varies from several hours to a few days, depending on how quickly you submit the necessary documentation. F5 Mortgage, for example, guarantees approval in less than an hour, enhancing the experience for clients. It’s important to note that prior approval is not a final commitment; underwriters can still deny loans based on further evaluations.

- Can I get pre-approved with a part-time job? Yes, acquiring prior approval with a part-time job is possible, but you may need to provide additional documentation to show income stability. Lenders prefer borrowers with stable income streams, so transparency in your monetary situation is essential. Additionally, lenders prefer a debt-to-income (DTI) ratio under 43% for mortgage approval, which is an important factor to consider.

- What occurs if my monetary situation changes after pre-approval? If your monetary situation changes—such as a job loss or a rise in debt—it’s crucial to inform your lender promptly. Alterations in your financial profile can greatly influence your final loan approval, as lenders reevaluate your eligibility during the underwriting stage. Maintaining stable finances and avoiding major changes during this period is crucial to prevent potential issues.

By comprehending these challenges and knowing how to tackle them, you can maneuver through the pre approval for mortgage process more effectively, thereby enhancing your chances of obtaining the mortgage you require. Furthermore, remember that obtaining pre approval for mortgage with multiple lenders within a 45-day window does not negatively impact your credit score, allowing you to explore your options without concern. We’re here to support you every step of the way.

Conclusion

Obtaining pre-approval for a mortgage is a crucial step that empowers homebuyers by providing a clear understanding of their financial capabilities. We know how challenging this can be, and this process not only enhances your position in negotiations but also streamlines your home-buying journey. It’s essential for anyone looking to purchase property.

Let’s explore three key steps for achieving mortgage pre-approval:

- Understanding the process

- Gathering the necessary documentation

- Navigating common challenges

By differentiating between pre-approval and pre-qualification, you can approach your home search with confidence. Furthermore, being well-prepared with the required documents and addressing potential hurdles can significantly improve your chances of securing a favorable mortgage.

Ultimately, the significance of mortgage pre-approval cannot be overstated. It serves as a vital tool in the competitive real estate market, allowing you to act swiftly and present yourself as a serious contender. By following these steps and being proactive in addressing your financial concerns, you can pave the way toward achieving your dream of homeownership. Embracing the pre-approval process is not just about securing a loan; it’s about taking control of your financial future and making informed decisions in your home-buying journey. We’re here to support you every step of the way.

Frequently Asked Questions

What is mortgage pre-approval?

Mortgage pre-approval is an official process where a lender evaluates your financial situation to determine how much you can borrow for a home. It involves a thorough review of your financial documents, including credit history, income, and debts.

How does pre-approval differ from pre-qualification?

Pre-approval involves a detailed assessment of your financial situation and results in a letter of intent, while pre-qualification provides a rough estimate based on self-reported information without a thorough review.

Why is obtaining mortgage pre-approval important?

Obtaining mortgage pre-approval is important because it shows sellers that you are a serious buyer with financial backing, simplifies the purchasing experience, and enhances your negotiating power when making an offer on a property.

How long does the pre-approval process take?

The initial approval process can often be completed in less than an hour.

What advantages does pre-approval provide in a competitive market?

Pre-approval allows buyers to act quickly and is often required by real estate agents to schedule showings. It signals to sellers that you are committed and financially ready, which can help in securing desirable properties.

What factors can affect mortgage pre-approval?

Maintaining a high credit score is crucial for quicker approvals and better mortgage terms. Major changes to your income, such as job loss or salary cuts, can complicate the approval process and may lead to denial.

How can homebuyers improve their chances of securing a property?

By focusing on mortgage pre-qualification, homebuyers can target properties that align with their budget and financial capabilities. Reducing contingencies in offers can also strengthen their homebuyer profile and make their offers more attractive.