Overview

This article is dedicated to providing mortgage tips specifically designed for families earning around $150,000 annually, enhancing their home-buying experience. We understand how challenging this can be, and we’re here to support you every step of the way. It highlights the significance of:

- Personalized consultations

- Understanding financial ratios

- Exploring down payment assistance programs

- Obtaining pre-approval

Each of these elements is aimed at empowering families to make informed decisions and maximize their home-buying potential.

By acknowledging the hurdles you face, we can expand on solutions that will ease your journey. Personalized consultations can provide you with tailored advice, ensuring that your unique financial situation is taken into account. Understanding your financial ratios is crucial, as it helps you see where you stand and what options are available to you. Additionally, exploring down payment assistance programs can open doors that you may not have considered.

Finally, obtaining pre-approval is a vital step that can significantly enhance your confidence in the home-buying process. It shows sellers that you are a serious buyer, which can give you an edge in a competitive market. Remember, we’re here to guide you through these steps, ensuring you feel supported and informed as you navigate this important decision.

Introduction

Navigating the mortgage landscape can feel overwhelming, especially for families earning around $150,000 annually. We understand how challenging this can be. It’s essential to grasp the intricacies of home buying, from assessing affordability to exploring diverse loan options. This understanding is crucial for making informed decisions.

In this article, we delve into ten essential mortgage tips designed specifically for families like yours. Our goal is to empower you to maximize your home-buying potential while minimizing financial stress.

How can you leverage your income to secure the best mortgage options and avoid common pitfalls in the home-buying process? We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Consultations for 150K Salary Homebuyers

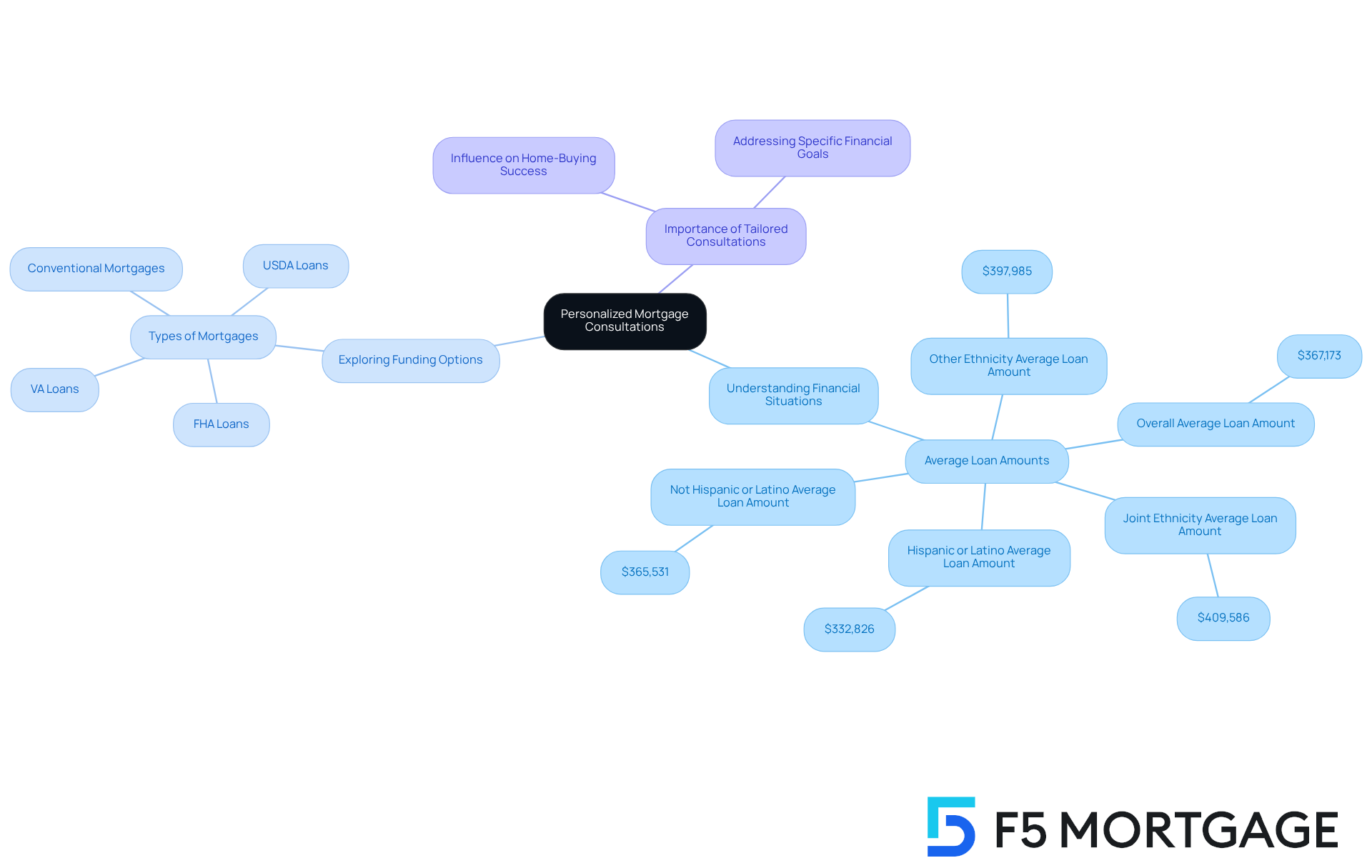

At F5 Mortgage, we understand how challenging the mortgage process can be for families. That’s why we focus on tailored loan consultations designed specifically for households earning around 150k annually. These personalized sessions empower you to gain a clear understanding of your financial situation while exploring various funding options that suit your needs.

By assessing your unique circumstances, our loan consultants can suggest the most suitable financing options, ensuring you maximize your home-buying capabilities with less stress. For instance, understanding typical financing amounts can be incredibly beneficial. In 2023, the average loan amount for home purchasers was approximately $367,173, with higher sums often seen among households with joint ethnicity, averaging $409,586. This data underscores the importance of personalized guidance, as it helps families navigate the complexities of mortgage financing effectively.

Mortgage brokers emphasize that tailored consultations can significantly influence your home-buying success. By addressing your specific financial goals and challenges, you will be better equipped to make informed decisions. Ultimately, this leads to a smoother and more successful home-buying experience. With F5 Mortgage’s commitment to , you can confidently embark on your journey to homeownership, knowing we are here to support you every step of the way.

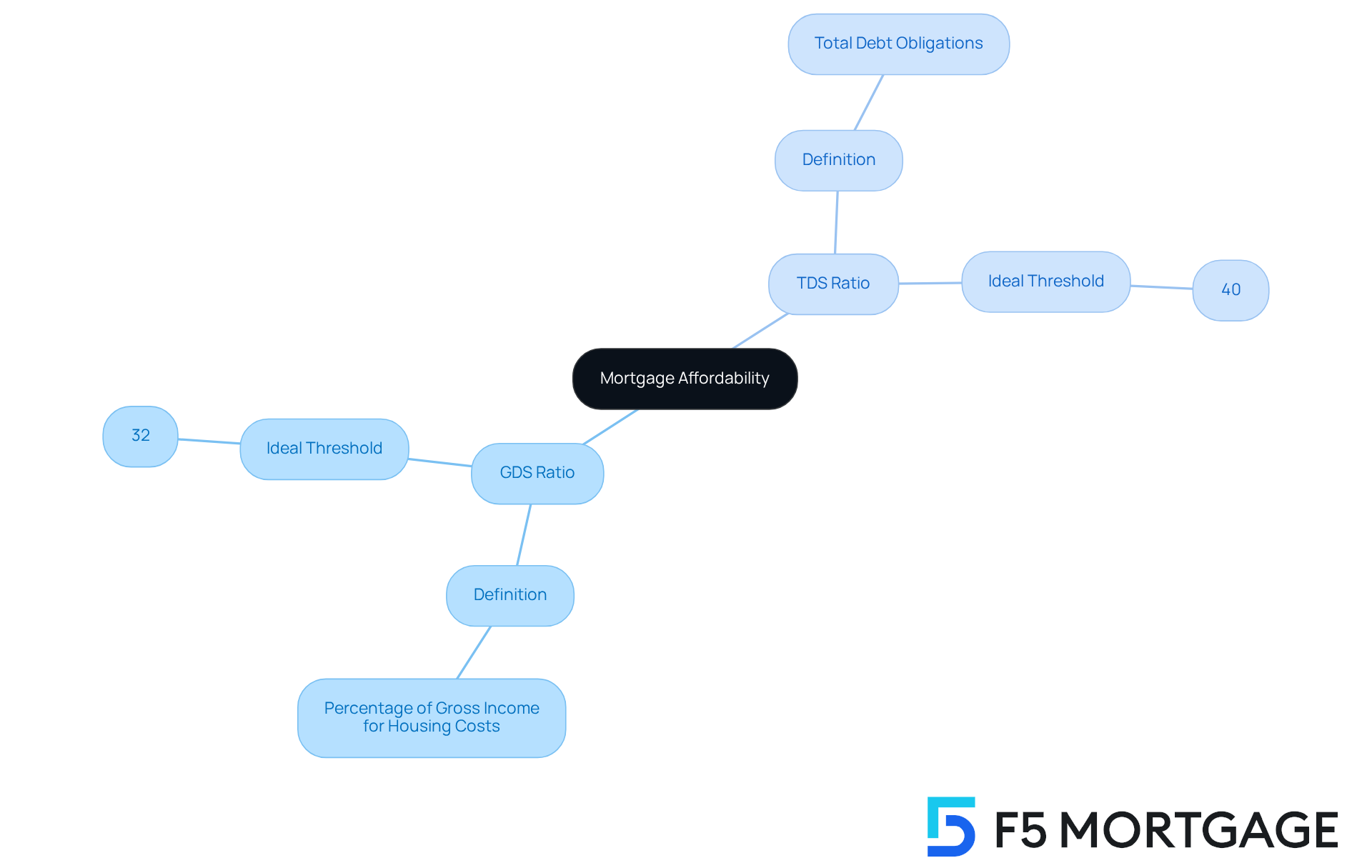

Understand GDS and TDS Ratios to Assess Mortgage Affordability

Understanding mortgage affordability can be daunting for families, but familiarizing yourselves with GDS and TDS ratios can make a significant difference. The GDS ratio reflects the percentage of your gross income that goes towards housing costs, while the TDS ratio encompasses all debt obligations. Ideally, your GDS should not exceed 32%, and your TDS should remain below 40%. We know how challenging this can be, but grasping these ratios empowers you to without overextending your finances.

Moreover, comparing lenders is crucial. It allows you to discover competitive rates and tailored services, like those offered by F5 Mortgage. By understanding your financial limits through GDS and TDS ratios, you can make informed choices as you explore various loan options. Remember, we’re here to support you every step of the way as you navigate this important decision.

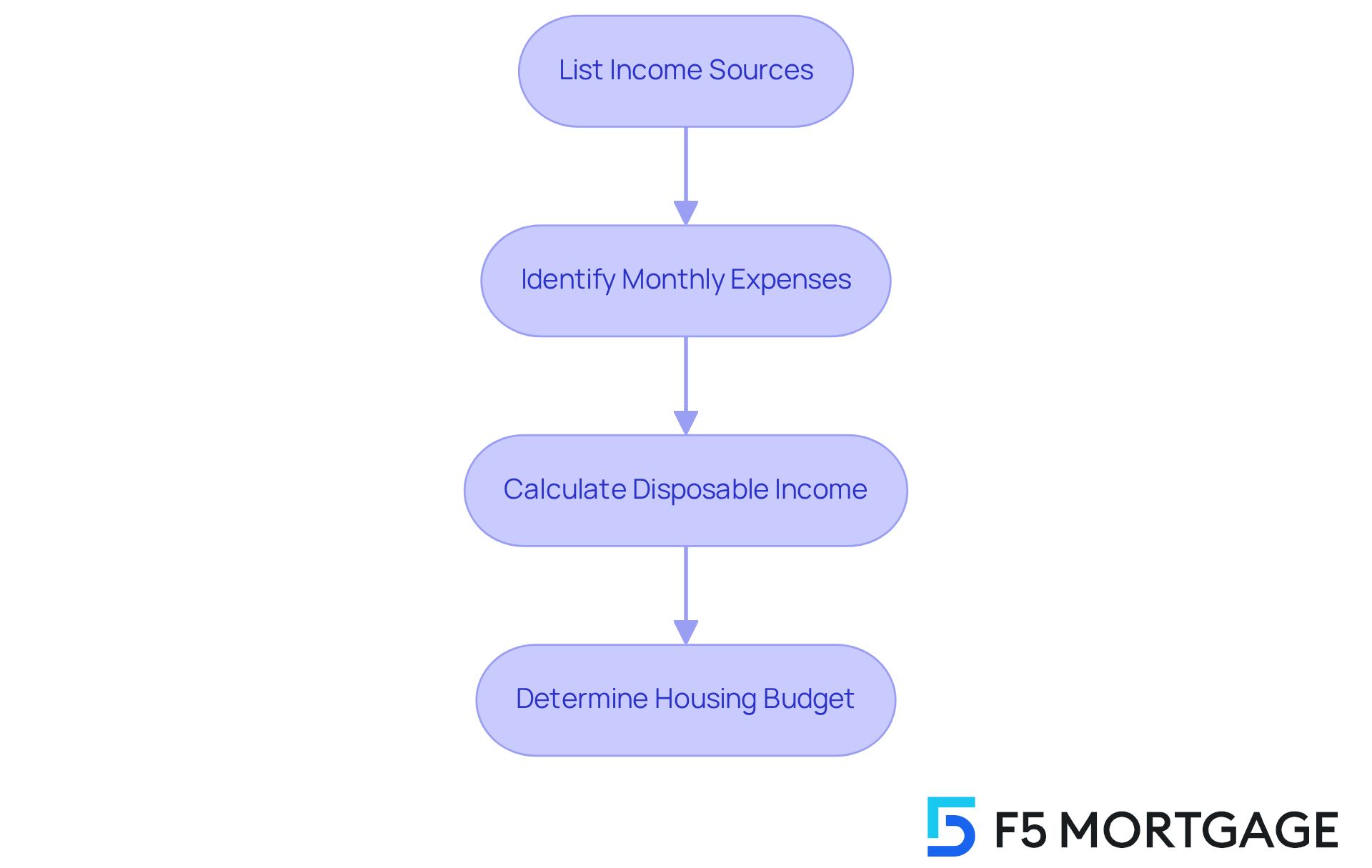

Break Down Monthly Income for Accurate Mortgage Calculations

Determining how much house you can afford is a crucial step, and we know how challenging this can be. Start by carefully breaking down your monthly income. Create a comprehensive list of all your income sources, including salaries, bonuses, and any side hustles. Then, deduct your monthly expenses, which encompass utilities, groceries, and debt obligations. This process will reveal your disposable income—the amount available for housing payments. Financial planners often recommend that housing costs should not exceed 28% of your gross monthly income. This ensures a manageable budget and peace of mind.

Understanding your Debt-to-Income (DTI) ratio is also essential. A maximum DTI of 43% is generally necessary for home loans, which can influence your loan rates. As Suze Orman wisely states, “The key to money is to stay invested.” This highlights the importance of making informed financial decisions.

To calculate your disposable income for mortgage affordability, follow these steps:

- List Income Sources: Include all forms of income, such as salaries, bonuses, and side jobs.

- Identify Monthly Expenses: Document all recurring expenses, including utilities, groceries, and debt obligations.

- Calculate Disposable Income: Subtract total monthly expenses from total monthly income.

- Determine Housing Budget: Apply the 28% rule to your gross monthly income to establish a comfortable housing budget.

For example, imagine a household earning 150k annually. This translates to a gross monthly income of approximately 150k per year. Following the 28% guideline, they should aim for housing costs around $3,500 per month. Alternatively, consider a household with a combined income of $100,000, resulting in a gross monthly income of around $8,333, allowing for housing expenses of roughly $2,333. By understanding and calculating disposable income and DTI, families can make informed decisions about their home buying options, ensuring financial stability and peace of mind.

Moreover, exploring refinancing options available in Colorado can provide additional pathways to secure favorable loan rates and terms, enhancing overall affordability. We’re here to as you navigate this important journey.

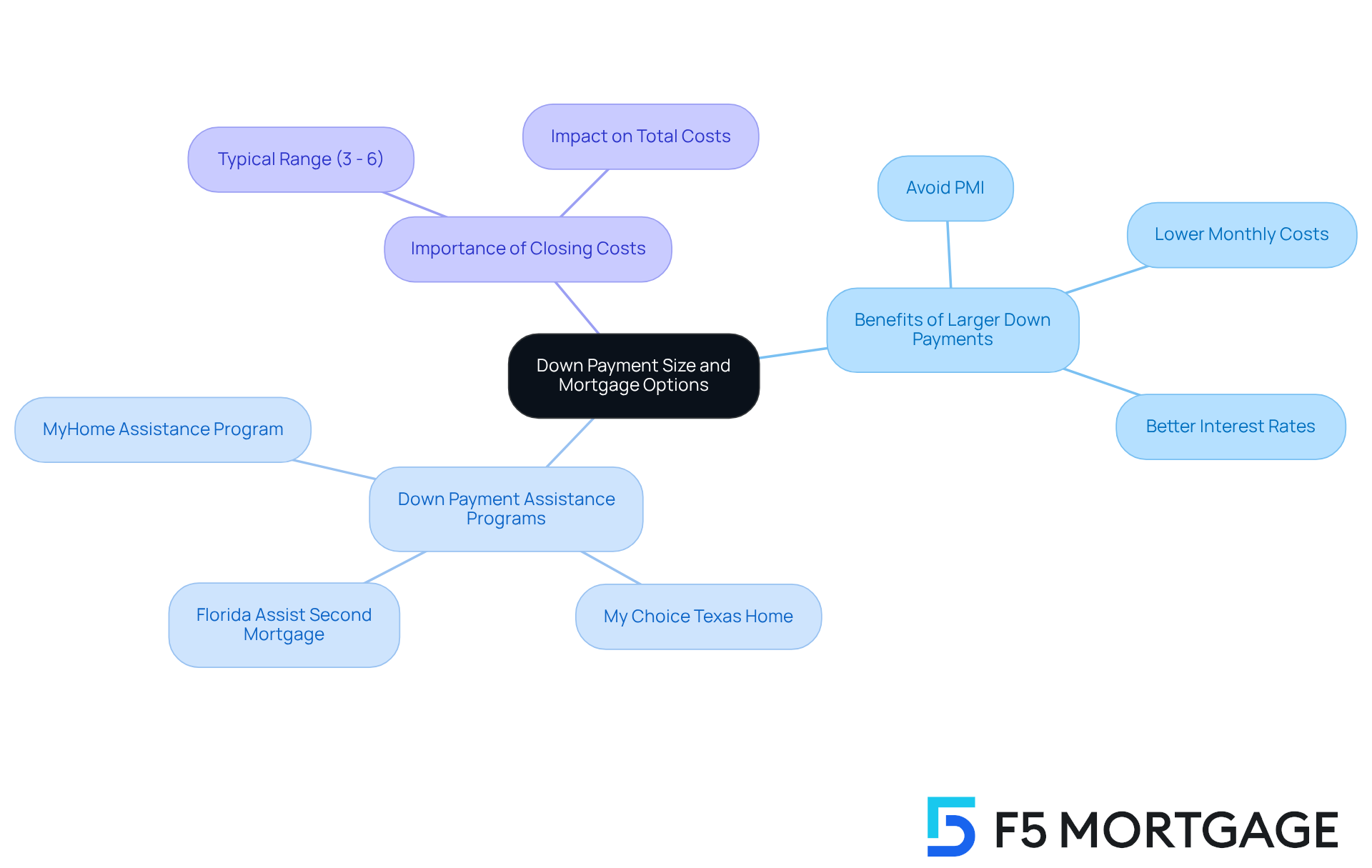

Evaluate Down Payment Size to Enhance Mortgage Options

Assessing the amount of your initial contribution is crucial when considering financing alternatives. We know how challenging this can be, but a larger initial contribution can significantly reduce monthly costs and secure better interest rates.

For households earning 150k, aiming for a down payment of at least 20% helps avoid private mortgage insurance (PMI) and reduces the total amount borrowed. This approach makes homeownership more economical. Mortgage specialists highlight that greater upfront contributions can lead to more advantageous loan conditions, ultimately improving your financial security over time.

While programs exist for individuals with smaller down payments, it’s essential to weigh the . Households that effectively contribute 20% frequently indicate enhanced mortgage conditions, allowing them to direct a larger portion of their budget towards home enhancements or savings.

Additionally, it’s important to factor in closing costs, which typically add up to between 3% and 6% of the purchase price. Families can explore down payment assistance programs, such as:

- The MyHome Assistance Program in California, which offers up to 3% of the home’s purchase price

- The My Choice Texas Home program, providing up to 5% for down payment and closing aid

- The Florida Assist Second Mortgage Program in Florida, which can offer up to $10,000 for upfront costs

A well-planned down payment strategy can empower families to maximize their home-buying potential. We’re here to support you every step of the way as you navigate this important journey.

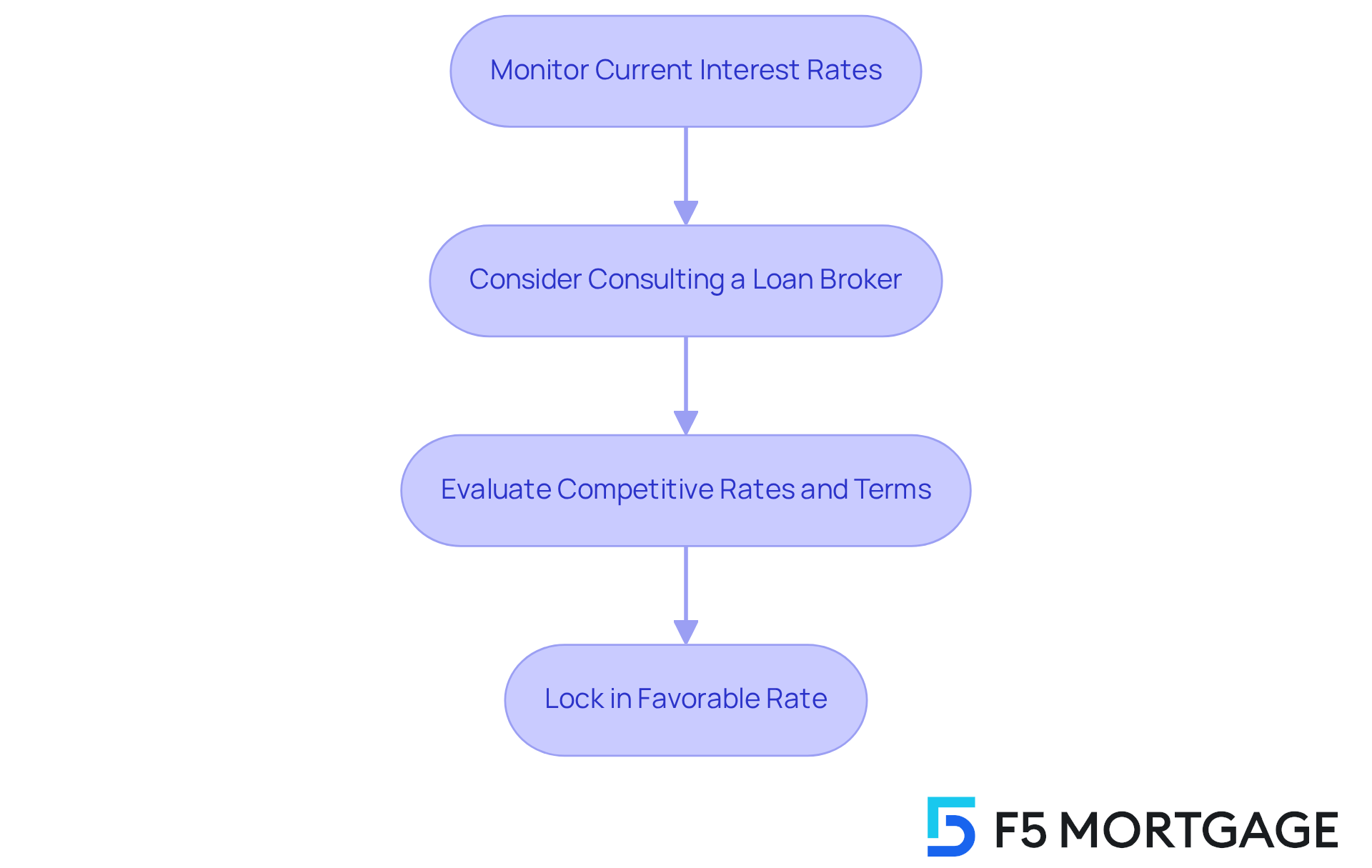

Consider Interest Rates When Planning Your Mortgage

When planning your home loan, understanding is crucial. We know how challenging this can be, and a lower interest rate can dramatically decrease the total cost of your mortgage over time. For families earning 150k, monitoring market trends is essential, as locking in favorable rates can lead to significant savings. Families who secured loans during periods of lower interest rates often report substantial reductions in their monthly payments, allowing them to allocate funds toward other important expenses.

Consider working with F5 Mortgage to compare rates, costs, and terms that match your needs. Their competitive rates and personalized service can assist you in navigating the complexities of loan lending effectively. Economists recommend that households should be proactive in their approach to interest rates. As one expert noted, ‘The current trend indicates that rates may rise in the coming months, making it imperative for homebuyers to act swiftly.’ This insight highlights the significance of consulting with a loan broker at F5 Mortgage, who can offer personalized guidance based on interest rate predictions and market conditions.

Historically, home loan interest rates have varied, with households facing different expenses based on economic conditions. For example, during the last decade, rates have seen lows around 3% and highs exceeding 6%. Families who secured rates during these lower periods have gained from decreased overall housing expenses, demonstrating the influence of timing in the home purchasing process. By staying informed and collaborating with experts at F5 Mortgage, households can navigate these fluctuations effectively and maximize their home buying potential.

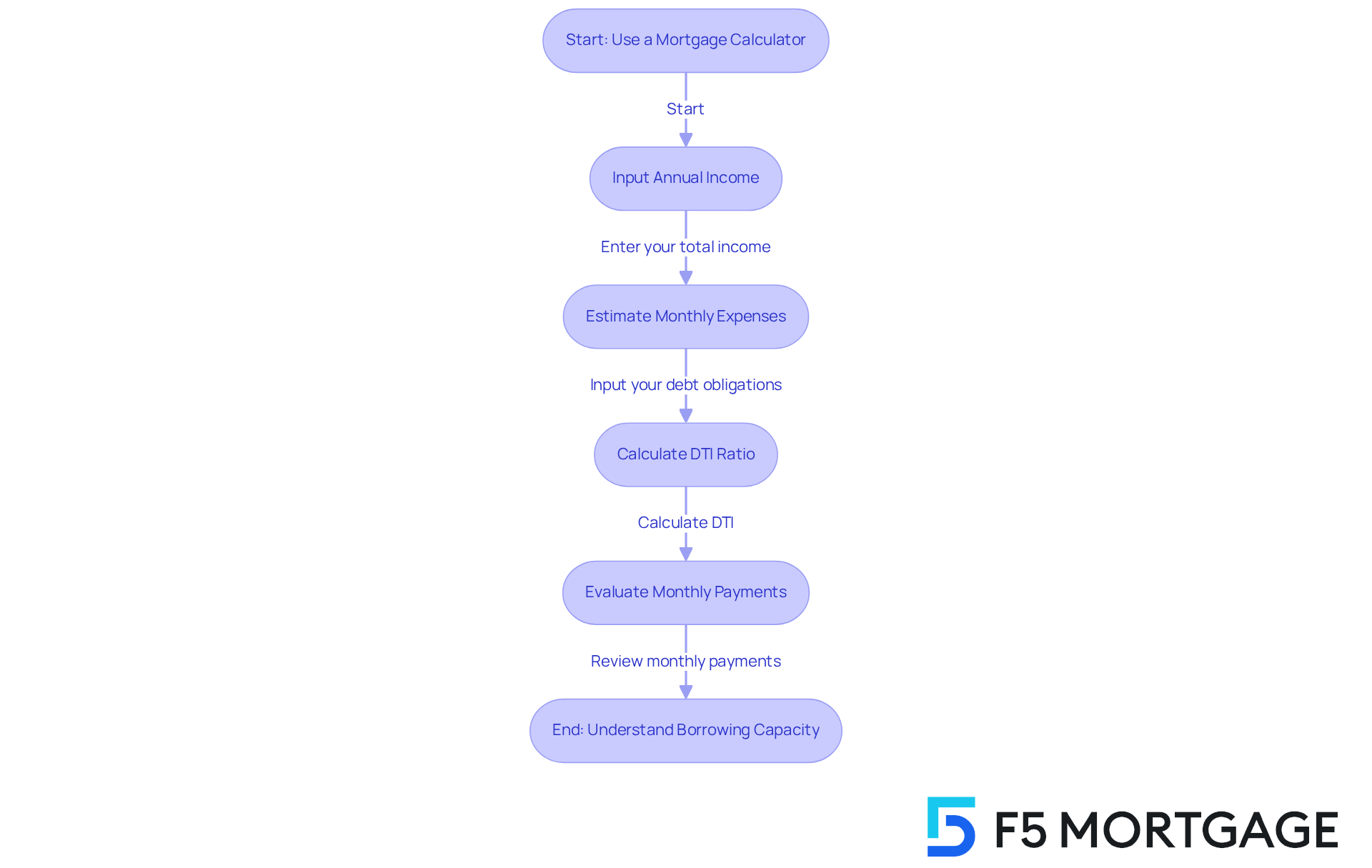

Use a Mortgage Calculator to Estimate Your Borrowing Capacity

Utilizing a is an essential step for households like yours, seeking to assess your borrowing ability based on income, expenses, and initial costs. By exploring various scenarios, you can see how different factors—such as interest rates, currently around 7%, and borrowing terms—affect your monthly payments. For instance, if your household earns 150k annually, you can input this income alongside estimated expenses to determine a realistic budget for your new home.

Understanding the Debt-to-Income (DTI) ratio is crucial in this process, as a maximum of 43% DTI is typically required for home loans. A better DTI can lead to more favorable loan rates, making it important for you to evaluate your current debts in relation to your income. This tool not only assists in establishing attainable expectations but also helps you visualize the financial consequences of your choices. Financial advisors frequently suggest using loan calculators early in the homebuying process to improve estimates as you gather more information. For example, you might find that a $400,000 residence with a 30-year fixed-rate loan at 5% interest results in a monthly expense of about $2,147, not including taxes and insurance.

Real-life examples demonstrate the effectiveness of loan calculators. Families have successfully used these tools to navigate their home-buying journey, adjusting their inputs to reflect changing financial circumstances. This adaptability is crucial, especially in a market where affordability is a significant concern, as many buyers feel stretched by homeownership costs.

Moreover, you should investigate refinancing alternatives offered by F5 Mortgage, including conventional loans, FHA loans, and VA loans, which can create opportunities to obtain improved rates and reduced monthly payments. Ultimately, utilizing a mortgage calculator enables you to make informed decisions, ensuring you are well-prepared for the financial commitment of homeownership. As a practical tip, we encourage families to regularly revisit their calculations as their financial situation changes to stay aligned with their homeownership goals.

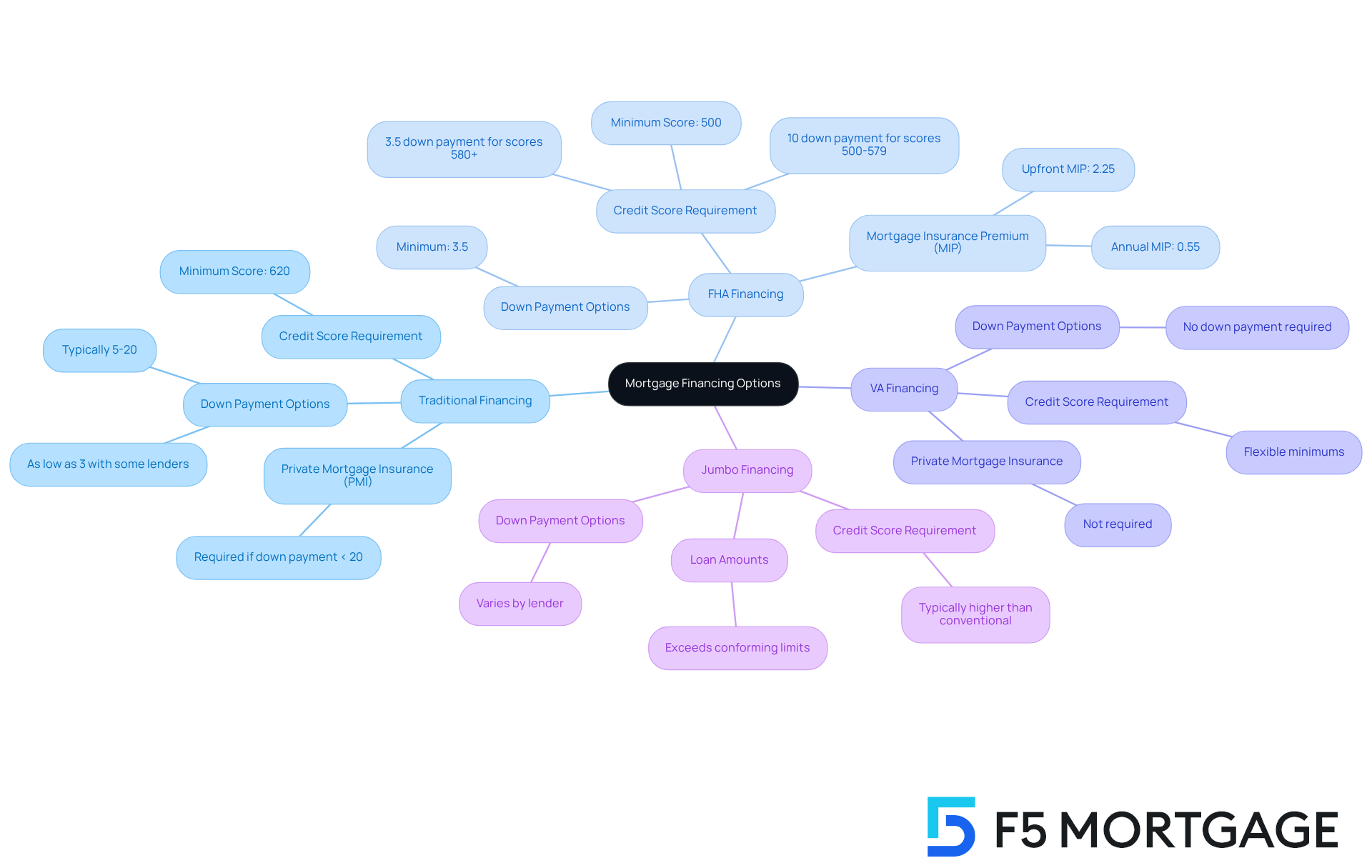

Explore Diverse Loan Programs to Find the Best Fit

Families often face the challenge of navigating the complex world of mortgage financing. It’s important to explore a variety of funding options to find the best fit for your financial circumstances. The main choices include:

- Traditional financing

- FHA financing

- VA financing

- Jumbo financing

Each option offers unique requirements and advantages that can cater to your specific needs.

For instance, FHA mortgages can be especially beneficial for individuals with lower credit ratings. They allow down payments as minimal as 3.5% for borrowers with scores of 580 or above, providing a more accessible path to homeownership. On the other hand, traditional financing typically requires a minimum credit score of 620 and an initial contribution ranging from 3% to 20%, depending on the lender’s conditions.

If you or a loved one has served in the military, VA financing could be a remarkable option. This program offers the significant advantage of no down payment and no private insurance, making it an attractive choice for military families. Jumbo mortgages, in contrast, cater to those looking to borrow amounts exceeding standard limits, which can be particularly useful in high-cost areas.

Engaging with a mortgage broker can provide you with valuable insights into the advantages and disadvantages of each program. For example, a household earning $150k might find that an FHA mortgage presents lower initial expenses, while a conventional mortgage could offer greater long-term value if they have a strong credit profile. Real-life examples show us that families often evaluate these options carefully, considering factors such as credit scores, down payment capabilities, and long-term financial goals.

Ultimately, understanding the nuances of each loan type is crucial. We know how challenging this can be, but having the right information empowers you to make informed decisions that align with your financial objectives. We’re here to as you navigate this important journey.

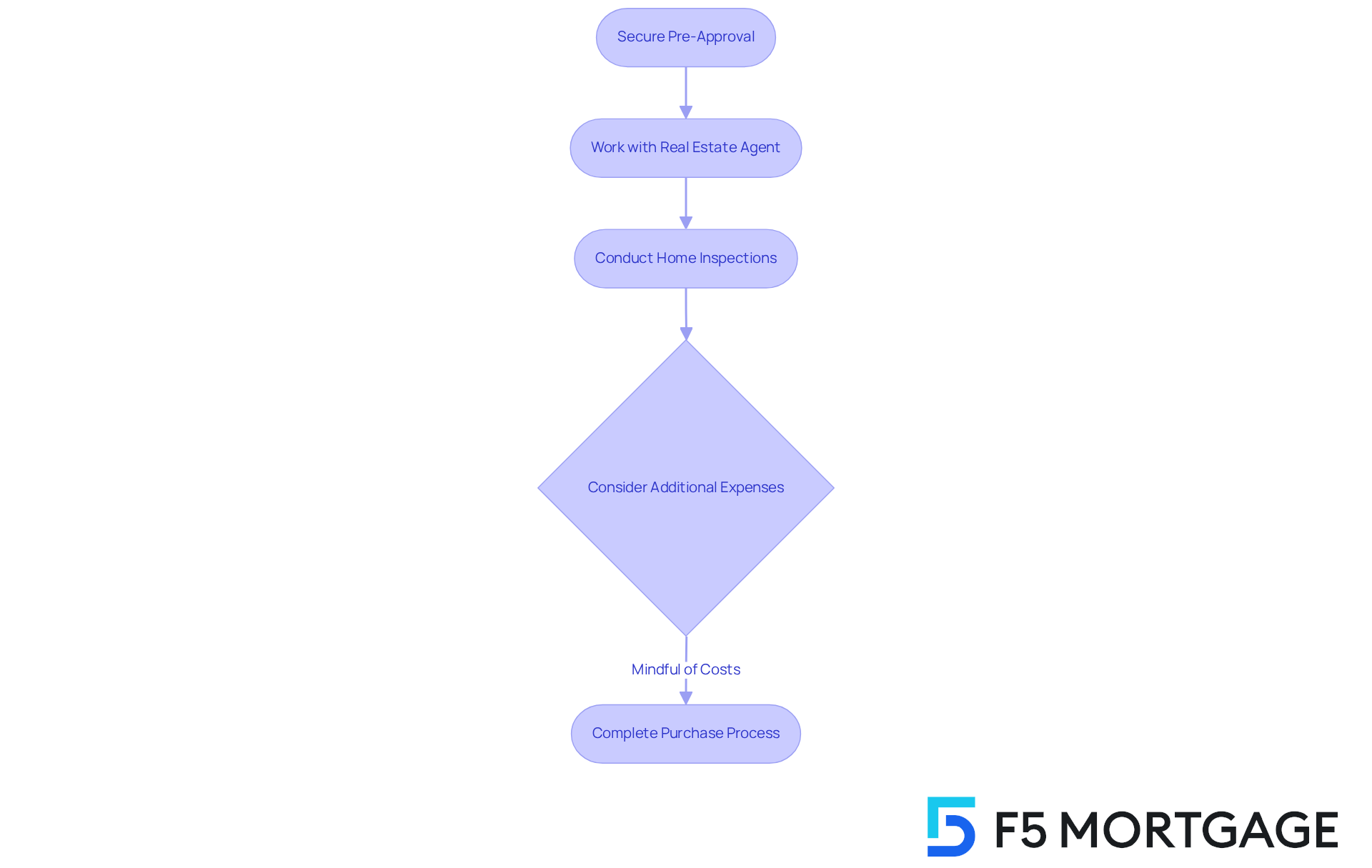

Learn the Home Buying Process to Avoid Common Pitfalls

Understanding the home purchasing process is essential for families looking to avoid common pitfalls. Securing pre-approval for a mortgage is a key step; it not only clarifies your budget but also strengthens your offers when bidding on homes. By working with an experienced real estate agent, you can gain invaluable insights into the local market, helping you find properties that meet your needs.

It’s also important to conduct thorough home inspections to uncover potential issues that could lead to costly repairs down the line. Remember, families should be mindful of additional expenses that could total up to 150k beyond the purchase price. Closing fees, property taxes, and homeowners insurance can collectively contribute to costs that reach up to 150k. Typically, households need around 30 to 45 days to complete the home purchasing process, but being well-prepared can significantly shorten this timeline.

Consider the experience of Mr. and Mrs. K. They faced challenges due to Mr. K’s American citizenship while pursuing a loan in the UK. However, they successfully navigated their situation by recognizing the importance of customized financial options and comprehensive planning. By following these steps and being aware of potential pitfalls, families can make informed decisions and enjoy a smoother home buying experience. We know how challenging this can be, and we’re here to .

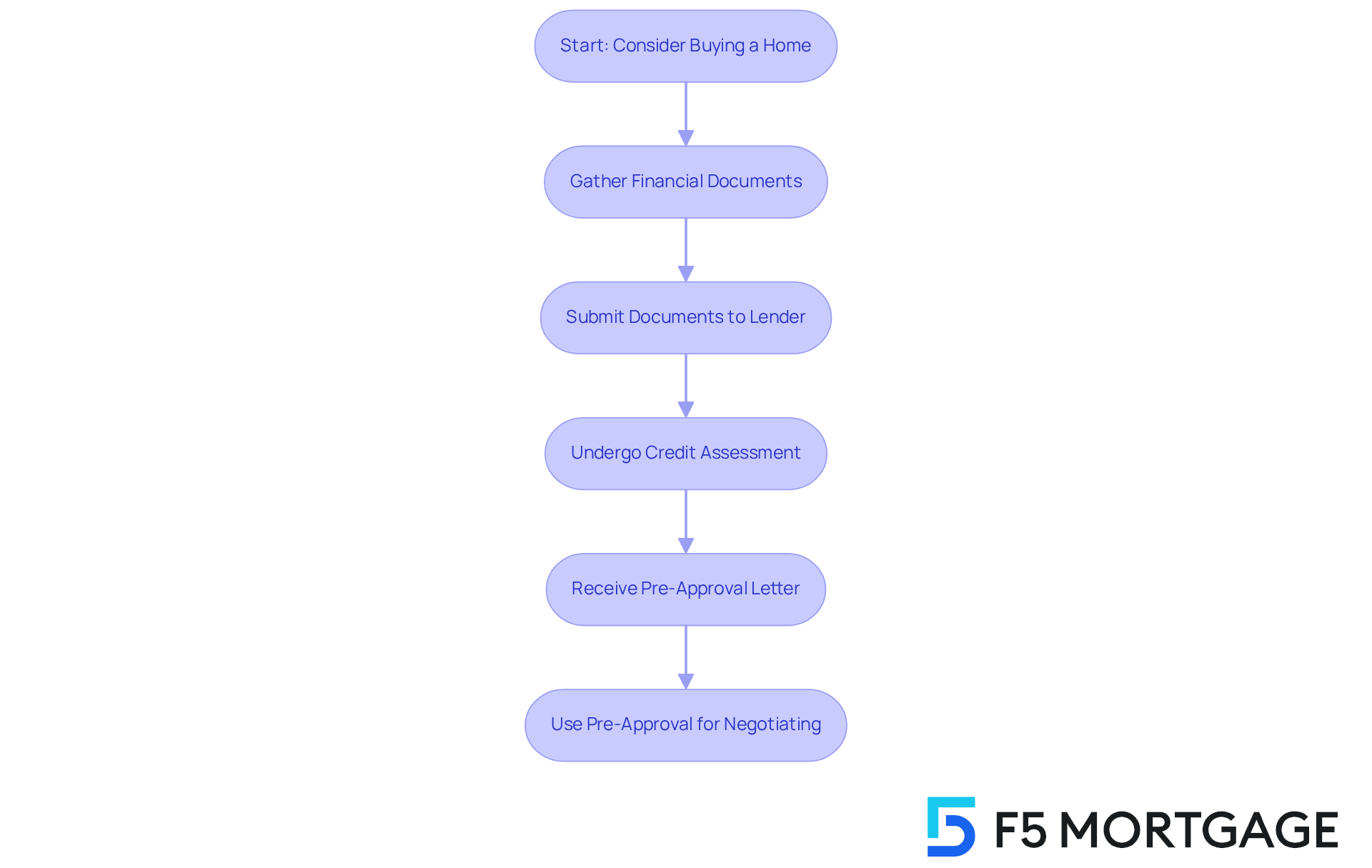

Get Pre-Approved to Strengthen Your Home Buying Position

Obtaining a mortgage pre-approval is an essential step for families looking to buy a home. We know how challenging this can be, but this process not only clarifies your budget; it also shows sellers that you are a committed buyer. By submitting your financial documents to a lender, you will undergo a thorough assessment of your creditworthiness, resulting in a pre-approval letter. This letter significantly boosts your negotiating power when making an offer on a property.

For instance, families who received pre-approval often found themselves in a stronger position during bidding wars. Sellers viewed them as more dependable candidates. One family shared their success story of acquiring their dream home after being pre-approved, allowing them to act swiftly in a competitive market.

Mortgage brokers emphasize that having a pre-approval letter can be a game-changer. “It not only gives buyers a clear understanding of their financial limits but also makes their offers more compelling to sellers,” notes a seasoned broker. This advantage can be crucial in negotiations, especially in areas where desirable homes attract multiple offers within days.

Moreover, F5 Mortgage offers various down payment assistance programs that can further enhance home purchasing opportunities for families. For example, programs in Florida and Michigan provide significant financial support, such as deferred second mortgages of up to $10,000, easing the burden of upfront costs. This approach demonstrates F5 Mortgage’s commitment to outstanding customer satisfaction and helps families navigate the home buying process with increased confidence.

In summary, pre-approval is not just a formality; it is a strategic tool that empowers families in their home buying journey, enhancing their chances of securing the right property at the right price. To enhance your opportunities, consider obtaining pre-approval early in your home purchasing journey and explore the available . We’re here to support you every step of the way.

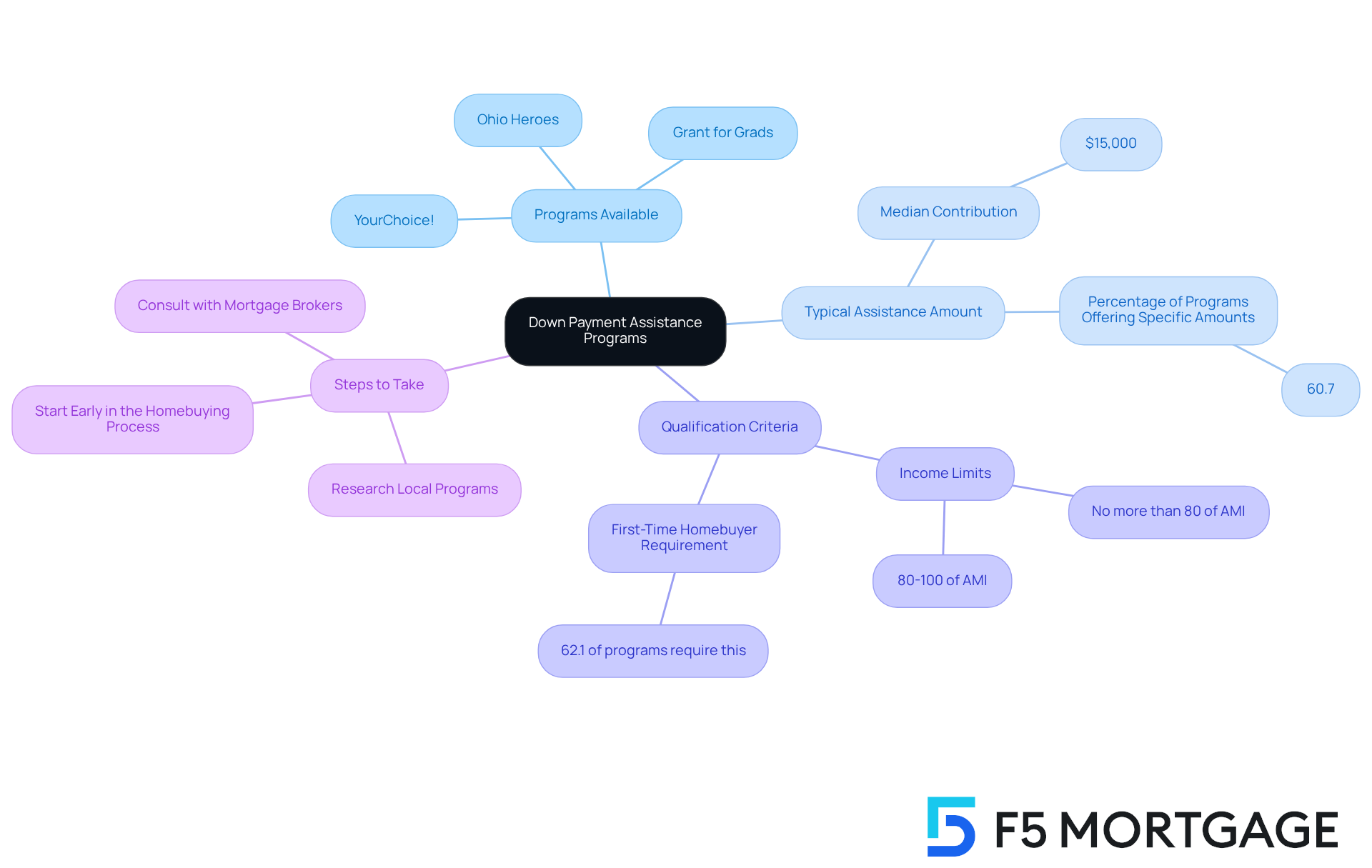

Seek Down Payment Assistance Programs to Ease Financial Burdens

Families often face significant financial challenges when it comes to buying a home, and we know how daunting this can be. That’s why it’s essential to actively explore down payment assistance programs that can ease this burden. In Ohio, for instance, initiatives like YourChoice!, Grant for Grads, and Ohio Heroes offer invaluable support, often through grants or low-interest loans designed to help with those initial costs. Typically, these programs provide around $15,000, with 60.7% offering a specific dollar amount to help with the down payment. This assistance can greatly alleviate the strain for first-time homebuyers or those with limited savings.

However, qualifying for down payment assistance can sometimes feel overwhelming due to extensive requirements. Many programs have income limits, often requiring borrowers to earn no more than 80% of the area median income (AMI). To find the right assistance options, families can begin by and government websites. Consulting with mortgage brokers like F5 Mortgage can also be a great step, as they can guide families through available programs and assist with the application process.

It’s crucial to start this research and the application process early in the homebuying journey. By doing so, families can enhance their chances of securing these valuable resources, ultimately paving the way for a more stable financial future. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the mortgage landscape can feel overwhelming for families earning around $150,000 annually. We know how challenging this can be, but with the right strategies and insights, it can also be a truly empowering experience. The core message here emphasizes the importance of personalized mortgage consultations, understanding financial ratios, and making informed decisions to maximize your home-buying potential. By leveraging tailored advice and exploring various financing options, families can confidently approach the home-buying process.

Key insights from our discussion highlight the significance of:

- Understanding GDS and TDS ratios for assessing affordability.

- Recognizing how down payment sizes impact mortgage options.

- The necessity of obtaining pre-approval to strengthen your purchasing power.

- Utilizing tools like mortgage calculators.

- Exploring down payment assistance programs to enhance financial readiness.

Ultimately, the journey to homeownership is not just about securing a mortgage; it’s about making informed choices that align with your long-term financial goals. We encourage families to take proactive steps, seeking personalized support and resources to navigate the complexities of the mortgage market. By doing so, you can pave the way for a successful and sustainable home-buying experience.

Frequently Asked Questions

What services does F5 Mortgage offer for homebuyers earning around 150k annually?

F5 Mortgage provides personalized mortgage consultations tailored for families earning approximately 150k per year. These sessions help clients understand their financial situation and explore suitable funding options.

Why is personalized guidance important in the mortgage process?

Personalized guidance is crucial as it helps families navigate the complexities of mortgage financing, ensuring they make informed decisions based on their unique financial goals and challenges, leading to a smoother home-buying experience.

What are GDS and TDS ratios, and why are they important?

GDS (Gross Debt Service) ratio indicates the percentage of gross income that goes towards housing costs, while TDS (Total Debt Service) ratio includes all debt obligations. Understanding these ratios is important as they help assess mortgage affordability, with ideal GDS not exceeding 32% and TDS remaining below 40%.

How can families accurately calculate their disposable income for mortgage affordability?

Families can calculate disposable income by listing all income sources, identifying monthly expenses, and subtracting total expenses from total income. This helps determine how much can be allocated for housing payments.

What is the recommended percentage of income to spend on housing costs?

Financial planners recommend that housing costs should not exceed 28% of gross monthly income to ensure a manageable budget.

What is the maximum Debt-to-Income (DTI) ratio generally acceptable for home loans?

A maximum DTI of 43% is generally necessary for home loans, which can influence loan rates.

Can refinancing options enhance mortgage affordability?

Yes, exploring refinancing options can provide additional pathways to secure favorable loan rates and terms, enhancing overall affordability for homebuyers.

How does F5 Mortgage support clients throughout the mortgage process?

F5 Mortgage is committed to supporting clients every step of the way, providing tailored consultations and guidance to help them navigate the mortgage process effectively.