Overview

Navigating the mortgage landscape can be challenging, especially for families looking to secure financing for high-value properties. In 2024, jumbo loan limits have increased to $806,500, a change that opens new doors for homebuyers in competitive markets. Understanding these new limits and qualifying requirements—like a minimum credit score of 700 and substantial cash reserves—can truly empower you.

We know how overwhelming this process can be, but with the right information, you can take advantage of these favorable financing conditions. By familiarizing yourself with the new guidelines, you can feel more confident in your ability to make informed decisions. Remember, we’re here to support you every step of the way as you embark on this important journey.

Introduction

As the housing market continues to evolve, we know how challenging this can be for prospective homebuyers. Understanding the nuances of jumbo loans becomes increasingly vital. With the Federal Housing Finance Agency raising the jumbo loan limit to $806,500 for 2024, families seeking to purchase high-value properties now have greater access to financing options. This change is promising, yet it brings forth a complex landscape of eligibility requirements, interest rates, and potential pitfalls that can leave many feeling overwhelmed.

How can buyers navigate these changes effectively? We’re here to support you every step of the way, helping you leverage the new limits to secure your dream home. Let’s explore how to make this journey smoother together.

F5 Mortgage: Personalized Jumbo Loan Solutions for 2024

At F5 Mortgage, we understand how challenging it can be for families seeking to buy high-value properties. That’s why we focus on tailored to your unique financial situation. With a broad network of over two dozen lenders, we ensure that truly meet your needs.

In 2024, the Federal Housing Finance Agency has increased the to $806,500, which is the amount of home financing that the . This change makes more accessible for families like yours. Our approach , empowering you to make informed decisions about your financing options.

Qualifying for a large mortgage typically requires a —usually 700 or above—and substantial cash reserves. We know that these requirements can feel daunting, but we’re here to support you every step of the way. Our emphasis on has allowed us to effectively assist many families in navigating the intricacies of large-scale financing, ensuring you achieve the most favorable results for your home funding.

Clients often praise F5 Mortgage for our exceptional service, highlighting the they received throughout the process. This reflects our commitment to providing a stress-free experience, where your needs and concerns are at the forefront of what we do.

Understanding Jumbo Loan Limits: What Qualifies as a Jumbo Loan?

Navigating the world of mortgages can be overwhelming, especially when it comes to . A large mortgage is classified as one that exceeds the (FHFA). The for a single-family home in most regions is approximately $766,550, marking an increase from the previous year. We understand how challenging it can be to , as these are not backed by Fannie Mae or Freddie Mac.

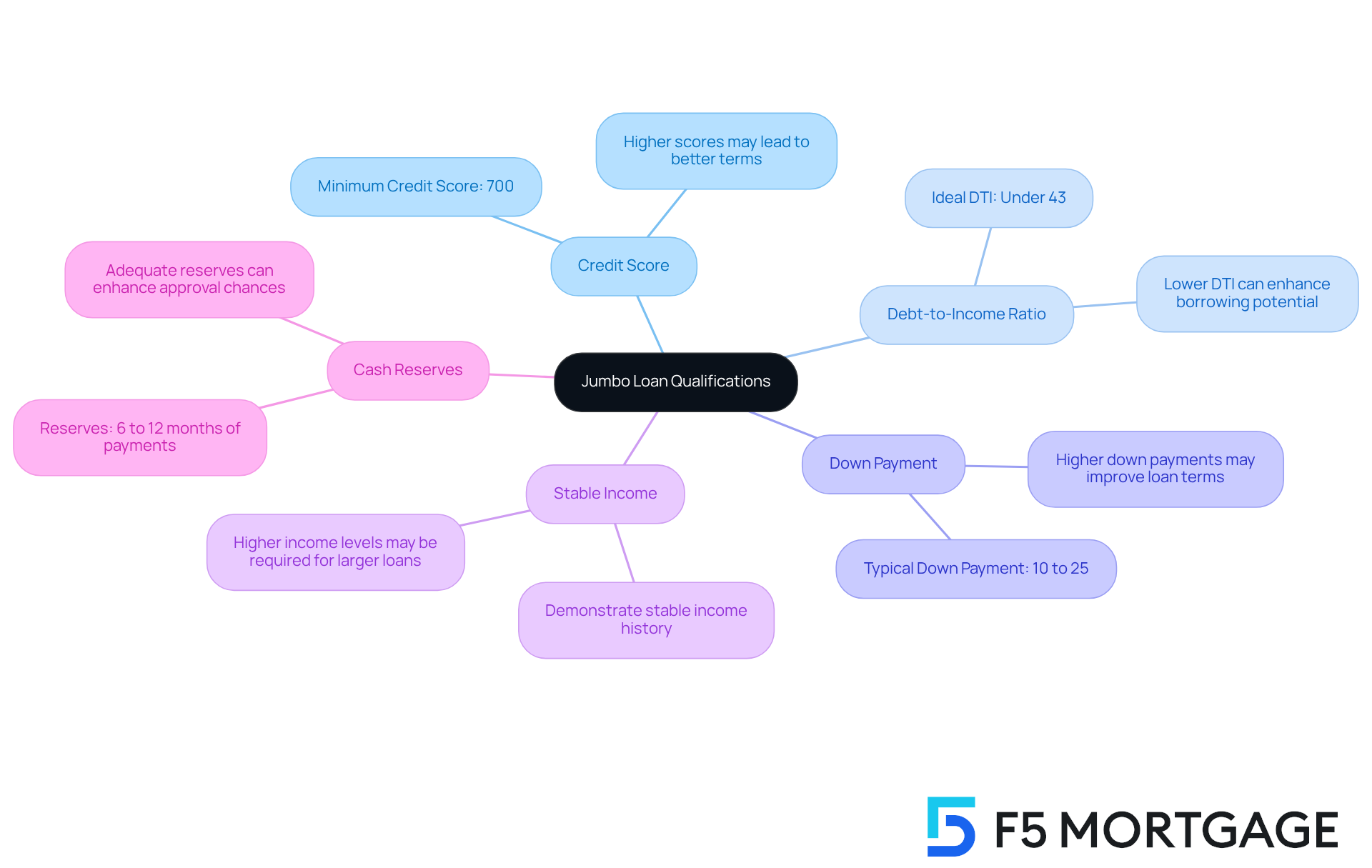

This means that if you’re looking to fund a property above this threshold, you’ll encounter . Generally, qualifying for a large mortgage involves meeting more stringent criteria, such as:

- A

- A

- A significant , typically between 10% and 25%

Moreover, lenders may ask you to demonstrate stable income and a solid employment history. It’s also to cover several months of mortgage payments—usually ranging from 6 to 12 months. Understanding these parameters is crucial for prospective homebuyers, particularly in expensive areas where the jumbo loan limit 2024 is more prevalent. Remember, we’re here to support you every step of the way as you explore your mortgage options.

2024 Jumbo Loan Limits: Key Figures You Should Know

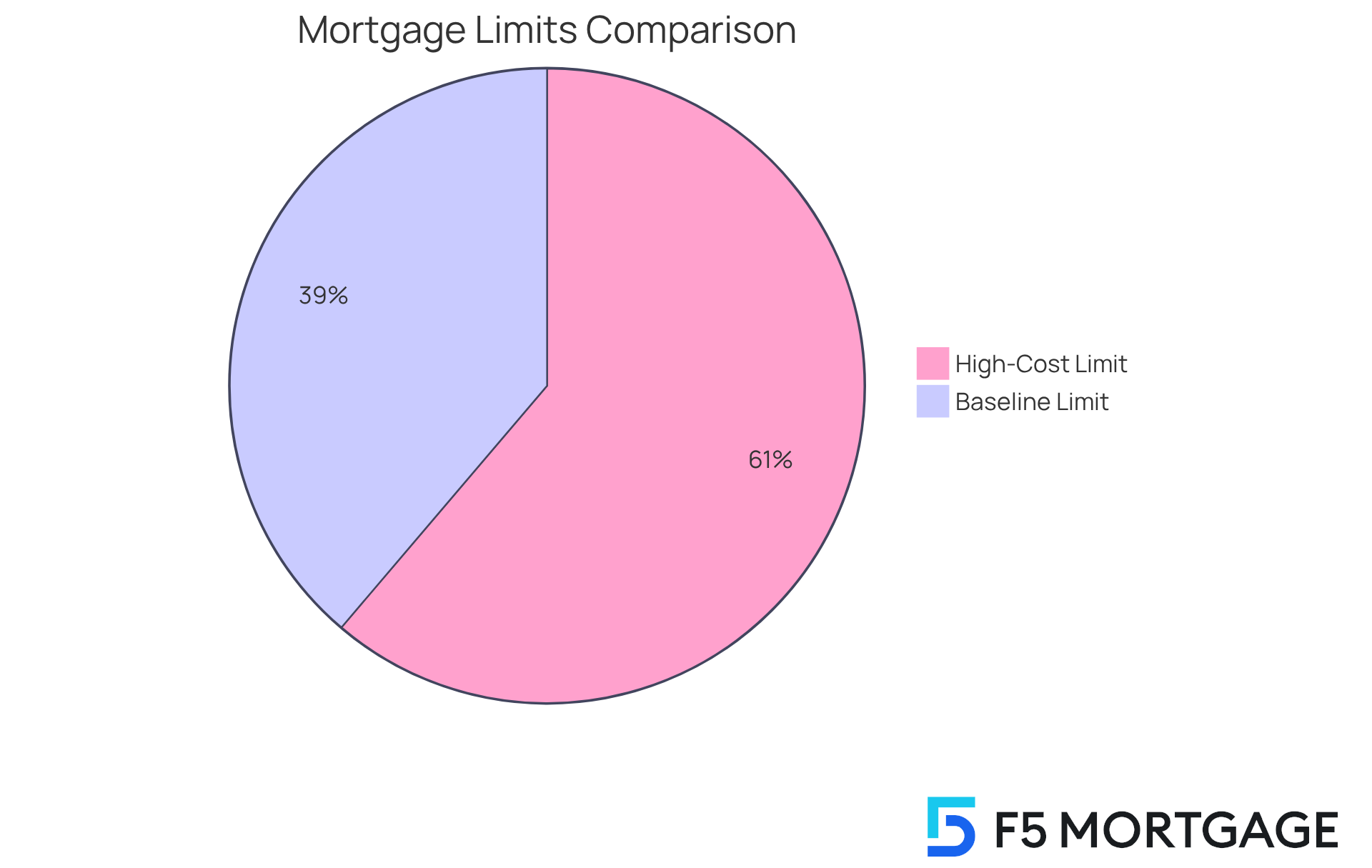

In 2024, the baseline , which is crucial to understanding the , is set at $766,550 across most areas in the United States. We know how challenging it can be to , especially when considering your dream home.

However, in designated high-cost areas, the jumbo loan limit 2024 can significantly increase, reaching as much as $1,209,750. This variation is essential for to contemplate. It directly affects the requirement for a 2024, depending on the property’s location and cost.

For instance, regions like San Francisco and New York City are recognized for their . Here, large mortgage amounts are frequently utilized to support the higher market values. is crucial for potential purchasers.

By grasping these details, you can manage your more efficiently. This knowledge empowers you to for your home acquisition. Remember, we’re here to support you every step of the way.

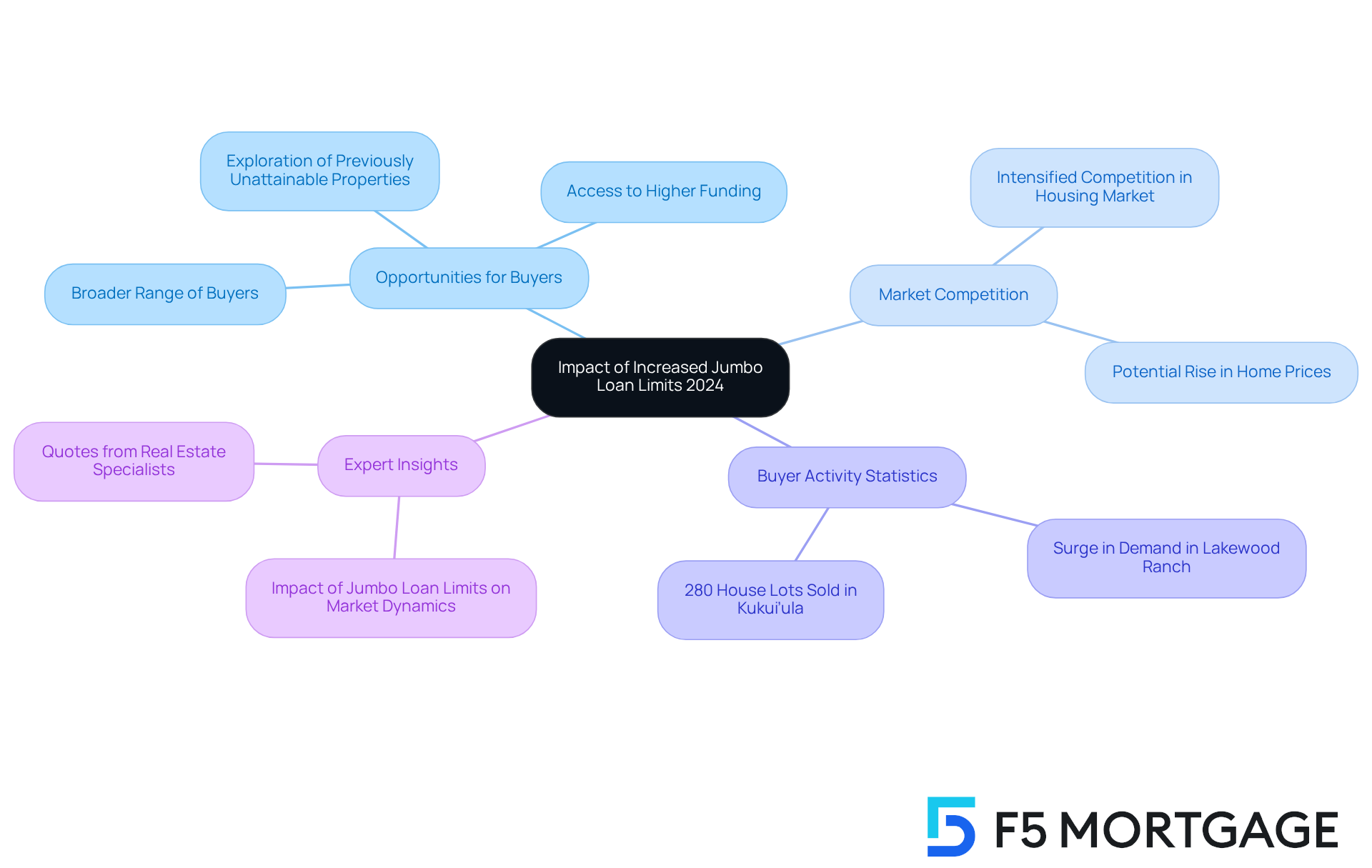

Impact of Increased Jumbo Loan Limits on Homebuyers in 2024

The rise in large mortgage thresholds, specifically the , presents significant opportunities for home purchasers, especially in high-cost areas where property prices have surged. We know how challenging it can be to , but with these , a can secure funding without turning to alternative lending methods, which often come with higher risks and costs. This shift may intensify competition in the housing market, potentially leading to rising home prices. However, it also empowers buyers to explore .

As we look ahead to 2024, the housing market is poised for a notable increase in competition. More buyers are eager to take advantage of the favorable . For example, in thriving areas like Lakewood Ranch, the influx of buyers could further drive demand, influencing overall pricing trends.

Statistics show that the housing market is already experiencing , with many regions reporting a surge in buyer activity. In the Kukui’ula community, approximately 280 house lots have been sold, reflecting a . This is a testament to how families are actively seeking their dream homes.

Real estate specialists suggest that the increased availability of financing within the jumbo loan limit 2024 will not only enhance buyer access but also invigorate market dynamics. As one specialist noted, “The capacity to obtain greater funding amounts without the restrictions of conventional borrowing thresholds can greatly change the environment for homebuyers, especially in competitive markets.”

There are numerous stories of homebuyers who have successfully leveraged the jumbo loan limit 2024 to secure their dream homes. can now consider properties that were once thought unattainable, broadening their options and enhancing their purchasing power in this competitive landscape.

Pros and Cons of Jumbo Loans: What to Consider in 2024

Jumbo financing offers several significant benefits, especially for families looking to fund . One major advantage is the ability to secure that exceed conforming limits. This can be crucial in competitive real estate markets where every advantage counts. As of April 1, 2024, the 30-year large mortgage rate stood at 7.06 percent, comparable to average rates for conventional mortgages. This context can help potential applicants make informed decisions. The flexibility of makes them an appealing choice for buyers seeking luxury residences or homes in expensive areas.

However, it’s important for potential borrowers to recognize the disadvantages associated with large mortgages. Stricter credit requirements are common; many lenders expect a , although some may accept scores as low as 680. Additionally, jumbo loans typically require larger , often ranging from 10% to 30%, along with higher closing costs due to the increased risk for lenders. These factors can complicate the approval process and may limit options for those with less robust financial profiles.

In 2024, families considering financing under the should carefully weigh these benefits and drawbacks. For instance, families aiming to purchase luxury properties may find that the advantages of a jumbo mortgage, such as the ability to consolidate financing under a single loan, outweigh the challenges. As one financial consultant wisely noted, “To determine if a large mortgage is suitable for you, reach out to an .” Understanding the is essential for making informed choices in today’s market.

Real-life examples reinforce this perspective: families who opted for large mortgages often express satisfaction with their financing decisions, particularly when they managed to secure favorable terms and rates. They also emphasize the importance of thorough preparation and discussions with knowledgeable lenders to navigate the complexities of the jumbo financing landscape effectively. Furthermore, borrowers should consider potential , such as the first $1 million in interest being tax-deductible, which can be a significant advantage. We know how challenging this process can be, and we’re here to support you every step of the way.

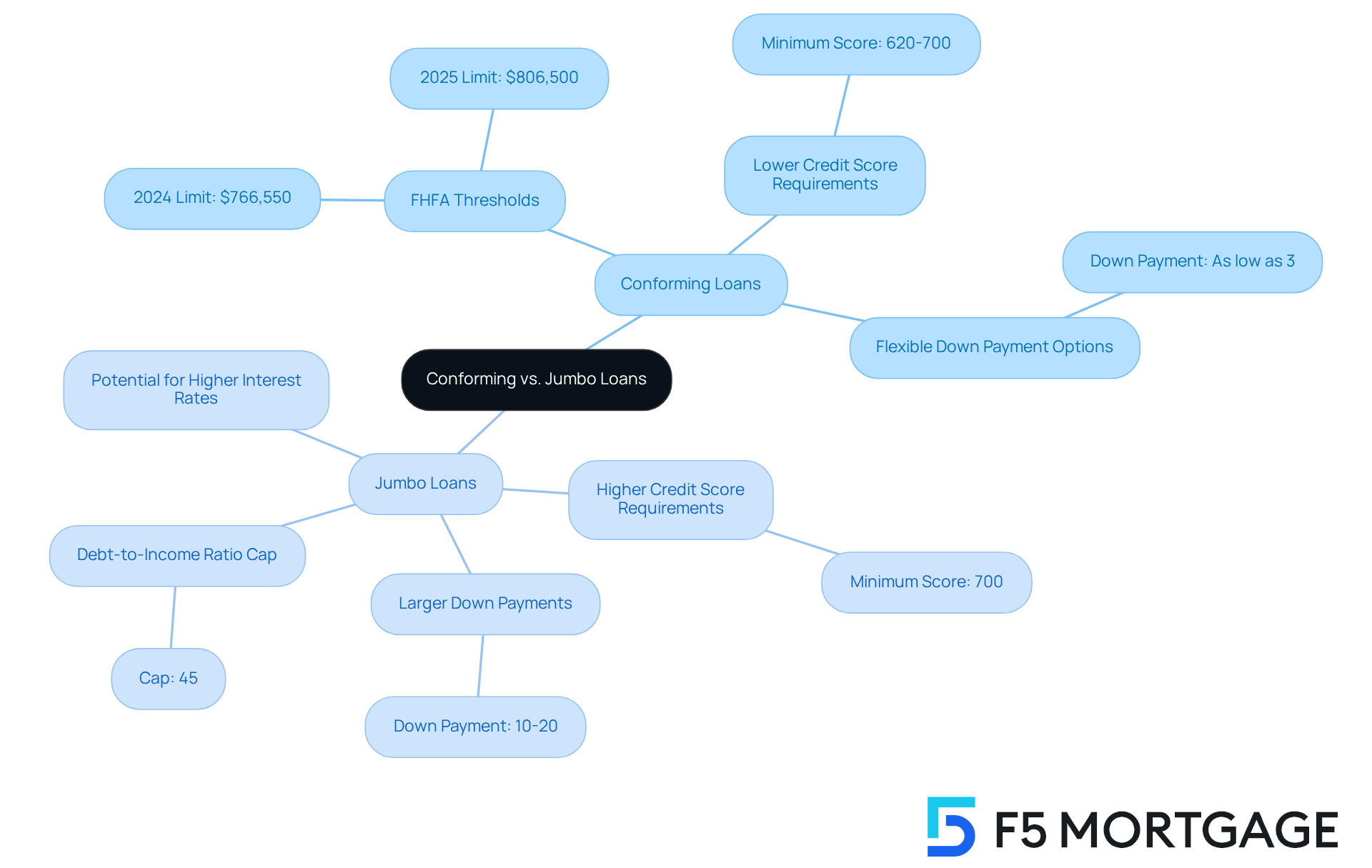

Conforming vs. Jumbo Loans: Key Differences Explained

Understanding the difference between is crucial for anyone navigating the . follow the thresholds set by the Federal Housing Finance Agency (FHFA), allowing them to qualify for acquisition by Fannie Mae and Freddie Mac. On the other hand, exceed these thresholds, which for 2025 is set at $806,500 for single-unit properties, and they lack government support. This absence of backing often leads to stricter underwriting criteria for large-scale financing, including:

- —typically a minimum of 700

- Larger down payments starting at 20%

- A debt-to-income ratio cap of 45%, which is a key factor in the qualification process

When seeking financing, it’s important to consider how differ. While large mortgages might carry higher rates, can emerge based on your . Some lenders may view large financing recipients as lower-risk, which could lead to better terms. Understanding these nuances is vital for prospective homebuyers, especially those who may benefit from conforming mortgages, which often allow for lower credit scores and more flexible down payment options.

As home prices continue to rise, the choice between conforming and large-scale financing becomes increasingly significant. Many individuals find themselves needing to assess their and long-term goals when selecting the right mortgage solution. Notably, the conforming credit limit increased in 2024, reflecting adjustments related to home price trends and the . This change further highlights the importance of comprehending these financing types. We’re here to support you every step of the way as you explore your options and make informed decisions.

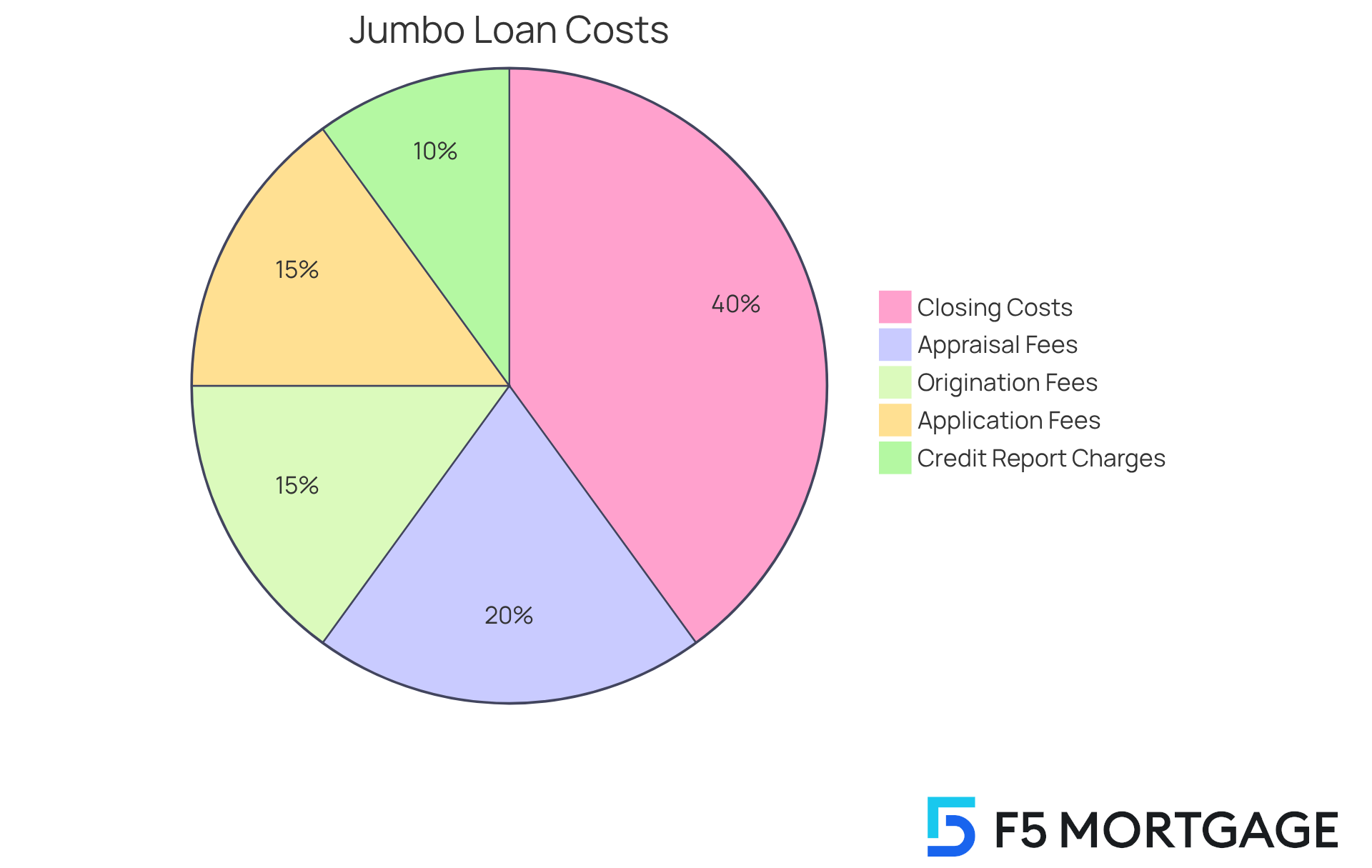

Financial Considerations: Interest Rates and Costs of Jumbo Loans

Navigating the world of can feel overwhelming, especially when it comes to understanding interest rates and associated costs. can vary significantly based on and your unique financial situation. Typically, these mortgages carry slightly higher rates compared to conforming mortgages due to the increased risk associated with larger amounts. As we look ahead to 2024, the national average for a 30-year fixed mortgage interest rate, relevant to the , hovers around 6.58%. This reflects a competitive landscape for those seeking larger financing options.

In addition to interest rates, it’s essential to be prepared for and fees when securing a large mortgage. For example, can range from $15,000 to $50,000, which is a significant factor to consider in your . These costs often include:

- Appraisal fees

- Title search fees

- Other related expenses that can substantially impact the total cost of obtaining a large mortgage.

A detailed analysis of typically includes:

- Application fees ranging from $75 to $500

- Origination fees between 0.5% and 1.5% of the loan amount

- Credit report charges around $35

- Appraisal fees that generally vary from $300 to $500, depending on the location and type of property.

Effective budgeting and financial planning are vital for anyone considering large-scale financing. We know how challenging this can be, so it’s advisable to set aside funds for closing costs, which can represent 1.5% to 5% of the purchase price. Additionally, individuals seeking loans may want to explore strategies like negotiating with sellers to cover part of these costs, especially in slower real estate markets.

Understanding these is crucial for potential homeowners who aim to navigate the complexities of large mortgages with confidence. We’re here to support you every step of the way as you embark on this important journey.

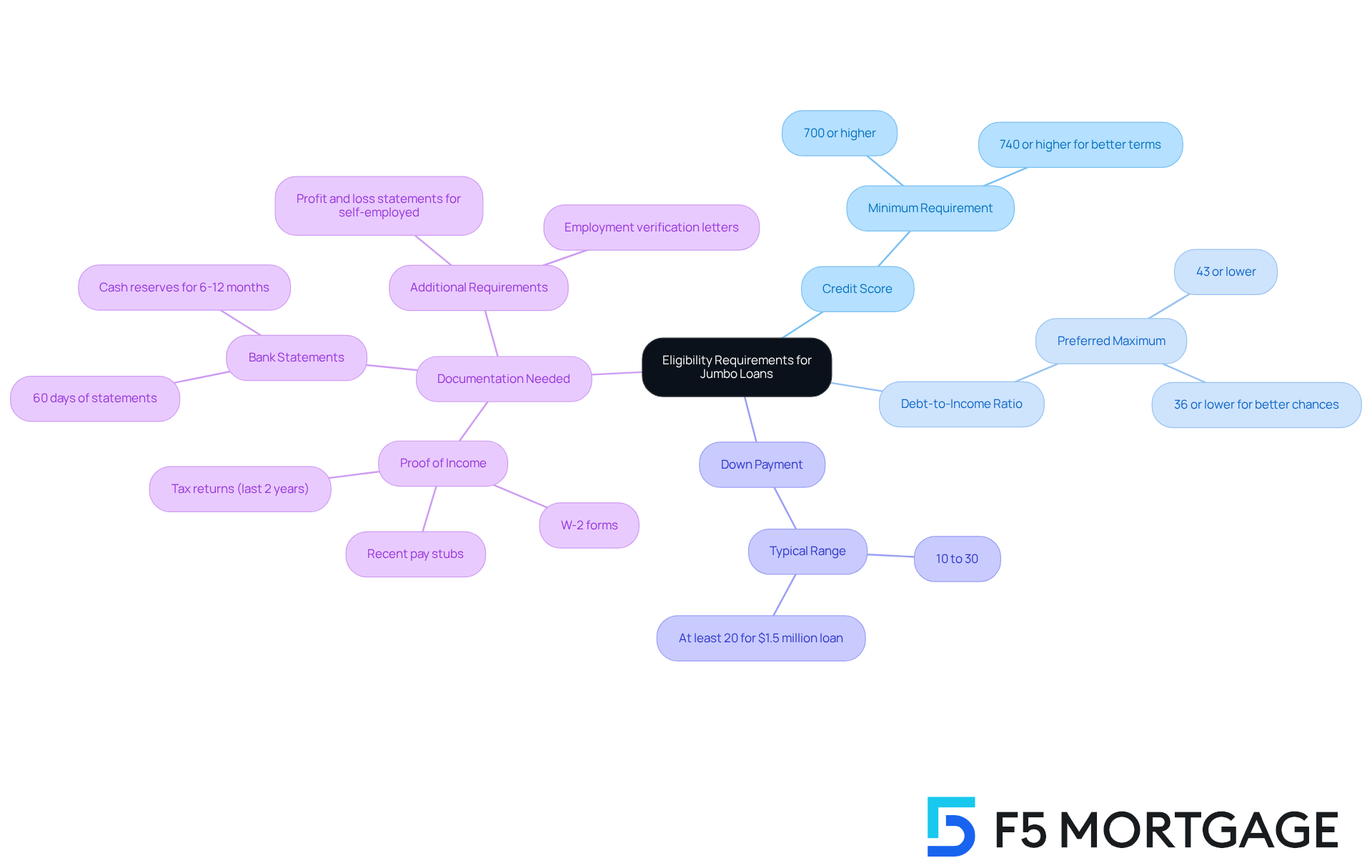

Eligibility Requirements for Jumbo Loans: What You Need to Qualify

can feel daunting, and we understand how challenging this process can be. Applicants typically need to meet several strict requirements, including a . Many lenders prefer scores above 740 to offer the best terms. Additionally, maintaining a low is crucial; lenders generally favor a DTI of 43% or lower. A lower ratio can significantly enhance your chances of approval.

When it comes to jumbo mortgages, especially with the , be prepared for a larger , which often ranges from 10% to 30%. This amount depends on the loan size and your . We know that gathering the necessary documentation can be overwhelming, but it plays a vital role in the . Borrowers must provide comprehensive proof of income, including:

- W-2 forms

- Recent pay stubs

- Tax returns from the past two years

Lenders may also request bank statements to verify cash reserves, which should ideally cover at least six to twelve months of mortgage payments. This requirement reassures lenders of your , especially given the increased risks linked with the financing. For instance, if you are seeking a $1.5 million advance, you might need to demonstrate:

- A credit score of 740

- A DTI below 36%

- A down payment of at least 20%

This level of financial readiness not only aids in the approval process but also positions you favorably in discussions for improved rates and terms.

As industry specialists emphasize, “Comprehending your is essential for maneuvering through the large-scale financing environment efficiently.” By taking these steps, you can ensure that you are adequately prepared to tackle the challenges of obtaining a large mortgage. Remember, we’re here to support you every step of the way.

Down Payments on Jumbo Loans: What to Expect in 2024

In 2024, we understand how challenging it can be to navigate for the . These requirements can vary significantly depending on the lender and your . Generally, borrowers can expect to . However, some lenders may offer options for lower down payments, especially for well-qualified buyers.

In Ohio, can range from a few thousand dollars to more than $30,000, . While some borrowings may require repayment or can be forgiven over time, grants typically do not require payback. Understanding these expectations and the is crucial as you plan your budget and financing strategies.

Additionally, it’s common for buyers to before finalizing a purchase. This negotiation process can impact overall costs, so it’s important to approach it with a clear strategy. Remember, it’s perfectly acceptable to walk away if an agreement cannot be reached. Being well-prepared for these discussions and understanding the will empower you to secure the . We’re here to support you every step of the way.

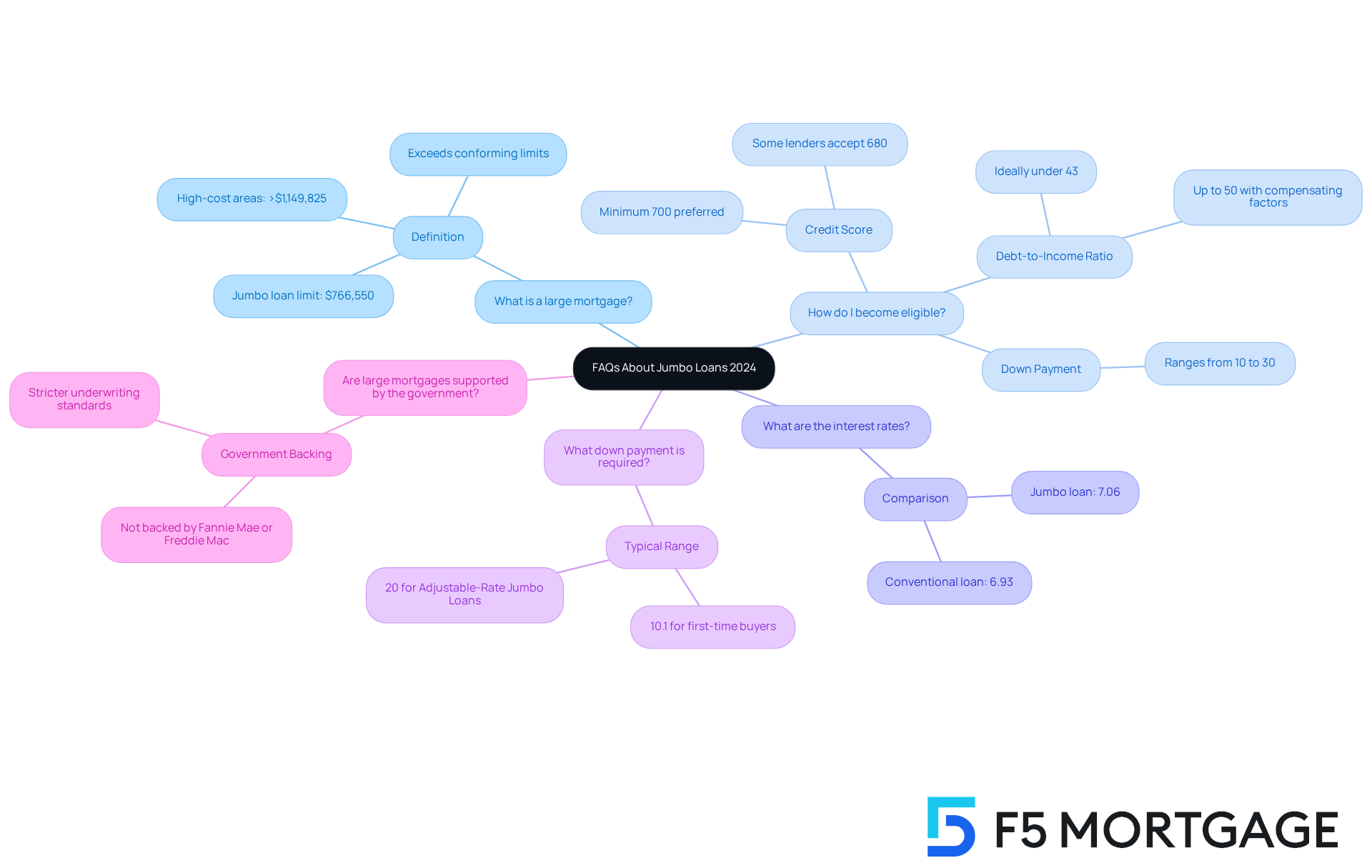

Frequently Asked Questions About Jumbo Loans in 2024

- What is a large mortgage? A large mortgage is a type of financing that goes beyond the conforming limits set by the Federal Housing Finance Agency (FHFA). As of 2024, the is approximately $766,550 in most areas, while define large-scale financing as amounts exceeding $1,149,825.

- How do I become eligible for a ? To qualify for a large mortgage, borrowers typically need a , though some lenders may accept scores as low as 680. Additionally, a is preferred—ideally under 43%—but some lenders might allow up to 50% with compensating factors. A , often ranging from 10% to 30%, is also necessary.

- What are the ? Interest rates for large mortgages can vary, but they are generally a bit higher compared to standard mortgages due to the increased risk associated with these non-conforming loans. As of April 2024, the average rate for a 30-year fixed mortgage that meets the jumbo loan limit 2024 was around 7.06%, compared to 6.93% for conventional mortgages.

- What down payment is required? The initial payment for large-scale financing usually ranges from 10.1% to 30%, depending on the lender and the borrower’s financial situation. For , the minimum down payment for a Fixed-Rate Jumbo Loan is often set at 10.1%, while Adjustable-Rate Jumbo Loans may require a minimum of 20%.

- Are large mortgages supported by the government? No, jumbo loans are not backed by . This absence of government backing means they face stricter underwriting standards and higher requirements from private lenders, making it crucial for borrowers to have a . We understand how challenging this can be, and we’re here to support you every step of the way.

Conclusion

The increase in the jumbo loan limit for 2024 marks an important milestone for families looking to purchase high-value properties. With the new limit set at $806,500, families now have greater access to financing options that can help them secure their dream homes without the limitations of conventional loans. This change not only expands the market for potential buyers but also highlights the necessity of understanding the intricacies of jumbo loans in today’s competitive landscape.

Throughout this discussion, we explored several key insights. We know how challenging it can be to navigate the stringent eligibility requirements for jumbo loans, which include higher credit scores and significant down payments. Additionally, we examined the varying limits based on geographic location, the impact of increased competition in the housing market, and the pros and cons associated with jumbo financing. These insights are vital for homebuyers as they work through the complexities of large mortgages.

Ultimately, the evolving jumbo loan landscape brings both opportunities and challenges. We encourage homebuyers to conduct thorough research, understand their financial readiness, and consider seeking personalized guidance from experts like F5 Mortgage. As the market adapts to these changes, being informed and prepared will empower families to make confident decisions in their homebuying journey.

Frequently Asked Questions

What is F5 Mortgage and what do they offer?

F5 Mortgage specializes in personalized jumbo loan solutions, providing customized large financing options tailored to individual financial situations, with access to over two dozen lenders for competitive rates and terms.

What is the jumbo loan limit for 2024?

The jumbo loan limit for 2024 has been increased to $806,500, which is the amount of home financing that the government can guarantee.

What are the typical requirements to qualify for a large mortgage?

To qualify for a large mortgage, you typically need a high credit score (usually 700 or above), substantial cash reserves, and may also need to demonstrate stable income and a solid employment history.

What are the general criteria for qualifying for a jumbo loan?

General criteria for qualifying for a jumbo loan include a minimum credit score of 700, a debt-to-income ratio ideally under 43%, and a significant down payment typically between 10% and 25%.

How do jumbo loan limits vary by location?

In 2024, the baseline conforming mortgage threshold for a single-family home is $766,550 in most areas, but in designated high-cost areas, the limit can increase significantly, reaching up to $1,209,750.

Why is understanding jumbo loan limits important for homebuyers?

Understanding jumbo loan limits is crucial for homebuyers as it affects the financing options available, particularly in expensive areas where higher mortgage amounts are often necessary to meet market values.

What feedback do clients give about F5 Mortgage?

Clients often praise F5 Mortgage for their exceptional service, highlighting personalized guidance and support throughout the mortgage process, which reflects the company’s commitment to client satisfaction.