Overview

This article highlights ten supportive programs for first-time homebuyers in Indiana, designed to ease the journey toward homeownership. We understand how daunting this process can be, which is why these programs offer valuable financial assistance, including down payment support and flexible loan options. Each initiative, from the Indiana Housing and Community Development Authority to USDA Rural Development, addresses the unique challenges that new buyers face.

By making homeownership more accessible and financially feasible, these programs aim to empower families. We know how challenging this can be, and we’re here to support you every step of the way. Explore these options to find the right fit for your needs and take the first step toward your dream home.

Introduction

Navigating the path to homeownership can feel overwhelming, especially for first-time buyers who are faced with a complex landscape of financing options and assistance programs. We know how challenging this can be, but fortunately, Indiana offers a variety of first-time home buyer programs designed to simplify this journey and make homeownership more accessible.

From down payment assistance to tailored mortgage solutions, these initiatives empower aspiring homeowners to turn their dreams into reality.

However, with so many choices available, how can one determine which program best fits their unique financial situation and homeownership goals?

We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Solutions for First-Time Homebuyers

F5 Mortgage understands the journey of new homebuyers and excels in providing designed with your needs in mind. By prioritizing competitive rates and , we ensure a that includes , access to a diverse range of loan programs, and a user-friendly mortgage calculator. This comprehensive approach empowers those participating in , helping you confidently navigate the complexities of mortgage financing.

is at the heart of what we do, as evidenced by our impressive 94% satisfaction rate. This positions F5 Mortgage as a aspiring to achieve their homeownership dreams. Client testimonials reflect the exceptional service provided by our team, with many praising the personalized guidance and , often under three weeks. As industry specialists emphasize, customized consultations are crucial for addressing the of new purchasers, ensuring you receive the best possible advice throughout your mortgage journey.

We know how challenging this can be, but we’re here to support you every step of the way. Let us help you turn your homeownership aspirations into reality.

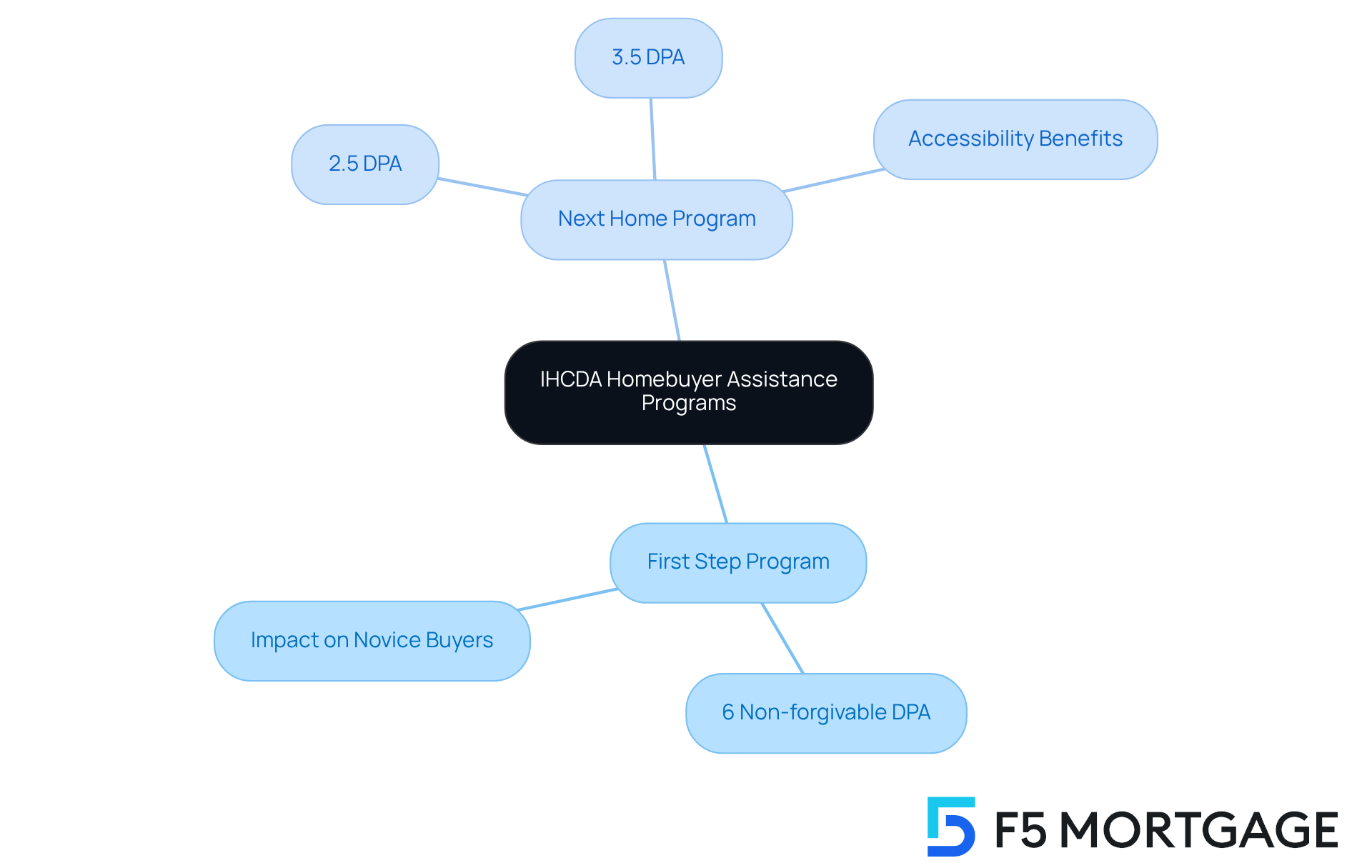

Indiana Housing and Community Development Authority (IHCDA): Homebuyer Assistance Programs

The Indiana Housing and Community Development Authority (IHCDA) understands how challenging it can be for novice buyers to navigate the , particularly with the . That’s why we offer a range of [first time home buyer programs Indiana](https://f5mortgage.com) that are designed to empower you every step of the way. Among these, the stands out by providing up to 6% of the as non-forgivable (DPA). This substantial support helps reduce the financial burden often associated with owning a home.

Additionally, the enhances accessibility by offering DPA options of 2.5% or 3.5%, tailored to the purchase price of your new home. These initiatives have made a significant impact, with numerous families benefiting from the first time home buyer programs Indiana provided by IHCDA. For instance, the First Step Program has successfully enabled many novice homebuyers to transition from renting to owning, showcasing the program’s effectiveness in fostering homeownership.

By utilizing these valuable resources, you can significantly lessen your initial . This support empowers you to make informed choices regarding your mortgage options, paving the way for a more secure . We’re here to support you every step of the way as you embark on this .

USDA Rural Development: Loans for Rural Homebuyers in Indiana

USDA Rural Development offers customized designed specifically for low- to moderate-income purchasers in designated rural regions, making them an appealing choice within the . These financial products provide 100% funding, which means no initial payment is required. This greatly reduces the barrier to homeownership, allowing families to realize their dreams.

Moreover, typically features compared to traditional options, enhancing their affordability. In fact, around 30% of first-time home buyer programs in Indiana are utilizing USDA financing, reflecting its growing popularity. Success stories abound, with many families achieving their through this program. For instance, a recent case study highlighted a family that acquired their first home with a USDA financing option, enabling them to invest in their community.

To qualify, applicants must meet and property eligibility criteria. We understand how challenging this process can be, so it’s crucial to explore this option if you’re considering . Potential purchasers are encouraged to using USDA’s online tools and connect with to simplify the application process. By utilizing USDA financing, new buyers can access a pathway to property ownership that is not only financially sustainable but also beneficial for rural community development. We’re here to support you every step of the way.

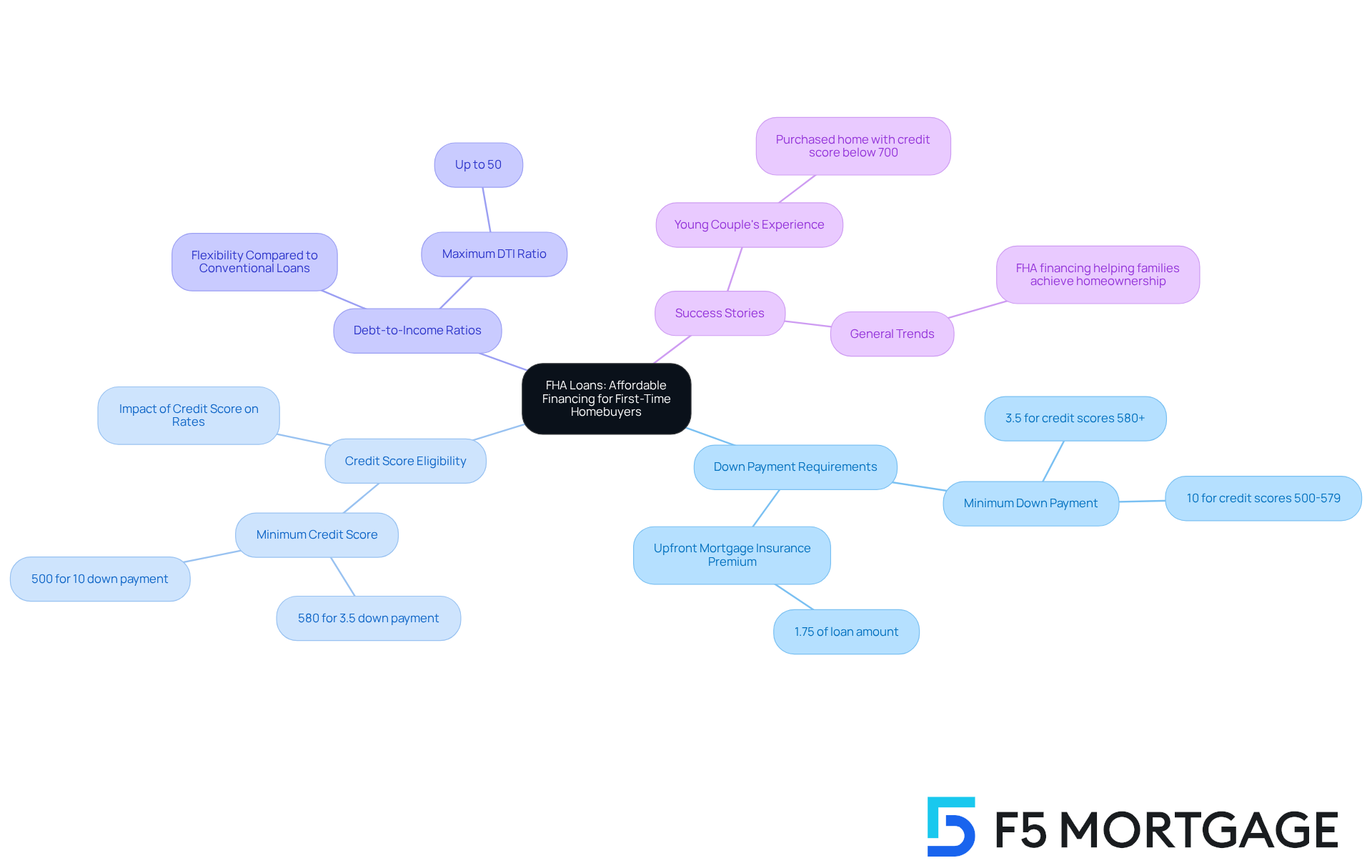

FHA Loans: Affordable Financing for First-Time Homebuyers

are a wonderful financing option available through , primarily due to their appealing , which can be as low as 3.5%. Backed by the Federal Housing Administration, these financial products are designed for borrowers with , making the dream of homeownership more attainable for many families. Additionally, FHA mortgages allow for higher debt-to-income ratios, offering buyers greater flexibility compared to traditional financing, which often imposes stricter criteria.

In Indiana, many first time home buyer programs Indiana, including , to secure their homes. For instance, a recent story highlighted a young couple who, despite having a credit score below 700, were able to purchase their first home with an FHA mortgage, thanks to the program’s accommodating guidelines. This success story reflects a broader trend, as FHA financing has been instrumental in helping numerous families achieve their .

frequently emphasize the advantages of FHA programs, particularly the . One expert noted, “FHA financing opens doors for many new buyers who might otherwise be held back by high down payment demands.” This accessibility is vital in today’s housing landscape.

Ultimately, should be viewed as a practical and affordable route to homeownership, especially with FHA options that offer flexibility and support for those with limited financial resources. We understand how challenging this journey can be, and we’re here to support you every step of the way.

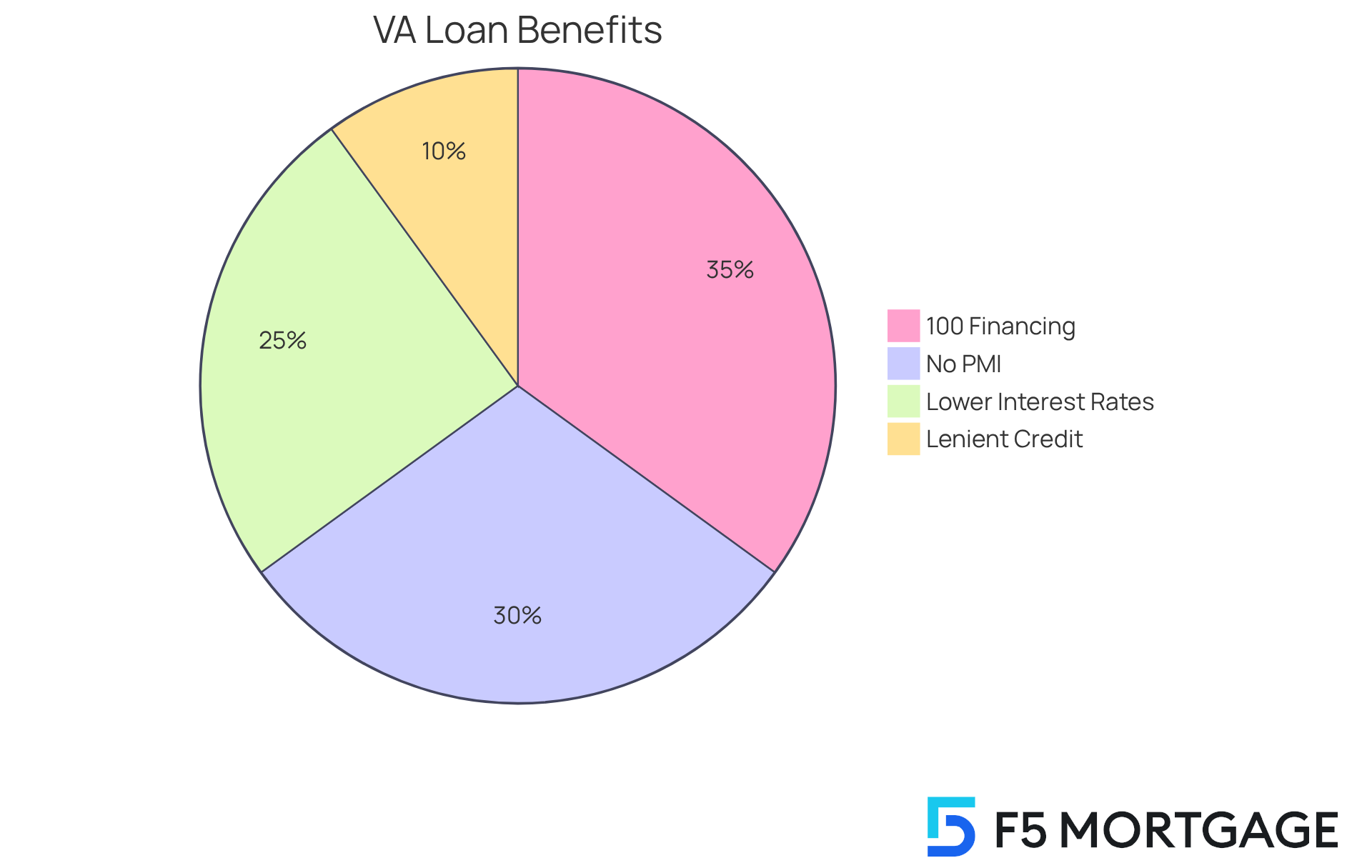

VA Loans: Benefits for Indiana’s Veteran Homebuyers

VA financing offers remarkable benefits for qualified veterans and active-duty personnel eager to purchase homes in Indiana. One of the standout advantages is the ability to finance , which removes the often-daunting requirement of a . This is especially beneficial for those who may find it challenging to save for traditional down payments.

Additionally, do not require , which can lead to significant savings for borrowers over the life of the loan. With that are often lower than traditional financing—averaging 0.47% less in 2024—VA mortgages present a for veterans.

The more further enhance accessibility, allowing individuals with credit scores as low as 580 to qualify under certain conditions. These advantages are for veterans in Indiana, helping them navigate the current housing market, which is characterized by rising prices and limited availability.

Success stories abound, with many of through VA loans. These loans not only facilitate financial savings but also empower veterans to invest in their futures. By taking advantage of these unique opportunities, Indiana’s veterans can secure their homes and create lasting stability for themselves and their families.

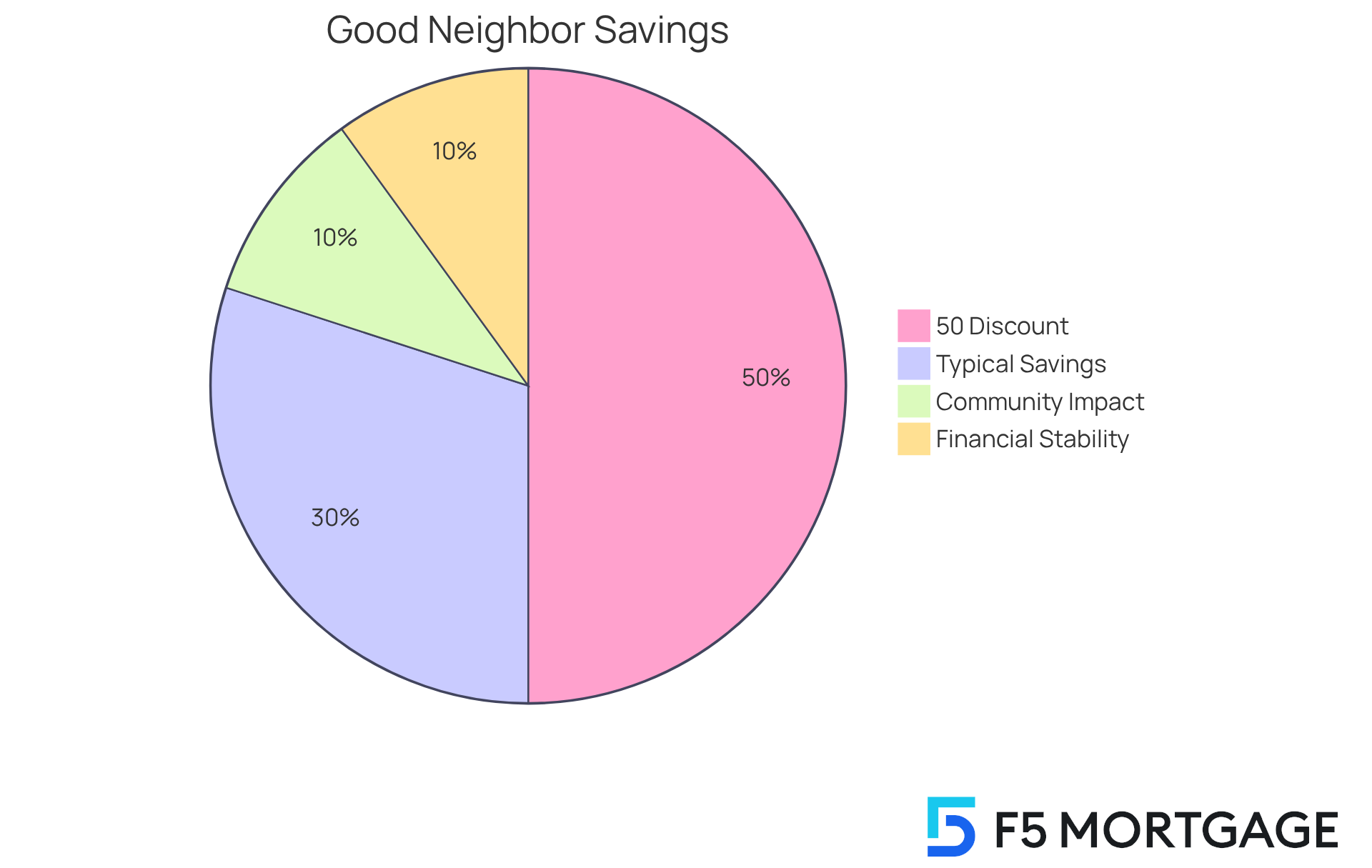

Good Neighbor Next Door: Special Financing for Public Service Professionals

The offers significant discounts to eligible , such as teachers, law enforcement officers, and firefighters. Imagine acquiring a home in a revitalization area at a remarkable 50% discount off the list price. This initiative not only makes much more attainable but also nurtures a among those who serve.

To qualify, applicants must meet specific employment criteria and commit to living in the home for at least 36 months. We know how challenging it can be to navigate homeownership, and success stories from participants highlight the . Many public service professionals report saving tens of thousands of dollars, into a reality while contributing to the revitalization of their neighborhoods.

Expert insights reveal that these discounts not only alleviate financial burdens but also empower public service professionals to establish roots in the communities they serve. This strengthens the vital connection between , fostering a supportive environment for everyone.

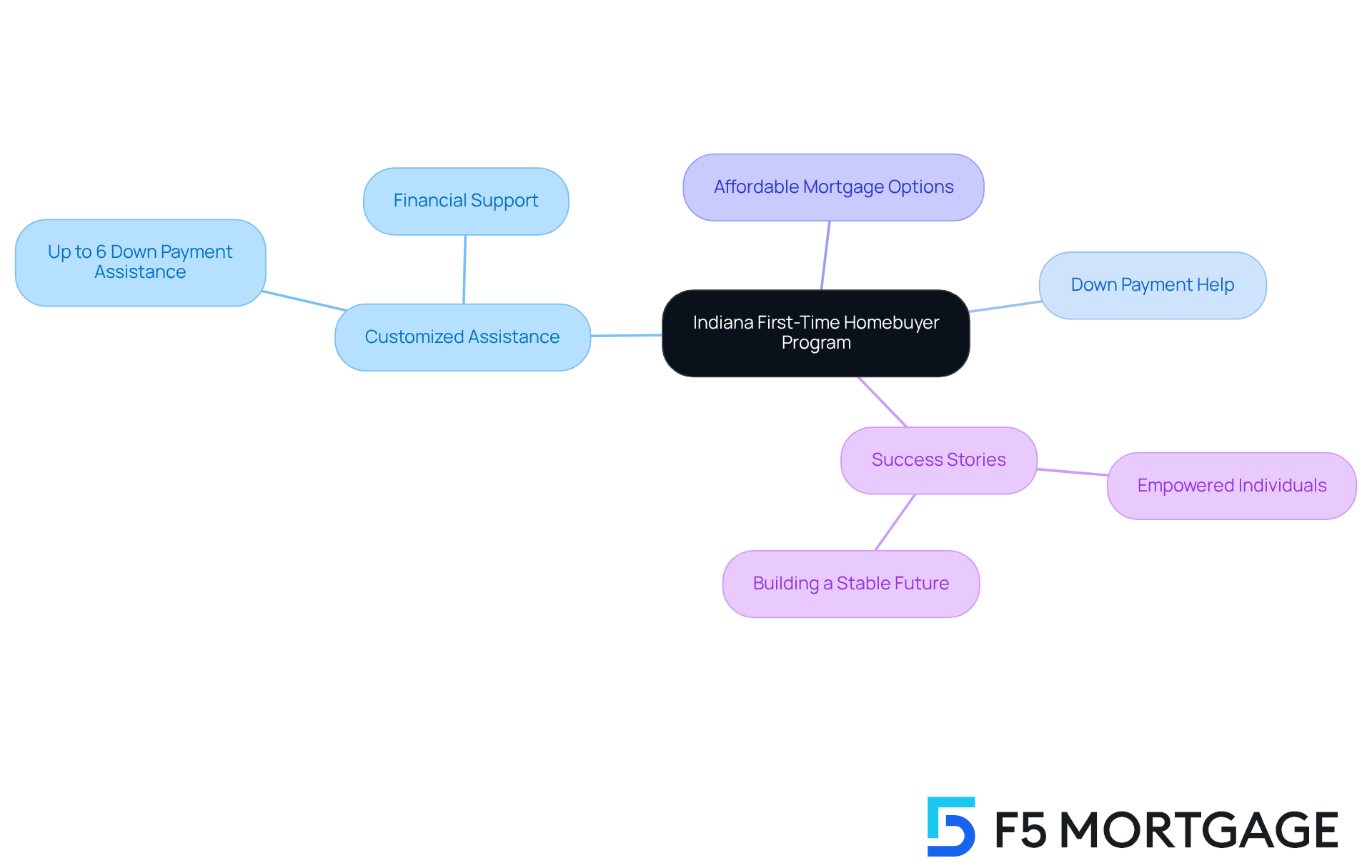

Indiana First-Time Homebuyer Program: Tailored Assistance for New Buyers

The are here to . We understand how challenging this can be, especially when it comes to managing finances. This program offers customized assistance, including down payment help and access to , specifically designed to aid new buyers like you through first time home buyer programs Indiana to overcome .

Eligible participants can receive up to 6% of the purchase price in . This significant support eases the burden of upfront costs and can help you more easily. By utilizing this program, you can with greater confidence and reduced financial stress.

Success stories from participants highlight the program’s effectiveness. These stories demonstrate how it and build a stable future. We’re here to support you every step of the way, helping you .

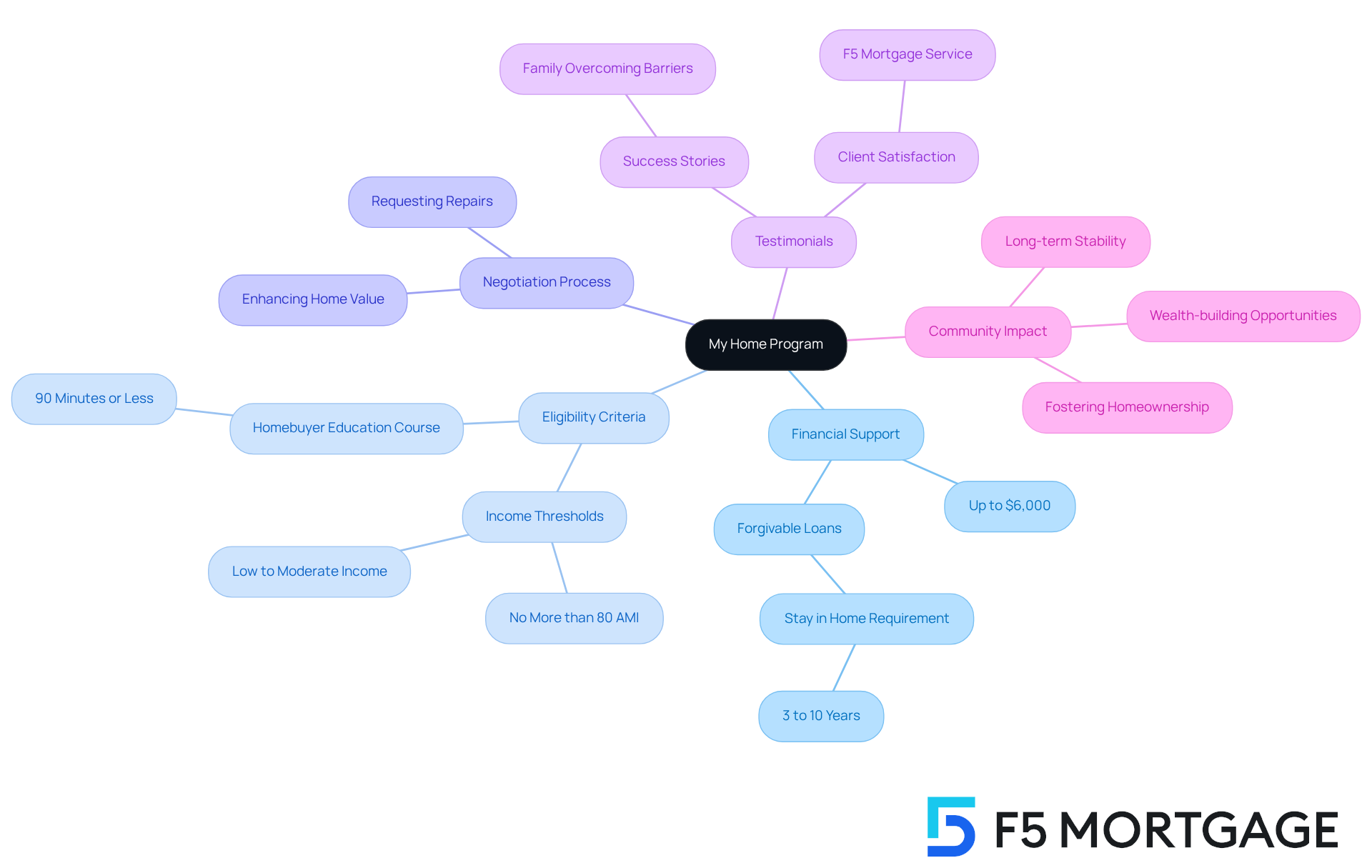

My Home Program: Down Payment Assistance for First-Time Buyers

The My Home Program is a vital resource within the , offering up to $6,000 in down payment support to alleviate the . This initiative is designed with individuals who have low to moderate incomes in mind, making homeownership more attainable. To qualify, applicants need to meet specific income thresholds and complete a , typically lasting 90 minutes or less. By taking advantage of the first time home buyer programs Indiana, , paving the way toward their dream of homeownership.

Understanding the negotiation process is crucial for buyers, especially when requesting repairs or enhancements from sellers. It’s common for buyers to ask sellers to complete repairs as part of the sale, which can enhance the overall value of the home. Many participants have shared how this to entering the housing market. For example, one family successfully purchased their first home after struggling to save for a down payment, illustrating the program’s .

Financial advisors emphasize the essential role of like My Home in fostering property ownership among low- to moderate-income families through first time home buyer programs Indiana. These programs provide immediate financial support and contribute to . Clients have expressed their gratitude for throughout the home buying journey, with testimonials reflecting a high level of satisfaction and support. The My Home Program has empowered countless families to realize their dream of homeownership, highlighting the significant impact of first time home buyer programs Indiana on communities and individuals alike. We know how challenging this can be, and we’re here to support you every step of the way. To learn more about the My Home Program and how to apply, visit the Indiana Housing and Community Development Authority’s website.

Fannie Mae HomeReady: Flexible Financing for Low-to-Moderate Income Buyers

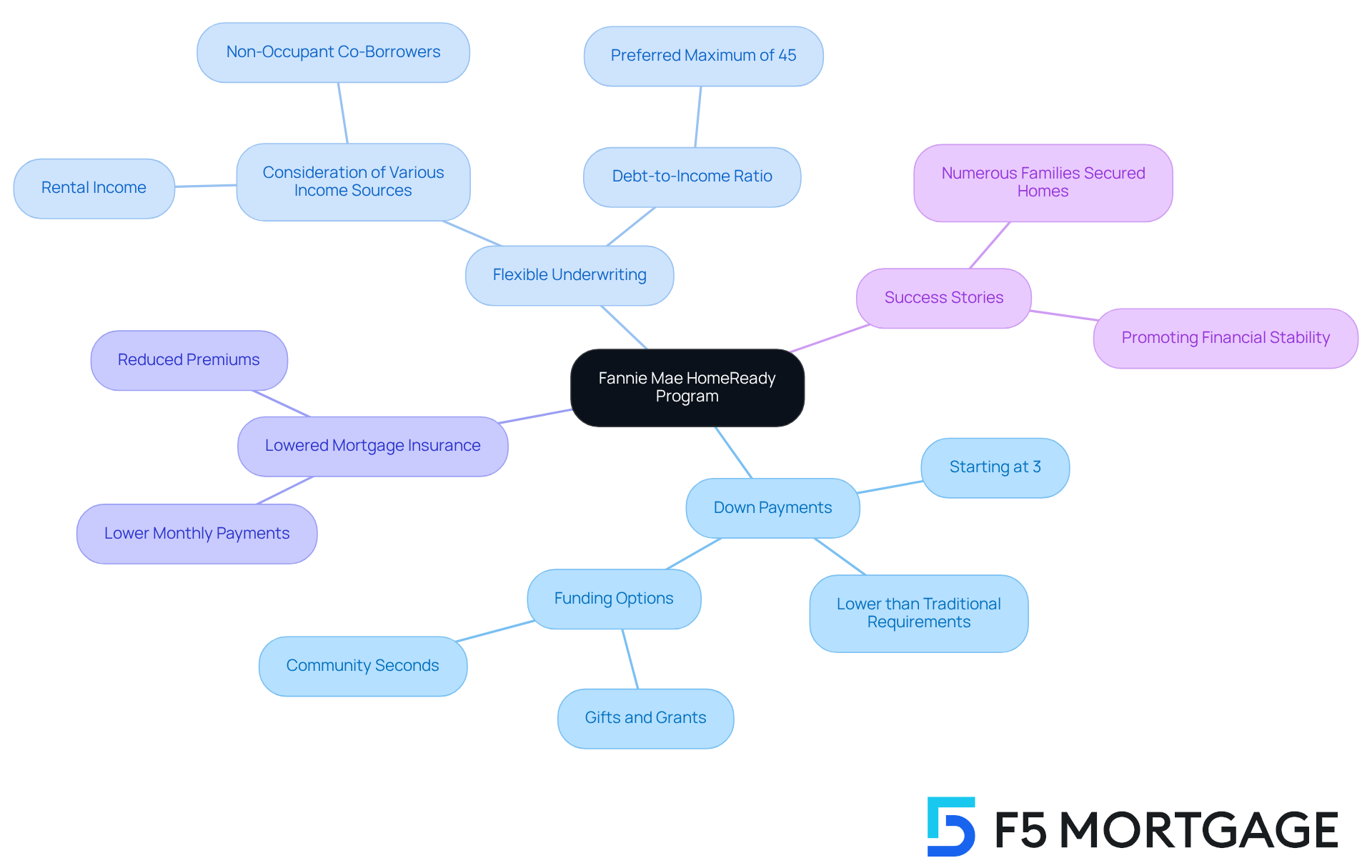

Fannie Mae’s HomeReady program offers a wonderful opportunity for low- to moderate-income individuals in Indiana to through , with . We understand how challenging this journey can be, and this initiative is designed to support you by featuring that consider various income sources, such as rental income and contributions from non-occupant co-borrowers. This flexibility enhances your borrowing capacity, making your dream of owning a home more attainable.

Moreover, HomeReady provides , making it a . Many participants in Indiana have reported that the [first time home buyer programs Indiana](https://f5mortgage.com) provide average down payments that are significantly lower than traditional requirements, allowing them to enter the housing market more easily. Success stories abound, with numerous low- to moderate-income families using HomeReady to secure their homes. This illustrates the program’s effectiveness in promoting property ownership and fostering financial stability.

We’re here to support you every step of the way, empowering you to take action towards your .

Next Home Program: Affordable Options for First-Time Homebuyers

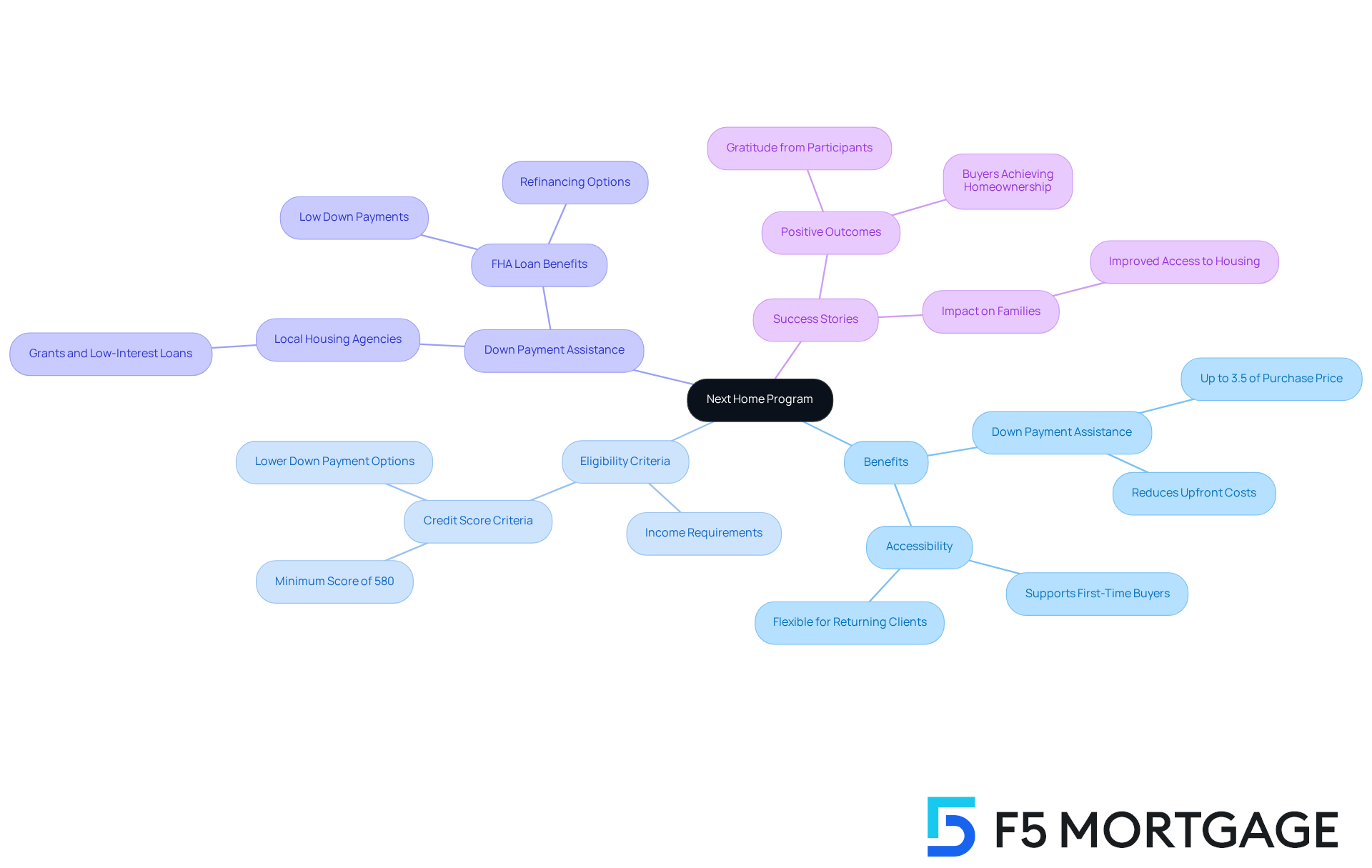

The presents a wonderful opportunity for new homebuyers in Indiana through , offering of up to 3.5% of the purchase price. We understand how daunting the can be, and this initiative, which includes first time home buyer programs in Indiana, is designed not just for first-time buyers but also for returning clients, making it a to owning a home.

Eligible participants must meet specific income and credit criteria, which helps ensure that the program effectively reaches those who truly need . By taking advantage of the Next Home Program, buyers can significantly , making the dream of homeownership more accessible and enhancing the overall affordability of housing in our state.

Success stories are plentiful, with many buyers expressing heartfelt gratitude for the assistance that turned their dream homes into reality. Housing authorities emphasize the vital role of first time home buyer programs Indiana, highlighting their importance in improving for families across the state. We’re here to as you embark on this exciting journey.

Conclusion

Navigating the journey to homeownership can feel overwhelming, especially for first-time buyers. We understand how challenging this can be. Fortunately, Indiana offers a variety of programs designed to support new homeowners through tailored financial assistance and flexible mortgage options. By leveraging these resources, aspiring homeowners can turn their dreams into reality with greater confidence and reduced financial stress.

This article highlights several key programs, including:

- F5 Mortgage’s personalized solutions

- The IHCDA’s down payment assistance initiatives

- USDA loans for rural buyers

- FHA and VA financing options

- Specialized programs like Good Neighbor Next Door and My Home

Each of these programs provides unique benefits, such as low down payment requirements and access to financial education, ultimately making homeownership more accessible for Indiana residents.

As the landscape of homeownership continues to evolve, it is essential for potential buyers to explore these first-time home buyer programs in Indiana. By taking advantage of the assistance available, individuals can pave the way for a stable financial future and contribute positively to their communities. Embracing these opportunities not only enhances personal well-being but also strengthens the fabric of neighborhoods across the state. We’re here to support you every step of the way as you embark on this exciting journey.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer for first-time homebuyers?

F5 Mortgage specializes in providing personalized mortgage solutions for first-time homebuyers. They offer competitive rates, exceptional service, tailored consultations, access to various loan programs, and a user-friendly mortgage calculator to help navigate mortgage financing.

What is the customer satisfaction rate at F5 Mortgage?

F5 Mortgage has an impressive customer satisfaction rate of 94%, indicating their commitment to providing exceptional service to their clients.

How quickly can loans be closed through F5 Mortgage?

F5 Mortgage often completes loan closings in under three weeks, reflecting their efficiency in processing applications.

What programs does the Indiana Housing and Community Development Authority (IHCDA) offer for first-time homebuyers?

The IHCDA offers several first-time homebuyer programs, including the First Step Program, which provides up to 6% of the purchase price as non-forgivable down payment assistance, and the Next Home Program, which offers down payment assistance options of 2.5% or 3.5%.

How does the First Step Program assist novice homebuyers?

The First Step Program helps reduce the financial burden of homeownership by offering substantial down payment assistance, enabling many novice homebuyers to transition from renting to owning.

What financing options does USDA Rural Development provide for rural homebuyers in Indiana?

USDA Rural Development offers customized home financing options that provide 100% funding for low- to moderate-income purchasers in designated rural areas, meaning no initial payment is required.

What are the benefits of USDA financing for first-time homebuyers?

USDA financing typically features lower mortgage insurance costs compared to traditional options, making it more affordable. Approximately 30% of first-time homebuyer programs in Indiana utilize USDA financing due to its benefits.

What are the eligibility requirements for USDA financing?

To qualify for USDA financing, applicants must meet specific income limits and property eligibility criteria. It is recommended to verify eligibility using USDA’s online tools and connect with USDA-approved lenders for assistance.