Introduction

Navigating the complexities of homeownership can feel overwhelming for Florida families. We know how challenging this can be, especially with the many FHA loan requirements that shape the journey. Understanding these requirements not only opens the door to affordable housing options but also empowers families to make informed financial decisions.

But with so much information out there, how can prospective buyers discern the essential criteria that will lead them to their dream home? This article delves into the critical FHA loan requirements specific to Florida, equipping families with the knowledge they need to confidently embark on their homebuying journey. We’re here to support you every step of the way.

F5 Mortgage: Personalized FHA Loan Solutions for Florida Homebuyers

At F5 Mortgage, we understand how challenging the journey to homeownership can be, especially in the Sunshine State. That’s why we focus on providing customized options that meet the FHA loan requirements Florida to cater to your unique needs. Our commitment to client satisfaction means you can expect a stress-free process, supported by user-friendly technology that simplifies every step of your mortgage journey.

Our expert team is here to guide you without any pressure, ensuring that you find the right fit for your financial situation. We know how important it is for families to feel confident in their decisions, and we’re dedicated to helping you navigate the complexities of FHA loan requirements Florida. With our assistance, you can secure favorable terms and experience quick closings in under three weeks.

Imagine stepping into your new home sooner than you thought possible! At F5 Mortgage, we’re here to support you every step of the way, making homeownership more attainable for you and your family. Let’s work together to turn your dream into reality.

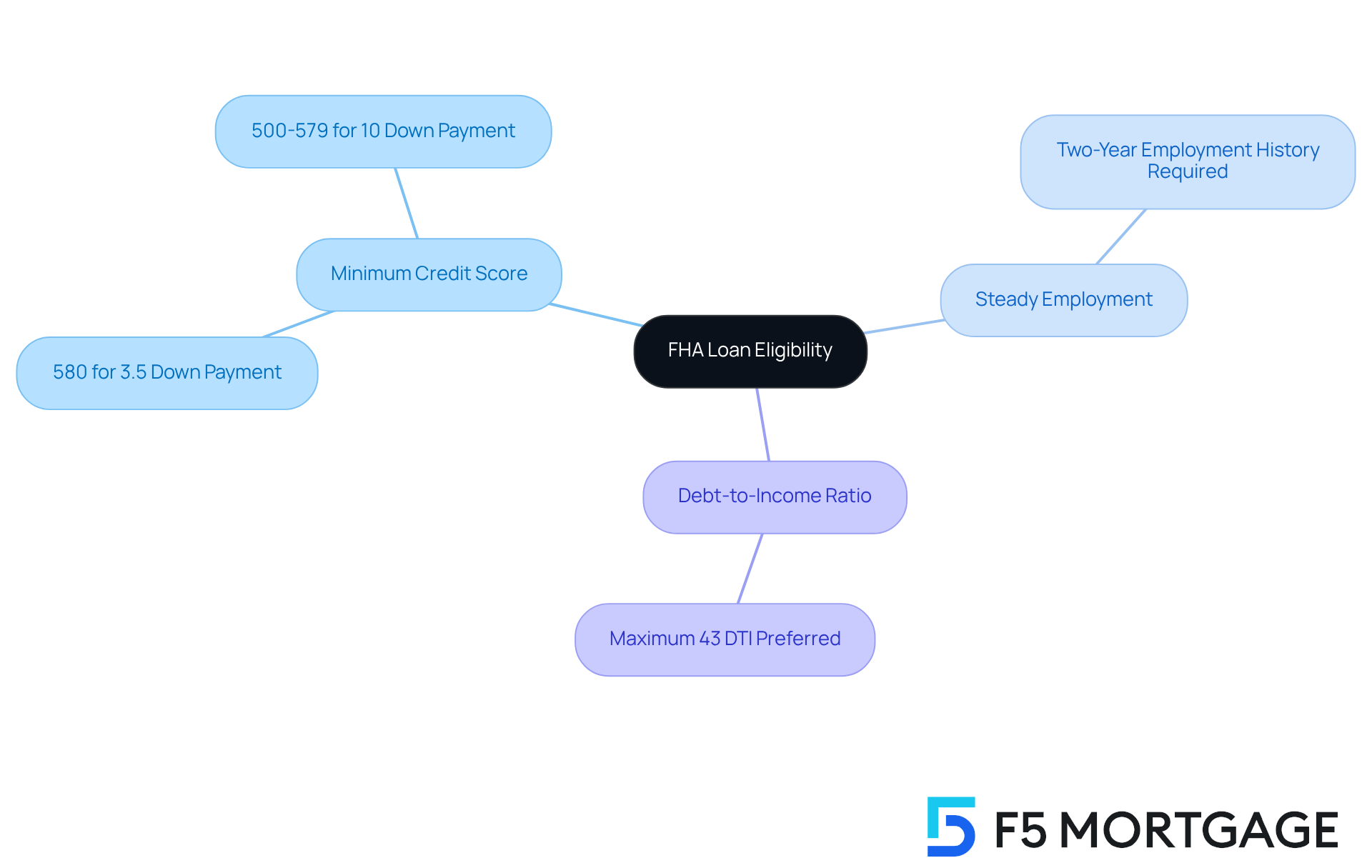

FHA Loan Eligibility: Key Requirements for Florida Applicants

If you’re considering an FHA loan in Florida, it’s important to familiarize yourself with the FHA loan requirements Florida to qualify. We understand how overwhelming this process can be, but we’re here to support you every step of the way. Here are some key requirements:

Minimum Credit Score: Generally, you’ll need a credit score of at least 580 to make a down payment of just 3.5%. If your score falls between 500 and 579, a larger down payment of 10% is required. Many applicants find themselves around this threshold, indicating that the FHA loan requirements in Florida are designed to be accessible, even for those with less-than-perfect credit.

Steady Employment: Lenders typically look for a stable employment history, ideally over the past two years. This consistency helps assure them that you can make regular mortgage payments.

Debt-to-Income Ratio: A maximum debt-to-income (DTI) ratio of 43% is usually preferred, though some lenders may offer a bit of flexibility. This ratio is crucial in assessing your financial health and ability to manage monthly payments.

Real-life stories can really highlight how families have successfully met these requirements. Take the Smith family, for instance. They faced challenges due to low credit scores but managed to secure an FHA mortgage, allowing them to buy their first home with a small deposit. Their journey shows how the program can truly support first-time buyers.

Experts agree that understanding the FHA loan requirements in Florida is vital, particularly as the FHA continues to adjust its guidelines to encourage homeownership among diverse applicants. With the right preparation and guidance, families can leverage FHA financing to achieve their dreams of homeownership in the Sunshine State.

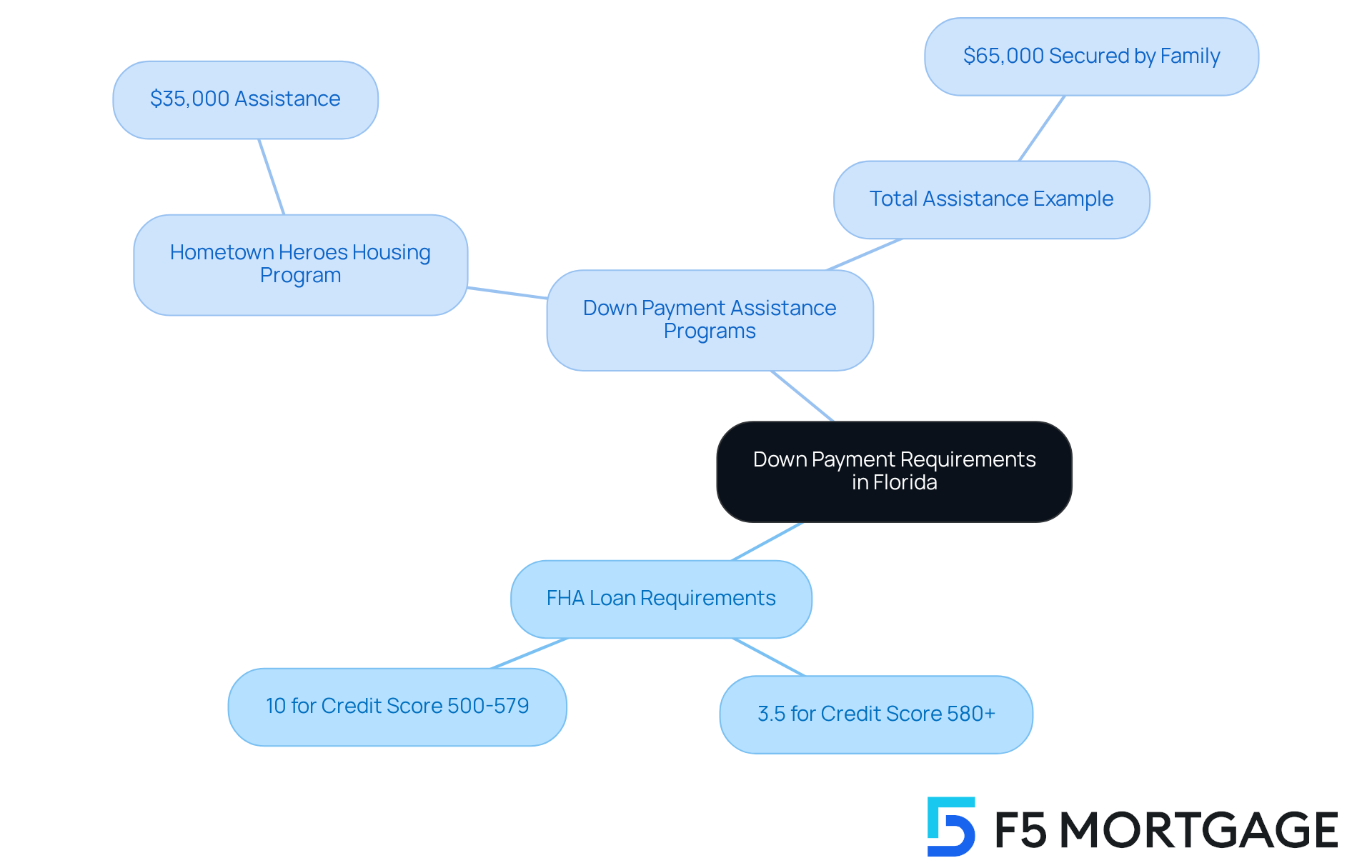

Down Payment Requirements: What Florida Homebuyers Need to Know

The FHA loan requirements in Florida provide flexible down payment options, making the journey to homeownership easier for families. Here’s a quick look at the standard down payment requirements:

- 3.5% for borrowers with a credit score of 580 or higher.

- 10% for those with credit scores between 500 and 579.

But that’s not all! There are various down payment assistance programs available to help eligible buyers manage these costs. For example, the Hometown Heroes Housing Program offers up to $35,000 in assistance, which can be combined with other funding sources to maximize support. This program has already helped over 20,000 individuals and families since it started, showing just how impactful it can be in making homeownership a reality.

We know how challenging this can be, and financial advisors stress the importance of exploring these assistance options. They can significantly lighten the financial load for first-time homebuyers. Take, for instance, a family in Jacksonville who accessed various state and local support programs, securing a total of $65,000 to help with their down payment. This support turned their dream of homeownership into a reality.

As the demand for affordable housing continues to grow, understanding the FHA loan requirements Florida has, along with available down payment assistance programs, is crucial for families looking to secure FHA financing. By leveraging these resources, potential homebuyers can navigate the complexities of the mortgage process with greater confidence and ease. We’re here to support you every step of the way!

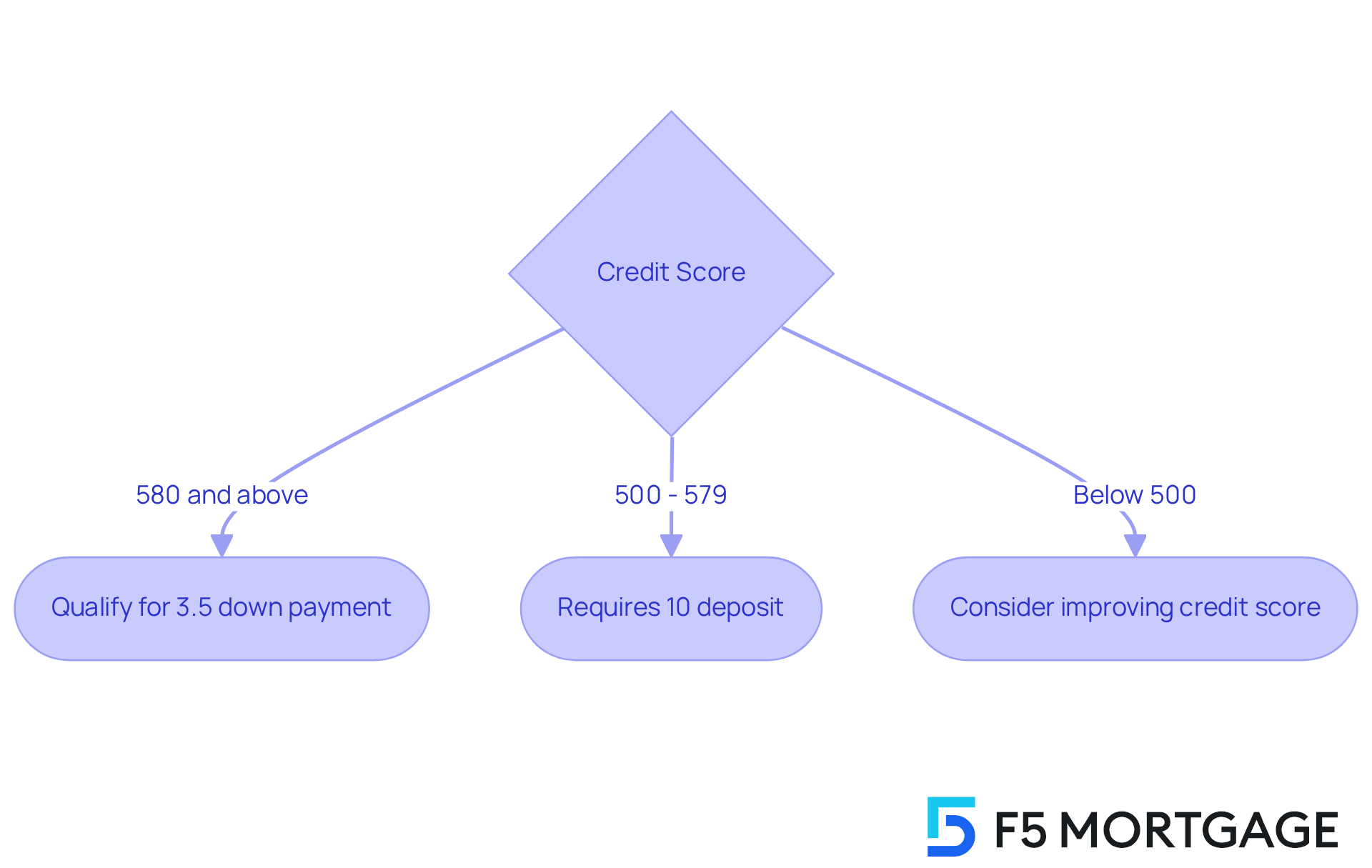

Credit Score Standards: FHA Loan Criteria for Florida Residents

Navigating the FHA loan requirements Florida can feel overwhelming, especially when it comes to understanding the credit score requirements. We know how challenging this can be, but we’re here to support you every step of the way.

To qualify for the low down payment option of 3.5%, you’ll need a minimum credit score of 580. If your score falls between 500 and 579, don’t worry – there’s still a path forward, but it will require a 10% deposit.

Improving your credit score before applying for an FHA loan can greatly influence the FHA loan requirements Florida. Many borrowers discover that by taking proactive steps to enhance their scores, they can qualify for better interest rates and lower monthly payments. Imagine the relief of knowing you’re getting the best possible deal!

Mortgage specialists emphasize the importance of maintaining a low credit utilization ratio and making timely payments. These simple actions can lead to significant improvements in your credit score. In fact, countless individuals have successfully raised their scores from below 580 to above it by focusing on these strategies. This not only helps them qualify for the more favorable options under FHA loan requirements Florida, but it also opens doors to homeownership that may have seemed out of reach before.

Remember, every step you take towards improving your credit score is a step towards making your dream of owning a home a reality. You’ve got this!

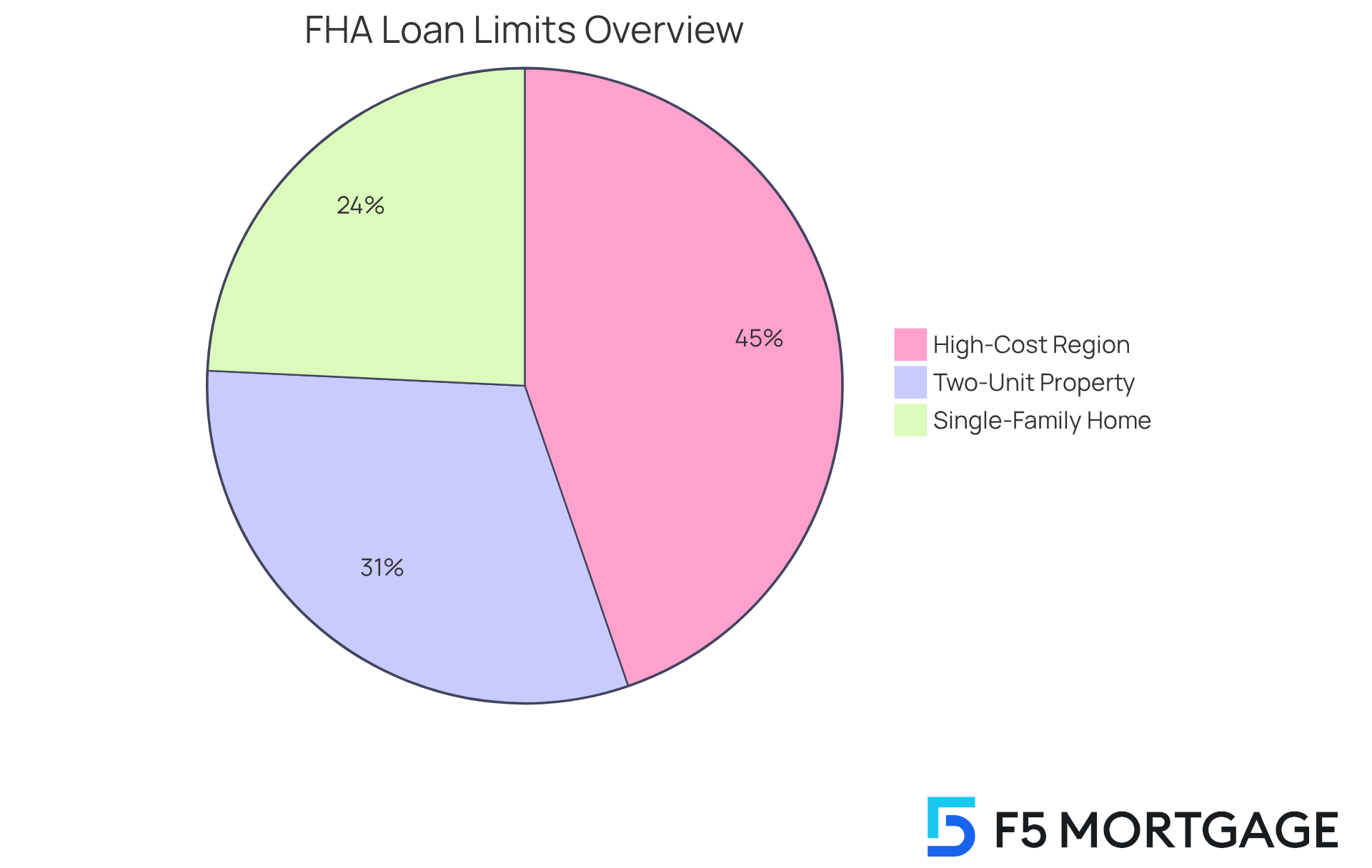

FHA Loan Limits: Maximum Borrowing Amounts for Florida Homebuyers

Navigating the world of FHA borrowing limits can feel overwhelming, especially when considering the diverse housing market across our counties. As of 2025, these limits for single-family homes vary significantly, ranging from $524,225 in more affordable areas to $967,150 in high-cost regions like Monroe County.

For families looking at multi-family properties, the borrowing limits are even more accommodating, offering greater financial flexibility. For example, in Union County:

- A single-family home has a limit of $524,225

- A two-unit property can go up to $671,200

These variations underscore the importance of verifying the specific limits that apply to your desired location. We know how challenging this can be, and understanding these limits is crucial for families as they navigate the home buying process. It directly influences your borrowing capacity and overall affordability.

So, take a moment to explore these limits. We’re here to support you every step of the way.

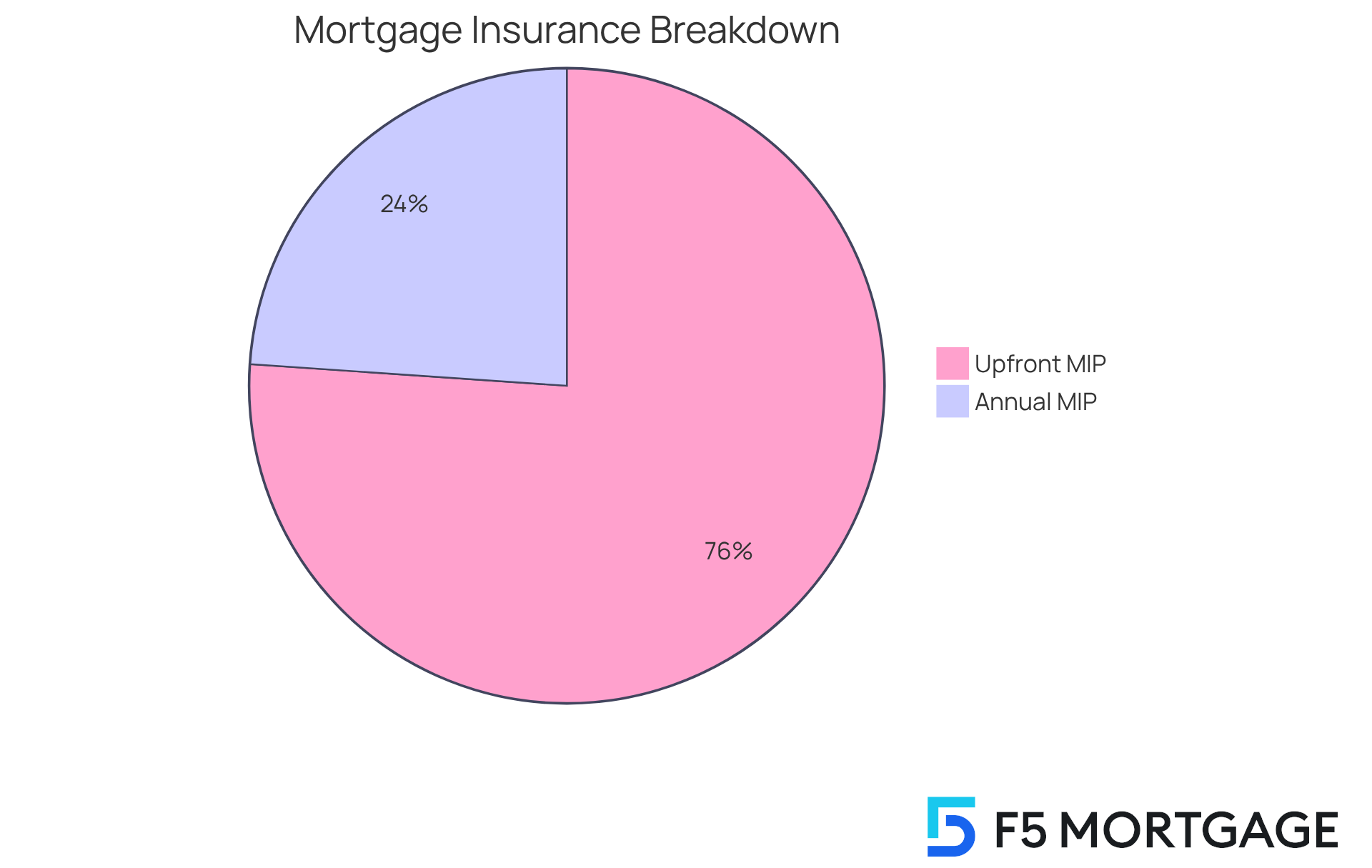

Mortgage Insurance Premiums: Understanding FHA Costs in Florida

FHA financing comes with mortgage insurance premiums (MIP), which are designed to protect lenders in case of borrower defaults. We understand how challenging it can be for prospective homeowners in Florida to navigate FHA loan requirements in Florida. That’s why F5 Mortgage is dedicated to transforming the mortgage experience, using technology to offer transparent and competitive solutions.

Let’s break down the MIP costs:

- Upfront MIP: Typically, this is 1.75% of the loan amount. Good news! You can incorporate this into your mortgage, allowing you to finance it instead of paying it out-of-pocket at closing.

- Annual MIP: This varies based on the amount borrowed and the term, usually ranging from 0.15% to 0.75% of the borrowed balance. For example, if your mortgage exceeds $726,200 with a loan-to-value (LTV) ratio above 90%, you might face an annual MIP of 0.70%.

Additionally, FHA financing allows for a debt-to-income (DTI) ratio of up to 56.9%. This offers you greater flexibility in managing your finances. If you’re in a flood zone, you’ll need to obtain flood insurance, which adds to your annual costs. But don’t worry-Florida has down payment assistance programs that align with FHA loan requirements in Florida to help first-time homebuyers with those initial expenses. This aligns perfectly with F5 Mortgage’s mission to empower families through personalized support.

It’s crucial to understand that if you put down less than 10% on an FHA mortgage, the MIP lasts for the lifetime of the agreement. This can significantly impact your long-term financial planning. So, it’s essential to factor these premiums into your budgeting to make informed decisions about your mortgage options.

By exploring down payment assistance programs and understanding the full range of expenses related to FHA financing, you can navigate the home purchasing process more effectively. Remember, we’re here to support you every step of the way with the outstanding service offered by F5 Mortgage.

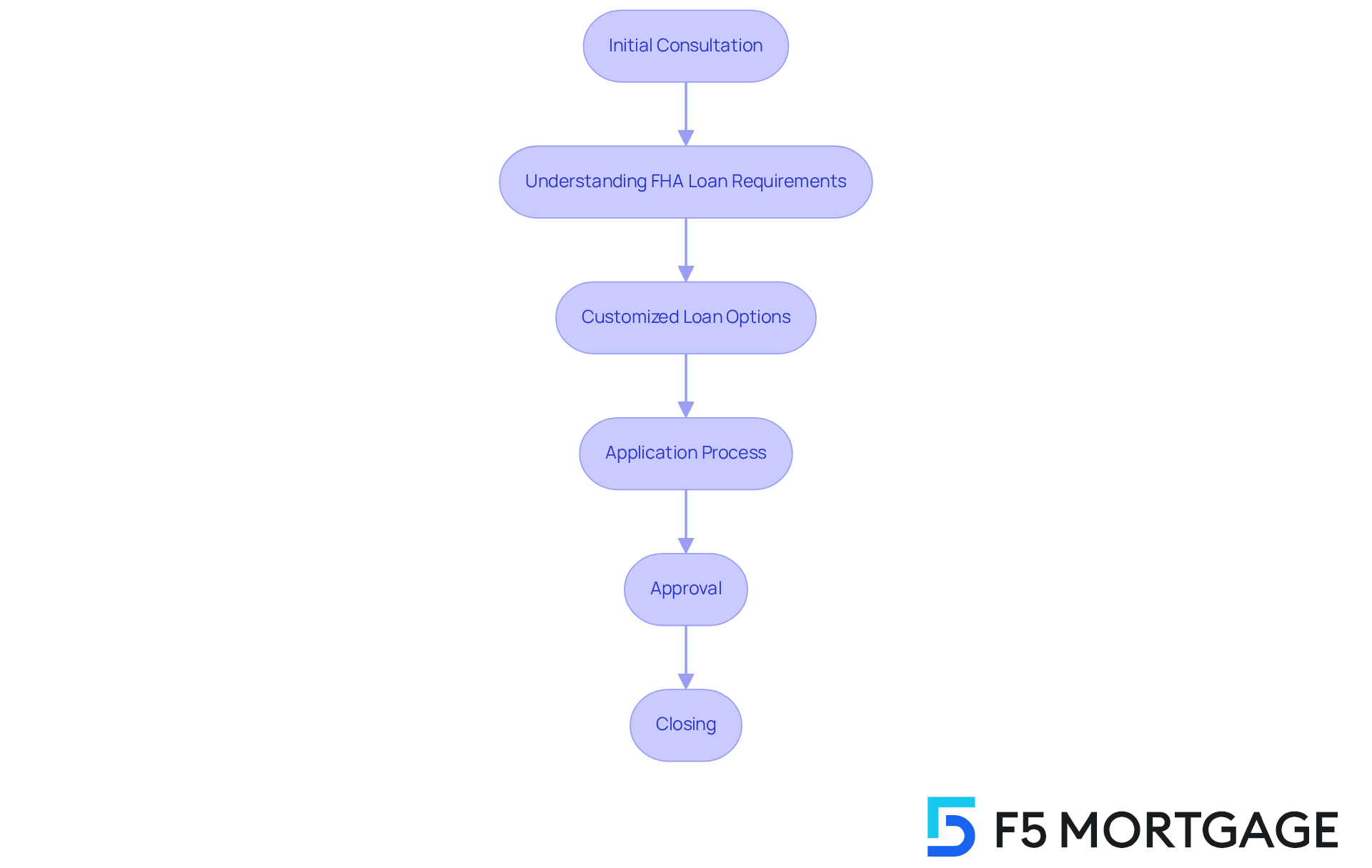

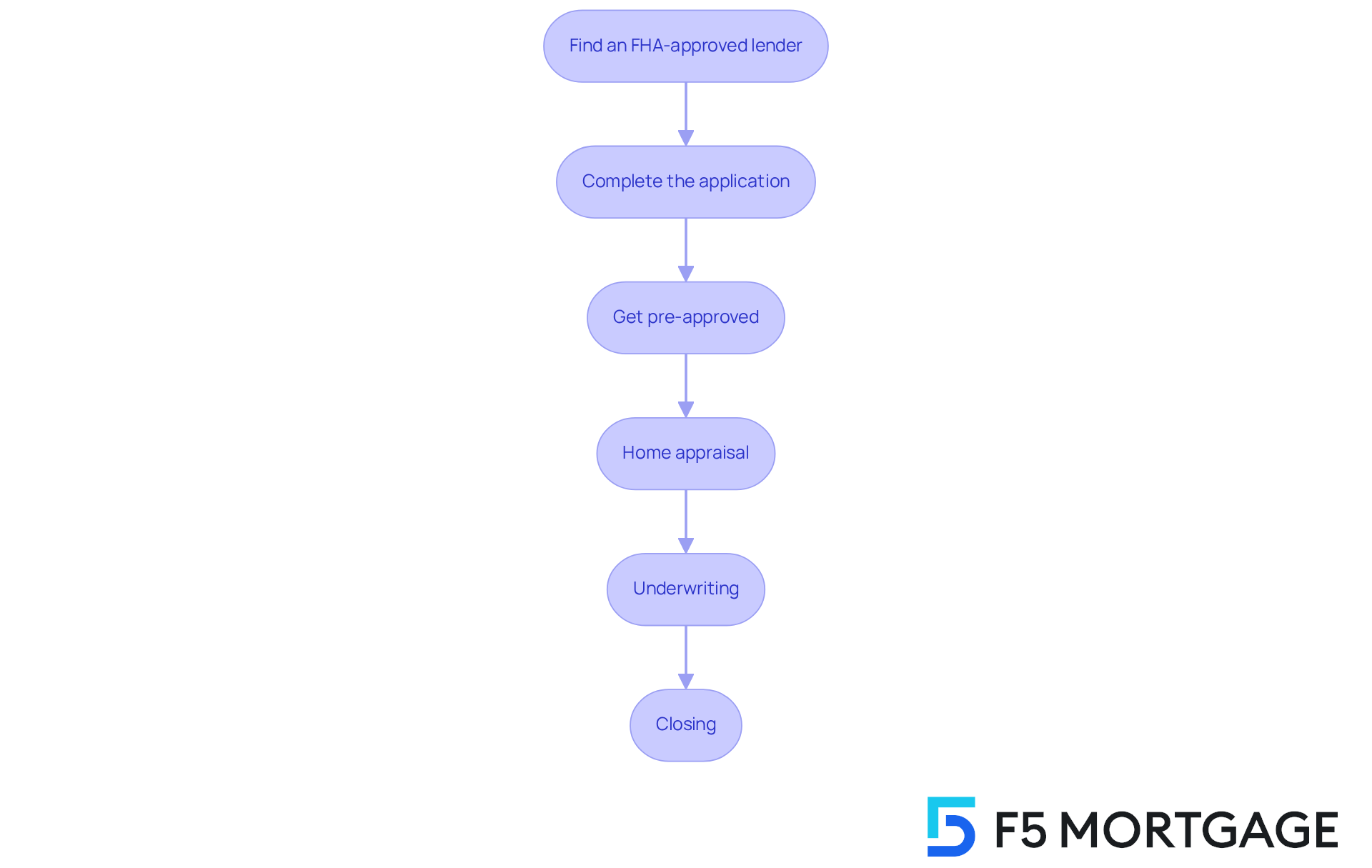

Application Process: Steps to Secure an FHA Loan in Florida

Navigating the application process while meeting FHA loan requirements in Florida can feel overwhelming, but we’re here to support you every step of the way. Understanding the key steps involved can make a significant difference in your journey toward homeownership. Here’s a simple guide to help you through:

Find an FHA-approved lender: Start by researching and choosing a lender who specializes in FHA financing. This is crucial, as their expertise can make the process smoother.

Complete the application: Gather the necessary documentation, including proof of income and credit history. We know how challenging this can be, but having everything ready will help you feel more prepared.

Get pre-approved: This important step not only helps you understand your borrowing capacity but also shows sellers that you’re a serious buyer. It’s a great way to boost your confidence!

Home appraisal: Your lender will require an appraisal to assess the property’s value, ensuring it meets FHA standards. This step is vital for protecting your investment.

Underwriting: During this phase, the lender reviews your application and supporting documents to evaluate your eligibility. It’s a thorough process, but it’s designed to ensure you’re on the right path.

Closing: Once your financing is approved, you’ll finalize the paperwork and receive the funds to purchase your home. This is the exciting moment you’ve been waiting for!

Understanding the FHA loan requirements in Florida can greatly improve your odds of a successful application, especially in the Sunshine State, where the typical approval duration varies from 30 to 60 days. Remember, timely document submission and maintaining a good credit standing are key to expediting the process. You’ve got this!

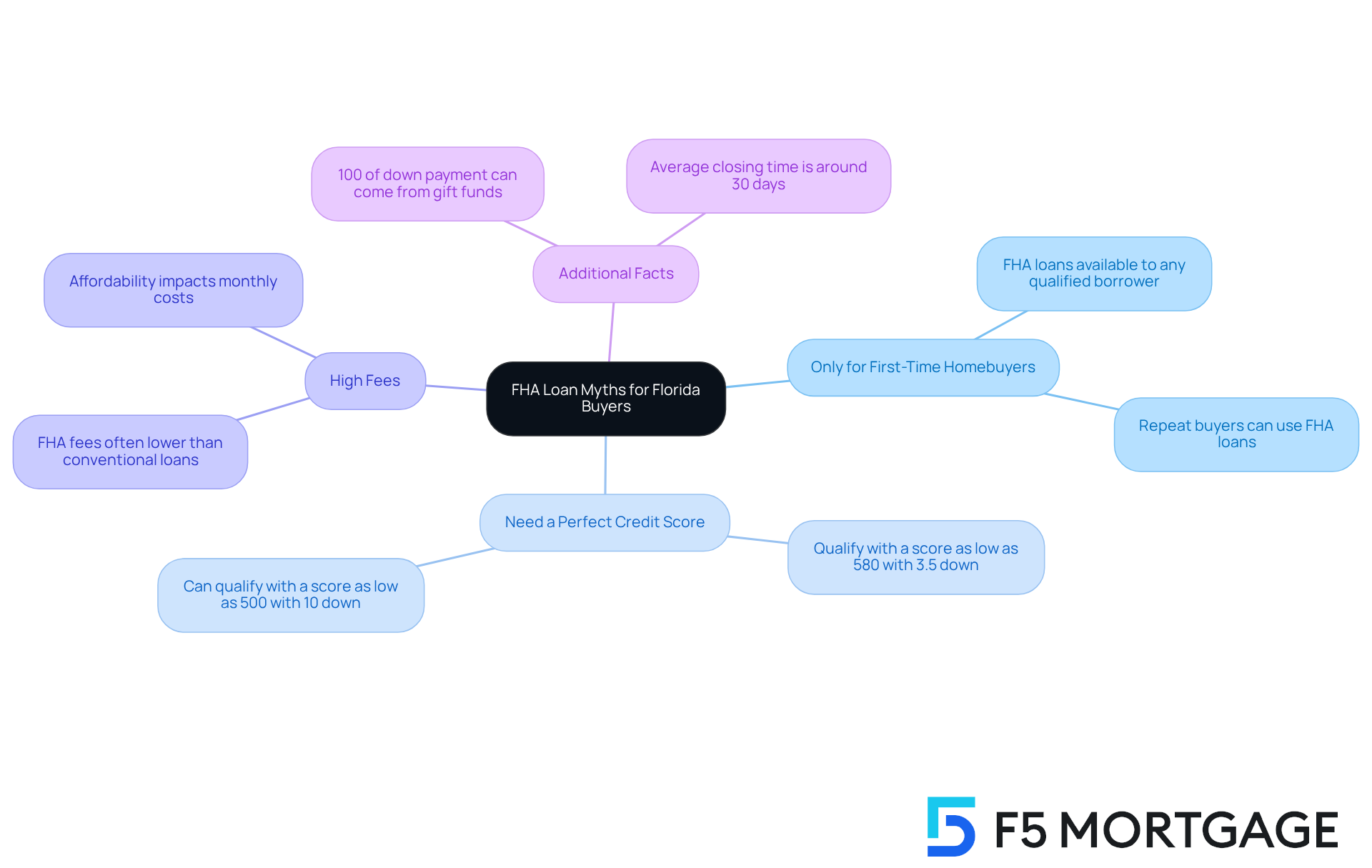

Frequently Asked Questions: Clarifying FHA Loan Myths for Florida Buyers

Many myths about FHA loan requirements Florida can mislead potential borrowers, especially in Florida. Let’s take a moment to address some of these common misconceptions:

Myth: FHA loans are only for first-time homebuyers.

Fact: FHA financing is available to any qualified borrower, including those who have owned homes before. This flexibility means that repeat buyers can enjoy the same favorable terms and down payment options. Plus, FHA financing can be used multiple times, as long as borrowers meet qualifications and don’t hold more than one FHA mortgage at a time.Myth: You need a perfect credit score.

Fact: FHA financing is designed to accommodate lower credit scores, making it a viable option for many. You can qualify with a credit score as low as 580 with a 3.5% down payment, or even 500 with a 10% down payment. This opens the door to homeownership for more families.Myth: FHA mortgages have high fees.

Fact: While FHA financing does involve certain costs, they are often lower than those associated with conventional financing, especially for borrowers with lower credit scores. This affordability can significantly impact your monthly costs.Additional Fact: FHA mortgages allow 100% of the down payment to come from gift funds, which can be a huge advantage for many families.

Additional Fact: The average closing time for an FHA mortgage is around 30 days, similar to conventional mortgages. This counters the misconception that FHA mortgages take longer to close.

These misconceptions can discourage qualified buyers from pursuing FHA loan requirements Florida, ultimately impacting application rates in the state. By dispelling these myths, you can gain a clearer understanding of the benefits of FHA financing and how it can support your journey to homeownership. We know how challenging this process can be, so we encourage you to consult with an experienced FHA lender who can guide you through the application process effectively.

Benefits of FHA Loans: Why Florida Homebuyers Should Consider Them

FHA loans offer a range of benefits that can truly make a difference for Florida homebuyers:

- Low Down Payment: We understand how daunting it can be to save for a home. With a minimum down payment of just 3.5%, the FHA loan requirements Florida allow many families to step into the housing market without a hefty upfront investment.

- Flexible Credit Requirements: We know that credit scores can be a hurdle for many. The FHA loan requirements in Florida are designed to support borrowers with lower credit scores, making homeownership more attainable. For instance, individuals with credit scores as low as 500 can qualify with a 10% deposit, broadening the pool of eligible buyers.

- Competitive Interest Rates: Every little bit helps, especially in Florida’s competitive housing market. FHA loan requirements in Florida typically lead to lower interest rates compared to conventional loans, which can significantly lower overall borrowing costs. Just think about how much a single percentage point can impact your monthly payments.

Many counties in the Sunshine State offer down payment assistance programs designed to meet FHA loan requirements in Florida, enhancing affordability. For example, the Hometown Heroes Program offers up to 5% of the first mortgage amount for qualifying professionals, making the dream of homeownership more achievable.

Real-world impact demonstrates that families across Florida have successfully navigated FHA loan requirements Florida to secure their homes. Take, for instance, a household in Hillsborough County that purchased a home priced at $524,225 with an FHA mortgage. They benefited from the lower upfront costs and flexible credit criteria, allowing them to settle into their dream home without financial strain.

These features collectively position the FHA loan requirements Florida as a vital resource for families looking to improve their living situations in the Sunshine State. It offers a pathway to homeownership that is not only feasible but also reliable. We’re here to support you every step of the way.

Down Payment Assistance Programs: Resources for Florida FHA Loan Borrowers

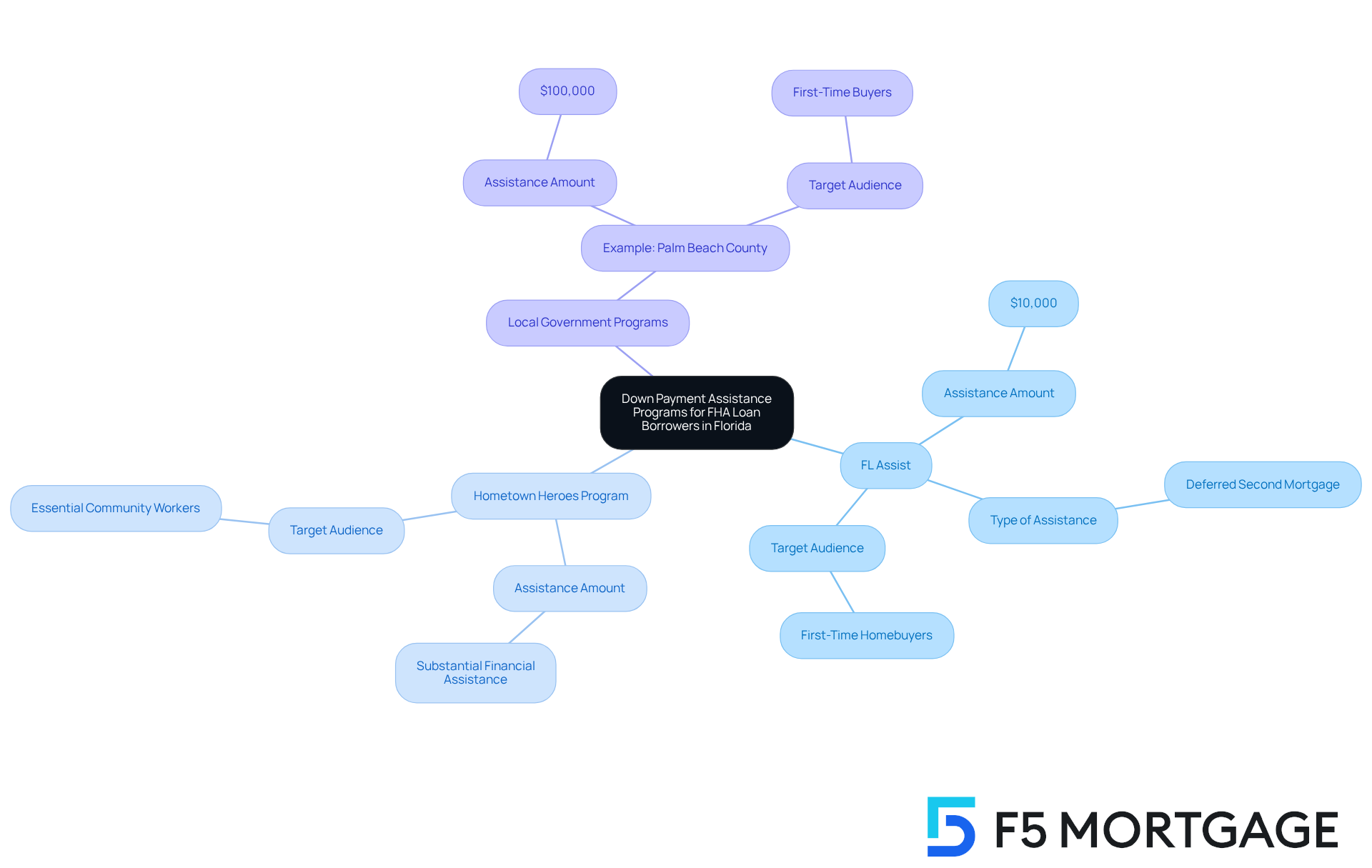

Navigating the path to homeownership can feel overwhelming, but the state offers a range of down payment assistance initiatives designed to support the FHA loan requirements Florida for borrowers. These programs simplify the journey, making it more accessible for families like yours. Here are some key resources:

- FL Assist: This program provides up to $10,000 in the form of a deferred second mortgage, which can be used for down payment and closing costs. It’s a vital resource for many first-time buyers, helping to ease financial burdens.

- Hometown Heroes Program: Tailored for first-time homebuyers who meet income qualifications, this initiative offers substantial financial assistance. It’s specifically aimed at helping essential community workers achieve their homeownership dreams.

- Local Government Programs: Many counties and cities across Florida have established their own assistance initiatives, providing significant financial support. For instance, Palm Beach County offers up to $100,000 in financial assistance for down payments, showcasing the commitment of local authorities to promote homeownership.

In 2025, these programs have collectively assisted thousands of families, demonstrating their effectiveness in overcoming financial barriers. One recent success story involved a family that utilized the FL Assist program to secure a $195,000 townhome with $95,000 in down payment assistance. This illustrates how these resources can truly transform the dream of homeownership into reality.

Overall, these programs not only alleviate the financial burden associated with purchasing a home but also empower families to navigate the complexities of the FHA loan requirements in Florida with greater confidence and support. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Navigating the FHA loan requirements in Florida can truly open doors to homeownership for many families. It’s a viable option for those seeking affordable housing solutions. In this article, we’ve explored the essential criteria – from credit score standards to down payment assistance programs – highlighting how these resources can empower potential homebuyers to achieve their dreams.

Key insights reveal that FHA loans are accessible through lower credit score thresholds and flexible down payment options. Additionally, various assistance programs are available to help alleviate financial burdens. Real-life examples illustrate the transformative impact of these loans, showing that with the right guidance and preparation, families can successfully secure their homes.

As the demand for affordable housing continues to rise, understanding and leveraging the FHA loan requirements is crucial. We know how challenging this can be, and we encourage families to explore the benefits of these loans and consider the assistance programs available in Florida. By taking proactive steps, potential homebuyers can navigate the complexities of the mortgage process with confidence and ease, ultimately making their homeownership dreams a reality.

Frequently Asked Questions

What is F5 Mortgage’s approach to FHA loans for Florida homebuyers?

F5 Mortgage focuses on providing personalized FHA loan solutions that meet the unique needs of Florida homebuyers, ensuring a stress-free process supported by user-friendly technology.

What are the key FHA loan requirements for applicants in Florida?

Key FHA loan requirements in Florida include a minimum credit score of 580 for a 3.5% down payment, steady employment history over the past two years, and a maximum debt-to-income ratio of 43%.

How does credit score affect down payment requirements for FHA loans in Florida?

Borrowers with a credit score of 580 or higher can make a down payment of 3.5%, while those with scores between 500 and 579 are required to make a larger down payment of 10%.

Are there down payment assistance programs available for Florida homebuyers?

Yes, there are various down payment assistance programs, such as the Hometown Heroes Housing Program, which offers up to $35,000 in assistance to eligible buyers, helping to make homeownership more attainable.

Can you provide an example of how families have successfully navigated FHA loan requirements?

The Smith family faced challenges due to low credit scores but managed to secure an FHA mortgage, allowing them to buy their first home with a small deposit, demonstrating the program’s support for first-time buyers.

Why is it important to understand FHA loan requirements in Florida?

Understanding FHA loan requirements is vital as the guidelines are continually adjusted to encourage homeownership among diverse applicants, and being well-prepared can help families leverage FHA financing effectively.