Introduction

Navigating the complex landscape of FHA loans can feel overwhelming for families dreaming of homeownership. We understand how challenging this can be, especially with specific requirements and fluctuating credit score standards. It’s crucial to grasp how to secure the best financing options available.

In this article, we’ll explore the essential FHA loan requirements and share valuable credit score tips. These insights can empower families to enhance their eligibility and potentially lower their costs. What challenges might arise on this journey? And how can families effectively overcome them to achieve their homeownership dreams?

We’re here to support you every step of the way.

F5 Mortgage: Your Guide to FHA Loan Requirements and Credit Scores

F5 Mortgage LLC is dedicated to helping families understand FHA lending criteria and financial ratings. We know how challenging this can be, so we offer personalized consultations to ensure you’re well-informed about your options. Our goal is to make the home-buying process smoother and more accessible for you.

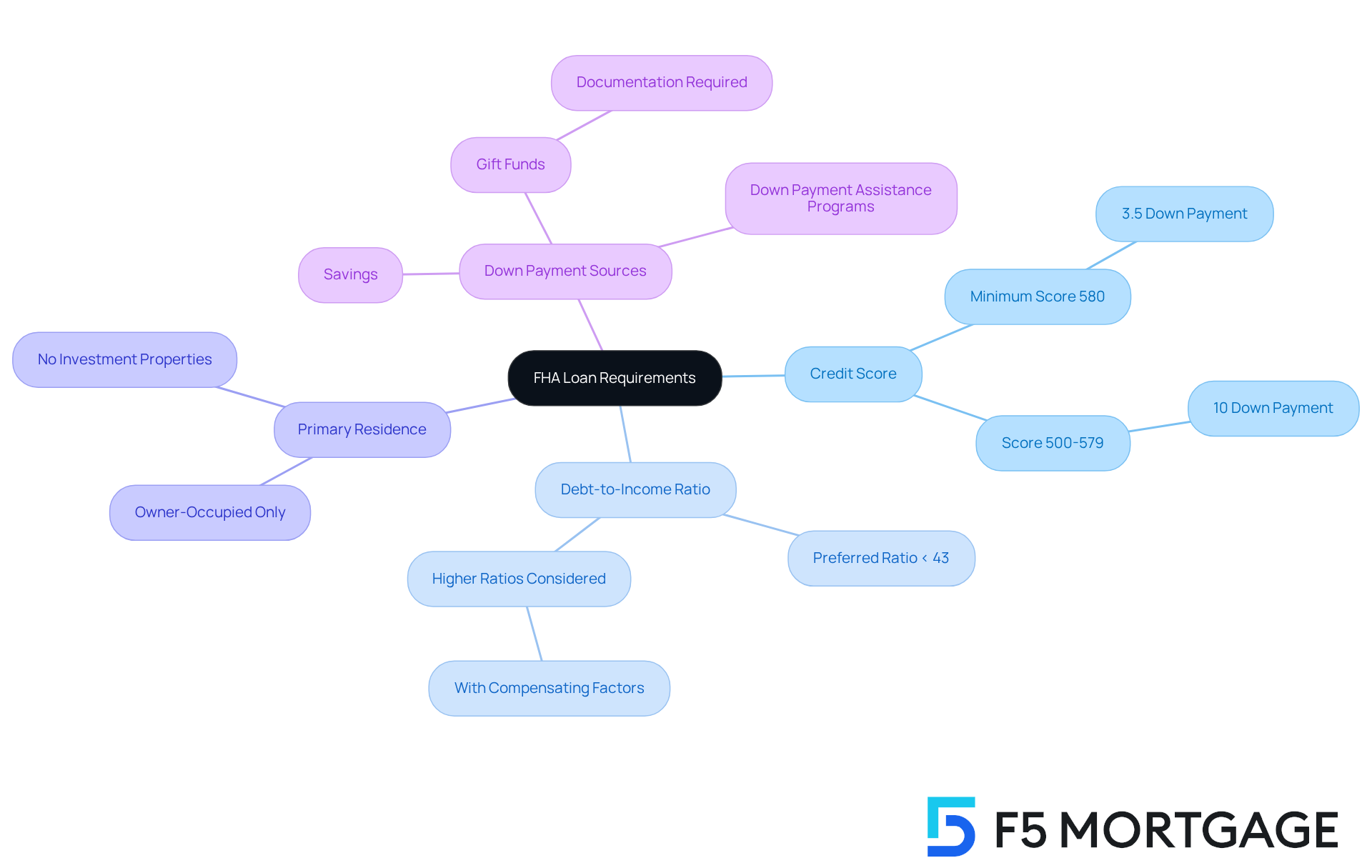

To qualify for FHA loans in 2025, here are some key requirements to keep in mind:

- Credit Score: A minimum credit score of 580 is necessary for a down payment as low as 3.5%. If your score falls between 500 and 579, you’ll need at least a 10% down payment. This flexibility allows many households to secure financing despite credit challenges.

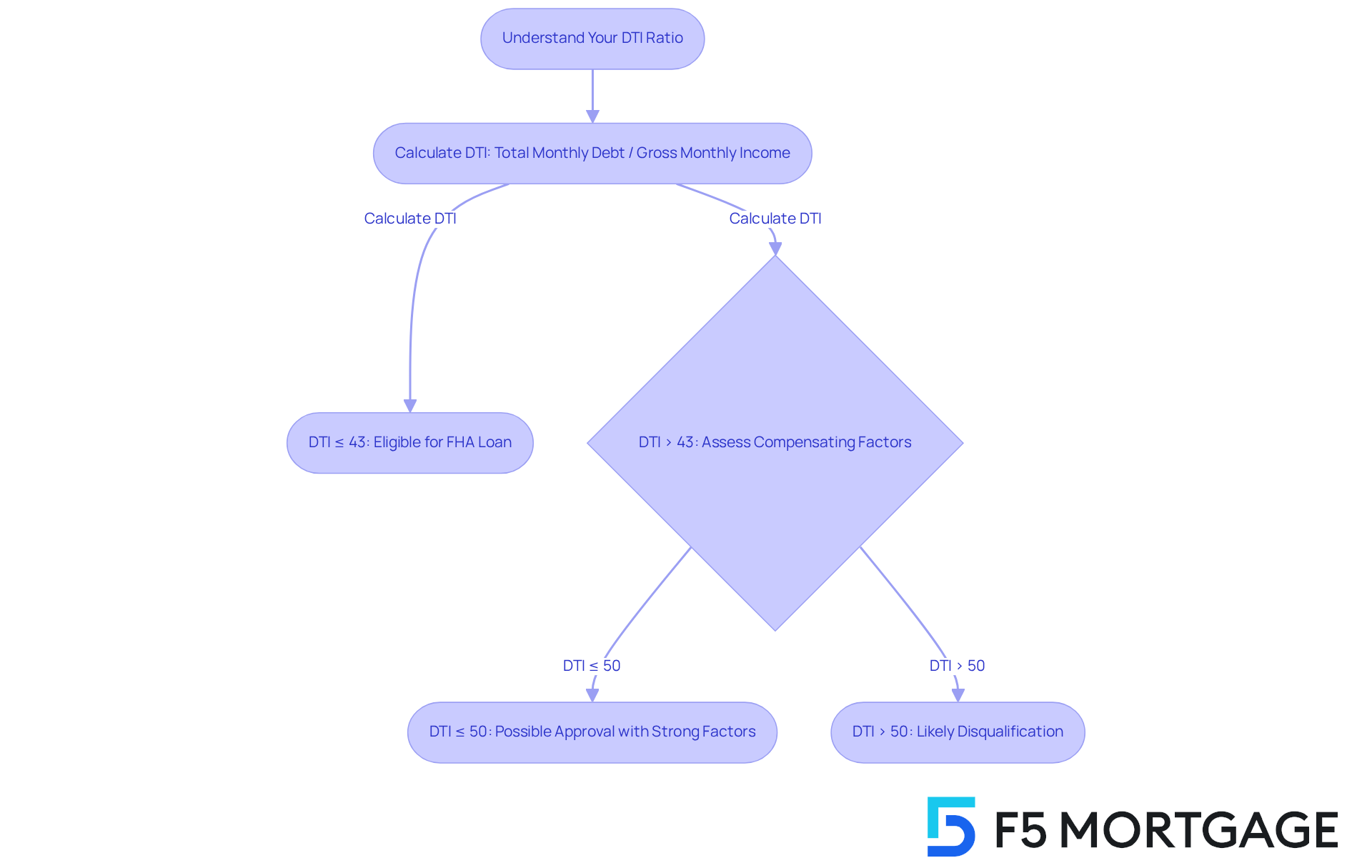

- Debt-to-Income Ratio: Generally, a debt-to-income (DTI) ratio of less than 43% is preferred, but higher ratios may be considered if there are compensating factors.

- Primary Residence: FHA financing is exclusively for properties that will be your primary residence, ensuring these options support homeownership rather than investment properties.

- Down Payment Sources: You can use savings, allowable gift funds, or approved down payment assistance programs for your down payment, making homeownership more achievable even if you have limited savings.

Current trends show that FHA financing remains a viable option for families, especially first-time homebuyers. The average FHA interest rate is around 6.08%. While this reflects a slight increase over the past week, it’s a decrease of 0.29% over the past year. Monitoring rates and exploring refinancing options can help lower monthly payments or eliminate mortgage insurance premiums.

Successful FHA financing applications often come from thorough preparation. Gather necessary documentation, like proof of income and employment, and verify the source of your down payment funds. Case studies reveal that families using down payment assistance programs, such as the Mortgage Credit Certificate in Los Angeles County, have significantly improved their chances of obtaining financing. This showcases the value of accessible resources.

Understanding the importance of your credit score is crucial when looking into FHA loan requirements. A solid credit history can help meet FHA loan requirements, leading to better financing conditions and lower down payments. Even if you have a limited credit history, you may still qualify through manual underwriting alternatives. By focusing on these aspects, you can enhance your eligibility and navigate the FHA financing process with confidence.

At F5 Mortgage, we’re here to support you every step of the way, ensuring you have the knowledge and resources needed to achieve your homeownership dreams.

Minimum Credit Score for FHA Loans: What You Need to Qualify

Navigating the world of mortgages can feel overwhelming, especially when you’re trying to find the right fit for your family’s needs. If you’re considering an FHA mortgage, it’s important to know that the FHA loan requirements credit score typically stipulates a minimum score of 580 to take advantage of the low down payment option of just 3.5%. But don’t worry if your score is between 500 and 579; you can still qualify under FHA loan requirements credit score, although it will require a higher down payment of at least 10%.

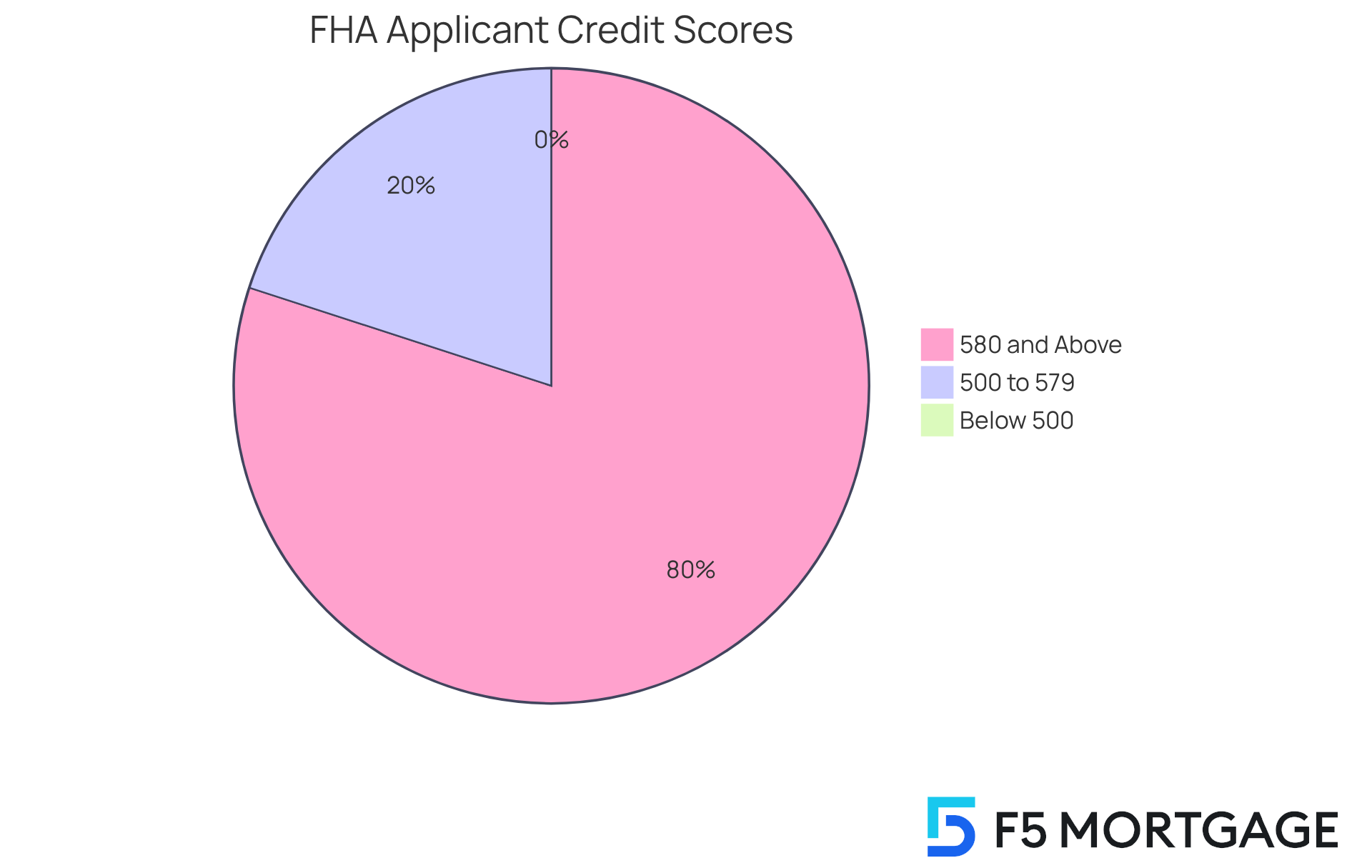

This flexibility is a lifeline for families facing financial challenges, opening doors to homeownership for those who might not meet traditional lending criteria. In fact, around 20% of FHA applicants have scores below 580, showcasing how accessible this program can be. We understand how crucial it is to maintain a healthy financial profile, as it can significantly improve your chances of securing favorable borrowing conditions. That’s why it’s essential to grasp the FHA loan requirements credit score as part of your financial planning.

Additionally, keep in mind that your debt-to-income ratio should not exceed 43% to qualify for an FHA mortgage. As we look ahead to 2025, the FHA is committed to adjusting its score requirements to further broaden access to homeownership, ensuring that more families can realize their dreams, regardless of their financial backgrounds.

For families in Ohio, exploring down payment assistance programs like YourChoice!, Grant for Grads, and Ohio Heroes can provide valuable support in making homeownership a reality. We encourage you to consult with an F5 Mortgage Home Loan Expert who can help you navigate these options and clarify any income limits associated with assistance programs. Remember, we’re here to support you every step of the way.

Credit History Impact: How Your Past Affects FHA Loan Approval

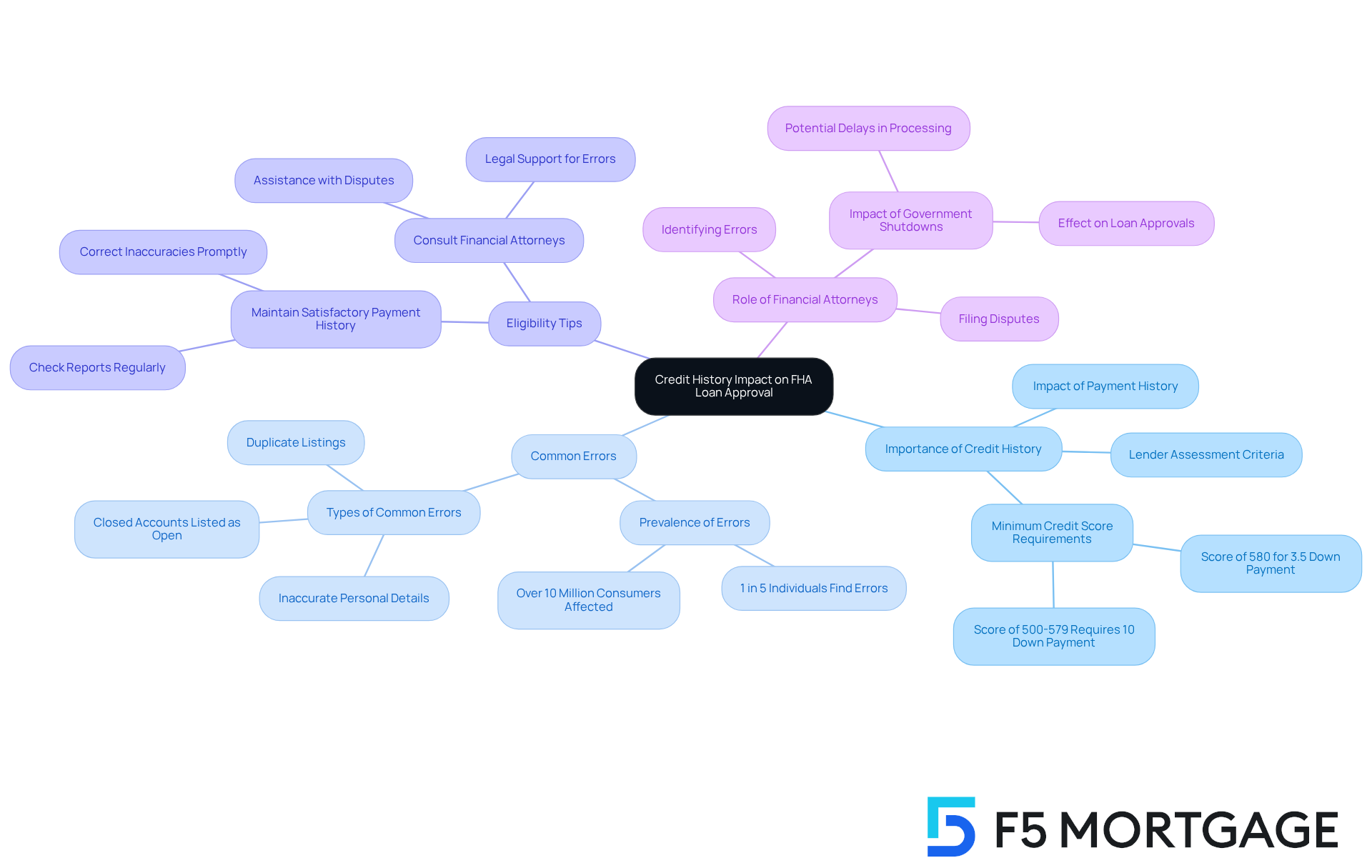

Understanding your credit history is crucial for meeting the FHA loan requirements credit score in order to obtain FHA approval. Lenders take a close look at your payment track record, existing debts, and any past bankruptcies or foreclosures. If you have a strong financial history with timely payments, your chances of approval increase significantly. However, negative marks can make the process more challenging.

Did you know that over 10 million consumers have errors on their credit reports that could hurt their borrowing opportunities? In fact, one in five individuals will find an error on their report. This is why it’s so important for families facing financial challenges to regularly check their reports. By identifying and correcting inaccuracies, you not only address potential problems but also position yourself more favorably when seeking FHA financing.

Experts suggest maintaining a satisfactory payment history for at least one year before applying. This can greatly enhance your eligibility. Remember, the FHA loan requirements credit score state that a score of 580 or above is necessary for a minimum down payment of 3.5%. By being proactive about your financial history, you can navigate the FHA financing process with greater confidence and success.

Consider working with a financial attorney, too. They can help you spot and contest mistakes quickly, making your application process smoother. And don’t forget to stay informed about the potential impact of a federal government shutdown on FHA financing, as it could affect processing times and approvals.

We know how challenging this can be, but by taking these steps, you’re already on the right path. We’re here to support you every step of the way.

Ideal Credit Score Range for FHA Loans: Know Where You Stand

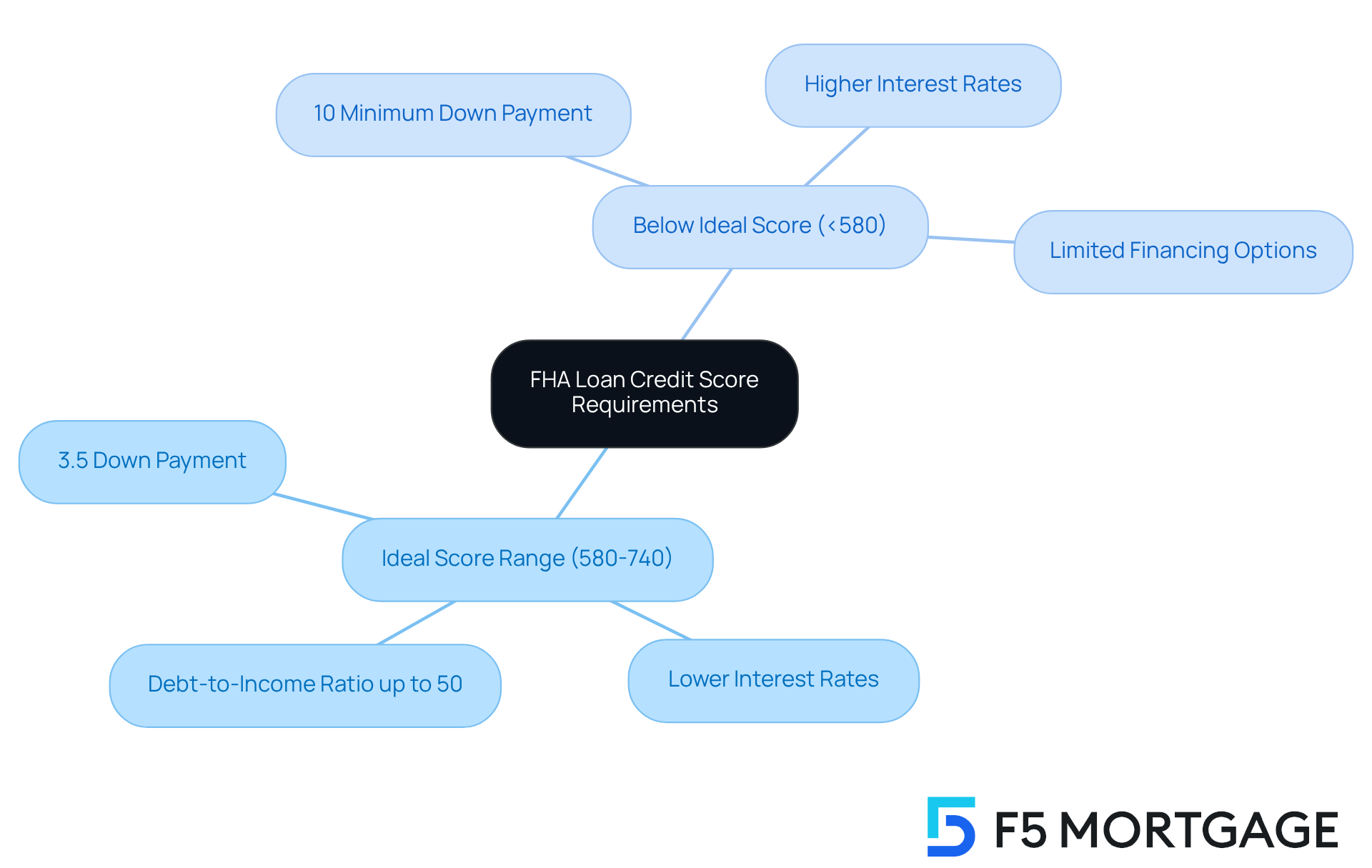

When it comes to FHA loans, we understand that navigating the fha loan requirements credit score can feel overwhelming. Ideally, your rating should fall between 580 and 740 to meet fha loan requirements credit score. If you satisfy the fha loan requirements credit score, you not only qualify for a minimum down payment of just 3.5%, but you also gain access to more favorable interest rates. Households aiming to meet the fha loan requirements credit score of 580 or above can benefit from lower rates, significantly reducing the overall cost of your mortgage.

At F5 Mortgage, we’re proud to have earned a 4.9 rating from over 300 reviews, highlighting our commitment to customer satisfaction and the seamless experience our clients have when working with our dedicated team. We know how challenging this can be, and we’re here to support you every step of the way.

However, if your fha loan requirements credit score is below 580, you might face higher interest rates and a minimum down payment requirement of 10%. Improving your credit rating can lead to better borrowing conditions, making it essential for families to focus on maintaining or enhancing their financial profiles. A higher rating can allow for a debt-to-income ratio of up to 50%, giving you more flexibility in your financing options.

As you work towards improving your credit rating, keep in mind that the fha loan requirements credit score has a direct link to better ratings and enhanced interest rates. This connection can make homeownership more affordable and achievable.

Looking ahead to 2025, average interest rates for FHA mortgages will vary by rating range. For those in the 580-619 category, rates are generally around 5.5%. Meanwhile, borrowers with ratings between 620-639 may see rates drop to approximately 5.0%. By maintaining a strong financial rating, you not only open doors to improved financing options but also empower your family to make informed decisions throughout your mortgage journey, with the personalized assistance of F5 Mortgage.

Debt-to-Income Ratio: A Key Component of FHA Loan Eligibility

Understanding your debt-to-income (DTI) ratio is crucial when it comes to securing a mortgage. We know how challenging this can be, especially when lenders assess your ability to repay a debt. For FHA financing, the ideal DTI ratio is typically 43% or less. However, some lenders may allow ratios up to 50% if you have strong compensating factors, like a solid credit score or significant savings.

Calculating your DTI is straightforward. Simply divide your total monthly debt payments by your gross monthly income. This calculation gives you a clearer picture of your financial standing and eligibility for FHA financing. Keeping your DTI low is essential; exceeding the suggested limit can hinder your chances of approval.

As we look ahead to 2025, understanding and managing your DTI ratio will be more important than ever for families pursuing FHA loan requirements credit score. A DTI ratio over 50% could lead to disqualification, which is why focusing on reducing debt and increasing income is vital. By taking these steps, you can enhance your chances of obtaining favorable credit conditions. Remember, we’re here to support you every step of the way!

Improving Your Credit Score: Steps to Enhance FHA Loan Eligibility

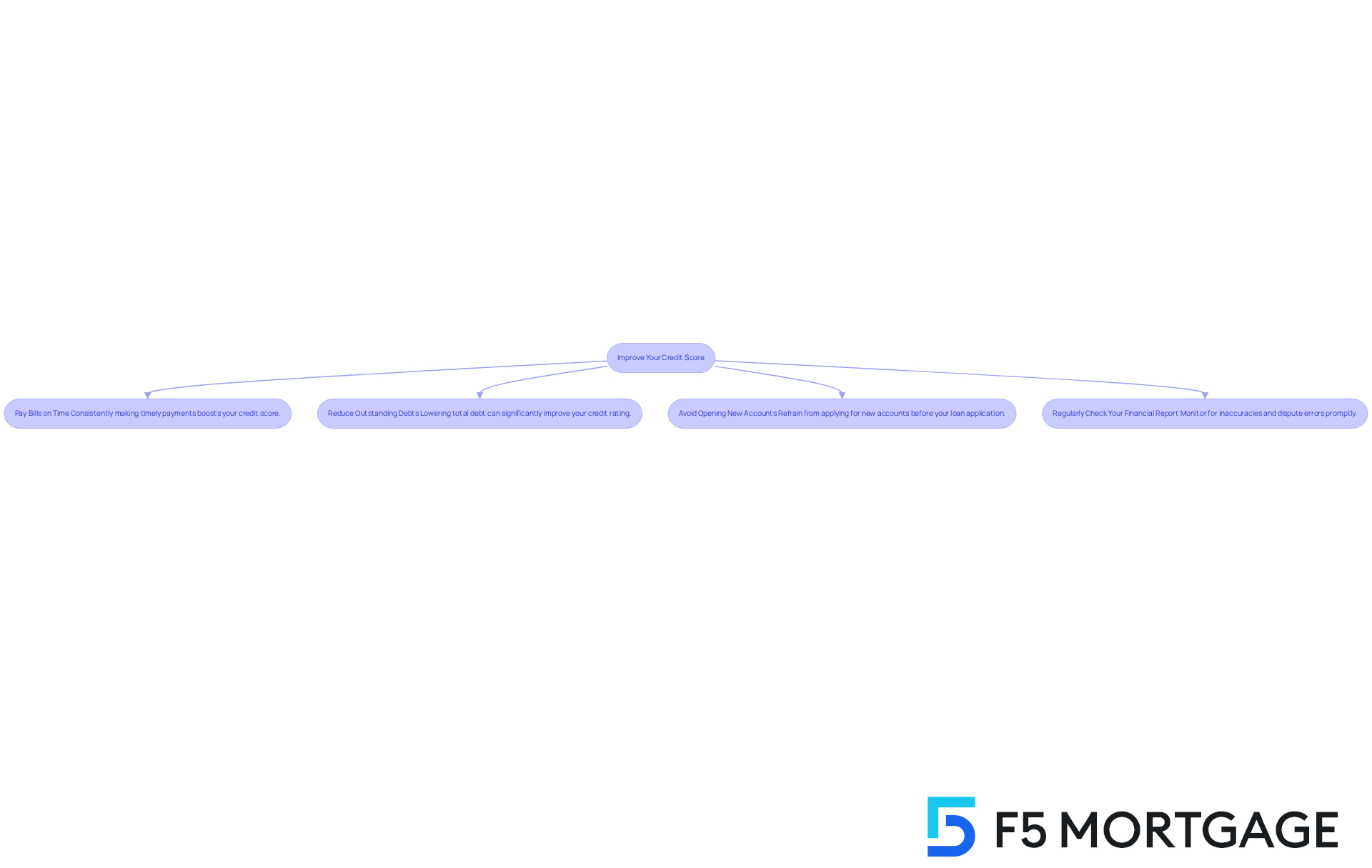

Improving your credit score can feel daunting, but we’re here to support you every step of the way. By enhancing your financial profile, you can improve your FHA loan requirements credit score and increase your eligibility for FHA loans. Here are some compassionate strategies to consider:

- Pay Bills on Time: We know how challenging it can be to keep track of payments, but consistently making timely payments is one of the most effective ways to boost your credit score. The FHA recommends having a satisfactory payment history of at least one year before applying for a loan.

- Reduce Outstanding Debts: Lowering your total debt can lead to a significant rise in your credit rating. Many families who have successfully reduced their debts often notice improvements in their financial ratings, which can be incredibly empowering.

- Avoid Opening New Accounts: It’s wise to refrain from applying for new accounts in the months leading up to your loan application. New accounts can negatively impact your rating, and we want to help you maintain the best possible score.

- Regularly Check Your Financial Report: Monitoring your financial report for inaccuracies is crucial. If you spot any errors, dispute them promptly to improve your score. This proactive approach not only helps you recognize elements that influence your financial profile but also ensures your report accurately reflects your economic situation.

By following these steps, you can significantly enhance your financial profile. This enhances your appeal as a candidate for FHA financing and may qualify you for reduced down payment options, depending on the FHA loan requirements credit score. Remember, we understand the challenges you face, and taking these steps can lead to a brighter financial future.

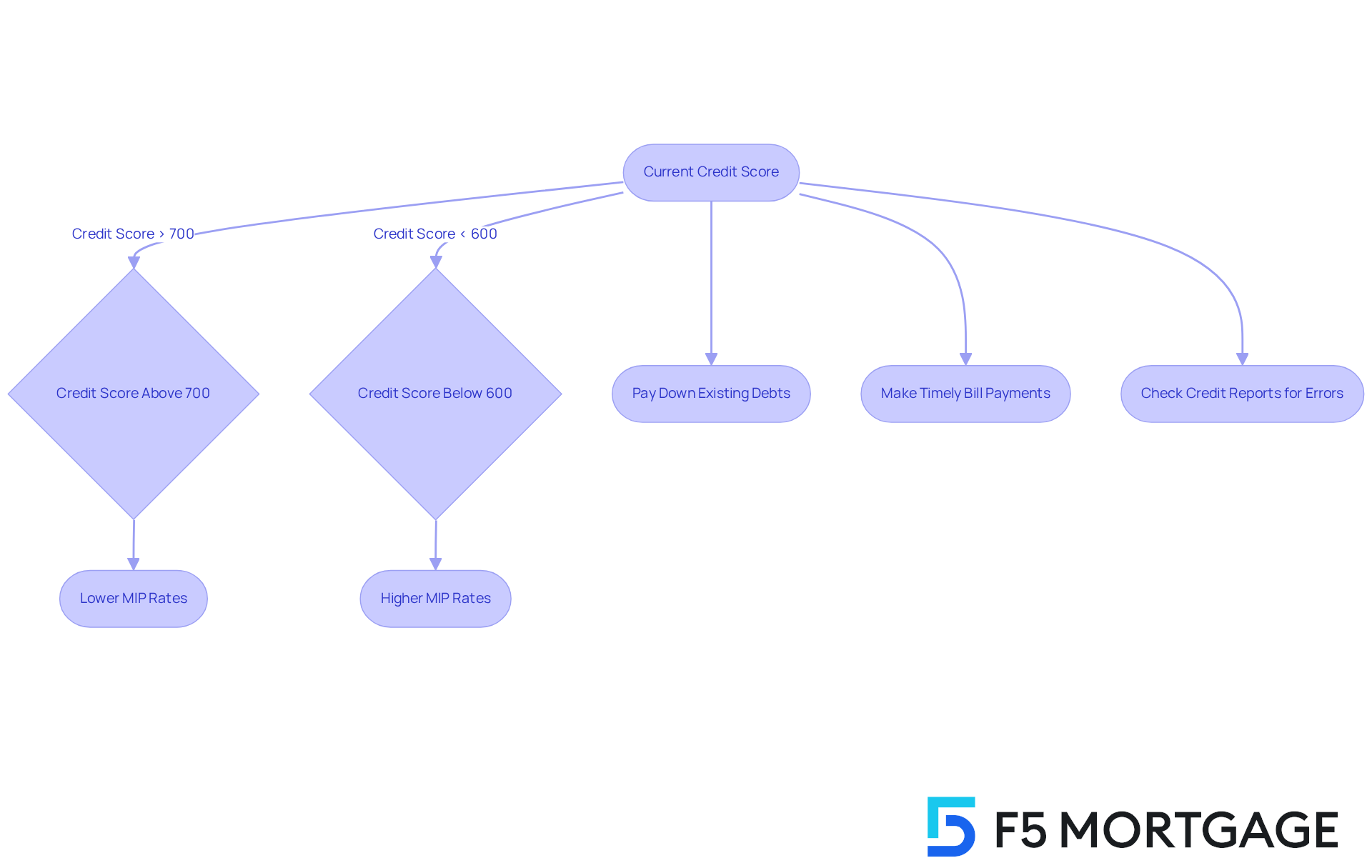

Mortgage Insurance Premiums: How They Relate to Your Credit Score

When considering FHA financing, it’s important to understand that Mortgage Insurance Premiums (MIP) are part of the equation. These premiums serve as a safety net for lenders, protecting them against borrower defaults. The amount you pay for MIP can vary significantly based on the FHA loan requirements credit score. If you have a higher credit score that meets the FHA loan requirements credit score, you’re likely to enjoy lower MIP rates, which can lead to substantial savings over the life of your loan. For example, a borrower who meets the FHA loan requirements credit score by having a score above 700 may see a notable decrease in their MIP compared to someone with a score below 600. This difference can really add up, making a big impact on your overall financing costs.

As families budget for FHA loans, it’s crucial to factor in MIP, as it can add a considerable expense to monthly payments. We know how challenging this can be, but enhancing your financial ratings can be a strategic step to reduce these costs. Simple actions like:

- Paying down existing debts

- Making timely bill payments

- Regularly checking your credit reports for errors

can lead to improved ratings. This, in turn, can help you meet the FHA loan requirements credit score, potentially lowering your MIP rates.

Looking ahead to 2025, the standard yearly MIP rate is set at 0.55% of the borrowed amount, but remember, this can fluctuate based on your credit rating. For families eager to minimize MIP expenses, focusing on improving financial ratings is key. As the mortgage landscape evolves, understanding the FHA loan requirements credit score and its link to MIP rates will empower you to make informed financial decisions when pursuing FHA financing. We’re here to support you every step of the way.

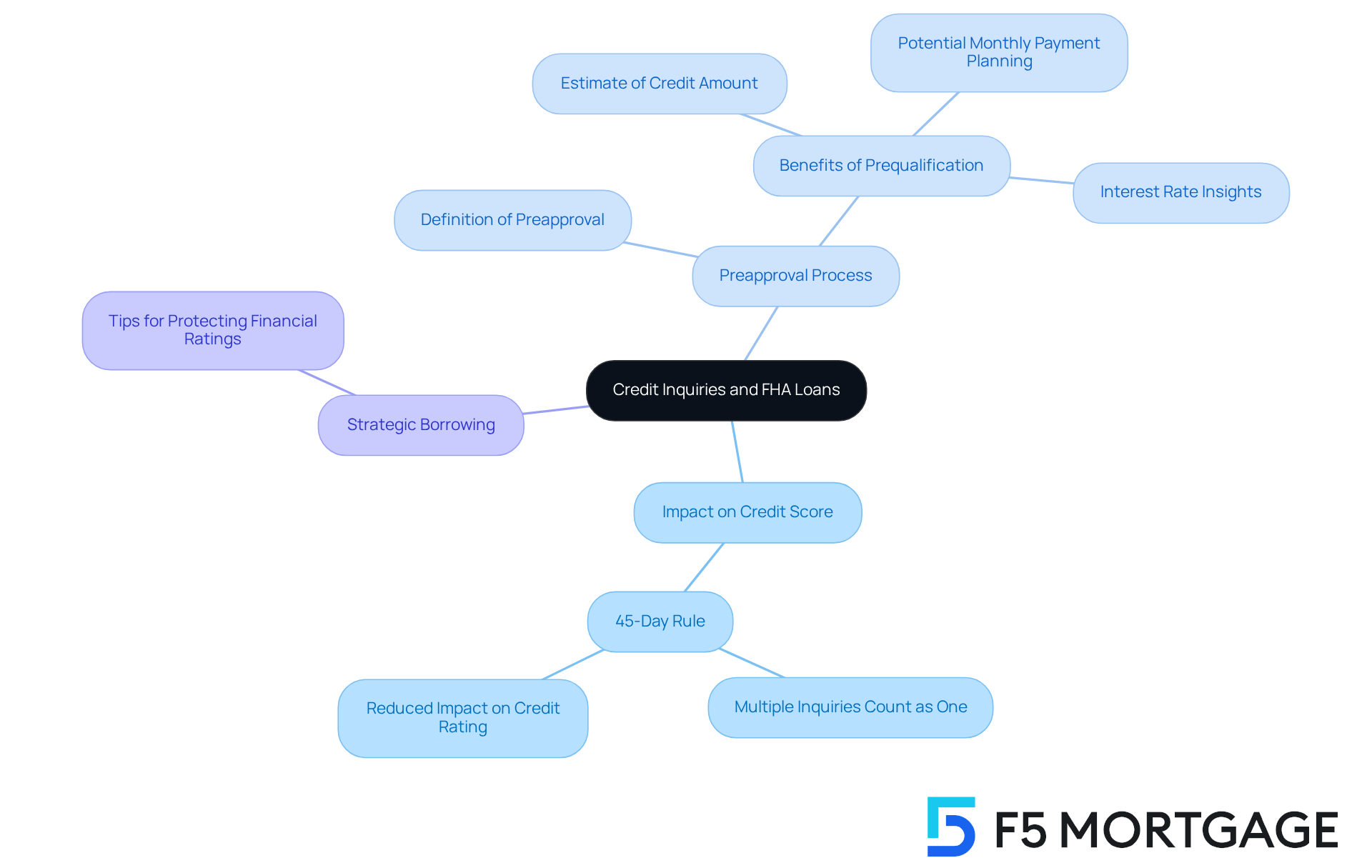

Credit Inquiries: Understanding Their Effect on FHA Loan Applications

When you’re looking for an FHA mortgage, it’s important to understand the FHA loan requirements credit score and how credit inquiries can impact your credit rating. We know how challenging this can be. If you request several credit checks within a 45-day window, don’t worry—these inquiries typically count as just one. This means less impact on your FHA loan requirements credit score, which is a relief!

Obtaining approval from a lender, frequently known as a ‘preapproval’ or ‘prequalification,’ is a positive step that can help you meet FHA loan requirements credit score. It shows that, based on your financial information, you qualify under the FHA loan requirements credit score, indicating you’re a strong candidate for a mortgage. This approval gives you an estimate of your credit amount, interest rate, and potential monthly payment, helping you plan better.

Families should be strategic about their borrowing requests. By doing so, you can protect your financial ratings while understanding how these approvals relate to your financing options. Remember, we’re here to support you every step of the way as you navigate this process.

Credit Counseling Services: A Resource for FHA Loan Applicants

Credit counseling services are vital for families looking to secure FHA financing. They provide essential support in managing debt, improving credit scores, and navigating the mortgage application process. By connecting with HUD-approved housing counselors, families can receive personalized guidance and resources, significantly boosting their chances of obtaining favorable loan terms.

In 2025, families who utilize HUD-approved housing counseling are expected to enjoy substantial benefits. This includes a reduction in upfront mortgage insurance premiums by 0.5 percentage points and a 0.1 percentage point decrease in annual premiums. Such financial assistance can be a game-changer for families striving to make homeownership more affordable.

We know how challenging this can be. Research indicates that more families are seeking financial counseling before applying for FHA loans, as they recognize the significance of FHA loan requirements credit score in preparing for the complexities of mortgage financing. Experts agree on the effectiveness of these services; studies show that borrowers who engage in counseling are often more informed about their financial commitments, which leads to lower default rates.

By actively pursuing financial guidance, families can enhance their financial knowledge and set themselves up for success in the competitive housing market. This strategic approach empowers them to make informed decisions, facilitating a smoother transition into homeownership. Additionally, borrowers who complete counseling can save nearly $325 a year, highlighting the significant financial impact of these services.

At F5 Mortgage, we’re here to support you every step of the way. We understand the importance of combining credit counseling with refinancing options. With competitive rates and customizable loan choices, we empower families to take control of their financial futures. Our innovative technology and transparent processes ensure that you can confidently explore your mortgage options, securing the best rates and terms available in the current Colorado market.

Maintaining a Good Credit Score: Essential for FHA Loan Success

We know how challenging it can be to navigate the world of finances, especially when it comes to securing a favorable financial score. To help families like yours, adopting responsible borrowing habits is essential. This means consistently paying your bills on time, which plays a significant role in shaping your credit history. Additionally, keeping your credit utilization below 30% shows lenders that you’re managing your finances responsibly.

Steering clear of excessive debt is crucial, too. Large balances can negatively impact your debt-to-income ratios, which are a crucial aspect of the FHA loan requirements credit score. And remember, an evaluation is a key part of the refinancing process. If your property doesn’t appraise for the amount you’re requesting, or even a portion of it, the lender might have to reject your application.

Regularly checking your credit reports is another vital step. This allows you to spot and correct any errors, further boosting your creditworthiness. By following these practices, you can enhance your chances of qualifying for FHA loans by meeting the FHA loan requirements credit score and accessing better financing options in 2025. We’re here to support you every step of the way!

Conclusion

Understanding the complexities of FHA loan requirements and the vital role of credit scores can truly empower families to achieve their dreams of homeownership. We know how challenging this can be, but by navigating these guidelines effectively, you can discover opportunities that might otherwise seem out of reach. The flexibility of FHA loans, especially for those with lower credit scores, shows a commitment to making homeownership accessible to a wider range of families.

Key insights from this article highlight the importance of:

- Maintaining a healthy credit score

- Understanding debt-to-income ratios

- Utilizing available resources like down payment assistance programs and credit counseling services

These elements work together to enhance your eligibility for FHA loans, ensuring that you’re well-prepared for the mortgage application process. The proactive steps outlined—such as improving credit scores and managing debts—can significantly influence your borrowing conditions and long-term financial health.

Ultimately, the journey to homeownership is a shared goal that requires informed decision-making and strategic planning. We encourage families to take charge of their financial futures by leveraging the insights provided, seeking expert guidance, and actively working towards meeting FHA loan requirements. This approach not only paves the way for successful mortgage applications but also fosters a sense of stability and security in homeownership.

Frequently Asked Questions

What is the minimum credit score required for FHA loans?

A minimum credit score of 580 is necessary for a down payment as low as 3.5%. If your score is between 500 and 579, you will need at least a 10% down payment.

What is the preferred debt-to-income ratio for FHA loans?

Generally, a debt-to-income (DTI) ratio of less than 43% is preferred, although higher ratios may be considered if there are compensating factors.

Can FHA loans be used for investment properties?

No, FHA financing is exclusively for properties that will be your primary residence.

What sources can be used for the down payment on an FHA loan?

You can use savings, allowable gift funds, or approved down payment assistance programs for your down payment.

What are the current trends in FHA financing?

FHA financing remains a viable option for families, especially first-time homebuyers. The average FHA interest rate is around 6.08%, which reflects a slight increase over the past week but a decrease of 0.29% over the past year.

How can families improve their chances of getting FHA financing?

Successful applications often come from thorough preparation, including gathering necessary documentation like proof of income and verifying the source of down payment funds. Utilizing down payment assistance programs can also significantly improve chances of obtaining financing.

How does credit history affect FHA loan approval?

Lenders review your payment track record, existing debts, and any past bankruptcies or foreclosures. A strong financial history with timely payments increases your chances of approval, while negative marks can complicate the process.

What should families do to ensure their credit reports are accurate?

Families should regularly check their credit reports for errors, as over 10 million consumers have inaccuracies that could hurt their borrowing opportunities. Correcting these errors can improve chances of securing FHA financing.

How long should one maintain a satisfactory payment history before applying for an FHA loan?

It is recommended to maintain a satisfactory payment history for at least one year before applying to enhance eligibility.

What should applicants be aware of regarding federal government shutdowns and FHA financing?

A federal government shutdown could affect processing times and approvals for FHA financing, so it is important to stay informed about potential impacts.