Overview

As we look ahead to 2025, understanding the FHA loan income requirements can feel daunting. We know how challenging this can be, especially when it comes to demonstrating stable income and maintaining a manageable debt-to-income (DTI) ratio, which is typically aimed at 43% or lower. What’s important to note is that there isn’t a minimum income threshold, allowing more families to explore their options.

While there are no maximum income limits, it’s crucial to recognize the value of consistent employment history and manageable debt levels. These factors play a significant role in determining eligibility for an FHA loan. By focusing on these aspects, we can help make homeownership more accessible to low to moderate-income families.

We’re here to support you every step of the way, guiding you through this process with understanding and expertise. Remember, achieving your dream of homeownership is possible, and we’re dedicated to helping you navigate these requirements with confidence.

Introduction

Navigating the complexities of homeownership can feel overwhelming, especially for families with limited financial resources. We understand how challenging this can be. FHA loans, backed by the Federal Housing Administration, provide a vital lifeline for low to moderate-income families. These loans offer accessible financing options, including lower down payments and more lenient credit requirements.

However, it’s essential to grasp the specific income criteria and potential pitfalls in the application process. What challenges might arise in meeting these FHA loan income requirements? We’re here to support you every step of the way as you position yourself for success in 2025.

Define FHA Loans and Their Purpose

FHA mortgages, or Federal Housing Administration mortgages, are government-supported financing options that incorporate FHA loan income requirements to help low to moderate-income families achieve their dream of homeownership. We understand how challenging this can be, and these financial products play a vital role in promoting affordable housing. They offer lower down payment options—often as low as 3.5%—and more lenient credit requirements, including FHA loan income requirements, compared to traditional financing. For many first-time homebuyers, the maximum property sale price of $224,500 makes FHA financing particularly beneficial, especially for those who may not have significant savings or a strong credit history. To meet the FHA loan income requirements, candidates must qualify with a minimum credit score criterion of 640, ensuring that support is accessible yet responsible.

In 2025, the FHA continues to stand by first-time buyers, having insured over 498,000 mortgages in the previous fiscal year. This statistic emphasizes the program’s importance in promoting homeownership. The FHA’s insurance lowers the risk for lenders, enhancing the chances that applicants will qualify for financing. Recent initiatives, such as the Michigan State Housing Development Authority’s First-Generation Down Payment Assistance program, provide qualified first-time homebuyers with a $25,000 deferred financial support for upfront costs. This assistance further eases the path to homeownership, making it more attainable.

Moreover, all borrowers are required to complete a face-to-face homebuyer education class. This class equips them with essential knowledge for navigating the home buying process, ensuring they feel confident and prepared. As the housing market evolves, the FHA loan income requirements remain a crucial resource for families overcoming financial obstacles, ensuring that homeownership is within reach for those who need it most. We’re here to support you every step of the way.

Detail FHA Loan Income Requirements for 2025

In 2025, we understand how challenging the mortgage process can be, especially when it comes to income requirements. For FHA loan applicants, there are no minimum income thresholds; however, it’s essential to meet the FHA loan income requirements by demonstrating stable and consistent income. Lenders typically look for a two-year employment history within the same field, which helps ensure reliability and trustworthiness.

While there is no maximum income limit, it is vital to maintain an acceptable debt-to-income (DTI) ratio, ideally 43% or lower. This means that no more than 43% of your gross monthly income should go toward debt payments, including your mortgage. This flexibility in FHA loan income requirements opens the door for a wider range of applicants, making homeownership more accessible for many individuals and families, especially those with low to moderate incomes.

We’re here to support you every step of the way, empowering you to explore your options and find the right path to homeownership. Remember, understanding these requirements can make a significant difference in your journey.

Identify Common Disqualifiers for FHA Loan Eligibility

Navigating the world of FHA financing can be daunting, especially when faced with the possibility of disqualification. We understand how challenging this can be, and it’s important to be aware of the common factors that might prevent applicants from securing a loan. Here are some key disqualifiers to consider:

- Low Credit Scores: If your FICO score is below 500, you may find yourself ineligible for FHA loans. As noted by FHANewsblog.com, “individuals with FICO scores below 500 are not eligible for an FHA mortgage loan.” However, if your score falls between 500 and 579, you might still qualify, but be prepared to make a larger down payment of 10% instead of the standard 3.5% for those with higher scores.

- High Debt-to-Income Proportions: A debt-to-income (DTI) ratio exceeding 50% can also lead to disqualification. Most lenders prefer borrowers with a DTI of 43% or less. In fact, many applicants are denied due to high DTI ratios, highlighting the importance of managing your debt levels. For instance, the case study titled ‘High Debt Levels as a Disqualifier’ shows that reducing high-interest debt or extending repayment terms can help lower monthly payments and improve your chances.

- Inadequate Down Payment: FHA mortgages require a minimum down payment of 3.5% for those with a credit score of 580 or above. If you can’t meet this requirement, it may result in denial, particularly for first-time homebuyers who might have limited savings.

- Delinquent Federal Debts: If you are currently delinquent on federal taxes or have unresolved federal debts, you may be disqualified from obtaining an FHA mortgage. This emphasizes the need to maintain a clean financial record before applying.

Understanding these disqualifiers is crucial for potential borrowers, especially those with lower credit scores or high debt levels, in relation to FHA loan income requirements. For example, if you have a history of overdrafts or insufficient funds, consider aiming for at least 12 months of on-time payments to enhance your chances of approval. By being aware of these factors, you can better prepare yourself for the FHA financing process and improve your eligibility. Remember, we’re here to support you every step of the way.

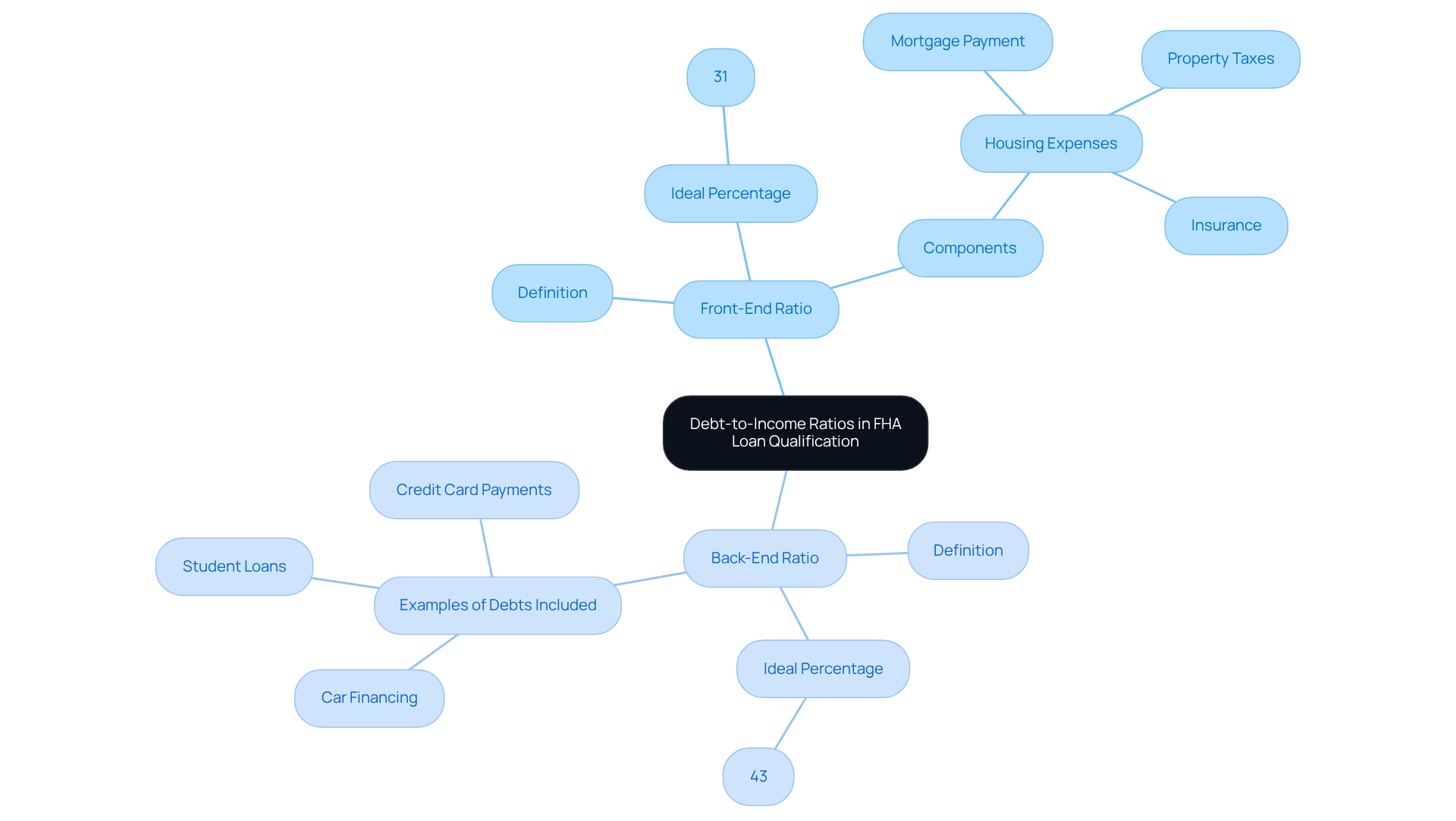

Explain the Role of Debt-to-Income Ratios in FHA Loan Qualification

Understanding the FHA loan income requirements is essential for anyone navigating the debt-to-income (DTI) measurements in the FHA financing process. We know how challenging this can be, and recognizing how these figures impact your eligibility can make a significant difference. The DTI ratio is calculated by dividing your total monthly debt payments by your gross monthly income. While the general guideline for FHA loans allows a maximum DTI level of 50%, many lenders may permit higher levels under specific conditions, especially if you have compensating factors that can strengthen your application.

The DTI ratio consists of two key components:

Front-End Ratio: This ratio measures the portion of your income allocated to housing expenses, including your mortgage payment, property taxes, and insurance. Ideally, this should not surpass 31% of your gross monthly income, allowing you to comfortably manage your housing costs.

Back-End Ratio: This includes all your monthly debt commitments, such as credit card payments, car financing, and student loans. Aiming for under 43% for this measurement can help lenders evaluate your overall financial well-being and your ability to manage debt.

Grasping and skillfully handling these figures is crucial for potential applicants to meet the FHA loan income requirements. By maintaining a lower DTI, you can significantly enhance your chances of securing approval, especially in 2025, when lenders are increasingly scrutinizing financial profiles. If your DTI levels are elevated, showcasing compensating factors—like a solid credit history or significant cash reserves—can also improve your chances of approval.

Additionally, with the current FHA average rate at 6.58% and the average mortgage rate at 6.56%, managing your DTI ratios effectively can lead to better loan terms. Furthermore, we encourage you to explore down payment assistance programs that may be available to help ease the financial burden of homeownership. Remember, we’re here to support you every step of the way.

Conclusion

FHA loans serve as a crucial pathway to homeownership for low to moderate-income families, offering accessible financing options that include lower down payments and lenient credit requirements. In 2025, understanding FHA loan income requirements is more important than ever. These guidelines empower potential homeowners to navigate the complexities of securing a mortgage. By ensuring that more individuals can qualify for financing, FHA loans play a pivotal role in promoting affordable housing and supporting first-time buyers.

Key points highlight the flexibility of FHA loan income requirements:

- There is no minimum income threshold.

- The emphasis is on maintaining a manageable debt-to-income (DTI) ratio.

We know how challenging the mortgage process can be, and understanding common disqualifiers—like low credit scores, high DTI ratios, and inadequate down payments—enables applicants to prepare effectively. Additionally, the role of DTI ratios is crucial, illustrating how they impact eligibility and loan terms, ultimately shaping the journey toward homeownership.

The significance of FHA loans extends beyond mere financing; they represent hope and opportunity for countless families striving for stability and a place to call home. As the housing market continues to evolve, staying informed about FHA loan income requirements and leveraging available resources—such as down payment assistance programs—can make a substantial difference. Embracing these insights not only enhances the likelihood of securing a loan but also contributes to a more inclusive housing landscape for all. We’re here to support you every step of the way.

Frequently Asked Questions

What are FHA loans?

FHA loans, or Federal Housing Administration mortgages, are government-supported financing options designed to help low to moderate-income families achieve homeownership.

What is the purpose of FHA loans?

The purpose of FHA loans is to promote affordable housing by providing lower down payment options and more lenient credit requirements compared to traditional financing.

What are the down payment requirements for FHA loans?

FHA loans often require down payments as low as 3.5%.

What are the credit requirements for FHA loans?

To qualify for FHA loans, candidates must have a minimum credit score of 640.

What is the maximum property sale price for FHA financing?

The maximum property sale price for FHA financing is $224,500, which is particularly beneficial for first-time homebuyers.

How many mortgages did the FHA insure in the previous fiscal year?

In the previous fiscal year, the FHA insured over 498,000 mortgages.

How does FHA insurance benefit lenders and applicants?

FHA insurance lowers the risk for lenders, enhancing the chances that applicants will qualify for financing.

What assistance programs are available for first-time homebuyers?

Recent initiatives, such as the Michigan State Housing Development Authority’s First-Generation Down Payment Assistance program, provide qualified first-time homebuyers with $25,000 in deferred financial support for upfront costs.

Are borrowers required to complete any educational programs before obtaining an FHA loan?

Yes, all borrowers are required to complete a face-to-face homebuyer education class to equip them with essential knowledge for navigating the home buying process.

How do FHA loans support families facing financial obstacles?

FHA loans remain a crucial resource for families by providing accessible financing options, ensuring that homeownership is within reach for those who need it most.