Overview

This article highlights the essential features of the house payment calculator in Texas, focusing on how it can simplify your home financing decisions. We know how challenging this can be, and this tool is designed to help you navigate the complexities of mortgage planning with ease. Key features, such as customizable loan options and real-time interest rate updates, empower you to make informed financial choices. The user-friendly interface ensures that you feel supported every step of the way, making the process less daunting and more manageable.

By utilizing this calculator, you can take charge of your financial future. Imagine being able to explore various loan options tailored to your needs, all while receiving up-to-date information on interest rates. This empowers you to make decisions that align with your goals and circumstances. We’re here to support you as you embark on this important journey, ensuring that you have the tools and knowledge necessary to succeed.

In conclusion, the house payment calculator is more than just a tool; it’s your partner in achieving homeownership. With its features designed to address your concerns and simplify the mortgage process, you can approach your financial decisions with confidence. Take the first step today and explore how this calculator can help you navigate your path to homeownership.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially for first-time buyers in Texas. We know how challenging this can be. The house payment calculator emerges as a vital tool, offering potential homeowners a clear pathway to understanding their financial commitments. By highlighting essential features like:

- Customizable loan options

- Real-time interest updates

- User-friendly interfaces

this article unveils how such calculators can empower individuals to make informed decisions. However, with numerous calculators available, how can one determine which features truly enhance the homebuying experience? We’re here to support you every step of the way.

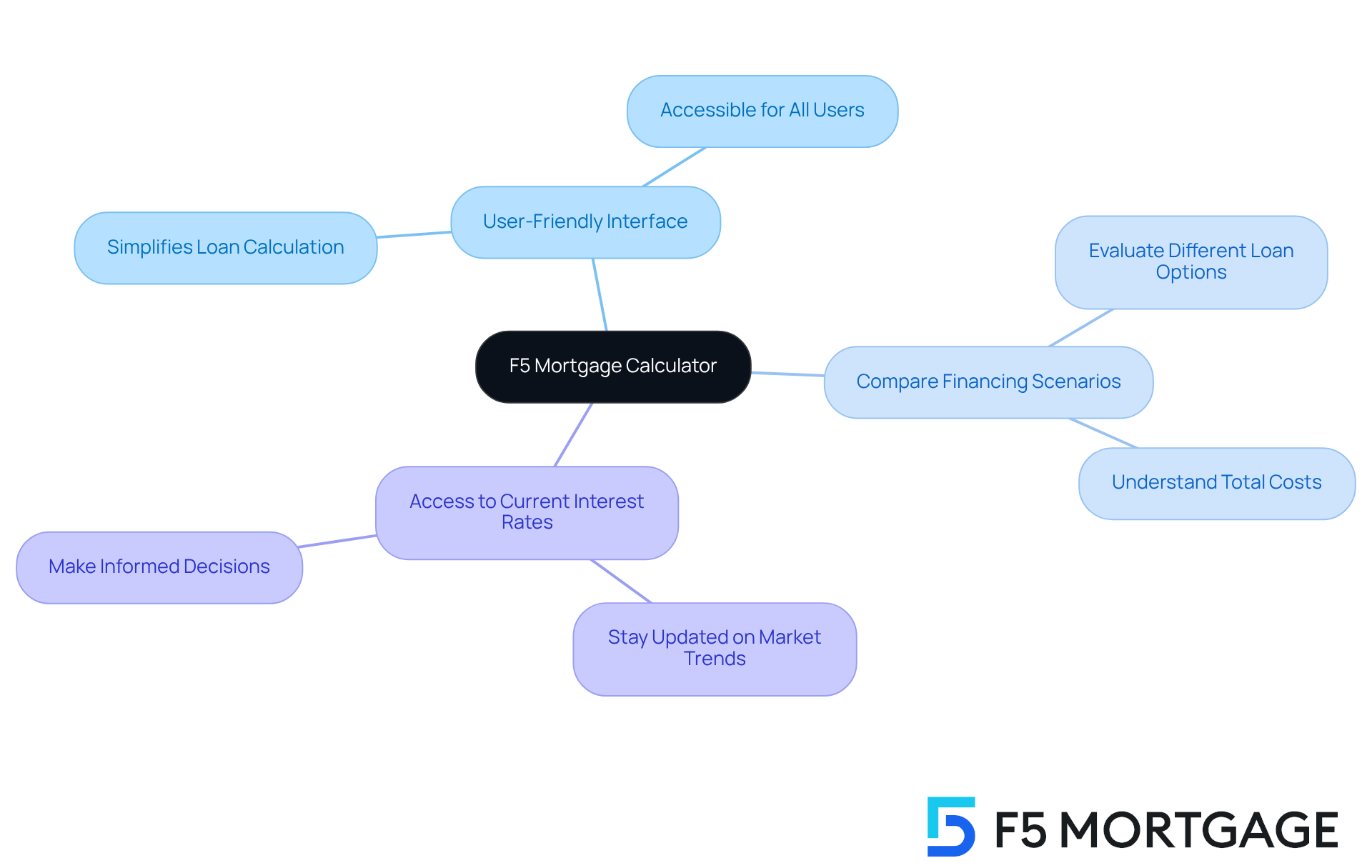

F5 Mortgage Calculator: Streamlined Home Financing Tool

We know how challenging it can be to navigate the world of loans. The offers a user-friendly platform designed to help you estimate your easily, similar to using a . Using the house payment calculator Texas, you can quickly receive accurate estimates by simply inputting like home price, down payment, and interest rate. This streamlined process empowers you to make informed decisions about your financing options.

In today’s market, where around 70% of property owners believe they secured the best financing through tailored lending instruments, evaluating your financial obligations is crucial. The house payment calculator Texas not only saves you time but also enhances your confidence in the homebuying journey. At F5, we are committed to delivering and ensuring your satisfaction.

Key features of the house payment calculator Texas include:

- The ability to compare various

- Access to

- A that simplifies the loan calculation process

With our dedicated team ready to assist you throughout the entire , F5 Finance ensures that families can with ease and support.

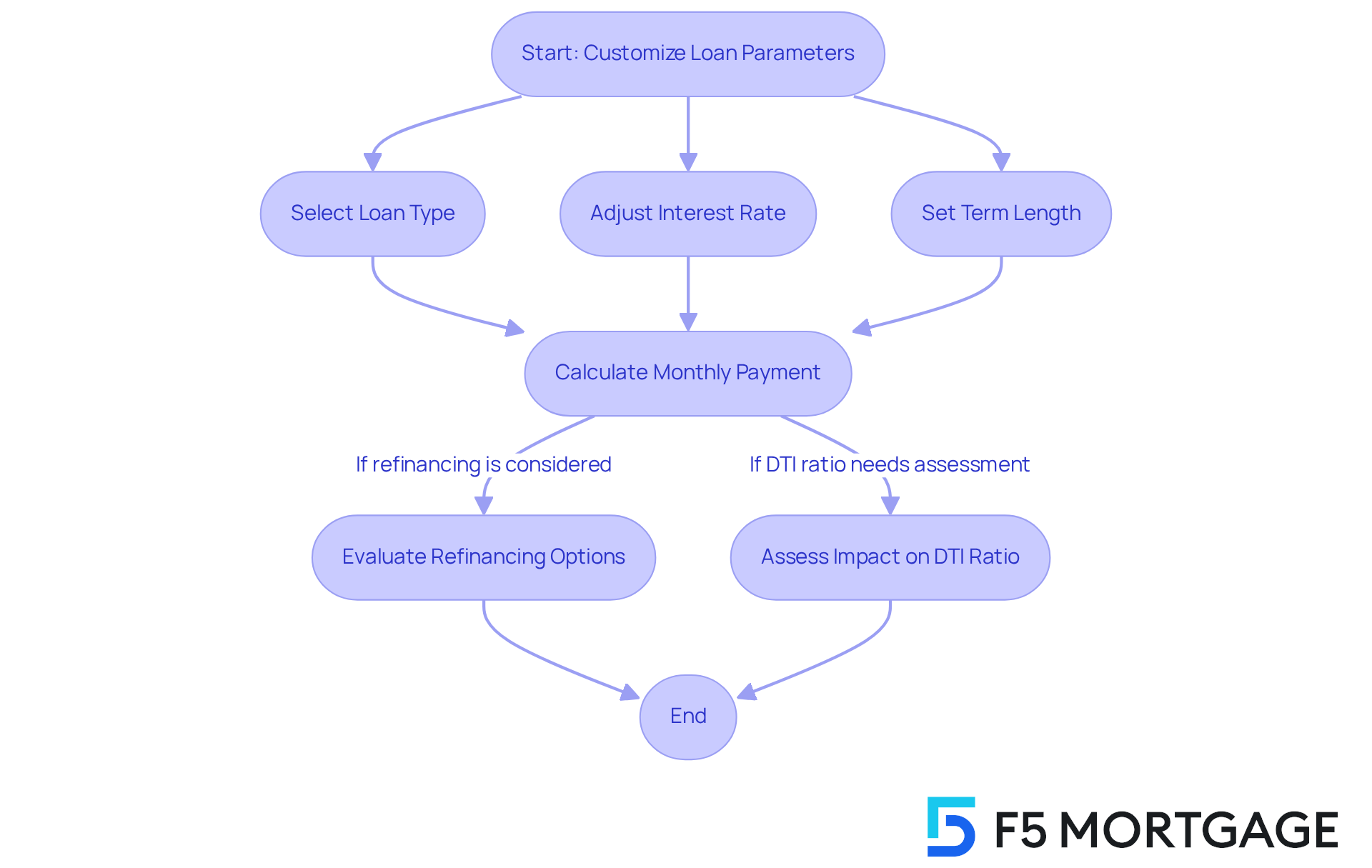

Customizable Loan Options: Tailor Your Payment Calculations

Navigating the mortgage landscape can be daunting, but the is designed to help you. This tool empowers you to , such as loan type, interest rate, and term length. By exploring various scenarios with a house payment calculator Texas, you can gain valuable insights into how these factors influence your .

We understand how important it is to evaluate . Research shows that using a house payment calculator Texas can help you consider different alternatives, such as adjusting the length of your loan. This could lead to or help you settle your debt more quickly. Many clients who tailor their calculations to fit their specific needs often find lending products that align better with their . For instance, refinancing might allow you to eliminate private mortgage insurance (PMI).

Financial consultants encourage using a house payment calculator Texas, emphasizing that and interest rates can significantly change your overall payment structure. Additionally, grasping home equity criteria and maintaining a favorable debt-to-income (DTI) ratio can lead to more competitive loan rates.

By utilizing these adaptable features, you can make informed choices that align with your long-term financial objectives. To enhance the effectiveness of your calculations, it’s advisable to , such as your income, debt obligations, and credit score. Remember, we’re here to support you every step of the way.

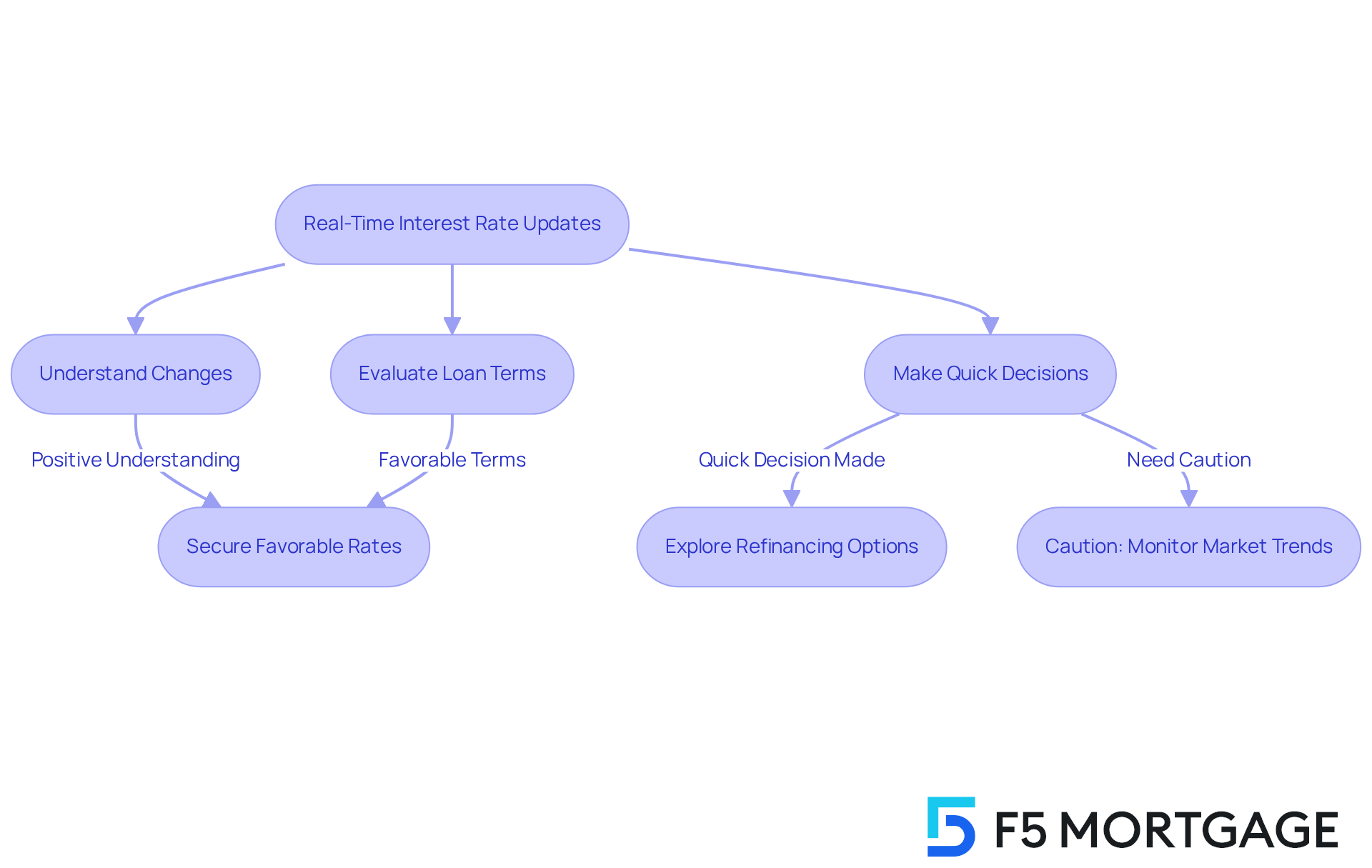

Real-Time Interest Rate Updates: Stay Informed on Market Changes

The offers real-time interest updates, ensuring that you have instant access to the . We know how challenging this can be, and this feature is crucial for borrowers. Even slight shifts in interest levels can lead to and overall loan expenses. By providing you with this timely information, F5 Mortgage empowers you to make quick decisions and secure the most .

Our dedicated team works diligently to find the tailored to your needs, ensuring you benefit from favorable rates and flexible conditions. Financial specialists emphasize that understanding these dynamics is essential. The stability of the is influenced by the balance of supply and demand, as well as .

As costs fluctuate, it’s important for in their approach. This ensures that you can take advantage of the best lending options. With F5’s , you can navigate this process with confidence. We’re here to support you every step of the way.

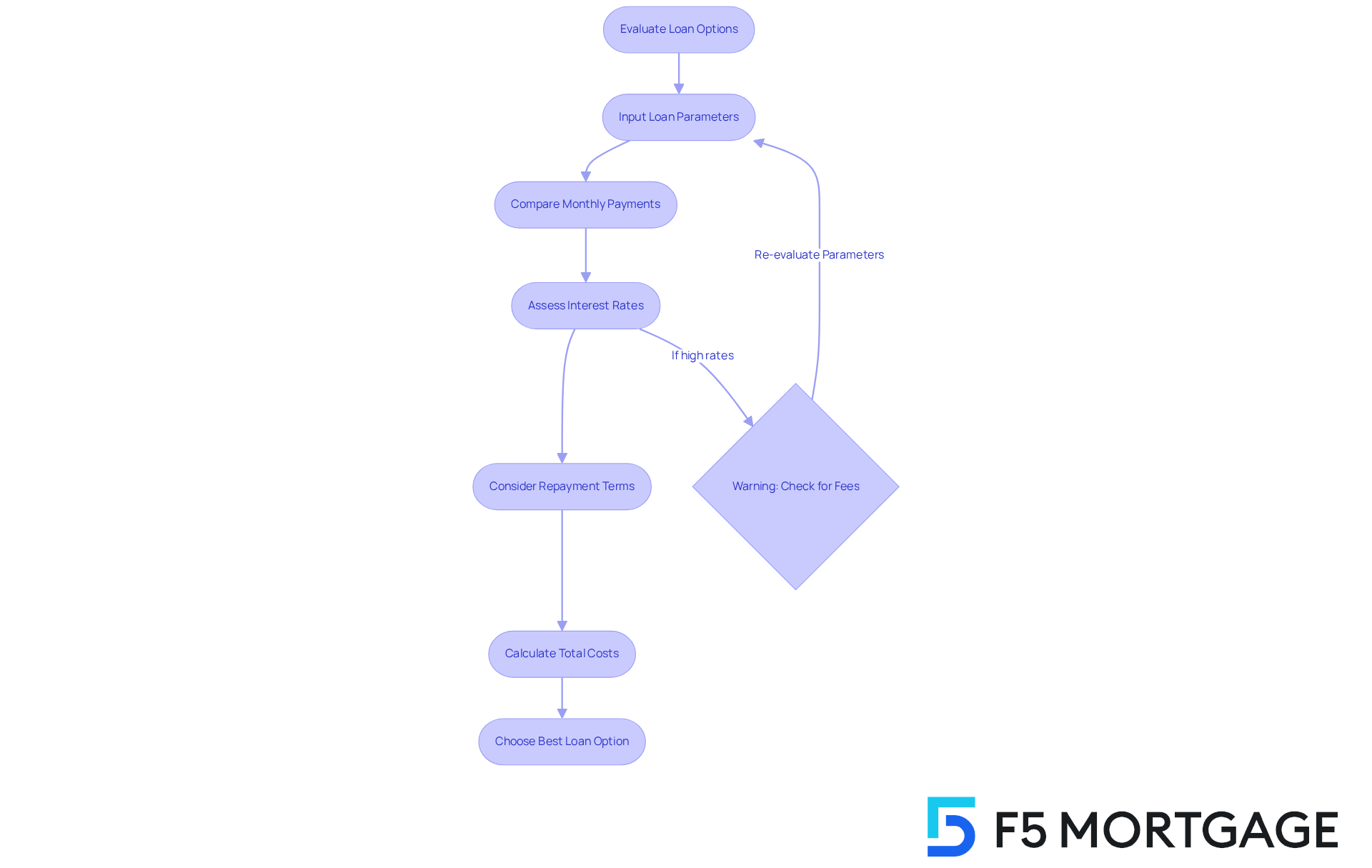

Loan Scenario Comparison: Evaluate Multiple Payment Options

A key feature of the F5 Loan Calculator is its . This tool empowers you to input various loan parameters and see how your stack up against different options. We understand how overwhelming it can be to choose the right loan product, terms, and costs. This capability simplifies your decision-making process, allowing you to find the best fit for your .

Many borrowers overlook the importance of , which can lead to missed savings of hundreds or even thousands of dollars. Did you know that just one could lower your costs by as much as 0.28 percentage points? This could translate to significant yearly savings. Financial experts recommend obtaining estimates from various lenders on the same day to ensure a fair comparison, as rates can fluctuate frequently.

Understanding the implications of different is also crucial. Shorter repayment terms often mean lower overall borrowing costs, since interest accrues for a shorter period. For instance, a loan with a 12.64% APR can lead to considerably less total interest compared to one with a higher rate. By using the , you can explore how different loan amounts, terms, and interest rates impact your monthly payments, guiding you toward the most financially sound choice.

Incorporating these insights into your not only empowers you but also helps you navigate the complexities of home financing with confidence. We’re here to .

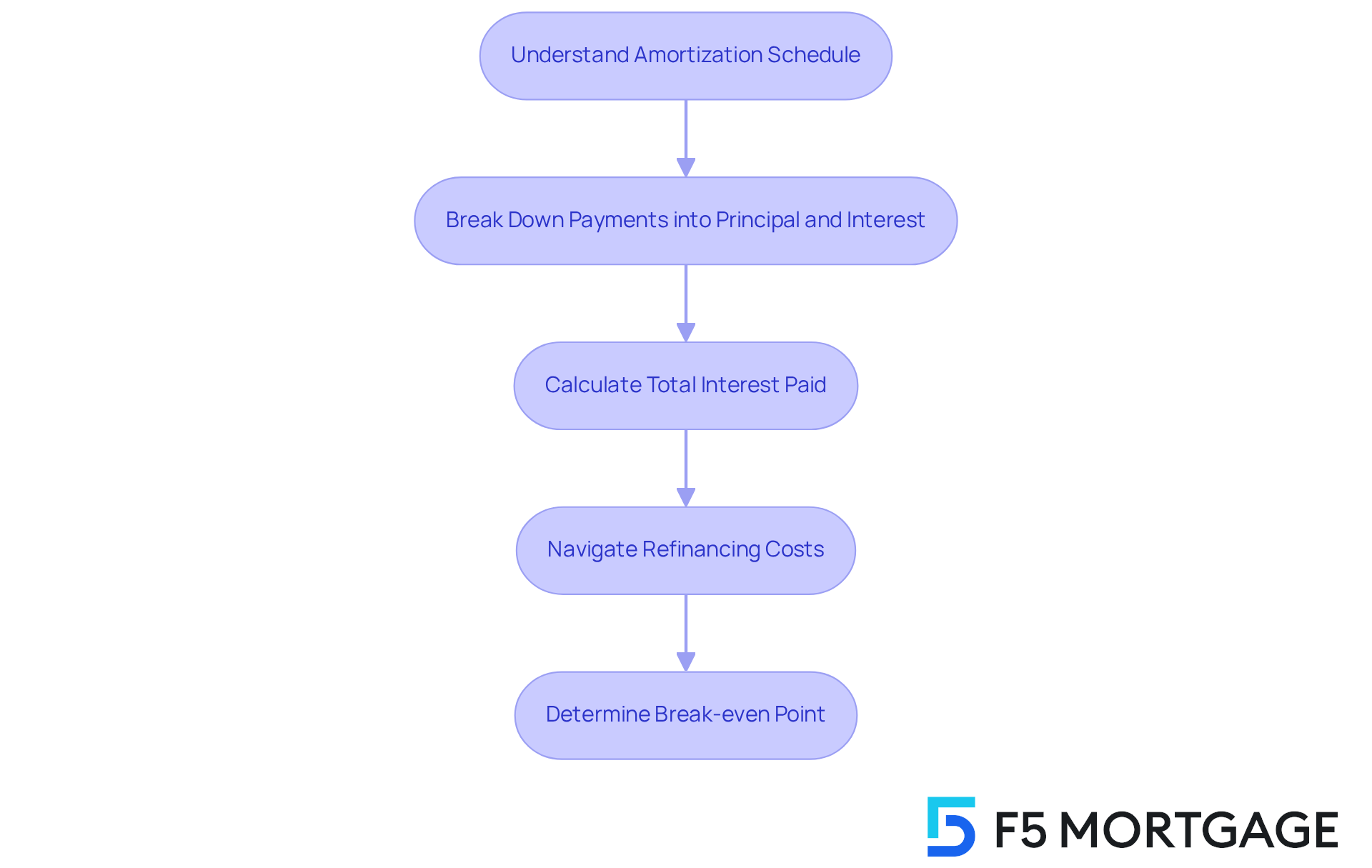

Amortization Schedule: Visualize Your Payment Progress

The serves as a vital resource for families, providing an invaluable that clearly outlines how each payment is divided between principal and interest throughout the loan’s term. This visual tool not only clarifies the payment structure but also illustrates the over the loan term, which can average around $327,490 for a typical 30-year fixed-rate loan of $400,000 at a 5% interest rate. By offering this perspective, to and foresee future payments, ultimately deepening their .

We know how challenging it can be to navigate , including closing fees and expenses, especially for families looking to upgrade their homes. Calculating your break-even point—by determining your —can help you assess how long it will take to recoup these costs through lower payments. As insightfully notes, “Understanding how much interest you’re paying may inspire you to make extra principal payments when you can and save money on interest, build home equity or pay off your loan early.” This understanding is essential for families, as it allows them to visualize their payment progress and consider strategies to reduce overall interest costs.

Mobile Accessibility: Calculate Payments Anytime, Anywhere

The is designed with you in mind, optimized for mobile devices so you can determine your . We understand how busy life can get, and this accessibility is especially beneficial for those who may not have the time to sit down at a computer. By making the calculator mobile-friendly, F5 addresses the needs of today’s borrowers, allowing you to on the go with ease.

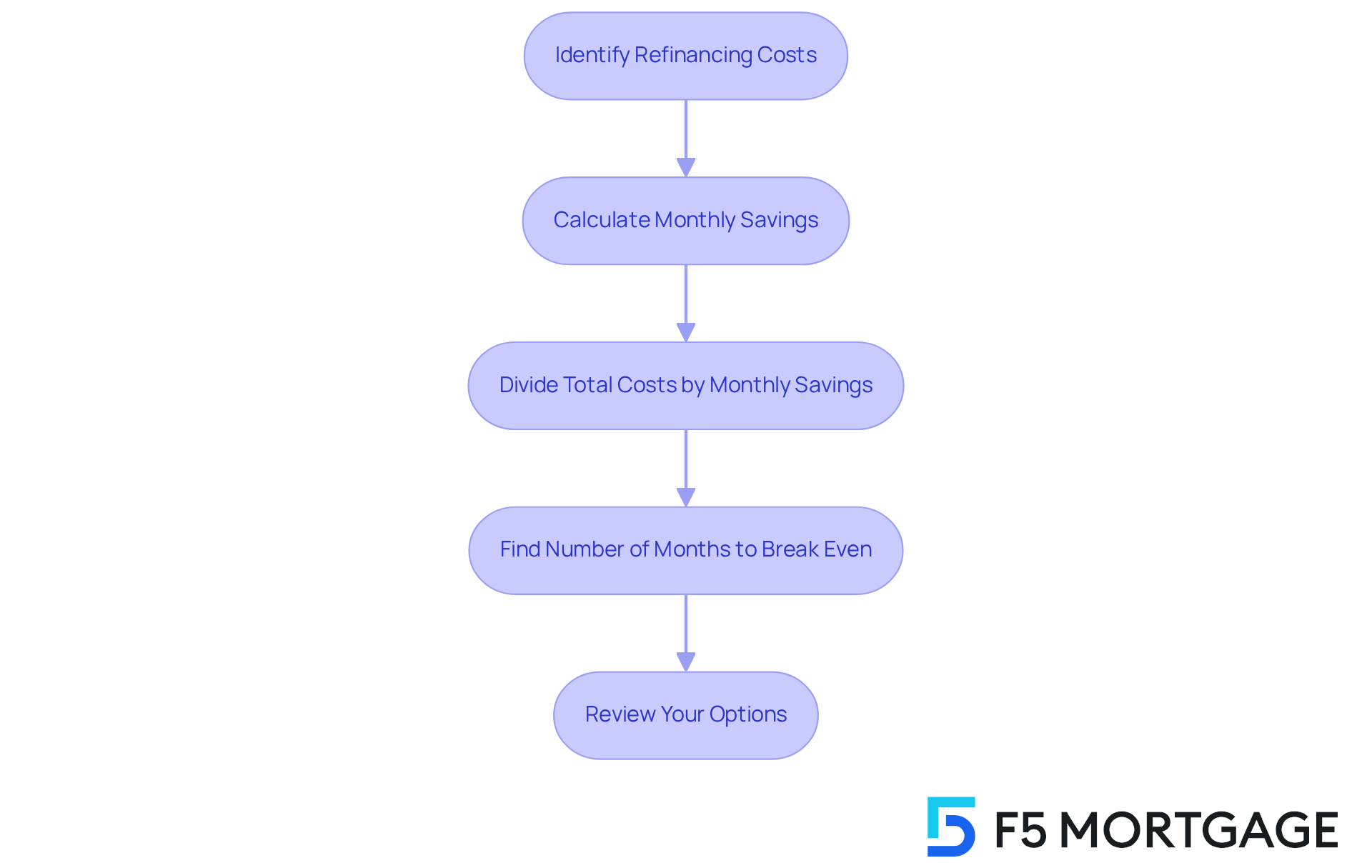

Understanding how to is crucial when considering . To help you navigate this process, here are some simple steps to follow:

- Identify your refinancing costs, including closing fees.

- Calculate your by subtracting your new payment from your current payment.

- Divide your total refinancing costs by your monthly savings to find out how many months it will take to break even.

At F5, we’re committed to providing throughout your loan journey, empowering families to with exceptional service and competitive rates. Whether you’re looking to purchase a new residence or , we’re here to assist you every step of the way.

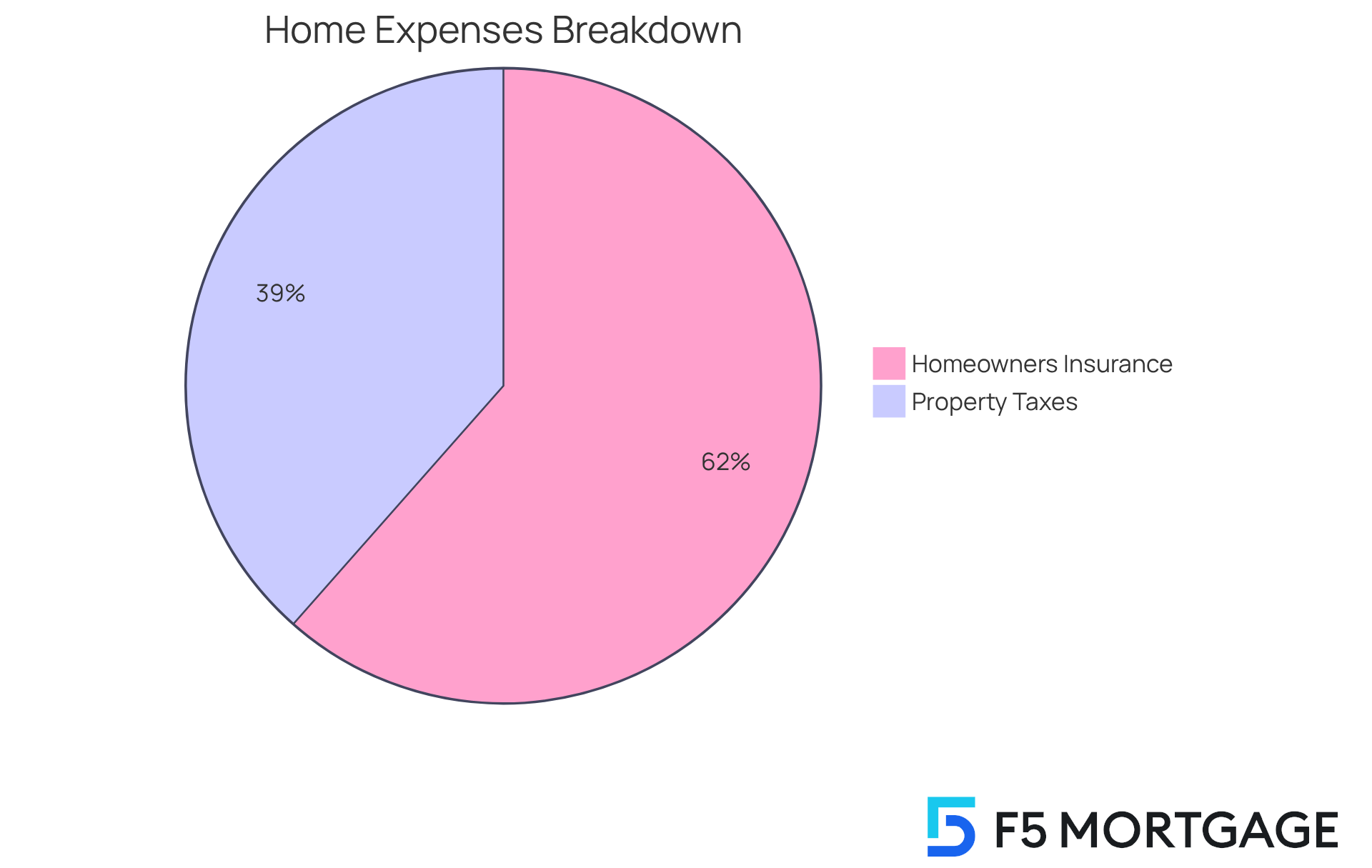

Tax and Insurance Estimates: Get a Complete Cost Overview

The is here to help you estimate your property taxes and , giving you a clearer picture of your potential monthly expenses. By factoring in these important costs, you can better understand your total financial obligations, helping to reduce the likelihood of unexpected expenses down the line. This thoughtful approach showcases and illustrates how , empowering you with the knowledge you need to .

In Texas, the is around $2,610. Knowing these figures is essential for effective budgeting. Financial advisors emphasize that is key to gaining a comprehensive view of your finances, ensuring that you are well-prepared for your responsibilities.

As one expert wisely noted, “Understanding how each component works can help you while avoiding misleading hard sales tactics.” This insight underscores the importance of utilizing tools like the to help navigate the complexities of home financing, ensuring you feel supported every step of the way.

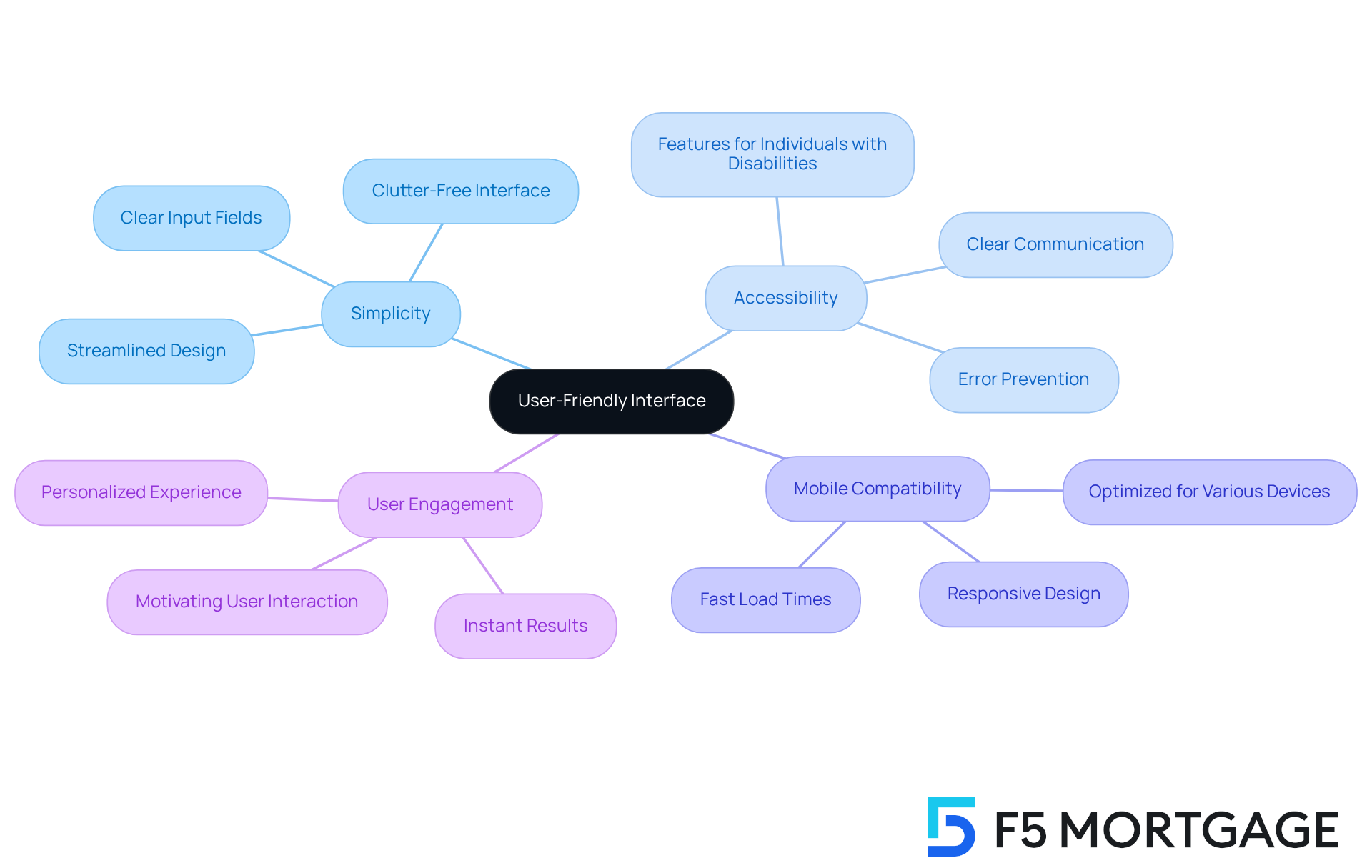

User-Friendly Interface: Simplify Your Calculation Experience

The F5 offers a designed to make the calculation process easier for families considering . We understand how overwhelming this can be, and with clear input fields and , you can effortlessly enter your information and receive instant results. This feature is especially beneficial when evaluating potential and break-even points.

By focusing on a design that enhances your experience, we hope to motivate more individuals to engage with this tool, making for everyone, regardless of their financial knowledge. Plus, the calculator is optimized for mobile compatibility, ensuring that you can access it seamlessly on various devices—an essential factor for boosting engagement.

Research indicates that even a one-second delay in load time can significantly impact user satisfaction. That’s why we prioritize a streamlined design. Furthermore, the inclusion of means that the calculator is usable for individuals with disabilities, promoting inclusivity. By emphasizing simplicity and accessibility, to navigate the complexities of loan calculations with confidence.

This is particularly important for . Understanding the costs associated with refinancing can lead to , helping you feel more secure in your choices. We’re here to support you every step of the way, ensuring that you have the tools you need to make the best decisions for your family’s future.

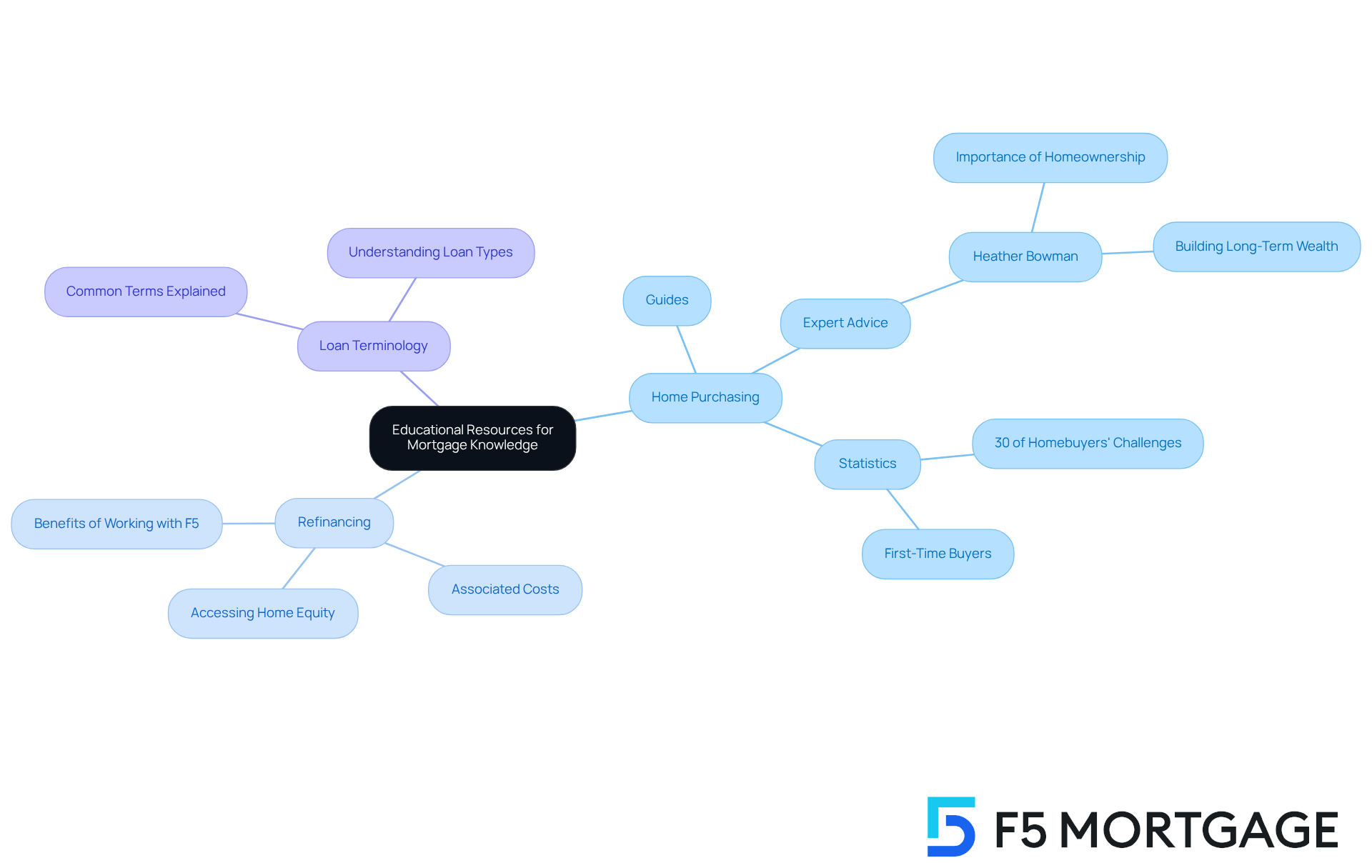

Educational Resources: Empower Your Mortgage Knowledge

At F5 Mortgage, we understand how challenging the can be. That’s why we offer a wide range of , including , refinancing, and loan terminology. These resources are designed to empower you with the knowledge needed to with confidence.

Research shows that 30% of homebuyers found the financing process more difficult than they expected in 2022. This statistic underscores the vital role that education plays in easing your journey. Experts in financial education, like Heather Bowman, emphasize that investing in is essential for achieving .

By ensuring our customers are well-informed about the —such as how to access home equity, the associated costs, and the benefits of —we position ourselves as a trusted partner in your path to homeownership. Our dedicated team is here to support you through every stage, from exploring your options to finalizing your new loan. We’re here to assist you every step of the way, ensuring you have the .

Customer Support: Get Help When You Need It

At F5 Financing, we understand how crucial it is for you to receive outstanding . We guarantee that help is always available whenever you need it. Whether you have questions about the , require assistance with your application, or seek guidance on , our knowledgeable team at F5 Mortgage is here for you. This unwavering commitment to customer service not only demonstrates our dedication to your satisfaction but also fosters lasting relationships with our borrowers.

Industry leaders emphasize that effective customer service is vital in finance, significantly . Bruce Gehrke, Senior Director of Wealth and Lending Intelligence at J.D. Power, states, “Lenders that take an active advisory role in assisting their customers navigate the current market are achieving significantly higher satisfaction, loyalty, and advocacy scores than those viewing lending as a transactional process.” By offering personalized assistance throughout the financing journey—especially tailored loan options for and those with unique financial situations—F5 enhances your satisfaction, leading to a smoother application experience and greater chances of success.

Our dedication to is reflected in the positive reviews from customers who have experienced the tailored solutions provided by F5. One client shared, “Alyssa & Jorge were both very patient with me & got me secured at rates I couldn’t believe,” showcasing our team’s commitment to guiding you step by step. In a landscape where client satisfaction with loan servicers has decreased to an average score of 596—down 10 points from 2024—F5’s commitment to exceptional service truly stands out.

Additionally, 51% of customers cite better customer service as a reason to switch mortgage providers. This underscores the importance of maintaining high service standards. We know how challenging this process can be, and we’re here to .

Conclusion

The house payment calculator in Texas is more than just a tool; it’s a companion for prospective homeowners, guiding them through the often daunting world of mortgage financing. We understand how overwhelming this process can feel, and that’s why this calculator is designed to empower you. With customizable loan options, real-time interest rate updates, and comprehensive cost estimations, you can make financial decisions that truly reflect your unique circumstances.

As we explored the features of the house payment calculator, we highlighted its user-friendly interface and mobile accessibility, which make it easier for you to compare multiple loan scenarios. These enhancements are not just about functionality; they’re about providing you with clarity on the factors that affect your monthly payments and overall loan costs. We also recognize the importance of educational resources and exceptional customer support, ensuring you feel supported every step of the way on your journey to homeownership.

In conclusion, utilizing tools like the house payment calculator in Texas is essential for anyone seeking to make wise financial choices in the housing market. By taking the time to understand and leverage these resources, you can save money and gain a deeper insight into your mortgage options. The path to homeownership may seem challenging, but with the right tools and unwavering support, it transforms into a more manageable and informed experience.

Frequently Asked Questions

What is the F5 Mortgage Calculator used for?

The F5 Mortgage Calculator is a user-friendly tool designed to help users estimate their monthly loan payments by inputting essential details like home price, down payment, and interest rate.

How does the house payment calculator Texas help users?

The house payment calculator Texas allows users to quickly receive accurate estimates for their loan payments, compare various financing scenarios, access current interest rates, and simplifies the loan calculation process.

Why is it important to evaluate refinancing options?

Evaluating refinancing options is crucial as it can lead to lower monthly payments or quicker debt settlement. Tailoring calculations to fit specific needs can help users find lending products that align better with their financial goals.

What customizable features does the house payment calculator Texas offer?

The house payment calculator Texas enables users to customize loan parameters such as loan type, interest rate, and term length, allowing them to explore how these factors influence their monthly payments.

How does the F5 Loan Calculator provide real-time interest rate updates?

The F5 Loan Calculator offers real-time interest updates, giving borrowers instant access to the latest market information, which is essential for making informed decisions regarding their loans.

What impact do interest rate changes have on loan payments?

Even slight shifts in interest rates can lead to significant changes in monthly payments and overall loan expenses, making it important for borrowers to stay informed about market changes.

What should users gather to enhance the effectiveness of their calculations?

Users should gather accurate financial information, such as their income, debt obligations, and credit score, to enhance the effectiveness of their loan calculations.

How does F5 Mortgage support users in the refinancing journey?

F5 Mortgage provides dedicated support throughout the refinancing journey, helping families explore their loan options with ease and ensuring they benefit from favorable rates and flexible conditions.