Introduction

Navigating the mortgage landscape can often feel like traversing a labyrinth. We know how challenging this can be, especially for families making one of the most significant financial decisions of their lives. That’s where a 500,000 mortgage calculator comes in, offering a beacon of clarity. It transforms complex calculations into manageable insights, guiding you through the process with ease.

This article explores the myriad benefits of utilizing such a tool. Imagine being able to visualize your financial commitments clearly. With this calculator, you can make informed choices and ultimately secure the best financing options available. But what hidden advantages might lie within these calculations? How can they reshape your family’s financial future?

We’re here to support you every step of the way. Let’s delve into how this tool can empower you and your family, making the mortgage process less daunting and more manageable.

F5 Mortgage: User-Friendly Mortgage Calculator for Easy Calculations

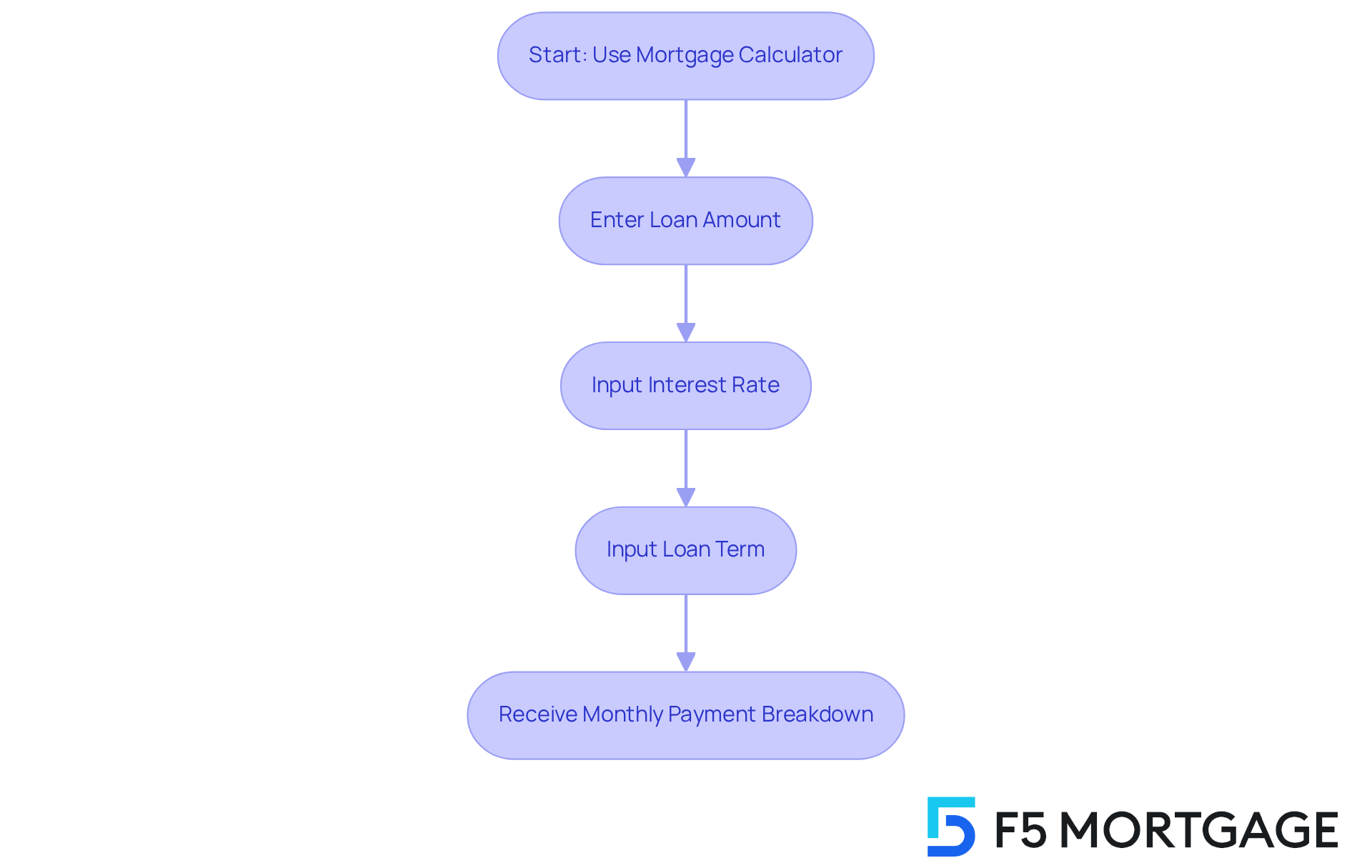

At F5 Mortgage, we understand how overwhelming the mortgage process can feel. That’s why we offer an easy-to-use loan calculator designed to help households calculate their monthly payments effortlessly. This intuitive tool takes the stress out of complex calculations, allowing you to input your loan amount, interest rate, and term, and receive instant results. With a clear and user-friendly interface, we empower you to navigate the mortgage journey with confidence and transparency, all while being backed by our commitment to exceptional customer service and competitive refinancing options.

Mortgage calculators are essential for families making home buying decisions. They help visualize financial commitments and assess what’s affordable. Industry experts agree that these tools are vital for informed decision-making, enabling you to explore various scenarios and understand how different financial factors impact your budget. With F5 Mortgage’s extensive network of over two dozen lenders, you can access competitive offers when considering refinancing, enhancing your financial planning.

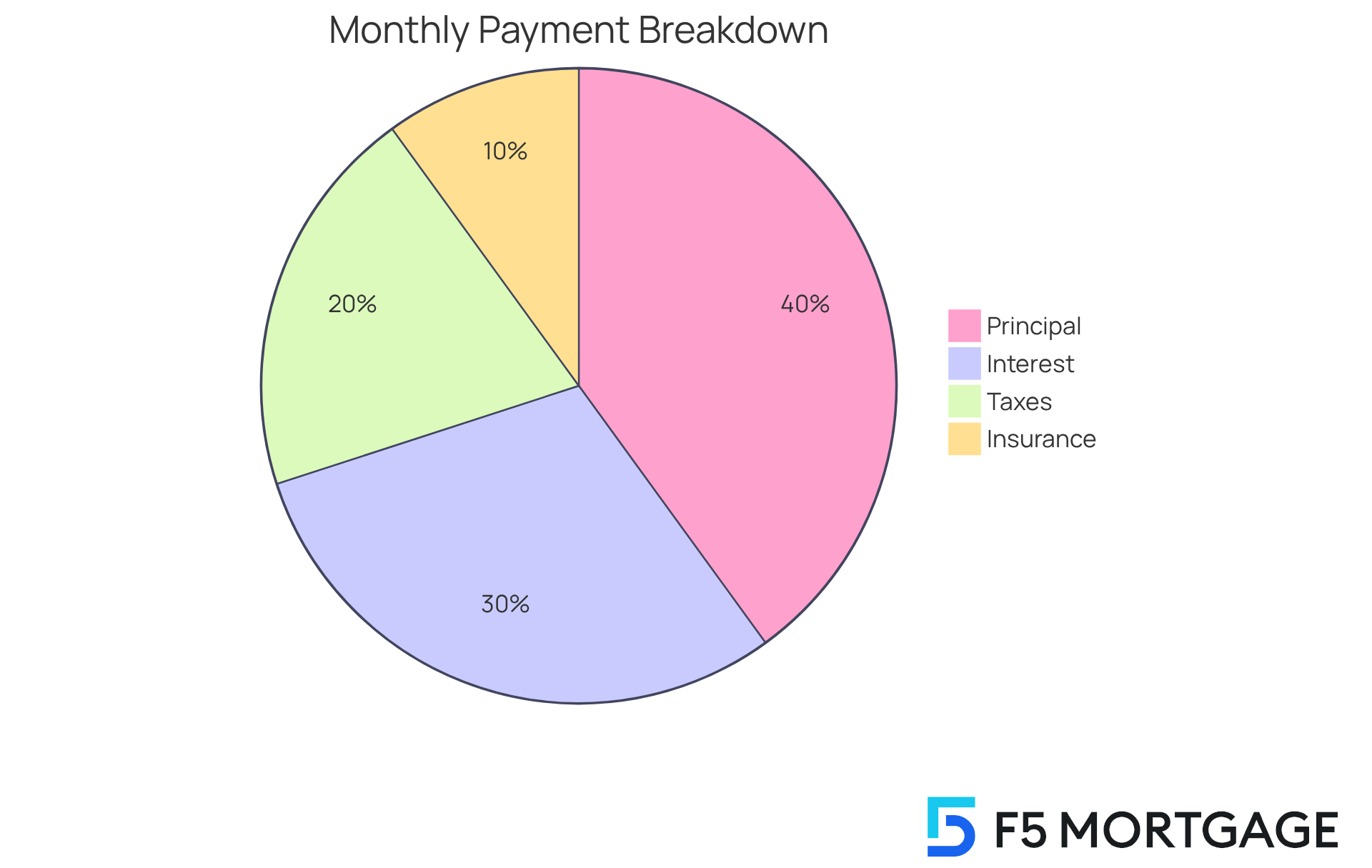

To make the most of a 500,000 mortgage calculator, start by entering your desired loan amount, which can be $500,000 or more, depending on your needs. Next, input the expected interest rate and loan term. The calculator will then break down your monthly payments, including principal, interest, taxes, and insurance. This information helps you make informed choices about your home financing options. By taking this proactive approach, you not only improve your budgeting but also boost your confidence in the home buying process.

As the industry evolves, the increasing use of AI and machine learning for personalized financial guidance enhances the functionality of modern loan calculators. This makes them even more valuable for families looking to optimize their home equity and secure favorable refinancing terms. Remember, we’re here to support you every step of the way.

Customizable Inputs: Tailor Your Mortgage Calculations to Fit Your Needs

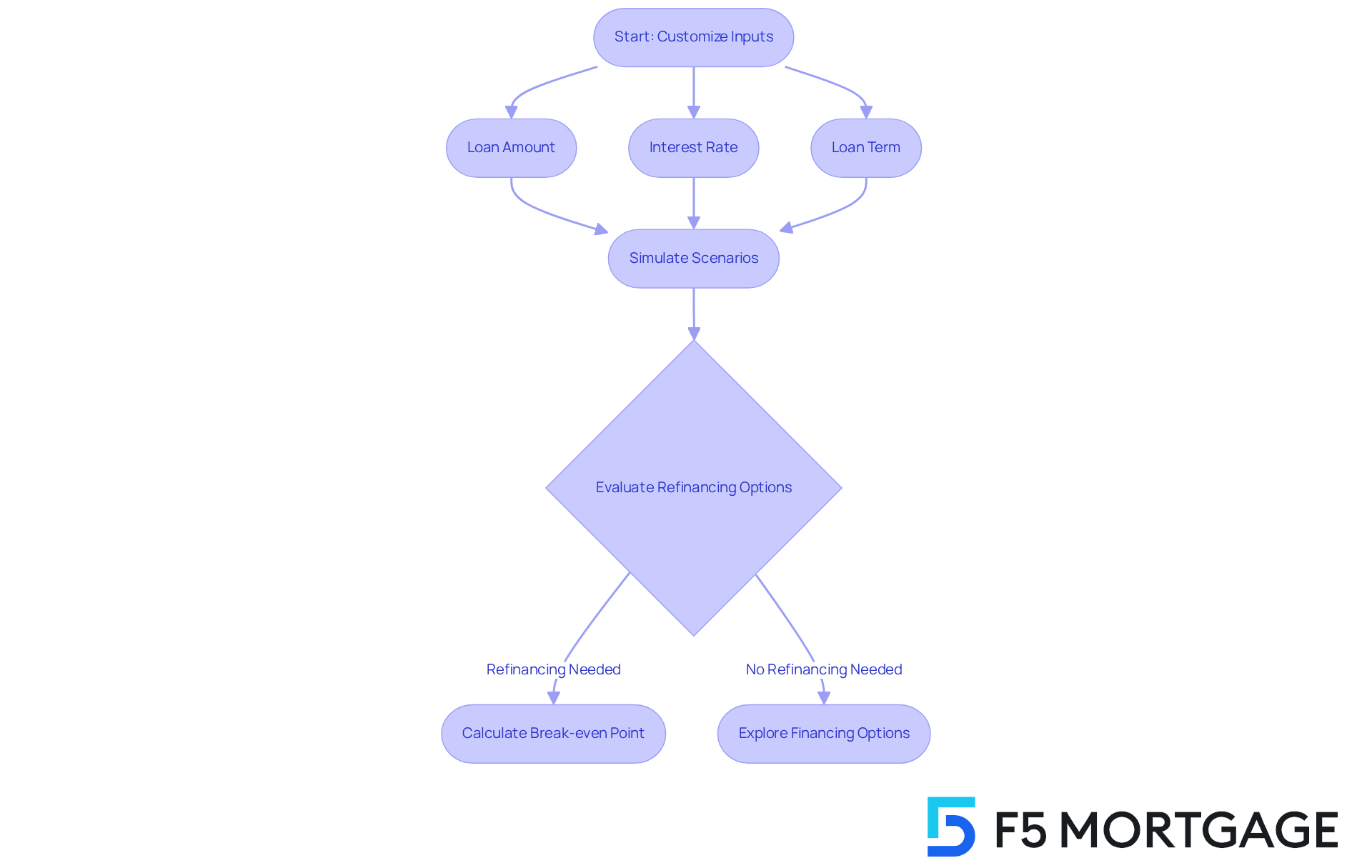

Navigating the mortgage process can feel overwhelming, but the F5 Mortgage calculator is here to help. This tool allows families to customize key inputs like loan amount, interest rate, and loan term, making it easier to simulate various scenarios. By adjusting these factors, you can gain valuable insights into how they affect your monthly payments.

We know how challenging this can be, and that’s why tailoring these calculations to fit your unique financial situation is so important. It empowers you to make informed choices about your financing options. Financial consultants emphasize that customized loan calculations provide clarity and confidence, guiding you through the complexities of home financing.

Additionally, the calculator enables you to explore refinancing alternatives. This could mean modifying your loan conditions to potentially lower your monthly payments or even eliminating private mortgage insurance (PMI) if you qualify. Understanding the break-even point for refinancing is crucial. By calculating the costs associated with refinancing and comparing them to your potential monthly savings, you can evaluate whether refinancing is the right choice for you.

The ability to modify inputs not only helps you understand possible expenses but also allows you to discover the best financing options available. Remember, we’re here to support you every step of the way as you navigate these important decisions.

Real-Time Interest Rate Updates: Stay Informed on Market Changes

F5 Mortgage’s calculator offers real-time interest updates, giving families instant access to the latest market information. We know how challenging it can be to navigate the mortgage landscape, and this feature helps you understand how existing fees impact your potential loan payments. For instance, as of November 19, 2025, the typical percentage on a 30-year fixed loan is 6.493%, while the 15-year fixed loan averages 5.85%. Even a small change in interest rates can significantly affect your monthly payments, making this information essential.

Economists suggest that households should consider refinancing if their current loan cost exceeds today’s rates by at least 0.50 percentage points. Staying informed about market changes is crucial. With F5 Mortgage, you benefit from a dedicated team that supports you throughout the refinancing process, ensuring you understand all associated costs and helping you access lower rates and flexible terms.

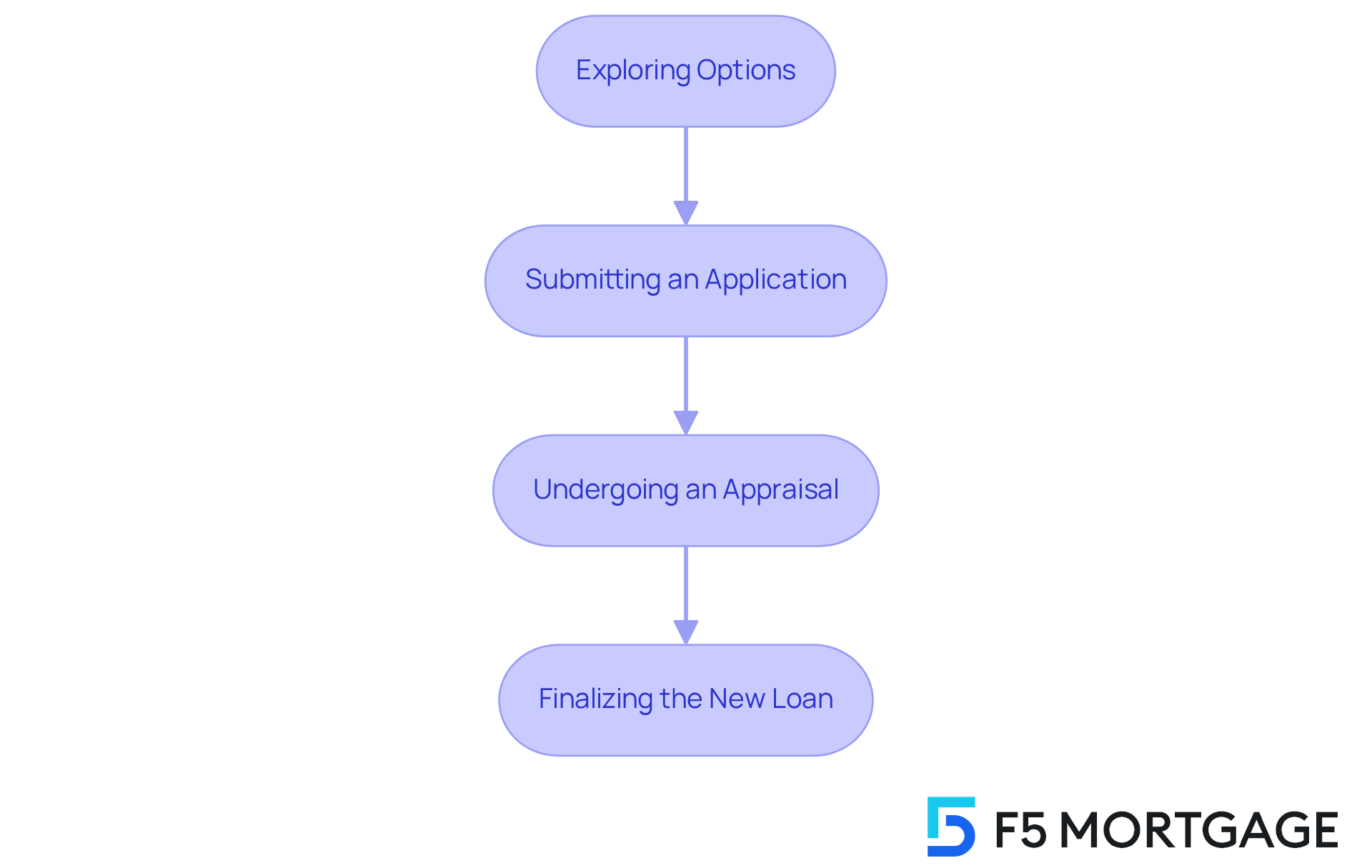

The refinancing journey involves:

- Exploring options

- Submitting an application

- Undergoing an appraisal

- Finalizing the new loan

As an independent broker, F5 Mortgage has access to a vast network of lenders, allowing families to secure the best possible terms and rates tailored to their needs.

By incorporating real-time data, our 500,000 mortgage calculator not only enhances accuracy but also ensures that families are well-prepared to navigate the complexities of financing in a dynamic economic landscape. We’re here to support you every step of the way.

Monthly Payment Breakdown: Understand Your Financial Commitment

Understanding your mortgage can feel overwhelming, but we’re here to support you every step of the way. The calculator offers a detailed monthly payment breakdown, showing exactly how much of each payment goes toward principal, interest, taxes, and insurance. This transparency helps families grasp their financial commitments and plan their budgets effectively.

By breaking down payments, you can see the long-term implications of your loan choices. It’s also crucial to understand the closing expenses tied to refinancing. These can include:

- Application fees, which range from $75 to $500

- Origination fees between 0.5% and 1.5% of the loan total

- Appraisal costs typically between $300 and $500

Knowing these costs is essential if you’re considering a mortgage refinance.

Calculating your break-even point can further empower you in this process. For example, if your refinancing costs total $4,000 and you save $100 each month, your break-even point would be 40 months. To truly benefit from refinancing, it’s important to plan to stay in your home long enough to reach this point.

Additionally, consider exploring down payment assistance programs available through F5 Mortgage. Programs like the MyHome Assistance Program in California can provide up to 3% of the home’s purchase price, while the My Choice Texas Home program offers up to 5% for down payment and closing support. These resources can significantly ease the financial burden of upgrading to a new home.

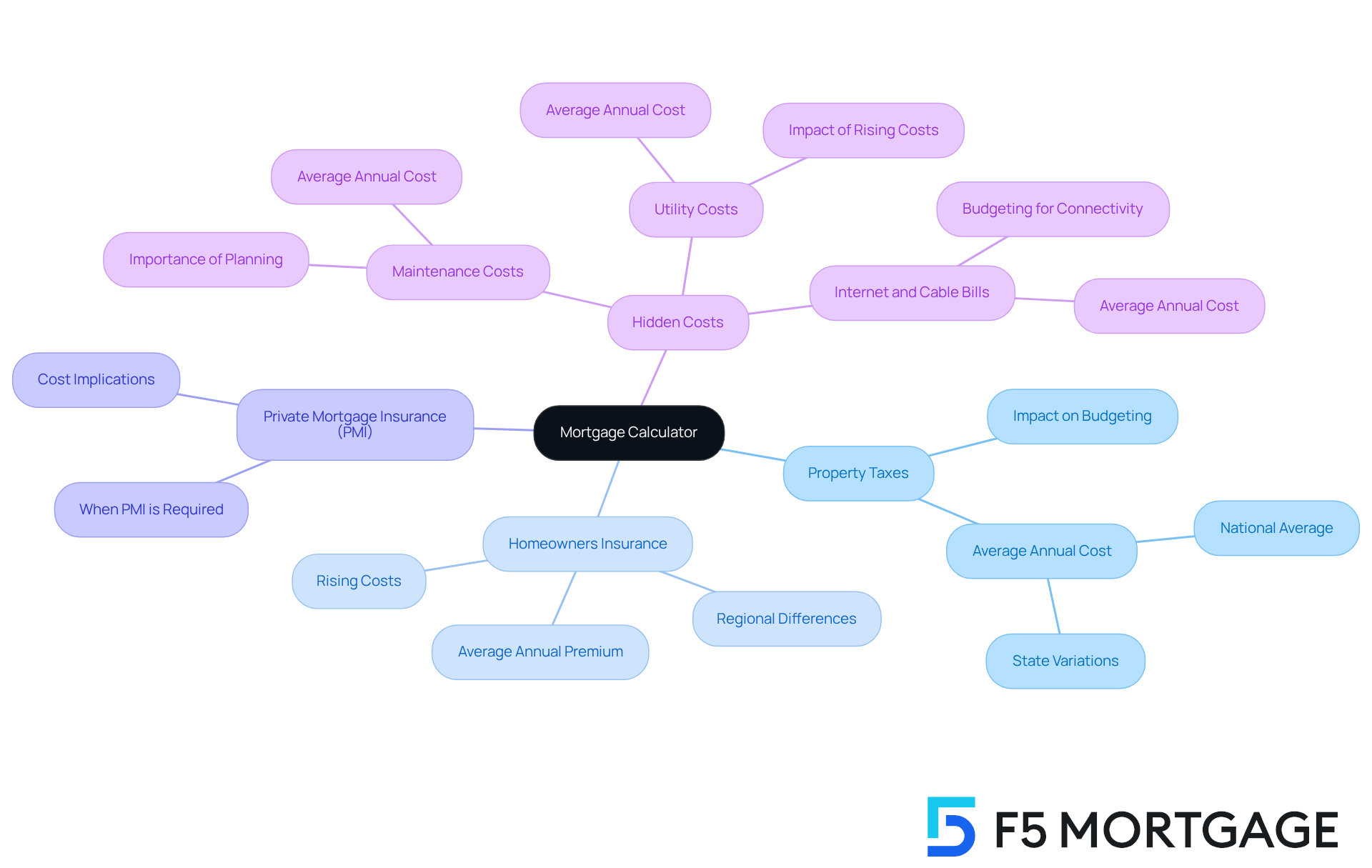

Inclusion of Additional Costs: Get a Complete Picture of Your Mortgage

At F5 Mortgage, we understand how challenging navigating the mortgage process can be. That’s why our 500,000 mortgage calculator provides more than just basic loan estimates. It includes essential expenses like property taxes, homeowners insurance, and private mortgage insurance (PMI). This comprehensive approach helps families gain a complete understanding of their overall loan costs, which is vital for effective financial planning.

Many households are often unaware of the hidden costs that come with homeownership. These unexpected expenses can significantly impact their budgets. By using our detailed 500,000 mortgage calculator, families can avoid these surprises and make informed decisions regarding their mortgage commitments.

This proactive strategy not only prepares you for your financial responsibilities but also empowers you to navigate the complexities of homeownership with confidence. We’re here to support you every step of the way, ensuring you feel equipped to handle your financial future.

Amortization Schedule: Visualize Your Loan Payoff Journey

The 500 000 mortgage calculator produces an amortization schedule that offers a detailed breakdown of each payment during the term. It clearly outlines the portions of each payment assigned to interest and principal, helping families visualize their repayment journey effectively. We know how challenging this can be, and understanding this process is essential. It empowers you to make informed choices about refinancing options or the possibility of settling your debts early.

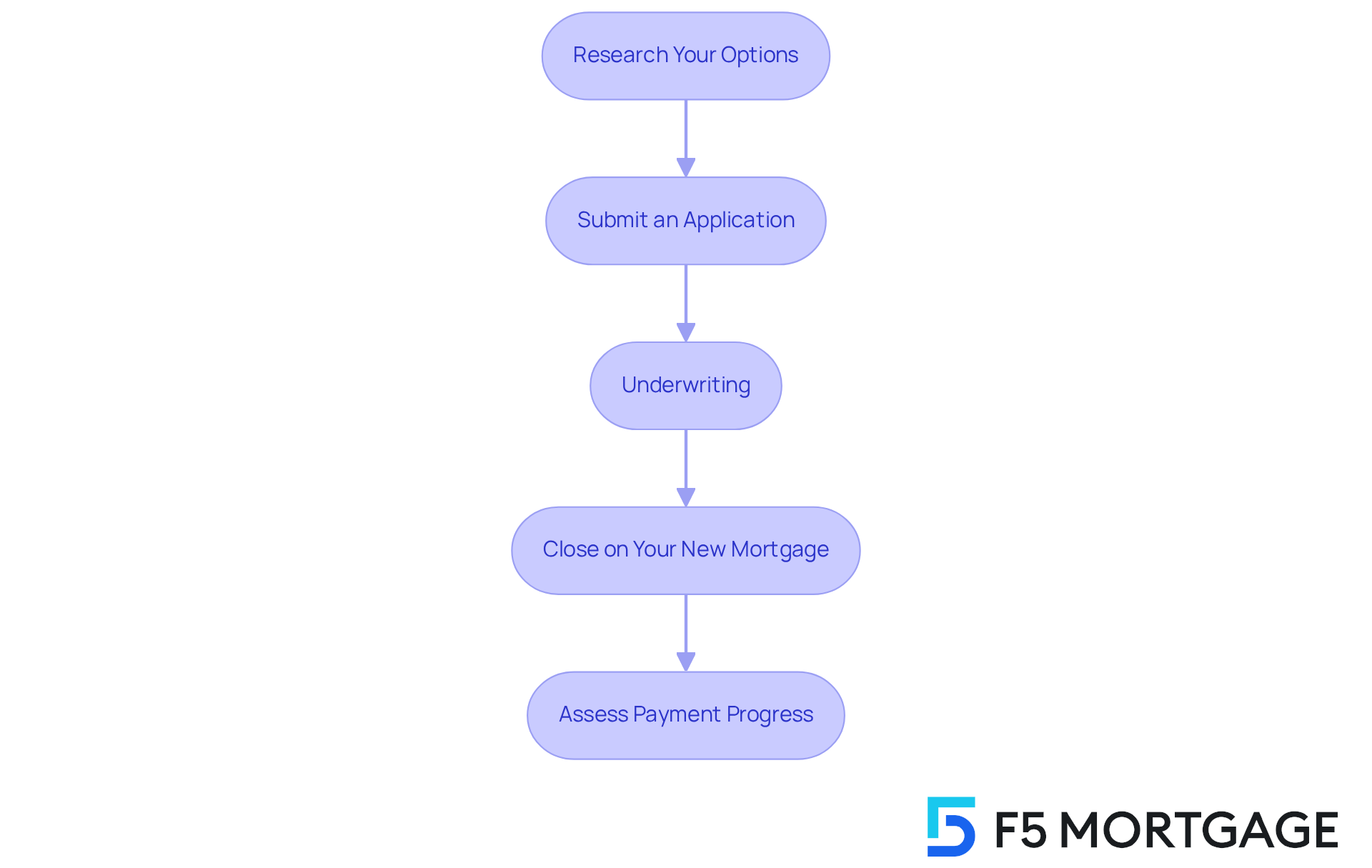

To refinance your mortgage, follow these steps:

- Research Your Options: Compare multiple lenders and loan options to find the best rates and terms.

- Submit an Application: Provide information about your property and financial documents.

- Underwriting: The lender reviews your application, credit history, and other requirements.

- Close on Your New Mortgage: Once approved, sign the new documents and pay closing costs.

By understanding the amortization process, families can utilize a 500 000 mortgage calculator to better navigate their financial commitments and plan for future expenses, ultimately enhancing their financial well-being. Additionally, mortgage interest payments may be tax-deductible, providing extra financial relief for your household. For instance, if you refinance to a lower interest percentage, the potential tax savings can further improve your financial situation.

To optimize the advantages of an amortization schedule, households should consistently assess their payment progress. Consider refinancing options when interest levels decrease – especially given the current favorable conditions in Colorado. Seeking advice from a financial consultant can help you explore possible tax benefits. With F5 Mortgage, families can access attractive terms and tailored financing choices, making refinancing a strategic decision to enhance their financial circumstances. We’re here to support you every step of the way.

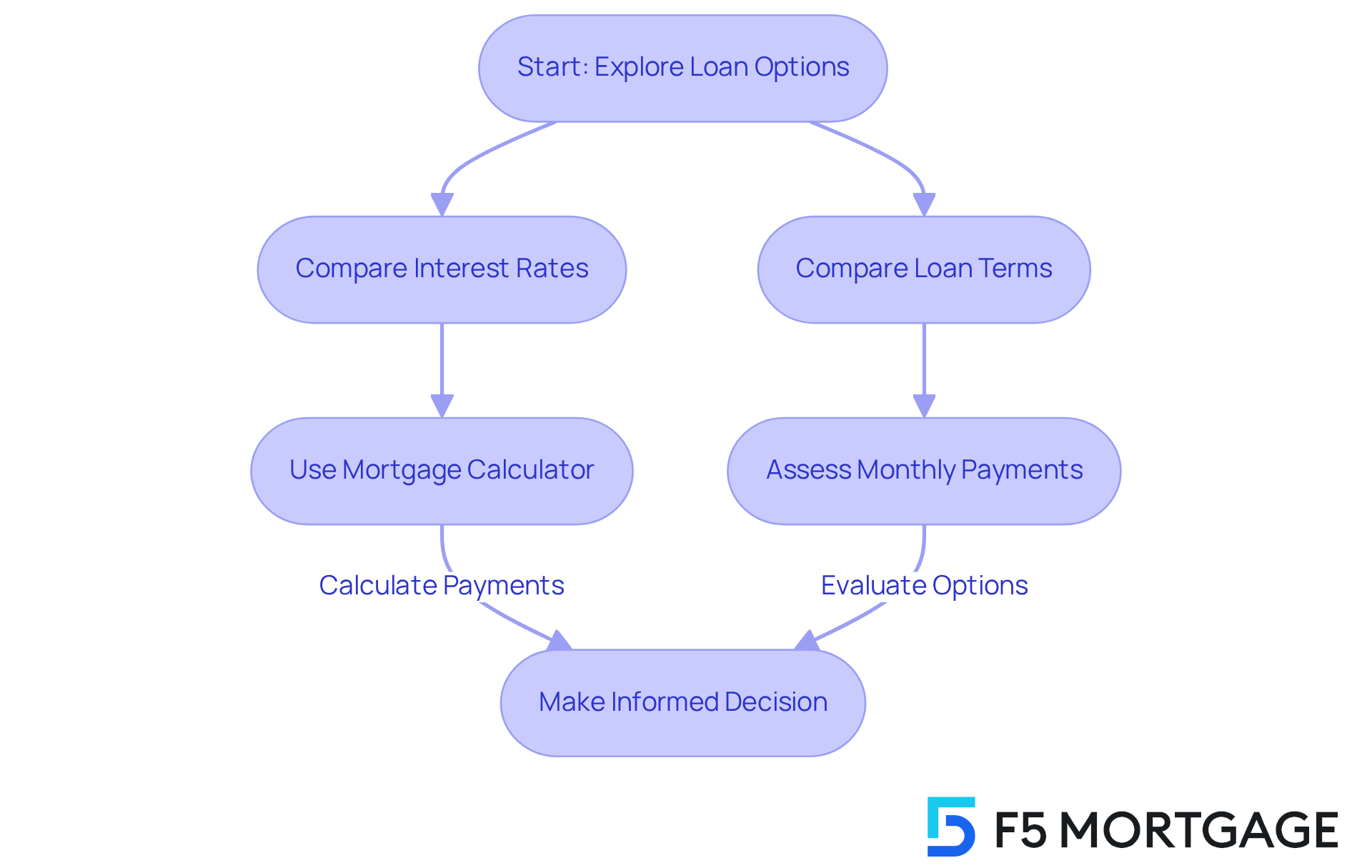

Loan Scenario Comparison: Explore Your Options for Better Decisions

At F5 Mortgage, we understand how challenging navigating loan options can be. That’s why our 500,000 mortgage calculator is designed to help families like yours compare various loan scenarios effortlessly. Whether it’s different interest rates or loan terms, this tool reflects our commitment to transparency and empowering you in your financial journey.

Imagine being able to see how changes in loan parameters affect your monthly payments and overall expenses using a 500,000 mortgage calculator. By examining multiple scenarios, you can make informed decisions that truly align with your financial goals. Financial advisors often emphasize the importance of exploring various financing options. Why? Because even a small difference in interest rates can significantly impact your total costs. It’s crucial to investigate all available choices.

Consider this: a mere 0.1 percent difference in interest could save you thousands over the life of your loan. That’s why comparing financing options is so important. Our Rate Checker tool is here to help you understand available interest rates, using underwriting variables similar to those lenders use. This ensures you get a fair comparison.

This comprehensive assessment not only assists you in choosing the right loan but also plays a vital role in shaping your household’s financial decisions. We want to ensure that the option you select aligns with your long-term objectives. The Consumer Financial Protection Bureau recommends comparing at least three lenders when seeking a loan, highlighting the significance of careful assessment.

At F5 Mortgage, we leverage technology to provide you with extremely competitive rates, all without the pressure of aggressive sales tactics. We’re here to support you every step of the way as you explore your financing choices with confidence.

Mobile Accessibility: Calculate Your Mortgage Anytime, Anywhere

F5 Mortgage’s mobile-friendly 500,000 mortgage calculator is a game changer for busy households. We know how challenging it can be to find time for financial planning, and this tool allows you to crunch the numbers anytime, anywhere. Imagine being able to evaluate your loan options while waiting for your kids at soccer practice or during your lunch break. It’s all about making informed choices without disrupting your daily routine.

Technology experts agree: mobile tools in financial planning not only enhance user engagement but also simplify the decision-making process. By using a mobile platform, F5 Mortgage is here to support you every step of the way. This means you can manage the complexities of financing with ease, ensuring you feel confident in your choices.

With the 500,000 mortgage calculator, you can quickly compute loan payments right from your phone and adjust factors like down payment and loan duration. This flexibility leads to more efficient budgeting and planning, allowing you to focus on properties that truly fit your financial comfort zone. Ultimately, this makes the home buying process smoother and less stressful for you and your family.

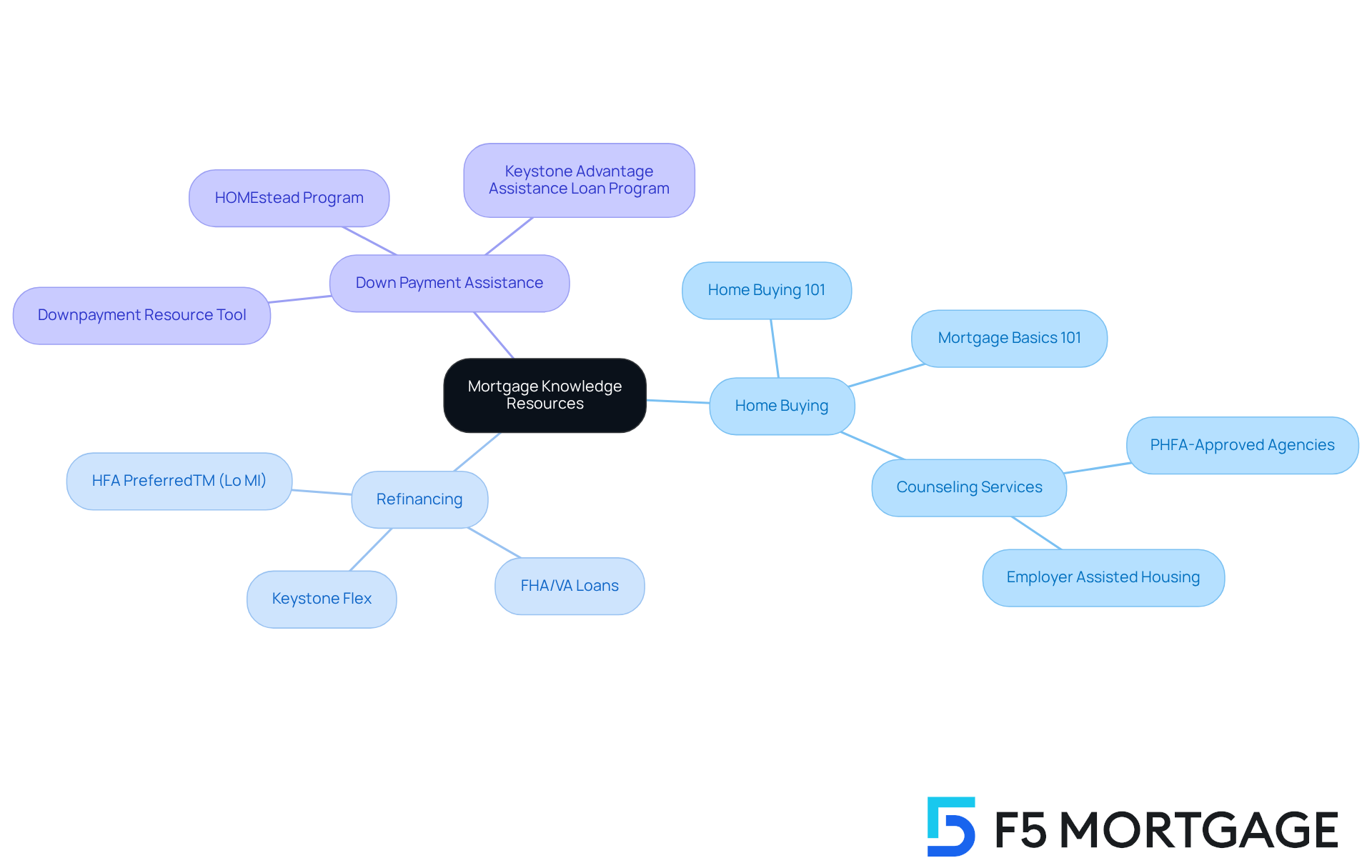

Educational Resources: Empower Yourself with Mortgage Knowledge

At F5 Mortgage, we understand how overwhelming the home buying and refinancing process can be. That’s why we offer a wide range of educational resources designed just for you. Our detailed guides cover everything from home buying to refinancing and down payment assistance, equipping you with the crucial information you need.

We know how challenging this can be, and our goal is to help you navigate the complexities of financing with confidence. By providing comprehensive educational support, we ensure that you’re not just informed but also well-prepared to make sound financial decisions. This dedication to housing finance education significantly enhances your understanding of your options, leading to more informed choices in your home purchasing and refinancing journey.

Financial educators emphasize that having access to home financing information is essential for fostering confidence and clarity in your decision-making process. We’re here to support you every step of the way as you pursue your homeownership goals. With the right knowledge, you can take charge of your financial future and make decisions that align with your dreams.

Customer Support: Get Help When You Need It Most

At F5 Mortgage, we understand how challenging the financing process can be for families. That’s why we emphasize committed customer support, ensuring that households receive the help they need every step of the way. Whether you’re trying to navigate the complexities of a 500,000 mortgage calculator or exploring various financing options, our knowledgeable support team is here to address your inquiries and provide guidance.

This dedication to outstanding customer service not only builds trust in your financing choices but also greatly enhances your overall satisfaction. Clients have shared their experiences with our team, praising our exceptional service and expertise. One client expressed, “Ryan and his team are amazing! I was pretty confused at the start of all this, but they helped me so much along the way.”

Another client highlighted our personalized approach, stating, “John really made me feel like family with how patient, educational, and kind he was in walking me through the whole process of being a first-time home buyer!” These testimonials underscore the critical role that dedicated support plays in ensuring a positive mortgage experience.

We know how important it is to feel supported during this journey. Let us help you navigate the mortgage process with confidence and care.

Conclusion

Using a $500,000 mortgage calculator can truly enhance your home buying experience. We know how challenging this journey can be, and this tool simplifies those complex financial decisions. It not only clarifies your monthly payments but also empowers you to make informed choices about your mortgage options. With features like customizable inputs, real-time interest rate updates, and detailed cost breakdowns, you can navigate the mortgage landscape with greater confidence and ease.

Throughout this article, we’ve highlighted key benefits of using a mortgage calculator. You can tailor calculations to fit your unique financial situation, visualize long-term payment impacts through amortization schedules, and effectively compare various loan scenarios. Plus, with comprehensive educational resources and dedicated customer support, you’ll feel well-equipped to manage your mortgage journey and make sound financial decisions.

In conclusion, embracing the advantages of a $500,000 mortgage calculator is essential for families looking to optimize their home financing strategies. By taking proactive steps to understand your financial commitments and explore available options, you can secure favorable terms and enhance your overall financial well-being. Engaging with tools like these not only simplifies the mortgage process but also empowers you to take control of your financial future. Together, we can make informed decisions that align with your goals and aspirations.

Frequently Asked Questions

What is the purpose of the F5 Mortgage calculator?

The F5 Mortgage calculator is designed to help households calculate their monthly mortgage payments easily by allowing users to input their loan amount, interest rate, and term to receive instant results.

How does the F5 Mortgage calculator assist in the mortgage process?

The calculator simplifies complex calculations, enabling users to visualize financial commitments, assess affordability, and make informed decisions about home financing options.

What features does the F5 Mortgage calculator offer?

The calculator allows customization of key inputs such as loan amount, interest rate, and loan term, and provides real-time interest rate updates to help users understand market changes.

How can I use the F5 Mortgage calculator for a $500,000 mortgage?

To use the calculator for a $500,000 mortgage, enter your desired loan amount (which can be $500,000 or more), expected interest rate, and loan term. The calculator will then provide a breakdown of monthly payments, including principal, interest, taxes, and insurance.

Why is it important to customize mortgage calculations?

Customizing mortgage calculations helps users understand how different financial factors affect their monthly payments, empowering them to make informed choices about their financing options.

What should I consider when exploring refinancing options with the calculator?

When exploring refinancing options, consider modifying loan conditions to potentially lower monthly payments or eliminate private mortgage insurance (PMI). It’s important to calculate the costs associated with refinancing and compare them to potential monthly savings to evaluate if refinancing is beneficial.

How does F5 Mortgage keep users informed about interest rates?

F5 Mortgage provides real-time interest rate updates, allowing users to access the latest market information and understand how changes in rates can impact their loan payments.

What is the typical interest rate for a 30-year fixed loan as of November 19, 2025?

As of November 19, 2025, the typical interest rate for a 30-year fixed loan is 6.493%.

What steps are involved in the refinancing process with F5 Mortgage?

The refinancing process involves exploring options, submitting an application, undergoing an appraisal, and finalizing the new loan.

How does F5 Mortgage support families during the mortgage process?

F5 Mortgage provides exceptional customer service, access to a vast network of lenders, and ongoing support to help families navigate the mortgage and refinancing journey confidently.