Overview

This article highlights seven essential FHA home loan calculator tools designed to help families navigate their mortgage options and financial commitments. We understand how challenging this can be, and these calculators simplify the complex calculations involved in home financing. By using these tools, families can make informed decisions about their purchasing power, monthly costs, and available assistance programs.

Moreover, we want to emphasize the importance of expert guidance throughout the homebuying process. We’re here to support you every step of the way, ensuring that you feel confident in your choices as you embark on this significant journey.

Introduction

Navigating the world of home financing can feel overwhelming, especially for families striving to secure their dream home. We understand how challenging this can be. With the FHA loan program offering lower down payment options, it’s essential to grasp the financial implications of homeownership.

This article explores seven vital FHA home loan calculator tools designed to empower families. These resources help you make informed decisions, streamline your budgeting, and enhance your purchasing power.

But how can these digital tools effectively bridge the gap between complex calculations and personalized financial guidance? We’re here to support you every step of the way.

F5 Mortgage: User-Friendly FHA Home Loan Calculator

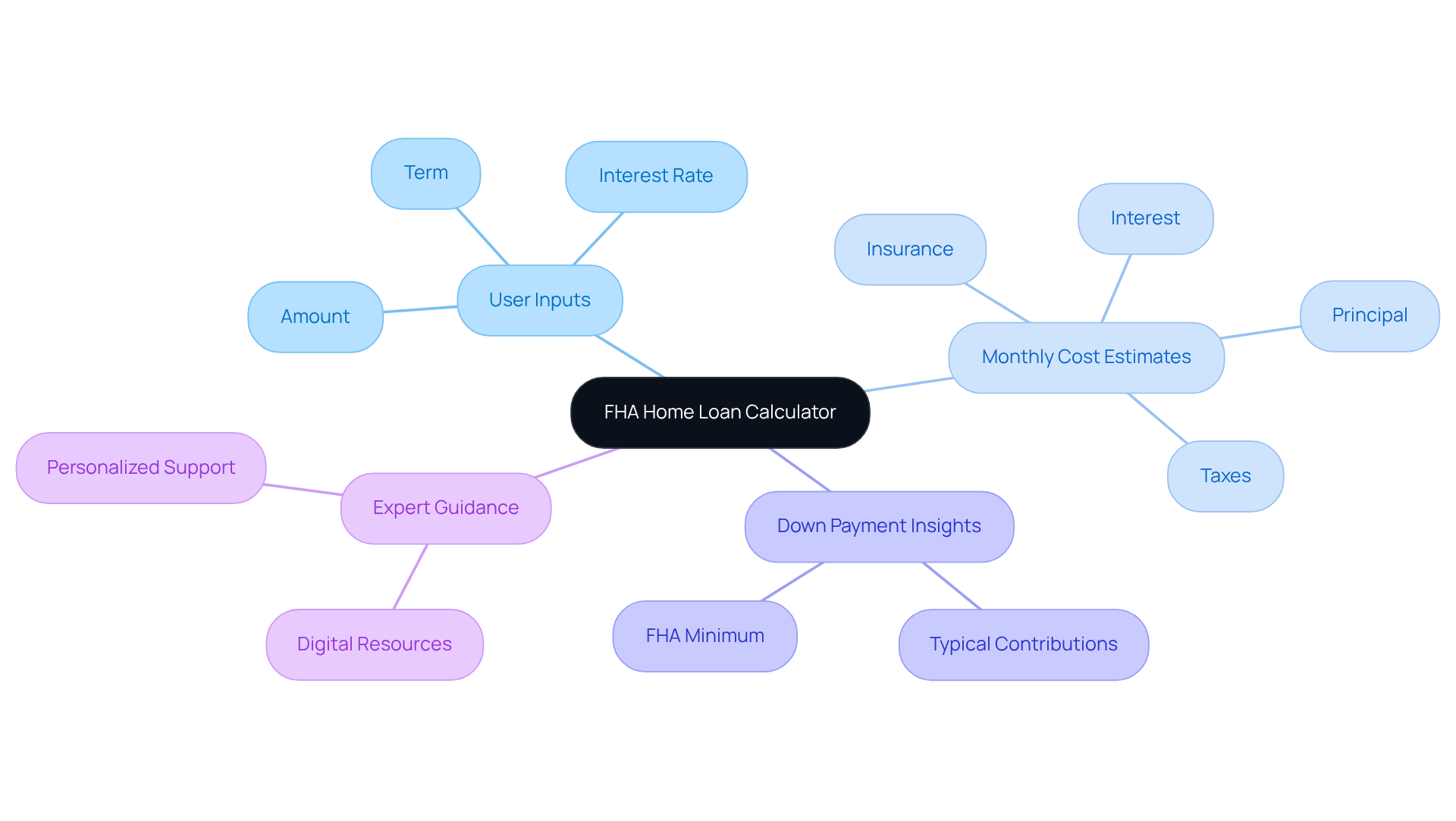

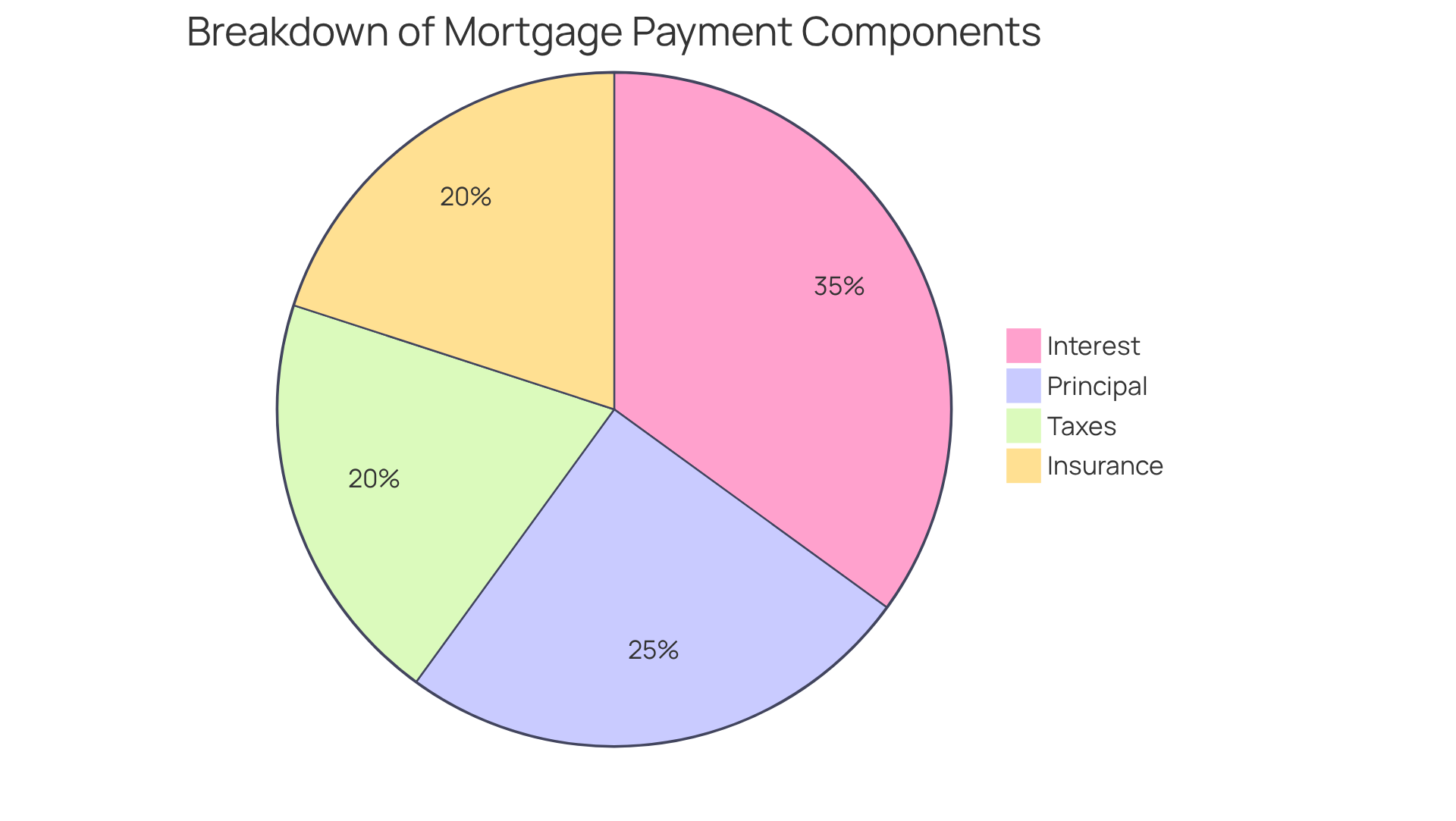

F5 Mortgage understands that navigating the complexities of home financing can be overwhelming. That’s why we provide an easy-to-use FHA home loan calculator designed to help families manage these intricacies. By allowing users to specify their preferred amount, interest rate, and term, this tool provides immediate estimates of monthly costs, including principal, interest, taxes, and insurance. This simplification of complex calculations empowers households to make informed choices about their mortgage options, ensuring they fully comprehend their financial obligations before proceeding with an application.

In 2023, first-time homebuyers typically made an initial contribution of 8%, highlighting the importance of understanding financial responsibilities. The FHA loan initiative, which requires a minimum deposit of just 3.5%, is particularly beneficial for families looking to enhance their purchasing power. With the FHA home loan calculator provided by F5 Mortgage, households can explore various scenarios, adjusting parameters to see how different down payments and interest rates influence their monthly payments.

While loan calculators provide valuable initial insights, expert opinions suggest they should not replace personalized guidance from financing specialists. F5 Mortgage bridges this gap by offering both sophisticated digital resources and access to knowledgeable experts who can support families throughout the financing process. We’re here to ensure you make informed choices tailored to your unique financial situation. This dual approach not only enriches the homebuying experience but also positions F5 Mortgage as a trusted partner in realizing your homeownership dreams.

US Bank: Comprehensive FHA Loan Calculator for Accurate Estimates

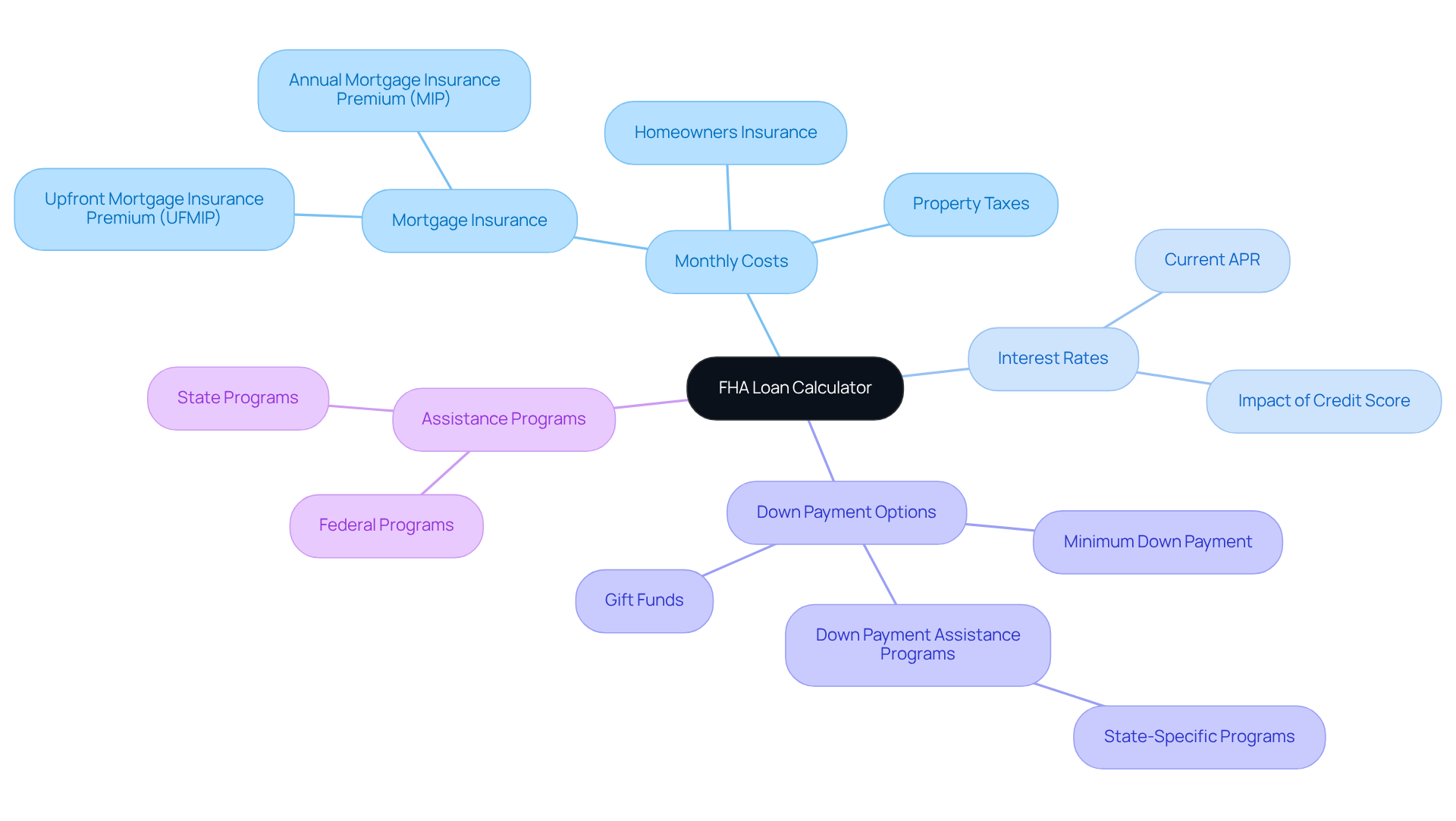

At F5 Mortgage, we understand how challenging navigating the world of home financing can be for families. That’s why we provide a strong FHA home loan calculator designed to give you accurate projections of your monthly costs. This essential tool takes into account important factors like the upfront mortgage insurance premium (MIP), property taxes, and homeowners insurance, ensuring you have a comprehensive overview of your financial commitments.

For instance, consider a standard FHA mortgage of $265,375 at a 6.250% interest rate. This leads to an estimated monthly cost of $1,663, with an annual percentage rate (APR) of 7.478%. We know that the lowest deposit needed for FHA loans is 3.5%, but with F5 Mortgage, you may qualify to purchase a home with as little as 3% down, or even 0% down for specific loan options. This flexibility is crucial for families planning their home purchase.

By utilizing the FHA home loan calculator, you can gain insight into your potential monthly costs and overall affordability, which aids in informed planning for your home acquisition. Accurate estimates are vital; they empower you to navigate the complexities of home financing with confidence, ultimately enhancing your homebuying experience.

Additionally, F5 Mortgage offers access to various down payment assistance programs available in states like California, Texas, and Florida. These programs can significantly alleviate the financial burden of homeownership. As Fred Bolstad, head of retail home lending for U.S. Bank, wisely notes, “For first-time homebuyers, an FHA mortgage is a great option because it can provide advantages to help buyers surpass the common barriers to purchasing – which is most often the initial cost.” We’re here to support you every step of the way.

Bankrate: Extensive Mortgage Calculator for FHA Loan Insights

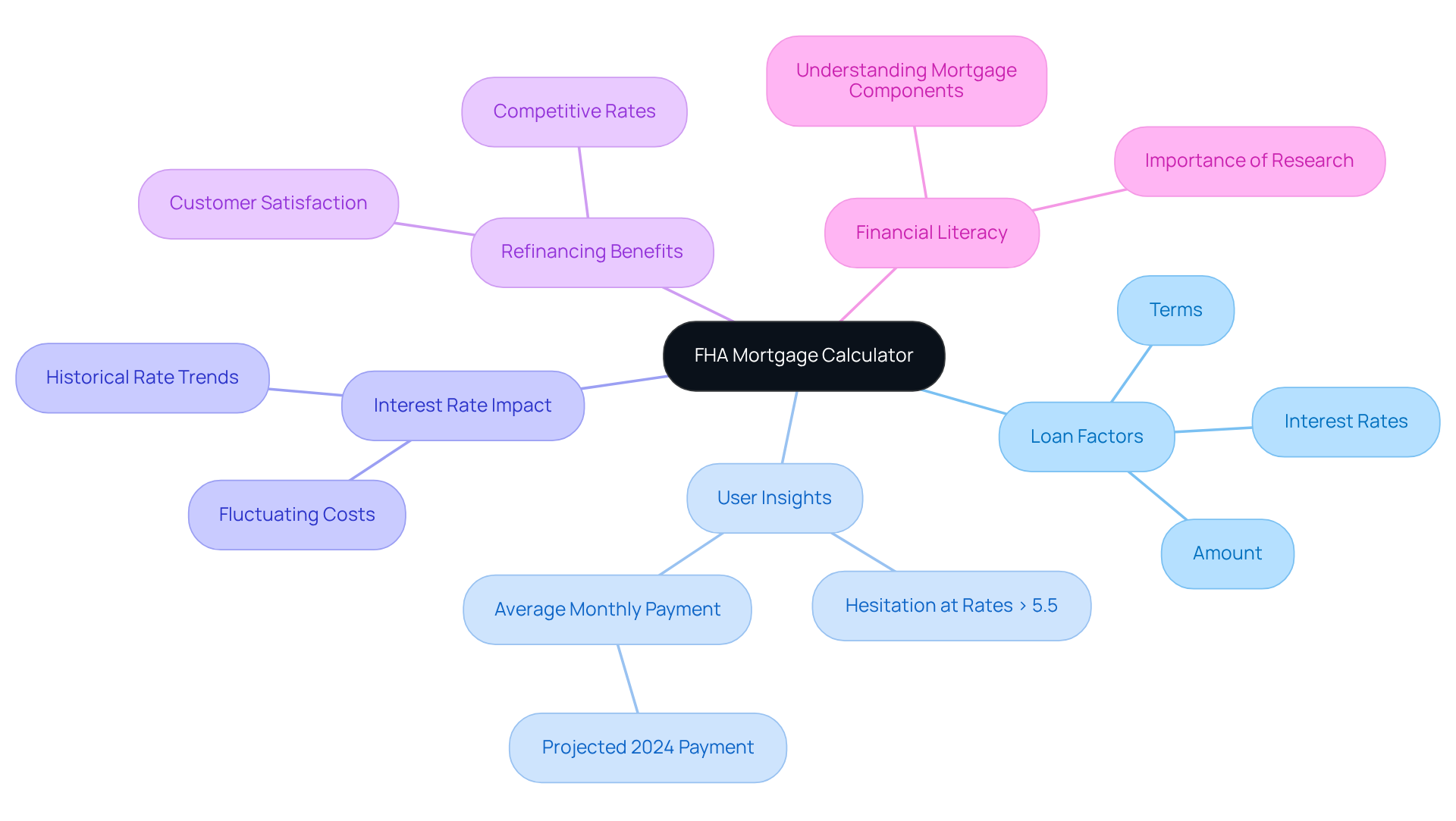

At Bankrate, we understand how challenging it can be to navigate the world of mortgages. Our extensive FHA home loan calculator empowers households to efficiently explore various FHA scenario options. By allowing users to enter different amounts, interest rates, and terms, the calculator illustrates how these factors influence monthly payments. This flexibility enables families to assess their choices and select the most suitable financing arrangement for their unique financial situation.

Moreover, our calculator reveals the impact of fluctuating interest rates on overall costs, equipping families with the knowledge they need to make informed decisions. For instance, with FHA loans offering up to 96.5 percent financing and an initial insurance premium of 1.75% of the loan amount, understanding how changes in interest rates can affect costs is crucial. We know that 71% of potential homebuyers are hesitant to proceed when rates exceed 5.5%. Additionally, the average monthly mortgage payment is projected to rise to $2,207 in 2024, underscoring the importance of utilizing this tool to navigate the complexities of home financing.

By refinancing with F5 Mortgage, households can benefit from competitive rates and dedicated support throughout the process. We’re here to support you every step of the way, ensuring you make the most informed decisions. Our clients have shared their appreciation for our services, stating, ‘The F5 Mortgage team made refinancing so easy and stress-free!’ The FHA home loan calculator not only simplifies the decision-making process but also enhances financial literacy, preparing households for their homeownership journey. Take the first step toward your refinancing goals with F5 Mortgage today!

Calculator.net: Specialized House Affordability Calculator for FHA Loans

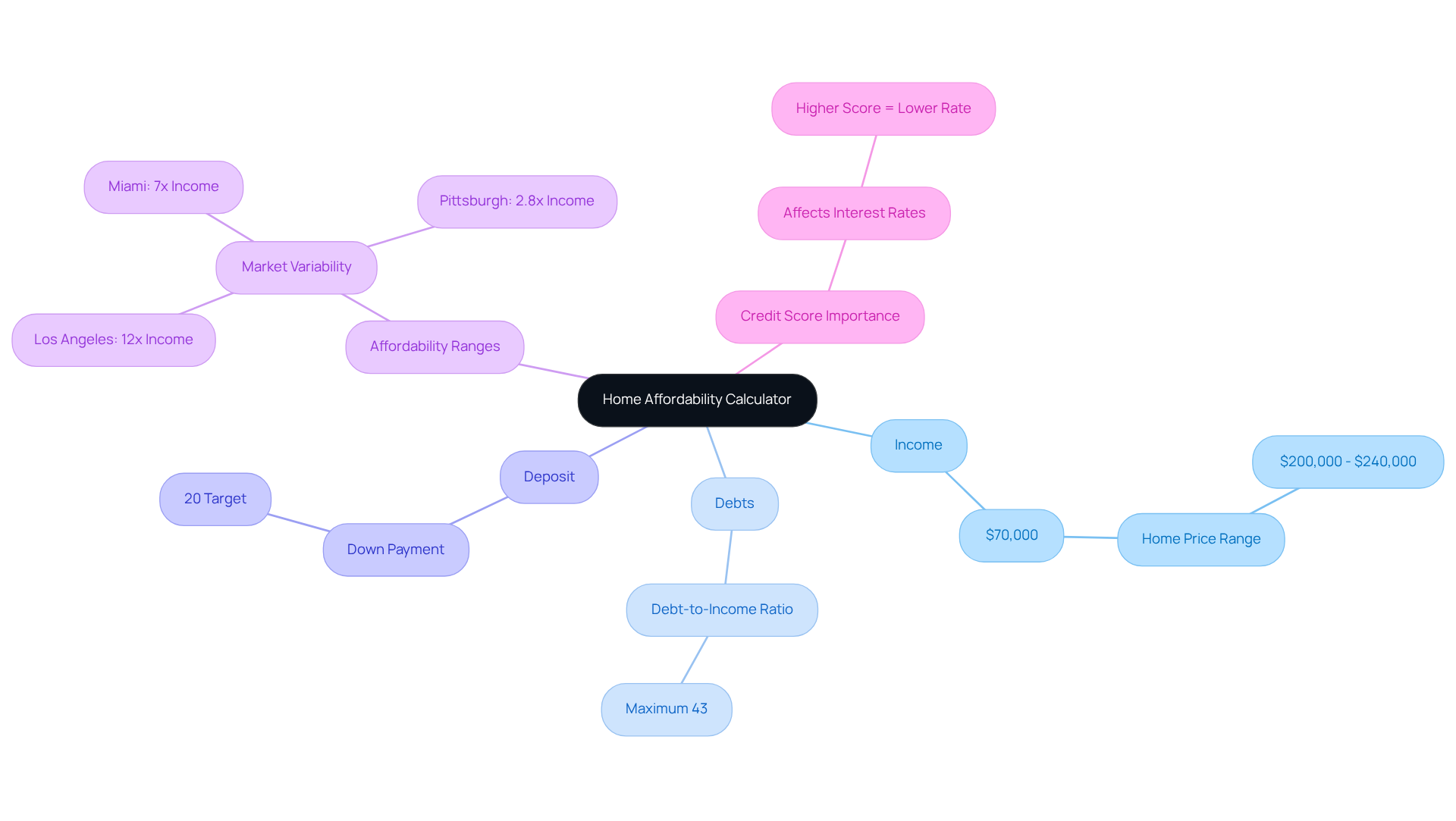

At Calculator.net, we understand how daunting the journey to homeownership can feel, especially for first-time buyers. That’s why we offer a specialized FHA home loan calculator specifically designed for house affordability. This invaluable tool allows you to assess your home-buying potential effectively. By simply entering your income, current debts, and deposit amounts, you can receive personalized estimates that clarify how much home you can afford.

For instance, if your household earns $70,000, you might find that you can afford a home priced between $200,000 and $240,000, given the current interest rates around 7%. This information empowers you to make informed decisions, particularly in areas where property prices significantly exceed income levels, like Los Angeles, where homes can cost up to 12 times the income of first-time buyers.

Many first-time buyers have successfully navigated their budgets with the FHA home loan calculator, which has led to more confident purchasing decisions. As one specialist wisely points out, ‘Enhancing your credit score prior to applying can also assist, as this can make you eligible for a reduced interest rate, which translates to a lower monthly payment.’ This highlights the importance of budgeting and financial planning for prospective homeowners. We’re here to support you every step of the way, making Calculator.net an essential resource in your journey toward homeownership.

CMHC: Tailored Mortgage Calculator for Canadian FHA Loans

At F5 Mortgage, we understand how challenging the journey to homeownership can be. We provide customized financing solutions that empower families to achieve their dreams. While the Canada Mortgage and Housing Corporation (CMHC) provides a FHA home loan calculator for Canadian FHA loans, we go a step further. Our dedicated team guides clients through the entire process, ensuring they fully comprehend their financial commitments and options.

We also offer access to down deposit assistance programs, significantly enhancing home buying opportunities for first-time purchasers. It’s essential to recognize the financial benefits of homeownership; owning a home can lead to long-term savings and stability. With our unwavering commitment to outstanding customer satisfaction, we have proudly assisted over 1,000 households in securing their homes with confidence.

We’re here to support you every step of the way, simplifying the journey to homeownership and ensuring it is as stress-free as possible. Let us help you turn your dream into reality.

MortgageCalculator.org: Robust FHA Loan Repayment Analysis Tool

At MortgageCalculator.org, we understand how challenging managing your mortgage can be. That’s why we provide a comprehensive FHA home loan calculator, which is designed to help households break down their monthly expenses into principal, interest, taxes, and insurance. This insightful examination allows families to see how much of their payment goes toward the principal versus interest, empowering them to make informed decisions about their repayment strategies.

Did you know that 21.9 percent of active loans have interest rates below 3 percent? With this tool, households can evaluate their financial obligations in light of current market trends. For families who secured their homes through traditional financing and put down less than 20%, there may be opportunities to eliminate private insurance by refinancing. This is especially relevant given the high property appreciation rates in California, which could significantly reduce monthly costs and enhance overall financial well-being.

As Sandra L. Thompson wisely noted, “The release of updated data will enable stakeholders to better comprehend emerging housing market trends.” This underscores the importance of tools like the FHA home loan calculator in navigating the complexities of FHA financing. By utilizing this tool, families can effectively plan for their financial future and manage their loan responsibilities, ensuring they stay on course with their obligations. Remember, we’re here to support you every step of the way.

Investopedia: Detailed FHA Loan Overview and Payment Calculator

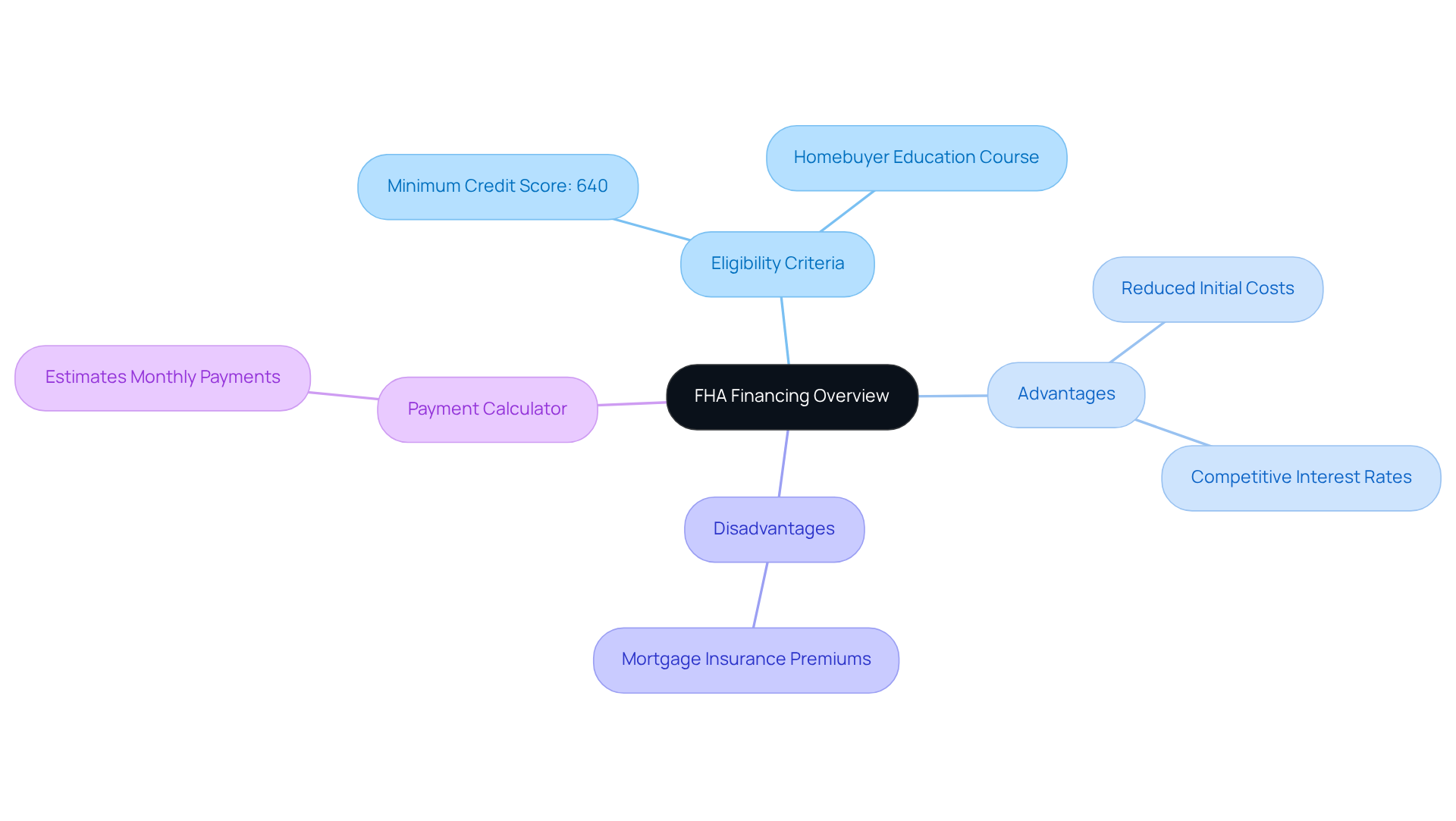

Navigating FHA financing can feel overwhelming, but Investopedia is here to help. They provide a comprehensive overview of FHA financing, highlighting essential details like the eligibility criteria for 2025. This includes a minimum credit score of 640 and the requirement for all borrowers to attend an in-person homebuyer education course. Understanding these requirements is the first step toward achieving your homeownership dreams.

FHA mortgages come with several advantages that can ease your financial journey. With reduced initial costs and competitive interest rates, they can make homeownership more accessible. However, it’s important to be aware of potential downsides, such as mortgage insurance premiums that may increase your overall expenses. By being informed, you can make the best choices for your family.

A valuable tool provided is the payment calculator, which allows households to estimate their monthly payments based on various financing parameters. This feature can help you visualize your financial commitments, making the process less daunting. By combining educational material with practical resources, Investopedia empowers families to manage the intricacies of FHA financing efficiently.

Real-world examples illustrate how families have successfully utilized FHA loan calculators to make informed decisions. We know how challenging this can be, but these stories show that you can choose the best mortgage options for your unique situation. This approach not only enhances understanding but also fosters confidence in the home buying process. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of FHA home loans can feel overwhelming, but it is crucial for families aiming to achieve homeownership. By highlighting essential FHA home loan calculator tools, we empower families to navigate their financial obligations with confidence. Utilizing these calculators provides valuable insights into monthly payments, down payment options, and overall affordability, ensuring families are well-prepared for their home-buying journey.

Key arguments emphasize the importance of accurate financial projections and the flexibility offered by various down payment assistance programs. Personalized guidance from financing specialists is also essential. Tools from F5 Mortgage, US Bank, and Bankrate simplify complex calculations and enhance financial literacy, enabling families to make informed decisions tailored to their unique situations. While calculators are invaluable, they should complement professional advice to optimize the home buying experience.

In conclusion, leveraging FHA home loan calculators can significantly enhance a family’s home-buying journey, making the process less daunting and more accessible. By taking advantage of these tools and seeking expert guidance, families can turn their homeownership dreams into reality. The path to owning a home is filled with opportunities—embrace them by utilizing the resources available and making well-informed choices for a secure financial future.

Frequently Asked Questions

What is the purpose of the F5 Mortgage FHA home loan calculator?

The F5 Mortgage FHA home loan calculator is designed to help families manage the complexities of home financing by providing easy estimates of monthly costs, including principal, interest, taxes, and insurance based on user-specified amounts, interest rates, and terms.

What are the typical down payment percentages for first-time homebuyers in 2023?

In 2023, first-time homebuyers typically made an initial contribution of 8%. However, FHA loans require a minimum deposit of just 3.5%.

How does the FHA home loan calculator help users?

The FHA home loan calculator allows users to explore various scenarios by adjusting parameters like down payments and interest rates, helping them understand how these factors influence their monthly payments.

Should loan calculators replace personalized guidance from financing specialists?

No, while loan calculators provide valuable insights, expert opinions suggest they should not replace personalized guidance. F5 Mortgage offers both digital resources and access to knowledgeable experts to support families throughout the financing process.

What factors does the FHA home loan calculator consider for accurate estimates?

The FHA home loan calculator takes into account important factors such as the upfront mortgage insurance premium (MIP), property taxes, and homeowners insurance to provide a comprehensive overview of financial commitments.

What is a specific example of an FHA mortgage cost provided in the article?

A standard FHA mortgage of $265,375 at a 6.250% interest rate leads to an estimated monthly cost of $1,663, with an annual percentage rate (APR) of 7.478%.

What down payment options are available through F5 Mortgage?

F5 Mortgage may qualify you to purchase a home with as little as 3% down, or even 0% down for specific loan options.

Are there any down payment assistance programs available through F5 Mortgage?

Yes, F5 Mortgage offers access to various down payment assistance programs available in states like California, Texas, and Florida, which can help alleviate the financial burden of homeownership.