Overview

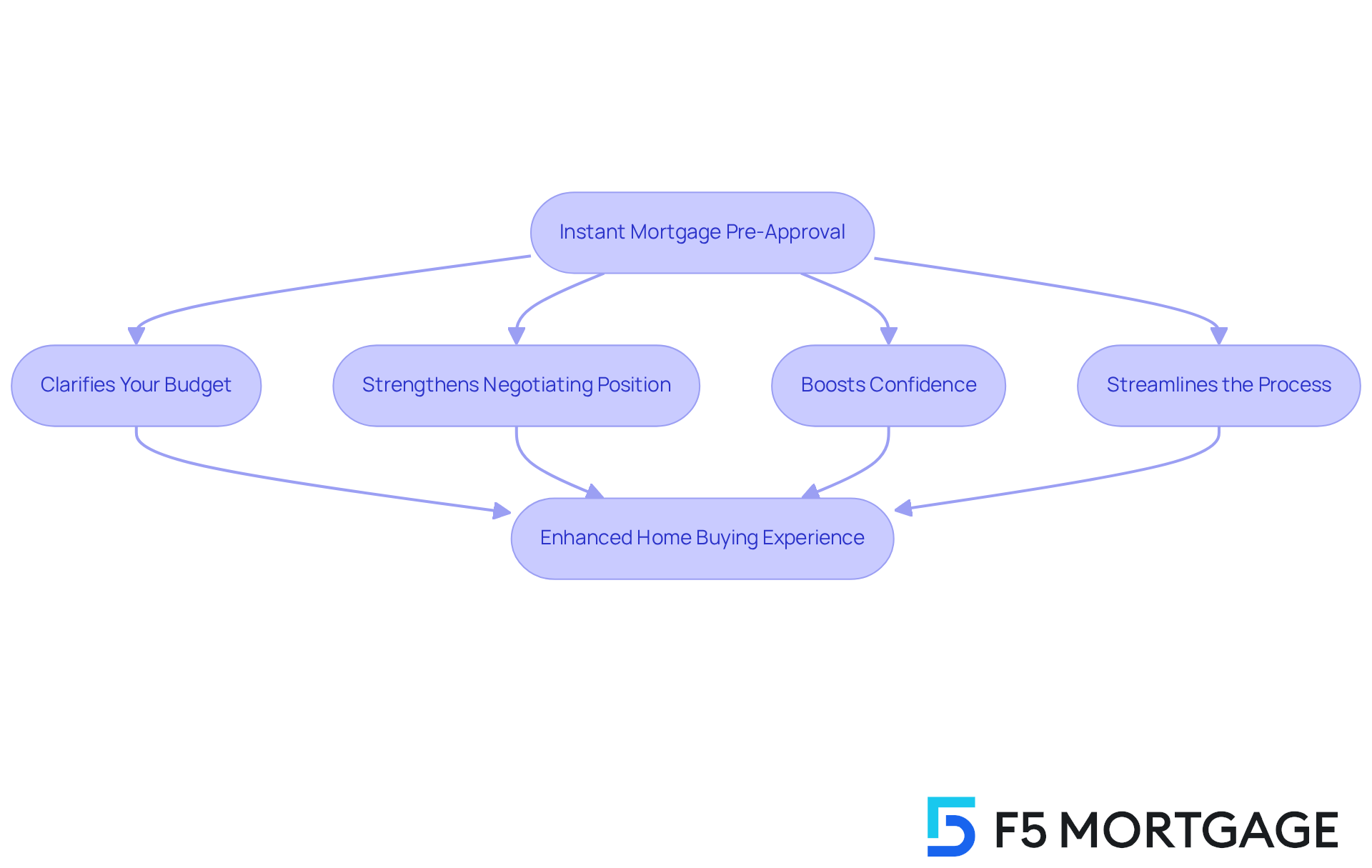

Navigating the mortgage process can be daunting, but we want you to know that instant mortgage pre-approval offers ten significant benefits for homebuyers. This process not only enhances your confidence but also clarifies your budget and strengthens your negotiating position in a competitive market. Imagine walking into a home showing, fully aware of your financial limits—this clarity empowers you to act decisively.

By expediting the buying process, instant mortgage pre-approval allows you to secure favorable terms. We understand how challenging this can be, and we’re here to support you every step of the way. With the insights and examples provided, you will see how this pre-approval can transform your home-buying experience, making it smoother and more manageable.

Introduction

Navigating the complex world of home buying can feel overwhelming, especially in a fiercely competitive market. We understand how challenging this can be. That’s why instant mortgage pre-approval is a vital tool for homebuyers, offering clarity and confidence in their financial journey. This article explores the numerous benefits of securing pre-approval. From enhancing your negotiating power to protecting against fluctuating interest rates, the advantages are significant.

But what happens when buyers overlook this crucial step? The implications can be substantial, potentially hindering your path to homeownership and leaving you vulnerable in a fast-paced real estate landscape. We’re here to support you every step of the way, ensuring that you feel empowered and informed as you embark on this important journey.

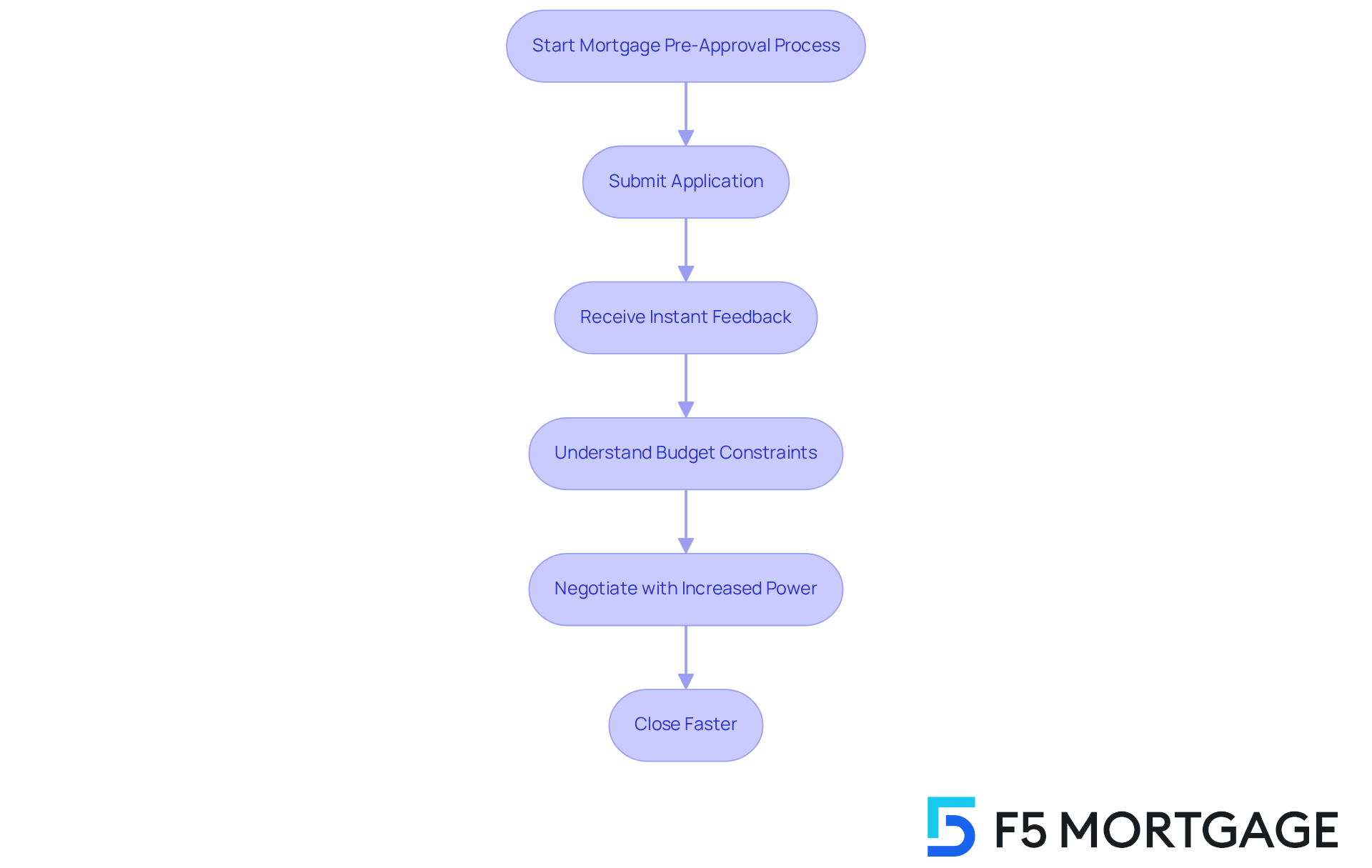

F5 Mortgage: Achieve Instant Pre-Approval in Under an Hour

At F5, we understand how daunting the mortgage process can be. That’s why we provide an efficient process for that can be completed in under an hour. This allows homebuyers to swiftly gauge their and proceed with confidence. As an independent broker, F5 Financing is dedicated to working for you, not the lenders, ensuring you receive that fit your unique budget and needs.

By utilizing cutting-edge technology and a dedicated team, F5 Finance delivers prompt feedback. This empowers our clients to act decisively in a , alleviating some of the stress that often accompanies home buying. The are substantial. You gain a clearer understanding of your budget constraints, increased negotiating power, and a .

As Certified Loan Advisor Neil Christiansen highlights, “I’m encouraged to see Fannie Mae take a more practical approach when evaluating borrowers who have limited credit or have no credit at all.” This emphasizes the importance of , such as instant mortgage pre-approval, which can make a significant difference in your . With access to over two dozen lenders and a commitment to , F5 stands out as a reliable partner for homebuyers.

We know how challenging this can be, and we’re here to support you every step of the way as you navigate the intricacies of financing your dream home.

Understand Your Borrowing Capacity to Make Informed Decisions

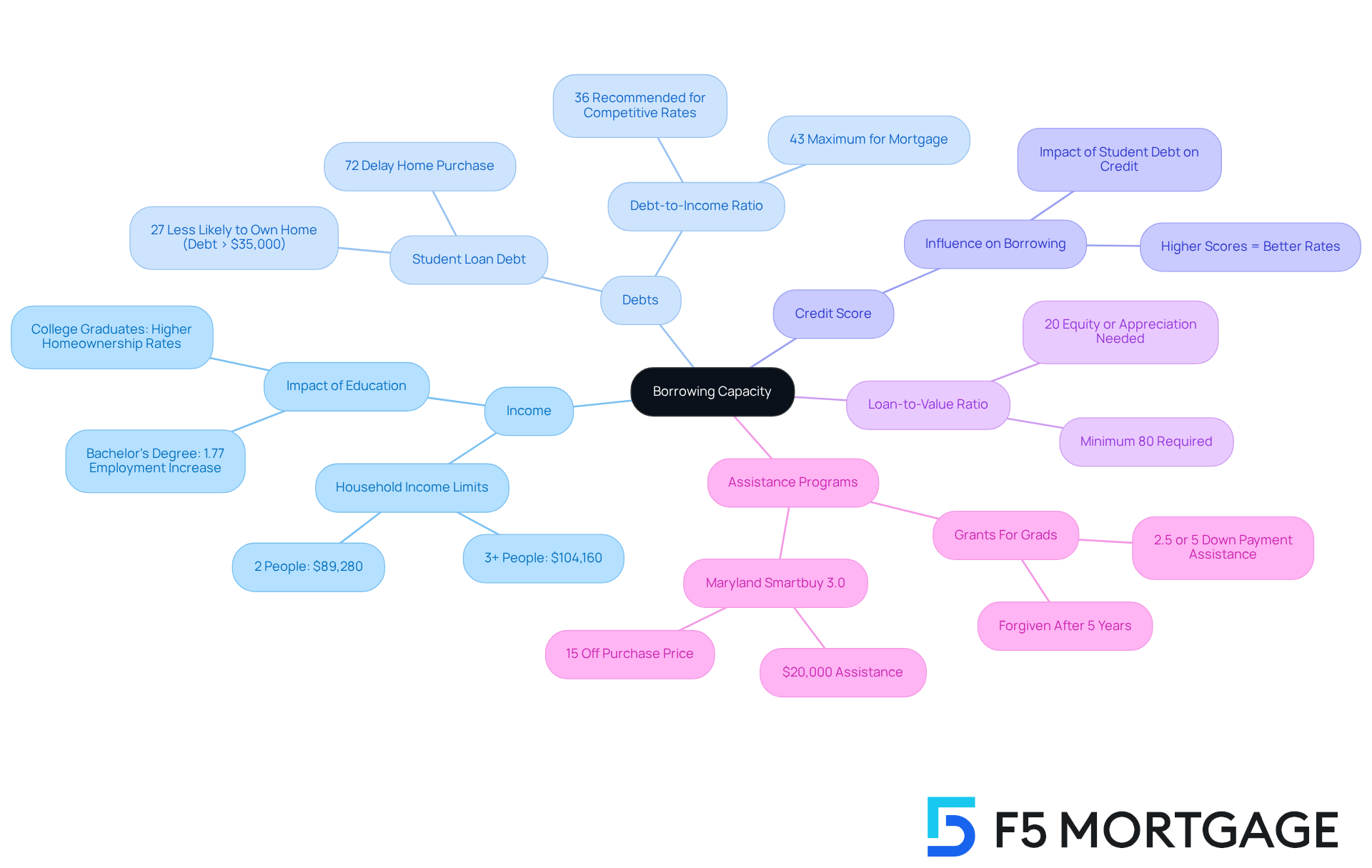

Understanding your is crucial for making informed choices during the . At , we recognize how overwhelming this process can be, and we’re here to support you every step of the way. We provide a clear picture of how much you can borrow based on your unique financial situation, which includes your income, debts, and credit score.

Many lenders require homeowners to maintain a . This means you should have reduced at least 20% of your initial loan amount or that your home has appreciated in value. Additionally, a maximum of 43% is generally expected for , whether you’re obtaining a traditional mortgage or refinancing an existing one.

This clarity helps you avoid overspending and ensures that you can comfortably manage your . We understand how important it is to feel secure in your , and we’re dedicated to helping you .

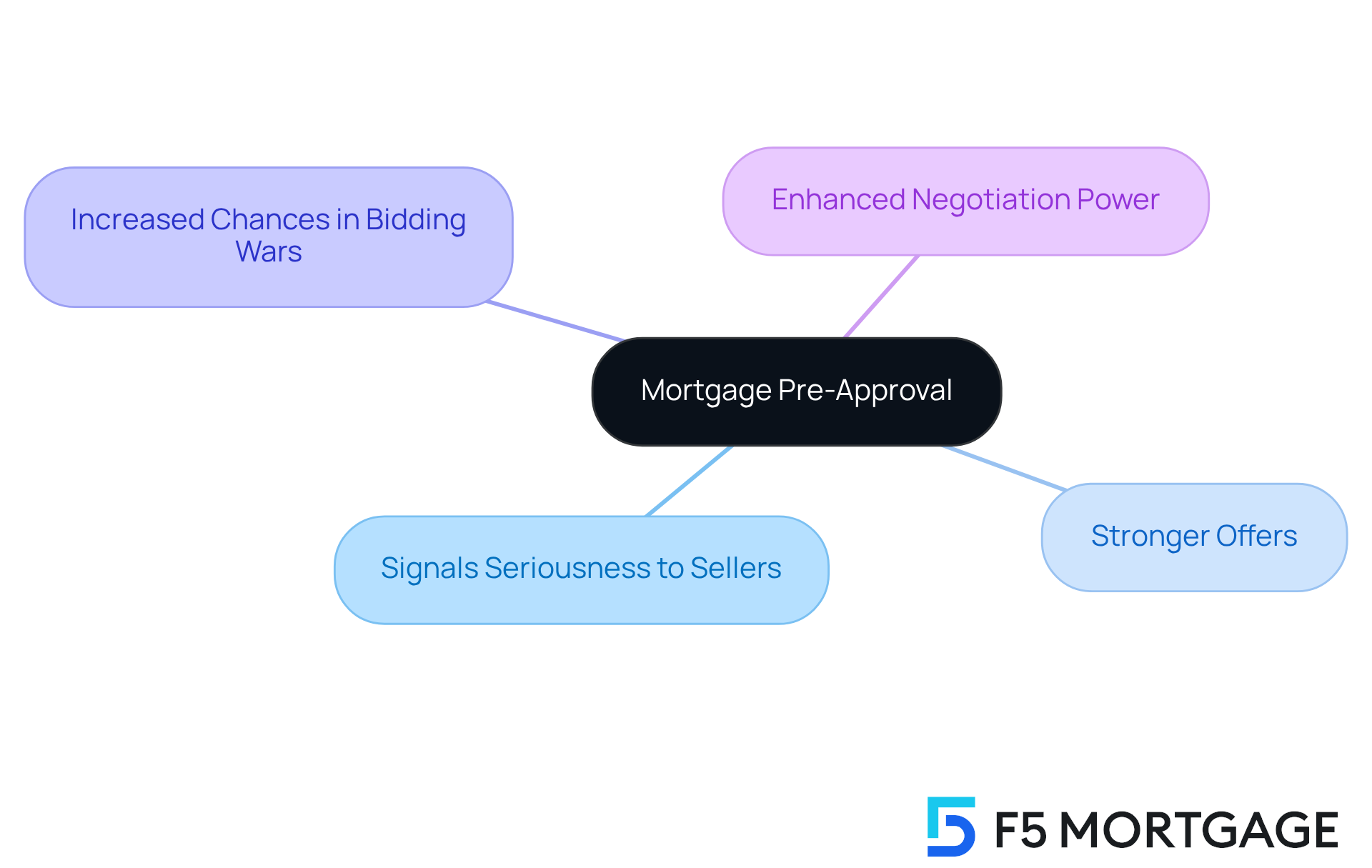

Gain a Competitive Edge with Pre-Approval in a Hot Market

In today’s competitive real estate market, we know how challenging it can be to navigate your options. Obtaining can provide you with a significant advantage. It signals to sellers that you are a serious buyer, backed by the necessary to make a purchase. This can lead to stronger offers and increase your chances of acceptance, especially in bidding wars where multiple offers are common.

By securing instant mortgage pre approval, you empower yourself in the . You’ll not only feel more confident, but you’ll also be in a . Remember, we’re here to support you every step of the way as you take this important journey toward homeownership.

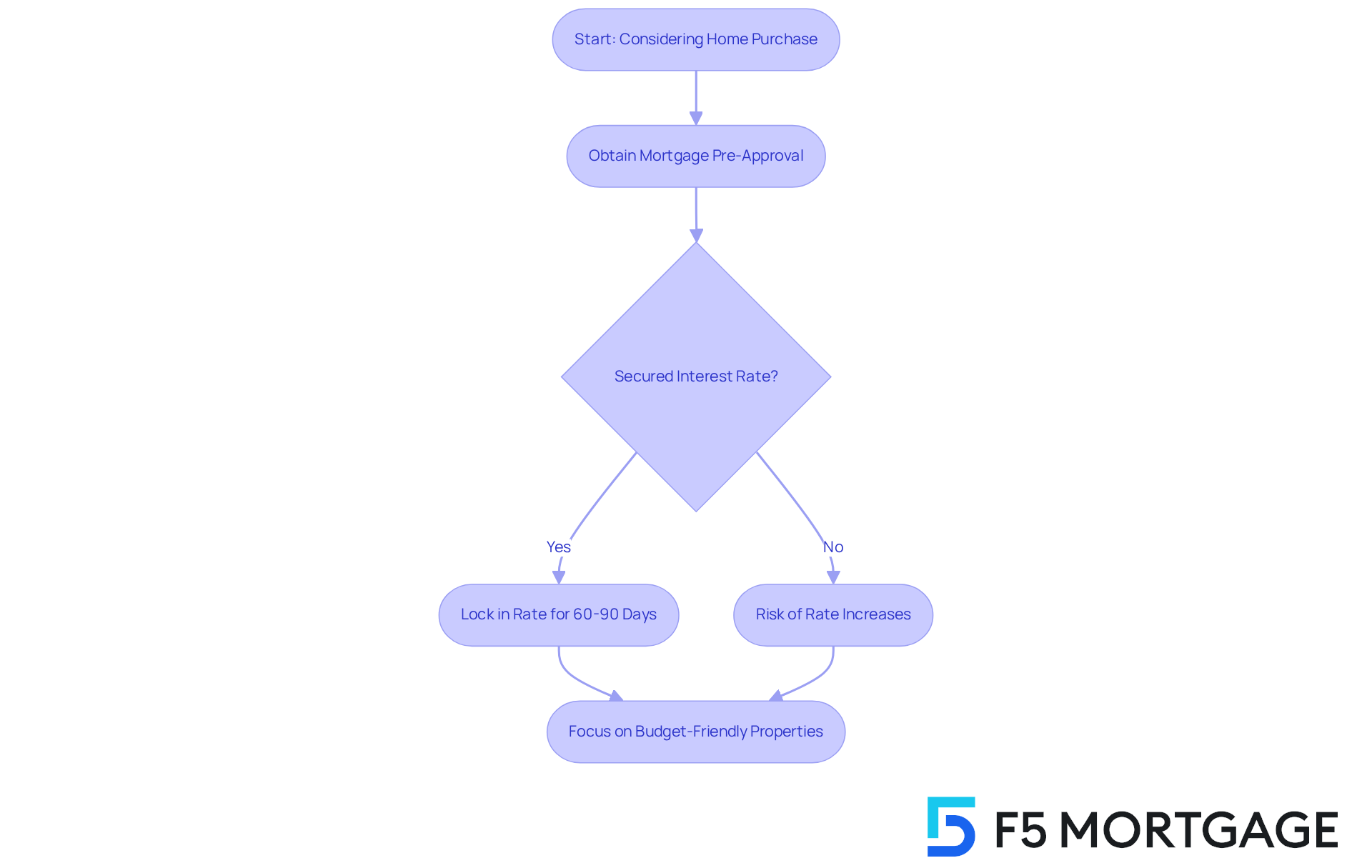

Protect Yourself from Interest Rate Increases with Pre-Approval

Obtaining prior authorization offers a significant advantage by allowing buyers to secure their for a specific period, typically between 60 and 90 days. This feature is especially important in today’s unpredictable market, where interest rates can change dramatically. For instance, in October 2023, mortgage rates peaked at 7.79%. This situation underscores the need for buyers to that could raise their monthly payments and overall housing costs. By securing , buyers can pursue their confidently, knowing they are shielded from sudden rate hikes.

Moreover, research indicates that nearly 60% of consumers who receive instant mortgage pre approval successfully lock in favorable interest rates, enhancing their . This proactive approach not only mitigates the risk of unexpected costs but also allows buyers to focus on properties that fit their budget. As Peter Miller points out, understanding the helps frame current conditions, making for navigating the complexities of the housing market in 2025. We know how challenging this process can be, and we’re here to .

Boost Your Confidence as a Buyer with Mortgage Pre-Approval

Having an can truly boost your confidence as a buyer. It provides a clear picture of your and what you can afford, enabling you to focus on homes that fit your budget with instant mortgage pre-approval. This newfound confidence is invaluable during negotiations. You can make offers knowing you have the of instant mortgage pre-approval to follow through.

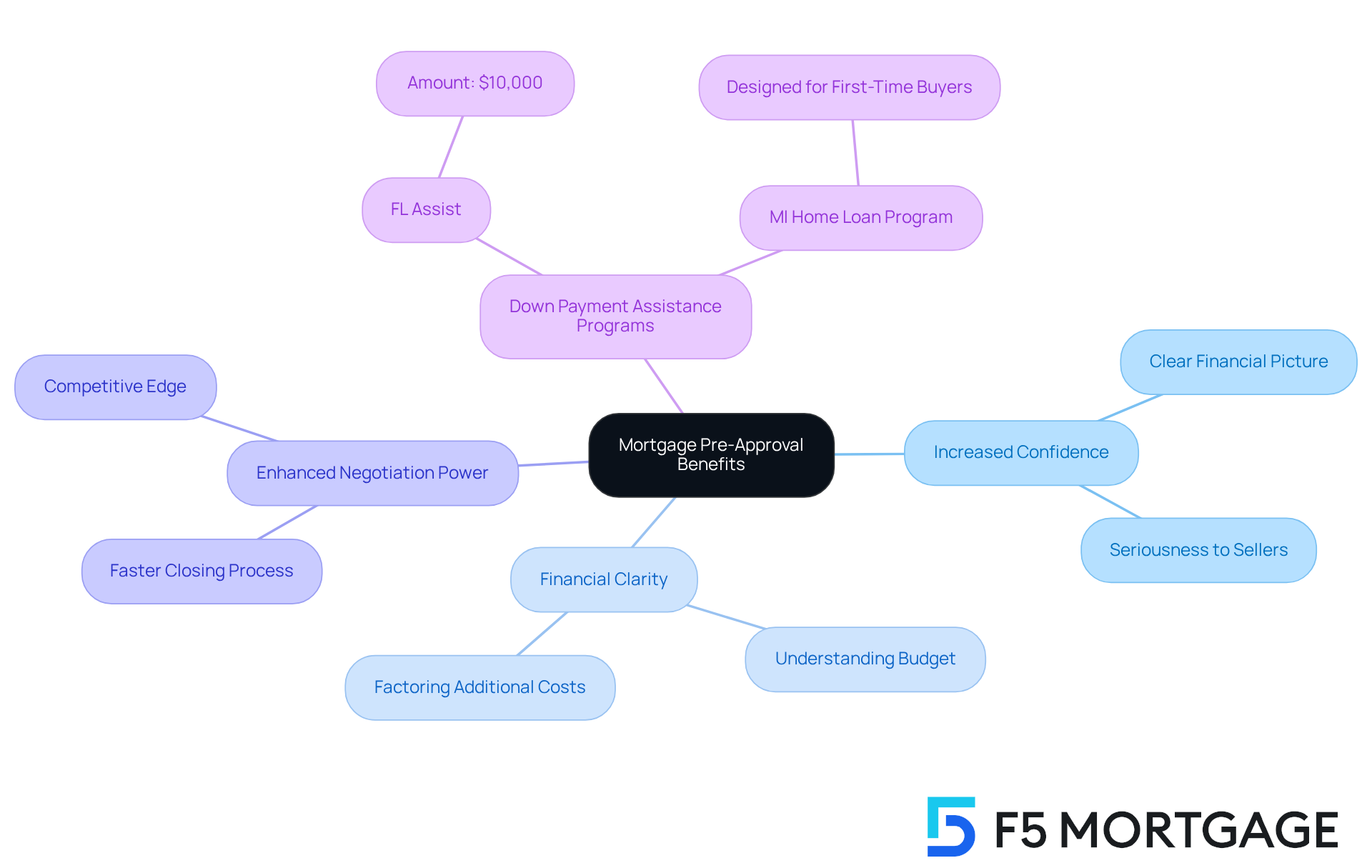

At , we understand how important this journey is for you. Our clients consistently express their , as reflected in our 5/5 star reviews on platforms like Google and Zillow. Many have highlighted how our team not only assists with the but also guides them through various available in their states. For instance:

- FL Assist offers up to $10,000

- The MI Home Loan program is designed specifically for

This customer-focused strategy significantly improves your chances of purchasing a property, making the process smoother and more attainable for families seeking to upgrade their residences. We know how challenging this can be, and we urge you to investigate these with F5 Financing. Together, we can enhance your property purchasing potential and ensure you feel supported every step of the way.

Demonstrate Seriousness to Sellers with Pre-Approval

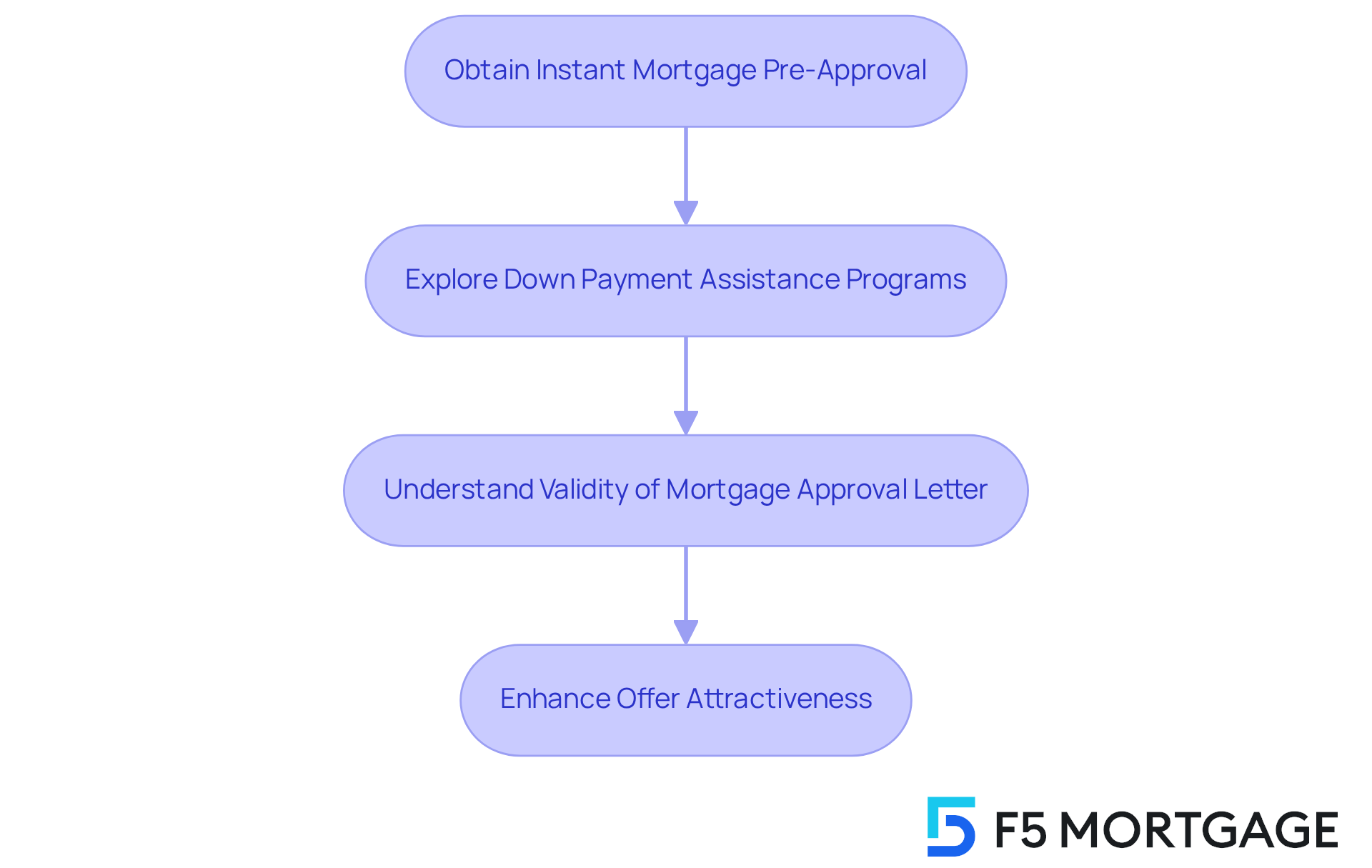

An instant serves as a powerful testament to sellers that you are a committed buyer who has taken the necessary steps to secure funding. This credibility can significantly , particularly in competitive situations where sellers may receive multiple bids. By demonstrating your with , you increase your chances of having your offer accepted.

Additionally, exploring available through F5 can further strengthen your . Programs like the MyHome Assistance Program in California offer up to 3% of the home’s purchase price, while the My Choice Texas Home program provides up to 5% for down payment and closing costs. Various programs in Florida also offer assistance, making it easier for you to .

It’s crucial to understand the validity of your mortgage approval letter, including renewal guidelines and variations in loan types. This knowledge directly relates to your . We know how challenging this can be, but by arming yourself with this information, you can approach your and clarity.

Experience a Streamlined Pre-Approval Process for Peace of Mind

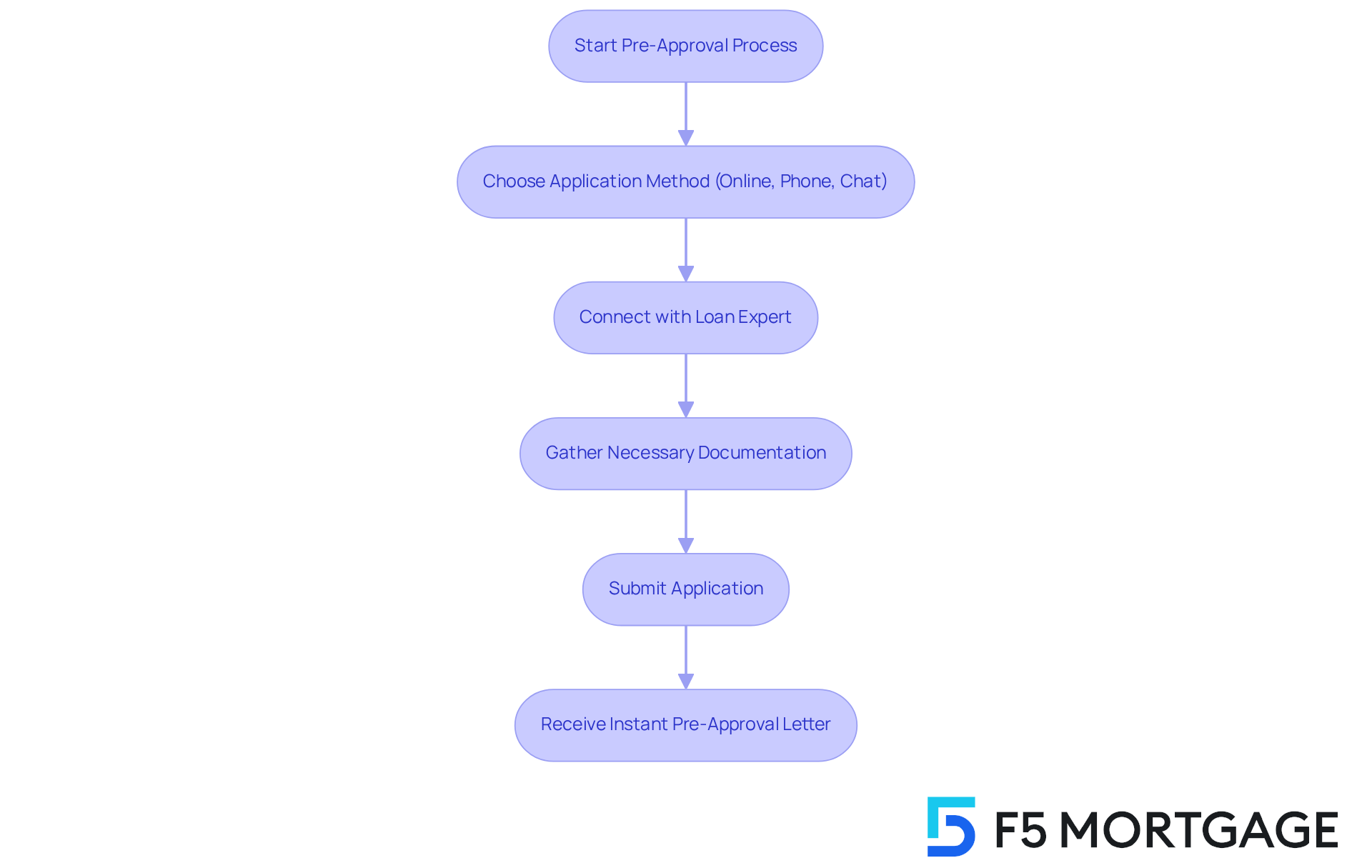

At F5 Mortgage, we understand how daunting the can be, and we take pride in providing an that alleviates stress for our clients. With convenient application options available online, by phone, or through chat, you can easily connect with our . They are dedicated to custom-tailoring a loan that aligns with your unique goals.

Clear communication and efficient processes ensure that you receive your instant mortgage pre approval letters promptly. This allows you to : discovering your ideal home. In a fast-paced market, this peace of mind is invaluable. Clients like Ruth Vest have shared their appreciation for our , highlighting the support we provide.

To make the most of your preliminary approval process, we encourage you to in advance. This simple step can significantly expedite your application, making the journey smoother. Remember, we’re here to support you every step of the way.

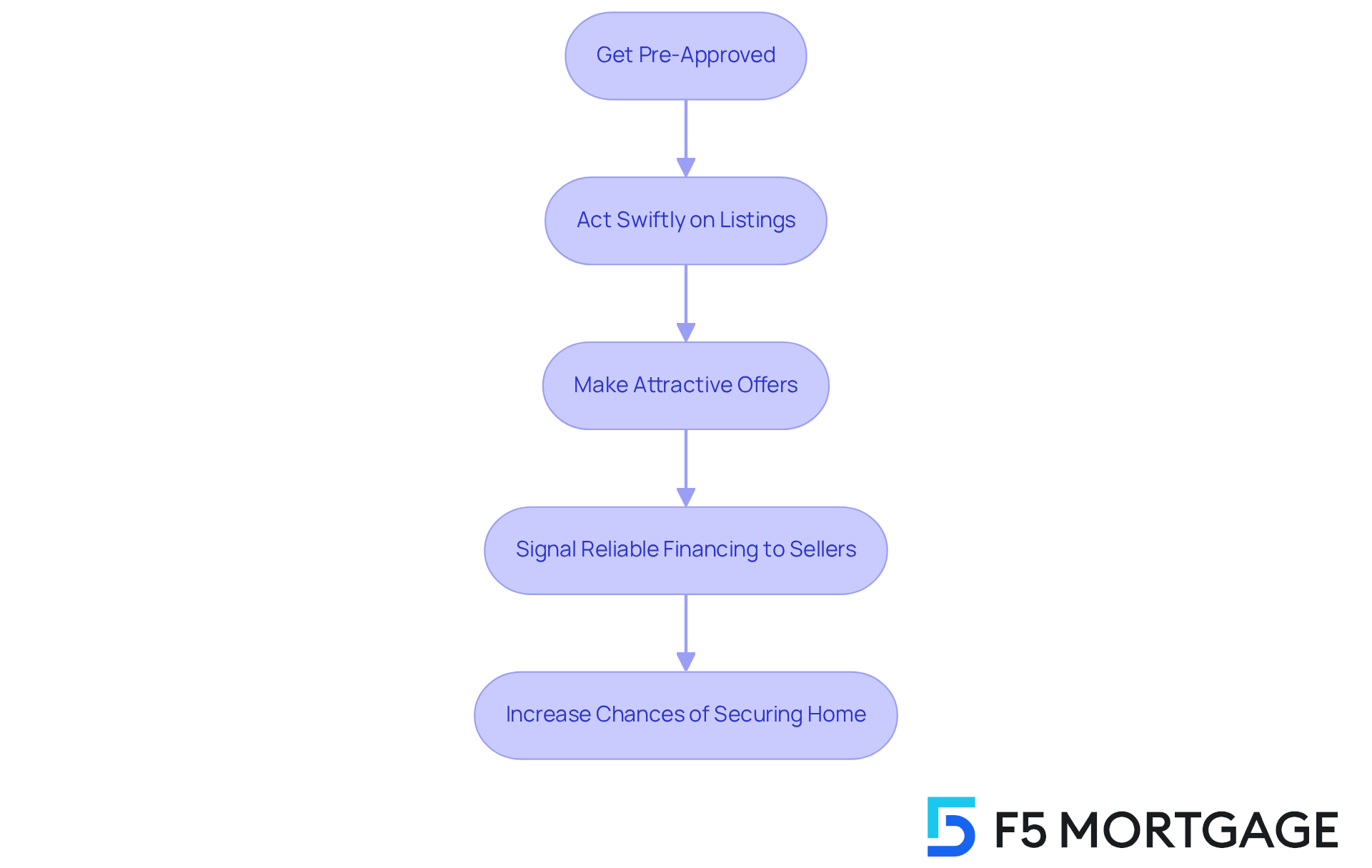

Respond Quickly to Opportunities with Instant Pre-Approval

Immediate authorization from to act swiftly on new listings and opportunities. We understand how challenging today’s competitive housing market can be, especially when inventory is often limited. . With prior authorization, you can make offers right away, demonstrating to sellers that you are serious and . This readiness not only enhances the attractiveness of your offers but also increases the likelihood of securing your dream home before other potential buyers can respond.

Many home purchasers have successfully navigated multiple-offer scenarios by leveraging their approval status. This signals to sellers that your financing is reliable, reducing the risk of agreements falling through. Additionally, as an , F5 Financing has , offering strategic refinancing opportunities that can unlock lower rates and flexible terms.

Our dedicated team is here to simplify the refinancing process, ensuring you have access to and comprehensive support. We also provide information on available in California, Texas, and Florida, which can enhance your financial options as you embark on your homebuying journey. To maximize your chances of success, consider before you start house hunting. We’re here to support you every step of the way.

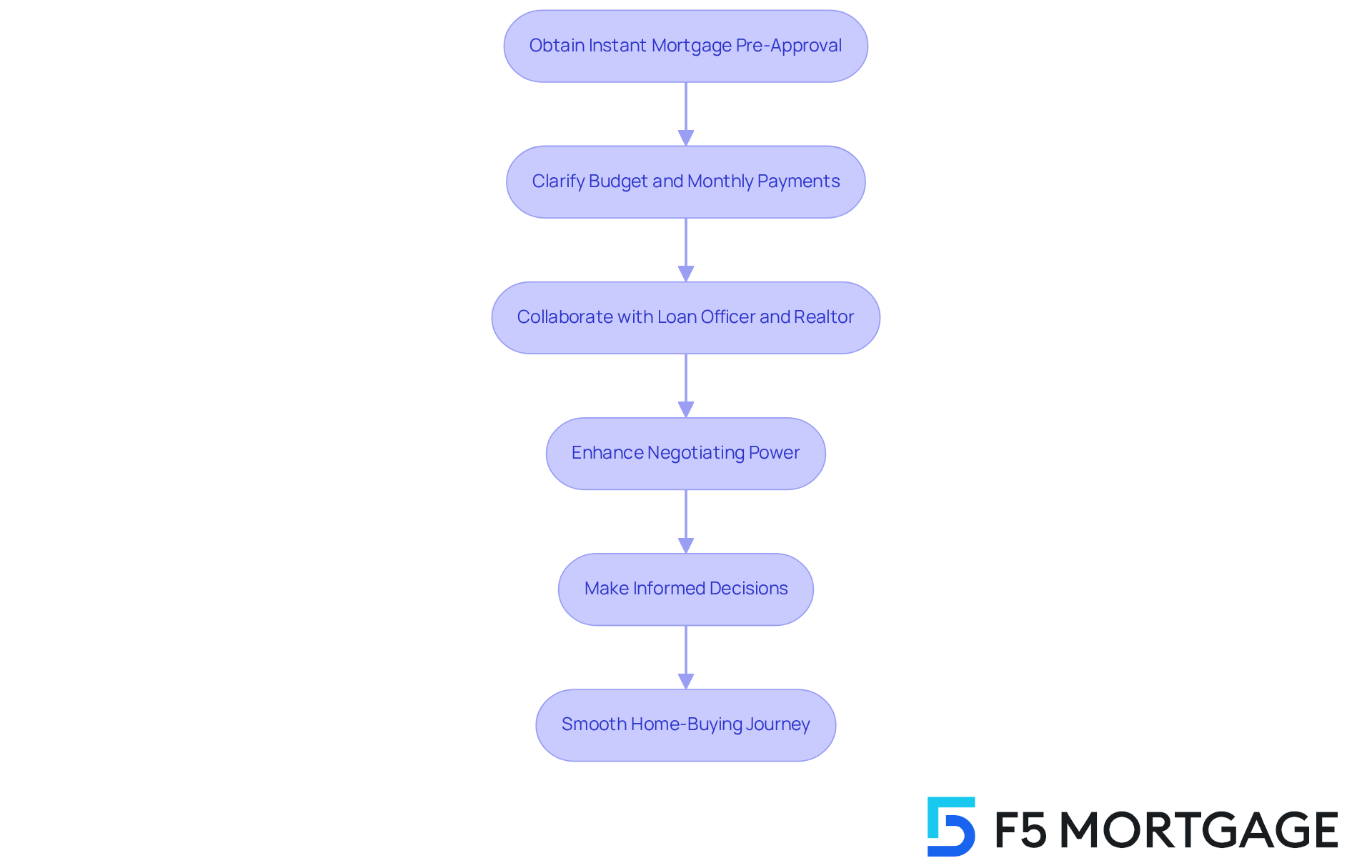

Clarify Your Budget and Monthly Payments with Pre-Approval

Obtaining is a pivotal step in clarifying your budget and understanding . At F5 Mortgage, we know how challenging this can be. Our dedicated team, including your loan officer and Account Manager, collaborates closely with you and your realtor to help you find your perfect home and get your offer accepted. This comprehensive support not only streamlines the process but also ensures you avoid unnecessary runarounds, making your smoother.

Instant mortgage pre approval provides a clear picture of your borrowing power and aids in budgeting for essential expenses such as utilities, insurance, and lifestyle costs. Families that have experienced the frequently indicate a notable decrease in financial pressure. As highlighted in the case study ‘Advantages of Pre-Authorization for Home Purchasers,’ pre-authorization enables purchasers to manage the acquisition process more efficiently and with increased assurance.

Moreover, obtaining instant mortgage pre approval enhances your negotiating power in a . Sellers are more inclined to consider offers from clients who have received instant mortgage pre approval, as it signals seriousness and . As noted by experts, “Being pre-approved signals that you are a serious and financially stable buyer,” which can lead to faster closing processes, allowing families to move into their new homes sooner.

is crucial. An instant mortgage pre approval indicates that, based on the , you’re a good candidate for a mortgage, offering you an estimate of your loan amount, interest rate, and potential monthly payments. This clarity is essential for making informed decisions and avoiding the pitfalls of overextending your finances. For instance, families employing prior approval have successfully focused on neighborhoods that align with their financial circumstances and personal tastes, as mentioned in the case study ‘Narrowing Down Neighborhood Options,’ ensuring a more customized home-buying experience.

In summary, securing instant mortgage pre approval not only but also enables you to make assured choices throughout your home-buying journey, backed by the knowledge of the . We’re here to support you every step of the way.

Empower Your Home Buying Journey with Instant Mortgage Pre-Approval

Empower Your Home Buying Journey with

We know how challenging the can be, and that’s why instant mortgage pre-approval is a powerful tool that significantly enhances your journey. It equips you with essential knowledge and confidence, enabling you to navigate the competitive real estate market effectively. With , you gain that simplifies the process, allowing you to focus on discovering your perfect residence. This support is vital for making informed decisions and realizing your .

Benefits of Instant Mortgage Pre-Approval:

- Clarifies Your Budget: Pre-approval helps you understand your financial limits, allowing you to focus on homes within your price range.

- : Sellers are more inclined to consider offers from pre-approved buyers, as it demonstrates serious intent and financial readiness. A verified pre-approval letter can substantially improve your chances of securing a property in a competitive market.

- : The tailored assistance offered by F5 Financing boosts your confidence during the property purchasing process. Clients like Ruth Vest have praised the team for their exceptional service, noting how the loan officer worked out an acceptable loan package and ensured all documentation was in order.

- : Pre-approval can lead to faster closing since much of the paperwork is completed in advance, streamlining the transaction process.

:

We’re here to support you every step of the way. F5 Mortgage offers access to various down payment assistance programs available in California, Texas, and Florida, which can enhance your home buying opportunities. These programs provide that can make homeownership more accessible. Specific benefits include:

- California: MyHome Assistance Program offers up to 3% of the home’s purchase price.

- Texas: My Choice Texas Home program provides a 30-year, low-interest-rate mortgage and up to 5% for down payment and closing assistance.

- Florida: Programs like the Florida Assist Second Mortgage Program offer up to $10,000 for upfront costs.

In summary, instant mortgage pre-approval simplifies the home buying process by providing clarity and confidence. It allows you to focus on properties within your financial reach, ensuring that your aspirations of homeownership are not just dreams but achievable realities.

Conclusion

Securing instant mortgage pre-approval is a transformative step for homebuyers. It provides clarity and confidence in a competitive real estate landscape. This process streamlines the journey toward homeownership and equips buyers with the necessary tools to navigate financial decisions effectively. By understanding their borrowing capacity and gaining a competitive edge, homebuyers can approach the market with assurance and readiness.

Throughout this article, we’ve highlighted the numerous benefits of instant mortgage pre-approval. From clarifying budgets and enhancing negotiating power to protecting against interest rate fluctuations, each advantage contributes to a more informed and empowered homebuying experience. The support offered by F5 Mortgage, including access to down payment assistance programs and personalized guidance, reinforces the significance of this process in achieving your homeownership dreams.

Ultimately, embracing instant mortgage pre-approval not only simplifies the home buying journey but also transforms aspirations into achievable realities. We know how challenging this can be, and we encourage homebuyers to take this vital step. By doing so, you ensure you are well-prepared to seize opportunities in the housing market. With the right support and knowledge, the path to finding your perfect home can be both smooth and rewarding.

Frequently Asked Questions

What is F5 Mortgage’s pre-approval process like?

F5 Mortgage offers an efficient process for instant mortgage pre-approval that can be completed in under an hour, allowing homebuyers to quickly gauge their borrowing capacity.

How does F5 Mortgage support homebuyers?

As an independent broker, F5 Financing works for the clients, providing customized loan solutions tailored to individual budgets and needs, along with prompt feedback through cutting-edge technology and a dedicated team.

What are the benefits of mortgage pre-approval?

The benefits of mortgage pre-approval include a clearer understanding of budget constraints, increased negotiating power, and a faster closing process.

What is the significance of understanding borrowing capacity?

Understanding your borrowing capacity is crucial for making informed choices, as it helps you avoid overspending and ensures you can comfortably manage your mortgage payments.

What financial factors are considered to determine borrowing capacity?

Borrowing capacity is determined based on your income, debts, and credit score, along with maintaining a minimum 80% loan-to-value ratio and a maximum debt-to-income (DTI) ratio of 43%.

How does pre-approval help in a competitive real estate market?

Instant mortgage pre-approval signals to sellers that you are a serious buyer with financial backing, which can lead to stronger offers and increased chances of acceptance in bidding wars.

What commitment does F5 Mortgage make to its clients?

F5 Mortgage is dedicated to supporting clients every step of the way as they navigate the intricacies of financing their dream home.