Overview

Fast home equity loans offer families a quick and compassionate solution for accessing funds needed for home upgrades. We understand how important timely renovations and improvements can be for your living space. These loans not only facilitate significant enhancements to your property, which can increase its value, but they also come with competitive rates and personalized support. This makes them an attractive financial option for homeowners ready to invest in their homes.

We know how challenging this process can be, but we’re here to support you every step of the way. Imagine transforming your home into a space that truly reflects your family’s needs and aspirations. With fast home equity loans, you can turn that vision into reality, ensuring your home becomes a haven for you and your loved ones.

Introduction

Home equity loans have emerged as a powerful financial tool for families looking to enhance their living spaces. We know how important it is for you to create a comfortable home, and with over $827 billion invested in property improvements in recent years, the demand for quick access to funds has never been greater. This article explores the numerous benefits of fast home equity loans, from rapid approval times to competitive rates. These features empower homeowners, like you, to make timely renovations that elevate both comfort and value.

But we also understand that navigating this financing option can come with hidden challenges. What are these challenges, and how can you ensure you make the most informed decisions? We’re here to support you every step of the way.

F5 Mortgage: Fast Home Equity Loans for Quick Access to Funds

At F5 Mortgage, we understand how challenging it can be to manage financial needs, especially when it comes to home improvements or consolidating debt. That’s why we provide a fast home equity loan, ensuring swift access to resources for necessary enhancements or renovations. Many households have successfully utilized these credits to transform their living spaces. In fact, over $827 billion was invested in property enhancements in the U.S. from 2021 to 2023, with an average spending of over $9,542 on residential projects in 2023. The ability to secure a fast home equity loan quickly can significantly impact a household’s financial planning.

We know that navigating the borrowing process can feel overwhelming, which is why we leverage user-friendly technology to simplify the application process. Our commitment to client support means that you will receive focused help throughout the refinancing journey, often leading to closings in under three weeks. We work diligently to find the best rates and terms available, making property financing an appealing option for families looking to enhance their homes in 2025. By tapping into their residential assets, families can not only improve their living conditions but also potentially access a fast home equity loan, making these financial options a strategic choice.

Additionally, it’s important to note that the interest on residential borrowing may be tax-deductible, further enhancing the financial appeal. We’re here to support you every step of the way, helping you make informed decisions that benefit your family.

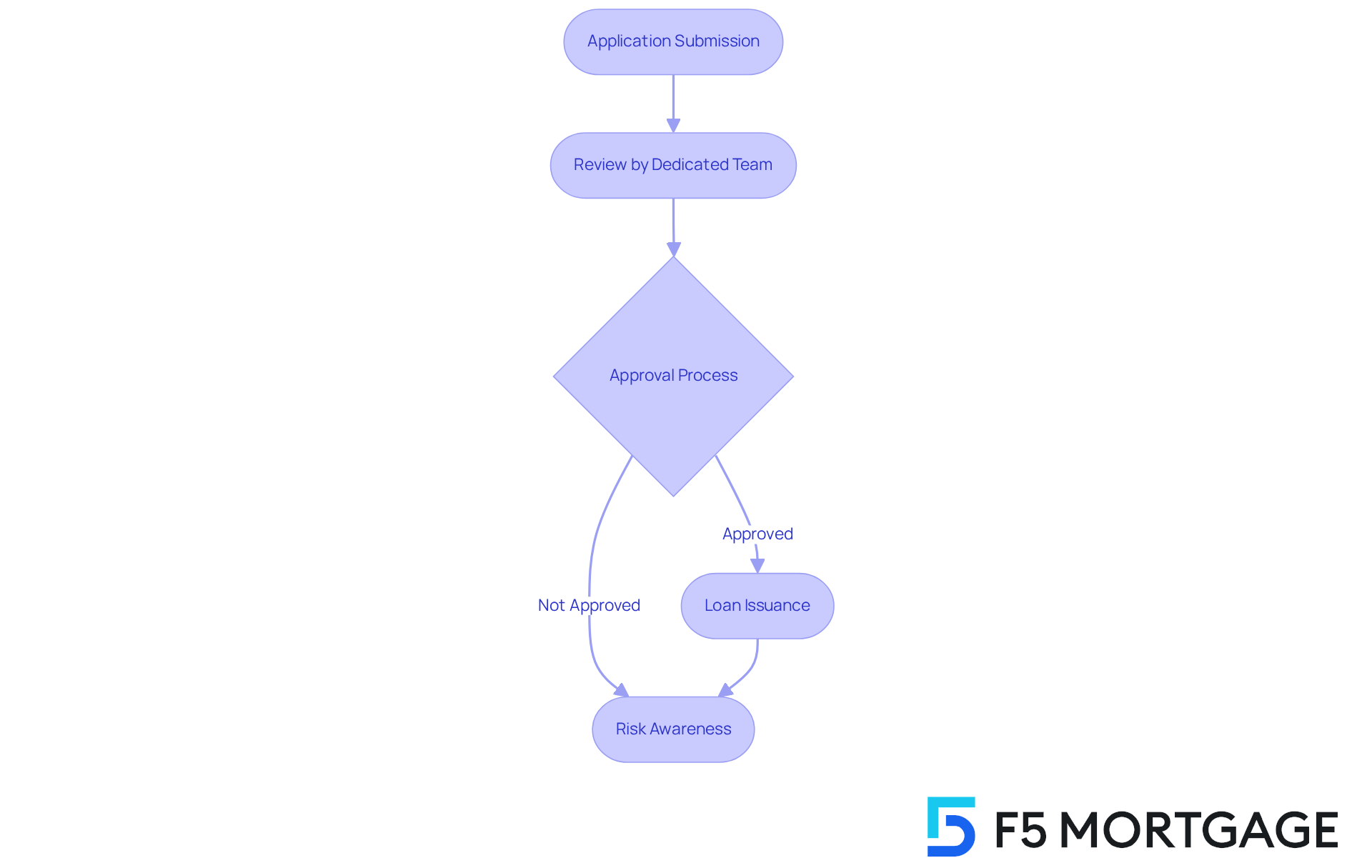

Rapid Approval Times: Get Your Home Equity Loan Approved in Under an Hour

At F5 Mortgage, we understand how challenging it can be to secure property financing. That’s why we provide a fast home equity loan with a quick approval process, allowing you to obtain financing approvals in less than an hour. This remarkable efficiency is powered by cutting-edge technology and a dedicated team focused on your satisfaction. Families can swiftly access a fast home equity loan to obtain the resources needed for enhancement projects or other financial goals, empowering them to seize opportunities without delay.

With F5 Mortgage, homeowners benefit from a streamlined refinancing process that connects them with over two dozen lenders. This ensures you receive the best possible rates and terms tailored to your unique needs. You can apply online, by phone, or through chat, making the process as convenient as possible for you.

Our commitment to offering a fast home equity loan not only enhances your borrowing experience but also empowers you to make timely decisions that align with your financial goals. However, we know how important it is to be aware of potential risks related to property value advances, such as market fluctuations that could impact your investment. By staying informed, you can make choices that truly reflect your best interests.

Flexible Loan Options: Tailored Solutions for Diverse Financial Needs

At F5 Mortgage, we understand how challenging the journey to homeownership can be. That’s why we offer a diverse range of adaptable financing options, including:

- Fixed-rate mortgages

- FHA programs

- VA products

- Jumbo offerings

This ensures that families can find the best solution tailored to their unique financial situations.

Whether you’re a first-time homebuyer or looking to refinance, our mortgage solutions are designed with your needs in mind. We know how important it is to feel supported during this process, and we are here to assist you every step of the way. With competitive rates and accessible technology, we streamline the refinancing process, allowing you to quickly obtain a fast home equity loan by tapping into the value of your property effectively.

Most mortgages finalize in under three weeks, which means you can move forward with your plans without unnecessary delays. Our devoted team is focused on guiding you through each phase, ensuring you obtain the most appropriate funding for your renovations. Let us help you make your dreams a reality.

Competitive Rates: Save More with F5 Mortgage’s Home Equity Loans

At F5 Mortgage, we understand how challenging property financing can be. That’s why we’re committed to providing attractive rates that allow households to save significantly while securing necessary funds for property improvements. By collaborating with over two dozen top lenders, we ensure that our clients receive the most favorable rates and terms available. Our personalized service simplifies the rate comparison process, making it easier for families to finance renovations or major purchases without straining their budgets.

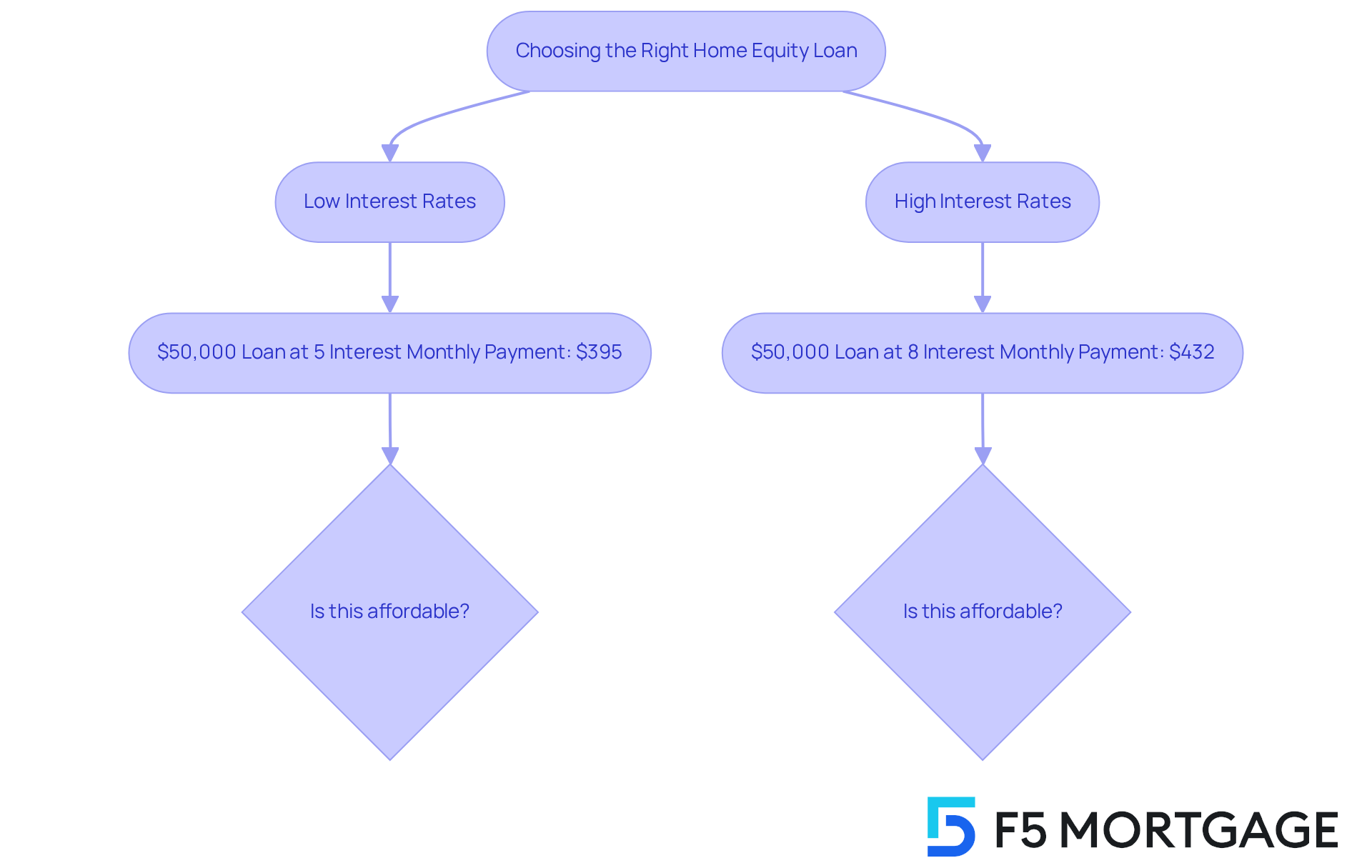

Currently, the typical residential collateralized borrowing rate is 7.95%, while HELOC rates hover around 8.30%. These rates can fluctuate, highlighting the importance of comparing options frequently. For instance, a $50,000 credit at a 5% interest rate results in a monthly payment of approximately $395. In contrast, an 8% rate increases that payment to about $432. This example underscores the necessity of securing the best possible rate to maximize savings.

Families can leverage a fast home equity loan not just for renovations but also for debt consolidation, often at lower interest rates compared to credit cards, which currently exceed 22% on average. At F5 Mortgage, we’re here to support you in navigating this process, ensuring you can take advantage of competitive rates to boost your savings. This financial strategy can lead to substantial savings over time. However, it’s essential to be cautious about borrowing too much or too little with a lump-sum distribution, as this can lead to additional financing costs.

With the right guidance from independent agents like us, households can manage the intricacies of property financing efficiently. We aim to empower you to make knowledgeable choices that align with your financial objectives. As Chris Horymski observes, “While these rates are presently comparable, property-secured credit and HELOC rates can fluctuate more, so you should review rates frequently.

Personalized Service: Dedicated Support Throughout Your Loan Process

At F5 Mortgage, we understand how challenging the mortgage process can be. That’s why personalized service is integral to the client experience. Each family is matched with a dedicated mortgage broker who offers customized support throughout the financing journey. This broker is there to respond to inquiries, provide insights, and ensure that clients feel supported at every step of their fast home equity loan financing journey.

Such dedication to outstanding service not only builds trust but also increases the chances of successful approvals. Families have reported feeling empowered and informed, thanks to the clear communication and personalized attention they receive. One satisfied client noted, ‘My mortgage broker was with me every step of the way, making the process feel seamless and stress-free.’ Another client shared, ‘Ryan and his team are amazing! I was pretty confused at the start of all this, but they helped me so much along the way.’

This level of dedicated support is crucial, especially in a landscape where 76% of consumers express frustration when personalized interactions are lacking. By emphasizing personalized service, F5 Mortgage greatly enhances client satisfaction and results. We’re here to support you every step of the way, ultimately assisting households in achieving their homeownership objectives with ease.

Educational Resources: Comprehensive Guides for Home Equity Loan Borrowers

At F5 Mortgage, we understand how challenging it can be to navigate the world of property financing. That’s why we offer a variety of educational materials designed to empower you. Our detailed guides cover essential topics like:

- Property value financing

- Refinancing

- Down payment support programs

We want you to feel confident and informed when making decisions about your financing options.

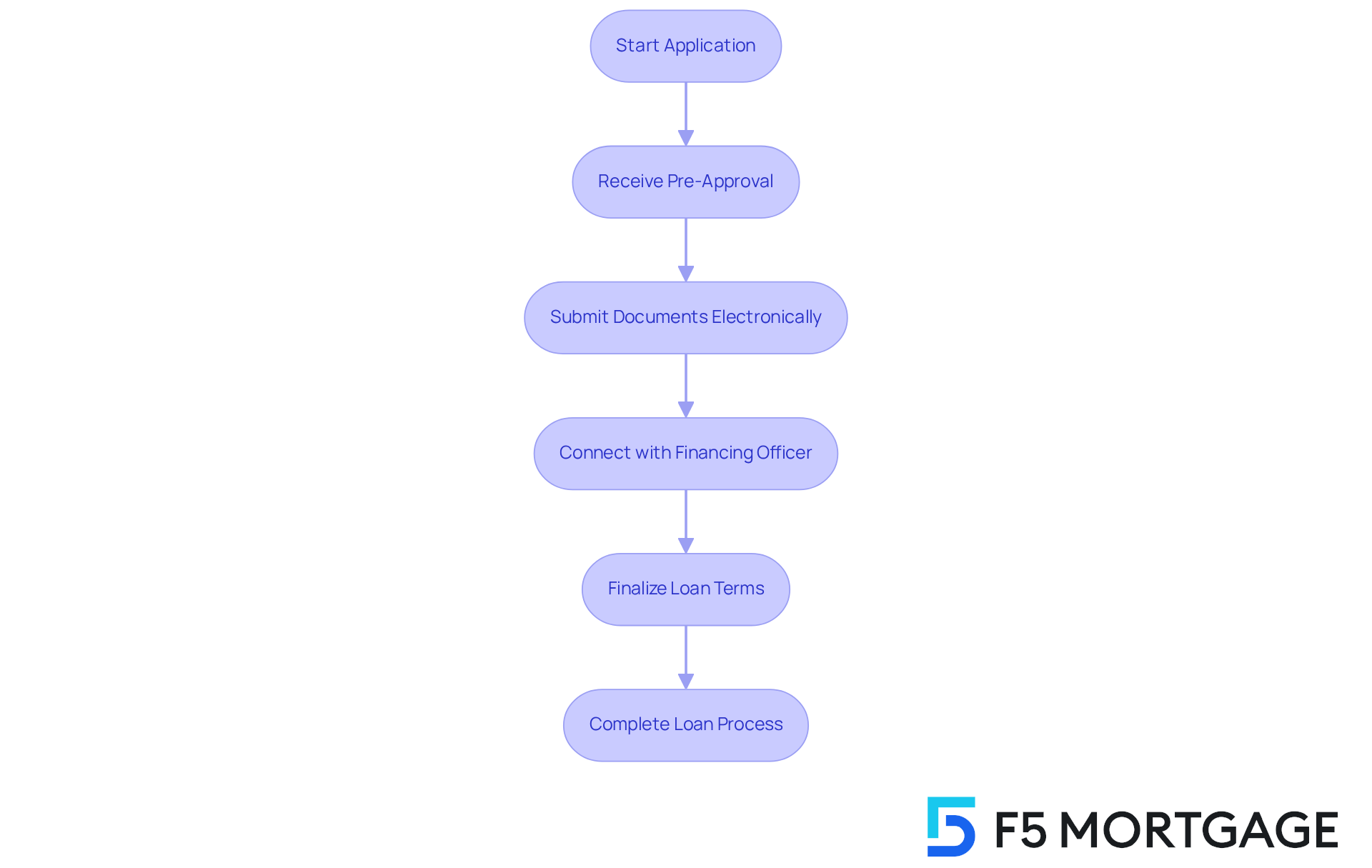

Our step-by-step guide walks you through the refinancing process. From researching your options to submitting an application, we cover everything you need to know. Understanding the importance of appraisal and underwriting is crucial, and we’re here to support you every step of the way. By prioritizing education, we ensure that households are well-prepared for their mortgage journey.

With access to a diverse range of financing programs tailored to meet your unique needs, you can feel reassured. We know how important it is to have the right support, and our commitment is to guide you through this process with compassion and expertise.

Streamlined Application Process: Simplifying Your Home Equity Loan Experience

F5 Mortgage understands how challenging the equity financing application process can be. That’s why we have transformed it by adopting a streamlined method that significantly reduces paperwork and application duration. As an independent broker, F5 Mortgage works for you, not the lenders, ensuring you receive the best possible terms and rates tailored to your refinancing needs.

Imagine completing your application for a fast home equity loan swiftly, often achieving pre-approval in under an hour. This efficiency not only saves you valuable time but also enhances your overall experience, allowing your family to focus on home improvement projects without the stress of cumbersome paperwork.

Statistics reveal that:

- 64% of consumers find the duration required to finalize a mortgage to be the most stressful aspect of the process.

- 81% of borrowers prefer to sign financial documents electronically.

We recognize these concerns and are committed to addressing them directly. By minimizing traditional barriers, F5 Mortgage showcases its dedication to modern consumer needs.

Our committed team offers you access to a financing officer and an account manager, guaranteeing assistance throughout the refinancing procedure. Experts in the field stress the importance of minimizing documentation in mortgage applications, highlighting that a smooth digital experience can lead to better financial choices for families. By embracing a technology-focused strategy and offering dedicated support, F5 Mortgage not only streamlines the process for obtaining a fast home equity loan but also empowers you to make informed decisions about your financial future.

We’re here to support you every step of the way.

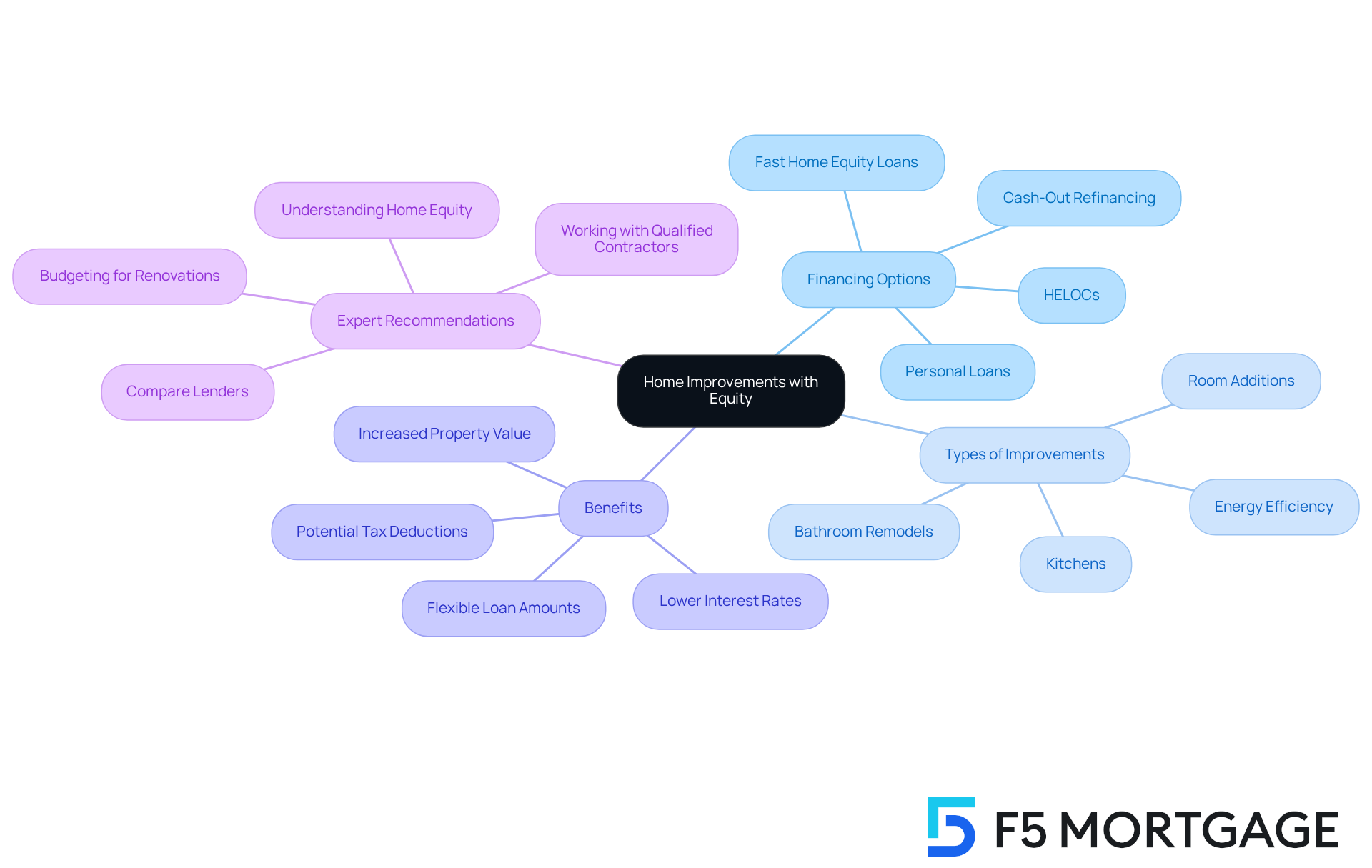

Home Improvements: Leverage Your Equity for Upgrading Your Living Space

Home financing options can be a valuable resource for families looking to enhance their living spaces. We understand how important it is to create a comfortable home, and by tapping into the value of their properties, homeowners can secure a fast home equity loan to fund renovations, remodels, or expansions that significantly improve their quality of life. Many families utilize these loans to transform kitchens, add new rooms, or boost energy efficiency, turning their homes into more functional and enjoyable environments.

Typically, the amount borrowed for property improvements ranges from 75% to 85% of the property’s value. This financial flexibility is especially beneficial for families pursuing significant renovations that can elevate their home’s worth. Experts emphasize that leveraging home equity, especially through a fast home equity loan, can be a smart financial move, particularly when considering the potential return on investment from high-ROI projects like kitchen upgrades or energy-efficient improvements.

Current trends indicate that more families are turning to fast home equity loans for their renovation projects. These fast home equity loans often provide lower interest rates compared to personal loans or credit cards, making them an attractive option for funding home improvements. Additionally, investing in renovations can lead to increased property value, providing a strong incentive for families to enhance their assets.

As personal finance specialist Sarah Archambault notes, “Home value loans, HELOCs, and cash-out refinancing are all strong options—if they align with your budget and financial circumstances.” This highlights the importance of careful planning and budgeting when considering property financing for improvements. By exploring their options and understanding the potential benefits, families can make informed decisions that align with their renovation goals. For those contemplating property financing, it’s wise to compare several lenders, such as F5 Mortgage, which offers competitive rates and personalized support.

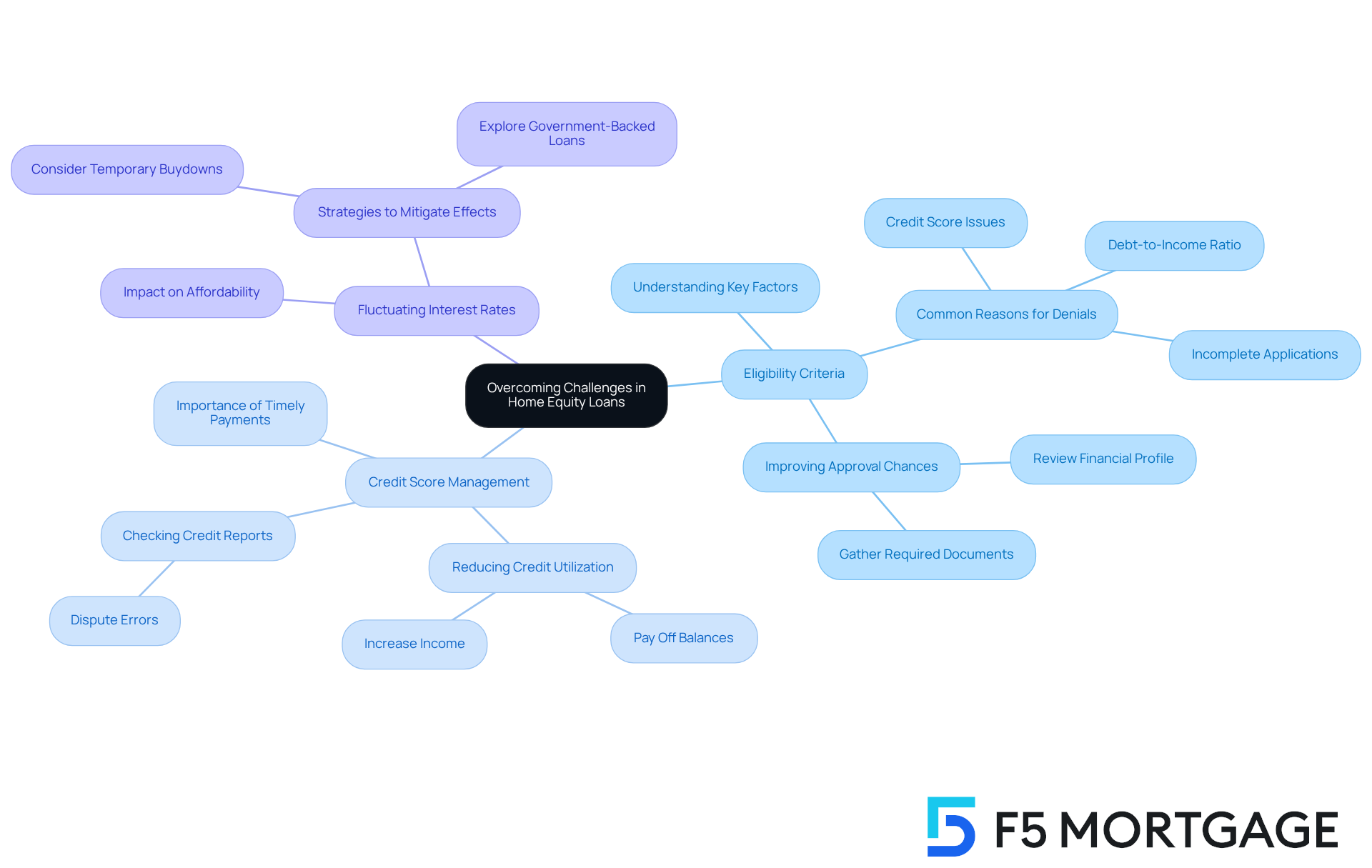

Navigating Challenges: Overcoming Common Obstacles in Home Equity Loans

Navigating the residential financing process can be challenging. We understand how overwhelming it can feel to grasp eligibility criteria, manage credit scores, and cope with fluctuating interest rates. At F5 Mortgage, we are dedicated to helping you overcome these obstacles with personalized support and expert guidance.

As your personal concierge, we take on the entire process for you. We walk you through the application and find the best lender tailored to your unique needs. By addressing these common concerns, we aim to provide you with the reassurance you need as you explore your property financing options.

With F5 Mortgage by your side, you can feel confident knowing that we are here to support you every step of the way. Let us help you turn your homeownership dreams into reality.

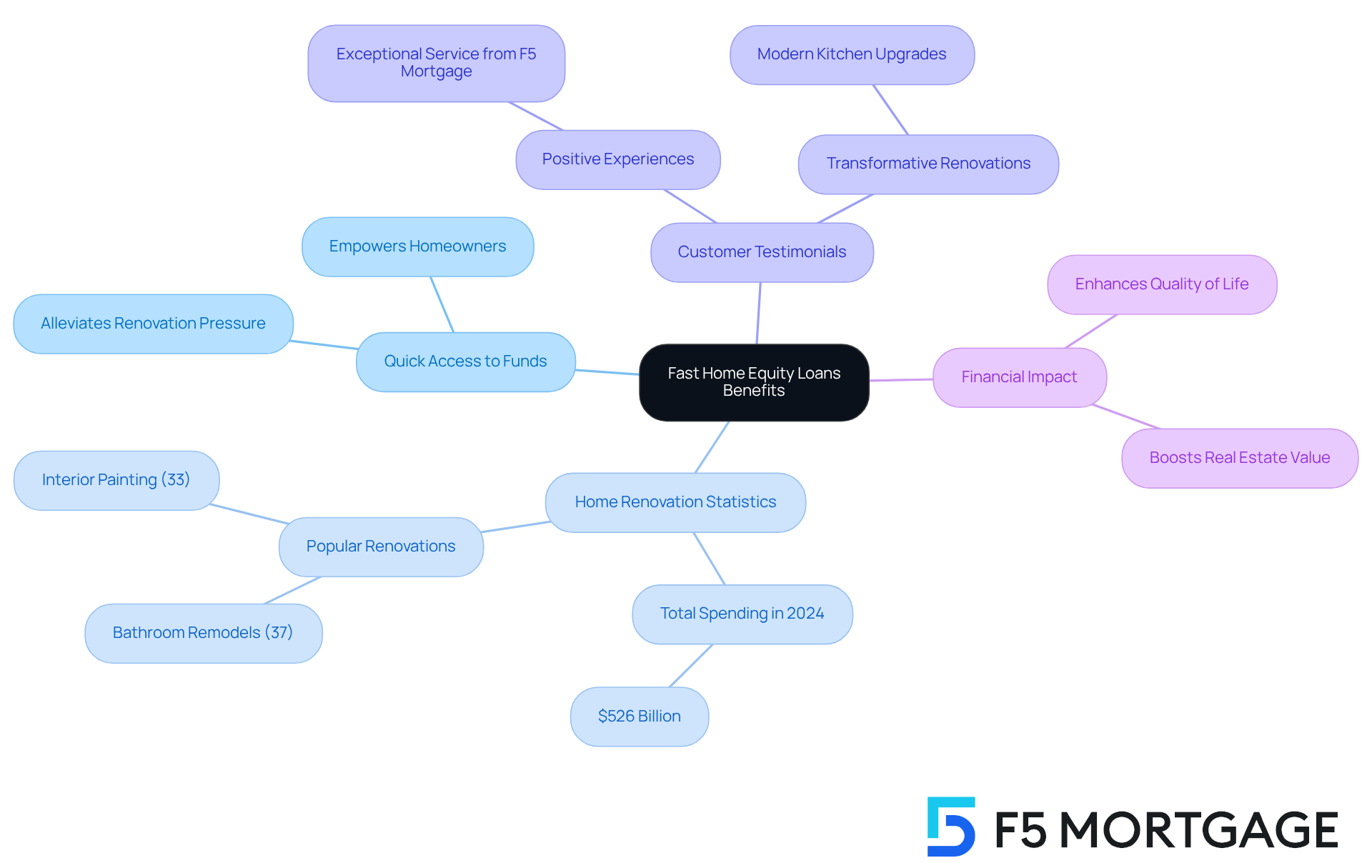

Overall Benefits: Why a Fast Home Equity Loan is Right for You

Quick equity financing offers numerous benefits for families eager to improve their homes. With rapid access to funds, these loans empower homeowners to undertake significant upgrades without delay. In 2024, the total spending on property enhancement in the U.S. reached 526 billion USD, highlighting the increasing trend of investing in renovations to enhance comfort and energy efficiency. We know how challenging it can be to manage home improvements, and families can utilize their property equity to fund projects that enhance their living spaces. Kitchen remodels and bathroom upgrades are among the most frequent renovations, with 37% of homeowners choosing bathroom remodels and 33% opting for interior painting.

The competitive rates provided by F5 Mortgage, along with tailored service and an efficient application process, establish it as a dependable ally in navigating the intricacies of financing a home. Clients have praised F5 Mortgage for their exceptional service. One satisfied customer shared, “Ryan and his team are amazing! I was pretty confused at the start of all this, but they helped me so much along the way.” Families have successfully utilized quick loans to transform outdated kitchens into modern culinary spaces, significantly enhancing both functionality and aesthetic appeal.

The impact of quick access to funds on property enhancement projects cannot be overstated. Property owners who secure funding swiftly are more inclined to finish renovations punctually and within budget, alleviating the pressure frequently linked to property improvements. Financial advisors stress that investing in property enhancements not only boosts real estate value but also enhances the quality of life for households. As one financial advisor mentioned, “Investing in your residence is one of the best methods to guarantee both comfort and financial stability for your household.”

In summary, a fast home equity loan is a wonderful option for families seeking to enhance their homes. They provide essential financial assistance to efficiently and effectively achieve renovation aspirations with a fast home equity loan. For personalized loan options tailored to your renovation needs, consider consulting with F5 Mortgage, where clients have consistently reported outstanding satisfaction and expert guidance. We’re here to support you every step of the way.

Conclusion

Fast home equity loans offer a wonderful opportunity for families eager to enhance their living spaces and improve their financial stability. With quick access to funds, these loans empower homeowners to undertake significant renovations without the delays often associated with traditional financing options. Tapping into home equity not only facilitates home upgrades but also has the potential to increase the property’s value, making it a strategic financial move.

Throughout this article, we’ve explored the various benefits of fast home equity loans, including:

- Rapid approval times

- Competitive rates

- Personalized service

Families can enjoy streamlined application processes that often lead to approvals in under an hour, allowing them to seize opportunities for home improvements promptly. Additionally, the educational resources and dedicated support from F5 Mortgage ensure that clients feel well-informed and confident in their financial decisions.

In light of these insights, it is clear that fast home equity loans are not merely a means of financing; they are a pathway to transforming homes and enhancing quality of life. We understand how challenging it can be to navigate these decisions, and we encourage families to explore their options. Consider how leveraging your home equity can lead to meaningful improvements. By partnering with reliable lenders like F5 Mortgage, homeowners can embark on their renovation journeys with the confidence and support necessary to achieve their goals.

Frequently Asked Questions

What is F5 Mortgage’s main offering?

F5 Mortgage offers fast home equity loans that provide quick access to funds for home improvements or debt consolidation.

How much was invested in property enhancements in the U.S. from 2021 to 2023?

Over $827 billion was invested in property enhancements in the U.S. during that period, with an average spending of over $9,542 on residential projects in 2023.

How quickly can I expect to close on a loan with F5 Mortgage?

F5 Mortgage typically leads to loan closings in under three weeks.

What technology does F5 Mortgage use to simplify the loan application process?

F5 Mortgage leverages user-friendly technology to streamline the application process and enhance the borrowing experience.

How long does it take to get a home equity loan approved at F5 Mortgage?

F5 Mortgage provides a quick approval process, allowing financing approvals in less than an hour.

What types of loan options does F5 Mortgage offer?

F5 Mortgage offers a diverse range of financing options, including fixed-rate mortgages, FHA programs, VA products, and jumbo offerings.

Can I apply for a loan online with F5 Mortgage?

Yes, you can apply for a loan online, by phone, or through chat, making the process convenient.

What should I be aware of regarding property value advances?

It’s important to be aware of potential risks related to property value advances, such as market fluctuations that could impact your investment.

Is the interest on residential borrowing potentially tax-deductible?

Yes, the interest on residential borrowing may be tax-deductible, enhancing the financial appeal of home equity loans.

How does F5 Mortgage support clients during the borrowing process?

F5 Mortgage provides focused client support throughout the refinancing journey, ensuring that clients receive assistance at every step.