Introduction

Navigating the journey to homeownership can be both exhilarating and daunting. We know how challenging this can be, especially when it comes to understanding the intricacies of mortgage payments. For families stepping into this new chapter, knowing the timeline and process for the first mortgage payment is crucial for financial stability.

What happens if that first payment isn’t made on time? How can families ensure they stay on track? This guide is here to support you every step of the way. We’ll unpack the essential steps for:

- Determining due dates

- Calculating payment amounts

- Successfully making that first payment

Along the way, we’ll highlight potential pitfalls to avoid, empowering you to navigate this process with confidence.

Determine Your First Mortgage Payment Due Date

Determining your first mortgage payment after closing due date can feel overwhelming, but we’re here to support you every step of the way. Here’s a simple guide to help you navigate this process with ease:

- Identify Your Closing Date: This is the moment when the property officially changes hands and your mortgage kicks off.

- Add 30 Days: Typically, the first mortgage payment after closing is due on the first day of the month following a 30-day period. For instance, if you close on June 15, your first payment will be due on August 1.

- Check Your Loan Documents: Your closing documents should clearly state the due date for your first payment. Look for sections labeled ‘Payment Schedule’ or ‘First Payment Due Date’.

- Contact Your Lender: If you’re unsure, don’t hesitate to reach out to your lender for confirmation. They can provide specific details based on your loan agreement.

Understanding when your first mortgage payment after closing is due is crucial for effective budgeting. With mortgage rates recently dropping to their lowest levels in over a year, many families are discovering favorable conditions for buying homes or refinancing. Plus, some lenders offer a grace period of up to 15 days after the due date, giving you a little extra flexibility.

By planning ahead and clarifying your financial timeline, you can set a positive tone for your homeownership journey. Remember, we know how challenging this can be, but with the right information and support, you’re well on your way to making your dream home a reality.

Calculate Your First Mortgage Payment Amount

Calculating your first mortgage payment after closing can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into manageable steps that can help ease your worries.

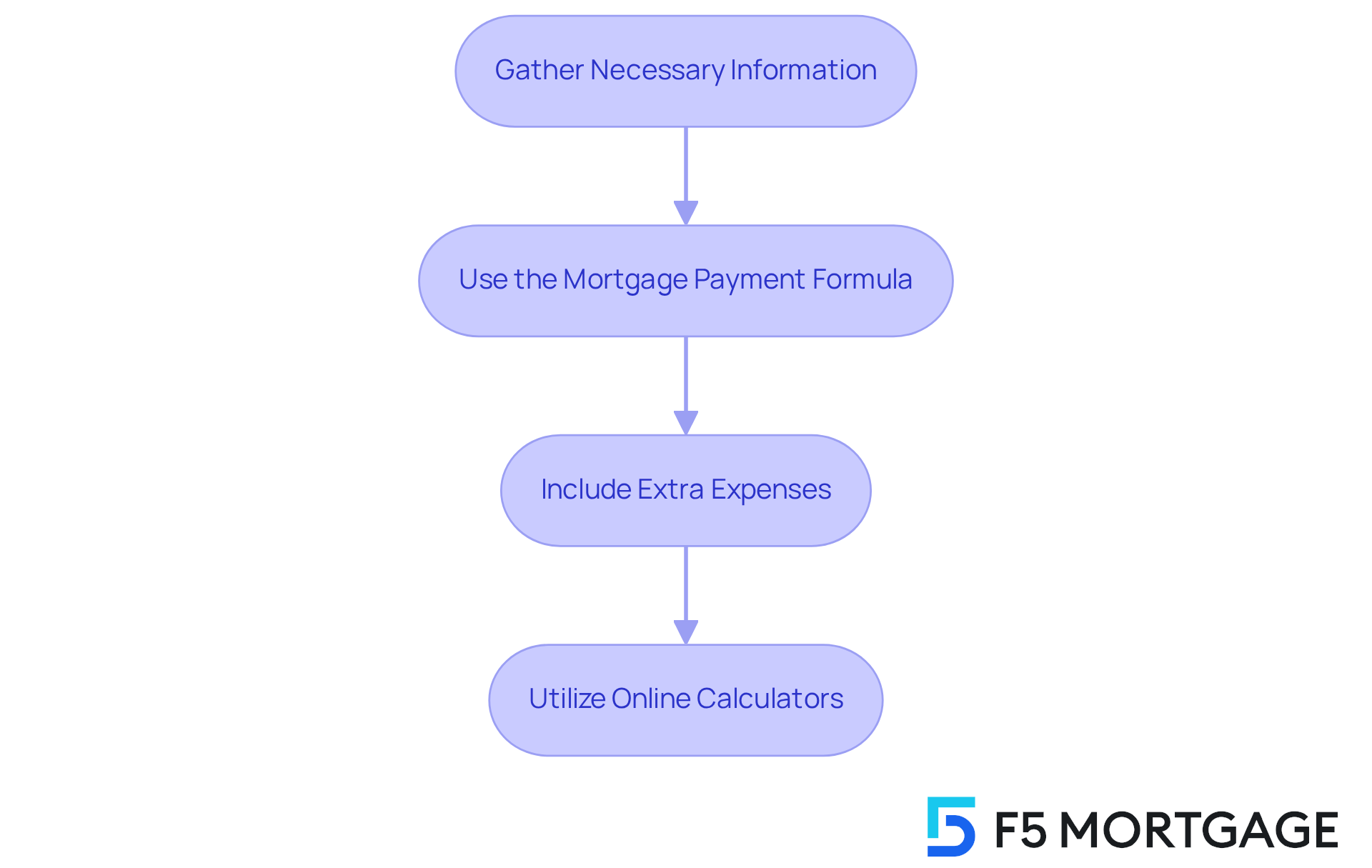

Gather Necessary Information: Start by collecting your loan amount, interest rate, loan term (in years), and any additional costs like property taxes and insurance. Knowing these details is the first step toward understanding your financial commitment.

Use the Mortgage Payment Formula: The formula for determining your monthly mortgage payment is:

M = P[r(1 + r)^n] / [(1 + r)^n - 1]

Where:

- M = total monthly mortgage payment

- P = principal loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in months)

This formula might seem complex, but it’s a crucial tool in figuring out what you’ll owe each month.

Include Extra Expenses: Don’t forget to account for property taxes, homeowners insurance, and any private insurance (PMI). These can significantly impact your monthly costs. For instance, if you’re looking at a $1 million loan, your overall projected monthly amount, including these extra expenses, can be around $1,956. It’s important to have a complete picture of your financial obligations.

Utilize Online Calculators: For added convenience, consider using online loan calculators. Just enter your loan information, and the calculator will provide an estimated monthly amount. This can make it easier to visualize your financial obligation and plan accordingly.

Understanding these calculations is essential, especially since the typical American homeowner spends less than 12 years in their home. By mastering your loan cost calculations, you can better manage your budget and prepare for future financial choices. Remember, we know how challenging this can be, but with the right tools and knowledge, you can navigate this process confidently.

Make Your First Mortgage Payment Successfully

Starting your mortgage journey can feel overwhelming, but we’re here to support you every step of the way. To help you make your first mortgage payment smoothly, follow these essential steps:

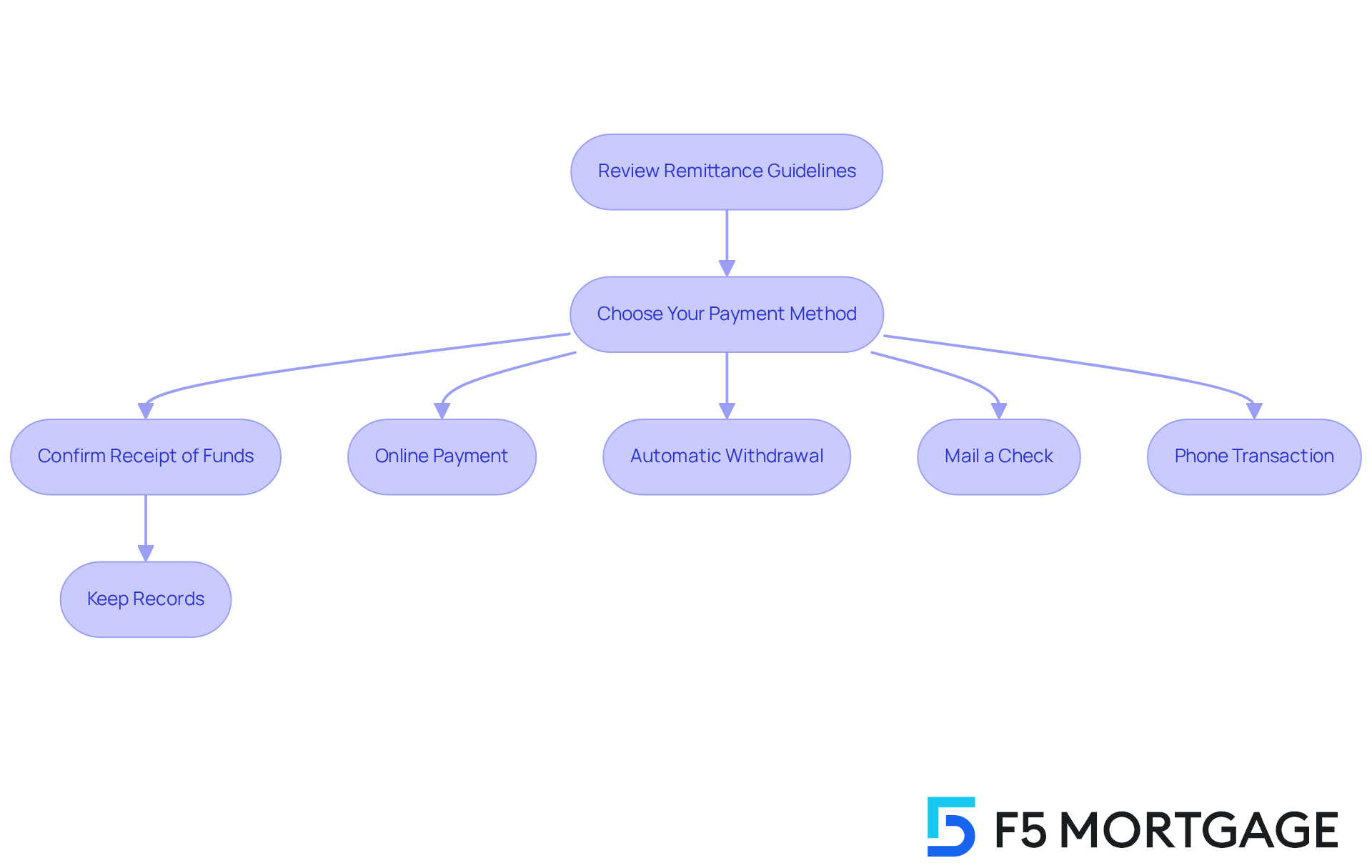

Review Remittance Guidelines: After closing, you’ll receive a welcome packet from your financial institution. This packet contains detailed remittance instructions. Take a moment to review this information thoroughly; it can help avoid any confusion down the line.

Choose Your Payment Method: Most lenders offer several options for making payments:

- Online Payment: This is the most popular method. You can log into your lender’s website or app for quick and easy transactions.

- Automatic Withdrawal: Setting up automatic deductions from your bank account ensures you never miss a due date, giving you peace of mind.

- Mail a Check: Prefer traditional methods? You can send a check to your creditor’s billing address. Just be sure to mail it well in advance of the due date to account for processing times.

- Phone Transaction: Some providers allow you to make transactions over the phone using a debit card. Just be cautious, as not all lenders accept credit card transactions.

Confirm Receipt of Funds: After you submit your payment, it’s important to verify that your funds have been received and processed. You can do this by checking your account online or reaching out to your lender directly.

Keep Records: Maintain a record of your transaction confirmation for your personal files. This documentation can be invaluable for tracking your payments and resolving any potential issues.

By following these steps, you can manage your initial loan installment with confidence. Remember, we know how challenging this can be, but with these guidelines, you’ll be well on your way to settling into your new home.

Understand Consequences of Missing Your First Payment

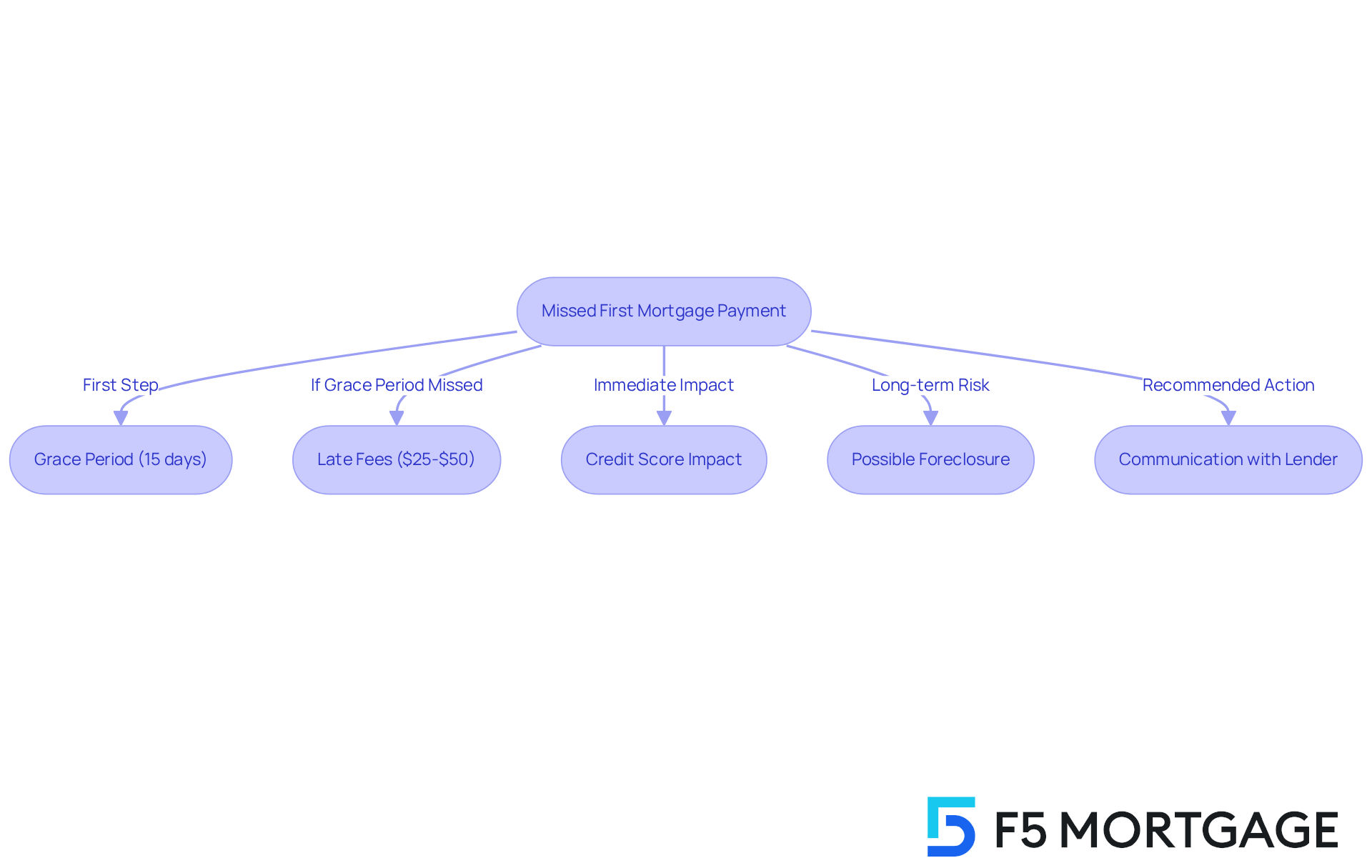

Understanding the consequences of missing your first mortgage payment after closing is crucial for maintaining financial stability. We know how challenging this can be, and here’s what you need to know:

- Grace Period: Most financial institutions offer a grace period of 15 days following the due date. Paying within this timeframe can help you avoid late fees.

- Late Fees: If you miss the grace period, late fees typically range from $25 to $50, depending on the lender. These fees can accumulate quickly, adding to your financial burden.

- Credit Score Impact: A missed obligation can significantly harm your credit score. Delayed transactions can stay on your credit report for as long as seven years, influencing your capacity to obtain future loans.

- Possible Foreclosure: Regularly failing to make dues can result in foreclosure actions, jeopardizing the loss of your home. Typically, foreclosure can commence after four consecutive missed installments or being 120 days overdue.

- Communication with Lender: If you anticipate challenges in making a contribution, reach out to your lender without delay. They may offer options such as forbearance or payment plans, which can provide temporary relief and help you manage your financial situation effectively. Remember, we’re here to support you every step of the way.

Conclusion

Navigating your first mortgage payment after closing is a big step for families stepping into homeownership. We know how challenging this can be, and understanding the timeline, payment calculations, and methods of making payments can truly empower you to manage your finances effectively and confidently.

Start by identifying your first payment due date. Then, calculate your payment amount using the mortgage formula. Choosing the most convenient payment method is also key. Remember, being aware of the consequences of missing a payment – like late fees and potential impacts on your credit score – underscores the importance of timely financial management.

Ultimately, proactive planning and clear communication with your lender can set the stage for a smooth transition into homeownership. By taking these steps, you can not only avoid pitfalls but also embrace the rewarding journey of owning a home with peace of mind and financial stability. We’re here to support you every step of the way!

Frequently Asked Questions

How do I determine my first mortgage payment due date after closing?

To determine your first mortgage payment due date, identify your closing date, add 30 days, and typically, your first payment will be due on the first day of the month following that 30-day period.

What is the significance of the closing date?

The closing date is the moment when the property officially changes hands, and it marks the start of your mortgage.

Can you provide an example of calculating the first mortgage payment due date?

For example, if you close on June 15, your first mortgage payment will be due on August 1.

Where can I find the due date for my first mortgage payment?

You can find the due date for your first payment in your closing documents, specifically in sections labeled ‘Payment Schedule’ or ‘First Payment Due Date’.

What should I do if I’m unsure about my first payment due date?

If you’re unsure, you should contact your lender for confirmation. They can provide specific details based on your loan agreement.

Why is it important to know my first mortgage payment due date?

Knowing your first mortgage payment due date is crucial for effective budgeting and financial planning as a new homeowner.

Are there any additional benefits or considerations regarding mortgage payments?

Some lenders offer a grace period of up to 15 days after the due date, providing extra flexibility for making your payment.