Overview

We understand how navigating mortgage payments can feel overwhelming. The first mortgage payment is due on the first day of the month following a complete month from the closing date. This timeline allows homeowners the necessary space to adjust their budgets accordingly.

It’s important to note that mortgage payments are made in arrears, which means that the payment you make in a given month covers the previous month’s interest. Understanding this timing is crucial for effective financial planning.

By being aware of when payments are due and how they work, you can better prepare yourself for this new financial responsibility. We’re here to support you every step of the way as you embark on this journey.

Introduction

Understanding the timeline for your first mortgage payment is crucial for effective financial planning as a new homeowner. We know how challenging this can be. Typically, your first payment is due on the first day of the month following a complete month after closing. This timeline allows you to manage your budget effectively. However, factors like closing dates and lender policies can influence this schedule, leading many to question the exact timing of their obligations.

How can you navigate these complexities? It’s important to stay informed and prepared. By understanding your specific situation and communicating with your lender, you can ensure that you are financially ready for your new responsibilities. We’re here to support you every step of the way as you embark on this journey.

Understand the Timing of Your First Mortgage Payment

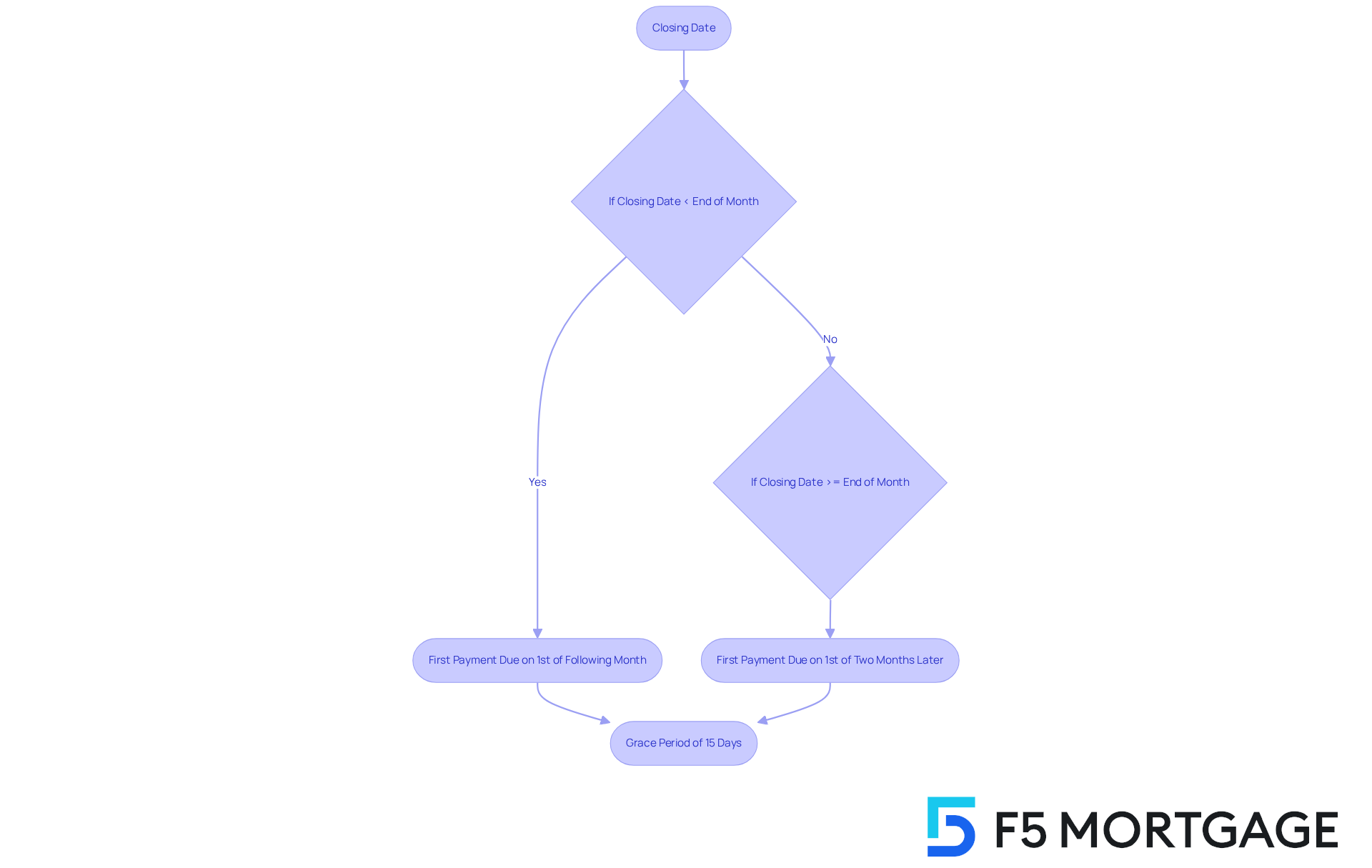

Typically, when is first mortgage payment due after closing? It is due on the first day of the month following a complete month from your closing date. For instance, if you finalize the purchase of your home on June 15, you might wonder when is first mortgage payment due after closing, which will be on August 1. This schedule arises because mortgage payments are made in arrears, meaning you are covering the interest that accrued during the previous month. Understanding this timing is essential for effective financial planning, as it allows you to prepare for your upcoming obligations without unexpected surprises.

Consider this: if a mortgage closes on March 12, you might wonder when is the first mortgage payment due after closing, as the initial installment would be due on May 1. This timeline gives homeowners a month to adjust their budgets and manage any moving expenses that may come up. Additionally, many lenders offer a grace period of about 15 days for overdue amounts, providing some flexibility if financial challenges arise during the transition.

It’s also important to note that the initial amount is detailed in your closing disclosure, which you receive at least three days before closing. This document outlines the components of your financial obligation, including principal, interest, taxes, and insurance (commonly referred to as PITI). Being aware of these details helps ensure that you are financially prepared for your initial mortgage installment and can avoid any potential pitfalls. We know how challenging this can be, and we’re here to support you every step of the way.

Identify Factors Affecting Your First Payment Due Date

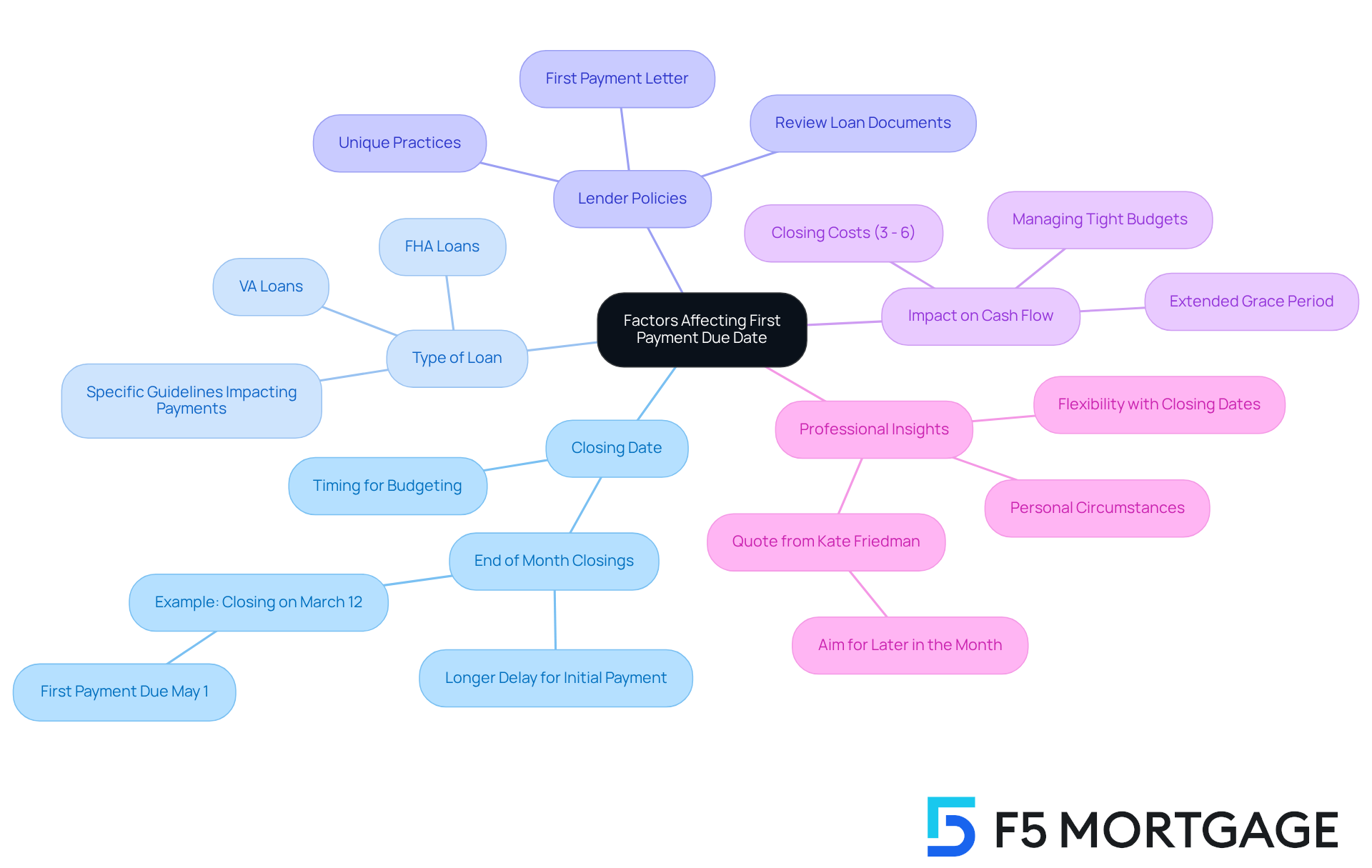

Several factors can significantly influence when the first mortgage payment is due after closing, and we know how challenging this can be. Understanding these elements can empower you to navigate this process with confidence.

-

Closing Date: The date you finalize your mortgage can alter your payment schedule. Ending at the conclusion of the month often leads to a longer delay for your initial payment, making it important to know when the first mortgage payment is due after closing, which usually becomes due on the first day of the second month following the closure. For instance, if you finalize on March 12, you may wonder when the first mortgage payment is due after closing; it would be due on May 1. This timing is crucial for budgeting and financial planning, and we’re here to support you every step of the way.

-

Type of Loan: Different loan categories, like FHA or VA loans, may have specific guidelines that influence repayment schedules. Understanding these nuances is essential for managing your financial commitments effectively. This knowledge can help you feel more in control of your situation.

-

Lender Policies: Each lender may have unique practices concerning due timelines. It’s important to review your loan documents carefully to understand your lender’s specific terms and any options available for modifying your payment schedule. The ‘First Payment Letter’ you receive at closing will clarify when the first mortgage payment is due after closing, helping you plan ahead.

-

Impact of Closing Date on Cash Flow: Closing later in the month can provide an extended grace period for budget management, allowing you to align your finances better. This strategy can be especially beneficial for those managing tight budgets, as it improves cash flow during the transition into homeownership. Additionally, remember that closing costs typically range from 3% to 6% of the loan amount, which is an important consideration when planning your finances.

-

Professional Insights: Mortgage experts often emphasize the importance of considering personal circumstances when choosing a closing time. Factors like job changes or family needs might require a faster closing, while others may prefer a later timeframe for better financial management. As Kate Friedman from Rocket Mortgage observes, “If you’re keen to reduce interest costs and can afford to be adaptable with your closing timeframe, target later in the month.”

Comprehending these factors will assist you in maneuvering through the intricacies of your mortgage schedule, making informed choices that align with your financial objectives.

Calculate Your First Mortgage Payment Due Date

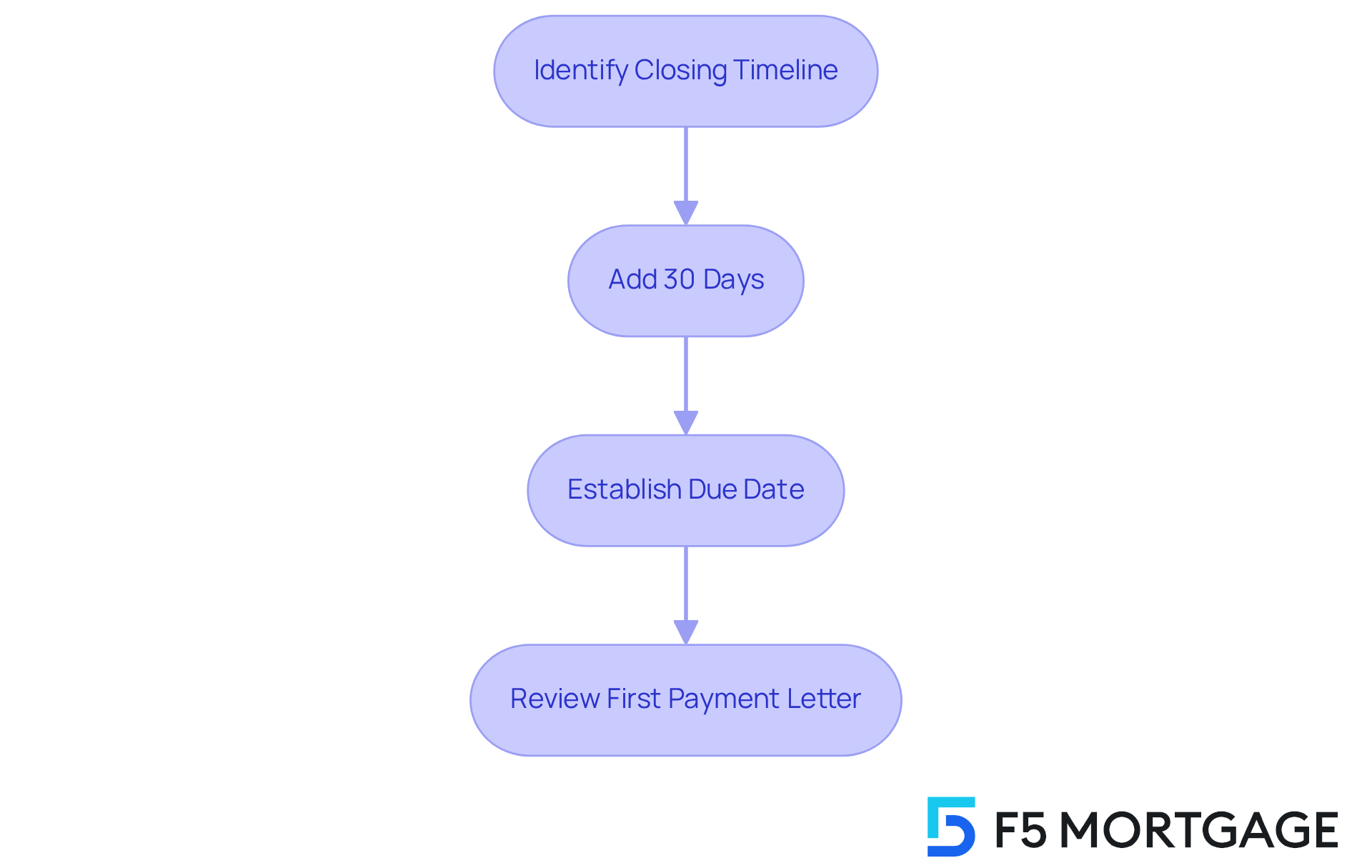

To determine your first mortgage payment due date, let’s walk through some simple steps together:

- Identify Your Closing Timeline: Start by noting the precise moment you finalized your mortgage. This is the foundation for understanding your payment schedule.

- Add 30 Days: Count 30 days from your closing date. This will guide you to the initial day of the next month, helping you plan ahead.

- Establish the due date: Understanding when the first mortgage payment is due after closing is important, as it is usually expected at the beginning of the month following this 30-day timeframe. For instance, if you finalized on June 15, then when is the first mortgage payment due after closing? It would be due on August 1.

Understanding when the first mortgage payment is due after closing is crucial for effective financial planning. For example, if you finalize on March 12, you might wonder when is first mortgage payment due after closing, which would be May 1. This structure allows homeowners to budget accordingly, ensuring they are prepared for their upcoming financial obligations.

Moreover, if you close at the start of the month, you might enjoy an extended interval before your initial charge is due, which can improve your cash flow management. Conversely, if you close in the middle of the month, you might find yourself asking when is first mortgage payment due after closing, as your first fee could be owed roughly 45 days later.

It’s important to recognize that because F5 Mortgage operates as a broker, you will direct your contributions to the lender with whom your loan concludes. If you have any questions or need assistance after closing, remember, we’re here to support you every step of the way. You can reach us at 1-888-459-0483 or via email at info@f5mortgage.com, Monday – Friday from 8:30am to 11:00pm (EST) and Saturday from 8:30am to 5:00pm (EST).

Lastly, please review the ‘First Payment Letter’ you receive at closing, which will inform you about when the first mortgage payment is due after closing and the amount of your initial installment. We know how challenging this can be, and we’re here to help you navigate through it.

Explore Options to Change Your Payment Due Date

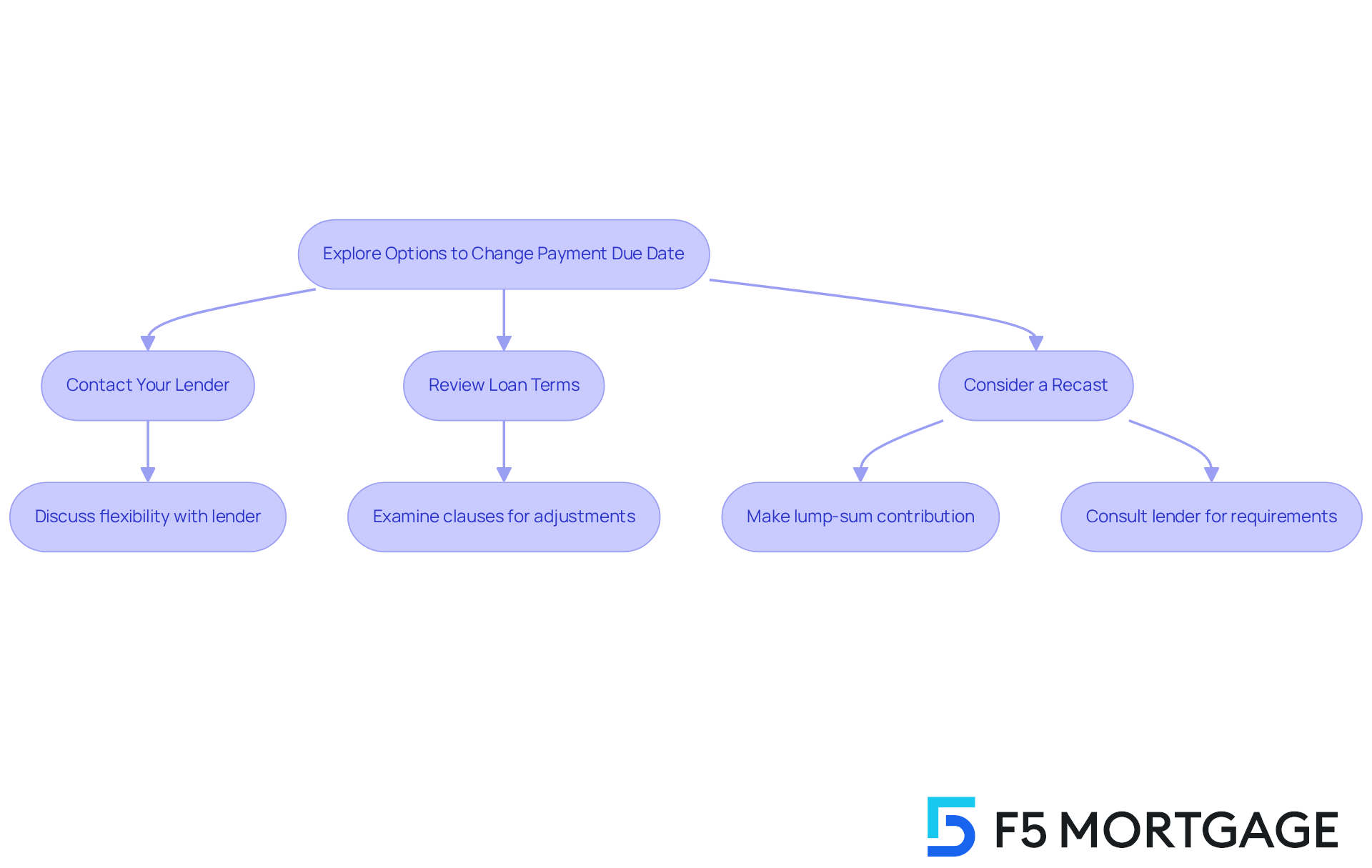

If you are uncertain about when the first mortgage payment is due after closing and it doesn’t align with your financial situation, we understand how challenging this can be. Fortunately, there are several options you can consider:

- Contact Your Lender: Start a conversation with your mortgage lender about the possibility of changing your due date. Many lenders are open to adjustments, often allowing changes within a specific range to better accommodate your needs.

- Review Loan Terms: Take a moment to examine your loan agreement for any clauses related to changes in the due amount. Some loans may include specific provisions that outline the process for making adjustments.

- Consider a Recast: If changing the deadline isn’t feasible, you might explore the option of recasting your mortgage. This process involves making a lump-sum contribution, which can lead to a recalibrated schedule for your payments. While recasting typically does not require refinancing, it’s essential to consult with your lender to understand the specific requirements and implications.

Clients who have successfully adjusted their mortgage due dates often discuss when the first mortgage payment is due after closing, which leads to improved financial management and reduced stress. Remember, engaging with your lender early can facilitate a smoother transition and help you align your payment schedule with your cash flow needs. We’re here to support you every step of the way.

Conclusion

Understanding when your first mortgage payment is due is essential for managing your new responsibilities as a homeowner. Typically, this payment is due on the first day of the month following a complete month from your closing date. So, if you close in the middle of the month, you’ll have some time to prepare your budget for this upcoming obligation.

Key factors influencing your first mortgage payment due date include:

- Your closing date

- The type of loan

- Lender policies

Each of these elements can significantly affect when your payment is due, allowing for flexibility in your financial planning. Remember, options exist to adjust your payment schedule if the initial due date doesn’t align with your financial situation. This provides further avenues to ensure that your mortgage fits comfortably within your budget.

Ultimately, being informed about when your first mortgage payment is due and understanding the factors that influence this date empowers you to navigate your financial commitments with confidence. Engaging with your lender and grasping your loan terms can lead to better financial management and reduced stress during this transition into homeownership. Taking proactive steps can make a significant difference in aligning your mortgage payment with your overall financial strategy. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

When is the first mortgage payment due after closing?

The first mortgage payment is due on the first day of the month following a complete month from your closing date. For example, if you close on June 15, your first payment would be due on August 1.

Why is the first mortgage payment due after a month?

Mortgage payments are made in arrears, meaning you are paying for the interest that accrued during the previous month. This schedule allows homeowners to prepare for their upcoming financial obligations.

How does closing date affect the timing of the first mortgage payment?

The closing date determines when the first payment is due. For instance, if a mortgage closes on March 12, the first payment would be due on May 1, giving homeowners time to adjust their budgets.

Is there any flexibility if I miss my mortgage payment deadline?

Many lenders offer a grace period of about 15 days for overdue amounts, providing some flexibility if financial challenges arise during the transition.

Where can I find details about my first mortgage payment?

The details about your first mortgage payment are outlined in your closing disclosure, which you receive at least three days before closing. This document includes information about principal, interest, taxes, and insurance (PITI).

Why is it important to understand the timing of my first mortgage payment?

Understanding the timing allows for effective financial planning, helping you prepare for your initial mortgage installment and avoid unexpected surprises.