Overview

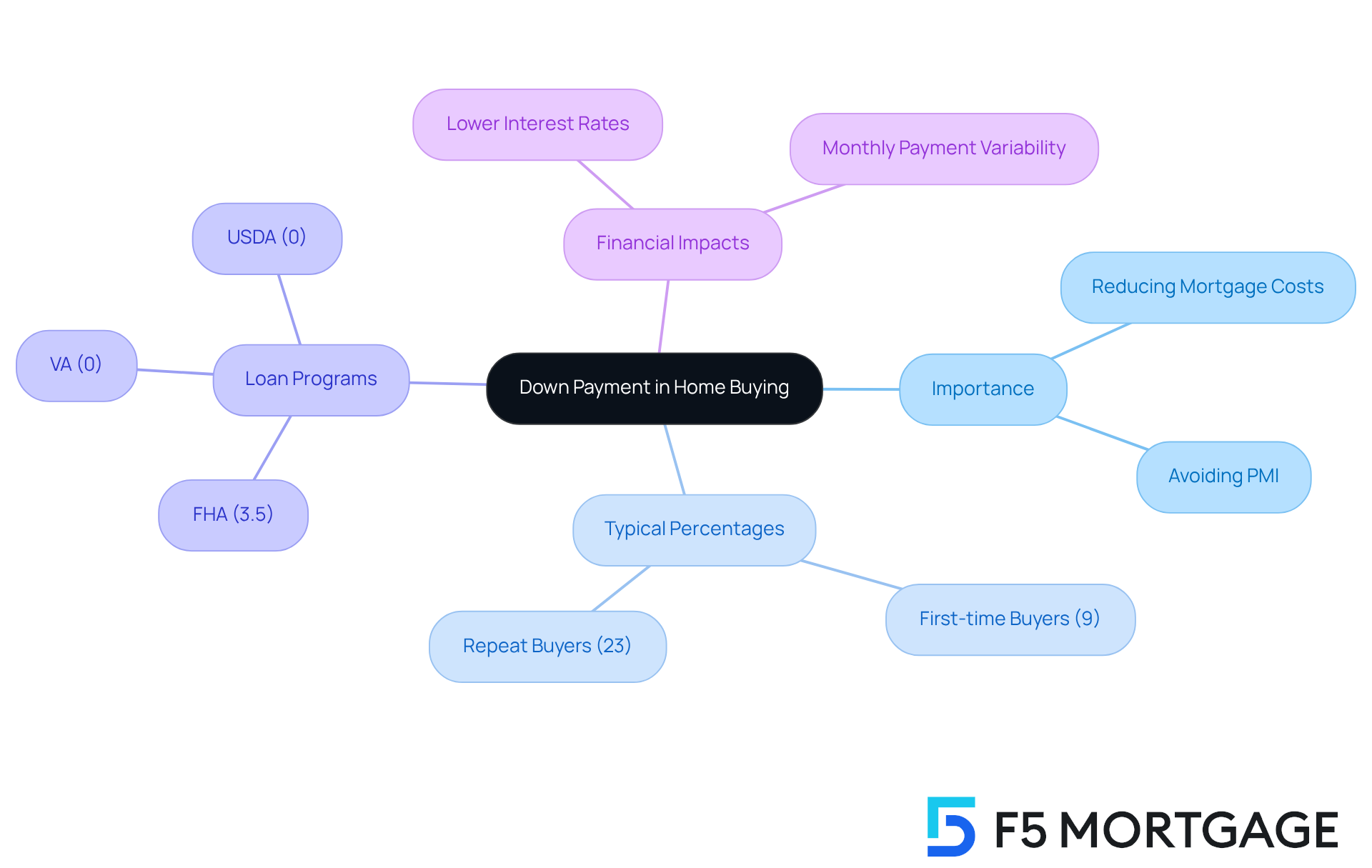

When it comes to buying a home, we know how challenging it can be to figure out the right down payment. Typically, a good down payment ranges from 3% to 20% of the purchase price. For first-time homebuyers, the average is around 9%, while repeat buyers often put down about 23%.

Understanding these numbers is crucial because a larger down payment can lead to lower monthly payments and better interest rates. Plus, it might help you avoid private mortgage insurance (PMI), which can save you money in the long run.

So, how do you determine the best amount for your needs? It’s essential to evaluate your financial situation and explore the loan options available to you. We’re here to support you every step of the way, helping you make informed decisions that align with your family’s goals.

Introduction

Understanding the nuances of a down payment is crucial for families embarking on the journey of homeownership. We know how challenging this can be. As the financial landscape evolves, prospective buyers often find themselves wondering what makes a good down payment for a house. This decision can significantly influence mortgage terms and long-term financial health.

With varying expectations based on market conditions and individual financial situations, families face a real challenge. How can you navigate these complexities to secure the best possible outcome in your home buying experience? We’re here to support you every step of the way.

By acknowledging your concerns and providing clear guidance, we can help you make informed decisions that align with your unique circumstances. Let’s explore the options together, ensuring you feel empowered and confident as you take this important step toward homeownership.

Define Down Payment: Understanding Its Role in Home Buying

Making a down payment raises the question of what’s a good down payment for a house, and it is often one of the first steps in the homebuying journey, which can be quite challenging. When considering what’s a good down payment for a house, it’s important to understand that a down payment is the initial cash contribution you make toward the purchase price of a home, typically provided upfront at closing. This transaction represents a portion of the overall expense and plays a crucial role in understanding the financial dynamics of your mortgage. When you make a larger initial deposit, it reduces the amount you need to finance, which can significantly impact your loan total, monthly payments, and overall financial well-being.

In 2024, first-time homebuyers faced a median deposit of about 9%, while repeat buyers averaged around 23%. This difference highlights how important the size of your deposit can be in securing favorable mortgage terms. Generally, a larger initial deposit can lead to lower interest rates and the chance to avoid private mortgage insurance (PMI), which can add an annual cost of 0.5% to 1% of your mortgage amount.

For instance, imagine putting down 20% on a $396,900 home. This choice could save you a significant amount over the life of your loan by eliminating PMI and securing a lower interest rate. Conversely, if you opt for a smaller down payment, you might face higher monthly costs due to increased borrowing and the necessity of PMI.

There are various loan programs available to help, such as:

- FHA loans that require as little as 3.5% down

- VA loans that offer 0% down options

- USDA loans that offer 0% down options

These programs can provide pathways for buyers with limited savings. However, it’s important to remember that even with these options, you’ll still need to consider closing costs and fees.

For prospective homeowners, understanding what’s a good down payment for a house is essential. It affects not just your immediate affordability but also your long-term financial stability. As the housing market evolves, being informed about your deposit options and their effects on mortgage conditions is vital for making wise financial decisions. We’re here to support you every step of the way.

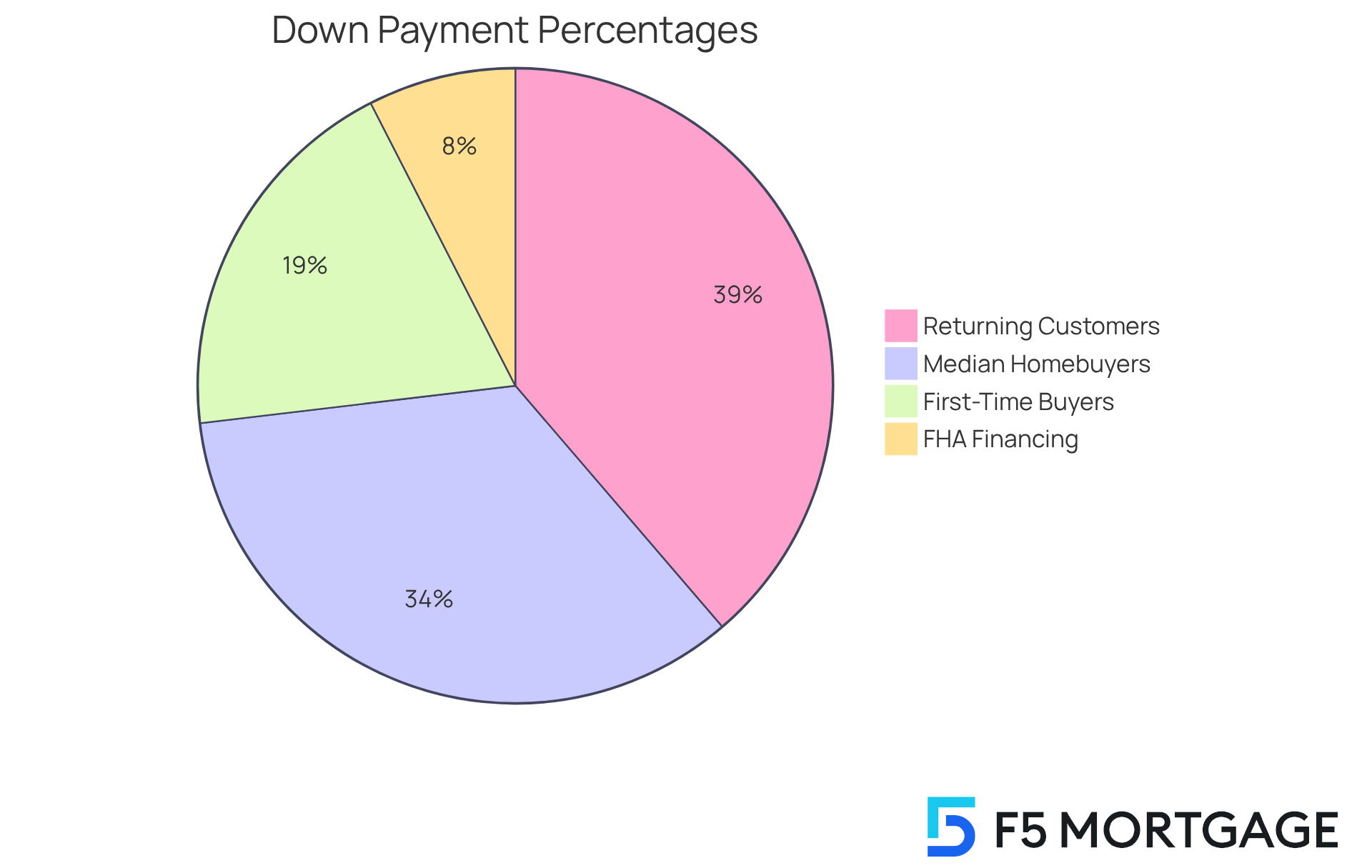

Explore Typical Down Payment Amounts: What Buyers Should Expect

In 2025, when discussing what’s a good down payment for a house, the median deposit for homebuyers is about 16% of the purchase price, which translates to roughly $62,000 based on the median home price of $390,000. We know how challenging this can be, especially for first-time buyers who often ask, what’s a good down payment for a house, as they typically contribute a median down payment of 9%. This reflects a shift from the traditional 20% benchmark that many still consider ideal when determining what’s a good down payment for a house. Rising home prices and the economic circumstances many families face today largely influence discussions about what’s a good down payment for a house.

For instance, FHA financing offers a more accessible entry point, which raises the question of what’s a good down payment for a house, requiring as little as 3.5% down. This can significantly ease the path to homeownership for families with limited savings. Imagine being able to step into your dream home sooner than you thought possible!

Recent data shows that returning customers tend to make a median deposit of 18%, highlighting their enhanced equity and economic stability. Moreover, down payment support initiatives are available, especially for first-time and low- to moderate-income purchasers. These often come as grants or forgivable funds, which can help lighten the load of that initial deposit.

Understanding these statistics is essential for prospective purchasers as they evaluate their financial preparedness and seek to determine what’s a good down payment for a house while exploring different financing options. With the evolving landscape of home financing, families are encouraged to consider their individual circumstances. There’s a wide variety of mortgage options available, including:

- Conventional mortgages

- FHA financing

- VA financing

Each presenting different down payment criteria and advantages.

We’re here to support you every step of the way as you navigate this journey. Take the time to explore your options and find the best fit for your family’s needs.

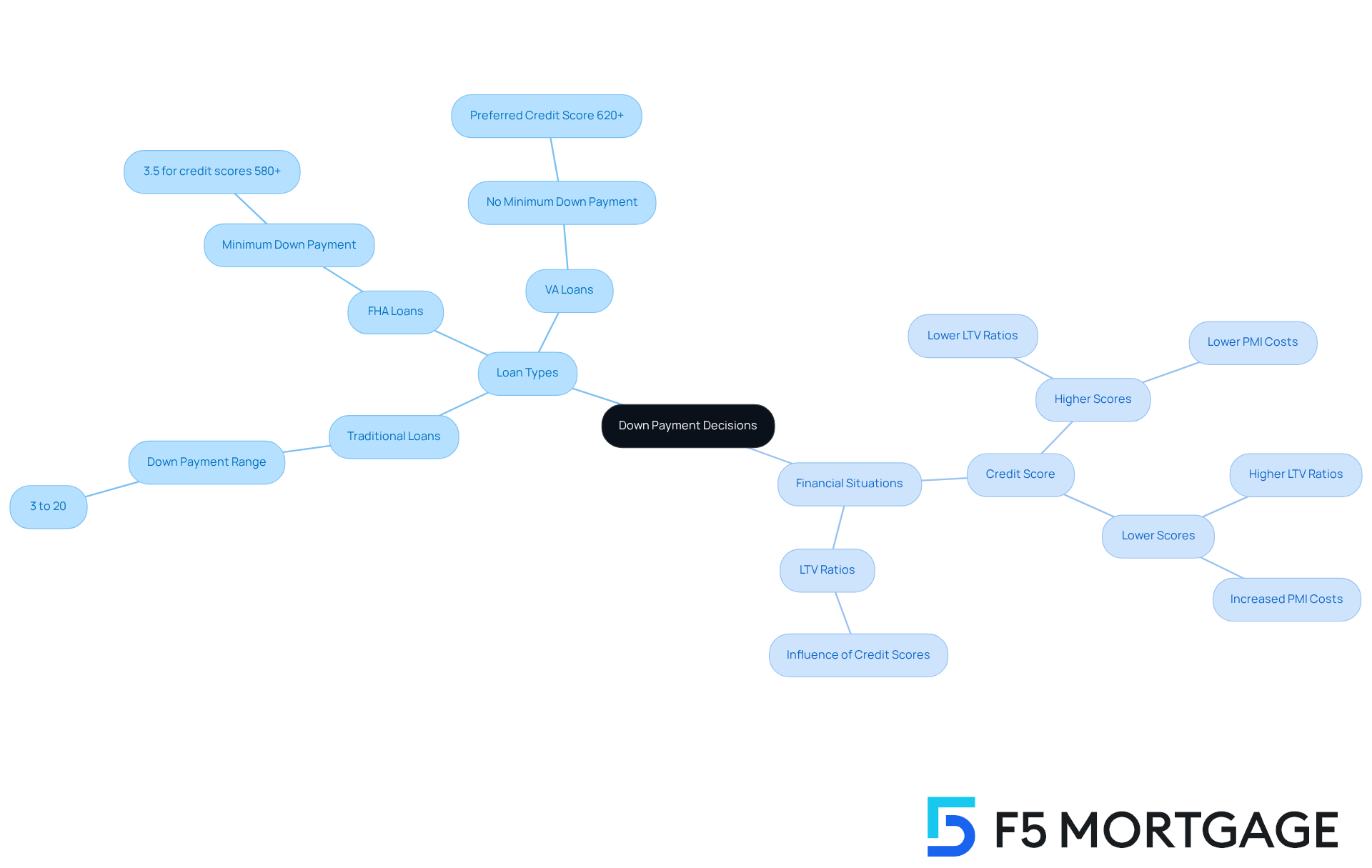

Analyze Key Factors Affecting Down Payment Decisions: Loan Types and Financial Situations

When it comes to buying a home, we know how challenging it can be to determine what’s a good down payment for a house. Several important factors come into play, and the type of mortgage you choose is especially crucial. When considering traditional financing, many potential buyers wonder what’s a good down payment for a house, as it typically requires an upfront contribution that ranges from 3% to 20%. On the other hand, government-supported options like FHA and VA loans can offer reduced upfront contributions, sometimes as low as 3.5% for FHA loans. As of 2025, understanding what’s a good down payment for a house is important, as the minimum down payment for FHA mortgages is set at 3.5% for borrowers with credit scores of 580 or higher. Meanwhile, VA mortgages often have no minimum down payment requirement, although lenders generally prefer a score of at least 620.

Your financial profile is crucial in figuring out what’s a good down payment for a house. If you have a better credit score, you might enjoy more favorable loan conditions, which can help answer the question of what’s a good down payment for a house, including lower upfront funding requirements. For example, borrowers with FICO scores above 740 may qualify for lower loan-to-value (LTV) ratios, which can greatly reduce the amount needed upfront. Conversely, those with lower credit scores may face higher LTV ratios, leading to larger initial investments and potentially increased private mortgage insurance (PMI) costs.

Recent data reveals that what’s a good down payment for a house has skyrocketed by 117.9% since Q3 2019, largely due to a 45% increase in home prices. In Q3 2025, the median initial contribution for U.S. homebuyers reached $30,400, prompting discussions about what’s a good down payment for a house given the ongoing affordability challenges in the housing market. Regional differences are also noteworthy; for instance, the Northeast has the highest average upfront cost percentage at 18.2%, with a median amount of $62,900—almost 2.5 times its figure from 2019.

Understanding these dynamics is essential for potential homebuyers. By maintaining a good credit score and managing your debt-to-income ratios, you can make it easier to access favorable financing options. Remember, financial consultants and mortgage brokers are here to support you every step of the way, offering personalized guidance to help you navigate these complexities. Together, we can ensure you’re well-prepared to make informed choices about your funding strategies.

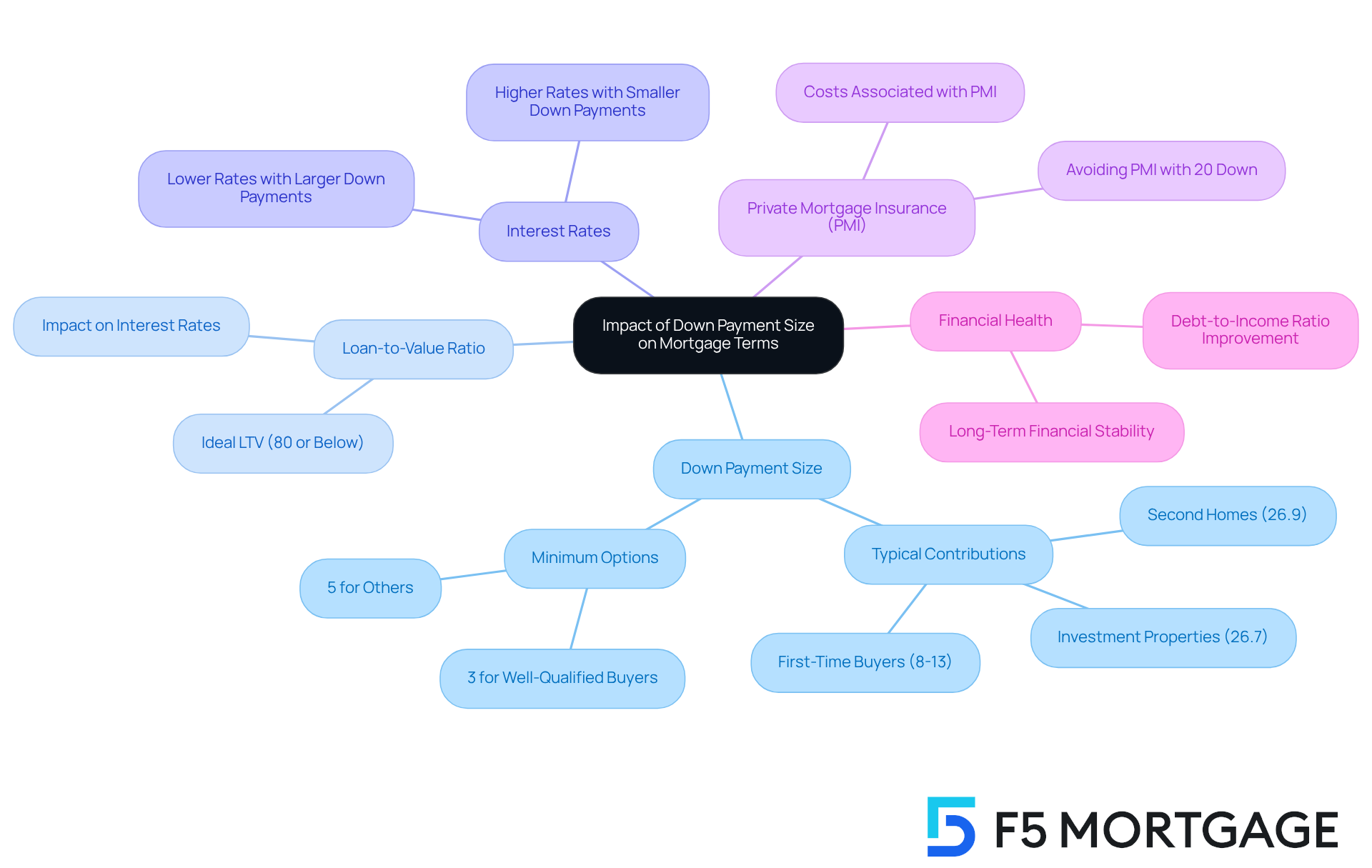

Evaluate Impact of Down Payment Size on Mortgage Terms and Financial Health

When it comes to buying a home, understanding what’s a good down payment for a house is more important than you might think. We know how challenging this can be, and understanding how your deposit shapes mortgage terms can make a big difference in your financial well-being. When considering a mortgage, it’s important to ask what’s a good down payment for a house, as a larger initial contribution usually means a lower loan-to-value (LTV) ratio, which can lead to better interest rates and lower monthly payments. For instance, if you’re considering what’s a good down payment for a house and can put down 20% or more, you not only avoid private mortgage insurance (PMI) but could also save hundreds of dollars each month.

On the flip side, a smaller deposit often requires PMI, which can add to the overall cost of homeownership and stretch your monthly budget. Many first-time buyers wonder, ‘what’s a good down payment for a house?’ as they typically contribute between 8% and 13%, but those who can afford to contribute more often find themselves in a better financial position in the long run. Financial experts emphasize that understanding what’s a good down payment for a house is essential, as a larger initial deposit not only reduces monthly costs but also improves your debt-to-income ratio, making it easier to qualify for future financing. Plus, keeping your LTV ratio at 80% or below is a smart move for securing better interest rates.

If you’re worried about having enough savings, traditional loans offer options with deposits as low as 3% for well-qualified buyers and 5% for others. This flexibility can be a relief for many families. Just remember to factor in closing costs, which can range from 2% to 5% of the property’s value and impact your overall financial situation.

Real-life examples show that buyers who opt for larger upfront contributions often enjoy greater economic stability. They can bypass PMI and benefit from lower interest rates. For instance, in Q3 2025, the average initial contribution for investment properties was 26.7%, highlighting how investors are prioritizing cash reserves and minimizing borrowing costs. This strategic approach can help determine what’s a good down payment for a house and lead to significant savings over time.

As you navigate the mortgage approval process, understanding your eligibility and potential loan amounts based on your financial situation is crucial. We’re here to support you every step of the way, helping you make informed decisions that align with your long-term financial goals.

Conclusion

Understanding the nuances of down payments is crucial for families embarking on the journey of homeownership. We know how challenging this can be, and a well-considered down payment not only influences the immediate affordability of a home but also significantly impacts long-term financial health. By grasping what constitutes a good down payment and how it relates to mortgage terms, families can make informed decisions that align with their financial goals.

Throughout this article, we’ve shared key insights that reveal a surprising trend: while traditional benchmarks suggest a 20% down payment, many first-time buyers are making median contributions of around 9%. This shift opens doors for many families. Various loan programs, like FHA and VA loans, offer lower down payment options, making homeownership more accessible than ever.

Additionally, it’s important to understand the relationship between down payment size and mortgage conditions, such as interest rates and the necessity of private mortgage insurance (PMI). This underscores the importance of strategic financial planning. As the housing market continues to evolve, families should actively explore their down payment options and the implications of their choices.

By prioritizing financial education and seeking guidance from professionals, prospective homeowners can navigate the complexities of the mortgage landscape. Remember, the journey to homeownership is not just about the initial investment; it’s about building a stable foundation for years to come. We’re here to support you every step of the way.

Frequently Asked Questions

What is a down payment in the context of home buying?

A down payment is the initial cash contribution made toward the purchase price of a home, typically provided upfront at closing. It represents a portion of the overall expense and impacts the financial dynamics of your mortgage.

How does the size of a down payment affect mortgage terms?

A larger down payment reduces the amount needed to finance, which can lower loan totals, monthly payments, and improve overall financial well-being. It can also lead to lower interest rates and the possibility of avoiding private mortgage insurance (PMI).

What are the median down payment percentages for first-time and repeat homebuyers in 2024?

In 2024, first-time homebuyers faced a median down payment of about 9%, while repeat buyers averaged around 23%.

What is private mortgage insurance (PMI) and how does it relate to down payments?

PMI is an additional cost that can range from 0.5% to 1% of your mortgage amount, typically required when the down payment is less than 20%. A larger down payment can help you avoid this cost.

Can you provide an example of how a larger down payment can save money?

For instance, putting down 20% on a $396,900 home could save significant money over the life of the loan by eliminating PMI and securing a lower interest rate, compared to a smaller down payment which may lead to higher monthly costs.

What loan programs are available for buyers with limited savings?

There are several loan programs available, including FHA loans that require as little as 3.5% down, VA loans that offer 0% down options, and USDA loans that also provide 0% down options.

Are there additional costs to consider beyond the down payment?

Yes, even with lower down payment options, buyers should consider closing costs and fees that may be associated with the home purchase.

Why is understanding down payment options important for prospective homeowners?

Understanding down payment options is essential as it affects immediate affordability and long-term financial stability, helping buyers make informed financial decisions in an evolving housing market.