Overview

We understand that navigating the world of mortgages can be challenging, especially for military families. The VA loan funding fee is a one-time cost associated with obtaining a VA-backed mortgage. It is calculated as a percentage of the loan amount and varies based on factors such as your military service and down payment size. This fee plays a crucial role in maintaining the self-sufficiency of the VA financing program.

By helping to fund this program, it allows veterans like you to access favorable mortgage conditions without the burden of monthly insurance premiums. This ultimately makes homeownership more accessible for military families. We’re here to support you every step of the way as you explore your options and make informed decisions about your future.

Introduction

Navigating the complexities of homeownership can be particularly daunting for veterans and active-duty service members. We know how challenging this can be, especially when it comes to understanding the intricacies of the VA loan funding fee. This one-time charge, which varies based on several factors, plays a crucial role in making VA-backed mortgages accessible and affordable.

However, many families remain unaware of the potential financial relief available through exemptions and the opportunity to roll the fee into their mortgage. It’s essential to recognize these options, as they can significantly ease the financial burden.

So, how can veterans and their families unlock the full benefits of the VA loan funding fee while avoiding common pitfalls in the home buying process? We’re here to support you every step of the way, guiding you through the resources and strategies that can help you achieve your homeownership dreams.

Define the VA Loan Funding Fee

Navigating the home buying process can be challenging, especially for veterans, active-duty service members, and certain surviving spouses. One important aspect to consider is the VA loan funding fee, a one-time cost associated with obtaining a VA-backed mortgage. This fee, determined as a percentage of the total loan amount, varies based on several factors, including the type of loan, the borrower’s military service background, and the size of the initial deposit.

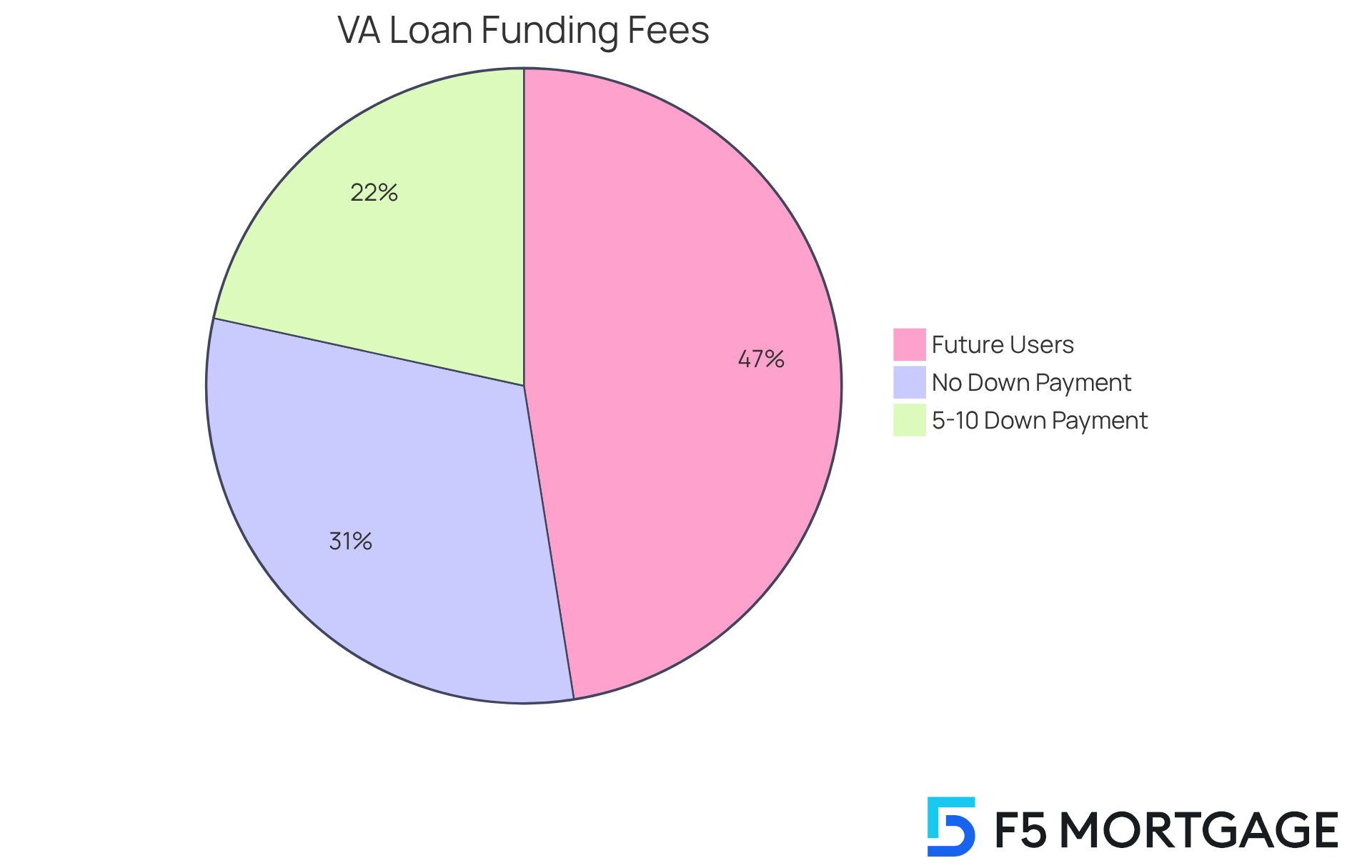

For instance:

- First-time borrowers without a down payment typically face a fee of 2.15%.

- Those who contribute a down payment of 5% to 10% benefit from a reduced charge of 1.5%.

- Future users may encounter higher fees, such as 3.3% for cash-out refinances.

Understanding the VA loan funding fee is crucial, as it can significantly impact the overall costs and affordability of the loan.

We understand how overwhelming this can be for families. However, there is good news: veterans may qualify for an exemption from the financial charge, offering additional monetary relief. Moreover, borrowers can choose to roll the VA loan funding fee into their mortgage, which can help manage upfront costs and make the process a bit easier.

At F5 Mortgage, we’re here to support you every step of the way. Families can explore various refinancing options, including the VA Interest Rate Reduction Refinance Loan (IRRRL) and cash-out refinancing. These options not only provide access to home equity but also allow you to tailor your mortgage solutions to meet your unique needs.

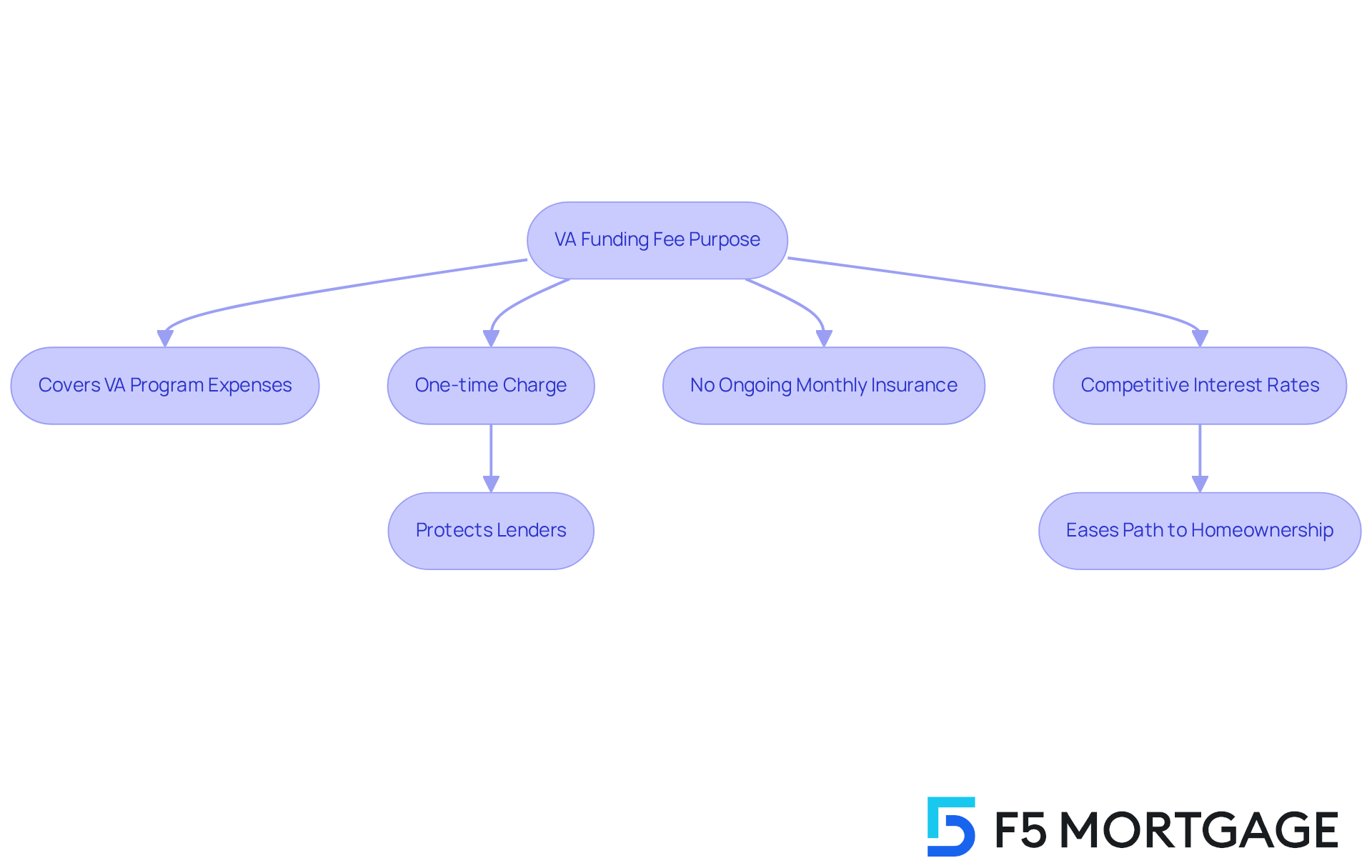

Explain the Purpose of the VA Funding Fee

The VA loan funding fee plays a vital role in making homeownership more accessible for veterans and their families. Its main aim is to help cover the expenses of the VA financing program, including the VA loan funding fee, to ensure it remains self-sufficient. Unlike traditional financing options that often require private mortgage insurance (PMI), VA programs stand out by not imposing ongoing monthly insurance premiums. Instead, the VA loan funding fee serves as a one-time charge that helps protect lenders from potential losses in case of default.

This unique arrangement allows the VA to offer favorable financing conditions, such as no initial cost and the VA loan funding fee, along with competitive interest rates. These benefits can significantly ease the path to homeownership for those who have served our country. However, it’s essential for applicants to verify that the property they wish to purchase aligns with the program’s location specifications, as some assistance programs are specific to certain areas. For veterans, first responders, and educators, understanding these requirements can open doors to additional support.

Once your application is approved, it’s crucial to lock in your mortgage rate. This step safeguards you against market fluctuations during the processing period, ensuring you secure the best possible terms. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

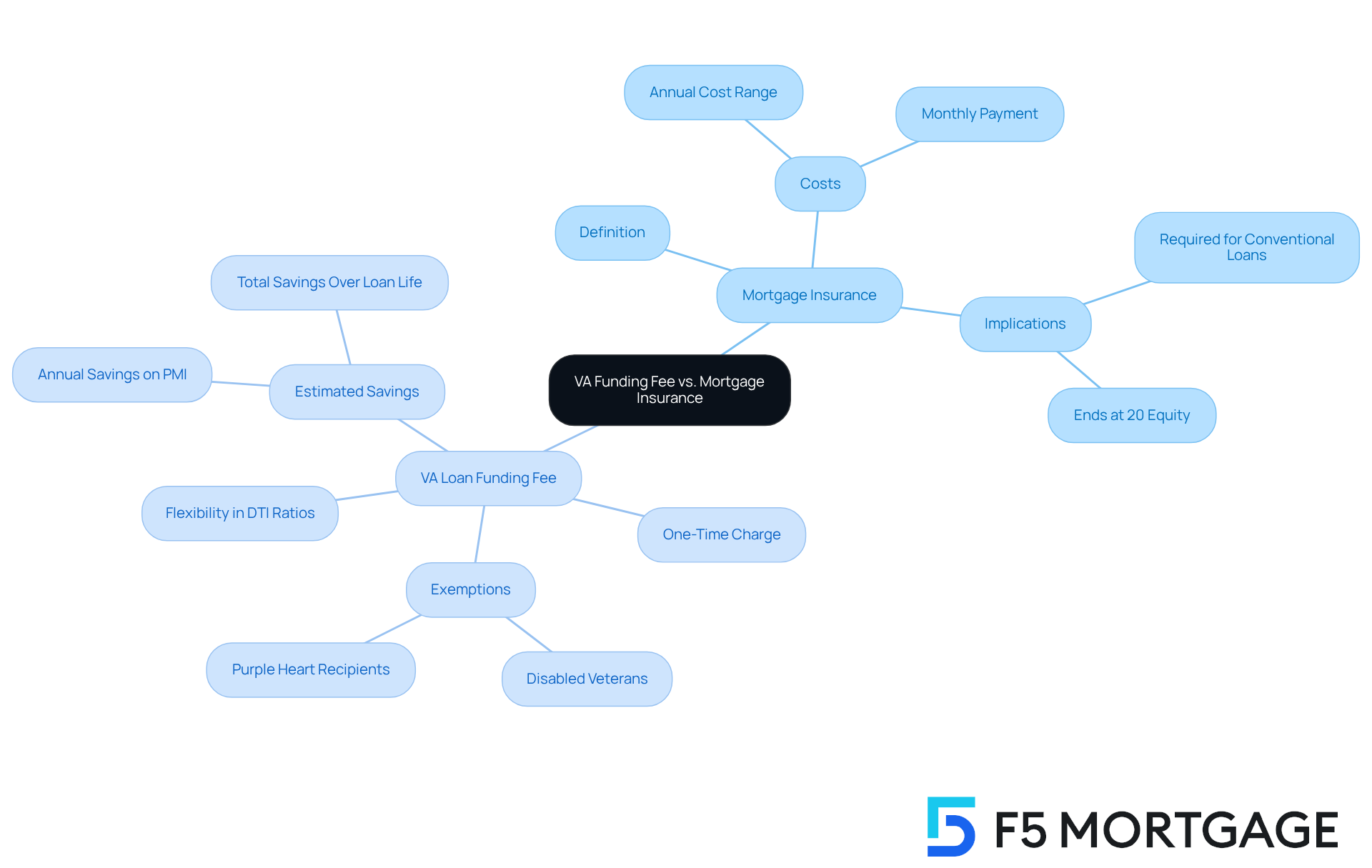

Differentiate Between VA Funding Fee and Mortgage Insurance

Navigating the home financing landscape can be challenging, and understanding the differences between mortgage insurance and the VA loan funding fee is crucial. Mortgage insurance typically comes into play with conventional financing when a borrower makes a down payment of less than 20%. This insurance protects the lender in the event of a default and is paid monthly as part of the mortgage payment.

On the other hand, the VA loan funding fee is a one-time charge that you pay at closing when opting for VA financing. While most VA mortgage borrowers are required to pay the VA loan funding fee, certain military service members and veterans may qualify for exemptions. It’s important to note that the VA loan funding fee helps maintain the VA financing program, rather than serving as insurance for the lender. One of the most significant advantages of VA financing is that it does not require monthly mortgage insurance, which can lead to substantial savings for you.

For instance, if you secure a VA mortgage on a $200,000 home, you could save between $600 and $2,300 each year in insurance costs. VA estimates suggest that Veterans who obtained a VA mortgage last year will save over $40 billion in private mortgage expenses throughout the life of their loans. This is a remarkable benefit that can ease financial burdens.

Additionally, VA financing offers flexibility in debt-to-income (DTI) ratios, making it more accessible for families. You can also negotiate with sellers to cover some or all of the VA service charge as a concession, further enhancing the financial benefits of choosing a VA option over traditional alternatives. If it’s your first time using a VA loan with a down payment of less than 5%, the VA loan funding fee is set at 2.15%. We’re here to support you every step of the way as you explore your options.

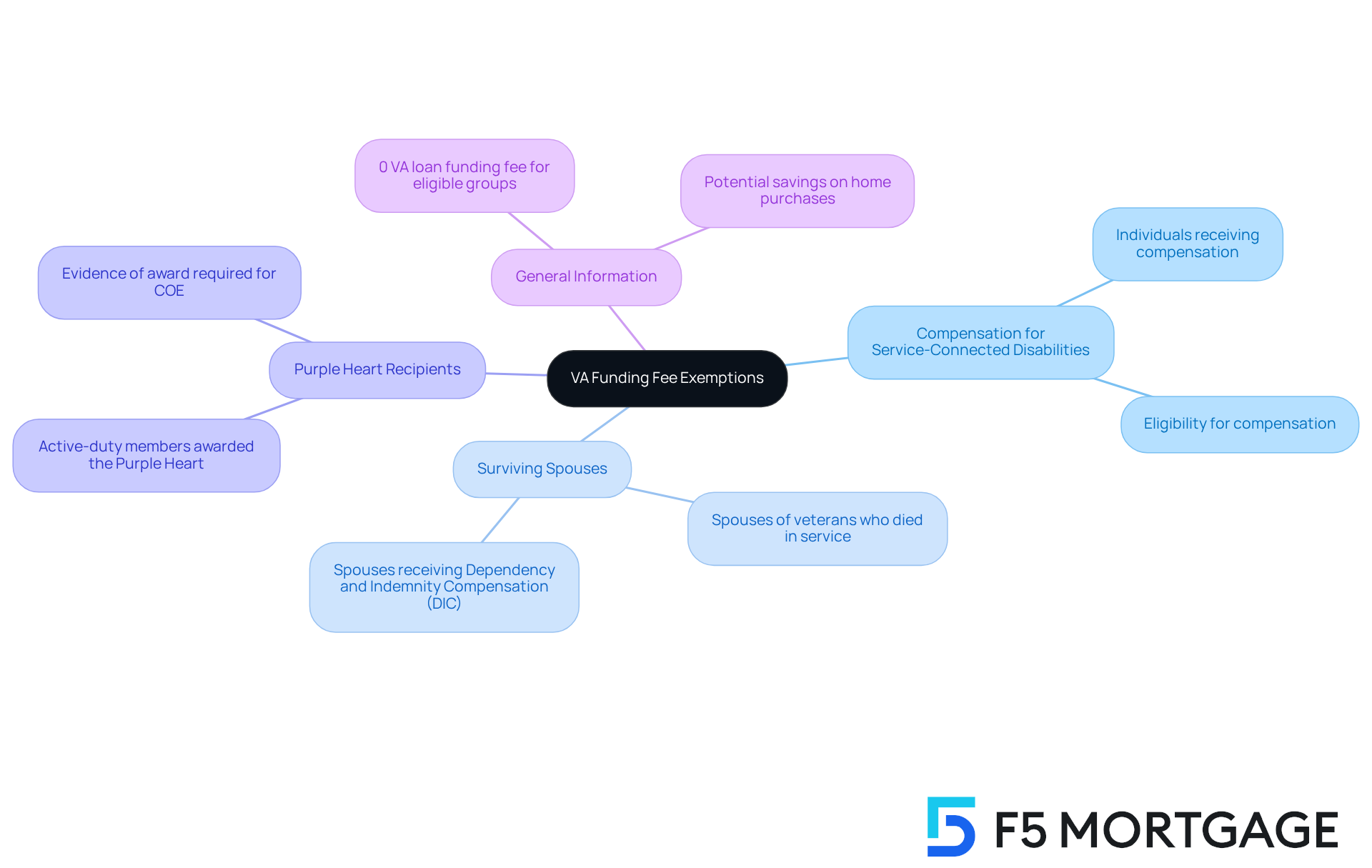

Identify VA Funding Fee Exemptions

Certain veterans and service members are exempt from paying the VA loan funding fee, which can significantly lower the overall expense of securing a VA mortgage. We know how challenging navigating these financial aspects can be, and understanding these exemptions is crucial for eligible borrowers. Exemptions apply to:

- Individuals receiving compensation for service-connected disabilities

- Those eligible for such compensation

- Surviving spouses of veterans who died in service or from a service-related disability

- Veterans awarded the Purple Heart (they must provide evidence of their award when requesting the VA Certificate of Eligibility (COE))

For many, like Maria, a surviving spouse, these exemptions can lead to substantial savings. Maria saved over $5,000 on her home purchase due to her exemption, allowing her to allocate funds towards moving costs and home improvements. Current statistics indicate that many veterans benefit from these exemptions, yet a significant number of eligible borrowers remain unaware of their status. Surviving spouses who meet the criteria for the exemption pay a 0% VA loan funding fee across all financing types.

By inquiring about their exemption eligibility when applying for financing, veterans can ensure they maximize their financial advantages. We’re here to support you every step of the way, helping you make informed decisions regarding your home funding options.

Detail How the VA Funding Fee is Calculated

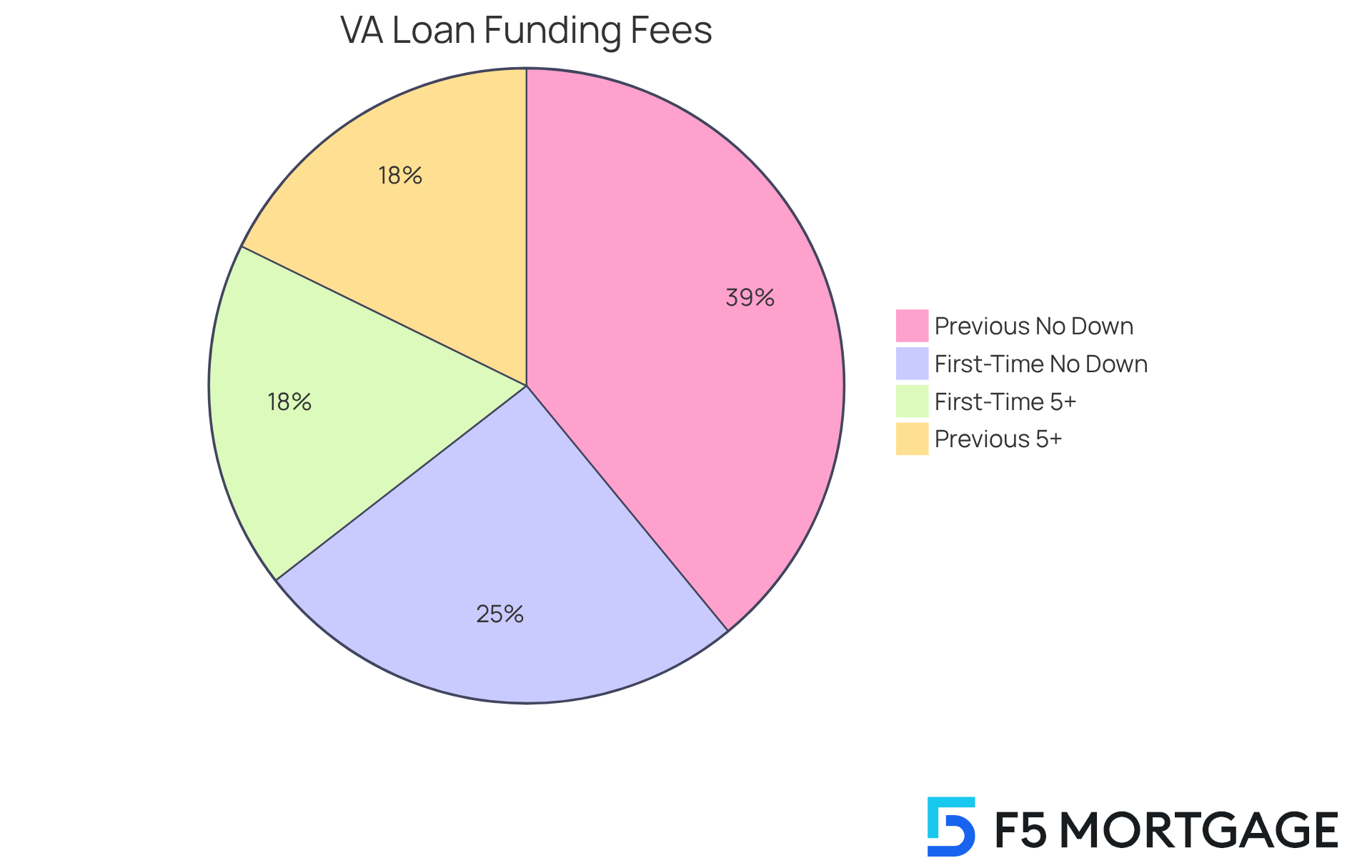

Navigating the VA financing process can feel overwhelming, but understanding the VA loan funding fee is a crucial step. The VA loan funding fee is determined as a percentage of the total loan amount, and it varies based on several factors. For instance, if you’re a first-time borrower without a down payment, you might face a fee of 2.15%. However, if you can provide a down payment of 5% or more, that fee is reduced to 1.5%.

If you’ve previously used your VA loan benefit, the fee increases significantly, ranging from 3.3% for no down payment to 1.5% for larger down payments. It’s important to note that veterans who receive or qualify for compensation due to a service-connected disability may be exempt from the VA loan funding fee, which can significantly ease your financial burden.

You have options when it comes to paying this fee. You can choose to pay the VA loan funding fee upfront at closing or roll it into your total loan amount. While financing the fee can lower your initial costs, it may lead to higher monthly payments and increased overall interest over time. Additionally, you can ask the seller to cover the funding fee, providing another way to manage your expenses.

We understand how complex this can be for families exploring the VA loan landscape. At F5 Mortgage, we offer various refinancing options, including conventional and FHA loans, that may provide competitive rates and personalized service tailored to your needs. We’re here to support you every step of the way.

Conclusion

Understanding the VA loan funding fee is essential for veterans, active-duty service members, and their families as they navigate the home buying process. This one-time fee, which varies based on several factors including loan type and military service history, plays a critical role in making homeownership more accessible by supporting the VA financing program. By providing favorable terms without the burden of monthly mortgage insurance, the VA loan funding fee helps veterans secure homes with greater ease and affordability.

Key insights from this article highlight the various fee percentages based on down payment contributions. We know how challenging it can be to understand these details, especially when considering exemptions for eligible borrowers. Importantly, this fee differs fundamentally from traditional mortgage insurance. The VA funding fee not only protects lenders but also significantly reduces the overall cost of home financing for veterans, allowing them to save thousands over the life of their loans. Additionally, options like rolling the fee into the mortgage or negotiating with sellers further enhance the financial benefits of VA loans.

Ultimately, the significance of the VA loan funding fee cannot be overstated. It serves as a vital tool in facilitating homeownership for those who have served the country. By being informed about the funding fee, its exemptions, and the calculation methods, veterans and their families can make empowered decisions that align with their financial goals. Exploring available resources and seeking guidance can pave the way for a smoother home buying experience and greater financial security. We’re here to support you every step of the way.

Frequently Asked Questions

What is the VA loan funding fee?

The VA loan funding fee is a one-time cost associated with obtaining a VA-backed mortgage, determined as a percentage of the total loan amount. It varies based on factors such as the type of loan, the borrower’s military service background, and the size of the initial deposit.

How much is the VA loan funding fee for first-time borrowers without a down payment?

First-time borrowers without a down payment typically face a fee of 2.15%.

Is there a reduced fee for borrowers who make a down payment?

Yes, borrowers who contribute a down payment of 5% to 10% benefit from a reduced fee of 1.5%.

What are the fees for future users and cash-out refinances?

Future users may encounter higher fees, such as 3.3% for cash-out refinances.

Can veterans be exempt from the VA loan funding fee?

Yes, veterans may qualify for an exemption from the funding fee, providing additional monetary relief.

Can the VA loan funding fee be rolled into the mortgage?

Yes, borrowers can choose to roll the VA loan funding fee into their mortgage to help manage upfront costs.

What is the purpose of the VA funding fee?

The VA funding fee helps cover the expenses of the VA financing program, ensuring it remains self-sufficient and protecting lenders from potential losses in case of default.

How does the VA loan funding fee differ from traditional financing options?

Unlike traditional financing that often requires private mortgage insurance (PMI), the VA loan funding fee is a one-time charge without ongoing monthly insurance premiums.

What benefits does the VA loan provide?

The VA loan offers favorable financing conditions, such as no initial cost and competitive interest rates, making homeownership more accessible for veterans and their families.

What should applicants verify regarding the property they wish to purchase?

Applicants should verify that the property aligns with the program’s location specifications, as some assistance programs are specific to certain areas.