Overview

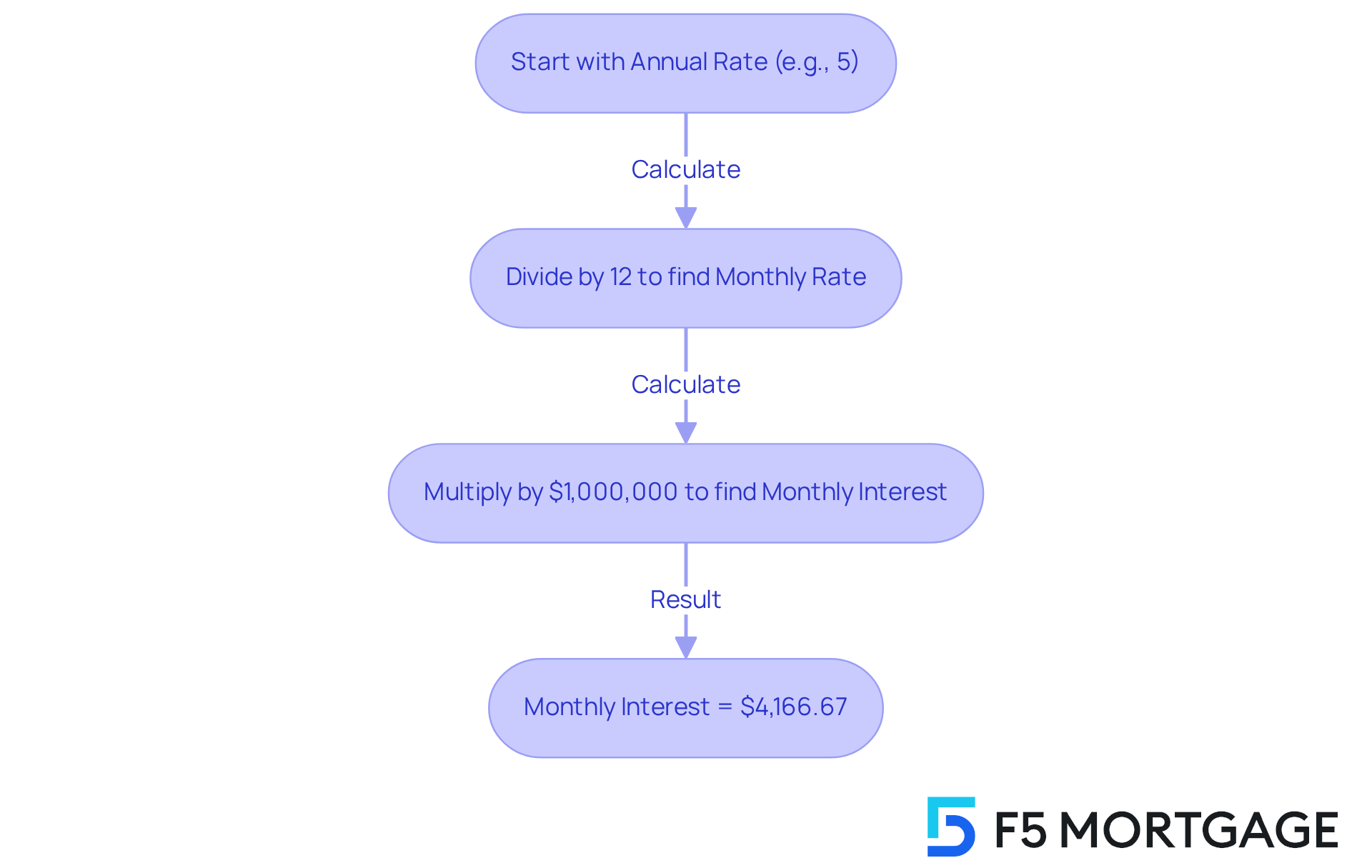

Understanding the monthly interest on $1,000,000 can feel daunting, but we’re here to support you every step of the way. By applying the annual interest rate to the principal, you can gain clarity. For instance, at a 5% annual rate, the monthly interest would be approximately $4,166.67. This simple calculation is essential for your financial planning.

We know how challenging it can be to navigate financial decisions. Understanding your earnings empowers you to make informed investment choices. Consider various factors like:

- Market conditions

- Investment types

With the right knowledge, you can confidently approach your financial future.

Introduction

Understanding the monthly interest on a substantial sum like $1,000,000 is not just a number; it’s a crucial aspect of your financial journey. We know how challenging this can be, and recognizing this figure can significantly impact your investment strategies and borrowing decisions. It reflects potential earnings and serves as a guide for making informed choices in an ever-changing economic landscape.

However, various factors influence interest rates—from market conditions to investment types. Navigating this complex terrain may feel overwhelming, but you’re not alone. We’re here to support you every step of the way as you explore how to maximize your returns and make confident financial decisions.

Define Monthly Interest on $1 Million

For anyone navigating financial decisions, understanding what is the monthly interest on $1,000,000 is essential. This figure represents the money gained or paid in returns over a month, based on the annual percentage applied to the principal sum. For example, if your investment yields an annual return rate of 5%, you can determine what is the monthly interest on $1,000,000 by dividing that rate by 12 and multiplying it by your principal. In this case, the monthly charge would be approximately $4,166.67.

We know how challenging financial planning can be, whether you are an investor or a borrower. This understanding is crucial, as it directly influences your strategies for allocating resources. By grasping this concept, you can better prepare for your financial future and make informed decisions that align with your goals. Remember, we’re here to support you every step of the way.

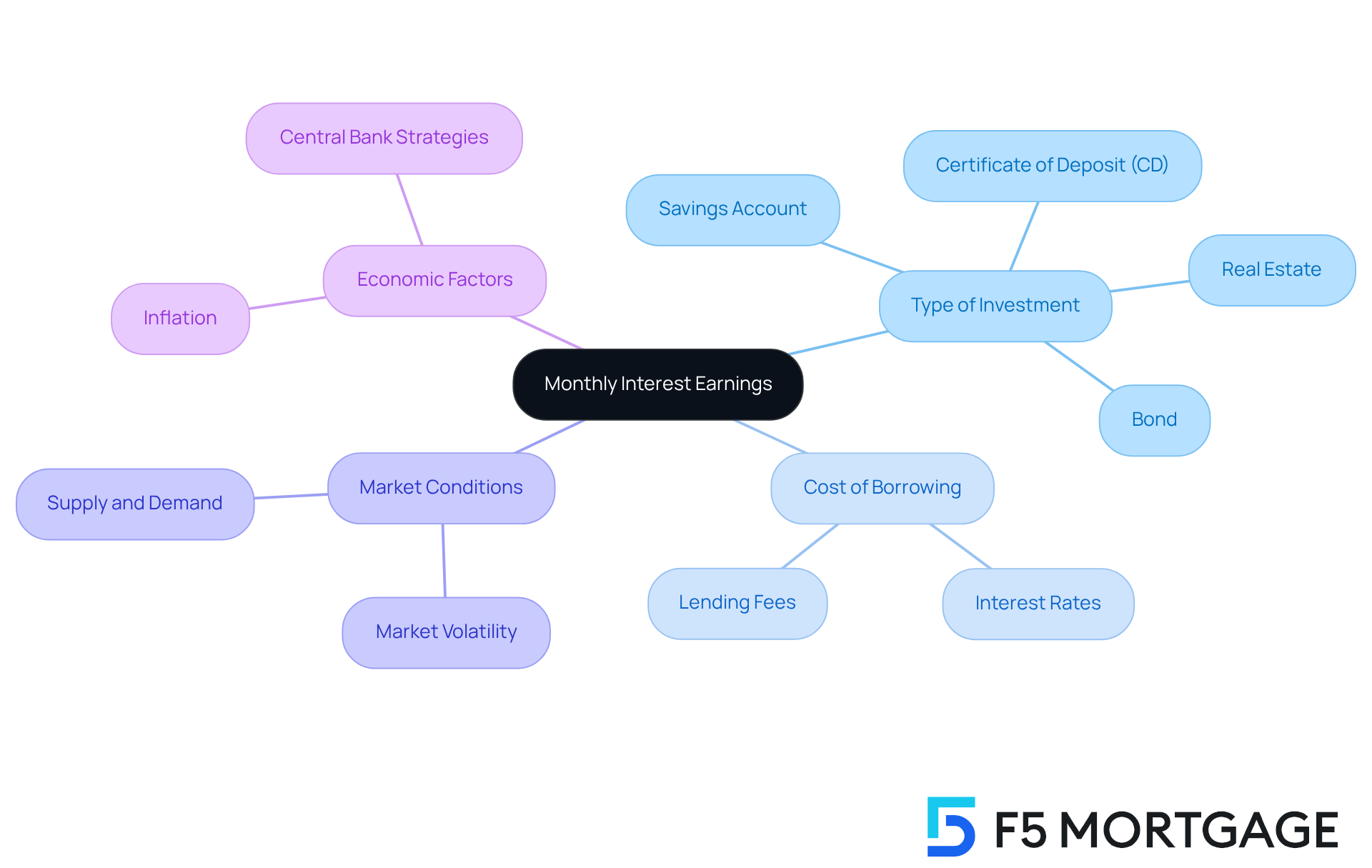

Explore Factors Affecting Monthly Interest Earnings

Understanding what is the monthly interest on $1,000,000 can feel overwhelming, but we’re here to support you every step of the way. Various elements can influence these earnings, and recognizing them is essential for making informed decisions. Factors like the cost of borrowing can fluctuate based on market conditions, while the type of investment—be it a savings account, bond, or real estate—plays a significant role. For instance, a high-yield savings account may offer a different return compared to a certificate of deposit (CD) or a bond.

Moreover, economic factors such as inflation and central bank strategies can impact lending costs, which in turn affects your overall earnings. We know how challenging this can be, but understanding these influences is crucial for maximizing your returns. By staying informed and aware of how these elements interact, you can make empowered investment choices that align with your financial goals.

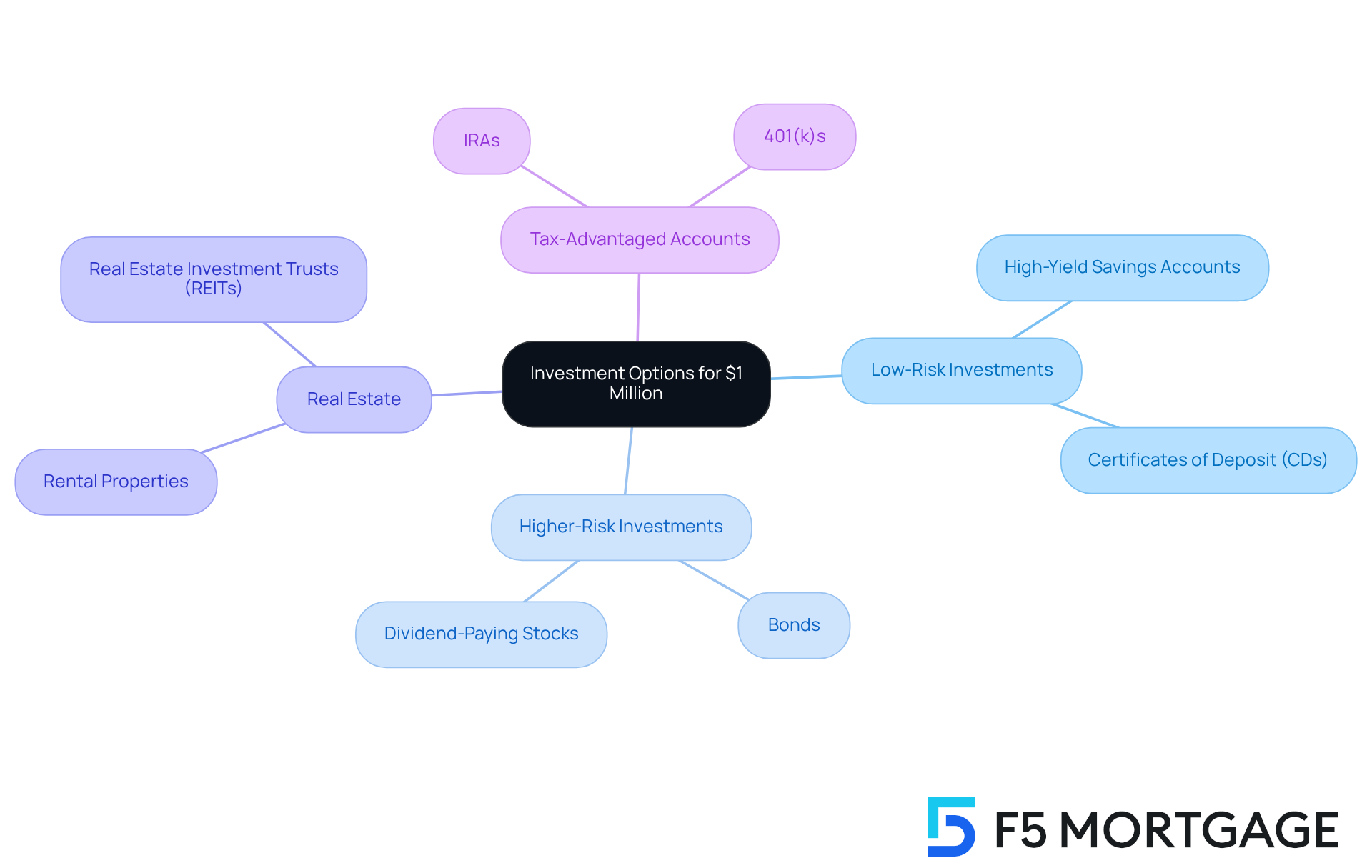

Review Investment Options for Maximizing Interest on $1 Million

When it comes to maximizing interest earnings on $1 million, we often ask what is the monthly interest on $1,000,000, and we understand how overwhelming the options can feel. High-yield savings accounts and CDs are often solid choices, offering competitive rates with low risk. If you’re open to taking on a bit more risk, consider investing in bonds or dividend-paying stocks, which can provide higher returns.

Real estate can also be a fruitful avenue. Whether it’s rental properties or real estate investment trusts (REITs), these options can generate substantial monthly income through rental payments. Additionally, exploring tax-advantaged accounts like IRAs or 401(k)s can significantly enhance your overall returns by minimizing tax liabilities.

It’s important to remember that each option carries its own risk and return profile. We know how challenging this can be, so take the time to assess your financial goals and risk tolerance. By doing so, you can make informed decisions that align with your unique situation.

Understand Tax Implications on Interest Income

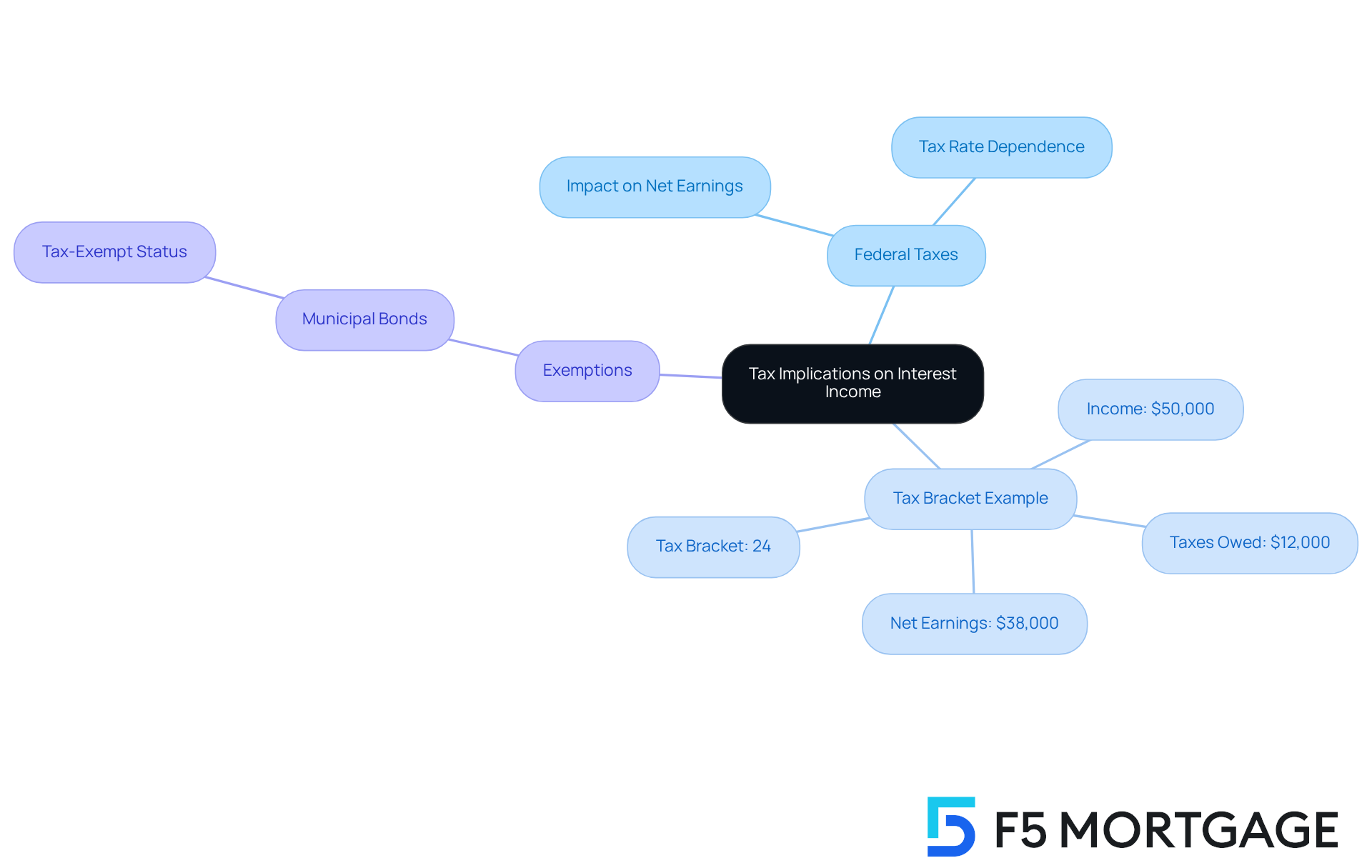

Interest income can often feel overwhelming, especially when considering federal income tax, which might significantly diminish your net earnings from investments. We understand how challenging this can be. The tax rate you face will depend on your overall income and tax bracket. For example, if you earn $50,000 and find yourself in the 24% bracket, you would owe approximately $12,000 in taxes, leaving you with $38,000 in net earnings.

However, there’s a silver lining. Certain types of interest, like that from municipal bonds, may be exempt from federal taxes. This is important to keep in mind as you navigate your financial journey. Understanding these tax implications is crucial for effective financial planning and maximizing your after-tax returns. We’re here to support you every step of the way.

Conclusion

Understanding the monthly interest on $1,000,000 is crucial for your financial planning. We know how challenging it can be to navigate investment strategies and resource allocation. This figure, derived from the annual percentage rate applied to the principal amount, plays a significant role in shaping your financial future. By learning how to calculate this interest and recognizing the factors that influence it, you can make informed choices that align with your financial goals.

Let’s explore the components that impact your monthly interest earnings. The type of investment, market conditions, and economic factors like inflation all play a part. It’s important to select the right investment vehicles—whether high-yield savings accounts, bonds, or real estate—to optimize your returns. Additionally, understanding the tax implications of interest income can significantly enhance your net earnings, allowing for more effective financial planning.

In conclusion, navigating the complexities of monthly interest on large sums like $1,000,000 requires a comprehensive understanding of various influencing factors and investment strategies. By staying informed and proactive, you can maximize your interest income while minimizing risks and tax liabilities. This knowledge not only empowers better financial decision-making but also paves the way for a more secure financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What does the monthly interest on $1,000,000 represent?

The monthly interest on $1,000,000 represents the money gained or paid in returns over a month, based on the annual percentage applied to the principal sum.

How can I calculate the monthly interest on $1,000,000?

To calculate the monthly interest, divide the annual interest rate by 12 and multiply it by the principal amount of $1,000,000.

What is an example of calculating monthly interest on $1,000,000?

If the annual return rate is 5%, the monthly interest would be calculated as (5% / 12) * $1,000,000, resulting in approximately $4,166.67.

Why is understanding monthly interest important for financial planning?

Understanding monthly interest is crucial as it directly influences strategies for allocating resources and helps individuals prepare for their financial future and make informed decisions.