Overview

Monthly Income Plans (MIPs) are mutual funds thoughtfully designed to provide a steady stream of income through regular distributions. They primarily appeal to conservative investors, especially retirees, who seek financial peace of mind. We understand how important it is to have reliable cash flow during retirement.

MIPs typically allocate 70% to 80% of their assets in lower-risk debt securities. This strategy not only ensures capital preservation but also offers potential returns of 10% to 12%. For those looking for financial stability, MIPs can be a strategic choice that aligns with your needs.

If you’re navigating your financial future, considering MIPs might be a step towards achieving the security you desire. We’re here to support you every step of the way as you explore your options.

Introduction

We know how challenging financial planning can be, especially when it comes to securing a reliable income stream. Monthly Income Plans (MIPs) offer a strategic solution for those seeking stability, particularly retirees and conservative investors. These investment vehicles promise not only potential returns but also a blend of liquidity and tax benefits, making them an appealing choice for many.

However, with various strategies and market conditions influencing performance, how can you navigate the complexities of MIPs? It’s essential to ensure they align with your personal financial goals. By understanding these intricacies, you can take empowered steps toward a more secure financial future.

Define Monthly Income Plans (MIPs)

What is MIP? A Monthly Income Plan (MIP) is a type of mutual fund that is designed to provide you with a steady stream of earnings through regular distributions, often in the form of dividends or interest. These typically allocate funds between debt and equity securities, focusing on preserving your capital while generating cash flows. For those who are cautious about their investments, like retirees, a significant portion of the portfolio is usually directed toward lower-risk securities, making these options particularly appealing.

Generally, the asset distribution in mutual investment plans ranges from 70% to 80% in debt securities and 20% to 30% in stocks, depending on the specific strategy of the fund. You have two choices with these plans:

- The Growth Option, where earnings are reinvested,

- The Dividend Option, which provides regular distributions that are not guaranteed and depend on the fund’s performance.

These financial instruments are also known for their considerable liquidity, allowing you to access your funds with relative ease. They can offer returns between 10% to 12%, making them a competitive alternative to traditional savings options. Additionally, these investment products may provide potential tax advantages, which can further enhance their appeal for those investing.

It’s crucial for you to [consider your personal needs](https://canarahsbclife.com/blog/saving-plan/what-is-a-monthly-income-plan-and-how-is-it-beneficial) and any tax implications when evaluating these investment products. Also, keep in mind the impact of interest rate fluctuations on the net asset values (NAVs) of these funds. In India, what is mip refers to Mutual Investment Plans, which are particularly favored as an essential investment choice for retirees and those seeking reliable income. We understand how important it is to make informed decisions, and we’re here to support you every step of the way.

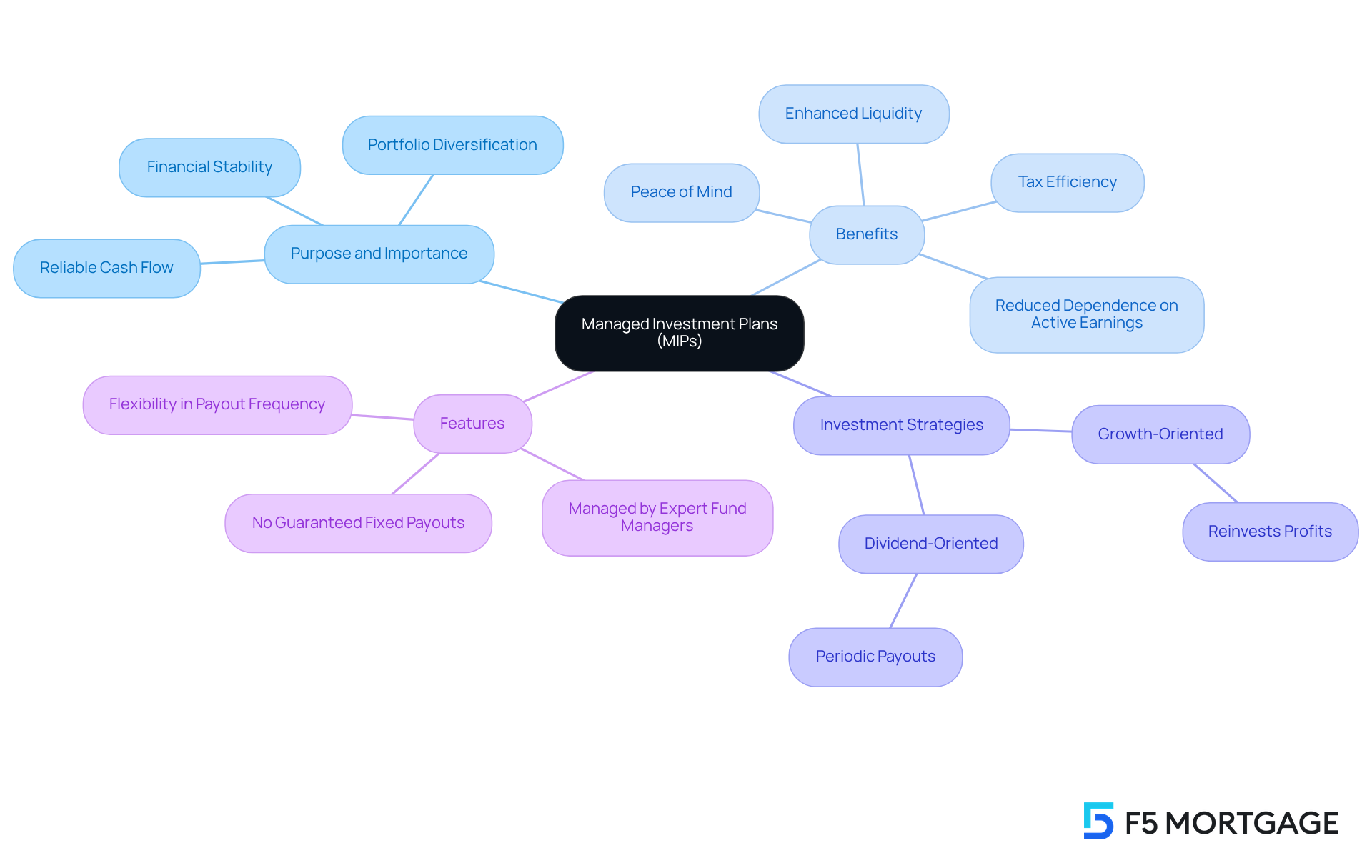

Understand the Purpose and Importance of MIPs

Monthly Revenue Plans are designed to provide a reliable cash flow, making them especially beneficial for individuals with limited revenue sources, such as retirees. We understand how challenging it can be to manage daily expenses and meet essential financial commitments like rent and bills. These plans can significantly reduce dependence on active earnings, offering peace of mind. Additionally, they serve as a strategic investment choice, allowing for portfolio diversification that balances risk and reward while preserving liquidity. Their dual ability to generate revenue and preserve capital makes these investment products an ideal option for conservative investors seeking stability.

For instance, retirees utilizing managed investment plans often report increased financial stability. These arrangements can provide a steady cash flow that supports their lifestyle without depleting savings. Research indicates that retirees with around $3,000 in safeguarded earnings each month experience substantial satisfaction, highlighting what is mip plans in achieving financial peace of mind. Furthermore, managed investment portfolios are overseen by skilled fund managers who make informed investment decisions, ensuring that resources are allocated wisely to mitigate risk while maximizing potential returns. These investment products also offer enhanced liquidity and tax efficiency compared to other fixed income instruments, making them even more appealing for retirees and conservative investors.

Investment plans can be categorized into growth-oriented and dividend-oriented strategies, offering choices that align with various financial goals. Growth-oriented plans reinvest profits into the investment corpus, while dividend-oriented plans provide periodic payouts, which can be selected monthly, quarterly, semi-annually, or annually. It’s important to note that managed investment plans do not guarantee fixed dividend payouts, as dividends depend on fund performance and available cash. This combination of features makes this approach a for those looking to secure their financial future.

Explore Investment Options in Monthly Income Plans

To understand what is mip, it’s important to know that Monthly Income Plans (MIPs) are thoughtfully designed to help you invest in a diversified portfolio that combines both debt and equity securities. The debt component typically includes government bonds, corporate bonds, and fixed deposits, providing a stable foundation and consistent interest returns that you can rely on. On the other hand, the equity portion may consist of dividend-paying stocks, offering the potential for capital appreciation and additional income streams.

We understand that the level of equity exposure in managed investment plans is limited to help mitigate price fluctuations. It’s also important to note that changes in interest rates can affect their net asset values (NAVs). This balanced investment strategy allows managed investment portfolios to generate consistent cash flows while effectively managing risk, giving you peace of mind.

However, it’s crucial to remember what is mip, as Managed Investment Plans do not guarantee a monthly return; earnings may vary based on market conditions. You can choose from a range of tailored to your risk tolerance, investment timeline, and revenue needs, making these strategies adaptable financial tools suitable for various financial objectives.

Additionally, short-term capital gains from managed investment plans are taxed at your standard tax rate for assets held under 12 months. The details provided about the plans are for your reference only, and we encourage you to check the insurer’s website for updates. We’re here to support you every step of the way as you navigate your investment journey.

Examine Tax Considerations for MIPs

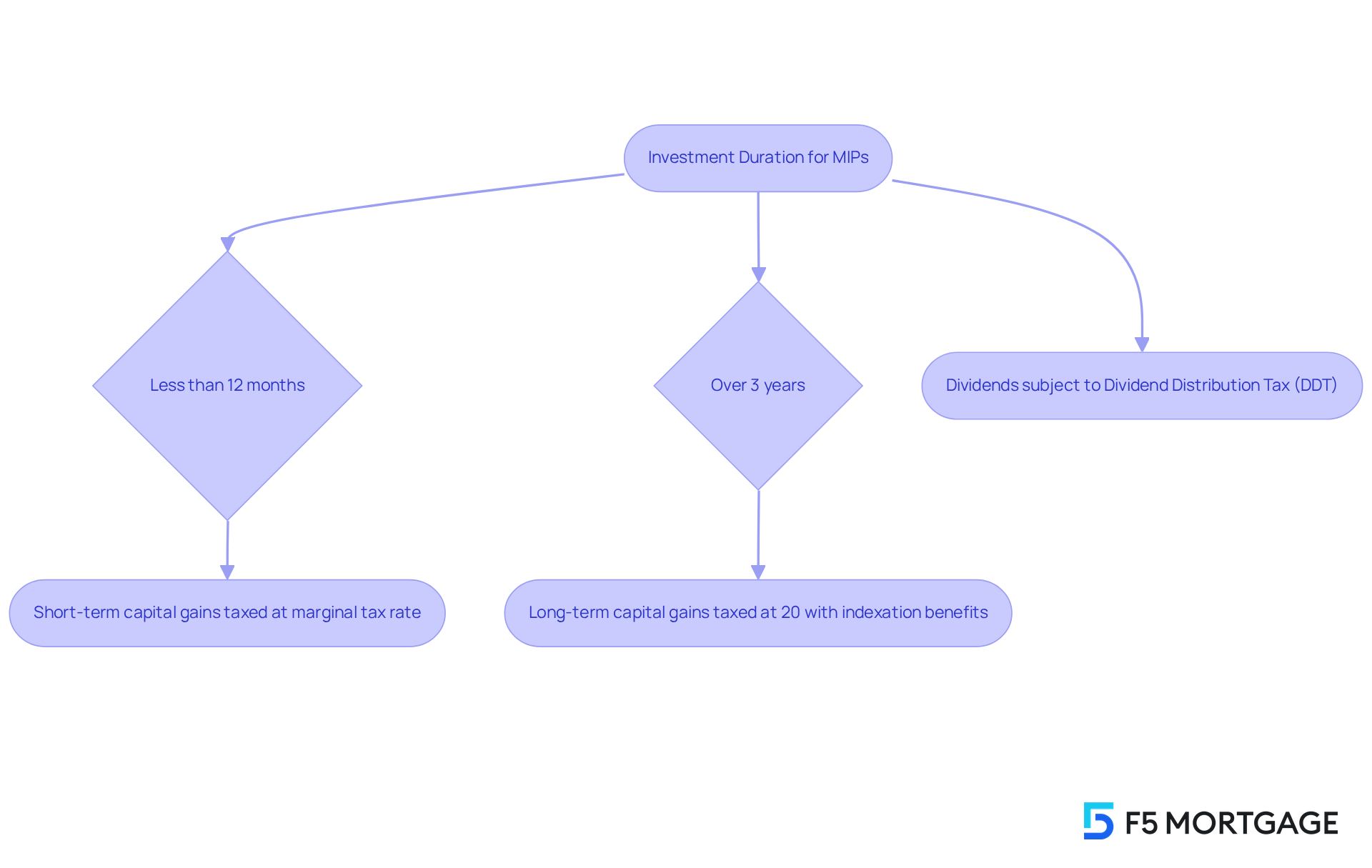

Understanding what is mip in relation to the can feel overwhelming, especially when considering how your investment duration and the type of earnings generated can impact your finances. Market-linked investments are classified as debt mutual funds for tax purposes. This means that:

- If you hold your investments for less than 12 months, short-term capital gains will be taxed at your marginal tax rate.

- If you can hold your investments for over three years, you’ll benefit from a reduced long-term capital gains tax rate of 20%, along with indexation benefits that can enhance your returns even further.

Additionally, it’s important to note that dividends from mutual investment portfolios come from the distributable surplus of the Asset Management Company (AMC) and are subject to dividend distribution tax (DDT). This can affect your overall returns, so being aware of these tax consequences is crucial. We know how challenging this can be, especially for retirees and those seeking consistent earnings. By grasping these elements, you can enhance your investment strategies and increase your after-tax returns.

For example, consider holding your mutual investment plans for longer periods to take advantage of the lower long-term capital gains tax rates. This approach can significantly improve your net returns. We’re here to support you every step of the way. Consulting with a tax professional can provide you with tailored strategies to navigate these considerations effectively. Before investing in MIPs, it’s important to understand what is mip, as this will help you assess your income needs and risk tolerance, ensuring that your investment aligns with your financial goals.

Conclusion

Monthly Income Plans (MIPs) are more than just a financial tool; they are a lifeline for those seeking a reliable income stream while safeguarding their hard-earned capital. By blending both debt and equity securities, these mutual funds cater to conservative investors, particularly retirees. We understand how crucial it is for you to have stability and a consistent cash flow to manage your expenses. The flexibility to choose between growth and dividend options allows you to customize your strategy to fit your unique financial needs.

This article explores the structure and benefits of MIPs, shedding light on their asset allocation, liquidity, and potential tax advantages. It’s essential to grasp your individual investment goals and recognize how interest rate fluctuations can impact your returns. We also discuss the tax implications associated with these plans, highlighting the importance of careful planning to maximize your net gains.

In conclusion, Monthly Income Plans present a compelling investment option for those who wish to secure their financial future with minimal risk. By understanding the intricacies of MIPs—from their structure to their tax implications—you empower yourself to make informed decisions that align with your long-term financial objectives. Embracing these plans can lead to enhanced financial stability and peace of mind, making them a valuable addition to your investment portfolio. Remember, we’re here to support you every step of the way as you navigate your financial journey.

Frequently Asked Questions

What is a Monthly Income Plan (MIP)?

A Monthly Income Plan (MIP) is a type of mutual fund designed to provide a steady stream of earnings through regular distributions, often in the form of dividends or interest.

How do MIPs allocate funds?

MIPs typically allocate funds between debt and equity securities, focusing on preserving capital while generating cash flows. Generally, the asset distribution ranges from 70% to 80% in debt securities and 20% to 30% in stocks, depending on the fund’s strategy.

What options do investors have with MIPs?

Investors have two choices with MIPs: The Growth Option, where earnings are reinvested, and The Dividend Option, which provides regular distributions that depend on the fund’s performance and are not guaranteed.

What are the liquidity features of MIPs?

MIPs are known for their considerable liquidity, allowing investors to access their funds with relative ease.

What kind of returns can one expect from MIPs?

MIPs can offer returns between 10% to 12%, making them a competitive alternative to traditional savings options.

Are there any tax advantages to investing in MIPs?

Yes, MIPs may provide potential tax advantages, which can enhance their appeal for investors.

What should investors consider when evaluating MIPs?

Investors should consider their personal needs, any tax implications, and the impact of interest rate fluctuations on the net asset values (NAVs) of these funds.

Who typically favors MIPs in India?

MIPs are particularly favored as an essential investment choice for retirees and those seeking reliable income in India.