Overview

Home equity represents the part of your home that you truly own. It’s calculated by taking the current market value of your property and subtracting any remaining mortgage balance. Understanding this concept is crucial for your financial planning.

Many homeowners face significant expenses and investments, and this is where leveraging your home equity can become a valuable tool. However, we know how challenging this can be, and it’s important to approach borrowing against your property with caution. While tapping into your equity can help you achieve your goals, being aware of the potential risks is essential.

Remember, we’re here to support you every step of the way as you navigate these decisions. By recognizing the value of your home equity, you can make informed choices that align with your financial aspirations.

Introduction

Understanding home equity is crucial for homeowners. It represents not just a financial metric but a pathway to leveraging one of their most significant assets. We know how challenging navigating the complexities of the housing market can be. By grasping the concept of equity in a home, individuals can unlock opportunities for renovations, debt consolidation, and strategic investments that can enhance their financial well-being.

However, with growing property values, how can homeowners effectively navigate the risks and rewards associated with their home equity? We’re here to support you every step of the way. Let’s explore how understanding home equity can empower you to make informed decisions for your future.

Define Home Equity: Understanding the Concept

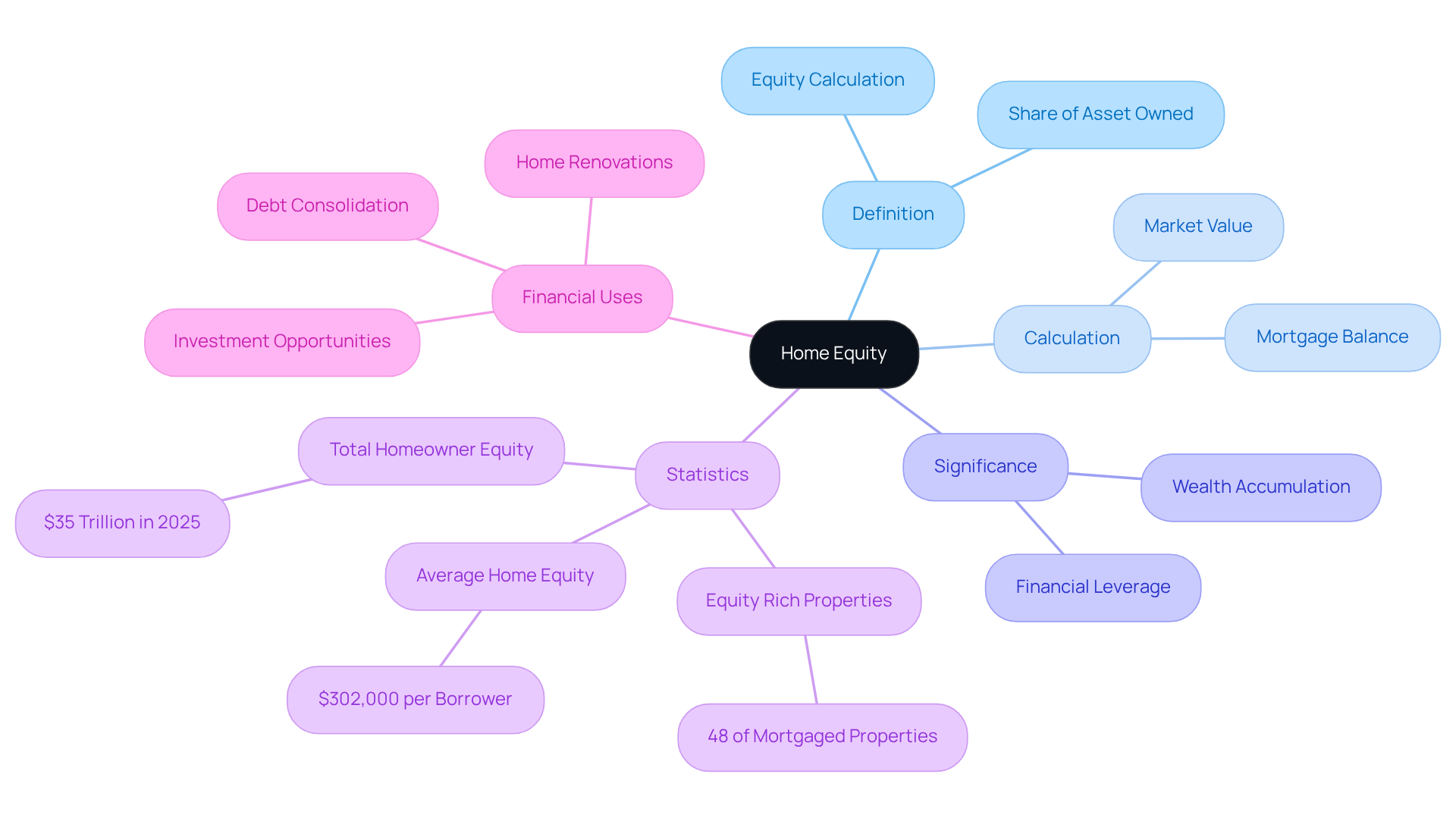

Understanding what is equity in a home is essential for homeowners, as it signifies the share of an asset they fully possess. To understand what is equity in a home, this value is determined by subtracting the remaining mortgage amount from the current market worth of the residence. For instance, if a home is valued at $300,000 and the mortgage balance is $200,000, the owner’s stake amounts to $100,000. Over time, as homeowners make mortgage payments and property values appreciate, they can better understand what is equity in a home, as this monetary investment grows.

We know how challenging it can be to navigate financial decisions, and comprehending property value represents a significant asset. Homeowners can utilize this value for various financial needs, such as renovations, debt consolidation, or investment opportunities. In 2025, the average property owner possesses around $302,000, which raises the question of what is equity in a home, reflecting a strong increase in property prices despite regional differences.

Recent statistics reveal that approximately 48% of mortgaged properties are classified as ‘equity rich,’ which helps explain what is equity in a home, meaning the outstanding loan balance is less than half the property’s value. This trend highlights the importance of monitoring residential value levels, especially in a market where homeowners can access $11.5 trillion in available assets.

Financial advisors emphasize that understanding what is equity in a home is crucial for making informed choices about leveraging property worth. A lender’s consent indicates that, based on the financial details provided, an individual is a strong candidate for a mortgage. This can be vital when considering options like property value loans or refinancing. As noted, ‘Home ownership provides a considerable economic benefit, facilitating wealth accumulation and access to funds.’ By understanding what is equity in a home, homeowners can strategically use their property value to enhance their financial well-being. We’re here to support you every step of the way.

Explore the Importance of Home Equity in Financial Planning

Understanding property value is essential for property owners navigating financial planning. It opens doors to funds through property value loans or lines of credit, which can be instrumental for significant expenses like housing renovations, education, or even debt consolidation. Did you know that as we approach 2025, mortgage-holding property owners are sitting on a remarkable $11 trillion in accessible value? That averages out to about $203,000 per resident, reflecting a growing trend in investing in property enhancements.

Moreover, your residential asset value acts as a safety net during challenging times. It allows you to access resources without the need to sell your home. It’s noteworthy that 41% of property owners have no mortgage obligations, which offers them greater flexibility in tapping into their home’s value during emergencies. As your residential value rises, it significantly boosts your net worth, enhancing financial stability and opening up opportunities for future investments.

A crucial step in understanding what is equity in a home is obtaining a property appraisal. This assessment, requested by your lender, helps evaluate the current market worth of your asset and determines what is equity in a home, which directly influences mortgage rates. Investment advisors often emphasize the thoughtful use of property value, reminding us that each dollar should play a specific role in our overall budget. This makes understanding and managing your residential value vital for achieving lasting financial well-being.

Consider this: utilizing $100,000 in property value can be a smart move for paying off high-interest debt, like credit card balances that often exceed 20% in interest rates. However, it’s important to recognize the potential risks associated with leveraging your home’s value. This strategy turns unsecured debt into secured debt backed by your property, making it suitable only for those confident in their repayment ability to avoid the risk of foreclosure. We know how challenging these decisions can be, and we’re here to support you every step of the way.

Calculate Your Home Equity: Key Components and Methods

Determining property value can feel overwhelming, but to understand what is equity in a home, you simply subtract the total mortgage balance from the current market value of your home. For instance, to understand what is equity in a home, if your property is appraised at $400,000 and the mortgage balance is $250,000, your equity amounts to $150,000. Understanding your home’s market worth is crucial, and you can do this through professional evaluations, researching similar sales in your neighborhood, or using online tools that reflect current market trends.

In 2025, the average property appraisal value in the U.S. has reached approximately $400,000, showing a significant increase in property values over recent years. This increase has allowed property owners to accumulate an average of $315,000 in value, nearly $129,000 more than in 2020. Regularly evaluating your property value is essential, especially before making significant financial decisions or seeking loans. It offers insight into what is equity in a home and how it can be leveraged for property improvements, refinancing, or other investments.

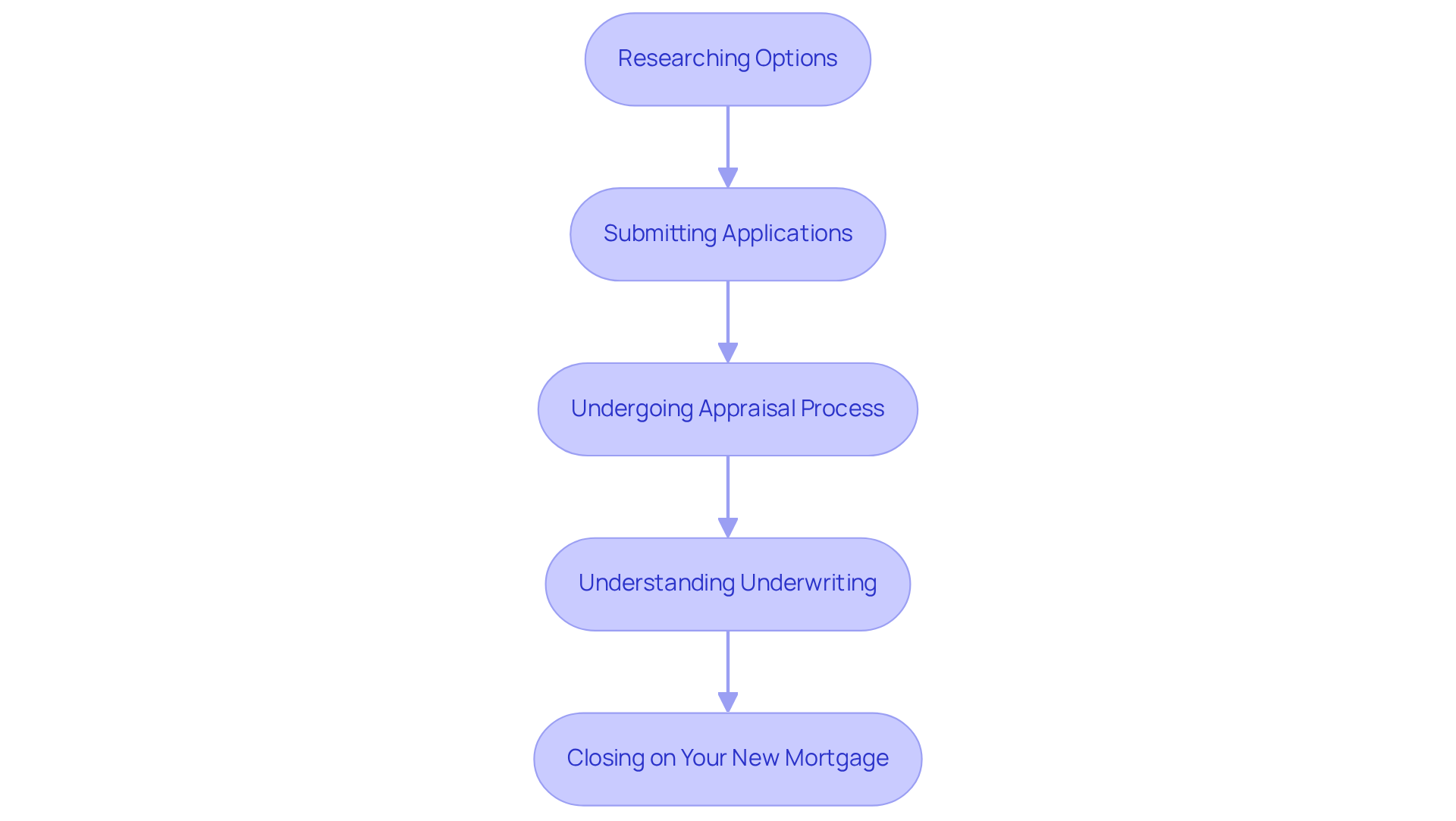

At F5 Mortgage, we understand how important this journey can be for families. That’s why we offer a comprehensive step-by-step guide to mortgage refinancing. This includes:

- Researching options

- Submitting applications

- Undergoing the appraisal process

- Understanding underwriting

- Closing on your new mortgage

We’re here to keep you informed every step of the way.

Additionally, F5 Mortgage provides valuable resources such as a buyer’s guide and refinancing manuals, empowering families to manage their financial choices with confidence. By utilizing cutting-edge technology, we ensure that you obtain the most favorable rates and conditions, making the process of accessing your property value even more seamless. Remember, we know how challenging this can be, and we’re here to support you throughout your refinancing journey.

Assess the Risks and Benefits of Home Equity

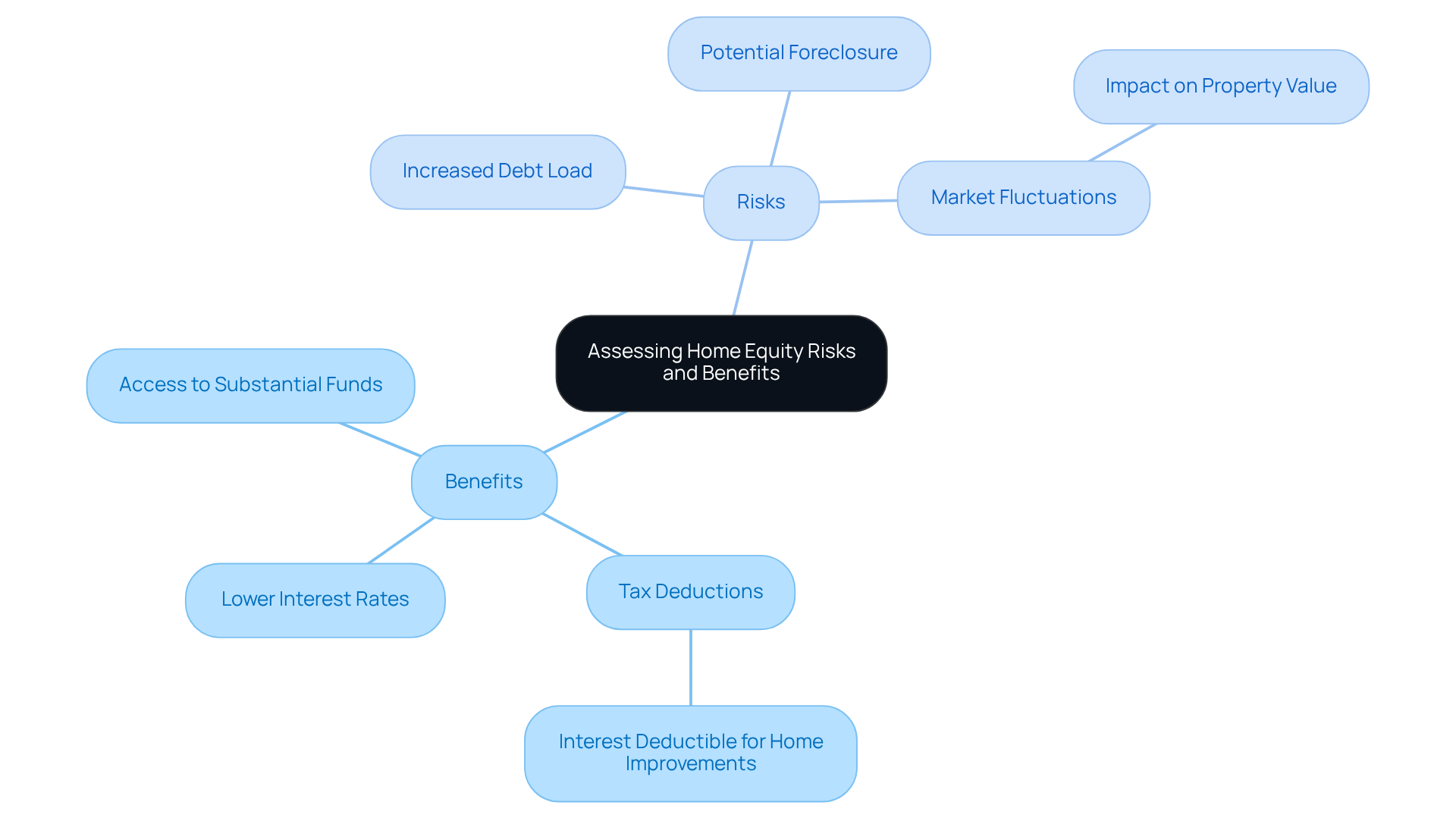

Utilizing property value can provide significant benefits for homeowners. It often grants access to lower interest rates compared to unsecured loans, potential tax deductions, and the ability to cover substantial expenses without needing to sell your home. For instance, the interest paid on a Home Equity Line of Credit (HELOC) may be tax-deductible if the funds are used for major property enhancements. This makes it an appealing option for many homeowners.

However, we know how challenging it can be to navigate these waters. It’s essential to recognize the inherent risks involved. Taking out loans against your property increases your total debt load, which could lead to foreclosure if payments aren’t kept up. Additionally, fluctuations in the housing market can impact property values, potentially resulting in owing more than your home is worth. For example, if you owe $150,000 on your main mortgage while your home is valued at $300,000, this situation helps explain what is equity in a home, as you would have $150,000 in equity. But if market conditions shift and your property’s value declines, it raises the question of what is equity in a home, which can diminish significantly.

To ensure fairness, your lender will arrange for a property appraisal to determine the current market value of your home. This evaluation is crucial as it directly influences the amount of capital available to you and the mortgage rates offered. Therefore, it’s vital for homeowners to thoroughly assess their financial situation. We’re here to support you every step of the way as you weigh both the risks and benefits before deciding to tap into your home equity.

Furthermore, once your application is approved, locking in your mortgage rate with F5 Mortgage can protect you from market fluctuations during the processing period. This proactive step can provide peace of mind as you move forward.

Conclusion

Understanding home equity is vital for homeowners, as it represents the portion of their property that they truly own. We know how challenging financial planning can be, and this concept, which involves calculating the difference between the home’s market value and the outstanding mortgage balance, serves as a crucial element in your journey toward stability. By grasping what home equity entails, you can leverage this asset to make informed decisions that enhance your financial stability and overall wealth.

Throughout this discussion, we highlighted key points, including:

- The significance of home equity in accessing financial resources

- The potential for wealth accumulation through property ownership

- Various methods to calculate and assess home equity

It’s important to understand both the benefits and risks associated with utilizing home equity. For instance, while you may benefit from lower interest rates and tax deductions, there are dangers of increasing debt and market fluctuations that you should consider.

Ultimately, recognizing the role of home equity in personal finance is essential for making strategic financial choices. We encourage you to regularly evaluate your property value and consider how you can effectively use your equity to support significant life expenses or investments. By doing so, you can navigate your financial journey with confidence, ensuring that your home remains a valuable asset in your overall financial portfolio.

Frequently Asked Questions

What is home equity?

Home equity is the share of a home that a homeowner fully possesses, calculated by subtracting the remaining mortgage amount from the current market value of the property.

How is home equity calculated?

Home equity is calculated by taking the current market value of the home and subtracting the outstanding mortgage balance. For example, if a home is valued at $300,000 and the mortgage balance is $200,000, the homeowner’s equity is $100,000.

Why is understanding home equity important for homeowners?

Understanding home equity is important because it represents a significant asset that homeowners can leverage for financial needs such as renovations, debt consolidation, or investment opportunities.

What does it mean for a property to be ‘equity rich’?

A property is classified as ‘equity rich’ when the outstanding loan balance is less than half of the property’s value, indicating a strong equity position for the homeowner.

What is the average home equity value in 2025?

In 2025, the average property owner possesses around $302,000 in home equity, reflecting an increase in property prices despite regional differences.

How can homeowners use their home equity?

Homeowners can use their home equity to access funds for various purposes, including renovations, debt consolidation, or taking advantage of investment opportunities.

What role do financial advisors play in understanding home equity?

Financial advisors emphasize the importance of understanding home equity for making informed financial decisions, such as leveraging property value for loans or refinancing options.

What economic benefits does home ownership provide?

Home ownership provides economic benefits by facilitating wealth accumulation and granting access to funds through the equity built in the property.