Introduction

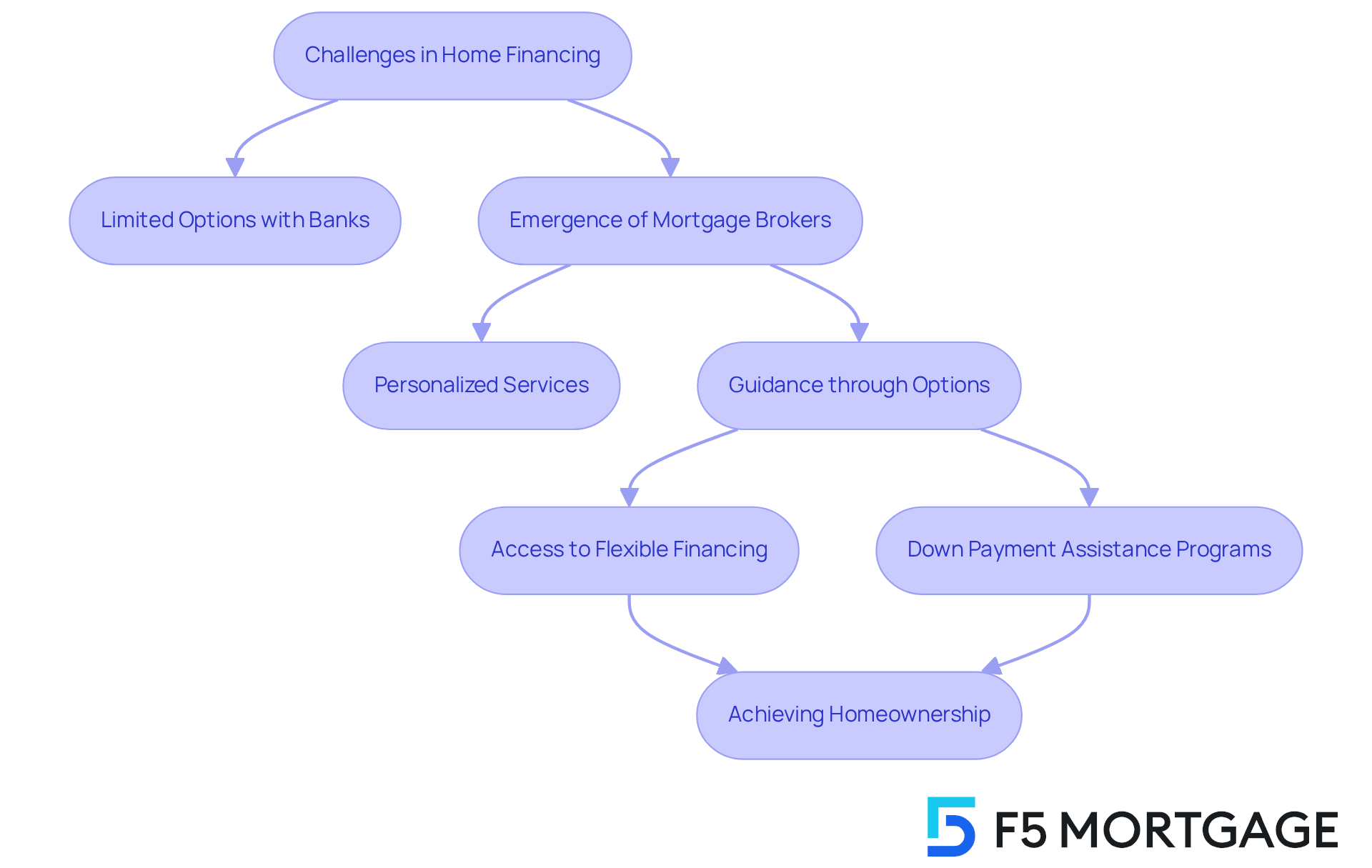

Navigating the complex landscape of home financing can feel overwhelming for families. We know how challenging this can be, especially with so many options available today. This is where mortgage brokerage firms come in. They act as knowledgeable intermediaries, connecting borrowers with tailored lending solutions that fit their unique needs.

As families face various financial challenges, it’s important to understand how a mortgage brokerage firm can simplify the process. These firms not only guide you through the maze of options but also empower you to make informed decisions in an ever-evolving market.

Imagine having a trusted partner by your side, helping you navigate the intricacies of home financing. With their expertise, you can feel more confident in your choices, knowing that you have support every step of the way.

So, how can you take the first step? Reach out to a mortgage brokerage firm today and discover how they can help you find the right lending solution for your family.

Define Mortgage Brokerage Firm

Navigating the world of financing can be overwhelming, especially for families looking to upgrade their homes. That’s where a mortgage brokerage firm like F5 Mortgage steps in as a caring intermediary, connecting borrowers with a variety of lending options. Unlike direct lenders, our mortgage brokerage firm does not provide the funds ourselves; instead, we help you explore the best choices tailored to your financial needs. We know how challenging this can be, and our goal is to make the process as smooth as possible for you.

At F5 Mortgage, we leverage user-friendly technology to simplify your experience. With established connections to over two dozen lenders, our loan specialists can offer a wide range of financing products, including:

- Fixed-rate loans

- FHA loans

- VA loans

- Jumbo loans

This approach not only streamlines the financing process but also empowers families to make informed decisions in a competitive market. Did you know that 83.2% of agency originations are now secured through intermediaries? This highlights the importance of having knowledgeable support from a mortgage brokerage firm as the lending landscape evolves.

What truly sets F5 Mortgage apart is our dedicated team approach. We provide no-pressure guidance and support throughout the entire refinancing process. With advancements in technology, such as artificial intelligence and machine learning, our agents can ensure transparency and quick responses to your inquiries. As consumer preferences shift, we’re also here to inform first-time homebuyers about eco-friendly financing options.

By maintaining long-term relationships with our clients, we offer ongoing support that goes beyond the initial transaction. We understand the challenges posed by rising home prices, and we’re here to support you every step of the way. Let us help you navigate this journey with confidence and care.

Contextualize the Role in Home Financing

Mortgage brokerage firms have become essential allies in today’s complex lending market, providing personalized services that truly cater to the diverse needs of homebuyers. We know how challenging this can be. In the past, borrowers often felt limited, relying solely on banks for their loan options. But as the market has evolved, loan consultants have emerged, fostering competition and expanding choices.

In 2025, these agents are especially crucial for families facing unique financial situations, like self-employment or credit challenges. By acting as representatives, loan advisors simplify the financing process, making it more approachable and less daunting for first-time homebuyers and those looking to refinance.

Statistics show that the average lending officer secures fewer than two agreements each month, underscoring the hurdles within the sector. Families often encounter significant obstacles, such as high-interest rates and complicated paperwork, which can discourage them from pursuing homeownership. In this landscape, a mortgage brokerage firm offers invaluable support, guiding clients through the overwhelming array of mortgage products available.

For instance, families with specific financial circumstances, like self-employed borrowers with complex tax returns, have successfully turned to F5 Mortgage for help. They’ve accessed favorable financing options through bank statement financing, which allows income to be assessed based on business cash flow. This flexible solution is perfect for those who might not meet traditional guidelines. Additionally, F5 Mortgage provides comprehensive down payment assistance programs in California, Texas, and Florida, helping families unlock the door to homeownership.

These agents not only help clients understand their options but also stand by them, ensuring they secure the best rates and terms. As the housing finance sector continues to evolve, the role of intermediaries remains vital in helping families achieve their homeownership dreams. Remember, we’re here to support you every step of the way.

Explore Key Characteristics and Functions

Mortgage brokerage firms stand out by prioritizing personalized service and having extensive access to a variety of loan programs. In 2025, agents take the time to thoroughly evaluate each customer’s financial situation. This careful assessment helps clarify options and navigate the complexities of the application process.

These agents act as advocates, negotiating with lenders to secure favorable terms and competitive rates for those they represent. This advocacy is crucial, especially since statistics show that individuals working with intermediaries report higher satisfaction levels than those who deal directly with lenders. For instance, a recent survey revealed that 94% of customers were satisfied with their representative’s services. This highlights how vital personalized attention is in a challenging market.

Moreover, agents equip clients with essential tools, like loan calculators and instructional resources, to support them throughout the financing process. This client-focused approach not only builds trust but also positions successful agents from a mortgage brokerage firm as invaluable allies for families striving to achieve their homeownership dreams. We know how challenging this can be, and we’re here to support you every step of the way.

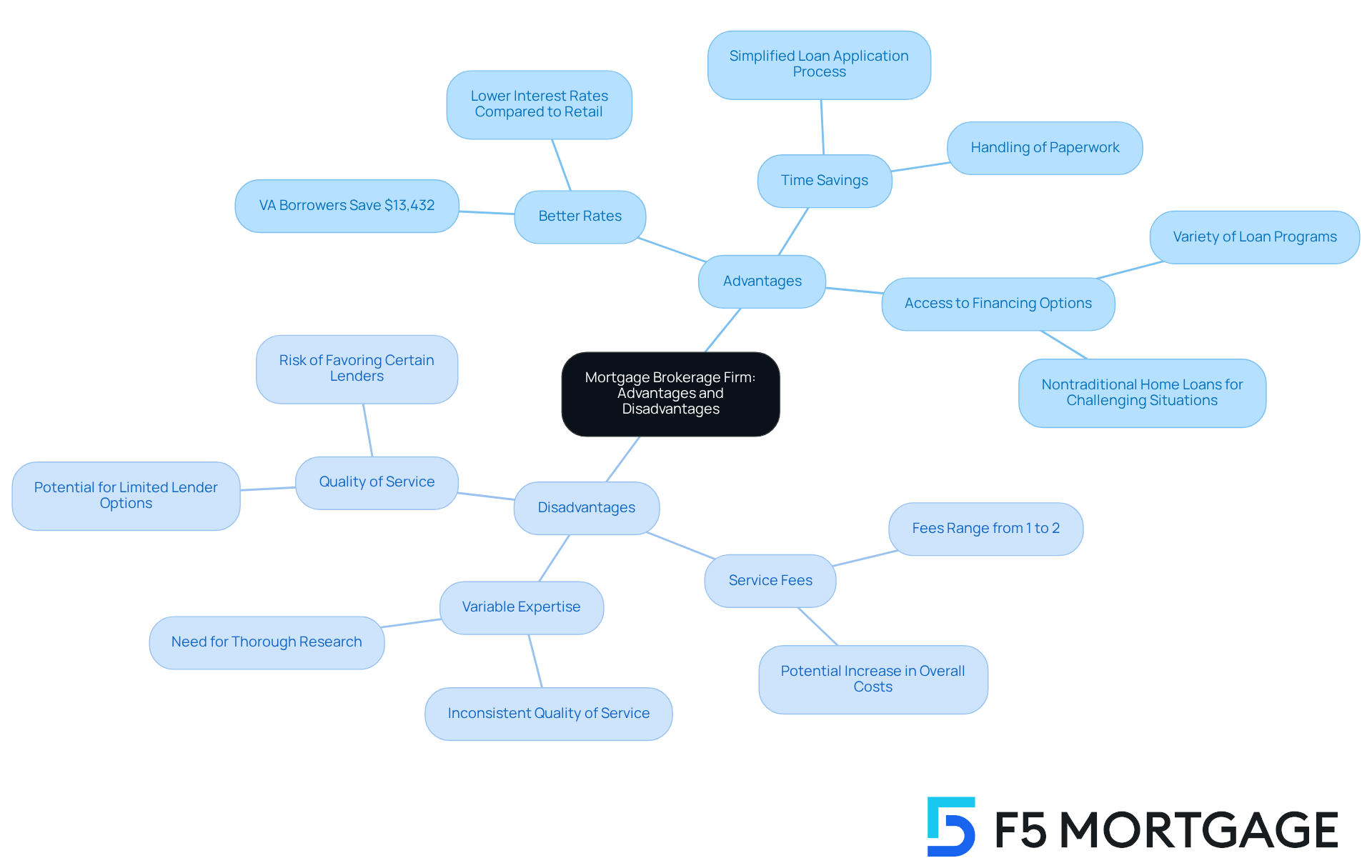

Analyze Advantages and Disadvantages

Choosing a mortgage brokerage firm can be a game-changer for families looking to navigate the mortgage landscape. We know how challenging this can be, and having access to a wide range of financing options can make a significant difference. Brokers at a mortgage brokerage firm often negotiate better rates than borrowers could secure on their own, thanks to their established relationships with lenders. For instance, VA financing recipients can save an average of $13,432 per transaction when working with a financing consultant instead of retail lenders. Plus, agents simplify the loan application process, saving you precious time by handling the necessary paperwork and communications.

However, it’s important to weigh the potential downsides. Some agents charge fees for their services, typically ranging from 1% to 2% of the mortgage amount, which can increase the overall cost of securing a mortgage. Additionally, the level of expertise and access to lenders can vary widely among agents, which may affect the quality of service you receive. In 2023, lending approval rates were 70% in Majority Minority Census Tracts, highlighting how intermediaries can improve access to loans in underserved communities.

To find a trustworthy agent, families should conduct thorough research and seek referrals. This step can help reduce risks associated with varying service quality. By carefully weighing the pros and cons, you can make informed decisions that align with your financial goals. Remember, we’re here to support you every step of the way.

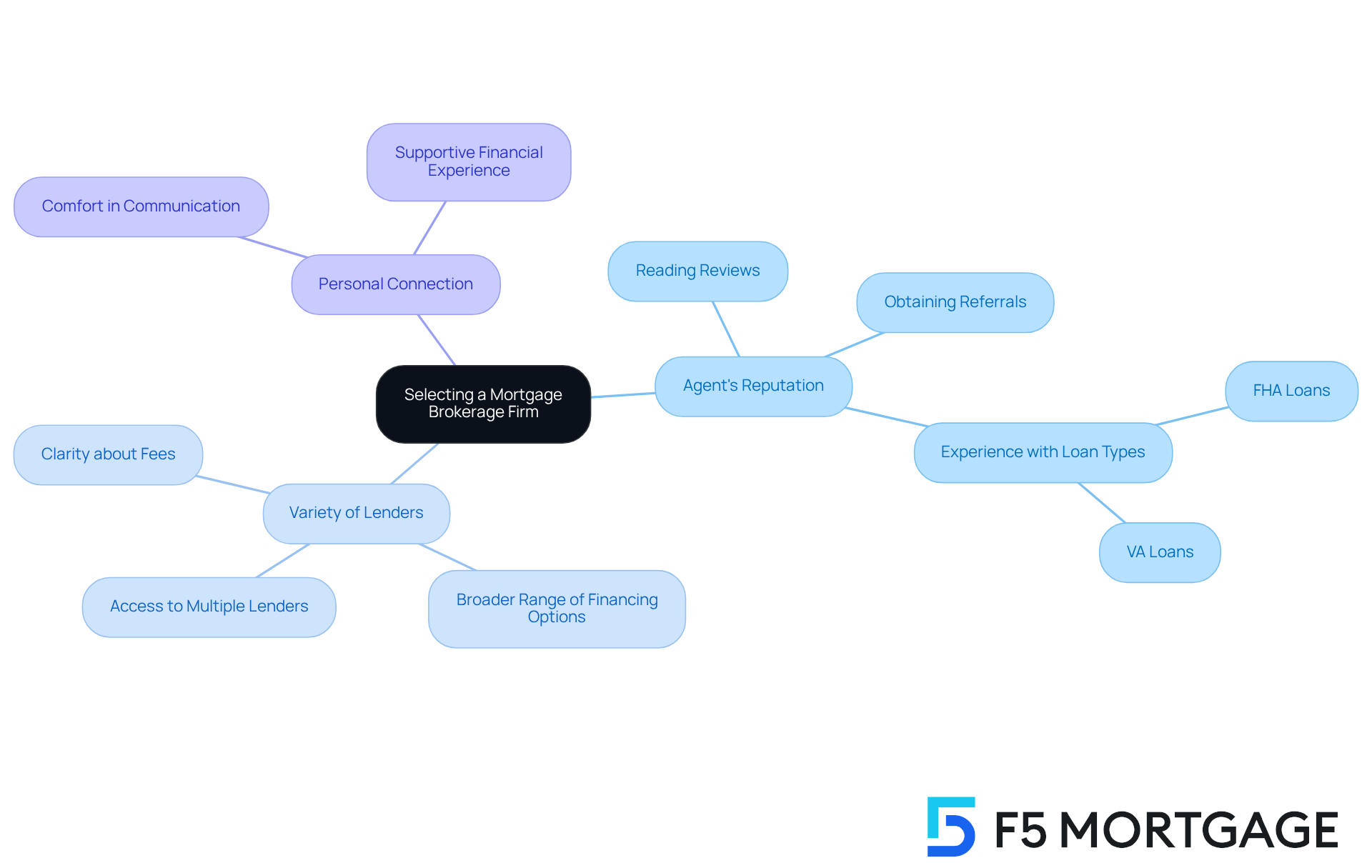

Guide to Selecting a Mortgage Brokerage Firm

When it comes to selecting a mortgage brokerage firm, we understand how challenging this can be for families. It’s essential to prioritize several key factors that can make a significant difference in your experience.

-

First and foremost, assessing the agent’s reputation is crucial. Reading reviews and obtaining referrals from trusted sources can provide valuable insights. Data shows that agents with solid reputations often enjoy increased referral rates, underscoring the importance of trust in this process. Additionally, families should inquire about the agent’s experience with various loan types, especially those that align with their financial needs, like FHA or VA loans.

-

Moreover, consider the variety of lenders a consultant partners with. An agent who has access to multiple lenders can offer a broader range of financing options, enhancing your chances of finding favorable terms. Clarity about fees and the loan process is another vital aspect; a trustworthy agent will clearly outline costs and expectations, helping families avoid any unexpected surprises.

-

Personal connection is just as important. Families should feel comfortable communicating openly with their advisor to foster a supportive financial experience. As one real estate expert wisely notes, “A good agent not only comprehends the figures but also the emotional experience of purchasing a home.”

By focusing on these factors, families can make informed decisions and choose a mortgage brokerage firm that will guide them effectively through the complexities of financing their home. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the complexities of home financing can feel overwhelming, especially for families eager to find the best mortgage options. We understand how challenging this can be. A mortgage brokerage firm serves as a vital ally in this journey, connecting borrowers with a variety of lending opportunities tailored to their unique needs.

By leveraging technology and strong relationships with multiple lenders, these firms simplify the mortgage process, making it more accessible. Imagine having a dedicated partner who not only understands your financial situation but also advocates for you in a competitive market. This personalized service can empower families to make informed decisions, ensuring they feel confident every step of the way.

Throughout this article, we highlighted the many advantages of working with a mortgage brokerage firm. From access to a wide array of financing products to the potential for significant savings through negotiated rates, these firms are here to support you. Selecting a reputable agent who understands specific loan types and offers transparent guidance is crucial. This choice can make all the difference in your home-buying experience.

Ultimately, the role of mortgage brokerage firms is indispensable for families striving for homeownership. As the lending landscape continues to evolve, the support provided by these intermediaries can significantly enhance your journey. We encourage families to take proactive steps in choosing the right mortgage brokerage firm, ensuring they receive the expert guidance necessary to navigate the complexities of financing their dream home. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a mortgage brokerage firm?

A mortgage brokerage firm, like F5 Mortgage, acts as an intermediary connecting borrowers with various lending options, helping them explore the best choices tailored to their financial needs without providing the funds directly.

What types of financing products does F5 Mortgage offer?

F5 Mortgage offers a wide range of financing products, including fixed-rate loans, FHA loans, VA loans, and jumbo loans.

How does F5 Mortgage simplify the financing process?

F5 Mortgage leverages user-friendly technology and has established connections with over two dozen lenders, streamlining the financing process and empowering families to make informed decisions.

Why are mortgage brokerage firms important in today’s lending market?

Mortgage brokerage firms provide personalized services that cater to diverse needs, fostering competition and expanding choices for borrowers who may have felt limited by traditional banks.

How do mortgage brokerage firms assist families with unique financial situations?

Mortgage brokerage firms, like F5 Mortgage, help families facing unique financial situations, such as self-employment or credit challenges, by simplifying the financing process and providing tailored solutions.

What specific assistance does F5 Mortgage offer for self-employed borrowers?

F5 Mortgage offers bank statement financing, which allows self-employed borrowers to have their income assessed based on business cash flow, providing them with favorable financing options.

What additional support does F5 Mortgage provide for families looking to buy a home?

F5 Mortgage provides comprehensive down payment assistance programs in California, Texas, and Florida, helping families unlock the door to homeownership.

How does F5 Mortgage ensure clients secure the best rates and terms?

The agents at F5 Mortgage guide clients through the mortgage options available, helping them understand their choices and ensuring they secure the best rates and terms.

What role do mortgage brokerage firms play in the evolving housing finance sector?

Mortgage brokerage firms remain vital in helping families achieve their homeownership dreams by providing knowledgeable support and navigating the complexities of the lending landscape.