Overview

Securing a home loan can feel daunting, especially when it comes to understanding credit scores. For conventional loans, a credit score typically starts at around 620, while FHA loans may allow scores as low as 580. However, it’s important to remember that higher scores generally lead to better loan terms.

We know how challenging this can be for families. Maintaining a strong credit profile is crucial, as it can significantly impact your ability to secure favorable financing options. By understanding these requirements, you empower yourself to save money over the life of your mortgage.

We’re here to support you every step of the way. Take the time to assess your credit situation and explore how you can improve your score. This knowledge will not only help you navigate the mortgage process but also ensure that you can achieve your dream of homeownership.

Introduction

Understanding the intricacies of credit scores is essential for families looking to secure a home loan. We know how challenging this can be. These numerical values not only reflect financial reliability but also play a pivotal role in determining loan terms and interest rates. As families strive to navigate the home financing landscape, a crucial question arises: what credit score is truly needed for a home loan? The answer could mean the difference between favorable rates and financial strain, highlighting the importance of maintaining a healthy credit profile.

With varying requirements across loan types, families must assess their credit standing. Exploring strategies for improvement can unlock the doors to homeownership. We’re here to support you every step of the way, ensuring that you can make informed decisions for your family’s future.

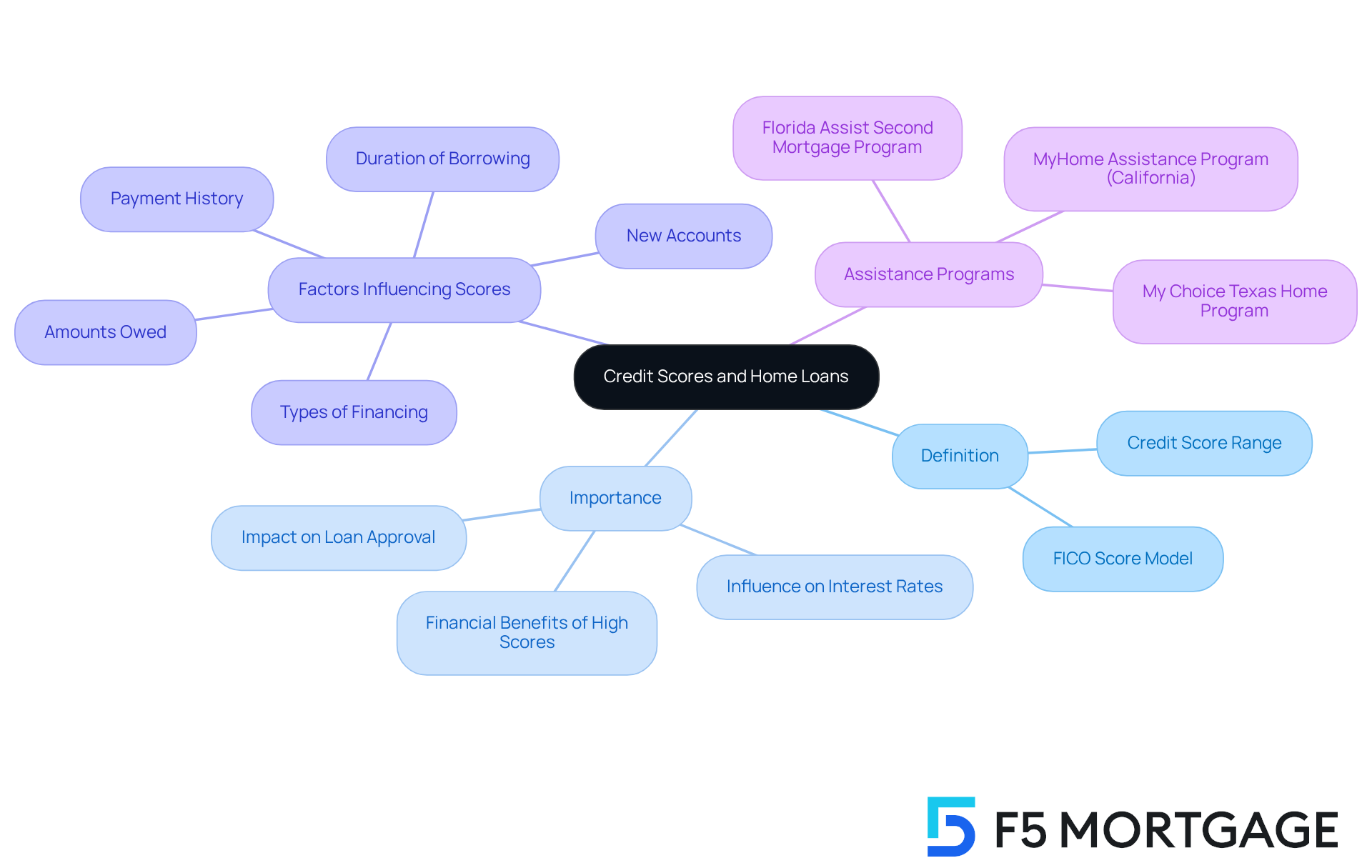

Defining Credit Scores and Their Importance in Home Loans

A numerical value serves as a measure of a person’s , typically ranging from 300 to 850. This score is influenced by several factors, including:

- Payment history

- Amounts owed

- The duration of borrowing history

- New accounts

- Types of financing used

In the realm of home financing, knowing indicates that a higher rating signifies a lower risk for lenders, which can lead to more and . For families, understanding what credit score is needed for a home loan is vital, as it directly impacts their ability to secure funding for home purchases or refinancing.

Data show that what credit score is needed for a home loan is often 740 or above to qualify borrowers for the best loan rates, while scores below 620 may limit options and result in higher interest rates. For instance, may face significantly larger monthly payments compared to those with a rating of 740, illustrating the financial benefits of maintaining a strong credit profile.

Real-life examples underscore what credit score is needed for a home loan and the importance of . Approval is a lender’s assessment that a borrower is a suitable candidate for a loan based on their financial information. This process can vary; some lenders refer to it as a “preapproval” or “prequalification.” Understanding helps families with good credit ratings successfully secure loans with lower interest rates, leading to substantial savings over the life of their mortgage. Conversely, individuals with lower ratings often encounter challenges, such as needing larger down payments or facing higher monthly payments, which can strain their budgets when they learn what credit score is needed for a home loan.

Additionally, families can explore available through F5 Mortgage. For example, the MyHome Assistance Program in California offers up to 3% of the home’s purchase price, while Texas provides the My Choice Texas Home program, which includes up to 5% for down payment and closing assistance. Florida also offers several programs, such as the Florida Assist Second Mortgage Program, providing up to $10,000 for upfront costs.

Industry experts emphasize this connection: “A higher rating often indicates a lower rate, which can lead to significant savings over time.” This reinforces the importance for families to , as even a small enhancement can lead to considerable economic benefits during the home buying process. Ultimately, understanding what credit score is needed for a home loan and how borrowing ratings influence mortgage rates and terms is crucial for families striving to navigate the complexities of home financing effectively.

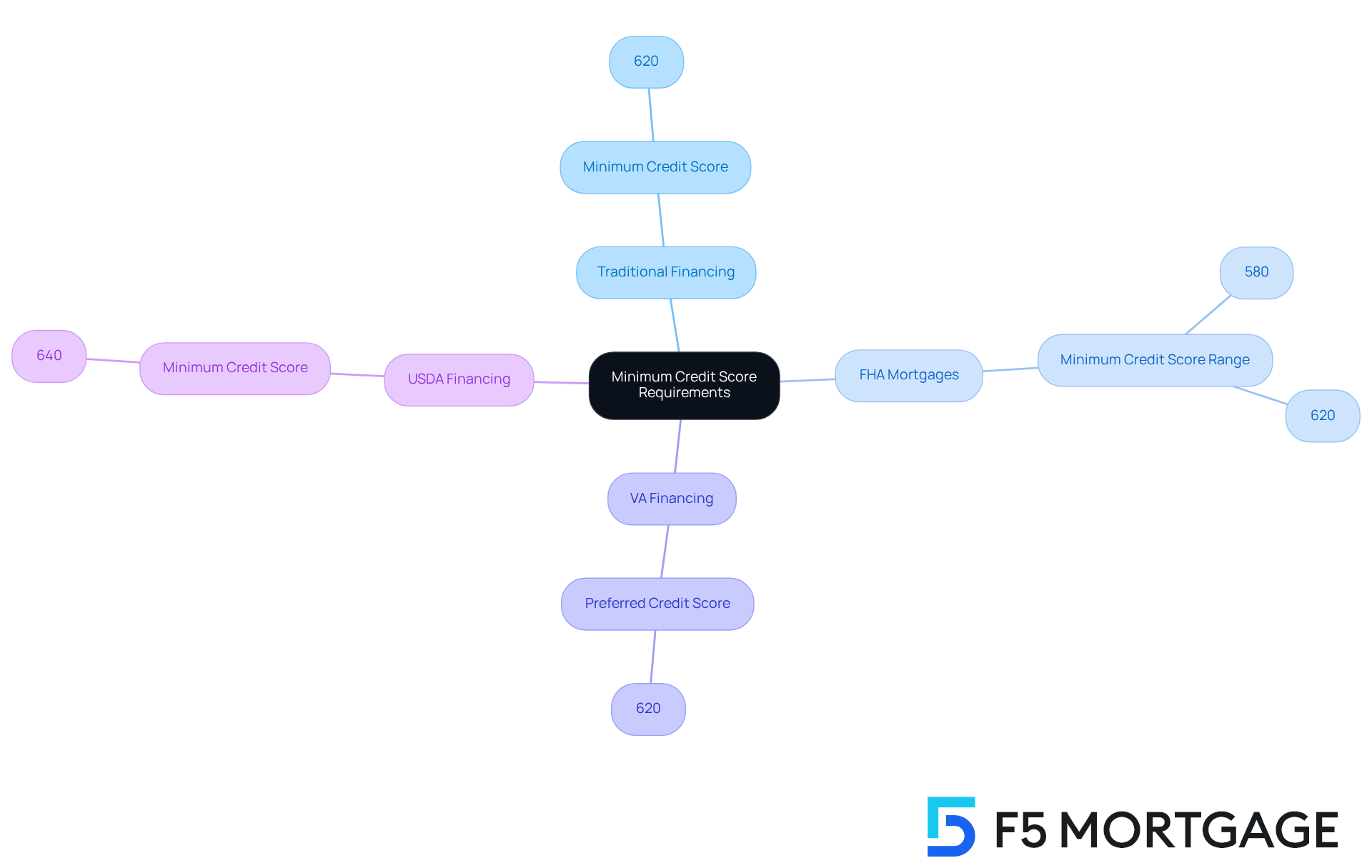

Minimum Credit Score Requirements by Loan Type

Navigating home financing can feel overwhelming, especially when considering , as this can significantly impact a family’s ability to secure funding. For traditional financing, typically requires a . , particularly regarding what credit score is needed for a home loan, allowing with a down payment of just 3.5%. On the other hand, VA financing doesn’t impose a strict minimum rating; however, most lenders have a preference for what credit score is needed for a home loan, which is typically at least 620 to mitigate risk. When considering , it’s important to know what credit score is needed for a home loan, as it typically requires a minimum rating of 640, although some lenders may allow manual underwriting with lower ratings in specific situations.

For families, understanding what credit score is needed for a home loan is essential. It empowers them to identify what credit score is needed for a home loan based on their financial profiles. For instance, families asking what credit score is needed for a home loan might find FHA loans to be a suitable choice with ratings in the 580-620 range, while those with ratings above 640 can consider USDA loans, which offer additional benefits like no down payment in qualifying areas. As of 2025, the hover around 692, showcasing the program’s accessibility for first-time homebuyers.

Moreover, is crucial for understanding what credit score is needed for a home loan, which can enhance their chances of securing better loan terms. are crucial strategies for boosting ratings, leading to improved financing options and lower interest rates. By grasping what credit score is needed for a home loan and actively working to enhance their economic situation, families can navigate the lending landscape with greater confidence. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

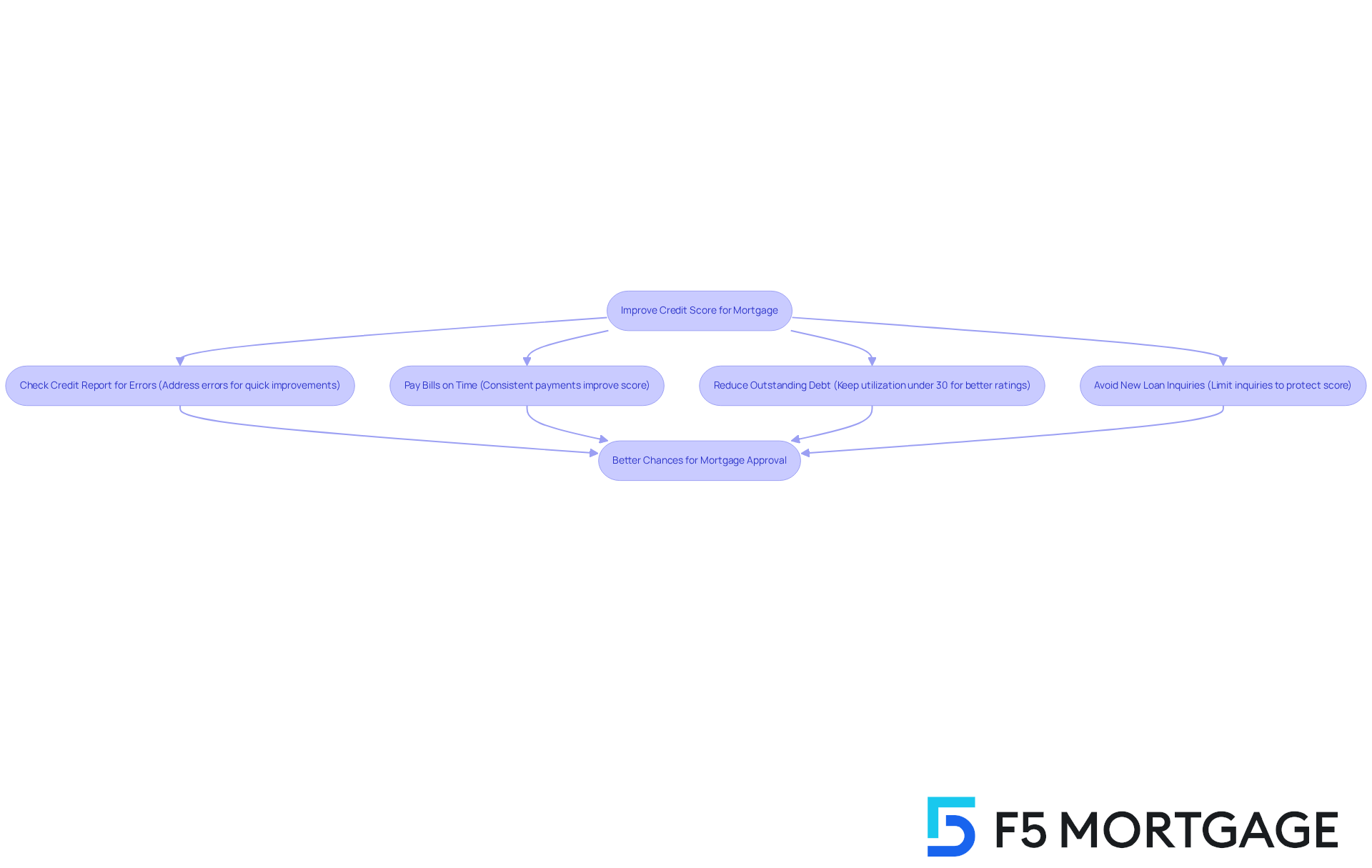

Strategies to Improve Your Credit Score Before Applying for a Mortgage

Improving your before applying for a mortgage can significantly enhance your chances of approval, especially when you know what . We understand how daunting this process can be, but there are key strategies you can implement to empower yourself:

- : Regularly review your credit reports from major bureaus for inaccuracies. Addressing these errors can lead to quick improvements in your rating, as 26% of individuals have found mistakes that negatively impacted their .

- : Your of your financial rating. Consistently making on-time payments is crucial; even just one late payment can have a serious effect.

- : Focus on lowering high credit card balances, particularly those with the highest interest rates. It’s advisable to keep your borrowing utilization ratio under 30%—or ideally below 10%—to positively influence your rating.

- Avoid New Loan Inquiries: Try to limit new loan applications before seeking a home loan, as hard inquiries can temporarily lower your rating.

We encourage families to apply these strategies well ahead of their loan application, allowing ample time for credit improvement. For instance, boosting your score from 580 to 620 can open doors to traditional financing, which often leads to questions about what credit score is needed for a home loan, typically requiring a minimum score of 620. Additionally, understanding your is vital; a maximum of 43% DTI is generally necessary for home financing, and a better DTI can lead to more competitive interest rates.

Families in Colorado have various , including conventional mortgages, FHA programs, and VA options, which can further improve their financial standing. By following these steps, you can enhance your financial profile, increasing your chances of securing more favorable loan terms and potentially saving thousands throughout the life of your loan. Remember, we’re here to support you every step of the way.

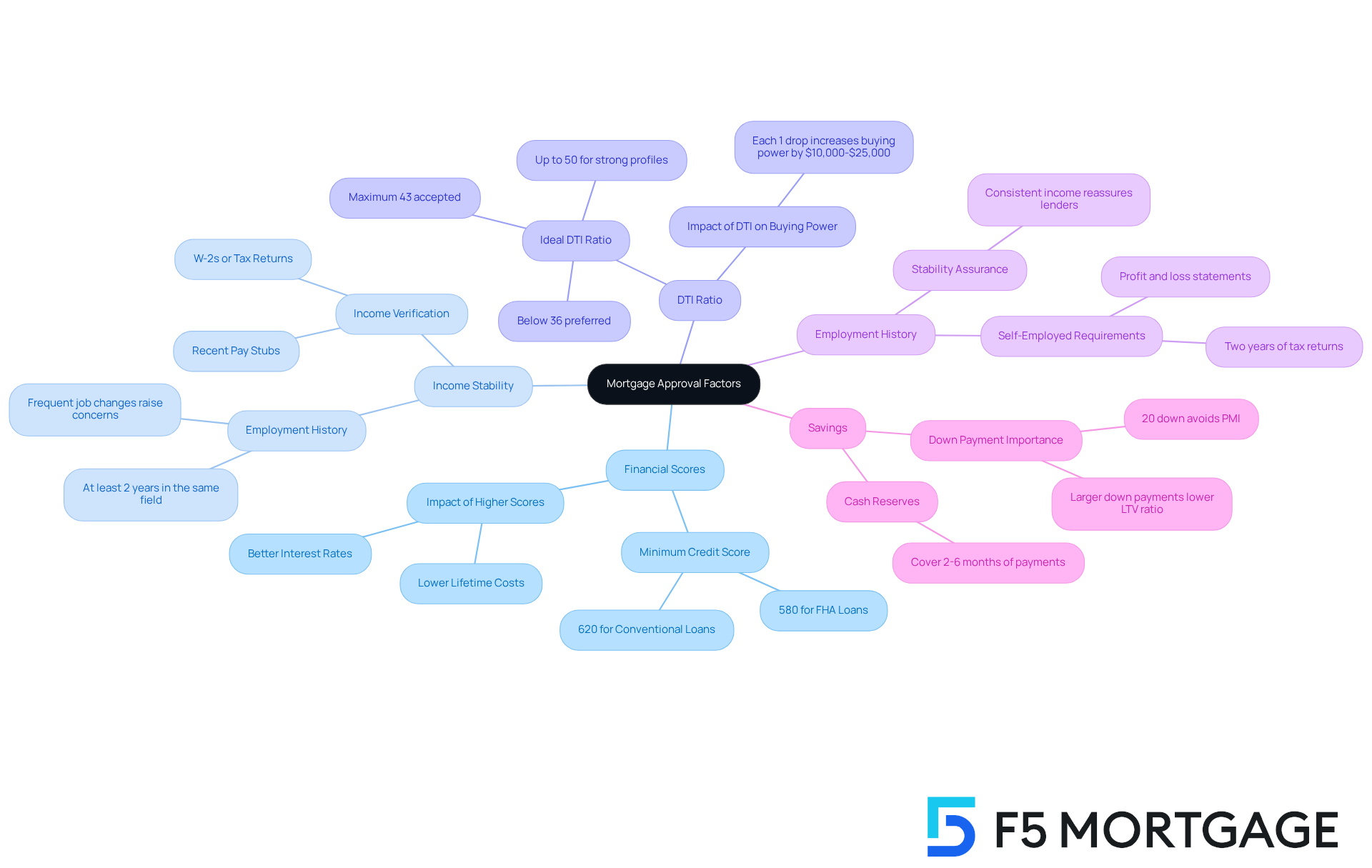

Other Key Factors Influencing Mortgage Approval

While financial scores are essential for , we understand that lenders also consider several other factors. These include:

- Income stability

- Employment history

- Savings

Typically, a DTI ratio below 36% is preferred, as it indicates that borrowers are not over-leveraged and can effectively manage their monthly payments. In 2025, lenders often accept a maximum DTI of 43%, with some , allowing ratios to reach up to 50% in certain cases. This flexibility can significantly impact a family’s ability to obtain financing; after all, each 1% decrease in DTI can potentially enhance buying power by $10,000 to $25,000.

is another critical factor. Lenders usually favor applicants with at least two years of steady employment in the same field. This stability reassures lenders of the borrower’s capacity to repay the loan. Families with and solid employment histories often find themselves in a better position to secure loans, presenting themselves as responsible borrowers. For instance, families who actively manage their debts and maintain a low DTI are more likely to receive favorable loan terms and interest rates.

To enhance their loan applications, families should focus on improving their . This can be achieved by:

- Increasing income

- Ensuring they have and closing expenses

Additionally, families should explore available through . For example, the MyHome Assistance Program in California offers up to 3% of the home’s purchase price, while the My Choice Texas Home program provides up to 5% for down payment and closing assistance. In Florida, programs like the Florida Assist Second Mortgage Program can offer up to $10,000 for upfront costs. By leveraging these assistance programs, families can improve their financial standing and significantly enhance their chances of mortgage approval. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding the credit score requirements for home loans is essential for families aiming to secure financing. We know how challenging this can be, but a strong credit score not only enhances the likelihood of loan approval but also significantly influences the interest rates and overall terms of the mortgage. Striving for a credit score of 740 or above can lead to the best rates, while those with scores below 620 may face limited options and higher costs.

Throughout this article, we highlighted the varying credit score requirements based on loan types, such as FHA, VA, and USDA loans, each offering different levels of flexibility. We discussed vital strategies for improving credit scores, including:

- Timely bill payments

- Reducing debt

- Checking for errors in credit reports

These steps are crucial for families looking to enhance their financial profiles. Additionally, understanding other factors like debt-to-income ratios and employment history further equips families to navigate the mortgage landscape effectively.

Ultimately, we encourage families to take proactive steps in monitoring and improving their credit scores. This can lead to significant financial benefits in the home buying process. By being informed about credit score requirements and actively working to enhance their financial standing, families can approach home financing with confidence. This knowledge unlocks better loan terms and paves the way for a successful homeownership journey.

Frequently Asked Questions

What is a credit score and what range does it typically fall within?

A credit score is a numerical value that measures a person’s financial reliability, typically ranging from 300 to 850.

What factors influence a credit score?

Factors that influence a credit score include payment history, amounts owed, the duration of borrowing history, new accounts, and types of financing used.

Why is it important to know what credit score is needed for a home loan?

Knowing what credit score is needed for a home loan is important because a higher rating signifies a lower risk for lenders, which can lead to more favorable loan terms and interest rates.

What credit score is generally needed to qualify for the best home loan rates?

A credit score of 740 or above is often needed to qualify borrowers for the best loan rates.

What challenges do individuals with lower credit scores face when applying for home loans?

Individuals with lower credit scores, especially those below 620, may face limited options, higher interest rates, larger down payments, and larger monthly payments, which can strain their budgets.

Can you provide examples of down payment assistance programs available for home buyers?

Yes, examples include the MyHome Assistance Program in California (up to 3% of the home’s purchase price), the My Choice Texas Home program in Texas (up to 5% for down payment and closing assistance), and the Florida Assist Second Mortgage Program in Florida (providing up to $10,000 for upfront costs).

How can improving a credit score benefit families during the home buying process?

Improving a credit score can lead to lower interest rates and better loan terms, which can result in substantial savings over the life of a mortgage.

What is the significance of preapproval or prequalification in the loan process?

Preapproval or prequalification is a lender’s assessment that a borrower is a suitable candidate for a loan based on their financial information, which can help families understand their borrowing capacity.