Overview

We understand how challenging financial decisions can be, especially for veterans and active-duty personnel. The VA cash-out refinance offers a supportive solution, allowing you to refinance your existing mortgage while tapping into your home equity. This can provide you with the financial flexibility you need for various important needs.

Imagine being able to consolidate debt or make necessary home improvements without the burden of private mortgage insurance. With competitive interest rates and no extra costs, this refinancing option can significantly enhance your financial stability. We’re here to support you every step of the way as you navigate this opportunity.

As you consider this option, remember the key benefits:

- The elimination of private mortgage insurance

- Access to cash for your needs

- The peace of mind that comes with a competitive interest rate

This could be your chance to take control of your finances and improve your quality of life. We know how important it is to make informed decisions, and we’re here to help you explore this path.

Introduction

Accessing home equity can feel like an elusive goal for many homeowners. We know how challenging this can be, especially for veterans and active-duty service members. However, the VA Cash-Out Refinance presents a powerful opportunity to turn that goal into a reality. This unique refinancing option not only allows eligible borrowers to tap into their home equity but also offers significant financial benefits, such as lower interest rates and no private mortgage insurance.

Yet, with such advantages come important questions:

- What are the eligibility requirements?

- How does the application process work?

- What are the best ways to utilize the funds?

We’re here to support you every step of the way. Understanding how to navigate this process effectively can help veterans maximize their financial well-being.

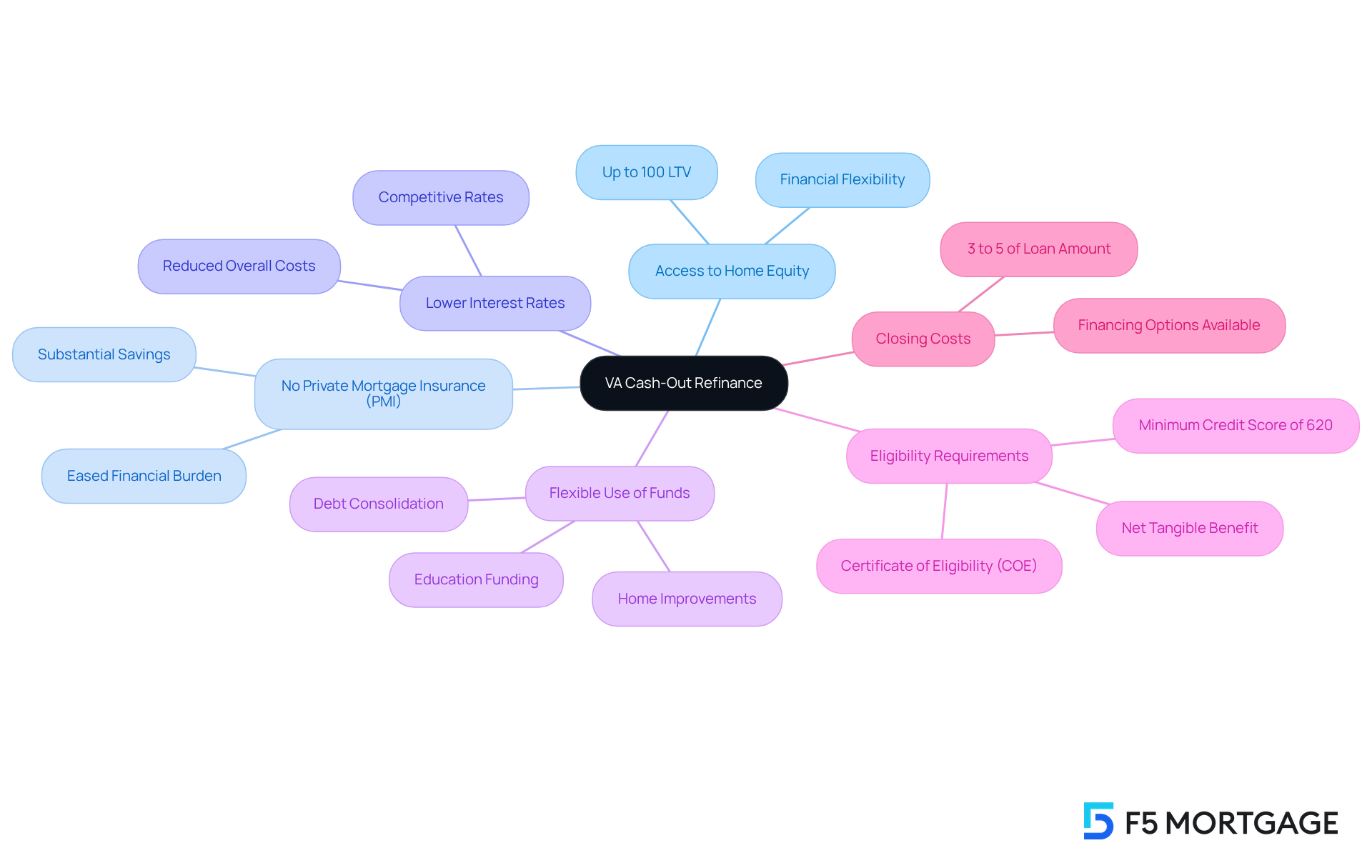

Define VA Cash-Out Refinance: Key Concepts and Benefits

A VA cash out refinance is a thoughtful loan option designed for qualified veterans and active-duty personnel, allowing them to refinance their current mortgage while accessing cash based on their property equity. This refinancing approach can be particularly advantageous for individuals who are looking to consolidate debt, fund home improvements, or manage significant expenses. Here are some key benefits:

- Access to Home Equity: Borrowers can leverage their home equity, potentially receiving up to 100% of their home’s appraised value. This can significantly enhance financial flexibility during challenging times.

- No Private Mortgage Insurance (PMI): Unlike traditional financing options, VA mortgages do not require PMI, leading to substantial savings for borrowers and easing financial burdens.

- Lower Interest Rates: VA financing typically offers competitive interest rates, making monthly payments more manageable and reducing overall borrowing costs.

- Flexible Use of Funds: The cash obtained through this refinancing can be used for various purposes, such as paying off high-interest debt, funding education, or making essential home renovations.

To qualify for a VA cash out refinance in 2025, borrowers must comply with both VA and lender guidelines. This includes a minimum credit score of 620 and the necessity for a Net Tangible Benefit, ensuring that the new arrangement provides a distinct economic advantage. We understand that many veterans are seizing the opportunity of the VA cash out refinance option, with a significant percentage utilizing it to improve their financial situations. For instance, veterans can convert non-VA mortgages into VA mortgages, eliminating mortgage insurance and securing better financing terms. This refinancing strategy not only offers immediate cash but also helps veterans position themselves for long-term financial stability. It’s important to note that the closing costs for a VA cash-out refinance typically range from 3% to 5% of the amount borrowed, which is a crucial factor for prospective borrowers to consider.

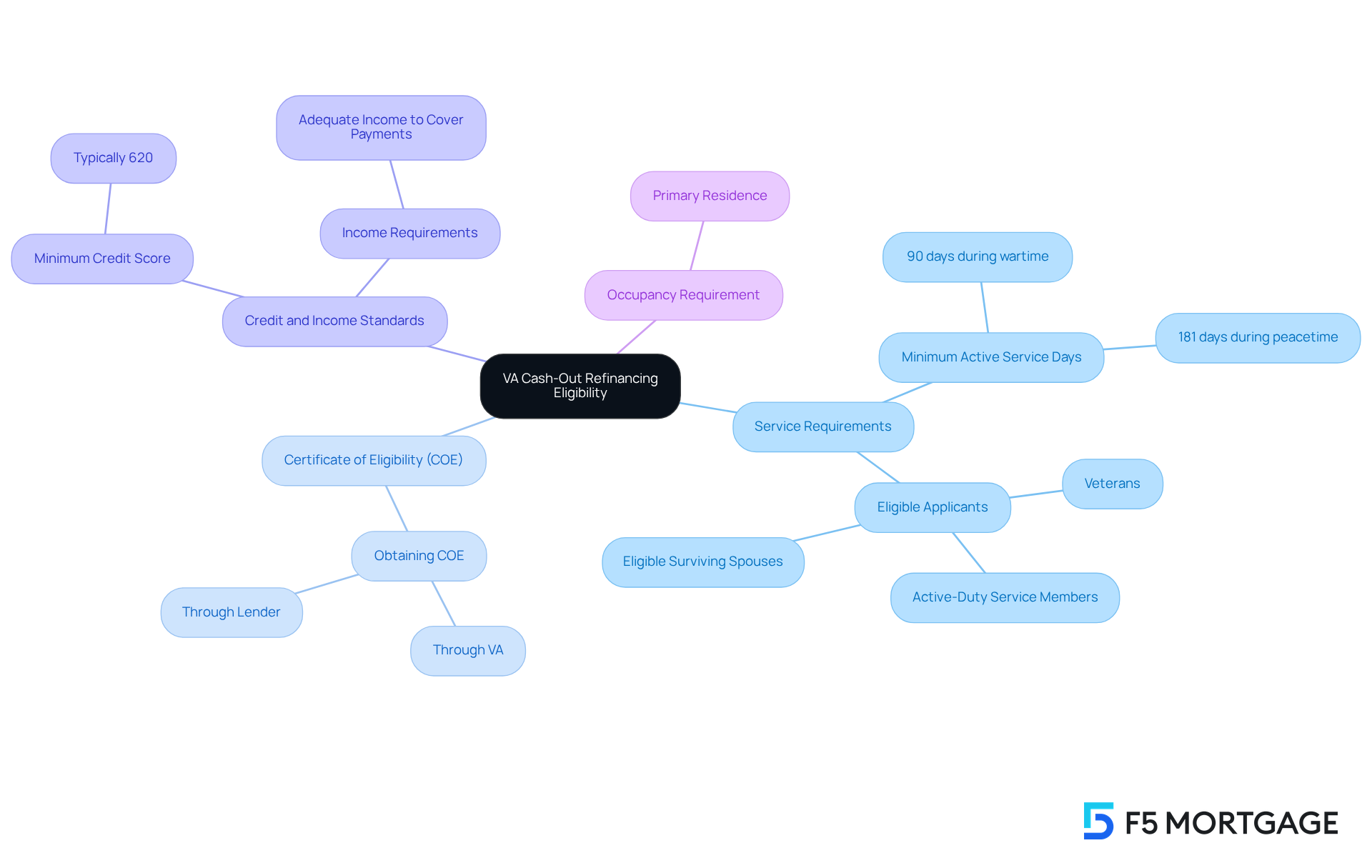

Establish Eligibility: Who Can Benefit from VA Cash-Out Refinancing?

To qualify for a VA cash out refinance, we understand that borrowers must meet specific eligibility criteria. These include:

- Service Requirements: We know how important it is for applicants to be veterans, active-duty service members, or eligible surviving spouses. Typically, they need to have served a minimum of 90 days of active service during wartime or 181 days during peacetime.

- Certificate of Eligibility (COE): Obtaining a COE is essential to confirm eligibility for VA financing benefits. This certificate can be obtained through the VA or a lender, streamlining the process for applicants.

- Credit and Income Standards: While the VA does not impose a minimum credit score, most lenders generally require a score of at least 620. Additionally, borrowers must show adequate income to cover the new payment obligations, ensuring they can handle their financial responsibilities.

- Occupancy Requirement: It’s important to note that the property must serve as the borrower’s primary residence, reinforcing the program’s focus on supporting homeownership.

Understanding these criteria is crucial for potential borrowers seeking a VA cash out refinance as they evaluate their eligibility and prepare effectively for the application process. Recent data shows that 93% of veterans and service members used a VA mortgage to buy their first residence, highlighting the program’s accessibility and popularity among those who qualify.

Veterans have shared positive experiences regarding their eligibility for VA financing. One veteran expressed, “The VA financing made it possible for me to buy my first home without the burden of a large down payment.” These real-life examples illustrate how veterans successfully navigate these requirements, further emphasizing the program’s role in facilitating homeownership for military families.

Additionally, VA refinancing allows veterans to merge several loans into one affordable VA loan, offering further financial assistance and flexibility. We’re here to support you every step of the way as you explore these opportunities.

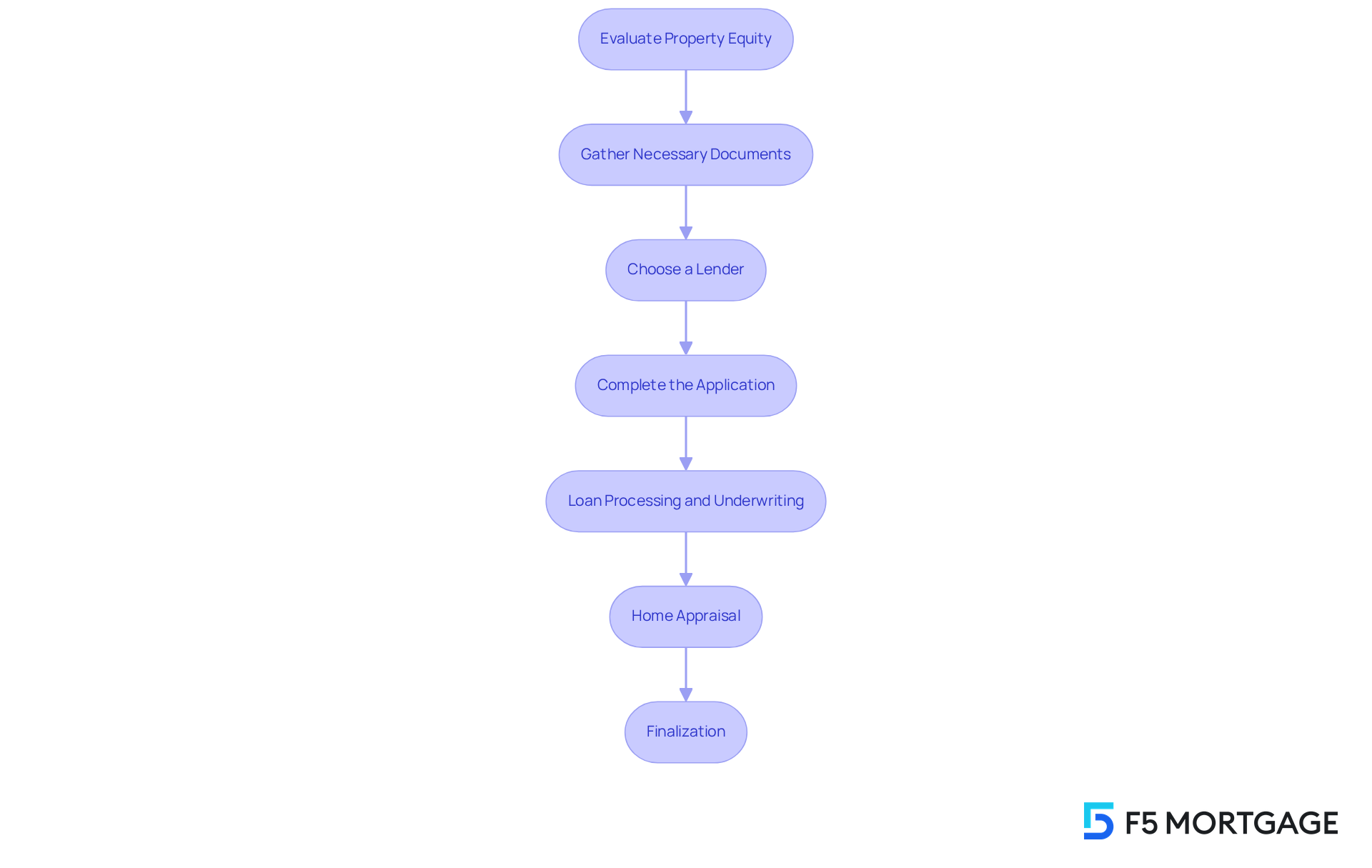

Navigate the Process: Step-by-Step Guide to VA Cash-Out Refinancing

Navigating the VA cash out refinance process can feel overwhelming, but grasping the essential steps can make it smoother and enhance your chances of success.

-

Evaluate Your Property Equity: Start by determining your property equity. Subtract your current mortgage balance from your property’s appraised value. As an eligible VA borrower, you can take advantage of a VA cash out refinance to access up to 100% of your home’s value, making this a crucial first step.

-

Gather Necessary Documents: Next, prepare key financial documents. This includes income verification, signed tax returns from the past two years, recent pay stubs, and your Certificate of Eligibility (COE). Having these ready can ease the process.

-

Choose a Lender: Take the time to research and select a VA-approved lender. Look for one that offers competitive rates and favorable terms for a VA cash out refinance. Comparing multiple lenders can help you secure the best deal, and we know how important that is for your financial peace of mind.

-

Complete the Application: Once you’ve chosen a lender, fill out the financing application. Be sure to include all required documentation to avoid delays. This step is vital, as it sets the stage for the rest of the process.

-

Loan Processing and Underwriting: After submitting your application, the lender will review it. They will verify your information and assess your creditworthiness. While the VA does not impose a minimum credit score for refinancing, most lenders typically require a score of at least 620. Remember, we’re here to support you every step of the way.

-

Home Appraisal: An appraisal will be conducted to determine your home’s current market value. This is essential for calculating your available equity and ensuring you make informed decisions.

-

Finalization: If your application is approved, you will attend a final meeting to sign the financing documents and receive your cash-out funds. Be aware that the closing costs for a VA cash out refinance usually vary between 2% and 6% of the loan amount. Additionally, the VA funding fee for a VA cash out refinance ranges from 1.25% to 2.15% for first-time use and from 1.25% to 3.3% for subsequent uses.

By following these steps, you can navigate the VA refinance process more effectively, ensuring a smoother experience and a successful outcome. While a VA cash out refinance can provide access to funds, it’s important to consider the associated risks, such as the potential for increased debt and the possibility of losing your home if payments are not made. We understand how challenging this can be, and we are here to help you make the best choices for your future.

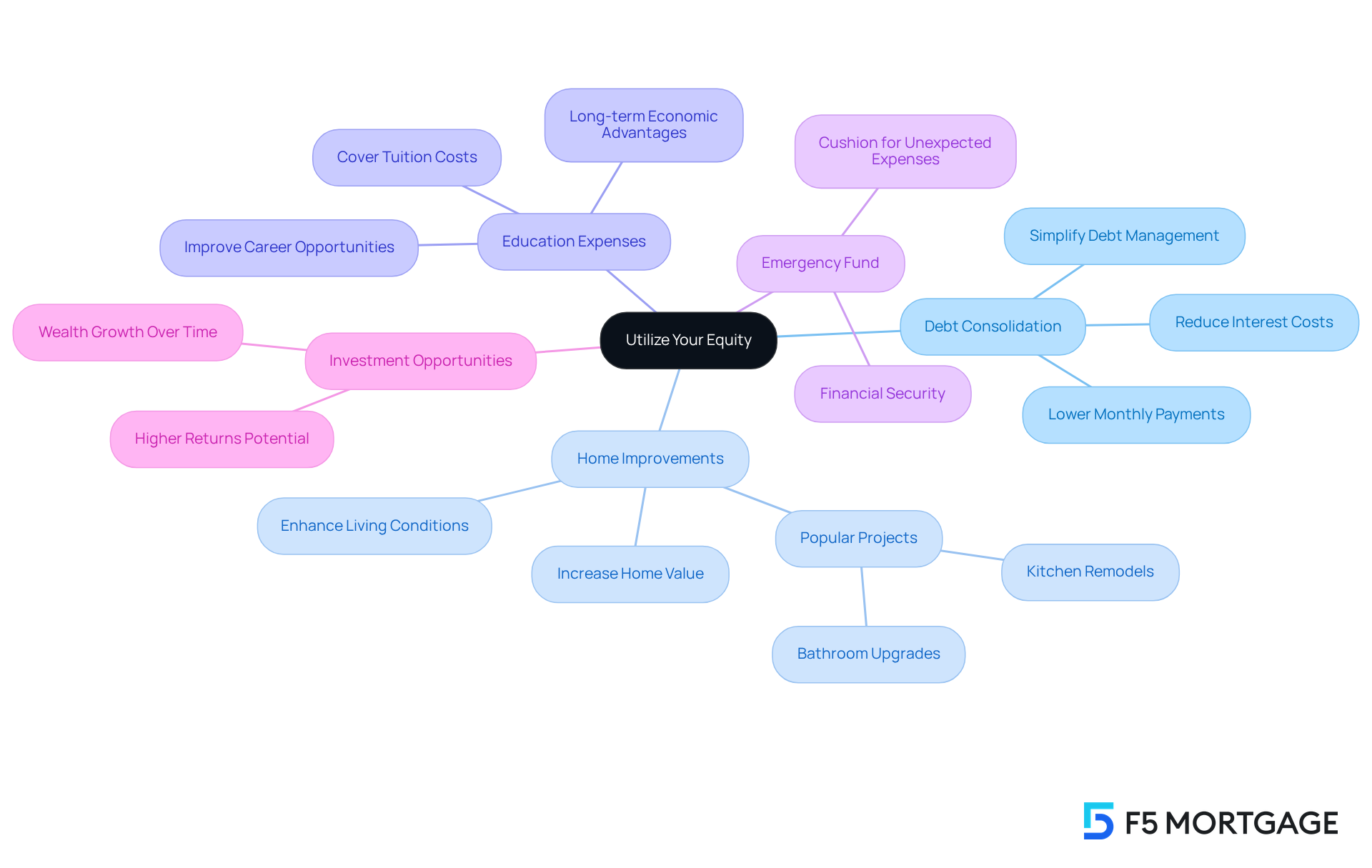

Utilize Your Equity: Smart Ways to Use Cash from a VA Cash-Out Refinance

Once you receive cash from a VA Cash-Out Refinance, consider these strategic ways to utilize your funds:

-

Debt Consolidation: We understand how overwhelming high-interest debts can be. Using the cash to pay off these debts, such as credit cards or personal loans, can significantly improve your financial situation. By consolidating your debts, you often lower your monthly payments and reduce interest costs. Many borrowers find that refinancing allows them to save on interest payments, especially when compared to credit card rates averaging around 24%. As noted by the United States Department of Veterans Affairs, if you have multiple debts or high-interest debt, you may want to consider a VA cash out refinance to assist in paying it down.

-

Home Improvements: Investing in renovations or upgrades can be a wonderful way to increase your home’s value. Many homeowners leverage a VA cash out refinance for projects like kitchen or bathroom remodels, which enhances living conditions while also boosting resale value.

-

Education Expenses: We know how important education is for your future. Consider using the funds to cover education or training costs. This investment can improve your career opportunities and earning potential, offering long-term economic advantages.

-

Emergency Fund: Establishing or bolstering an emergency fund can provide peace of mind during uncertain times. Having a monetary cushion to cover unexpected expenses can make a significant difference in your financial security.

-

Investment Opportunities: Explore investment options that could yield higher returns than the interest on your mortgage. By strategically investing your cash, you can potentially grow your wealth over time.

By thoughtfully utilizing the cash from a VA cash out refinance, you can enhance your financial stability and work towards achieving your long-term goals. Remember, we’re here to support you every step of the way.

Conclusion

A VA cash-out refinance serves as a powerful financial tool for veterans and active-duty service members, enabling them to tap into their home equity while refinancing their existing mortgage. This option not only provides immediate access to funds but also offers significant long-term benefits, such as lower interest rates and no private mortgage insurance. It stands out as an attractive choice for those looking to improve their financial situation.

Navigating the VA cash-out refinance process can feel overwhelming, but it doesn’t have to be. Start by:

- Evaluating your property equity

- Gathering the necessary documents

- Selecting the right lender

Understanding eligibility requirements, such as service duration and obtaining a Certificate of Eligibility, is crucial. By following these guidelines, you can streamline your refinancing experience and enhance your chances of success.

Ultimately, leveraging a VA cash-out refinance can lead to improved financial stability and open doors to various opportunities. Whether it’s:

- Debt consolidation

- Home improvements

- Educational investments

This refinancing option not only facilitates immediate cash access but also supports your long-term financial health. We know how challenging this can be, and taking proactive steps to explore this opportunity can empower you to make informed financial decisions and work towards achieving your goals.

Frequently Asked Questions

What is a VA cash-out refinance?

A VA cash-out refinance is a loan option for qualified veterans and active-duty personnel that allows them to refinance their current mortgage while accessing cash based on their property equity.

What are the key benefits of a VA cash-out refinance?

Key benefits include access to home equity (up to 100% of the home’s appraised value), no requirement for private mortgage insurance (PMI), lower interest rates, and flexible use of funds for various purposes such as debt consolidation or home improvements.

Who is eligible for a VA cash-out refinance?

To qualify for a VA cash-out refinance in 2025, borrowers must meet both VA and lender guidelines, including a minimum credit score of 620 and the requirement for a Net Tangible Benefit.

How can veterans use the cash obtained from a VA cash-out refinance?

The cash obtained can be used for various purposes, including paying off high-interest debt, funding education, or making essential home renovations.

What are the closing costs associated with a VA cash-out refinance?

The closing costs for a VA cash-out refinance typically range from 3% to 5% of the amount borrowed.

Can veterans convert non-VA mortgages into VA mortgages through this refinancing option?

Yes, veterans can convert non-VA mortgages into VA mortgages, which can eliminate mortgage insurance and secure better financing terms.

How does a VA cash-out refinance help with long-term financial stability?

This refinancing strategy provides immediate cash access and helps veterans position themselves for long-term financial stability by potentially reducing overall borrowing costs and improving their financial situation.