Overview

Understanding vacation home mortgage rates can be a bit overwhelming, especially when you consider their unique features. These rates often come with higher interest rates and stricter borrowing standards compared to primary residences. We know how challenging this can be, but recognizing these aspects is the first step toward making informed decisions.

Factors like:

- Credit score

- Loan-to-value ratio

- Property location

play a significant role in determining these rates. It’s essential to consider how each of these elements can impact your financial journey. We’re here to support you every step of the way, providing guidance tailored to your needs.

As you navigate this process, remember that you’re not alone. Many families face similar concerns, and understanding these influences can empower you to take action. With the right information, you can confidently approach your mortgage decisions, ensuring a brighter future for you and your loved ones.

Introduction

Navigating the world of vacation home mortgages can feel overwhelming. We understand how challenging this can be, especially when faced with unique features and complexities that set these loans apart from traditional home financing. With average mortgage rates hovering around 6.906% in 2024, it’s crucial for potential buyers to grasp the intricacies of financing a second property. This includes higher down payments and stricter lending standards.

What challenges might arise during the application process? How can buyers position themselves for success? In this article, we delve into the key factors influencing vacation home mortgage rates. Our goal is to offer valuable insights and practical tips to help prospective owners make informed decisions and avoid common pitfalls. We’re here to support you every step of the way.

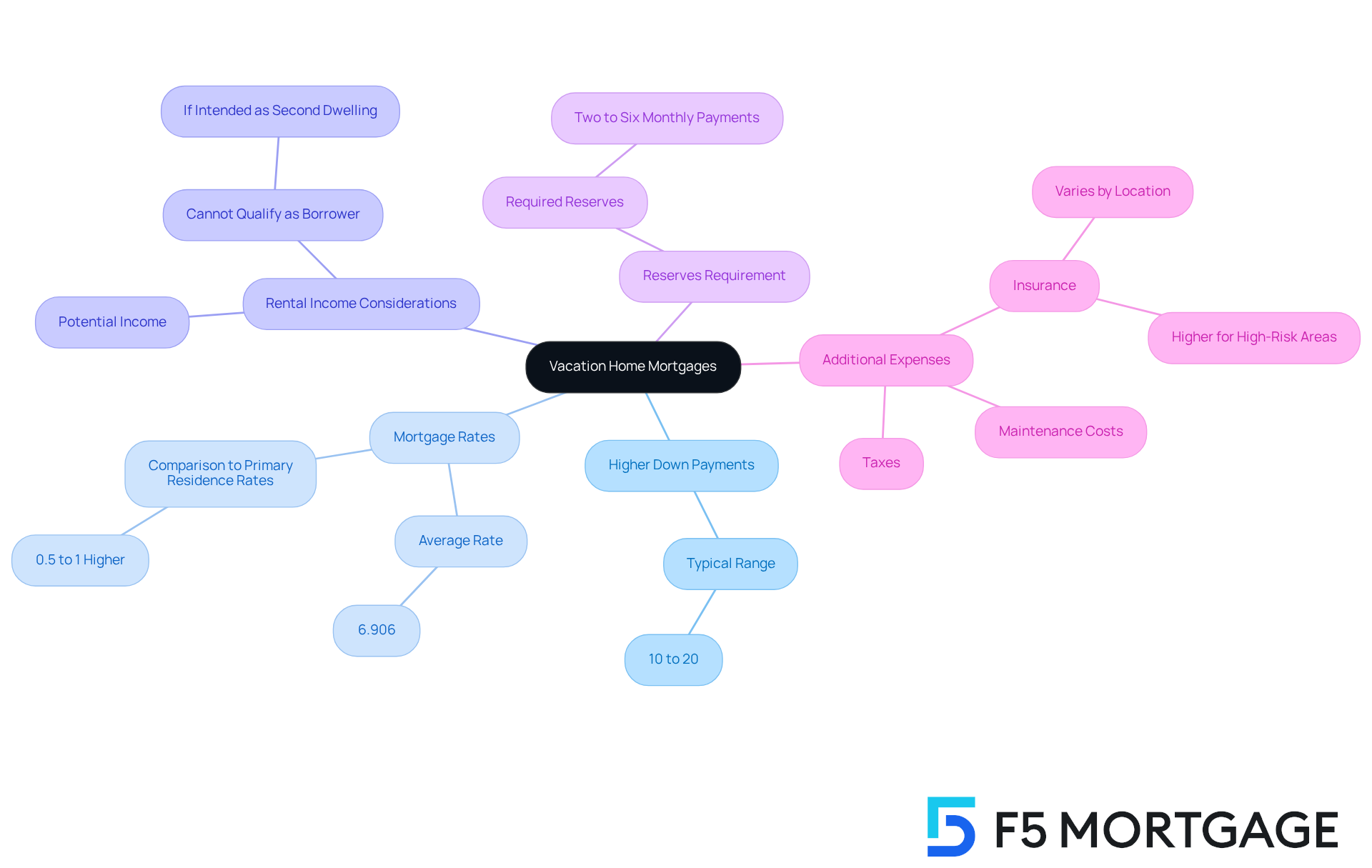

Define Vacation Home Mortgages and Their Unique Features

Vacation property loans are specialized financing options designed for real estate that isn’t meant to be a primary residence. We understand how overwhelming this process can feel, and it’s important to know that these loans come with distinct characteristics. Typically, vacation home mortgage rates feature higher interest rates compared to loans for primary residences, along with more stringent borrowing standards. Lenders often require a larger down payment—usually between 10% to 20%—and may assess your ability to manage both the loan on the vacation property and your main residence. Additionally, holiday homes might face varying taxation levels and insurance needs, which can affect your overall expenses. By understanding these features, you can navigate your options effectively and avoid unexpected financial burdens.

Key features include:

- Higher Down Payments: Expect to pay more upfront compared to primary residences.

- Vacation home mortgage rates: Generally higher due to perceived risk. In 2024, vacation home mortgage rates for additional properties were reported at an average of 6.906%, with an average loan size of $505,132.

- Rental Income Considerations: If you plan to lease the property, lenders may consider potential rental income when evaluating your application. However, keep in mind that anticipated rental income cannot qualify you as a borrower if the residence is intended as a second dwelling.

- Reserves Requirement: Lenders typically require reserves equivalent to two to six monthly mortgage payments for vacation property loans, which is a crucial aspect of financial planning.

Furthermore, owning a vacation residence involves additional expenses, such as taxes, insurance, and maintenance. Homeowners insurance is mandatory, and premiums can vary significantly based on the property’s location and type. For instance, properties in high-risk areas, like coastal regions, may incur higher insurance costs due to the potential for natural disasters.

By grasping these unique features and preparing for the associated costs, you can make informed decisions that align with your financial goals. We’re here to support you every step of the way.

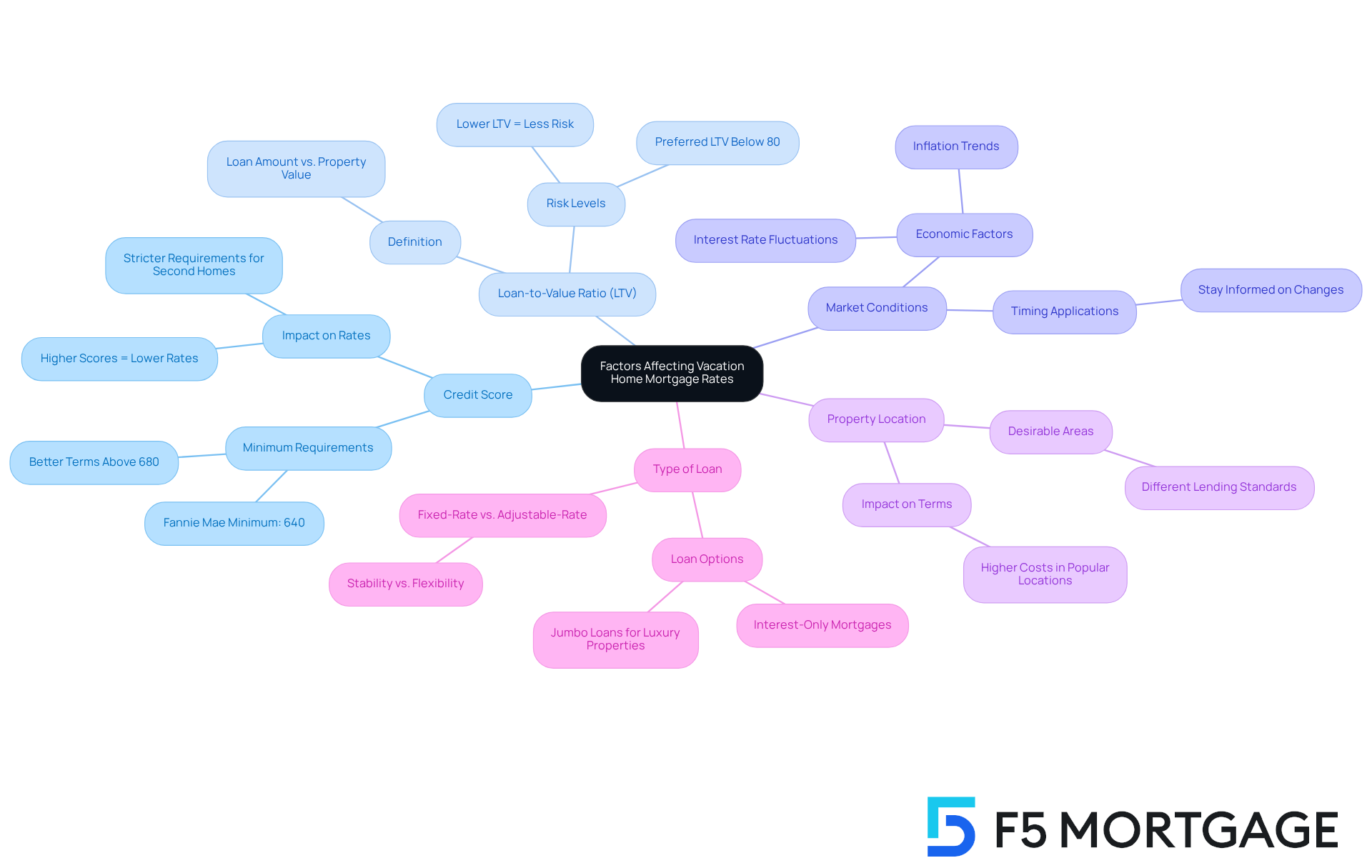

Explore Factors Affecting Vacation Home Mortgage Rates

When considering vacation home mortgage rates, various elements can significantly impact costs, with credit score being one of the most crucial factors. We understand how important your credit score is; a higher score typically leads to lower interest charges. Lenders view borrowers with strong credit histories as less risky. For instance, Fannie Mae requires a minimum FICO score of 640 for second property loans, offering better terms for those with scores above 680. As we look ahead to 2025, the average credit score for approval of vacation home mortgage rates is expected to reflect these strict requirements, underscoring the importance of maintaining a solid credit profile.

Another vital aspect is the loan-to-value ratio (LTV). This ratio compares the loan amount to the property’s value. A lower LTV indicates less risk for the lender, which can lead to more favorable terms. Additionally, market conditions are influential. Economic factors like inflation and interest trends can affect loan costs, making it essential for you to stay informed about these changes to time your applications wisely.

The location of the property also plays a role in mortgage costs. Properties in desirable areas may have different lending standards and terms compared to those in less sought-after locations. Moreover, the type of loan you choose—whether fixed-rate or adjustable-rate—can impact overall costs, especially when considering vacation home mortgage rates that present varying rates and terms.

As Morgan Stanley strategists emphasize, understanding these elements can help you navigate the complexities of vacation property financing. We know how challenging this can be, but by assessing your personal financial situation alongside these factors, you can make informed decisions about your loan options. We’re here to support you every step of the way.

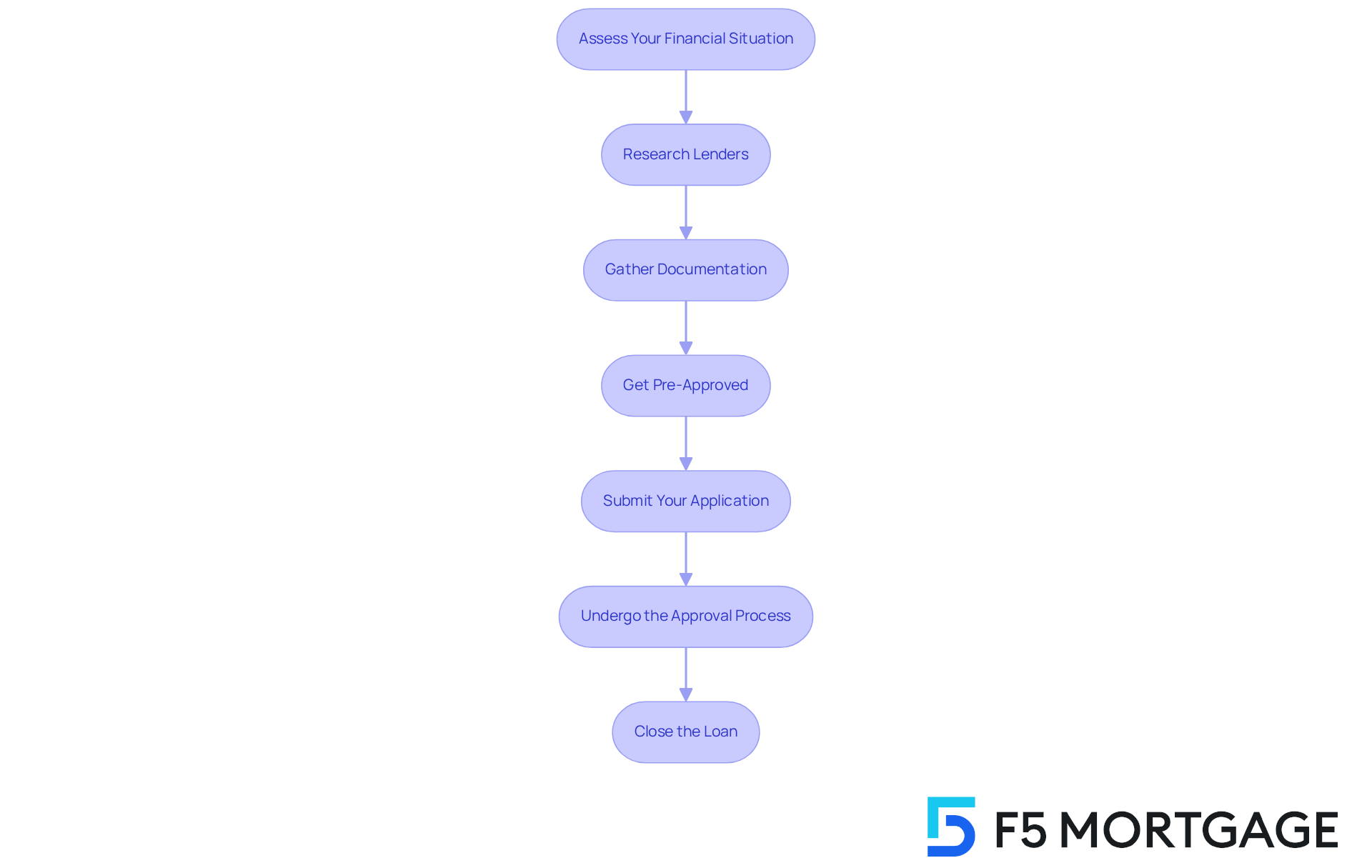

Navigate the Process of Securing a Vacation Home Mortgage

Securing a vacation home mortgage rates can feel overwhelming, but we’re here to guide you through each step with care and understanding.

-

Assess Your Financial Situation: Start by taking a close look at your credit score, income, and existing debts. Many lenders look for a credit score of at least 680 and a debt-to-income (DTI) ratio below 45% when evaluating vacation home mortgage rates for vacation property loans. Understanding your financial standing is crucial, as it helps clarify your borrowing capacity.

-

Research Lenders: Take the time to compare different lenders, especially those specializing in vacation home loans. This research is key to finding competitive vacation home mortgage rates and terms that suit your needs.

-

Gather Documentation: Prepare the necessary documentation, such as tax returns, pay stubs, and bank statements. Lenders will need proof of income and assets to assess your financial stability, so being organized can make this process smoother.

-

Get Pre-Approved: Seeking pre-approval is a smart move, as it clarifies how much you can borrow. This step not only gives you insight into your budget but also strengthens your position in competitive markets, signaling to sellers that you are a serious buyer.

-

Submit Your Application: When you’re ready, complete the mortgage application with your chosen lender. Ensure that all information is accurate and comprehensive, as a well-prepared application can expedite the approval process.

-

Undergo the Approval Process: Be prepared for a thorough evaluation by the lender. This will include a valuation and confirmation of your financial details. This step is essential for ensuring that the asset meets the lender’s requirements, so stay engaged throughout.

-

Close the Loan: Once you receive approval, take the time to carefully review the closing documents before signing. Make sure you fully understand all terms and conditions, including closing costs, which typically range from 2% to 5% of the loan amount.

By following these steps, potential purchasers can navigate the process of vacation home mortgage rates and financing with confidence. We know how challenging this can be, and we’re here to support you every step of the way toward ownership.

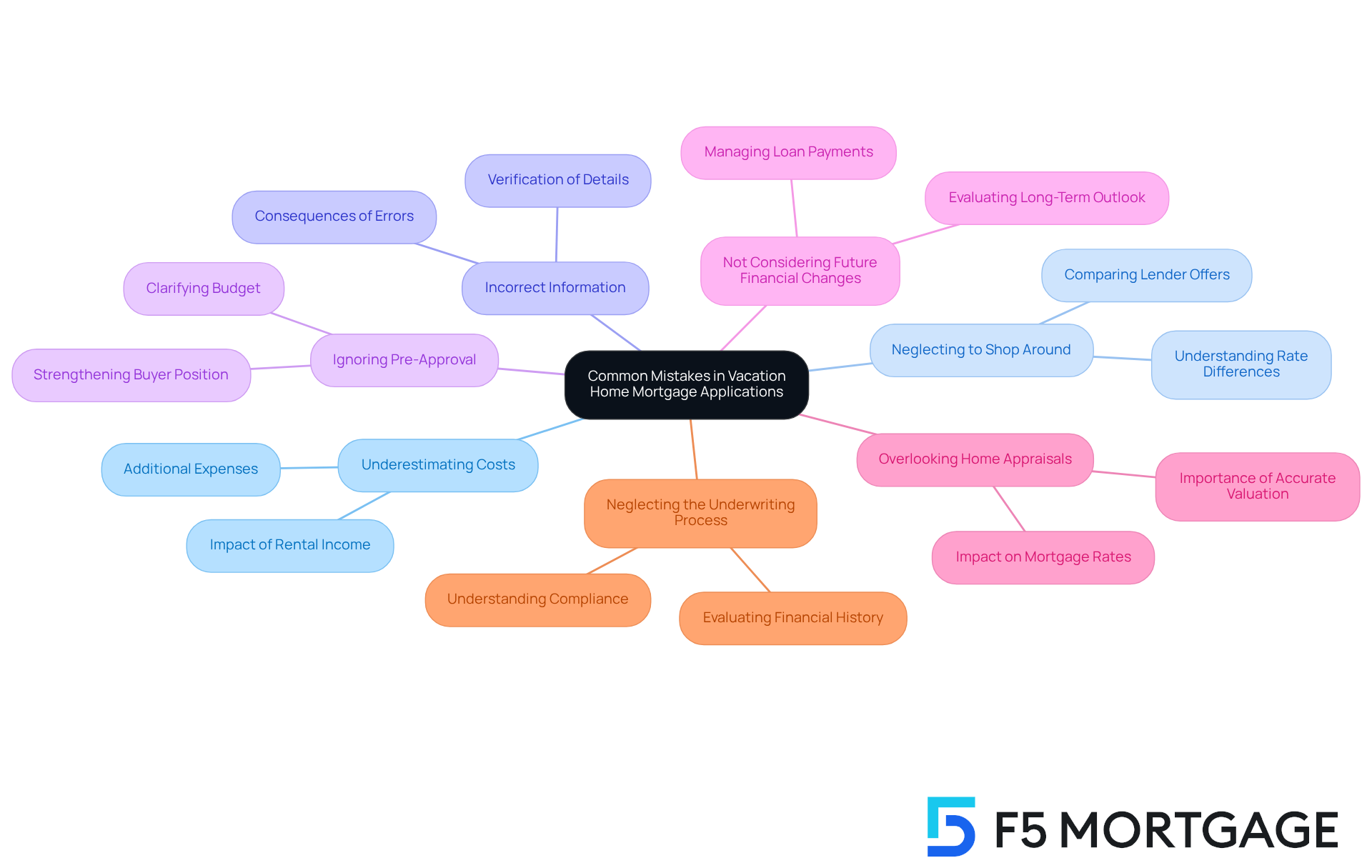

Identify Common Mistakes in Vacation Home Mortgage Applications

When applying for a vacation home mortgage, we understand how overwhelming it can be to navigate the various challenges associated with vacation home mortgage rates that may lead to financial strain. Here are some common pitfalls to be aware of:

-

Underestimating Costs: Many buyers focus solely on the mortgage payment, overlooking additional expenses such as property taxes, insurance, maintenance, and potential homeowners association fees. In 2025, the average extra expenses for vacation property ownership can significantly impact your overall budgeting. It’s essential to consider these factors. If the property has a rental history, numerous lenders will factor in rental income in loan applications, which can help ease some financial pressure.

-

Neglecting to Shop Around: Failing to compare offers from various lenders may mean missing out on better prices and conditions. Since vacation home mortgage rates often exceed those for primary residences, thorough investigation is crucial to secure the most favorable funding. Consider reaching out to F5 Mortgage, which offers competitive rates and personalized service tailored to your needs.

-

Incorrect Information: Providing erroneous or incomplete details on loan applications can lead to delays or outright refusals. To avoid complications in the approval process, buyers should meticulously verify their information.

-

Ignoring Pre-Approval: Skipping the pre-approval process can leave buyers vulnerable in competitive markets, where sellers often favor buyers with secured financing. A pre-approval not only strengthens your position but also clarifies your budget.

-

Not Considering Future Financial Changes: It’s important to evaluate your long-term financial outlook, including potential shifts in income or expenses. This foresight is essential to ensure you can manage loan payments over time without undue stress.

-

Overlooking Home Appraisals: Understanding the importance of home appraisals is crucial, as they can significantly affect mortgage rates and the overall financing process. A proper evaluation ensures that the asset value aligns with the loan amount, which is essential for securing favorable terms.

-

Neglecting the Underwriting Process: The underwriting process is vital for ensuring loan compliance and assessing risk. Buyers should be aware of how their financial history and property details will be evaluated during this stage.

Case studies reveal that many buyers underestimate the total costs associated with vacation home purchases, leading to financial strain. For instance, one buyer focused solely on the mortgage payment and later faced unexpected maintenance costs that strained their budget. Another instance highlighted the significance of budgeting for ongoing asset management to safeguard the value of the investment and secure steady rental income.

Mortgage professionals emphasize that overlooking these additional costs can lead to significant financial challenges. As one expert observed, “A vacation property isn’t merely a location — it’s a real estate tactic and if executed effectively, a wealth generator.” Another professional stated, “Budgeting for ongoing maintenance and property management is essential to protect your investment and ensure it remains a source of enjoyment and income.” Understanding the full scope of expenses involved in vacation home ownership, such as vacation home mortgage rates, is essential for making informed decisions and enjoying the benefits of a second home.

Conclusion

Understanding vacation home mortgage rates is crucial for anyone considering the purchase of a second property. These specialized loans come with unique features that differ significantly from traditional home mortgages, including higher interest rates, larger down payments, and stringent lending criteria. We know how challenging this can be, but by grasping these differences, potential buyers can better navigate the complexities of financing a vacation home and make informed decisions that align with their financial goals.

Throughout this article, we have highlighted key factors influencing vacation home mortgage rates, such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

The importance of thorough research, pre-approval, and avoiding common pitfalls in the application process cannot be overstated. By being aware of these elements, buyers can position themselves more favorably in a competitive market and secure the best possible terms for their mortgage.

Ultimately, the journey to owning a vacation home should be approached with careful planning and consideration. By understanding the financial implications and preparing adequately, individuals can transform their dream of a second home into a reality. Taking the time to educate oneself about current vacation home mortgage rates and the intricacies of the mortgage process will not only facilitate a smoother transaction but also enhance the overall experience of owning a cherished getaway. We’re here to support you every step of the way.

Frequently Asked Questions

What are vacation home mortgages?

Vacation home mortgages are specialized financing options for purchasing real estate that is not intended to be a primary residence.

How do vacation home mortgage rates compare to primary residence loans?

Vacation home mortgage rates are generally higher than those for primary residences due to perceived risk. In 2024, the average vacation home mortgage rate for additional properties was reported at 6.906%.

What is the typical down payment required for a vacation home mortgage?

Lenders typically require a larger down payment for vacation home mortgages, usually between 10% to 20% of the property’s purchase price.

Do lenders consider rental income when applying for a vacation home mortgage?

Yes, if you plan to lease the property, lenders may take potential rental income into account when evaluating your application. However, anticipated rental income cannot qualify you as a borrower if the property is intended solely as a second dwelling.

What are reserves, and why are they important for vacation property loans?

Reserves are funds that lenders require borrowers to have set aside, usually equivalent to two to six monthly mortgage payments. This requirement is crucial for financial planning when obtaining a vacation property loan.

What additional expenses should be considered when owning a vacation home?

Owning a vacation home involves additional expenses such as taxes, insurance, and maintenance. Homeowners insurance is mandatory, and premiums can vary significantly based on the property’s location and type.

How does the location of a vacation home affect insurance costs?

Properties in high-risk areas, such as coastal regions, may incur higher insurance costs due to the potential for natural disasters, impacting overall expenses for the homeowner.