Overview

The VA funding fee chart serves as an essential resource for homebuyers using VA-backed mortgages. This chart outlines the one-time fee, which varies based on loan type, military status, and prior use of VA benefits. Understanding this chart is crucial for effective budgeting and financial planning. We know how challenging this can be, as the fee can significantly affect overall mortgage costs and impact access to homeownership for veterans and service members.

By familiarizing yourself with the funding fee, you can better prepare for the financial responsibilities of homeownership. This understanding empowers you to make informed decisions, ensuring that you and your family can navigate the mortgage process with confidence. We’re here to support you every step of the way.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially for veterans and service members eager to make the most of their VA benefits. We understand how challenging this can be. That’s why the VA funding fee chart is such a vital resource; it clearly outlines the costs associated with VA-backed mortgages, helping you grasp your financial commitments.

However, with fees that vary based on loan type, military status, and other factors, how can you ensure that your decisions align with your financial goals? We’re here to support you every step of the way.

Defining the VA Funding Fee Chart

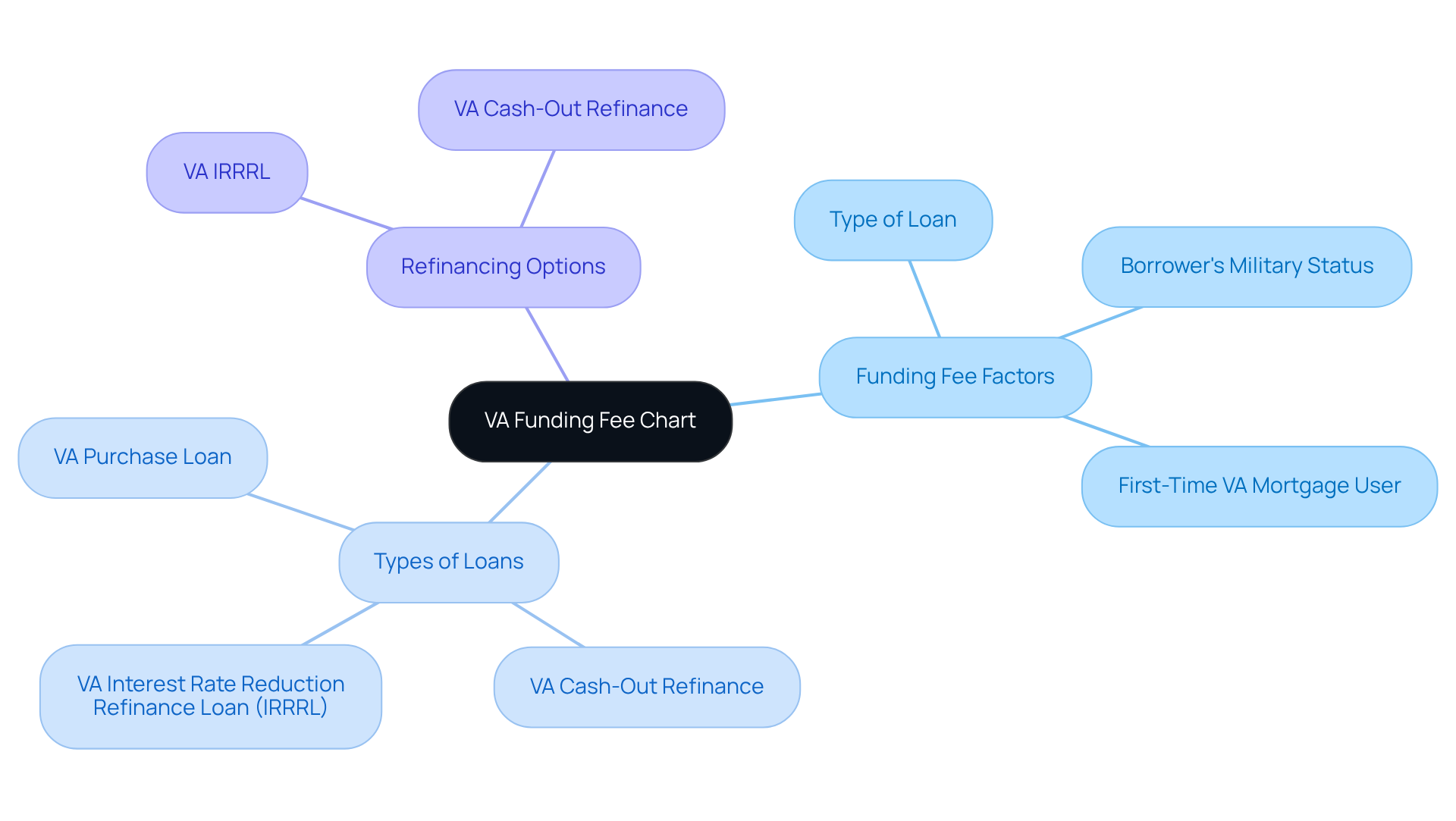

Navigating the VA funding fee chart can feel overwhelming, but it’s an essential tool for veterans and service members seeking a VA-backed mortgage. This one-time charge, calculated as a percentage of the total amount borrowed, varies based on factors like the type of loan, the borrower’s military status, and whether it’s their first time using a VA mortgage.

In California, VA financing offers remarkable benefits, allowing families to purchase a primary home without a down payment. We understand how crucial this is for enhancing . Once you build equity in your home, there are refinancing options available. For instance, the VA Interest Rate Reduction Refinance Loan (IRRRL) can help lower your monthly payments, while a VA cash-out refinance provides flexibility for various financial needs.

This VA funding fee chart serves as a vital resource, helping you understand your financial responsibilities when utilizing VA benefits. We know how challenging this can be, and we’re here to support you every step of the way, ensuring you make informed choices throughout the mortgage process.

Context and Importance of the VA Funding Fee Chart for Homebuyers

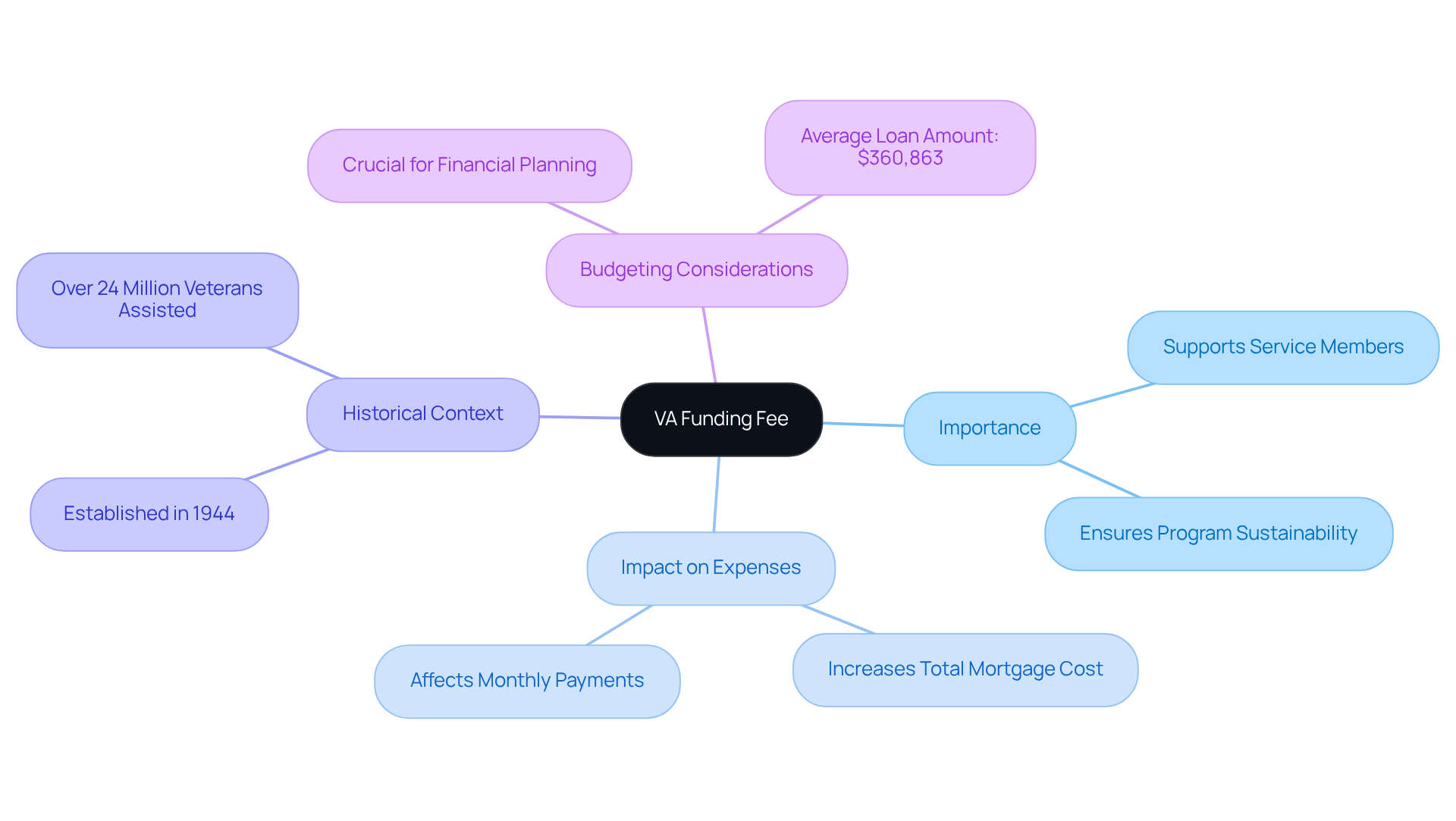

An essential resource for homebuyers is the VA funding fee chart, which outlines the expenses associated with VA financing. By providing economical funding options for service members, the VA aims to support those who have served our country. The introduction of a funding fee helps ensure the program’s sustainability, enabling it to assist future generations of veterans. This fee is vital in balancing program costs, allowing lenders to offer financing without the burden of down payments or private mortgage insurance.

Understanding the VA funding fee chart is crucial for effective budgeting and financial planning, as it directly impacts the total mortgage expense. We know how challenging this can be, so financial advisors recommend that prospective borrowers carefully consider the VA funding fee chart when assessing their budget for a VA mortgage. For example, with the average loan amount for VA loans around $360,863, the funding fee can significantly affect monthly payments and overall loan costs.

Since its inception in 1944, the VA Home Loan program has enabled more than 24 million service members to achieve homeownership by 2025, underscoring its importance. As families think about improving their homes, being informed about the funding fee and its implications can lead to more strategic financial decisions. We’re here to support you every step of the way, ensuring that former service members can .

Historical Background of the VA Funding Fee

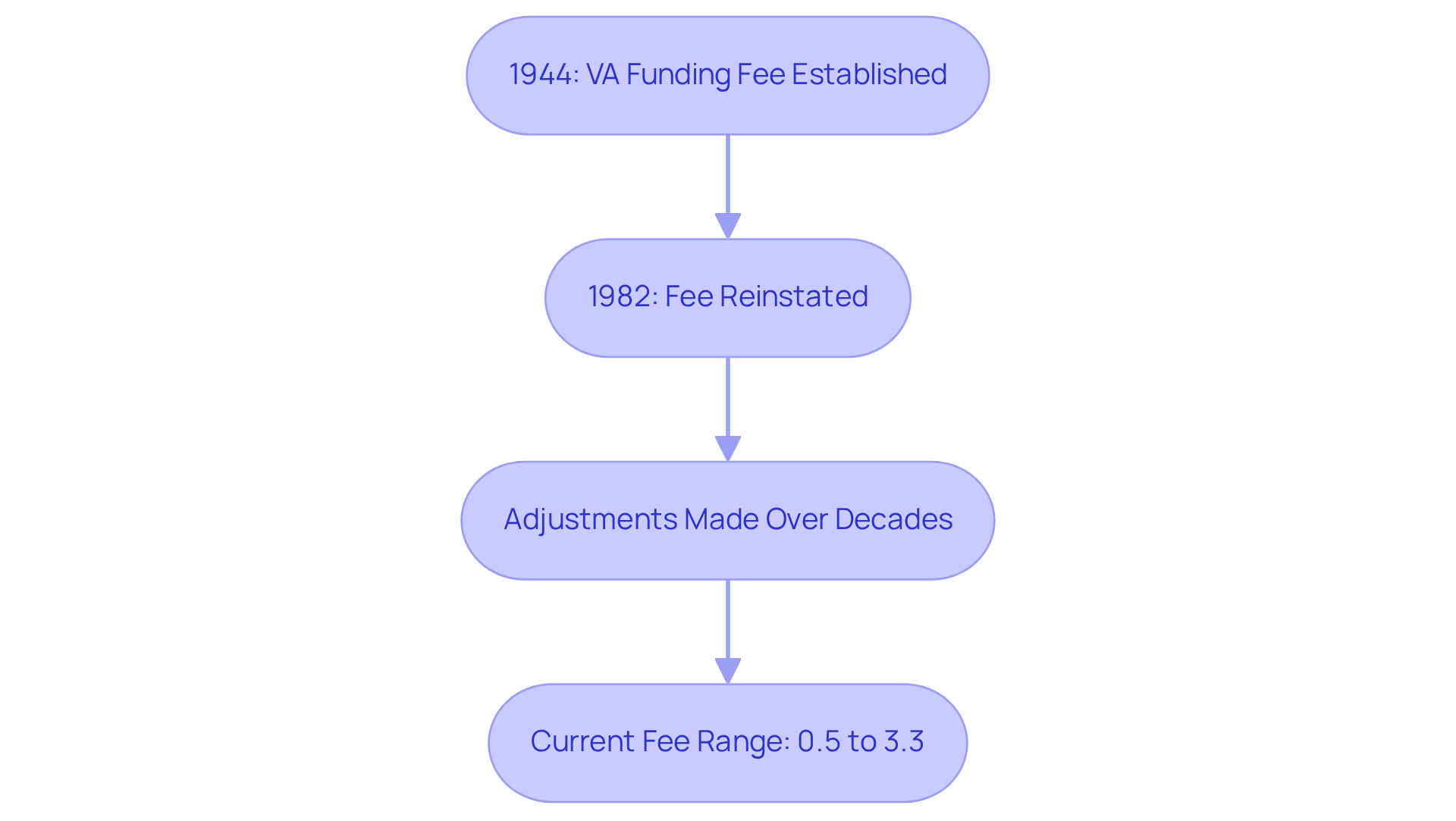

The VA Funding Fee was established as part of the VA Home Loan initiative in 1944, aimed at assisting former military personnel returning from World War II in purchasing homes. Initially, this fee was set at a modest rate, ensuring that homeownership remained affordable for those who served. Over the decades, adjustments have been made to the fee, reflecting economic conditions and the evolving needs of our veteran community.

For instance, in 1982, the funding fee was reinstated after a temporary suspension, showcasing the government’s dedication to sustaining this vital program. Today, the fee, as indicated in the VA funding fee chart, ranges from 0.5% to 3.3%, depending on various factors such as the type of credit and the borrower’s military service record.

We understand how navigating these details can feel overwhelming, but we’re here to .

Key Characteristics and Variations of the VA Funding Fee

Understanding the is essential for homebuyers, as it can vary significantly based on a few key factors.

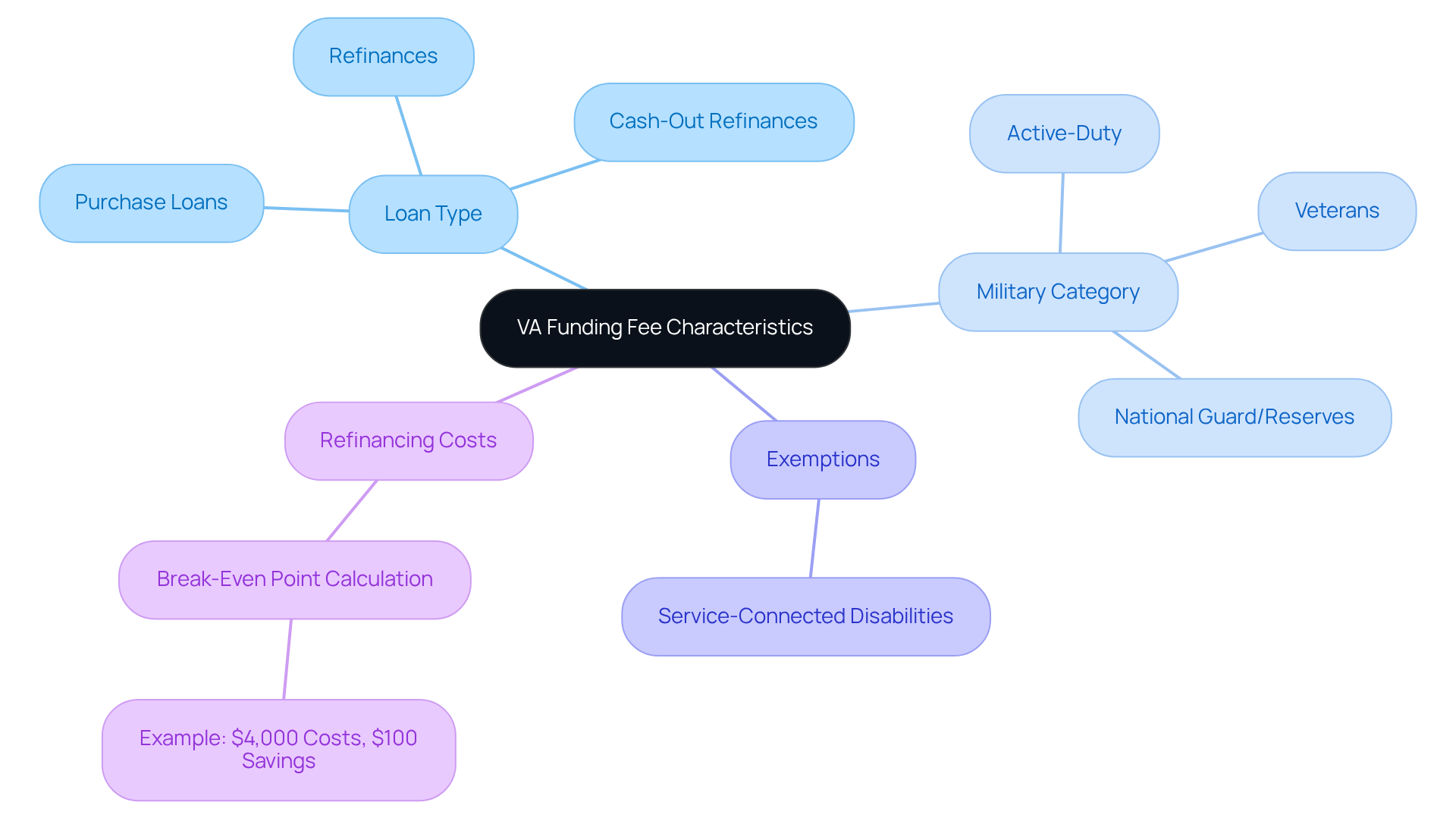

- Loan Type: The fee differs for various loan types, such as purchase loans, refinances, and cash-out refinances. For example, first-time homebuyers who choose a VA loan with no down payment typically face a higher funding fee of 2.15%. This translates to $6,450 on a $300,000 home, which is notably higher than those who make a down payment.

- Military Category: Your military status also plays a role in determining the funding fee. Active-duty service members, veterans, and those in the National Guard or Reserves will encounter different fees, reflecting their unique service categories.

- Exemptions: It’s important to note that certain veterans, especially those with service-connected disabilities, may qualify for exemptions from the funding fee entirely. This can significantly affect their financial planning and overall affordability.

We know how challenging navigating these variations can be, but grasping them empowers you to accurately assess potential expenses and make informed choices about your financing options. For those considering refinancing, recognizing the associated costs—typically ranging from 2% to 5% of the loan amount—is crucial.

For instance, if you’re restructuring a $300,000 home, your closing costs could fall between $6,000 and $15,000. Determining your break-even point by evaluating refinancing expenses against monthly savings can help you decide if refinancing is a financially sound choice.

Let’s say your refinancing costs amount to $4,000 and you anticipate monthly savings of $100. In this case, your break-even point would be 40 months ($4,000 divided by $100). This analysis is vital for making well-informed financial decisions, and remember, we’re here to support you every step of the way.

Conclusion

Navigating the complexities of the VA funding fee chart is crucial for veterans and service members looking to secure a VA-backed mortgage. We understand how challenging this can be, and this essential tool helps borrowers comprehend their financial obligations and the associated costs of homeownership. By doing so, it ensures that they can make informed decisions that align with their financial goals.

Key insights highlighted throughout the article include:

- The historical context of the funding fee

- Its variations based on loan type and military status

- The potential exemptions available for certain veterans

Understanding these elements not only aids in effective budgeting but also empowers borrowers to take full advantage of the benefits offered by the VA Home Loan program.

Ultimately, being well-informed about the VA funding fee and its implications can significantly enhance the home buying experience for veterans. As families plan for their futures, taking the time to thoroughly understand this fee can lead to more strategic financial choices. We’re here to support you every step of the way, helping to pave the path for successful homeownership. Embracing this knowledge is not just about navigating costs; it’s about honoring the service of veterans by ensuring they have access to the resources they need for a stable and prosperous future.

Frequently Asked Questions

What is the VA funding fee chart?

The VA funding fee chart is a tool that outlines the one-time charge, calculated as a percentage of the total amount borrowed, that veterans and service members must pay when seeking a VA-backed mortgage.

What factors influence the VA funding fee?

The VA funding fee varies based on the type of loan, the borrower’s military status, and whether it is the borrower’s first time using a VA mortgage.

What benefits does VA financing offer in California?

VA financing in California allows families to purchase a primary home without a down payment, enhancing homeownership accessibility.

What refinancing options are available for VA mortgage holders?

VA mortgage holders can consider the VA Interest Rate Reduction Refinance Loan (IRRRL) to lower monthly payments or a VA cash-out refinance for various financial needs.

How does the VA funding fee chart help borrowers?

The VA funding fee chart helps borrowers understand their financial responsibilities when utilizing VA benefits, ensuring they make informed choices throughout the mortgage process.