Overview

In 2024, the VA funding fee is a one-time charge that applies to veterans, active-duty service members, and certain surviving spouses when securing a VA-backed mortgage. This fee plays a crucial role in ensuring the sustainability of the VA financing program, which aims to support those who have served our country.

We understand that navigating the mortgage process can be challenging. The fee’s tiered structure is designed with your needs in mind, varying based on down payment amounts and borrower status. Additionally, there are exemptions available for eligible veterans, making homeownership more accessible for many families.

This fee not only highlights the importance of the VA program but also compares favorably against other mortgage costs, such as private mortgage insurance. We’re here to support you every step of the way as you explore your options and make informed decisions about your home financing.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially for our veterans and active-duty service members. We understand how important it is to leverage the benefits of a VA-backed mortgage, and we’re here to support you every step of the way. Central to this journey is the VA funding fee, a vital one-time cost that significantly contributes to the sustainability of the VA financing program.

As mortgage costs evolve, it becomes essential to grasp the nuances of the VA funding fee for 2024—its rates, exemptions, and overall impact. This understanding is crucial for making informed financial decisions.

How can veterans maximize their benefits while minimizing costs in this intricate financial terrain? Together, we can explore the answers and empower you to navigate this process with confidence.

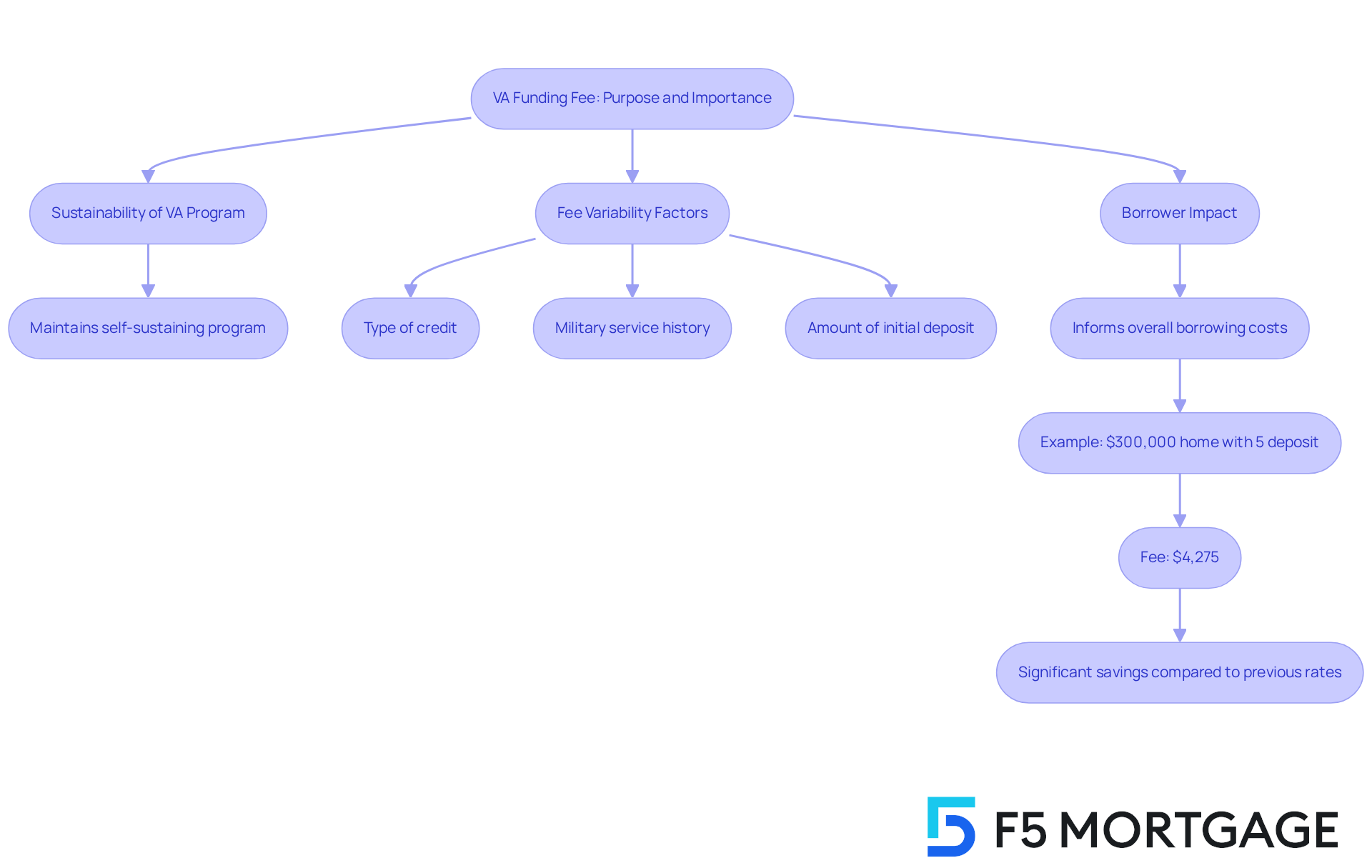

Define the VA Funding Fee: Purpose and Importance

The VA funding fee 2024 is a vital one-time cost that veterans, active-duty service members, and certain surviving spouses encounter when securing a VA-backed mortgage. This fee is essential for maintaining the sustainability of the VA financing program, which offers significant benefits, such as no upfront cost and the absence of monthly mortgage insurance. By collecting this fee, the VA ensures that the program remains self-sustaining, enabling it to continue providing affordable housing options for those who have served.

It’s important to note that the financing charge is not fixed; it varies based on several factors, including the type of credit, the borrower’s military service history, and the amount of the initial deposit. For instance:

- First-time borrowers with a down payment of less than 5% face a charge of 2.15%.

- Those who contribute 10% or more benefit from a reduced fee of 1.25%.

This tiered structure is thoughtfully designed to cater to diverse borrower situations, with exemptions available for specific veterans, such as those with a service-connected disability.

Understanding the VA funding fee 2024 is crucial for borrowers, as it directly impacts their overall borrowing costs. For example, a first-time VA mortgage user purchasing a $300,000 home with a 5% deposit would incur a fee of $4,275, showcasing a significant saving compared to previous rates. This financial insight empowers veterans to make informed decisions about their home financing options, helping them navigate the complexities of the mortgage process with confidence.

Veterans have expressed the importance of the VA financing fee in making homeownership possible. One veteran shared, “The VA home financing program has been a lifeline for many of us, making homeownership attainable without the burden of a large upfront cost.” This sentiment highlights the fee’s crucial role in assisting veterans in obtaining homes, reinforcing the program’s significance in the housing market.

Explore VA Funding Fee Rates and Calculation Methods for 2024

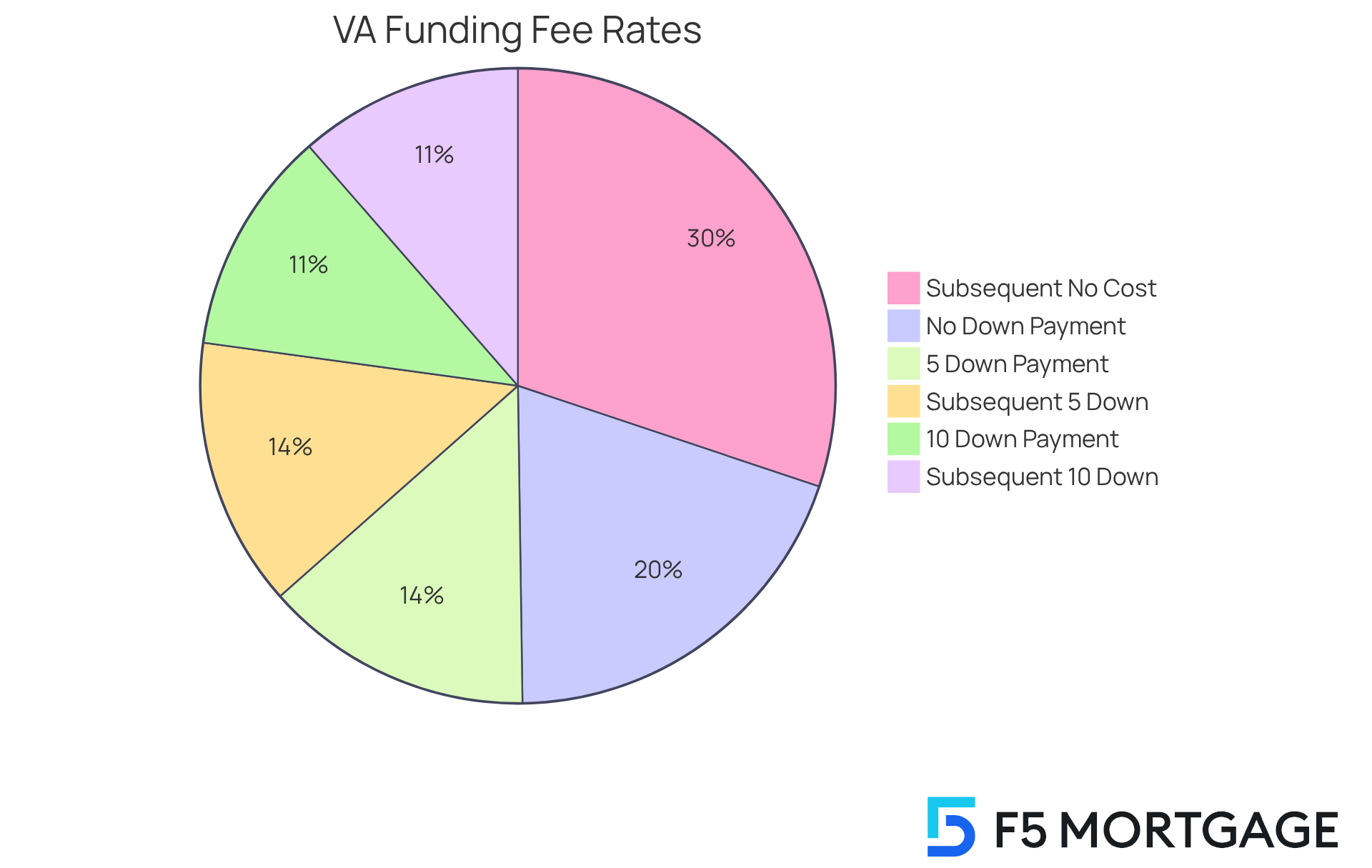

As we look ahead to 2024, it’s important to understand the VA funding fee 2024 rates, which are designed to assist you in your journey. Here’s how they are structured:

- First-time borrowers with no down payment: 2.15% of the loan amount.

- First-time borrowers with a down deposit of 5% or more: 1.5%.

- First-time borrowers with a down deposit of 10% or more: 1.25%.

- Subsequent use of VA loan advantages with no upfront cost: 3.3%.

- Following utilization with a down deposit of 5% or more: 1.5%.

- Following use with a down deposit of 10% or more: 1.25%.

To determine the charge, simply multiply the loan amount by the relevant percentage. For instance, if a veteran takes a loan of $200,000 with no initial deposit as a first-time borrower, the charge would be $4,300 (which is 2.15% of $200,000). We know how challenging this can be, and understanding this calculation method is crucial for anticipating your financial obligations accurately. We’re here to support you every step of the way.

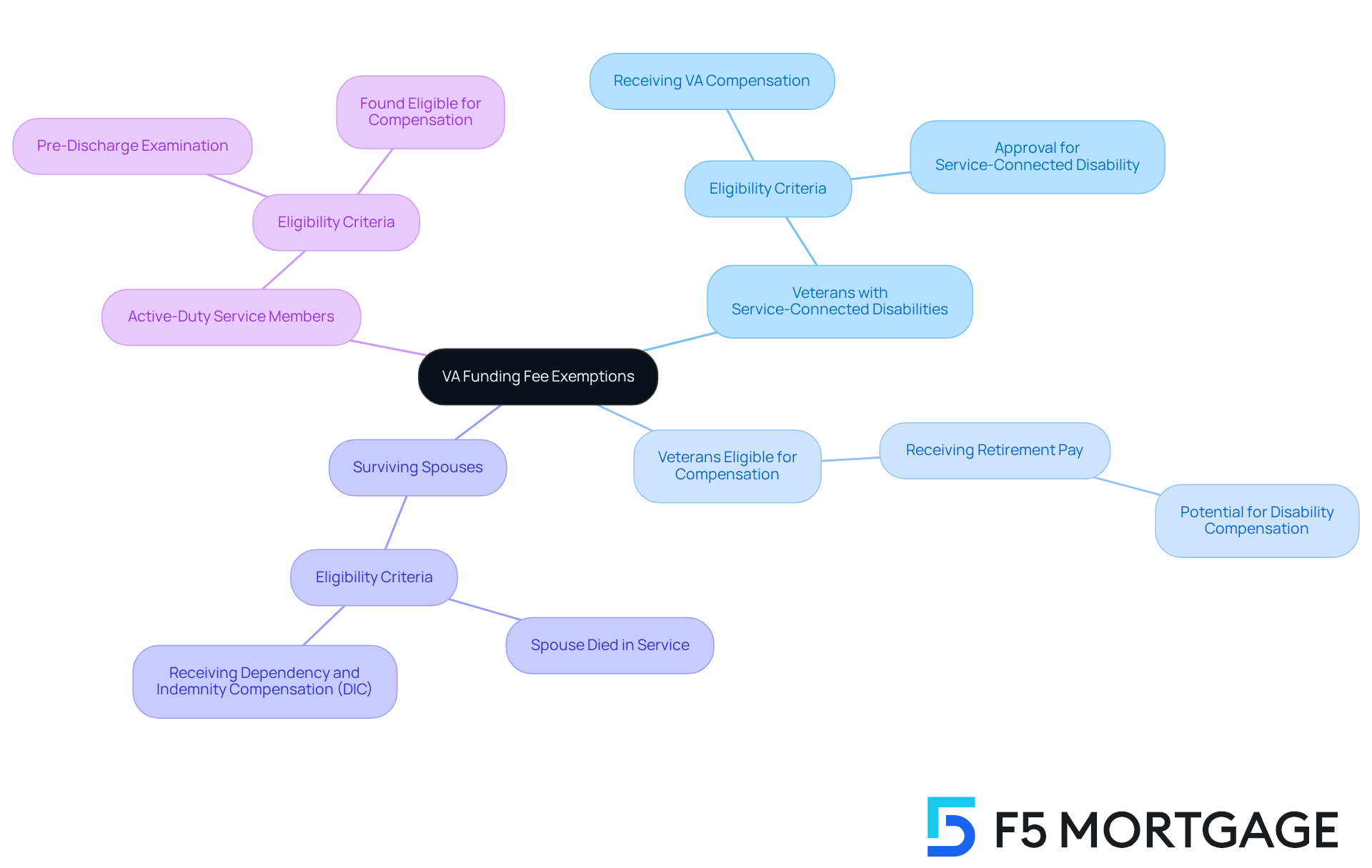

Identify Exemptions: Who Qualifies for a Reduced or Waived VA Funding Fee?

Certain individuals may qualify for a waiver of the VA service charge, a one-time fee applied to all VA home mortgages that helps reduce overall expenses for taxpayers. We understand how important financial relief can be, especially for those who have served. Eligible groups include:

- Veterans receiving compensation for service-connected disabilities: This group represents a significant portion of veterans, as many are approved for compensation due to their service-related conditions.

- Veterans who would be eligible for compensation if they were not receiving retirement pay: This includes those who have served honorably but are currently receiving retirement benefits instead of disability compensation.

- Surviving spouses of veterans who died in service or from a service-related disability: These individuals can benefit from the exemption, easing their financial burden during a challenging time.

- Active-duty service members who have received a pre-discharge examination and are found to be eligible for compensation: This provision allows those still serving to access benefits that can assist them in their transition to civilian life.

The VA funding fee 2024 fluctuates depending on factors such as the initial contribution and whether it is the borrower’s first VA mortgage. For instance, for loans with no down payment, the VA funding fee 2024 is typically 2.3% for first-time users, which can add significant costs to closing. To apply for an exemption related to the VA funding fee 2024, eligible borrowers must submit the necessary documentation to their lender, who will then verify the exemption status with the VA. Understanding these exemptions is crucial for veterans and their families, as it enables them to maximize their benefits and minimize costs associated with home financing.

For instance, veterans like Maria have saved more than $5,000 on their home acquisitions because of the VA fee exemption, allowing them to direct those resources towards moving expenses or home enhancements. Furthermore, if a veteran qualifies for a service-connected disability after closure, they might be able to request a refund of the VA fee. By being aware of eligibility requirements and the application procedure, veterans can navigate the complexities of VA financing more effectively. We know how challenging this can be, and we’re here to support you every step of the way.

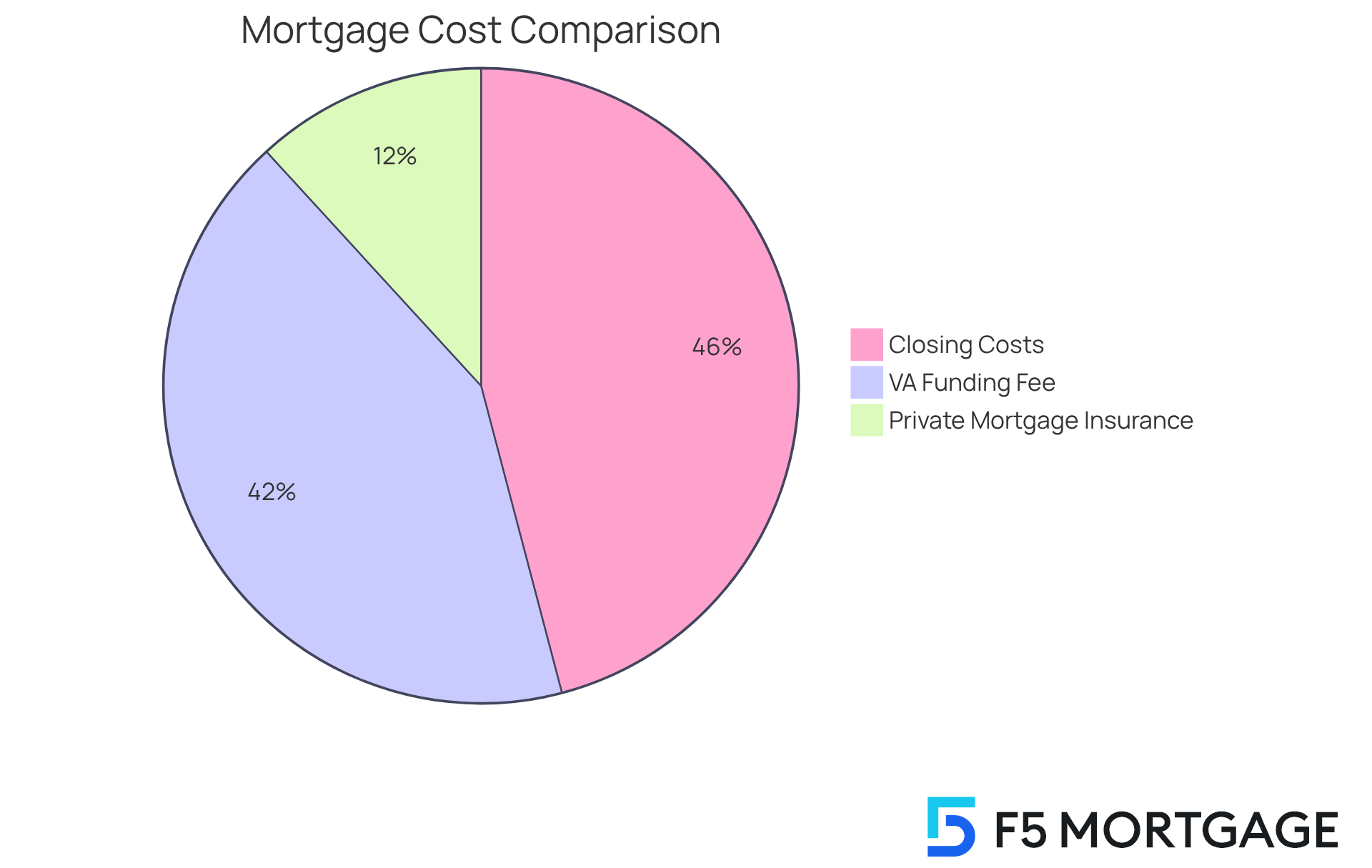

Compare VA Funding Fee with Other Mortgage Costs: Understanding the Financial Landscape

When evaluating the VA funding fee 2024, we understand how important it is to compare it with other mortgage costs, such as private mortgage insurance (PMI) and closing costs.

Private Mortgage Insurance (PMI): Typically necessary for conventional financing with less than a 20% down payment, PMI can cost between 0.3% to 1.5% of the initial borrowing amount each year. For a $200,000 loan, this could mean an extra $600 to $3,000 annually.

Closing Costs: These can vary from 2% to 5% of the borrowing amount, depending on the lender and location. For a $200,000 mortgage, closing expenses might range from $4,000 to $10,000.

In contrast, the VA funding fee 2024 is a one-time charge that can be incorporated into the total amount, making it a more manageable expense for many borrowers. For instance, a first-time VA mortgage borrower acquiring a $300,000 home with no upfront cost would incur a VA funding fee 2024 of $6,450. Notably, for a second-time VA mortgage, the VA funding fee 2024 would rise to $9,900.

Furthermore, VA mortgages do not require monthly mortgage insurance payments, which can lead to significant savings over the life of the loan. Additionally, sellers can contribute up to 4% of the sales price in concessions for VA loans, providing you with extra financial flexibility.

Understanding these comparisons helps veterans and service members make informed decisions about their mortgage options. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

The VA funding fee for 2024 plays a vital role in making VA-backed mortgages accessible for veterans, active-duty service members, and certain surviving spouses. This one-time fee not only ensures the sustainability of the VA financing program but also offers significant benefits, such as no upfront costs and no monthly mortgage insurance. By grasping the nuances of this fee, you can navigate your home financing options more effectively and make informed decisions that align with your financial goals.

In this article, we’ve explored various aspects of the VA funding fee, including its tiered structure based on down payments, the importance of exemptions for eligible individuals, and how it compares to other mortgage costs. This information clarifies how the fee is calculated and highlights the financial relief available to certain veterans. Understanding the overall impact of the VA funding fee can enhance homeownership affordability, allowing you to appreciate the value of the VA financing program as you embark on your journey toward homeownership.

Ultimately, understanding the VA funding fee goes beyond just the mechanics; it’s about recognizing how it empowers you to achieve your dreams of homeownership. By taking advantage of available exemptions and comparing this fee with other mortgage costs, you can significantly lighten your financial load. We know how challenging this can be, and it’s essential for you and your family to stay informed and proactive in leveraging your benefits. Together, we can ensure you maximize your opportunities within the housing market.

Frequently Asked Questions

What is the VA funding fee?

The VA funding fee is a one-time cost that veterans, active-duty service members, and certain surviving spouses must pay when securing a VA-backed mortgage. It is essential for maintaining the sustainability of the VA financing program.

Why is the VA funding fee important?

The funding fee is important because it helps keep the VA financing program self-sustaining, allowing it to continue offering significant benefits like no upfront cost and no monthly mortgage insurance.

How does the VA funding fee vary?

The VA funding fee varies based on factors such as the type of credit, the borrower’s military service history, and the amount of the initial deposit. For example, first-time borrowers with a down payment of less than 5% face a charge of 2.15%, while those with a down payment of 10% or more have a reduced fee of 1.25%.

Are there exemptions to the VA funding fee?

Yes, there are exemptions available for specific veterans, such as those with a service-connected disability.

How does the VA funding fee impact overall borrowing costs?

The VA funding fee directly impacts overall borrowing costs. For instance, a first-time VA mortgage user purchasing a $300,000 home with a 5% deposit would incur a fee of $4,275, which represents a significant saving compared to previous rates.

What do veterans think about the VA funding fee?

Many veterans view the VA funding fee as a crucial element that makes homeownership possible. It allows them to obtain homes without the burden of a large upfront cost, reinforcing the program’s significance in the housing market.