Overview

Home equity loans can offer families significant financial benefits. They often come with lower interest rates and predictable payments, making them an appealing option for funding major expenses. However, we know how challenging this decision can be. These loans also carry risks, such as:

- The potential for foreclosure if payments are missed

- Increased overall debt

It’s essential to carefully weigh both the advantages and disadvantages before proceeding.

As you consider your options, think about how these loans could impact your family’s financial future. We’re here to support you every step of the way, helping you navigate these important choices. Remember, understanding the full picture is crucial to making the best decision for your family.

Introduction

Homeownership often represents a significant financial milestone, and we understand how important it is for families to make the most of their investment. Many families, however, may not be aware of the opportunity to leverage their property’s value through home equity loans. These loans can provide a substantial cash influx for essential expenses, such as education or home improvements, while offering the stability of fixed interest rates.

Yet, it’s crucial to recognize that the allure of easy access to funds comes with its own set of risks. Families must be aware of the potential for foreclosure and the possibility of increased debt. How can families navigate this complex landscape of home equity loans? By understanding the challenges and exploring the solutions available, they can make informed financial decisions that align with their long-term goals.

We know how challenging this can be, but we’re here to support you every step of the way. Let’s explore how to approach home equity loans with confidence and care.

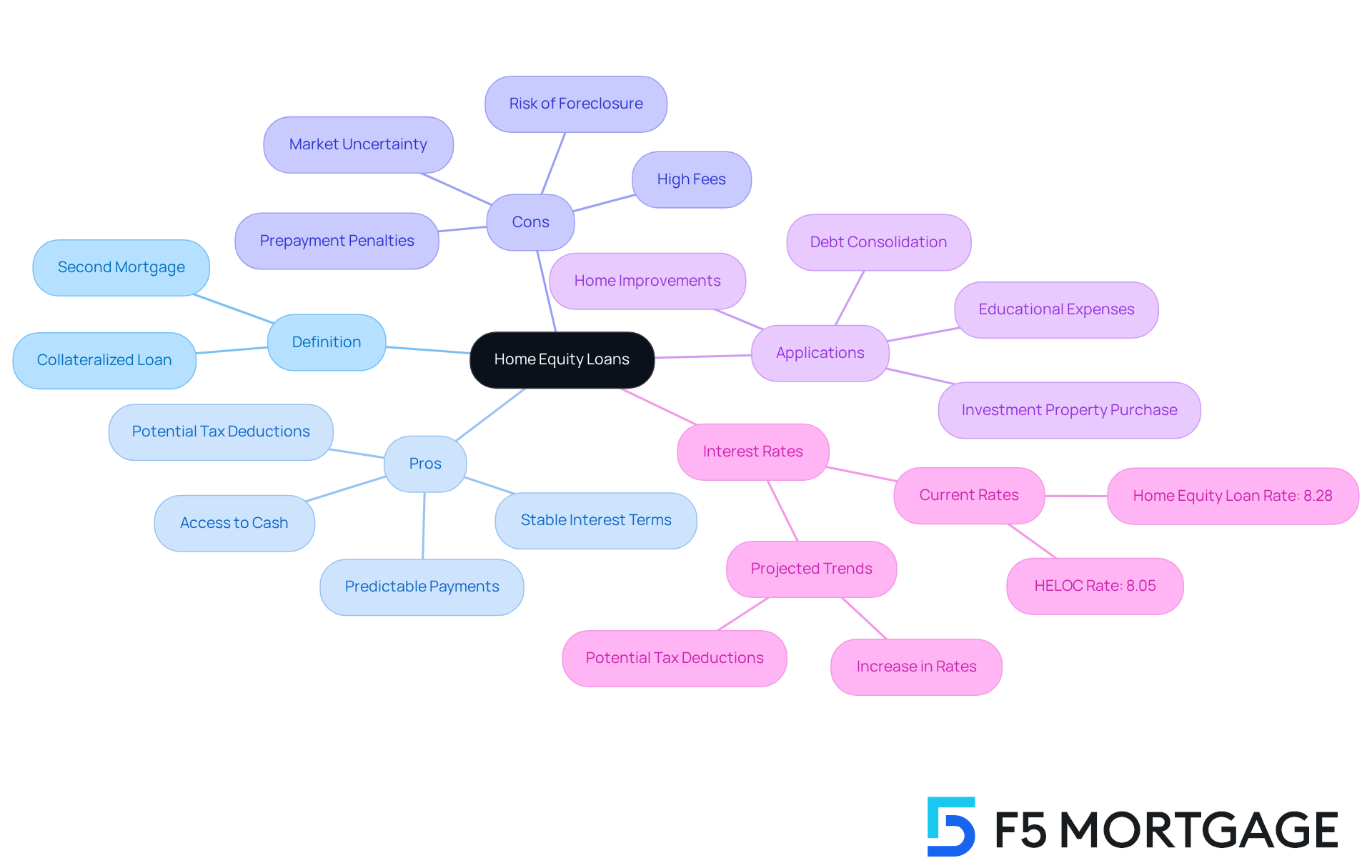

Define Home Equity Loans: Understanding the Basics

A property value credit, commonly known as a second mortgage, provides a way for property owners to utilize the value they’ve built in their homes, highlighting the pros and cons of home equity loan. This type of financing highlights the pros and cons of home equity loan, as it provides a lump sum secured by your residence, meaning your property serves as collateral. Many families find comfort in the stable interest terms and predictable monthly payments that highlight the pros and cons of home equity loan.

We understand that funding significant expenses, such as home improvements, educational costs, or consolidating debt, can feel overwhelming. This type of loan allows you to access a , typically determined by your home’s current market value minus any existing mortgage balance, which illustrates the pros and cons of home equity loan.

Starting in 2025, the average interest rate for home financing is projected to be around 8.28%. This makes property value credits an appealing option for those looking to understand the pros and cons of a home equity loan to maximize their home assets. We’re here to support you every step of the way as you navigate this process and explore your options.

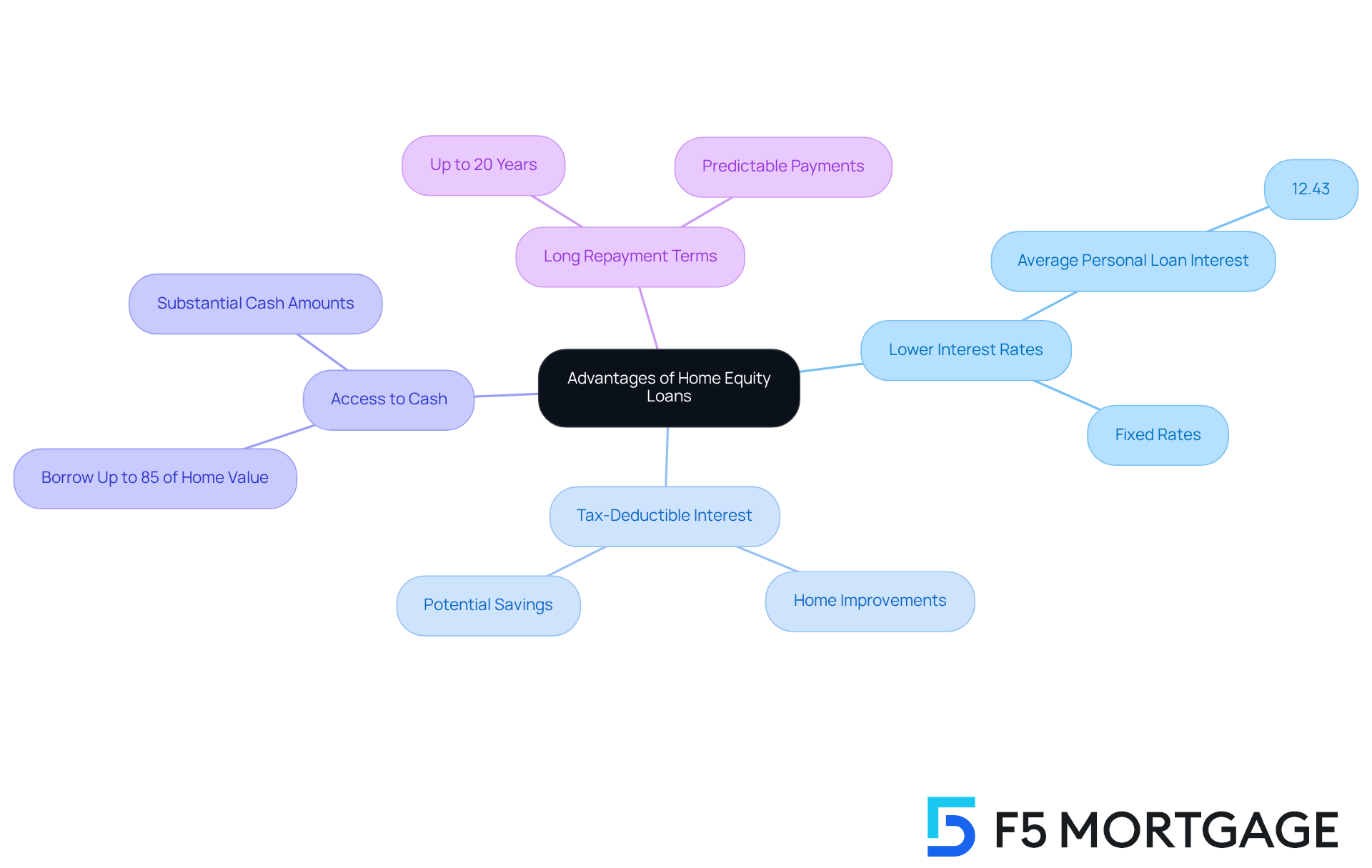

Explore the Advantages of Home Equity Loans

Home equity options can be a lifeline for families, especially when it comes to refinancing their mortgages. They often come with lower interest rates compared to unsecured loans or credit cards, making them a more budget-friendly choice. With mortgage costs recently dropping in Colorado, families can explore through F5 Mortgage, which can enhance their financial flexibility.

To put this into perspective, the average interest on an unsecured personal loan is 12.43%. This starkly contrasts with the affordability of property-backed financing. The stable interest rates associated with residential property financing ensure consistent monthly payments, helping families manage their budgets more effectively.

Additionally, if the funds are used for home improvements, the interest paid on these loans may even be tax-deductible, making them even more appealing. Imagine saving over $500 each month by refinancing high-interest debt with a property-backed credit option—this is a tangible way to experience financial relief.

Families can also access substantial cash amounts, often up to 85% of their property’s value, allowing them to address significant expenses without resorting to high-interest credit options. With repayment terms extending up to 20 years, property-backed financing provides a long-term solution that can ease financial stress.

This blend of lower rates, potential tax benefits, and significant borrowing power makes residential asset financing an attractive option for families, particularly when evaluating the pros and cons of home equity loan alongside the refinancing choices available through F5 Mortgage. We understand how challenging financial decisions can be, and we’re here to support you every step of the way.

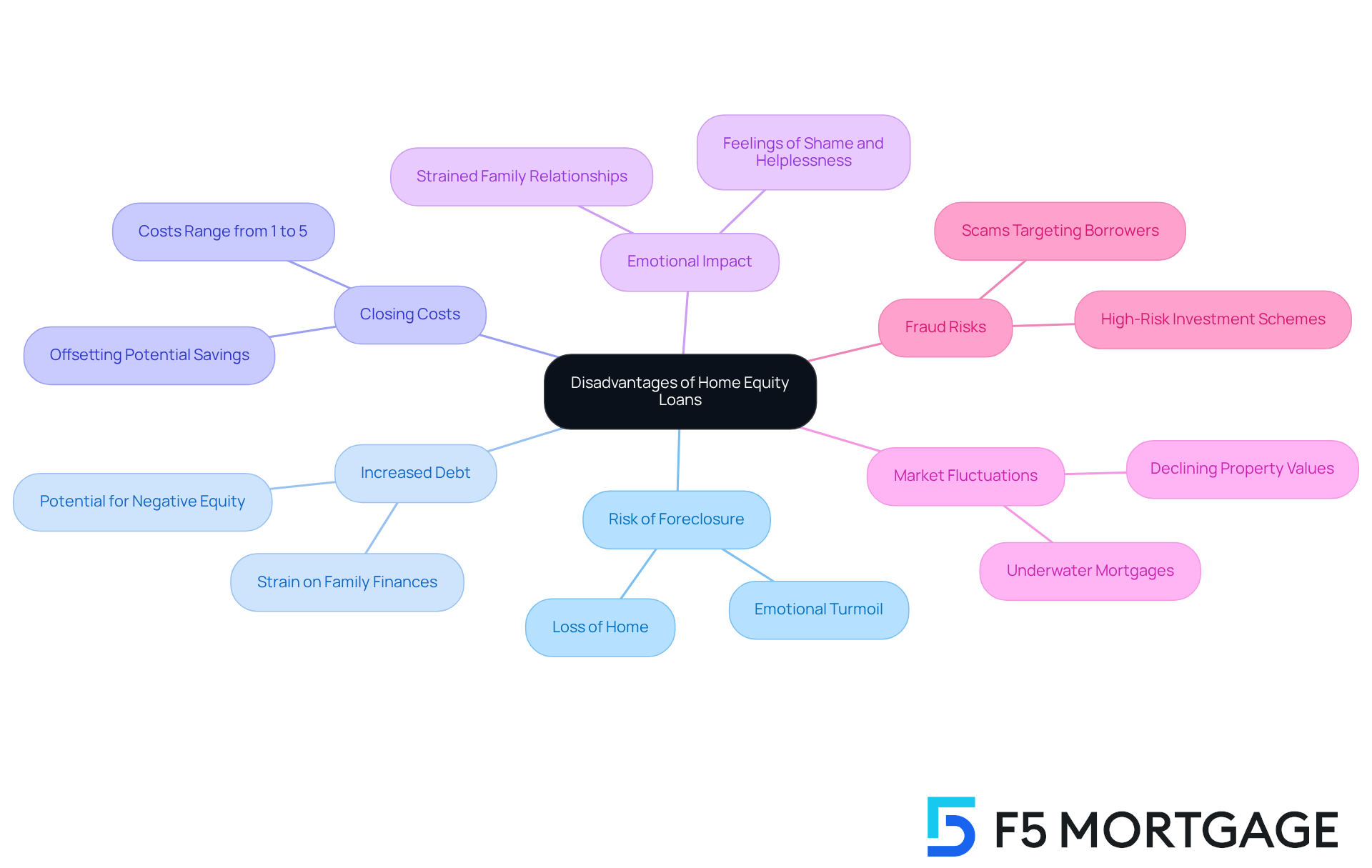

Examine the Disadvantages of Home Equity Loans

While residential financing can provide families with essential resources, it is crucial to understand the , as well as the significant drawbacks that accompany it. We understand how challenging this can be, especially when the residence serves as collateral. If timely payments are missed, the risk of foreclosure looms, which could result in losing the family’s home. This concern is heightened by the fact that understanding the pros and cons of home equity loan can increase overall debt, potentially straining a family’s finances, particularly when unexpected expenses arise.

In 2025, closing costs for property value loans can range from 1% to 5% of the total amount. This variability may diminish some of the financial advantages these options might provide. Financial advisors often highlight that understanding the pros and cons of home equity loan fees can offset potential savings, making it essential for families to thoroughly assess all expenses involved. Moreover, if property values decline, homeowners might find themselves in a negative equity situation, highlighting the pros and cons of home equity loan. This predicament complicates future financial choices and can lead to increased distress.

Consider families facing foreclosure due to property value borrowing; they often experience severe emotional and financial turmoil. Case studies reveal that the emotional toll of foreclosure can lead to feelings of shame and helplessness, which can strain family relationships. Experts like Matt Richardson emphasize the importance of understanding the pros and cons of home equity loan risks, particularly in an ever-changing economic landscape with fluctuating interest rates. Currently, residential asset borrowing rates average 8.37%, compared to 8.03% for HELOCs, underscoring the need for families to carefully evaluate their financing options.

Additionally, property owners should remain vigilant about the potential for fraud targeting those seeking housing financing. By thoughtfully considering the pros and cons of home equity loan, families can make informed decisions about whether property-backed borrowing aligns with their financial goals. We’re here to support you every step of the way as you navigate these important choices.

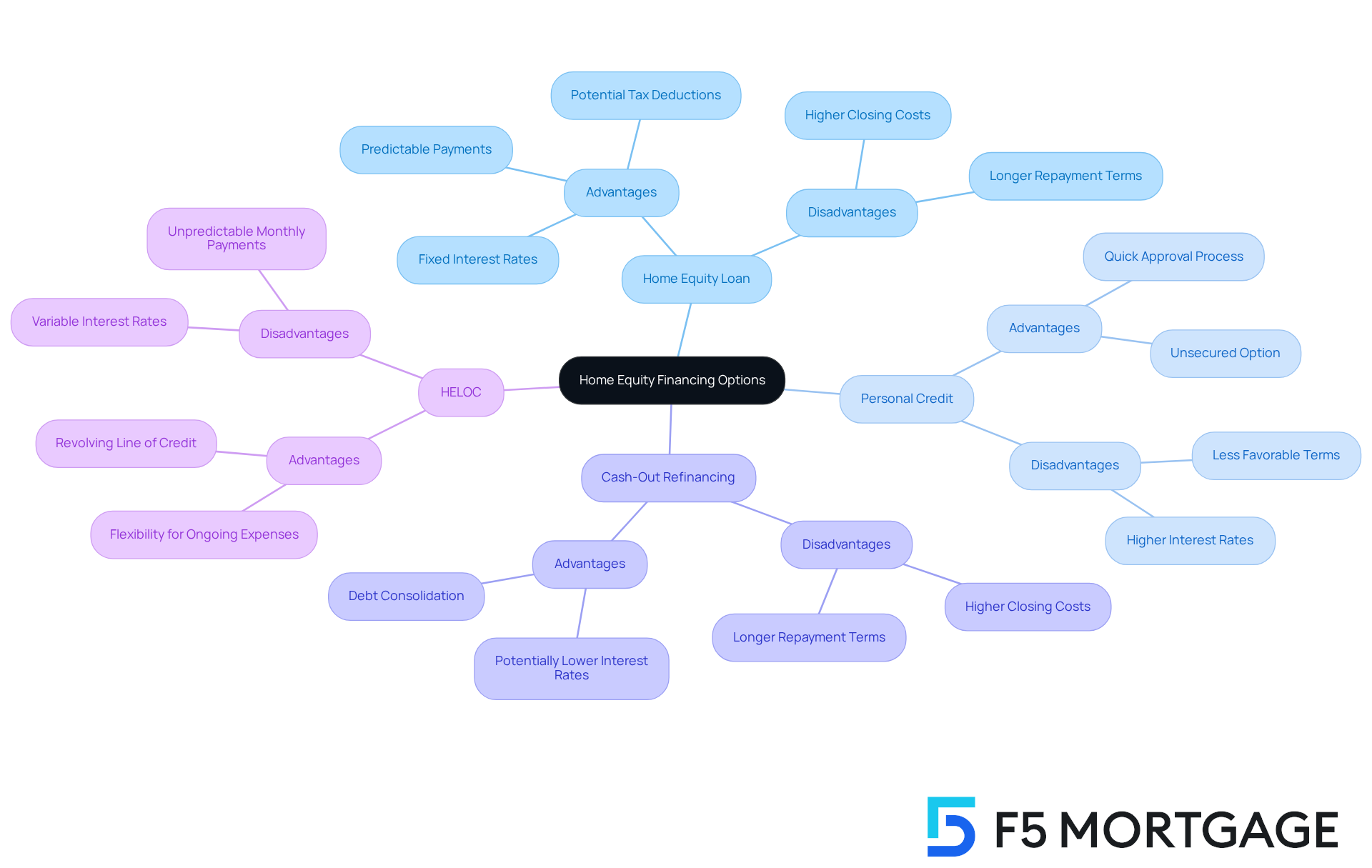

Compare Home Equity Loans with Alternative Financing Options

Families often find themselves navigating the complexities of home equity financing options, alongside other funding alternatives like personal credit, cash-out refinancing, and home equity lines of credit (HELOCs). We understand how challenging this can be. Personal financing, while generally unsecured, often carries higher interest charges and less favorable conditions, making it a more expensive choice for many families. On the other hand, cash-out refinancing allows homeowners to replace their current mortgage with a new, larger loan, potentially at a lower interest rate. However, this option may come with higher closing costs and longer repayment terms, which could affect long-term affordability.

HELOCs offer a revolving line of credit based on property value, providing flexibility for ongoing expenses or projects. Yet, they often come with that can rise over time, introducing unpredictability in monthly payments. As of September 2025, the average HELOC interest rate stands at 8.10%, which is somewhat lower than property financing rates that have been steadily decreasing.

Each financing option, including the pros and cons of home equity loan, has its own set of advantages and disadvantages. For example, cash-out refinancing can be a great choice for families looking to consolidate debt or cover significant expenses, while understanding the pros and cons of a home equity loan reveals that it provides fixed rates that shield against market fluctuations. It’s crucial for families to carefully assess their financial needs, risk tolerance, and the specific terms of each option. By doing so, they can make an informed decision that aligns with their long-term goals. Remember, we’re here to support you every step of the way.

Conclusion

Home equity loans offer families a unique opportunity to leverage the value of their homes, presenting both advantages and potential risks. We understand how challenging this can be, and by grasping how these loans function and their implications, families can make informed decisions that align with their financial goals.

This article highlights the significant benefits of home equity loans. Families can enjoy:

- Lower interest rates compared to unsecured loans

- Potential tax deductions on interest

- Access to substantial cash amounts for important expenses

However, it’s essential to recognize the critical drawbacks as well. There is:

- A risk of foreclosure if payments are missed

- The potential for increased overall debt

- The emotional strain that financial distress can impose on families

Navigating the landscape of home equity loans requires careful consideration of both the benefits and challenges. Families must assess their financial situations and explore alternative financing options. By weighing the pros and cons of home equity loans against their unique needs, they can make strategic choices that not only provide immediate financial relief but also safeguard their long-term financial stability. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan, also known as a property value credit or second mortgage, allows property owners to utilize the value they’ve built in their homes by providing a lump sum secured by their residence, which serves as collateral.

What are the advantages of a home equity loan?

Advantages include stable interest terms, predictable monthly payments, and the ability to access a substantial amount of cash for significant expenses such as home improvements, educational costs, or debt consolidation.

What are the disadvantages of a home equity loan?

The article does not explicitly list disadvantages, but common concerns may include the risk of losing the home if payments are not made, as well as potential fees and interest rates.

How is the amount available for a home equity loan determined?

The amount available is typically determined by the home’s current market value minus any existing mortgage balance.

What is the projected average interest rate for home financing starting in 2025?

The projected average interest rate for home financing starting in 2025 is around 8.28%.

How can a home equity loan help with financial challenges?

A home equity loan can help by providing access to cash for significant expenses, making it easier to manage costs such as home improvements, education, or debt consolidation.