Overview

Navigating the world of home financing can be daunting, especially when considering options like a Home Equity Line of Credit (HELOC) and a home equity loan. We understand how challenging this can be, and we’re here to support you every step of the way.

A HELOC offers you the flexibility of revolving credit with variable interest rates, allowing you to draw funds as needed. This can be a valuable resource for families looking to manage unexpected expenses or ongoing projects. On the other hand, a home equity loan provides a lump sum at a fixed rate, which can be ideal for those who prefer stability in their payments.

By understanding these distinct structures and purposes, you can make an informed choice based on your financial needs and stability. Remember, we’re here to help you navigate these options, ensuring you find the solution that best fits your family’s situation.

Introduction

Understanding the nuances of home equity can unlock significant financial opportunities for homeowners. We know how challenging it can be to navigate these waters. As property values soar, the ability to leverage one’s home for funding—whether for renovations, education, or debt consolidation—becomes increasingly vital. However, the choice between a Home Equity Line of Credit (HELOC) and a home equity loan can feel daunting. Which option serves your financial needs best, especially in a fluctuating market?

This article delves into the distinctions between these two powerful financial tools. We’re here to support you every step of the way, guiding you toward informed decisions that align with your long-term goals.

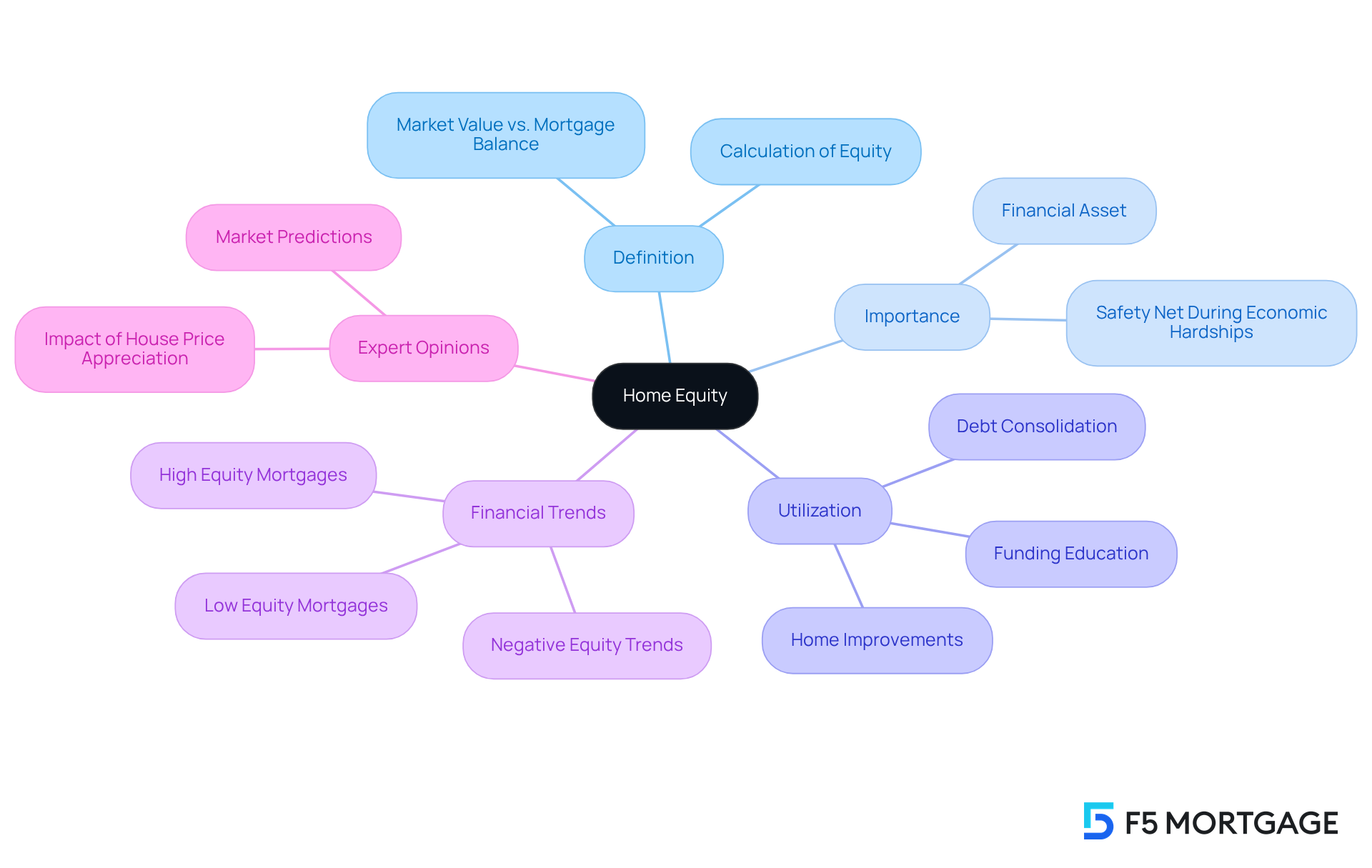

Define Home Equity and Its Importance

Understanding the is crucial. It’s defined as the difference between the current market worth of your home and the remaining balance on your mortgage. For instance, if your home is valued at $300,000 and you owe $200,000, your property value stands at $100,000. This ownership represents a significant financial asset, which can be leveraged for various purposes, such as home improvements, debt consolidation, or funding education. In 2025, grasping property value is essential for homeowners, as it can provide a safety net during economic hardships and serve as a resource for future investments or expenses.

Real-life stories illustrate how homeowners have utilized their assets for financial stability. Many individuals have tapped into their property value to finance necessary renovations, enhancing their living spaces while simultaneously increasing the overall worth of their homes. Additionally, using property value for debt consolidation can lead to lower interest rates and more manageable monthly payments, alleviating financial stress.

The financial benefits of residential property are underscored by recent trends, with 97% of outstanding first-lien mortgages in the U.S. having values above 10%. This reflects a significant trend of rising property values, driven by house price growth and effective mortgage repayment strategies. As of Q1 2023, the percentage of mortgages with high value (30% or more) has surged from 46.1% in Q1 2013 to 83.3% in Q1 2023. This indicates that most homeowners who purchased or refinanced before Q2 2022 have seen substantial gains in their property value.

Experts agree that residential value is a vital asset, providing homeowners with opportunities to secure loans or credit lines, which illustrates the [difference between HELOC and home equity loan](https://f5mortgage.com/understanding-the-difference-between-home-equity-loans-and-lines-of-credit/). These options can be instrumental in achieving financial goals, whether it’s funding a child’s education or managing unexpected expenses. As the housing market evolves, the importance of property value for homeowners remains a key consideration in financial planning.

Differentiate Between HELOCs and Home Equity Loans

A Home Equity Line of Credit (HELOC) and a residential property financing option are both effective ways to utilize your property value, yet they serve different purposes, highlighting the difference between HELOC and home equity loan. A HELOC operates like a revolving line of credit, similar to a credit card, allowing homeowners to borrow, repay, and borrow again up to a predetermined limit. This option typically features a variable interest rate, offering flexibility in how much and when you withdraw funds. As we look ahead to 2025, HELOC rates are projected to average around 7.25 percent, reflecting a competitive borrowing environment. Furthermore, HELOC balances exceeded $45,000 in 2024, indicating a rising trend in using property value for various financial needs.

On the other hand, a property-backed credit offers a lump sum at a fixed interest rate, which is repaid over a designated period. This structure can be particularly helpful for those needing a specific amount upfront for significant expenses, such as major renovations or debt consolidation. Current projections suggest that home collateral loans will average 7.90 percent in 2025, making them a viable option for borrowers seeking stability in their repayment plans.

Recent trends reveal a notable increase in the popularity of HELOCs, with withdrawals approaching $25 billion. Homeowners are increasingly accessing their assets despite rising expenses. This shift highlights a growing preference for flexible borrowing options in a fluctuating market. We understand that navigating these choices can be overwhelming, which is why financial advisors stress the . Both can significantly impact your long-term financial health. As Andrew Dehan, a Senior Writer at Bankrate, notes, “The opportunity to accumulate value is one of the main reasons homeownership is so appealing to many, and continues to be a reliable aspect of the American Dream.” By making regular mortgage payments, homeowners can gradually increase their ownership stake, as payments shift from interest to principal over time.

In conclusion, while both HELOCs and property equity loans provide access to property equity, the difference between HELOC and home equity loan depends on your personal financial needs and circumstances. We encourage homeowners to carefully consider their options, especially in light of current interest rates and market trends, to make informed decisions that align with their financial goals. As of Q1 2025, there are 1.2 million underwater U.S. properties, a 17% increase from Q1 2024, which further emphasizes the importance of understanding these borrowing options. Remember, we’re here to support you every step of the way.

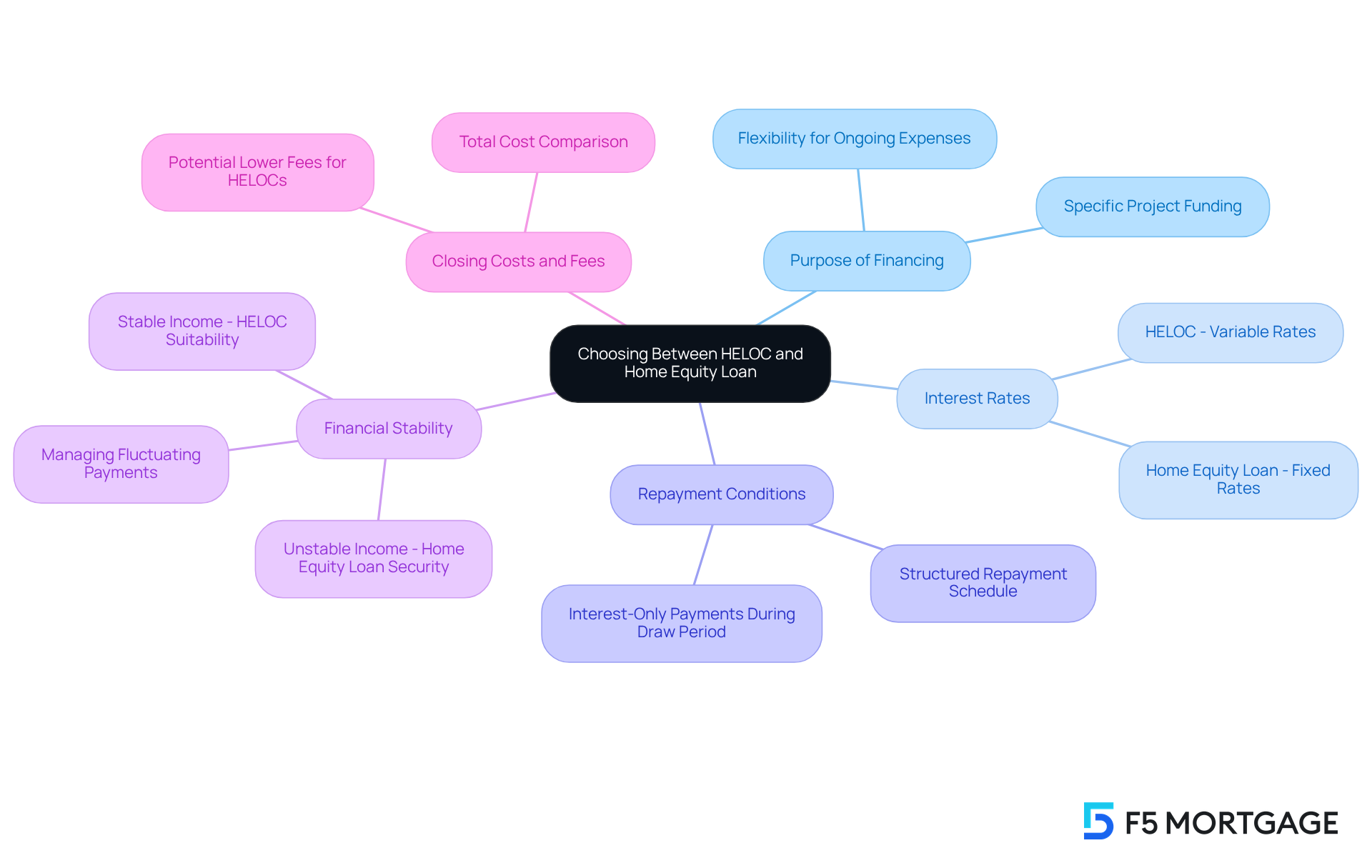

Evaluate Key Factors for Choosing Between HELOC and Home Equity Loan

When deciding the , it’s important to consider a few key factors that can impact your financial journey.

- Purpose of the Financing: We understand that you may need funds for a specific project. In such cases, a property-backed credit might be the right choice. However, if you’re looking for flexibility for ongoing expenses or projects, a HELOC could be the perfect fit.

- Interest Rates: It’s crucial to be aware that HELOCs often come with variable interest rates, which can change over time. On the other hand, home equity loans typically offer fixed rates, ensuring your payments remain consistent.

- Repayment Conditions: With home collateral financing, you’ll have a structured repayment schedule. In contrast, HELOCs may allow for interest-only payments during the draw period, which could lead to larger payments down the line. We know how challenging this can be, so it’s essential to carefully consider the difference between HELOC and home equity loan options.

- Financial Stability: Assess your ability to manage fluctuating payments associated with a HELOC compared to the fixed payments of a home equity loan. If your income is stable, a HELOC might serve you well; if not, a home equity loan could offer more security.

- Closing Costs and Fees: Both options may involve closing costs, but HELOCs sometimes come with lower fees. It’s vital to compare the total costs linked to each choice before making a decision. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the distinction between a Home Equity Line of Credit (HELOC) and a home equity loan is essential for homeowners looking to leverage their property value for financial needs. We know how challenging this can be, and both options provide access to funds, but they cater to different financial situations and requirements. By grasping these differences, homeowners can make informed decisions that align with their financial goals.

This article highlights several key points, including:

- The importance of understanding property value

- The unique structures of HELOCs and home equity loans

- The factors influencing the choice between the two

HELOCs offer flexibility and a revolving line of credit, while home equity loans provide a fixed sum with structured repayment. Additionally, considerations such as interest rates, repayment conditions, and financial stability play a crucial role in determining the best option for individual circumstances.

Ultimately, the ability to navigate these financial tools can significantly impact long-term financial health. Homeowners are encouraged to evaluate their needs carefully, considering current market trends and interest rates. By making informed choices, individuals can effectively utilize their home equity to achieve financial stability and pursue their personal goals. Understanding these borrowing options not only empowers homeowners but also reinforces the importance of property value as a vital asset in personal finance. We’re here to support you every step of the way as you explore these options.

Frequently Asked Questions

What is home equity?

Home equity is defined as the difference between the current market value of your home and the remaining balance on your mortgage. For example, if your home is valued at $300,000 and you owe $200,000, your home equity would be $100,000.

Why is understanding home equity important?

Understanding home equity is crucial for homeowners because it represents a significant financial asset that can be leveraged for various purposes, such as home improvements, debt consolidation, or funding education. It also provides a safety net during economic hardships and serves as a resource for future investments or expenses.

How can homeowners utilize their home equity?

Homeowners can utilize their home equity for financing necessary renovations, which can enhance their living spaces and increase the overall worth of their homes. Additionally, they can use it for debt consolidation to achieve lower interest rates and more manageable monthly payments, thereby alleviating financial stress.

What recent trends have been observed regarding home equity in the U.S.?

Recent trends indicate that 97% of outstanding first-lien mortgages in the U.S. have values above 10%, reflecting a significant rise in property values due to house price growth and effective mortgage repayment strategies. The percentage of mortgages with high value (30% or more) has increased from 46.1% in Q1 2013 to 83.3% in Q1 2023.

What are the financial benefits of home equity?

The financial benefits of home equity include the ability to secure loans or credit lines, which can help homeowners achieve financial goals such as funding a child’s education or managing unexpected expenses.

What are the differences between a HELOC and a home equity loan?

A HELOC (Home Equity Line of Credit) and a home equity loan are two options for accessing home equity. A HELOC provides a revolving line of credit based on your home equity, allowing you to borrow as needed, while a home equity loan provides a lump sum amount that is repaid over time, typically at a fixed interest rate.